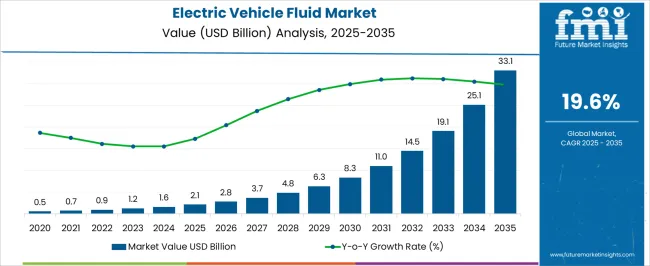

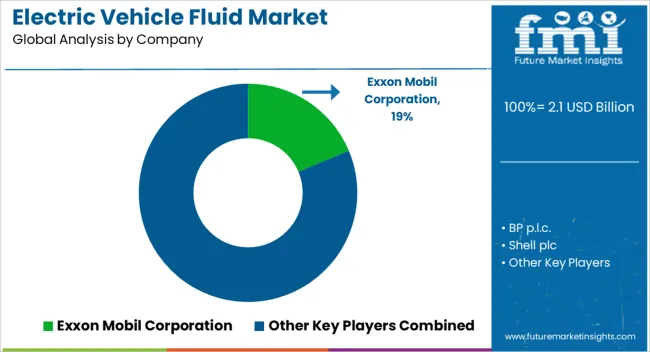

The Electric Vehicle Fluid Market is estimated to be valued at USD 2.1 billion in 2025 and is projected to reach USD 33.1 billion by 2035, registering a compound annual growth rate (CAGR) of 19.6% over the forecast period.

| Metric | Value |

|---|---|

| Electric Vehicle Fluid Market Estimated Value in (2025 E) | USD 2.1 billion |

| Electric Vehicle Fluid Market Forecast Value in (2035 F) | USD 33.1 billion |

| Forecast CAGR (2025 to 2035) | 19.6% |

The electric vehicle (EV) fluid market is expanding rapidly, driven by the accelerated adoption of EVs worldwide and the need for specialized fluids that ensure optimal performance, safety, and efficiency. Unlike conventional vehicles, EVs require fluids engineered for high electrical conductivity protection, battery cooling, and drivetrain efficiency.

The current market scenario highlights strong demand from OEMs as well as the aftermarket, with innovation in advanced thermal management solutions driving growth. Regulatory pressures to reduce emissions, combined with incentives for EV adoption, are reinforcing the need for high-performance fluids tailored to electric mobility.

The outlook remains positive as automakers and lubricant manufacturers collaborate to develop next-generation fluids that extend component life, improve energy efficiency, and enable faster charging cycles. With rising EV penetration and continuous R&D in dielectric and thermal fluids, the market is expected to witness sustained double-digit growth over the forecast period.

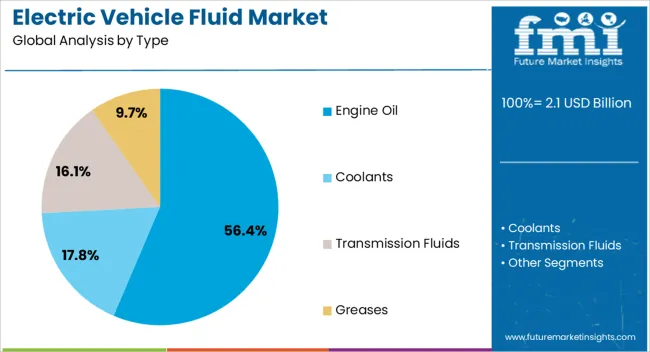

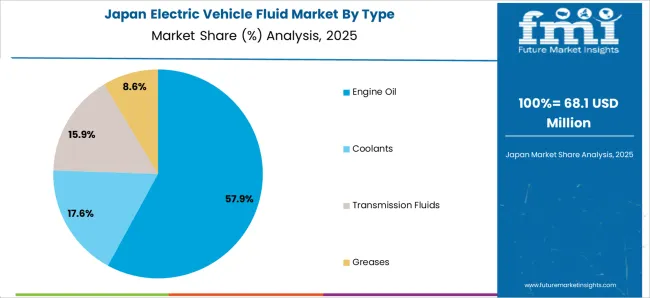

The engine oil segment leads the type category, accounting for approximately 56.40% share of the EV fluid market. This dominance is attributed to its critical role in ensuring smooth lubrication and cooling of e-motors, gearboxes, and bearings in electric vehicles.

Specialized formulations have been designed to reduce wear, manage higher torque loads, and provide thermal stability under varying operating conditions. Growth in this segment is reinforced by OEM specifications requiring advanced e-fluids tailored to EV drivetrains, which differ significantly from traditional combustion engines.

The integration of high dielectric strength and oxidation stability properties has strengthened adoption. As vehicle electrification intensifies, demand for advanced engine oils is expected to remain high, with continued innovation enhancing efficiency and protecting critical components.

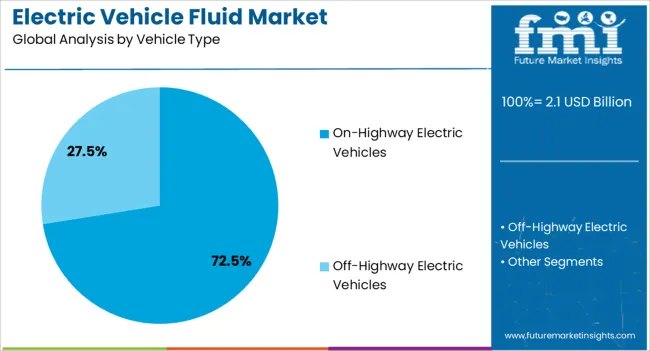

The on-highway electric vehicles segment dominates the vehicle type category, representing approximately 72.50% share of the EV fluid market. This segment’s prominence is driven by the rising penetration of passenger cars, buses, and heavy-duty trucks, which collectively account for the majority of EV sales globally.

On-highway applications require advanced fluids capable of managing long operational cycles, thermal load balancing, and drivetrain protection under varied driving conditions. Expanding infrastructure for electric mobility, coupled with regulatory support for commercial fleet electrification, has further stimulated growth.

With on-highway electrification accelerating across regions, this segment is projected to sustain its dominance in the coming years.

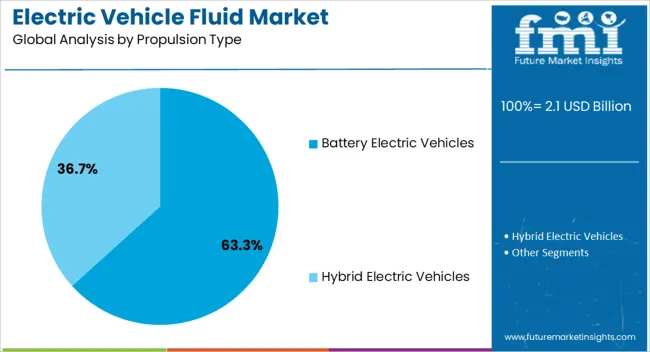

The battery electric vehicles (BEV) segment leads the propulsion type category with approximately 63.30% share, reflecting the rapid global adoption of fully electric platforms. BEVs rely heavily on advanced fluid technologies for battery thermal management, electronic insulation, and gearbox lubrication, making fluids a critical enabler of vehicle performance and safety.

Demand is further supported by the absence of hybrid combustion engines, which increases reliance on specialized cooling and dielectric fluids. With governments and automakers investing significantly in BEV production and charging infrastructure, the segment’s dominance is expected to strengthen.

Continuous innovation in thermal conductivity and fire-resistant fluids will ensure sustained demand for BEVs over the forecast period.

The scope for global electric vehicle fluid market insights expanded at a 36.3% CAGR between 2020 and 2025. The market is anticipated to develop at a CAGR of 31.7% over the forecast period from 2025 to 2035.

| Historical CAGR from 2020 to 2025 | 36.3% |

|---|---|

| Forecast CAGR from 2025 to 2035 | 31.7% |

From 2020 to 2025, the global market witnessed remarkable expansion with a CAGR of 36.3%. This significant growth was propelled by the surge in electric vehicle adoption worldwide, emphasizing the crucial role of specialized fluids in maintaining electric vehicles' efficient performance.

During this period, advancements in electric vehicle technology, increasing environmental consciousness, and government initiatives spurred the demand for innovative fluid solutions. The rapid pace of development showcased the dynamic nature of the market, positioning it as a pivotal segment within the broader electric vehicle ecosystem.

Looking ahead to the forecast period from 2025 to 2035, the market is poised to sustain robust growth, albeit at a slightly moderated CAGR of 31.7%. This projection indicates a continued upward trajectory, emphasizing the enduring demand for electric vehicle fluids as the market evolves.

Factors such as ongoing technological advancements, increased focus on sustainable transportation, and the expanding global electric vehicle market contribute to the optimistic forecast.

| Attributes | Details |

|---|---|

| Opportunities |

|

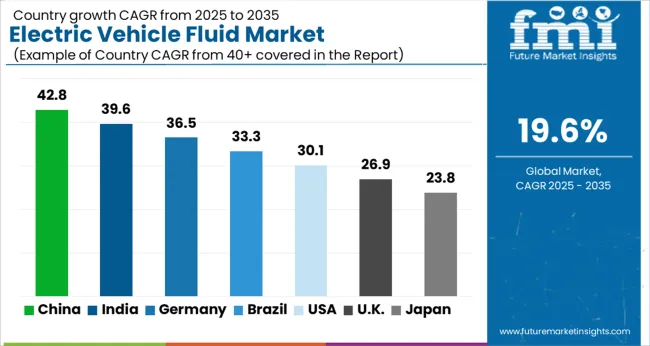

The table below showcases CAGRs from the five countries spearheaded by the United States, Japan, China, the United Kingdom, and South Korea.

The market in South Korea is dynamic and rapidly advancing, poised for significant growth with a 34.1% CAGR by 2035. Embracing innovation, the country contributes to diverse industries, showcasing a thriving landscape in its economic evolution.

The substantial adoption of electric vehicles in the United States is a key driver for the high CAGR of 32% for electric vehicle fluids. The United States witnesses robust demand due to its large electric vehicle market, driven by governmental initiatives, environmental consciousness, and consumer preference for sustainable transportation solutions.

The need for specialized fluids aligns with the commitment of the country to advancing electric mobility, fostering a high market growth rate.

Japan has a leading position in technological innovation, and its strong focus on electric mobility contributes to the notable CAGR of 33.7%. The automakers are at the forefront of electric vehicle development, necessitating advanced fluids to optimize the performance of electric drivetrains and components.

The dedication to environmental sustainability and a technologically advanced automotive industry solidifies the significant use of electric vehicle fluids within the country.

China, considered to have the largest electric vehicle market, exhibits a compelling CAGR of 32.6%. The proactive policies, substantial investments in electric vehicle infrastructure, and a burgeoning middle class contribute to the rapid adoption of electric vehicles.

The high CAGR in electric vehicle fluids reflects the crucial role in supporting ambitious goals for electric vehicle proliferation in China and underscores the essentiality of fluid solutions in the rapidly expanding electric mobility landscape.

The commitment to reducing carbon emissions and promoting sustainable transportation fuels the adoption of electric vehicles, leading to a significant CAGR of 33%.

The stringent environmental regulations of the government, coupled with incentives for electric vehicle adoption, drive the need for specialized fluids to enhance the performance and efficiency of electric vehicles. The emphasis on green mobility positions electric vehicle fluids as integral components in achieving their sustainable transportation objectives.

The notable CAGR of 34.1% in South Korea reflects its strong push towards electric vehicle integration. The major automotive manufacturers actively invest in electric mobility solutions, driving the demand for advanced fluids.

Government support, coupled with a growing awareness of environmental issues, fosters the adoption of electric vehicles. The high CAGR underscores the critical role of electric vehicle fluids in supporting endeavors toward sustainable and eco-friendly transportation in South Korea.

The table below provides an overview of the electric vehicle fluid landscape on the basis of product type and vehicle type. Engine Oil is projected to lead the product type of market at a 31.5% CAGR by 2035, while on-highway electric vehicles in the vehicle type category are likely to expand at a CAGR of 31.3% by 2035.

One reason engine oil is prominent in the electric vehicle fluid landscape is the need for specialized lubricants that cater to the unique requirements of electric drivetrains.

The increasing adoption of electric propulsion systems for public road transportation is driving the significance of on-highway electric vehicles in the electric vehicle fluid landscape.

| Category | CAGR until 2035 |

|---|---|

| Engine Oil | 31.5% |

| On-highway Electric Vehicles | 31.3% |

Engine Oil emerges as a leading product type within the electric vehicle fluid landscape, projected to exhibit a robust CAGR of 31.5% by 2035. Despite the name, Engine Oil in this context pertains to lubricants designed for the various moving parts within electric vehicles, excluding traditional internal combustion engines.

Specialized lubricants play a critical role in enhancing the efficiency and longevity of components such as electric motors and transmissions. The high CAGR underscores the increasing demand for advanced lubrication solutions tailored to the unique requirements of electric drivetrains, reflecting the dynamic nature of the market.

In the vehicle type category, the on-highway electric vehicles segment is anticipated to experience substantial growth with a projected CAGR of 31.3% by 2035. This segment encompasses electric vehicles designed for public roads, including electric cars, buses, and trucks.

The remarkable CAGR emphasizes the accelerating adoption of electric propulsion systems in on-highway transportation. The growth in this category is propelled by factors such as government incentives, environmental regulations, and a shifting automotive landscape towards sustainable mobility.

As electric vehicles become increasingly prevalent in on-road applications, the demand for specialized fluids, including lubricants and cooling solutions, is set to surge, contributing to the overall expansion of the market.

The competitive landscape of the electric vehicle fluid market is marked by the presence of key players vying for market share and technological leadership. The landscape is characterized by continuous research and development initiatives, focusing on formulating specialized fluids to meet the evolving demand forelectric vehicles.

Strategic collaborations, partnerships, and product launches are common strategies as companies aim to stay ahead in this dynamic market. As electric vehicle technology advances, competition intensifies, prompting companies to differentiate their offerings through innovations in fluid solutions that enhance the efficiency and performance of electric drivetrains, batteries, and cooling systems.

Overall, the competitive landscape reflects a dynamic industry where key players strive for innovation and market leadership to address the growing requirements of the expanding electric vehicle market.

Some recent developments are as follows:

| Attributes | Details |

|---|---|

| Estimated Market Size in 2025 | USD 1.6 billion |

| Projected Market Valuation in 2035 | USD 25.5 billion |

| CAGR Share from 2025 to 2035 | 31.7% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD billion |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania; Middle East and Africa |

| Key Market Segments Covered | By Product Type, By Vehicle Type, By Propulsion Type, By Fill Type, By End-use, By Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Rest of Latin America, Germany, Italy, France, The United Kingdom, Spain, Russia, BENELUX, Rest of Europe, China, Japan, South Korea, India, Thailand, Malaysia, Indonesia, Rest of South Asia, Australia, New Zealand, GCC Countries, Rest of the Middle East and Africa |

| Key Companies Profiled | Exxon Mobil Corporation; BP p.l.c.; Shell plc; FUCHS; TotalEnergies; Petroliam Nasional Berhad (PETRONAS); Saudi Arabian Oil Co.; Repsol; PTT LUBRICANTS; ENEOS Corporation |

The global electric vehicle fluid market is estimated to be valued at USD 2.1 billion in 2025.

The market size for the electric vehicle fluid market is projected to reach USD 33.1 billion by 2035.

The electric vehicle fluid market is expected to grow at a 19.6% CAGR between 2025 and 2035.

The key product types in electric vehicle fluid market are engine oil, coolants, transmission fluids and greases.

In terms of vehicle type, on-highway electric vehicles segment to command 72.5% share in the electric vehicle fluid market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electric Aircraft Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electric Traction Motor Market Forecast Outlook 2025 to 2035

Electric Off-Road ATVs & UTVs Market Size and Share Forecast Outlook 2025 to 2035

Electric Blind Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Electric Fireplace Market Size and Share Forecast Outlook 2025 to 2035

Electric Glider Market Size and Share Forecast Outlook 2025 to 2035

Electric Power Steering Motors Market Size and Share Forecast Outlook 2025 to 2035

Electric Motor Market Size and Share Forecast Outlook 2025 to 2035

Electric Gripper Market Size and Share Forecast Outlook 2025 to 2035

Electric Boat Market Size and Share Forecast Outlook 2025 to 2035

Electric Bicycle Market Size and Share Forecast Outlook 2025 to 2035

Electrical Enclosure Market Size and Share Forecast Outlook 2025 to 2035

Electrical Sub Panels Market Size and Share Forecast Outlook 2025 to 2035

Electric Cargo Bike Market Size and Share Forecast Outlook 2025 to 2035

Electrical Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Electric Sub-meter Market Size and Share Forecast Outlook 2025 to 2035

Electrical Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Electrically Conductive Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Electrically-Driven Heavy-Duty Aerial Work Platforms Market Size and Share Forecast Outlook 2025 to 2035

Electrically Actuated Micro Robots Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA