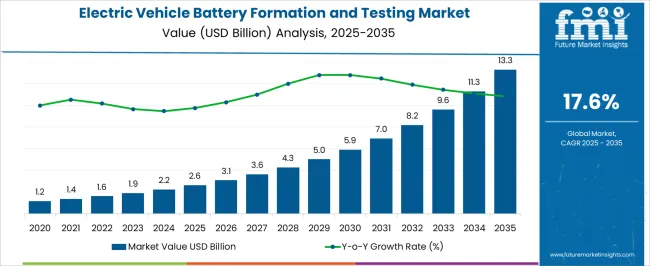

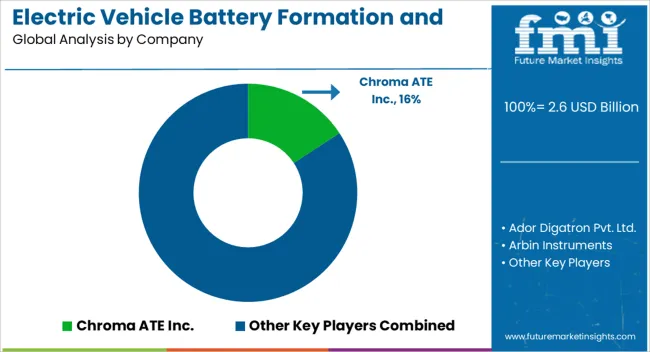

The electric vehicle (EV) battery formation and testing market is estimated to be valued at USD 2.6 billion in 2025 and is projected to reach USD 13.3 billion by 2035, registering a compound annual growth rate (CAGR) of 17.6% over the forecast period. A half-decade weighted growth analysis highlights the distribution of market expansion over two five-year intervals, demonstrating how early-stage and late-stage growth contribute to overall revenue accumulation.

Between 2025 and 2030, the market grows from USD 2.6 billion to USD 5.9 billion, representing the first half-decade, which accounts for approximately 28% of the total decade growth. This early phase is driven by increasing EV production, rising adoption of lithium-ion and solid-state batteries, and investments in formation and testing facilities to improve battery efficiency, longevity, and safety. Technological innovations such as high-precision formation systems and automated testing protocols accelerate adoption among OEMs and battery manufacturers.

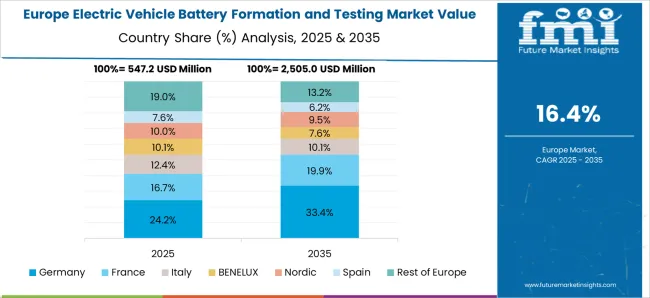

From 2030 to 2035, the market accelerates further, from USD 5.9 billion to USD 13.3 billion, representing the second half-decade. This period contributes around 72% of total growth, highlighting a weighted late-stage expansion. Growth is fueled by scaling of EV production, mass deployment of next-generation batteries, and global standardization of formation and testing processes. Asia-Pacific leads volume growth, while North America and Europe drive value growth through high-technology adoption.

| Metric | Value |

|---|---|

| Electric Vehicle Battery Formation and Testing Market Estimated Value in (2025 E) | USD 2.6 billion |

| Electric Vehicle Battery Formation and Testing Market Forecast Value in (2035 F) | USD 13.3 billion |

| Forecast CAGR (2025 to 2035) | 17.6% |

The electric vehicle battery formation and testing market is primarily driven by the electric vehicle (EV) battery manufacturing market, which accounts for approximately 40–45% of total demand, as formation and testing processes are essential to ensure battery quality, capacity, and safety. The lithium-ion battery market contributes around 20–22%, reflecting the need for energy density optimization, extended lifecycle, and reliable performance through controlled formation and diagnostic testing.

The battery testing and equipment market holds roughly 15–17%, driven by the deployment of formation equipment, cyclers, and testing systems required for validation and quality assurance. The automotive electric vehicle market contributes approximately 12–14%, as increasing EV production necessitates reliable battery testing and formation processes to comply with performance and safety regulations. The energy storage systems (ESS) market accounts for 5–6%, supporting formation and testing of large-scale battery packs for grid storage and stationary applications.

The electric vehicle battery formation and testing market is expanding in response to accelerating EV adoption, stringent quality control requirements, and advancements in battery manufacturing processes. Current growth is underpinned by rising production capacities among cell manufacturers, coupled with the need for precise formation and testing systems to ensure performance, safety, and longevity.

Li-ion technology dominance is shaping equipment specifications, prompting manufacturers to invest in automation, advanced diagnostics, and energy-efficient systems. Regulatory frameworks emphasizing battery safety standards are reinforcing the integration of high-precision testing protocols within production lines.

While initial capital expenditure remains a consideration, long-term operational efficiency and reduced defect rates are supporting wider adoption of advanced formation and testing equipment. The future outlook is strengthened by government incentives for EV manufacturing, the scaling of gigafactories, and the proliferation of BEVs, which together are projected to sustain demand momentum and drive technological innovation in battery processing and validation systems.

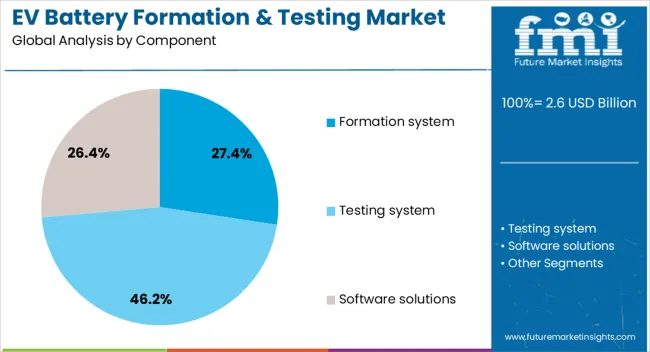

The electric vehicle battery formation and testing market is segmented by component, battery, electric vehicle, end user, and geographic regions. By component, the electric vehicle battery formation and testing market is divided into Formation system, Testing system, and Software solutions. In terms of battery, the electric vehicle battery formation and testing market is classified into Li-ion, Solid-state, Lead-acid, and Nickel-metal hydride.

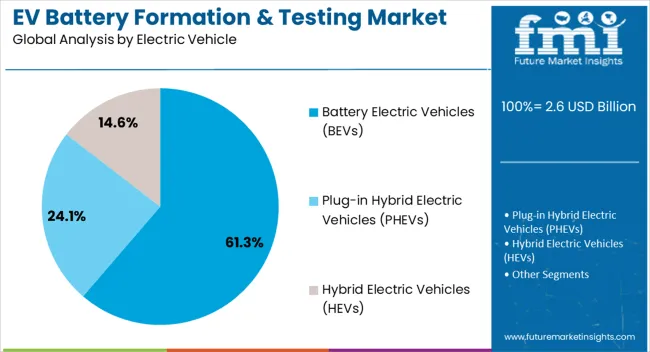

Based on electric vehicles, the electric vehicle battery formation and testing market is segmented into Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), and Hybrid Electric Vehicles (HEVs). By end user, the electric vehicle battery formation and testing market is segmented into Battery manufacturers, Automotive OEMs, Third-party testing service providers, and EV charging infrastructure companies. Regionally, the electric vehicle battery formation and testing industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The formation system segment, with a 27.4% share in the component category, is maintaining a crucial role due to its function in conditioning cells to achieve optimal electrochemical stability before deployment. Its importance is reinforced by the necessity for consistent charging and discharging cycles during the manufacturing stage, which directly influence battery performance and lifecycle.

Demand is being driven by large-scale production facilities requiring scalable, automated solutions to match EV industry growth. Energy efficiency in formation processes has become a key competitive factor, prompting suppliers to integrate regenerative charging technologies that reduce operational costs.

Continuous advancements in software control systems have enhanced process precision, improving yield rates and minimizing variability. As battery capacities increase and production lines become faster, the reliance on high-throughput, reliable formation systems is expected to grow, ensuring this segment retains its relevance and contributes significantly to market revenues.

The Li-ion segment, representing 52.6% of the battery category, leads the market owing to its high energy density, favorable weight-to-power ratio, and proven performance in electric mobility. This dominance is further reinforced by ongoing cost reductions through economies of scale and advancements in cell chemistry, particularly in enhancing thermal stability and cycle life.

Manufacturers are increasingly standardizing Li-ion designs to streamline testing protocols, allowing for consistent quality assurance at scale. The segment benefits from extensive research and development aimed at improving fast-charging capabilities and safety mechanisms, which align with evolving EV industry requirements.

Global investments in Li-ion production facilities, supported by strategic raw material sourcing and recycling initiatives, are enabling stable supply and competitive pricing. With BEV adoption rising rapidly, Li-ion technology is expected to remain the benchmark for EV batteries, ensuring its continued leadership in formation and testing applications.

The battery electric vehicles (BEVs) segment, holding 61.3% of the electric vehicle category, commands market leadership due to the complete reliance on large-capacity battery systems for propulsion. This dependence drives significant demand for precise formation and testing solutions to guarantee reliability, safety, and performance consistency.

BEV manufacturers are scaling production aggressively, necessitating highly automated, high-throughput testing infrastructure integrated directly into assembly lines. Regulatory compliance regarding battery safety and emissions-free performance has reinforced the need for rigorous quality validation processes.

Market traction is further supported by falling battery costs, expanding charging infrastructure, and growing consumer acceptance of BEVs as mainstream transportation. As BEVs gain a larger share of global vehicle sales, the demand for advanced formation and testing systems tailored to large battery packs will intensify, ensuring this segment’s sustained dominance and shaping equipment innovation strategies among key market suppliers.

The electric vehicle battery formation and testing market is expanding as OEMs, battery manufacturers, and EV integrators focus on ensuring battery safety, performance, and longevity. Formation and testing processes, including formation cycling, capacity testing, impedance analysis, and quality assurance, are critical for lithium-ion, solid-state, and next-generation battery chemistries.

Rising adoption of EVs, stricter performance standards, and demand for high-energy-density batteries are driving the need for reliable and scalable formation and testing solutions. Suppliers offering advanced formation equipment, automated testing systems, and technical support are best positioned to secure partnerships with battery manufacturers, EV OEMs, and research institutions, ensuring operational efficiency, compliance, and consistent product quality.

EV battery manufacturers are increasingly investing in formation and testing solutions to enhance performance, detect defects, and extend the lifecycle. Formation processes establish electrochemical stability, while testing systems monitor capacity, cycle life, and thermal characteristics to prevent failures. Quality assurance and safety testing are critical for high-voltage battery packs used in passenger cars, commercial vehicles, and buses. Growing demand for faster charging, longer driving ranges, and thermal management drives the adoption of advanced testing methods such as electrochemical impedance spectroscopy, in-line formation, and high-throughput testing. Suppliers providing reliable, automated, and scalable solutions with robust technical support are best positioned to help manufacturers achieve high yield, reduce rework, and maintain compliance with industry standards.

Market constraints include high capital expenditure for formation and testing equipment, energy-intensive processes, and maintenance of precision instruments. Supply chain fluctuations for critical components such as test cells, sensors, and automation modules can affect production schedules. Regulatory compliance with safety standards, environmental guidelines, and battery certification protocols adds complexity, especially for international operations. Technical challenges involve achieving consistent formation cycles, accurate performance measurement, and thermal control for high-capacity batteries. Buyers increasingly seek suppliers offering certified systems, predictive maintenance, calibration services, and technical training to ensure efficiency, reduce downtime, and maintain quality throughout the battery manufacturing lifecycle.

Opportunities are emerging in automated formation lines, high-throughput testing systems, and equipment compatible with next-generation battery chemistries such as solid-state, lithium-sulfur, and high-nickel cathodes. EV market growth in Asia-Pacific, Europe, and North America supports the adoption of scalable, efficient testing and formation solutions. Integration with digital monitoring, data analytics, and predictive maintenance enhances process control and reduces rework. Suppliers offering turnkey solutions, including equipment, software, and technical expertise, are well-positioned to capture growth. Collaborations with battery manufacturers, research institutions, and EV OEMs further enhance adoption by providing application-specific guidance and ensuring compliance with evolving industry standards.

The market is trending toward digital integration of formation and testing equipment with real-time monitoring, data analytics, and predictive maintenance capabilities. Automated lines with inline testing reduce cycle times, improve consistency, and enhance safety. High-throughput formation systems allow large-scale battery pack production without compromising quality. Advanced diagnostic tools, including electrochemical impedance spectroscopy and thermal mapping, provide actionable insights for process optimization. Suppliers providing application-ready, digitally integrated, and technically supported solutions are best positioned to meet the evolving demands of EV battery manufacturers, ensuring safety, reliability, and performance across global production networks.

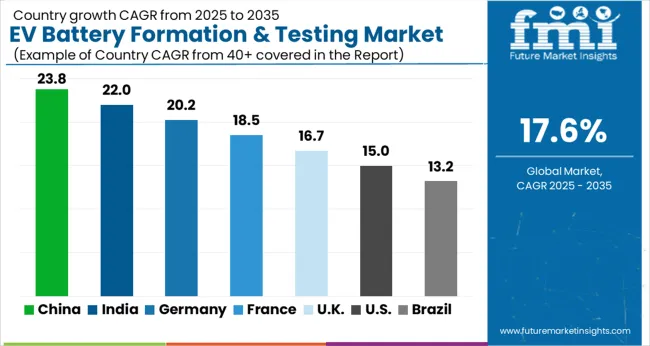

| Country | CAGR |

|---|---|

| China | 23.8% |

| India | 22.0% |

| Germany | 20.2% |

| France | 18.5% |

| UK | 16.7% |

| USA | 15.0% |

| Brazil | 13.2% |

The global electric vehicle battery formation and testing market is projected to grow at a CAGR of 17.6% from 2025 to 2035. China leads with 23.8%, followed by India at 22.0%, France at 18.5%, the UK at 16.7%, and the USA at 15.0%. Growth is driven by rising EV adoption, industrial battery production, and regulatory compliance requirements. Demand for automated, high-throughput formation and testing equipment, thermal management, and real-time monitoring is accelerating. Asia-Pacific dominates in terms of production scale, while Europe and North America focus on precision, quality, and predictive analytics to ensure performance, safety, and efficiency across automotive and energy storage applications. The analysis includes over 40+ countries, with the leading markets detailed below.

China’s electric vehicle (EV) battery formation and testing market is expected to grow at a CAGR of 23.8% from 2025 to 2035, driven by the country’s massive EV production and expanding automotive supply chain. High demand for lithium-ion and solid-state batteries is prompting manufacturers to invest in advanced formation and testing equipment, including formation cyclers, capacity testers, and safety analyzers. Government policies supporting NEVs and incentives for domestic battery production further accelerate adoption. Domestic and global suppliers are expanding local R&D and manufacturing facilities to meet stringent quality and performance standards. Rapid scaling of EV battery production lines in provinces like Jiangsu, Guangdong, and Shanghai requires highly automated formation and testing processes to improve cycle efficiency and reduce defects. Battery OEMs are also focusing on real-time monitoring, energy efficiency, and thermal management during formation.

India’s EV battery formation and testing market is projected to grow at a CAGR of 22.0% from 2025 to 2035, fueled by rising electric vehicle adoption and government initiatives like FAME II. Lithium-ion battery manufacturers are investing in formation cyclers, capacity testers, and safety testing systems to ensure high-quality output. Local production hubs in Tamil Nadu, Gujarat, and Karnataka are expanding capacity for EV and energy storage batteries. Automation is increasingly integrated into formation lines to minimize human error, improve throughput, and enhance testing accuracy. Collaborations with global equipment providers are accelerating technology transfer and enabling standardized testing processes. OEMs in India are focusing on thermal management, cell balancing, and predictive maintenance during battery formation to extend battery life.

France’s market is projected to grow at a CAGR of 18.5% from 2025 to 2035, driven by European EV mandates and the expansion of lithium-ion battery production for automotive and stationary storage applications. Demand for precision formation and testing equipment, such as cyclers, impedance analyzers, and safety testers, is rising to ensure compliance with EU quality and safety standards. Industrial adoption is concentrated around automotive hubs in Île-de-France, Auvergne-Rhône-Alpes, and Occitanie. Companies are increasingly investing in high-throughput and automated formation systems to optimize battery cycle times and consistency. France is also witnessing collaborations with German and Italian equipment manufacturers for advanced testing solutions. Sustainability-oriented OEMs emphasize performance testing, thermal monitoring, and end-of-line quality assurance to improve battery efficiency and lifespan.

The UK market is expected to expand at a CAGR of 16.7% from 2025 to 2035, supported by growth in electric mobility and large-scale EV battery assembly plants. Lithium-ion battery OEMs are investing in automated formation cyclers, capacity testers, and safety analyzers for consistent quality and regulatory compliance. Industrial clusters around Birmingham, Coventry, and Sunderland are driving the adoption of high-capacity formation lines with integrated thermal management and predictive testing features. Government incentives for EV adoption and battery R&D funding are accelerating domestic manufacturing of formation and testing equipment. OEMs also prioritize real-time monitoring and energy efficiency during battery formation to improve performance and reduce cycle times. Leasing models for high-end testing equipment are gaining traction among small and mid-sized battery producers.

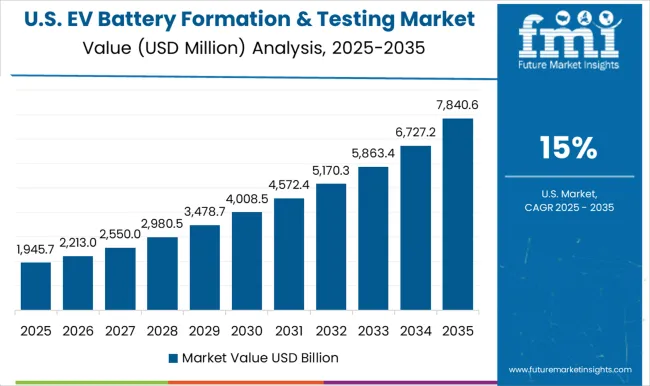

The USA market is projected to grow at a CAGR of 15.0% from 2025 to 2035, driven by expanding EV production, energy storage projects, and government incentives under the Inflation Reduction Act. Lithium-ion battery manufacturers are increasingly adopting high-throughput formation cyclers, capacity testers, impedance measurement systems, and thermal management solutions to ensure battery performance, safety, and longevity. Industrial clusters in Michigan, California, and Texas are deploying automated and modular formation lines for EV, stationary, and utility-scale storage batteries. OEMs are integrating real-time data monitoring, predictive maintenance, and process analytics to improve yield and reduce cycle time. Domestic suppliers are also scaling production of testing and formation equipment to meet growing demand from automotive and energy storage sectors.

Competition in the electric vehicle battery formation and testing market is defined by precision, throughput, and data accuracy. Chroma ATE Inc. leads with high-speed formation systems, programmable charge-discharge units, and scalable test platforms for lithium-ion and next-generation EV batteries. Ador Digatron Pvt. Ltd. focuses on turnkey solutions with automated handling, integrated data acquisition, and modular testing configurations for R&D and production lines. Arbin Instruments differentiates through flexible channel configurations, advanced cycling protocols, and software analytics supporting battery chemistry innovation. AVL emphasizes large-scale formation systems with temperature control and high current capability for automotive OEM validation. Bitrode Corporation specializes in formation, testing, and aging solutions for high-capacity cells, emphasizing reproducibility and compliance with international battery standards. Keysight Technologies offers high-precision battery testers with real-time monitoring, communication interfaces, and high-speed data logging.

Maccor Inc. competes with fully automated formation and testing stations optimized for throughput, safety, and integration with production line software. Strategies focus on scalability, automation, and compliance with industry standards. Multi-channel systems, modular racks, and flexible test sequences are used to accommodate varying battery sizes and chemistries.

Thermal management, precision current control, and cycle life prediction are emphasized to enhance battery quality and efficiency. Remote monitoring, predictive maintenance, and integration with battery management systems are increasingly offered to support OEMs and cell manufacturers.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.6 Billion |

| Component | Formation system, Testing system, and Software solutions |

| Battery | Li-ion, Solid-state, Lead-acid, and Nickel-metal hydride |

| Electric Vehicle | Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), and Hybrid Electric Vehicles (HEVs) |

| End User | Battery manufacturers, Automotive OEMs, Third-party testing service providers, and EV charging infrastructure companies |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Chroma ATE Inc., Ador Digatron Pvt. Ltd., Arbin Instruments, AVL, Bitrode Corporation, Keysight Technologies, and Maccor Inc. |

| Additional Attributes | Dollar sales by system type (formation, testing, aging), battery chemistry (lithium-ion, solid-state, lead-acid, nickel-metal hydride), and end-use (automotive OEMs, battery manufacturers, research institutions). Demand is driven by EV adoption, government incentives, and advancements in battery technology. Regional trends indicate strong growth in North America, Europe, and Asia-Pacific, with Asia-Pacific leading due to large-scale EV production and battery manufacturing hubs. |

The global electric vehicle battery formation and testing market is estimated to be valued at USD 2.6 billion in 2025.

The market size for the electric vehicle battery formation and testing market is projected to reach USD 13.3 billion by 2035.

The electric vehicle battery formation and testing market is expected to grow at a 17.6% CAGR between 2025 and 2035.

The key product types in electric vehicle battery formation and testing market are formation system, formation chargers, control system, testing system, battery cyclers, battery testing equipment, others and software solutions.

In terms of battery, li-ion segment to command 52.6% share in the electric vehicle battery formation and testing market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electric Aircraft Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electric Traction Motor Market Forecast Outlook 2025 to 2035

Electric Off-Road ATVs & UTVs Market Size and Share Forecast Outlook 2025 to 2035

Electric Blind Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Electric Fireplace Market Size and Share Forecast Outlook 2025 to 2035

Electric Glider Market Size and Share Forecast Outlook 2025 to 2035

Electric Power Steering Motors Market Size and Share Forecast Outlook 2025 to 2035

Electric Motor Market Size and Share Forecast Outlook 2025 to 2035

Electric Gripper Market Size and Share Forecast Outlook 2025 to 2035

Electric Boat Market Size and Share Forecast Outlook 2025 to 2035

Electric Bicycle Market Size and Share Forecast Outlook 2025 to 2035

Electrical Enclosure Market Size and Share Forecast Outlook 2025 to 2035

Electrical Sub Panels Market Size and Share Forecast Outlook 2025 to 2035

Electric Cargo Bike Market Size and Share Forecast Outlook 2025 to 2035

Electric Sub-meter Market Size and Share Forecast Outlook 2025 to 2035

Electrically Conductive Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Electrically-Driven Heavy-Duty Aerial Work Platforms Market Size and Share Forecast Outlook 2025 to 2035

Electrically Actuated Micro Robots Market Size and Share Forecast Outlook 2025 to 2035

Electrically Conductive Coating Market Size and Share Forecast Outlook 2025 to 2035

Electric Fabric Shaver Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA