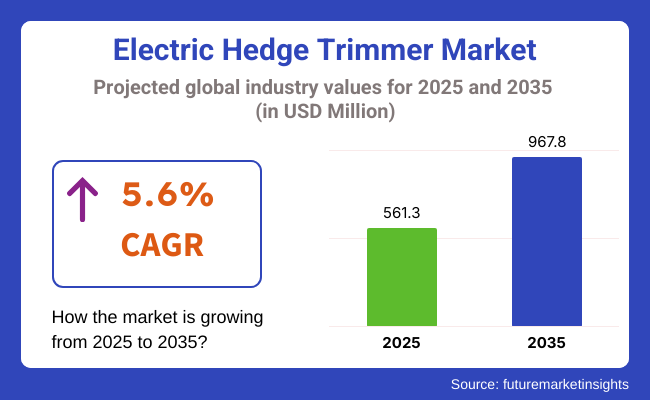

The electric hedge trimmer market is anticipated to rise gradually, its value reaching around USD 561.3 million in 2025, as estimated, with the value projected to be nearly USD 967.8 million by 2035, with a growth of about 5.6% CAGR. This increase is a result of increased demand for gardening in homes, urban landscaping, and green grass machines.

Increased demand for do-it-yourself home and landscape gardening is one of the largest industry drivers. Homeowners have been increasing their spending on outdoor spaces, particularly since the pandemic when the world went indoors. These trimmers are convenient to use, require low maintenance, and are less noisy compared to older gas-powered equipment-making them a great fit for domestic usage.

The commercial landscaping industry is also growing as urbanization creates the demand for green spaces in cities, resorts, corporate parks, and public spaces. Landscaping contractors like electric models because they emit fewer pollutants, reduce noise, and allow for improved employee ergonomics in areas with noise sensitivities.

Technologies are enhancing performance and customer experience. Lithium-ion battery-powered cordless trimmers are becoming popular due to their handheld portability, fast charging, and longer runtime. Brushless motor technologies also improve efficiency, reliability, and cutting capability, making battery-powered equipment more viable for competition with fuel-powered equipment.

The industry is also fueled by increasing environmental concern and regulation to lower emissions from small engines. In states such as California, strict regulations on gas-powered gardening equipment are spurring the move to electric, opening up new industries for environmentally friendly product lines.

The industry is challenged by constrained cutting time and duration of some entry-level battery-powered trimmers, particularly in high-end commercial or extensive-area applications. Also, price sensitivity in emerging industries will potentially affect the uptake of premium-priced battery-operated variants.

These challenges are being met by manufacturers in the form of multi-speed settings, replaceable batteries, and ergonomic lightweight models to appeal both to user groups and professionals. Incorporation of smart features like power display, noise-reduction technology, and safety lock is adding to appeal and usability across segments.

The industry is growing robustly, fueled by demands for more efficient and environmentally friendly garden tools. The evolving technology for battery, including lithium-ion batteries, has improved the power and ease of use of electric hedge trimmers and positioned them as the choice over their gas-powered counterparts.

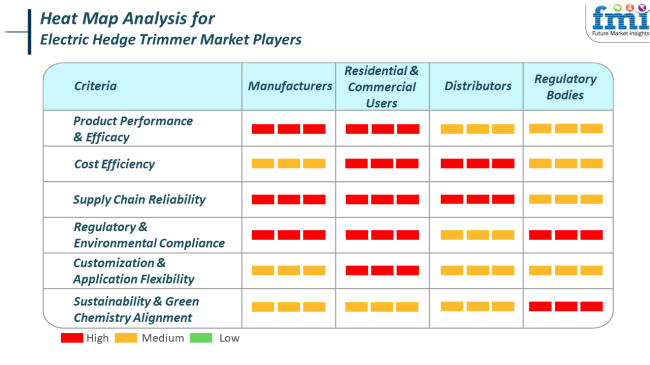

Manufacturers are emphasizing the production of lighter, ergonomic designs with enhanced battery life and cut efficiency. Innovations such as laser-cut and diamond-ground blades are being proposed to serve the varied consumer requirements.

Residential & Commercial Users value tools with ease of use, minimal maintenance, and eco-friendliness. The movement towards sustainable living has made it easier to use electric hedge trimmers in domestic landscapes and commercial landscaping projects.

Distributors emphasize the importance of having a stable supply chain to meet the growing demand. They focus on offering a diverse range of products that are suitable for different applications while ensuring timely delivery and competitive prices.

Regulatory agencies enforce compliance with environmental and safety standards, driving companies to adopt green and sustainable gardening practices. They play a critical role in shaping the industry by adopting policies that encourage the use of green technologies and reduce the environmental footprint of gardening practices.

Between 2020 and 2024, the industry grew at a steady rate, fueled by growing residential gardening activities and increasing demand for do-it-yourself (DIY) gardening instruments. Urban residence owners and lawn care service firms moved towards electric hedge trimmers because they were easy to operate, required low maintenance, and produced less noise than gas-fueled competitors.

Corded types continued to have popularity in backyard gardens on a small scale, whereas battery models started to increase with the improved performance of lithium-ion batteries. There was also environmental awareness with consumers demanding less emission-producing tools and higher efficiency. Nonetheless, battery limitations regarding power and duration of usage continued to limit large-scale application.

From 2025 up to 2035, the industry will change drastically. Battery technology will keep improving, providing longer runtime and quicker charge times, and cordless models will become the choice in both the commercial and residential landscaping industries.

More emphasis will be placed on smart integration with technologies like app-based controls, battery gauges, and even AI-driven trimming assistance. Designers will concentrate on noise-reducing, lightweight, and ergonomic designs to maximize user comfort.

Sustainability projects will drive more use of recycled content and sustainable packaging. Urban green space management expansion and tighter environmental controls will drive further demand for high-efficiency, low-emission electric equipment, further pushing industry innovation and adoption.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Increased residential gardening, DIY activity, and quieter, low-maintenance tool preference. | Focus on sustainability, integration of intelligent technology, and increased battery power. |

| Cord models for limited backyard gardens; reduced usage of cordless based on battery limitations. | Cordless models sweep the industry owing to advanced lithium-ion batteries and adaptive uses. |

| Evolution of minor enhancements to battery life and cutting blade effectiveness. | Intelligent options such as application connectivity, artificial intelligence-facilitated trimming, and greater safety regulation. |

| Homeowners and small operators favor small, cheap tools. | High-end cordless models with sophisticated controls are adopted increasingly by professional landscapers. |

| Limited manufacturer response and growing concern with sustainable design and packaging. | Large-scale adoption of green manufacturing procedures and encouragement to use recyclable, eco-friendly materials. |

| North America and European demand increase in garden culture and suburbanization. | Growing in Asia-Pacific and Latin America with growing interest in urban landscaping and improvement in affordability. |

The industry is faced with various pressing threats in 2024, most of which stem from its reliance on lithium-ion battery technology. Battery-powered products drive consumer demand, but supply chain risk for raw materials such as lithium and cobalt has introduced uncertainty to costs and availability of production.

Additionally, the sector is under growing pressure from increasing global scrutiny of environmental and safety levels. Electric trimmer manufacturers are compelled to achieve new standards of noise emissions, recycling, and secure battery disposal.

Noncompliance with such legislation can incur fines from the regulatory authorities as well as reputational damage, particularly in the North American and European industries where compliance with ecological demands is not a matter for discussion.

Another major risk is increasing competition from established power tool brands and new players with new features or lower prices. Such a hypercompetitive landscape necessitates continuous R&D expenditure, putting pressure on margins. Slow-moving brands-be it in ergonomics, power efficiency, or smart connectivity-can lose industry share rapidly.

Consumer behavior contributes to further uncertainty. The industry is highly dependent on discretionary home improvement expenditure, which can easily be derailed by macroeconomic slumps. Additionally, electric hedge trimmers are seasonal products, and their sales are highest in spring and summer seasons.

In the industry, approximately 65% of the share is held by the gardening segment, which is predicted to drive sales in 2025, leaving a margin of 35% for commercial applications. Gardening is probably becoming the latest activity among homeowners, mostly in urban and suburban settings, which contributes to the rapid increase in the use of residential landscaping tools. This is due to the use of electric hedge trimmers for convenience in handling, less maintenance, and being eco-friendly.

Users are now gradually switching to cordless electric types when it comes to residential use, as they are proven to be more functional when it comes to portability due to their soundless operation. Prime examples of these companies in this section are WORX, EGO Power+, and Einhell. WORX, for example, industries the WG261 20V PowerShare hedge trimmer as a lightweight yet efficient tool for performing light-duty trimming: "ideal for hobbyist gardeners." Similarly, Einhell offers the GE-CH 1846 Li, a new compact battery-driven matched tool that can manage accurate, low-noise trimming in domestic gardens.

The commercial segment pays much attention to heavy-duty tools for long periods of continuous use: landscape maintenance companies, golf parks, parks departments, and caretakers of large estates. DEWALT, Milwaukee Tool, and Oregon Tool are doing quite well in this segment.

DEWALT has developed a hedge trimmer that professional landscapers can use for the long-lasting and high-output device it offers with the 60V MAX hedge trimmer. The M18 FUEL hedge trimmer from Milwaukee Tool is yet another commercial-grade offering, promising high durability and quick work completion for large-scale trimming.

Innovation continues in both segments as the industry pushes towards greener tools. Oregon Tool, well-known for chainsaws, has entered the hedge trimmer industry with electric counterparts running the fine line between performance and environmental compliance.

The growth of this industry also comes from various incentives for using electric landscaping tools in some parts, such as California and the EU, where the ban on gas-powered tools accelerates adoption. All in all, continuous product innovations, better battery technology, and higher awareness of sustainability are what progress the industry forward.

It is predicted that in 2025, based on blade type, the industry will be led by laser-cut blades, accounting for an estimated share of 55% of the total industry, while diamond-ground blades will aggregate the remaining 45%. The growing preference for laser-cut blades can be attributed to their more exact manufacturing processes, which result in sharper, more durable blades for cleaner and more accurate cuts.

This is especially important for those who hedge and maximize aesthetics and detail in their work. These blades have a very good application, both for residential DIY users and professionals looking for smoother operation with cutting-edge performance.

Brands like Bosch and Makita have ushered in this electric hedge trimmer OEMs into laser-cut technology. For example, Bosch has an AHS 70-34 model, which has laser-cut, diamond-ground blades and cuts high thick branches at a much higher efficiency. Another highly popular model in this category is Makita's DUH523Z cordless hedge trimmer, which promises to deliver laser precision together with a sturdy battery operation.

Diamond ground blades make up a sizable 45% of the industry but are appreciated for much longer-lasting use and cleaving quality. These blades are ground through a high-precision grinding process, which creates a razor-sharp edge capable of holding cutting performance over very long periods of use.

These are particularly esteemed in commercial landscaping, being very sturdy and able to cut through tightly packed foliage. As one of the giants dealing in outdoor power equipment, STIHL brings forth trimmers such as the HSA 56, boasting diamond-ground blades for professional results with less vibration.

EGO Power+ and BLACK+DECKER have models featuring exchangeable blade systems, allowing one to mix and match blade types depending on the trimming requirements of the user. Blade technology is doing wonders in terms of comfort for the commercial industry and noise reduction, and thus, it has a wider appeal among casual users. This sugar coats greater efficiency and environments for which blade quality remains an important differential factor in product choice.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 6.2% |

| UK | 5.4% |

| France | 5.7% |

| Germany | 6 % |

| Italy | 5.1% |

| South Korea | 4.9% |

| Japan | 4.7% |

| China | 7.1% |

| Australia-NZ | 5.3% |

The USA is projected to grow at a rate of 6.2% CAGR through the analysis period. The rising adoption of low-maintenance electric gardening tools among suburban dwellers as well as landscaping professionals is expected to drive the industry. Advantageous environmental regulations and a transition to battery-operated trimmers that cut down on emissions are further reinforcing industry adoption.

Technological innovation - including more efficient cordless and ergonomic products with longer battery life - is improving usability and driving consumer interest. In addition, a well-established retail distribution network and the presence of major players play a considerable role in getting into the industry.

Another catalyst for growth is the increasing spending on both home improvement projects and landscaping aesthetics among the urban population. Government rebates on electric garden equipment in some states are also hastening the switch from gasoline-powered tools to electric ones.

The UKindustry is projected to show growth at a pace of 5.4% from 2025 through 2035. Two factors driving this trend are the transition to sustainable home gardening practices and the rise in compact outdoor spaces in urban and suburban areas. Increasing awareness of noise and air pollution due to conventional fuel-based tools will support the demand for electric hedge trimmers.

The modern urbanist lifestyle also increases adoption; as urban dwellers invest more in sustainable gardening solutions today. More garden experts in the industry are also making energy-savvy, cordless electric products available that are ideal for the small garden sizes that most UK households are used to.

In fact, a strong focus on cleantech in policies further incentivizes consumers to opt for electric models as opposed to gas-powered variants. Access is expanded by retail chains and e-commerce platforms selling cheap product bundles.

The French industry is estimated to register a 5.7% CAGR in the study period. Factors such as the strong cultural inclination of French consumers towards gardening and the high adoption of eco-friendly practices among consumers are creating ideal conditions for the industry in France.

The country’s weather enables seasonal landscaping needs, and this generates periodic demand for these tools. Improvements in battery technology and a growing preference for quiet, lightweight models are playing with domestic expectations of efficiency and comfort.

Electric versions are starting to become popular with landscaping companies as well for regulatory compliance and to reduce operational emissions. Institutional buyers are being encouraged to opt for electric trimmers thanks to awareness campaigns promoting green gear in urban settings. And an expanding network of local retailers is making high-end, battery-powered tools more available to residential users.

The German industry is anticipated to register a growth of 6% CAGR over the forecast period. Strong customer preference for precision landscaping equipment and robust DIY gardening culture are key drivers of growth. The German industry prefers long-lasting, high-quality tools, and electric hedge trimmers with improved safety features and optimized blade systems fulfill those preferences.

Harsh emissions regulations are pushing consumers towards switching from gasoline-powered products to environmentally friendly electric ones. The availability of globally known brands producing locally guarantees both innovation and confidence.

Consumer preference is moving toward smart garden equipment with automation and app-based operation, driving industry growth. Excessive demand for seasonal trimming services in urban residential areas is also generating steady commercial use cases, contributing to the volume growth.

The Italian industry is anticipated to register a growth of 5.1% CAGR throughout the study. With a growing emphasis on aesthetic gardening and heritage landscaping in both urban and rural homes, there is an increasing demand for efficient and quiet hedge trimmers.

Consumers are becoming more interested in easy-to-use tools to take care of small to medium-sized hedges without producing high levels of noise or fumes. The existence of small electric models caters well to Italian garden schemes, which tend to focus on style and efficiency in small spaces.

Festivals during seasonal periods and outdoor recreation have helped sustain landscape looks, hence raising the application of such equipment. Small landscaping and property maintenance businesses are also adopting battery-powered hedge trimmers to cut expenses and meet changing green practices.

The South Korean industry is anticipated to expand at 4.9% CAGR throughout the research period. The nation is experiencing increasing consumer demand for home improvement devices, such as electric hedge trimmers.

With urban centers continuing to develop rooftop gardens and community garden areas, demand for light and simple-to-use equipment is increasing. South Korean customers are technology-advanced, and the penetration of smart features like cordless functionality, digital displays of power consumption, and safety locks is picking up industry momentum.

Additionally, government policies to encourage eco-friendly tools as a part of carbon reduction initiatives are establishing a supporting policy framework. The availability of local electronics and appliance companies moving into this space is expected to drive product development and competitive pricing.

The Japanese industry is forecast to rise at 4.7% CAGR from the period under study. Neatly groomed hedge appearance and the culture of keeping closely trimmed hedges in conventional dwellings are the most important drivers in demand for electric hedge trimmers. Intense demands on ergonomics, accuracy, and low noise dominate the industry.

Older consumers are most susceptible to electric forms that are more convenient to handle and have very low maintenance requirements. Policies at the regulatory level favoring electric equipment as opposed to gasoline-based equipment are encouraging retailers to introduce more electric product lines.

Lighter, rechargeable units providing consistent performance are attractive to domestic and small-commercial users alike. Innovation in battery and blade design is further refining product performance, ensuring continuous growth.

The Chinese industry is anticipated to grow at 7.1% CAGR over the study period. Urbanization and rising disposable income are boosting consumer expenditure on landscaping and gardening tools for personal use. The spread of suburban housing and home gardening as a growing trend in metropolitan cities is driving the industry strongly.

Local manufacturers are significantly investing in electric gardening tools, fueling the high availability of products and price competitiveness. Furthermore, policy frameworks that promote the curtailment of fossil fuel consumption in equipment and machinery are at the forefront of facilitating the shift to electric hedge trimmers. Online retail models and e-commerce platforms are also driving product visibility and consumer access, making a wave of demand across industries possible.

The Australia-New Zealand industry is anticipated to grow at a 5.3% CAGR over the study period. Outdoor living and extensive gardening culture in both countries play a vital role in fueling the robust demand for electric hedge trimmers. The industry is witnessing rising consumer inclination toward cordless, low-noise, and eco-friendly tools ideal for large as well as small properties.

Advances in the performance of lithium-ion batteries and longer usage intervals fuel the increasing use of battery-powered models. Landscaping companies providing services for homes and businesses also are replacing equipment to meet environmental standards. In addition, consumer interest in doing-it-yourself gardening projects and favorable climatic conditions for a large part of the year establish a stable base of customers.

The industryis in strong competition as established power tool manufacturers and garden equipment specialists compete for shares in the industry. Husqvarna, STIHL as well as Robert Bosch manufacture hedge trimmers for the residential and commercial sectors based on their brand recognition and technological expertise.

They all invest in advanced motor technology, battery efficiency, and ergonomic designs among the products so that their customers can find a hedge trimmer that truly suits them even in such a crowded marketplace.

Innovations in battery-powered hedge trimmers have now focused more on companies such as GreenWorks Tools and Makita on endurance lithium-ion battery technology and brushless motors for higher power efficiency.

Husqvarna and STIHL boast smart connectivity features that allow users to track battery life and consumption to achieve optimal cut performance via mobile applications. Innovations also include noise suppression and vibration restrictions.

Companies have thus made industry expansion possible with strategic alliances and acquisitions, for example, through brand and targeted acquisitions within outdoor power equipment, such as Stanley Black & Decker. American Honda Motor and The Toro Company will keep focusing on their highly existing customer base. They will continue to expand hedge trimmer offerings in lightweight, easy-to-handle, and environmentally friendly models.

Global expansion continues to be a central strategy for companies targeting emerging industries in the Asia-Pacific and Latin America. Zhejiang Zomax Garden Machinery and Flymo take advantage of local manufacturing capabilities to provide competitively priced hedge trimmers. In contrast, STIHL and Husqvarna maintain their strong presence in North America and Europe by leveraging dealership networks and retail partnerships to enhance their distribution.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Husqvarna | 20-25% |

| STIHL | 15-20% |

| Robert Bosch | 12-17% |

| GreenWorks Tools | 8-12% |

| Stanley Black & Decker | 5-9% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Husqvarna | Develops smart hedge trimmers with long battery life and IoT integration. |

| STIHL | It offers high-power electric hedge trimmers that reduce noise and vibration. |

| Robert Bosch | Focuses on lightweight, ergonomic hedge trimmers with precision cutting. |

| GreenWorks Tools | Specializes in battery-powered hedge trimmers with extended runtime. |

| Stanley Black & Decker | Expands through acquisitions and brand diversification in garden equipment. |

Key Company Insights

Husqvarna (20-25%)

Husqvarna leads the industry with smart electric hedge trimmers, incorporating IoT-based battery monitoring and optimized power efficiency.

STIHL (15-20%)

STIHL emphasizes high-performance electric hedge trimmers, integrating noise reduction and ergonomic features for professional landscapers.

Robert Bosch (12-17%)

Robert Bosch provides lightweight, user-friendly hedge trimmers with precision blades for residential and commercial applications.

GreenWorks Tools (8-12%)

GreenWorks Tools specializes in cordless hedge trimmers with advanced lithium-ion batteries, catering to eco-conscious consumers.

Stanley Black & Decker (5-9%)

Stanley Black & Decker expands its outdoor power tools segment through strategic acquisitions and brand diversification.

Other Key Players (30-40% Combined)

By application, the industry is categorized based on application into gardening and commercial applications.

By blade type, the industry is segmented by blade type into laser cut and diamond ground variants.

By size of hedge, the segments include small, medium, and large.

By length of blade, the industry is classified by blade length into up to 46 cm, from 47 to 56 cm, and 57 cm or more.

Geographically, the industry is divided into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East and Africa.

The industry is estimated to reach USD 561.3 million by 2025.

The industry is projected to grow to USD 967.8 million by 2035.

China is expected to have a 7.1% CAGR.

The gardening segment is the dominant product type in the industry, with electric hedge trimmers widely used for residential and commercial gardening.

Key players include Husqvarna, STIHL, Robert Bosch, GreenWorks Tools, Stanley Black & Decker, American Honda Motor, ECHO, The Toro Company, Blount International, Ernak, Makita, MTD, RYOBI, Zhejiang Zomax Garden Machinery, and Flymo.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electric Vehicle Sensor Market Forecast and Outlook 2025 to 2035

Electric Vehicle Motor Market Forecast and Outlook 2025 to 2035

Electric Off-Road ATVs & UTVs Market Size and Share Forecast Outlook 2025 to 2035

Electric Blind Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Electric Fireplace Market Size and Share Forecast Outlook 2025 to 2035

Electric Glider Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Battery Conditioners Market Size and Share Forecast Outlook 2025 to 2035

Electric Power Steering Motors Market Size and Share Forecast Outlook 2025 to 2035

Electric Motor Market Size and Share Forecast Outlook 2025 to 2035

Electric Gripper Market Size and Share Forecast Outlook 2025 to 2035

Electric Boat Market Size and Share Forecast Outlook 2025 to 2035

Electric Bicycle Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Transmission Market Size and Share Forecast Outlook 2025 to 2035

Electrical Enclosure Market Size and Share Forecast Outlook 2025 to 2035

Electrical Sub Panels Market Size and Share Forecast Outlook 2025 to 2035

Electric Cargo Bike Market Size and Share Forecast Outlook 2025 to 2035

Electrical Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Electric Sub-meter Market Size and Share Forecast Outlook 2025 to 2035

Electric Light Commercial Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Fluid Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA