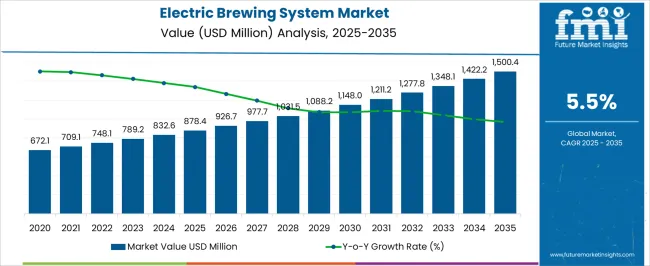

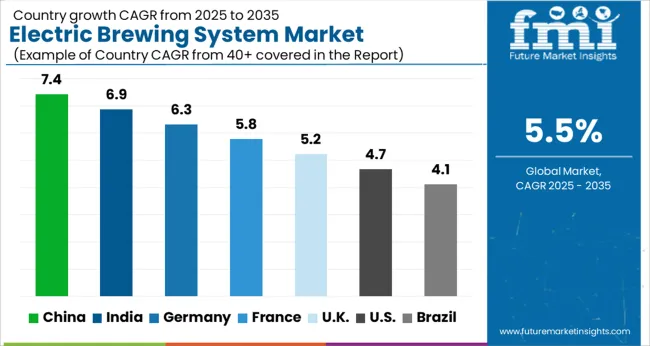

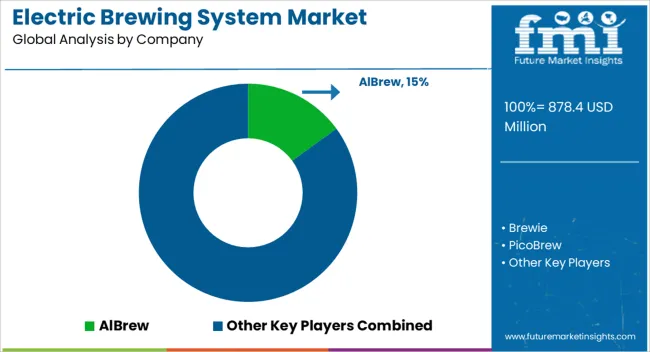

The Electric Brewing System Market is estimated to be valued at USD 878.4 million in 2025 and is projected to reach USD 1500.4 million by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

| Metric | Value |

|---|---|

| Electric Brewing System Market Estimated Value in (2025 E) | USD 878.4 million |

| Electric Brewing System Market Forecast Value in (2035 F) | USD 1500.4 million |

| Forecast CAGR (2025 to 2035) | 5.5% |

The electric brewing system market is witnessing consistent growth driven by increasing demand for efficiency and automation in brewing processes. Advancements in brewing technology and a shift towards more sustainable and energy-efficient operations have accelerated the adoption of electric systems across commercial and artisanal breweries. Industry players are focusing on improving precision, reducing manual intervention, and enhancing product consistency through innovative designs and smart controls.

The growing popularity of craft beers and premium brews is further propelling investment in electric brewing solutions that offer scalability and quality improvements. Regulatory emphasis on energy conservation and environmental compliance is also contributing to the transition from traditional brewing methods.

Future growth is expected to be supported by integration with IoT and data analytics, enabling brewers to optimize operations and ensure product quality. Collaborations between technology providers and breweries are paving the way for expanded applications and market penetration.

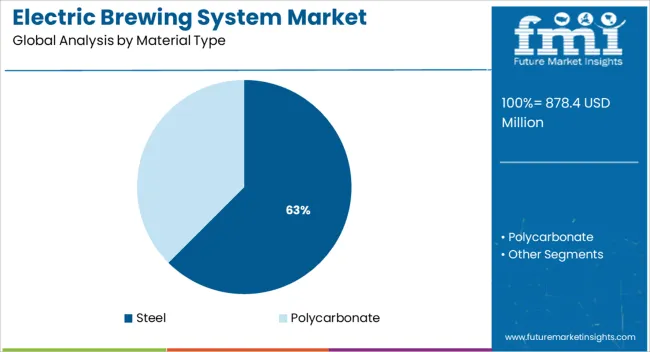

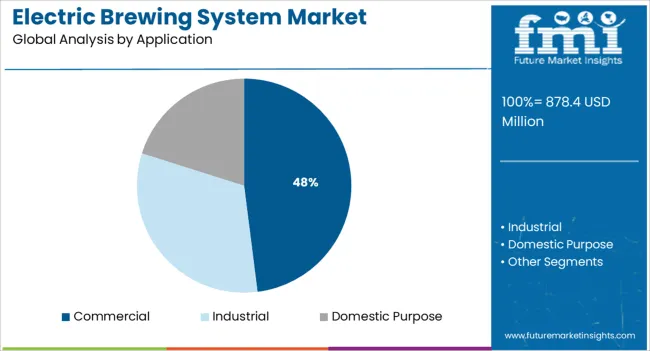

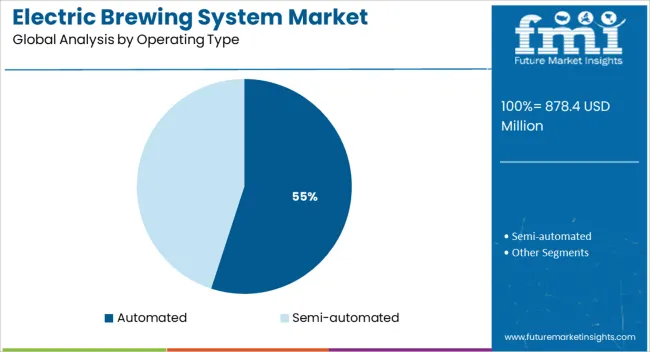

The market is segmented by Material Type, Application, and Operating Type and region. By Material Type, the market is divided into Steel and Polycarbonate. In terms of Application, the market is classified into Commercial, Industrial, and Domestic Purpose. Based on Operating Type, the market is segmented into Automated and Semi-automated. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by material type, steel is expected to hold 62.5% of the total market revenue in 2025, making it the leading material choice. This preference is attributed to steel’s superior durability, corrosion resistance, and ability to withstand high temperatures and pressures inherent in brewing processes.

The ease of cleaning and compliance with sanitary standards have made steel systems highly favorable for commercial-scale operations. Additionally, steel’s recyclability aligns well with sustainability objectives pursued by breweries.

Investment focus on stainless steel variants with enhanced surface finishes and hygienic designs has strengthened its adoption. The cost-effectiveness of steel in long-term use compared to alternative materials has also reinforced its dominant position within the market.

Segmented by application, commercial usage is projected to account for 48.0% of market revenue in 2025, positioning it as the largest application segment. The leadership is driven by the growing number of large-scale breweries and beverage manufacturers adopting electric brewing systems to increase production capacity and improve consistency.

Commercial breweries prioritize automation and energy efficiency to meet increasing consumer demand while maintaining quality standards. The ability to integrate electric systems into existing infrastructure and optimize brewing cycles has accelerated deployment in this segment.

Moreover, stringent regulations around product safety and environmental impact have encouraged commercial operators to invest in advanced brewing technologies, solidifying this segment’s growth and market share.

When segmented by operating type, automated systems are forecast to capture 55.0% of the market revenue in 2025, establishing them as the dominant operating type. Automation has been favored for its ability to reduce manual labor, minimize human error, and enhance process repeatability, which is critical for maintaining product quality.

The integration of programmable controls and real-time monitoring allows brewers to fine-tune parameters and respond quickly to production needs. Automated electric brewing systems also enable better energy management and resource optimization, aligning with industry trends towards sustainability.

Investments in smart brewing technologies and digital interfaces have facilitated the adoption of automated solutions across various brewery sizes, consolidating their position as the leading operating type segment.

The global market for electric brewing systems is primarily set to be fueled by the rising emphasis of beer manufacturers on equipment use and virtual installation to maintain & improve efficiency. Expansion of the brewery industry is also expected to increase demand for such products.

Severe growth forecasts are expected to limit industry opportunities for new entrants in the next ten years. High costs and initial design setup are also likely to be significant impediments to sales of brewery equipment such as electric brewing systems.

Need to Produce Small Batches of Beer to Bolster Sales of Electric Brewing Systems

Increasing demand for home brewing kits for the purpose of brewing a small batch of beer, which would not be otherwise possible without these kits is likely to propel sales in the global market. Commercially available beer is extensively produced in large-scale factories that require sophisticated machinery and huge investments.

Thus, home brewing is gaining traction globally as it is considered a valid option to produce a small batch for limited consumption. However, difficulty in finding specific ingredients required for home brewing such as extracts, yeast, hops, and malts may hamper sales of electric brewing systems worldwide.

Rising Popularity of Home Brewing in the US to Propel Sales of Electric Brewing Kits

The US electric brewing system market is projected to overgrow at a share of over 34.7% in 2025, according to a new report by FMI. Major factors driving the market include rising demand for energy-efficient & eco-friendly brewing systems, the growing popularity of home brewing, and increasing disposable income.

However, the high cost of electric brewing systems is expected to restrain the market over the forecast period. Moreover, the availability of alternative products such as brewing systems running on propane and natural gas is likely to challenge the market in the next ten years.

The US electric brewing system market is highly competitive with several large- and small-scale players operating in the country. Some of the key players in the market are New Belgium Brewing Company, Inc., Stone Brewing Co., and Sierra Nevada Brewing Co. among others.

German Beer Brewing Kit Manufacturers Plan on Targeting Home Brewers and Commercial Breweries

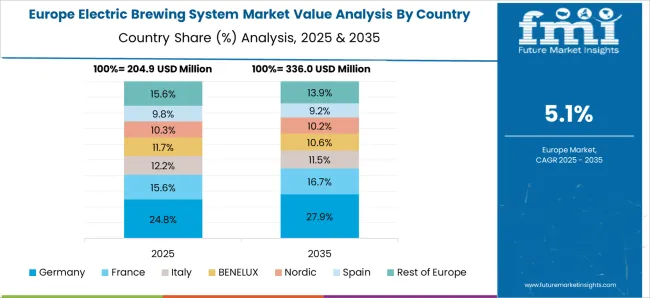

In recent years, Germany has been the driving force behind growth in the Europe electric brewing system market. German manufacturers have captured a large share of this market due to their ability to offer innovatively designed, superior-quality products.

As the dominant producer of electric brewing systems across Europe, Germany has been able to control the market in terms of both sales and production in the last few years. In 2020, German manufacturers accounted for over 50% of all electric brewing system sales in Europe.

This figure is expected to surge in the next ten years as more consumers switch to electric brewing systems due to their ease of use and high energy efficiency. German manufacturers have also been able to successfully promote their products through unique marketing campaigns through social media platforms. In the future, such movements are anticipated to target both home brewers and commercial breweries, thereby resulting in a significant increase in terms of sales.

Indian Beverage Companies to Premiumize their Beers and Create High Demand for Electric Brewing Controllers

In Asia Pacific, India is set to be the leading country in terms of growth in the electric brewing systems industry. High demand for beer among millennials and gen z with increasing disposable income and changing lifestyles is expected to drive sales in India.

Moreover, the country’s beer industry is extremely consolidated with a few key players. United Breweries Limited (UBL), for instance, is considered one of the prominent firms in the beer sector, with a leading brand named Kingfisher. Under its Kingfisher brand, UBL distributes around eight products appealing to multiple beverage preferences and price points- right from mild to strong.

The company also unveiled premium products such as Kingfisher Buzz and Ultra Max. Thus, the launch of such innovative products by leading Indian beer makers is anticipated to expand the premium category, thereby propelling sales of electric brewing systems.

Sales of Electric Home Brewing Systems to Skyrocket with Launch of Innovative Features

Based on application, the domestic purpose segment is estimated to generate the largest share of the market for electric brewing systems throughout the forecast period. Easy availability of various types of home brewing kits through e-commerce websites and retail shops is likely to drive the segment.

Need to experience the feeling of home brewing, freedom to adjust traditional recipes, unavailability of various types of beer in local markets, and the expensive nature of commercially available beer are some of the common factors pushing consumers towards home brewing practices.

In June 2025, for instance, Spinn, a hardware and electronics manufacturing company based in California, introduced the new cold brew feature for its existing brewing system. The new feature would allow coffee enthusiasts to develop innovative cold brews in less than 60 seconds. The novel feature can be used by users by updating their Spinn app. Therefore, similar product launches would enable key companies to expand their portfolios and increase sales of home brewing kits.

Some of the key players in the global electric brewing system market include AlBrew, Alfa Laval, Brewie, PicoBrew, Della Taffola, Krones, Paul Mueller, GEA Group, Meura, Shandong Eagle Machinery Co., Lehui, Ziemann, and XIMO among others.

Renowned companies in the market are focusing on expanding their positioning by investing huge sums in new product launches. They are also joining hands with local firms to co-develop new technologies or devices. A few other companies are aiming to engage in joint ventures to provide better after-sales service to their clients.

For instance,

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 878.4 million |

| Projected Market Valuation (2035) | USD 1500.4 million |

| Value-based CAGR (2025 to 2035) | 5.5% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value (USD Million) |

| Key Regions Covered | North America; Latin America; Europe; Asia Pacific; Oceania; Middle East & Africa (MEA) |

| Key Countries Covered | The USA, Canada, Mexico, Germany, The UK, France, Italy, Spain, China, Japan, India, South Korea, Australia, Brazil, Argentina, South Africa, UAE |

| Key Segments Covered | Operating Type, Application, Material Type, Region |

| Key Companies Profiled | AlBrew; Alfa Laval; Brewie; PicoBrew; Della Taffola; Krones; Paul Mueller; GEA Group; Meura; Shandong Eagle Machinery Co.; Lehui; Ziemann; XIMO |

| Report Coverage | Market Forecast, Company Share Analysis, Competitive Landscape, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global electric brewing system market is estimated to be valued at USD 878.4 million in 2025.

The market size for the electric brewing system market is projected to reach USD 1,500.4 million by 2035.

The electric brewing system market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in electric brewing system market are steel and polycarbonate.

In terms of application, commercial segment to command 48.0% share in the electric brewing system market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electric Aircraft Onboard Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electrical Label Market Size and Share Forecast Outlook 2025 to 2035

Electric Round Sprinklers Market Size and Share Forecast Outlook 2025 to 2035

Electric Cloth Cutting Scissors Market Size and Share Forecast Outlook 2025 to 2035

Electrical Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Electric Aircraft Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electric Traction Motor Market Forecast Outlook 2025 to 2035

Electric Vehicle Sensor Market Forecast and Outlook 2025 to 2035

Electric Vehicle Motor Market Forecast and Outlook 2025 to 2035

Electric Off-Road ATVs & UTVs Market Size and Share Forecast Outlook 2025 to 2035

Electric Blind Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Electric Fireplace Market Size and Share Forecast Outlook 2025 to 2035

Electric Glider Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Battery Conditioners Market Size and Share Forecast Outlook 2025 to 2035

Electric Power Steering Motors Market Size and Share Forecast Outlook 2025 to 2035

Electric Motor Market Size and Share Forecast Outlook 2025 to 2035

Electric Gripper Market Size and Share Forecast Outlook 2025 to 2035

Electric Boat Market Size and Share Forecast Outlook 2025 to 2035

Electric Bicycle Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Transmission Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA