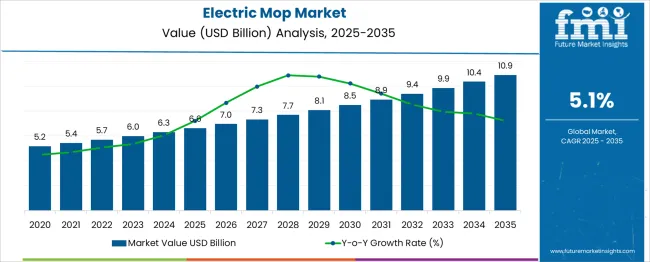

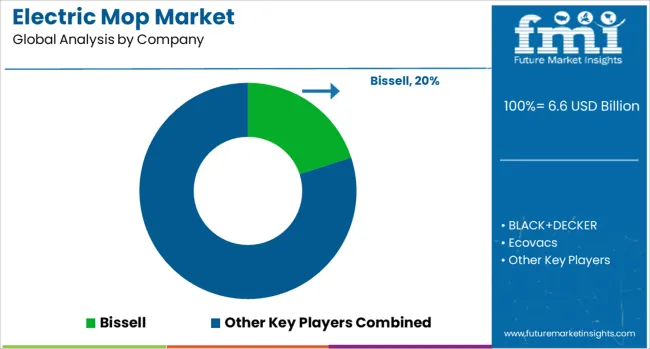

The electric mop market is estimated to be valued at USD 6.6 billion in 2025 and is projected to reach USD 10.9 billion by 2035, registering a compound annual growth rate (CAGR) of 5.1% over the forecast period.

The electric mop market is projected to move from USD 6.6 billion in 2025 to USD 10.9 billion in 2035, reflecting a compound annual growth rate of 5.1%. The growth momentum over these 10 years appears steady, with incremental year-over-year value additions ranging between USD 0.3 billion and USD 0.5 billion. The upward trend is primarily shaped by increasing household acceptance of automated floor cleaning equipment, particularly in apartment-centric urban spaces. Consumer adoption is increasingly influenced by convenience features such as auto-dispense systems, swivel steering, and dual-tank mechanisms. Between 2025 and 2030, the market will add USD 1.9 billion, supported by replacement demand for traditional wet mops in developed regions.

Between 2030 and 2035, the market adds USD 2.4 billion, showing slightly stronger momentum as the product transitions from an early-adoption phase to a utility-grade category. Cordless electric mops with rechargeable lithium-ion batteries are being favored due to minimal setup time and suitability for multi-surface cleaning. Improved unit economics are reducing consumer hesitation, especially in mid-income brackets. Markets in East Asia and Eastern Europe are recording above-average shipment volumes, while price compression in North America and Western Europe is driving multi-unit ownership per household. Industry consolidation is expected to optimize distribution models and reduce SKU overlap.

| Metric | Value |

|---|---|

| Electric Mop Market Estimated Value in (2025 E) | USD 6.6 billion |

| Electric Mop Market Forecast Value in (2035 F) | USD 10.9 billion |

| Forecast CAGR (2025 to 2035) | 5.1% |

The electric mop market is witnessing significant growth owing to increasing consumer preference for efficient and hygienic cleaning solutions. The current scenario is shaped by rising awareness of indoor air quality and hygiene, which has heightened demand for advanced cleaning devices, as highlighted in corporate press releases and product launch announcements.

Technological advancements in lightweight materials, battery efficiency, and steam generation capabilities have been observed to enhance usability and performance, encouraging adoption across residential and commercial sectors. Prospects appear promising as companies focus on sustainability, offering energy-efficient and durable products, as outlined in investor presentations and industry news.

Additionally, the increasing penetration of smart home ecosystems and rising disposable incomes are expected to drive demand further. These trends, combined with greater emphasis on convenience and time savings in household chores, have created favorable conditions for the sustained growth of the Electric Mop market globally.

The electric mop market is segmented by product, operation mode, power source, application, price, floor type, distribution channel, and geographic regions. The electric mop market is divided into steam mops and spray mops. The electric mop market is classified into Cordless electric mops, Corded electric mops, and Robotic electric mops.

The electric mop market is segmented based on power source into Battery-operated and Plug-in. The electric mop market is segmented into Residential and Commercial. The electric mop market is segmented by price into Medium, Low, and High. The electric mop market is segmented by floor type into Tile floors, Hardwood floors, Laminate floors, Marble floors, carpeted floors, and Others. The distribution channel of the electric mop market is segmented into Online and Offline. Regionally, the electric mop industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

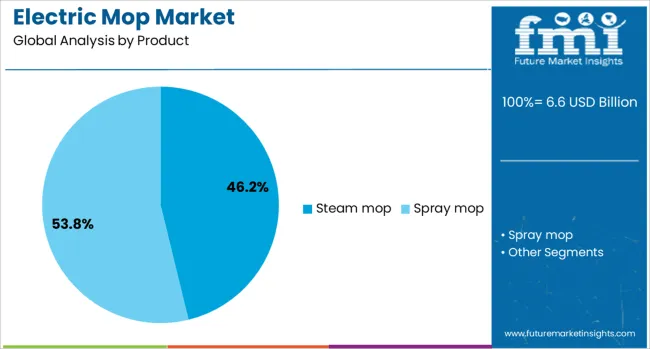

The steam mop product segment is anticipated to contribute 46.2% of the Electric Mop market revenue share in 2025, making it the largest product segment. This dominance has been supported by its ability to deliver superior sanitization without the need for chemical detergents, as emphasized in manufacturer announcements and product whitepapers.

Steam mops have been preferred by consumers due to their capability to eliminate germs and allergens effectively while maintaining user convenience. The segment has also benefited from innovations such as faster heat-up times and adjustable steam settings, which enhance user experience and efficiency.

In addition, the growing awareness about environmentally friendly cleaning solutions has been observed to further strengthen the adoption of steam mops. Retailers and brands have highlighted the increased sales of steam mops in regions where stringent hygiene standards and eco-consciousness prevail, securing its leading position in the market.

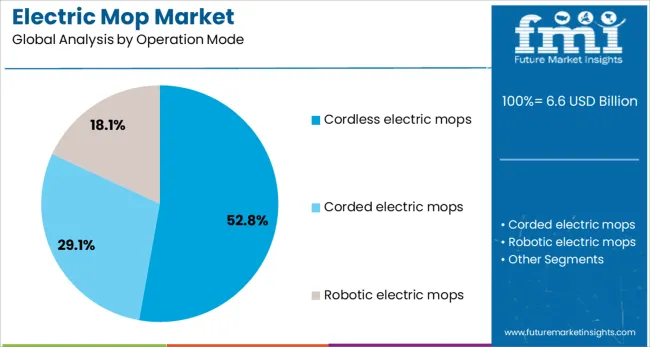

The cordless electric mops operation mode segment is projected to hold 52.8% of the Electric Mop market revenue share in 2025, making it the largest operation mode segment. This leadership has been driven by the demand for hassle-free and portable cleaning solutions, as reported in trade publications and investor updates.

Cordless mops have been adopted widely due to their ease of maneuverability and ability to access hard-to-reach areas without the constraints of power cords. Advances in battery technology have significantly improved their run time and efficiency, enhancing their appeal to both residential and light commercial users.

The segment’s growth has also been fueled by the increasing availability of lightweight, ergonomically designed models that reduce user fatigue and improve cleaning productivity. These advantages, combined with rising consumer expectations for convenience and modern design, have enabled cordless electric mops to secure the highest share in this category.

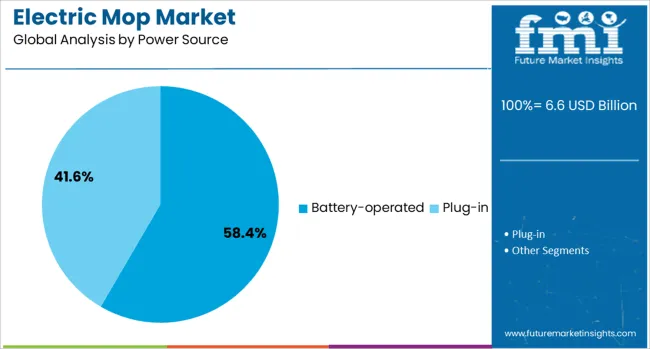

The battery-operated power source segment is expected to account for 58.4% of the Electric Mop market revenue share in 2025, establishing it as the largest power source segment. Its prominence has been driven by growing consumer preference for untethered and energy-efficient devices, as evidenced in product briefings and technology news. Battery-operated mops have been observed to offer consistent performance while eliminating dependence on constant power supply, making them suitable for diverse cleaning needs.

Innovations in rechargeable battery technology have extended operational time and improved overall reliability, which has encouraged adoption. Furthermore, brands have positioned battery-operated models as environmentally conscious choices by incorporating recyclable components and energy-saving features.

This segment has also gained traction due to its compatibility with smart charging systems and reduced maintenance requirements. These factors combined have reinforced its leadership and ensured strong demand in the Electric Mop market.

The electric mop segment is expanding rapidly as households and commercial facilities seek efficient, hygienic, and user-friendly cleaning solutions. Demand is being accelerated by the shift toward low-maintenance appliances that save time while improving cleaning quality, with steam mops and cordless designs emerging as clear favorites. Integration of features such as dual water tanks, rotating pads, and 180-degree swivel heads has made these products attractive for both daily maintenance and deep cleaning. North America currently leads the market due to high consumer awareness and strong brand penetration, while Asia-Pacific is showing the fastest uptake, supported by rising disposable incomes and increased adoption in urban households.

Growth is also linked to post-pandemic hygiene priorities and the willingness to invest in appliances that minimize physical effort. However, barriers such as higher price points compared to traditional mops, competition from other floor-cleaning equipment, and limited awareness in some developing markets continue to shape the adoption curve. Increasing innovation, smart connectivity, and multi-functional designs are creating significant opportunities for expansion across both residential and commercial segments.

The primary driver for electric mops is the heightened consumer preference for cleaning tools that combine efficiency, ease of use, and thorough sanitation. Cordless variants provide mobility without being tethered to a power source, while steam mops eliminate the need for harsh chemicals by relying on high-temperature steam for disinfection. Busy lifestyles, especially among dual-income households, have increased the appeal of devices that reduce manual labor and cleaning time. Growing awareness of hygiene and the desire to prevent cross-contamination in homes and workplaces have also boosted adoption, with steam-based models particularly appealing in environments that require allergen and germ control. Technological innovation, including adjustable cleaning modes, self-cleaning pads, and ergonomic handles, is further enhancing market appeal. Expanding online retail availability with detailed product demonstrations has widened the customer base, allowing consumers to compare features and purchase based on performance rather than just brand familiarity.

Despite the benefits, the adoption of electric mops is restricted in some regions by their relatively high cost compared to conventional cleaning tools. Premium cordless or steam-powered models often cost several times more than basic mops and buckets, limiting access for price-sensitive consumers. Additionally, familiarity and affordability of traditional cleaning methods, such as manual mops, vacuums, or wet-dry sweepers, pose a significant competitive threat in markets where modernization of cleaning tools is still at an early stage. Product maintenance requirements, such as battery replacement, motor servicing, and pad replenishment, can also discourage potential buyers who prefer low-maintenance solutions. Limited awareness in certain emerging economies means that consumers may not fully understand the efficiency and health benefits offered by electric mops, further slowing adoption. In commercial environments, resistance to switching from bulk cleaning equipment to smaller electric mops can also hinder penetration, particularly in cost-driven procurement processes.

Opportunities for growth lie in combining electric mop functionality with smart home integration, enabling users to control cleaning schedules and settings through apps or voice assistants. Multi-functional models that integrate vacuuming and mopping capabilities are gaining attention, appealing to consumers who want consolidated cleaning solutions. Manufacturers are increasingly focusing on lightweight designs, noise reduction, and quick-dry technologies to improve usability and extend product appeal. The Asia-Pacific region presents strong potential due to a growing middle class and increased acceptance of premium home appliances, while the commercial sector offers untapped potential for devices that can clean efficiently in high-traffic areas. Partnerships with e-commerce platforms and expansion into subscription-based consumable sales, such as cleaning pads and detergents, can create recurring revenue streams for manufacturers. Product differentiation through specialized cleaning modes for hardwood, tile, and carpeted floors is also becoming an important competitive lever.

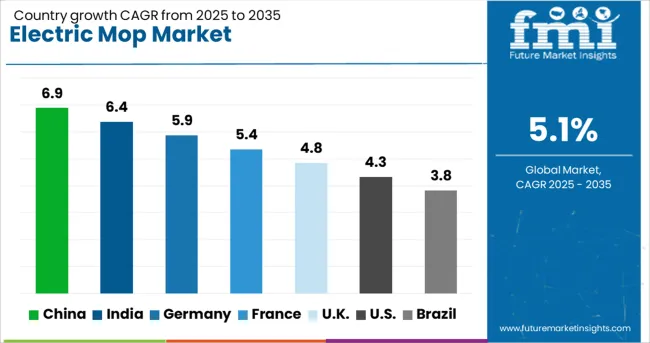

| Country | CAGR |

|---|---|

| China | 6.9% |

| India | 6.4% |

| Germany | 5.9% |

| France | 5.4% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

The market is forecast to grow at a CAGR of 5.1% from 2025 to 2035. China leads with 6.9%, exceeding the global average by 1.8%, driven by rising demand for compact household cleaning devices in urban households. India follows at 6.4%, where market growth is supported by increased availability of mid-range robotic cleaning appliances across online retail. Germany (OECD) posts 5.9%, 0.8% above the global average, with adoption concentrated in energy-efficient and ergonomic product categories.

The United Kingdom (OECD) records 4.8%, slightly below the global trend due to a preference for traditional cleaning tools. The United States (OECD) registers 4.3%, hindered by limited consumer shift from manual to automated solutions in price-sensitive segments. The report includes detailed analysis of 40+ countries, with the top five countries shared as a reference.

China held 6.9% of global market demand in 2025. The electric mop sector evolved through domestic innovation, with emphasis on dual-motor spin systems and extended battery runtimes. Compact models with self-cleaning rollers and high-speed mop heads were introduced to appeal to both urban apartment users and rural homeowners. Brands prioritized water-saving spray functions and ergonomic handle design.

India accounted for 6.4% of global demand in 2025. Lightweight, bucket-free electric mops with multiple pad attachments were favored across growing residential sectors. Cordless electric mop units with built-in spray mechanisms and rechargeable batteries were marketed toward homemakers in tier-2 and tier-3 cities. Consumer preference shifted toward dual-purpose models capable of both dry and wet cleaning.

Germany held 5.9% of global share in 2025. Efficient motorized mop systems with water-saving designs gained popularity among eco-conscious households. Electric mops with heated cleaning options, adjustable steam levels, and anti-scratch pads were adopted in kitchens and office cleaning environments. Product compliance with EU appliance safety standards remained essential for in-store retail approvals.

The United Kingdom accounted for 4.8% of global consumption in 2025. Compact, foldable mop units with long handle reach were introduced for smaller apartments and heritage homes. Emphasis remained on lightweight body construction, quiet motor function, and mop heads optimized for textured floor tiles. The need for fast-drying and low-noise operations supported expansion across elderly and assisted living households.

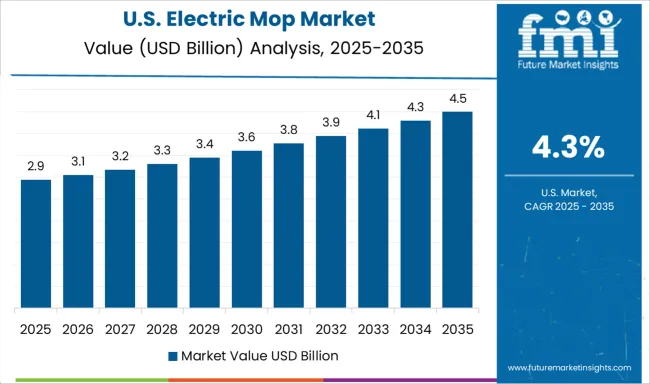

The United States accounted for 4.3% of global market share in 2025. Battery-operated mop units with multi-surface compatibility gained traction in suburban and semi-urban residences. Preference was observed for models with dual-tank systems, spray nozzles, and automated mop pad wringers. Noise control and lightweight portability were major selling points for aging population segments.

The electric mop market is driven by companies offering motorized floor cleaning solutions for residential and light commercial environments. Bissell leads with corded and cordless spin mops, combining scrubbing pads with spray functions designed for sealed hard floors. SharkNinja delivers dual-action mops that integrate steam or rotating heads, positioned for consumers seeking all-in-one surface care.

Tineco focuses on smart electric mops with digital displays, self-cleaning features, and wet-dry vacuum integration, gaining traction among tech-savvy users. BLACK+DECKER provides entry-level powered mops for basic floor maintenance, emphasizing affordability and simplicity.

Kärcher and Vileda target European consumers with upright electric mops designed for fast-drying cleaning and ergonomic handling. Hoover offers wet and dry electric mops with onboard solution tanks and antimicrobial brush heads. Eufy, Roborock, ILIFE, Yeedi, and Ecovacs compete in the robotic mop segment, offering mopping modules paired with navigation systems for multi-surface cleaning.

iRobot’s Braava series specializes in pad-based robotic mops with targeted water control, used in smaller homes and apartments. Xiaomi incorporates electric mopping functions into its robotic vacuum range, expanding its smart home ecosystem. Samsung supports premium floor care through robot mops featuring LiDAR mapping and dual spinning pads, designed for high-end interiors. Competitive positioning is influenced by tank capacity, pad material, battery life, and automation features.

Kärcher introduced the K10 Ultra with UV‑C sterilization in 2023 to target residential and light commercial users focused on hygiene. Techtronic Industries rolled out its V‑MAX Smart Mop, selling over half a million units in North America in Q4 2023, while Xiaomi released a Wi‑Fi‑enabled mop in mid‑2023 that saw rapid adoption within months. In Europe, Tineco launched the Floor One S6, featuring a low‑profile design to clean under furniture with strong wet‑dry suction. Eureka unveiled the J15 Max Ultra robot vacuum‑mop at CES 2025, capable of detecting liquids, avoiding carpets, and washing its mop pads automatically.

Dreame plans to deploy its Aqua10 roller‑mop robot with self‑cleaning fluffer and high suction by the end of 2025. Emerging brands Mamibot and Narwal are pushing into hospital-grade and multi-surface robots, with antimicrobial coatings and multi-pad swap stations. Subscription models for consumables and app‑based updates are gaining traction across multiple manufacturers.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.6 Billion |

| Product | Steam mop and Spray mop |

| Operation Mode | Cordless electric mops, Corded electric mops, and Robotic electric mops |

| Power Source | Battery-operated and Plug-in |

| Application | Residential and Commercial |

| Price | Medium, Low, and High |

| Floor Type | Tile floors, Hardwood floors, Laminate floors, Marble floors, Carpeted floors, and Others |

| Distribution Channel | Online and Offline |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Bissell, BLACK+DECKER, Ecovacs, Eufy, Hoover, ILIFE, iRobot, Kärcher, Roborock, Samsung, SharkNinja, Tineco, Vileda, Xiaomi, and Yeedi |

| Additional Attributes | Dollar sales by model (corded, cordless, steam) and application (residential, commercial, hospitality), demand fueled by home cleaning trends, rental/property management and facilities, led by Asia‑Pacific with North America catching up, innovation in smart navigation, app control, and multi‑surface cleaning modes. |

The global electric mop market is estimated to be valued at USD 6.6 billion in 2025.

The market size for the electric mop market is projected to reach USD 10.9 billion by 2035.

The electric mop market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in electric mop market are steam mop and spray mop.

In terms of operation mode, cordless electric mops segment to command 52.8% share in the electric mop market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electric Aircraft Onboard Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electrical Label Market Size and Share Forecast Outlook 2025 to 2035

Electric Round Sprinklers Market Size and Share Forecast Outlook 2025 to 2035

Electric Cloth Cutting Scissors Market Size and Share Forecast Outlook 2025 to 2035

Electrical Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Electric Aircraft Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electric Traction Motor Market Forecast Outlook 2025 to 2035

Electric Vehicle Sensor Market Forecast and Outlook 2025 to 2035

Electric Vehicle Motor Market Forecast and Outlook 2025 to 2035

Electric Off-Road ATVs & UTVs Market Size and Share Forecast Outlook 2025 to 2035

Electric Blind Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Electric Fireplace Market Size and Share Forecast Outlook 2025 to 2035

Electric Glider Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Battery Conditioners Market Size and Share Forecast Outlook 2025 to 2035

Electric Power Steering Motors Market Size and Share Forecast Outlook 2025 to 2035

Electric Motor Market Size and Share Forecast Outlook 2025 to 2035

Electric Gripper Market Size and Share Forecast Outlook 2025 to 2035

Electric Boat Market Size and Share Forecast Outlook 2025 to 2035

Electric Bicycle Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Transmission Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA