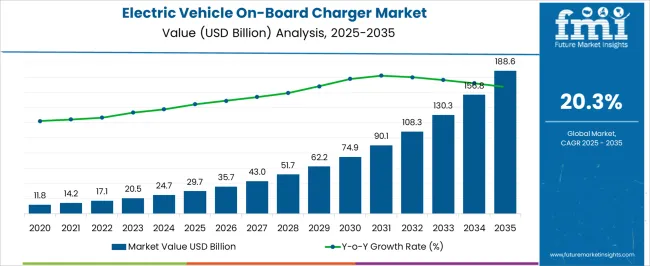

The electric vehicle on-board charger (OBC) market is projected to grow from USD 29.7 billion in 2025 to USD 188.6 billion by 2035, reflecting a CAGR of 20.3%. During the early adoption phase (2020–2024), OEMs and electric vehicle manufacturers gradually integrated OBCs to enhance charging efficiency and vehicle performance. By 2025, rising demand for electric vehicles across passenger and commercial segments will drive broader adoption. This phase represents the transition from selective use in niche models to wider integration across fleets, as manufacturers expand production and strengthen supply chains, laying the foundation for the scaling phase.

From 2025 to 2030, the market enters a scaling phase, marked by rapid uptake across passenger vehicles, commercial fleets, and specialty EV applications. Market value rises from USD 29.7 billion in 2025 as increased EV production and adoption accelerate OBC integration. By 2030, OBCs become a standard component across most electric vehicle models, preparing the market for consolidation. Between 2030 and 2035, the market reaches USD 188.6 billion, with steady CAGR-driven growth. Consolidation occurs as leading suppliers optimize production, secure partnerships, and expand distribution, resulting in a mature and competitive market landscape with widespread adoption across the EV ecosystem.

| Metric | Value |

|---|---|

| Electric Vehicle On-Board Charger Market Estimated Value in (2025 E) | USD 29.7 billion |

| Electric Vehicle On-Board Charger Market Forecast Value in (2035 F) | USD 188.6 billion |

| Forecast CAGR (2025 to 2035) | 20.3% |

The electric vehicle on-board charger (OBC) market is a key segment of the broader electric vehicle (EV) components and charging systems market. In 2025, OBCs account for approximately 16% of the total EV components market, reflecting growing adoption across passenger and commercial electric vehicles. The broader EV components market, which includes batteries, inverters, motors, and charging infrastructure, is projected to grow at a CAGR of around 18–19% during 2025–2035, driven by increasing EV production and adoption globally. Within EV charging systems, on-board chargers hold an estimated 40% share in 2025, with off-board chargers and infrastructure equipment accounting for the remainder.

By 2030, scaling adoption is expected to increase the OBC share to nearly 44%, supported by widespread integration into mid-range and high-volume EV models. Between 2030 and 2035, consolidation is anticipated as leading suppliers expand production, optimize supply chains, and form strategic partnerships with OEMs. By 2035, OBCs are projected to represent roughly 45% of the EV charging systems segment and about 18–19% of the overall EV components market, solidifying their role as a critical revenue driver and an essential part of the growing electric vehicle ecosystem.

The electric vehicle on-board charger market is experiencing strong expansion, supported by the accelerating shift toward electrification in the global automotive industry. Growing adoption of battery electric vehicles, driven by environmental regulations, government incentives, and advancements in battery technology, has created a significant demand for efficient and high-performance on-board charging systems. The market is further influenced by the rapid deployment of charging infrastructure and increasing consumer expectations for shorter charging times and improved driving range.

Technological advancements, including higher charging efficiencies and compact designs, are enabling integration into diverse vehicle models while maintaining cost-effectiveness. Additionally, rising investments from automakers and component manufacturers are contributing to capacity expansion and innovation in power electronics.

The outlook for the market remains highly positive, with growth driven by both passenger and commercial EV segments, as well as regional policies promoting zero-emission mobility. Over the forecast period, ongoing enhancements in charging speed, energy conversion efficiency, and grid integration capabilities are expected to solidify the role of on-board chargers as a critical component in the EV ecosystem.

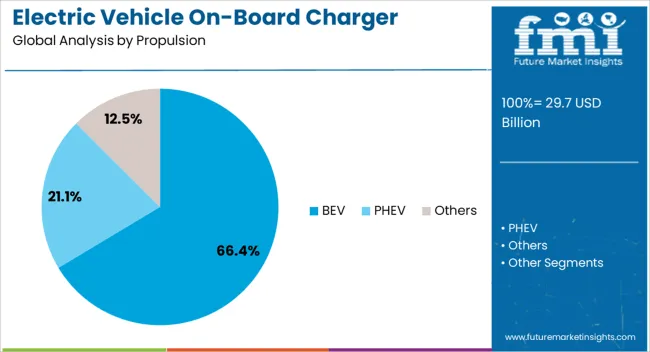

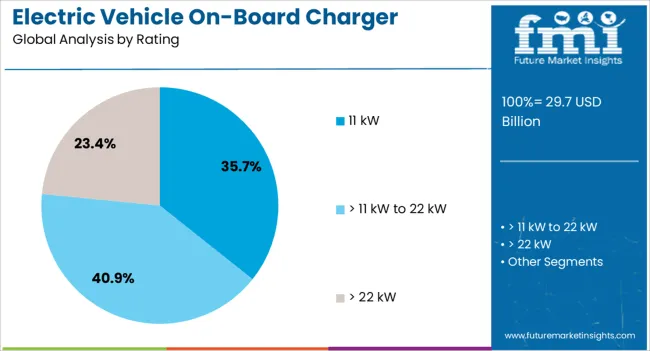

The electric vehicle on-board charger market is segmented by propulsion, rating, and geographic regions. By propulsion, electric vehicle on-board charger market is divided into BEV, PHEV, and Others. In terms of rating, electric vehicle on-board charger market is classified into 11 kW, > 11 kW to 22 kW, and > 22 kW. Regionally, the electric vehicle on-board charger industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The battery electric vehicle (BEV) segment holds the leading share in the propulsion category, accounting for approximately 66.4% of the electric vehicle on-board charger market. This dominance is attributed to the complete reliance of BEVs on electric propulsion, making efficient and reliable on-board chargers essential for optimal performance.

Growth in this segment has been driven by rising consumer adoption of fully electric vehicles across both developed and emerging markets, alongside supportive regulatory frameworks and incentives that favor zero-emission mobility. Manufacturers have been focusing on enhancing charging efficiency, reducing heat generation, and enabling compatibility with a wide range of charging networks to cater to the BEV segment.

Furthermore, the growing availability of long-range BEVs and the global rollout of high-power charging stations have further increased the requirement for advanced on-board charging systems. With automakers intensifying their BEV production targets and consumers increasingly prioritizing sustainability and lower operating costs, the BEV segment is expected to maintain its leadership position throughout the forecast period.

The 11 kW rating segment commands the highest share in the power rating category, representing approximately 35.7% of the electric vehicle on-board charger market. This prominence is due to its balanced performance in delivering faster charging speeds while maintaining cost and energy efficiency for both residential and public charging applications.

The segment benefits from its compatibility with widely available AC charging infrastructure, making it a preferred option for mid-range and premium EV models. Automotive OEMs have been integrating 11 kW chargers to cater to consumer expectations for shorter charging times without the need for extensive electrical upgrades.

Additionally, the 11 kW configuration offers an optimal trade-off between charging duration, grid load, and overall vehicle cost, which has contributed to its adoption across diverse vehicle categories. As the penetration of home and workplace charging solutions continues to rise, along with technological refinements in charger design, the 11 kW segment is anticipated to sustain its leading market position over the forecast period.

The electric vehicle (EV) on-board charger market is growing due to rising EV adoption, government incentives, and the expansion of charging infrastructure. North America and Europe lead adoption with advanced EV fleets, supportive policies, and technological integration. Asia-Pacific shows rapid growth driven by increasing EV production, urbanization, and government-backed electrification programs. Manufacturers differentiate through charging speed, efficiency, and thermal management. Regional differences in infrastructure readiness, vehicle types, and regulatory frameworks strongly influence adoption, technological innovation, and market competitiveness.

Increasing EV sales globally are driving the demand for efficient and reliable on-board chargers. North America and Europe prioritize high-efficiency OBCs to support fast charging, grid integration, and energy management in passenger and commercial EVs. Asia-Pacific markets, particularly China, Japan, and India, are expanding rapidly with government incentives, fleet electrification, and urban EV adoption. Differences in EV penetration rates, battery capacities, and charging infrastructure influence OBC power ratings, modularity, and thermal management systems. Leading suppliers provide compact, high-efficiency, and multi-standard compatible chargers, while regional manufacturers focus on cost-effective solutions for mass-market adoption. Adoption contrasts between mature EV markets and emerging regions shape product innovation, market growth, and competitiveness globally.

Advances in OBC technology, including high power density, bi-directional charging, and smart communication protocols, are boosting market growth. North America and Europe adopt advanced chargers integrated with vehicle energy management systems, ensuring optimal battery health and reduced charging time. Asia-Pacific markets focus on affordable, reliable chargers that support standard AC infrastructure and urban mobility needs. Differences in technology readiness, EV battery chemistry, and user expectations influence OBC design, efficiency, and control systems. Leading suppliers develop modular, high-efficiency chargers with thermal protection and grid compatibility, while regional players provide basic, cost-effective models. Technological contrasts drive adoption, performance optimization, and competitive positioning across global EV on-board charger markets.

Regulatory frameworks and grid integration requirements significantly affect OBC market adoption. North America and Europe enforce strict safety standards, electromagnetic compatibility, and energy efficiency regulations, guiding charger development and deployment. Asia-Pacific markets vary, with developed countries following international standards and emerging regions adopting simplified compliance measures. Differences in grid infrastructure, regulatory stringency, and certification timelines influence charger ratings, communication protocols, and installation procedures. Leading suppliers provide certified, high-performance OBCs compatible with various grids and charging standards, while regional manufacturers focus on affordable, compliant solutions. Regulatory and grid contrasts shape adoption patterns, reliability, and global competitiveness.

The growing diversity of EV platforms drives demand for customizable on-board chargers. North America and Europe emphasize modular chargers compatible with multiple EV segments, including passenger vehicles, commercial fleets, and high-performance models. Asia-Pacific markets adopt chargers tailored for specific vehicle classes, balancing cost and charging speed. Differences in battery capacity, vehicle architecture, and user charging behavior influence charger power output, size, and thermal management solutions. Leading suppliers provide scalable, multi-standard OBCs with advanced safety features, while regional players focus on adaptable, cost-efficient units. Platform diversity contrasts drive adoption, product innovation, and competitiveness across the global EV on-board charger market.

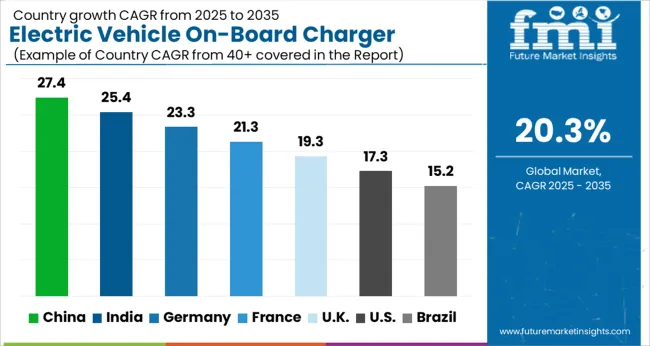

| Country | CAGR |

|---|---|

| China | 27.4% |

| India | 25.4% |

| Germany | 23.3% |

| France | 21.3% |

| UK | 19.3% |

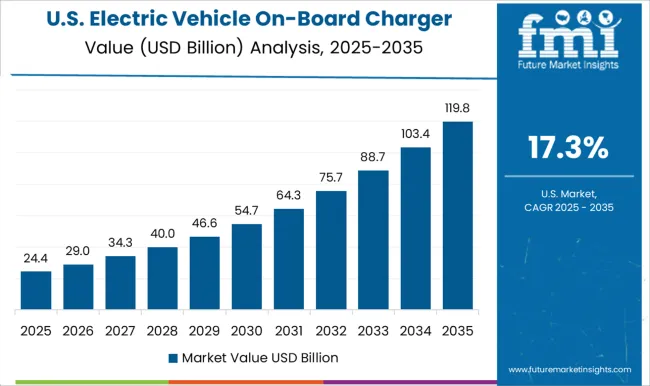

| USA | 17.3% |

| Brazil | 15.2% |

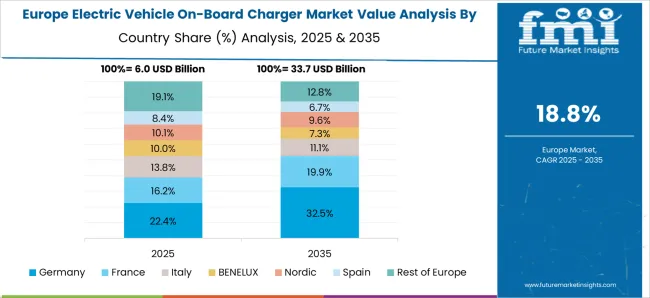

The global electric vehicle on-board charger market is projected to grow at a 20.3% CAGR through 2035, driven by demand in passenger EVs, commercial vehicles, and charging infrastructure. Among BRICS nations, China led with 27.4% growth as large-scale manufacturing and deployment facilities were commissioned, while India at 25.4% expanded production and integration in electric mobility networks. In the OECD region, Germany at 23.3% maintained steady utilization under stringent safety and regulatory standards, while the United Kingdom at 19.3% supported moderate-scale deployment across commercial and residential EV segments. The USA, growing at 17.3%, sustained adoption in passenger and fleet applications while adhering to federal and state-level energy and transportation regulations. This report includes insights on 40+ countries; the top countries are shown here for reference.

The electric vehicle on-board charger (OBC) market in China is growing at a 27.4% CAGR, driven by rapid adoption of electric vehicles (EVs) and government incentives for clean mobility. Policies promoting EV manufacturing, subsidies for consumers, and expansion of charging infrastructure are accelerating market growth. Domestic manufacturers are investing heavily in research and development to improve OBC efficiency, reduce charging time, and integrate smart features such as vehicle-to-grid compatibility. Partnerships between EV manufacturers, energy providers, and technology companies are fostering innovation. The increasing adoption of private and fleet EVs for urban mobility, ride-sharing, and logistics is further supporting demand. Overall, China’s market reflects strong governmental support, industrial innovation, and rapidly increasing EV penetration, making it the largest and fastest-growing market globally.

Electric vehicle OBC market in India is registering a 25.4% CAGR, supported by government initiatives promoting electric mobility and clean energy adoption. Policies such as tax benefits, subsidies, and infrastructure development are encouraging manufacturers and consumers to adopt EVs. Domestic manufacturers are focusing on producing high-efficiency chargers with fast-charging capabilities suitable for two-wheelers, passenger cars, and commercial EVs. The growth of urban transportation, ride-sharing, and logistics sectors is further fueling OBC demand. Collaborations between automakers, energy providers, and technology firms are driving innovation in charger design and performance. Market expansion is also supported by rising awareness of environmental sustainability and increasing investments in EV infrastructure across tier-one and tier-two cities.

Germany’s electric vehicle OBC market is growing at a 23.3% CAGR, driven by the strong automotive sector and government support for low-emission vehicles. EV adoption is rising steadily among private and commercial users, increasing the need for high-efficiency on-board chargers. Manufacturers are innovating with smart, compact, and fast-charging solutions to improve vehicle performance and consumer convenience. Collaboration between automotive OEMs and technology providers is fostering advanced OBC development. The government is incentivizing EV purchases and charging infrastructure expansion, while regulatory compliance ensures safety and reliability. Industrial and fleet adoption, combined with focus on energy efficiency and integration with renewable power, is driving steady market growth.

The United Kingdom OBC market is expanding at a 19.3% CAGR, supported by increasing EV adoption and government policies aimed at reducing carbon emissions. Incentives for electric vehicles, development of charging infrastructure, and subsidies for manufacturers encourage OBC deployment. Manufacturers focus on compact, high-efficiency chargers compatible with passenger cars and commercial EVs. Fleet operators and private vehicle owners are integrating EVs into transportation, logistics, and ride-sharing services, increasing demand for reliable onboard charging solutions. Research and development efforts aim to improve efficiency, reduce weight, and enhance vehicle-to-grid capabilities. Overall, the UK market reflects growing government support, technological innovation, and rising EV penetration.

The United States OBC market is growing at a 17.3% CAGR, fueled by strong electric vehicle adoption, regulatory support, and increasing investments in EV infrastructure. Demand is rising across passenger vehicles, commercial fleets, and ride-sharing services. Manufacturers focus on high-efficiency, fast-charging, and compact on-board chargers with advanced safety features. Federal and state incentives encourage EV adoption and infrastructure expansion, boosting the OBC market. Technological innovations, including smart chargers and vehicle-to-grid compatibility, are driving product differentiation. Industrial and private EV demand, combined with environmental sustainability goals, supports steady growth in the USA OBC market. The market reflects technological advancement, government support, and rapidly increasing EV adoption.

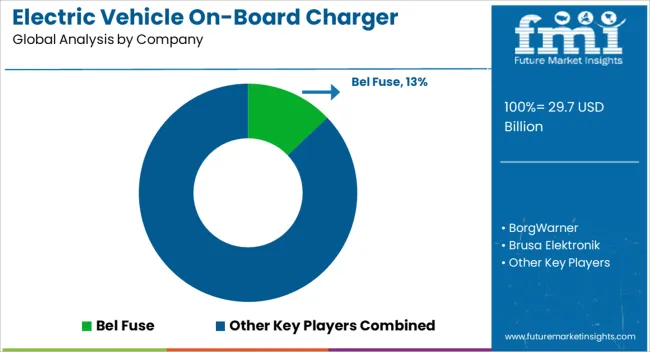

The electric vehicle (EV) on-board charger market is dominated by leading suppliers such as Bel Fuse, BorgWarner, Brusa Elektronik, Delta Energy Systems, Eaton, Ficosa Internacional, Hyundai Motor, Infineon Technologies, Innolectric, Nissan Motor, Phinia, Stercom Power Solutions, and STMicroelectronics. These companies provide advanced charging solutions that convert AC power from the grid into DC power to charge EV batteries efficiently. Their products are critical for enhancing charging speed, energy efficiency, and overall vehicle performance, supporting the rapid adoption of electric mobility worldwide. Market leaders emphasize innovation and technological advancements to improve charging efficiency, reduce heat generation, and integrate smart features. Companies like BorgWarner and Brusa Elektronik focus on high-power, compact charger designs that enable faster charging times, while Infineon Technologies and STMicroelectronics supply key semiconductor components that enhance reliability and power management. Automotive manufacturers such as Hyundai Motor and Nissan Motor incorporate on-board chargers into their EV models to ensure compatibility, safety, and optimal performance, catering to both consumer and commercial vehicle segments. Eco-efficiency and regulatory compliance are central to market growth, with suppliers adopting energy-efficient designs and environmentally friendly manufacturing processes. Companies such as Delta Energy Systems and Ficosa Internacional prioritize lightweight, modular designs to reduce energy losses and vehicle weight, further enhancing efficiency. With global expansion, strategic partnerships, and continuous R&D investment, these leading suppliers are positioned to meet growing demand, support emerging EV technologies, and contribute to the transition toward a cleaner, electrified transportation ecosystem.

| Item | Value |

|---|---|

| Quantitative Units | USD 29.7 Billion |

| Propulsion | BEV, PHEV, and Others |

| Rating | 11 kW, > 11 kW to 22 kW, and > 22 kW |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Bel Fuse, BorgWarner, Brusa Elektronik, Delta Energy Systems, Eaton, Ficosa Internacional, Hyundai Motor, Infineon Technologies, Innolectric, Nissan Motor, Phinia, Stercom Power Solutions, and STMicroelectronics |

| Additional Attributes | Dollar sales vary by charger type, including AC chargers, DC fast chargers, and bi-directional chargers; by vehicle type, spanning passenger EVs, commercial EVs, and buses; by application, such as residential, commercial, and public charging; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by EV adoption, government incentives, and expansion of charging infrastructure. |

The global electric vehicle on-board charger market is estimated to be valued at USD 29.7 billion in 2025.

The market size for the electric vehicle on-board charger market is projected to reach USD 188.6 billion by 2035.

The electric vehicle on-board charger market is expected to grow at a 20.3% CAGR between 2025 and 2035.

The key product types in electric vehicle on-board charger market are bev, phev and others.

In terms of rating, 11 kw segment to command 35.7% share in the electric vehicle on-board charger market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bi-Directional Electric Vehicle Charger Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Sensor Market Forecast and Outlook 2025 to 2035

Electric Vehicle Motor Market Forecast and Outlook 2025 to 2035

Electric Vehicle Battery Conditioners Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Transmission Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Fluid Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle E-Axle Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Plastics Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Finance Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Contactor Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Communication Controller Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Charging Cable and Plug Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Battery Formation and Testing Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Range Extender Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Charging Station Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Relays Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle DC Contactor Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Battery Connector Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Reducer Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA