The electric lift truck market is forecast to reach USD 57 billion by 2025, growing at a compound annual growth rate of 14.6%. Applying this growth rate over the next 10 years results in a multiplying factor of approximately 4.61, which means the market value is expected to exceed USD 263 billion by 2035. This increase reflects growing adoption of electric lift trucks in warehouses, manufacturing, and logistics due to stricter emission rules and the drive to reduce operating expenses. Companies are shifting from diesel and gas-powered models to electric alternatives that offer lower maintenance and environmental impact

.webp)

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 57 billion |

| Industry Value (2035F) | USD 263 billion |

| CAGR (2025 to 2035) | 14.6% |

Market saturation analysis indicates the sector remains far from maturity. Adoption is expanding globally as electric lift trucks become more common across industries. Saturation might occur when these vehicles dominate most regions, especially where environmental regulations and incentives encourage their use.

Current market penetration remains below capacity, leaving room for further growth. Challenges such as infrastructure development and initial costs could affect adoption speed in some markets, but ongoing technological improvements and cost declines support expansion. The multiplying factor and growth outlook suggest the market will continue to expand well beyond 2035, with no immediate saturation risk.

The electric lift truck market holds distinct shares across its parent markets, reflecting its specialized role. Within the material handling equipment market, electric lift trucks represent approximately 5-7%. In the broader industrial equipment market, the share is around 3-5%.

Their presence is more significant in the warehouse and logistics equipment market, accounting for about 20-25%, and within the electric vehicle market, the share is estimated at 3-5%. In the broader commercial vehicles market, electric lift trucks comprise roughly 1-2%, highlighting their specialized nature. These percentages underscore the unique position of electric lift trucks in the industrial landscape.

The market is experiencing significant advancements.Key manufacturers are investing in lithium-ion battery technology, enhancing energy efficiency and reducing downtime.Companies are integrating automation and telematics into lift trucks, improving operational efficiency and safety.There is a growing emphasis on sustainability, with firms adopting eco-friendly practices and materials.

Strategic partnerships are being formed to expand market reach and capabilities.Additionally, the development of charging infrastructure is being prioritized to support the widespread adoption of electric lift trucks.These trends indicate a dynamic shift towards more efficient, sustainable, and technologically advanced material handling solutions.

The electric lift truck market is growing steadily as companies adopt energy-efficient and eco-friendly material handling solutions. Significant improvements in lithium-ion batteries have increased operational runtimes by approximately 40% compared to traditional lead-acid batteries. Investment in warehouse automation, surpassing USD 20 billion globally, supports rising demand in logistics and manufacturing sectors.

Strict emission regulations in regions such as North America, Europe, and Asia favor electric lift trucks due to their zero on-site emissions. Despite higher upfront costs, electric trucks lower operational expenses by nearly 30% through savings on fuel and maintenance.

Warehouse automation spending is increasing annually by 10-15%, creating significant demand for electric lift trucks. Their compatibility with automated systems and clean operation make them preferred choices in modern warehouses. Emission regulations in major markets limit diesel truck use, steering companies toward electric alternatives.

Lithium-ion battery prices have declined around 20% over the past five years, improving the cost-effectiveness of electric lift trucks. Additionally, e-commerce growth, expected to increase by more than 14% annually, fuels the need for efficient material handling equipment. Together, these factors boost adoption rates and strengthen market expansion.

Electric lift trucks come with initial costs that are 20-40% higher than diesel or LPG models, posing challenges for budget-sensitive buyers. Charging infrastructure installation ranges between USD 10,000 and USD 50,000 per facility, adding to total investment costs. Charging lead-acid batteries typically takes 6-8 hours, which can reduce operational uptime without access to fast-charging solutions.

Battery maintenance requires skilled technicians, increasing complexity and expenses. Moreover, battery replacement cycles generally occur every 5-7 years, adding further financial considerations. These factors restrict adoption, particularly for small and medium-sized enterprises.

The growing adoption of lithium-ion batteries, which recharge approximately 50% faster and last 20-30% longer than lead-acid types, presents significant opportunities. IoT-enabled fleet management systems provide real-time diagnostics and predictive maintenance alerts, reducing downtime by up to 15%. Emerging markets with rapid warehousing growth offer new potential customers.

Leasing and battery-as-a-service business models lower upfront expenses, making electric lift trucks accessible to smaller operators. Increased corporate focus on sustainability further drives demand for zero-emission equipment, opening additional avenues for market growth.

Electric lift trucks are increasingly equipped with semi-autonomous navigation and remote monitoring technologies, enhancing safety and operational efficiency. Large warehouses adopting autonomous forklifts report labor cost reductions of around 20%. Cloud-based maintenance platforms improve fleet management by optimizing uptime and asset tracking.

Manufacturers focus on sustainable practices, developing recyclable battery technologies and eco-friendly production methods. Collaboration between electric lift truck makers and technology companies accelerates innovation, aligning products with stricter emission standards and evolving customer needs. These trends collectively influence the future direction of the market.

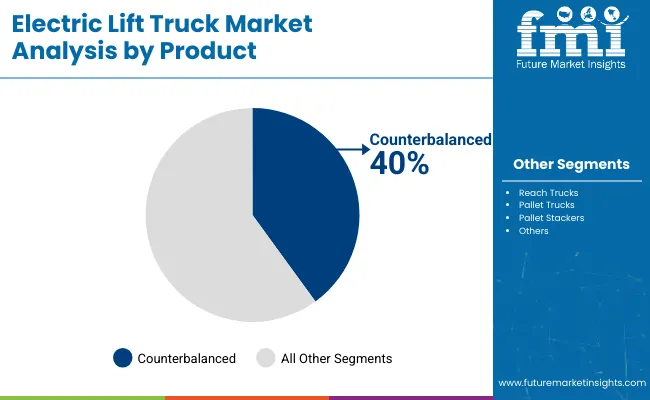

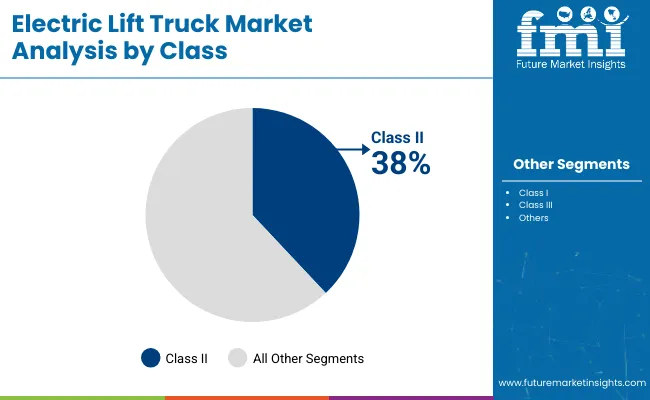

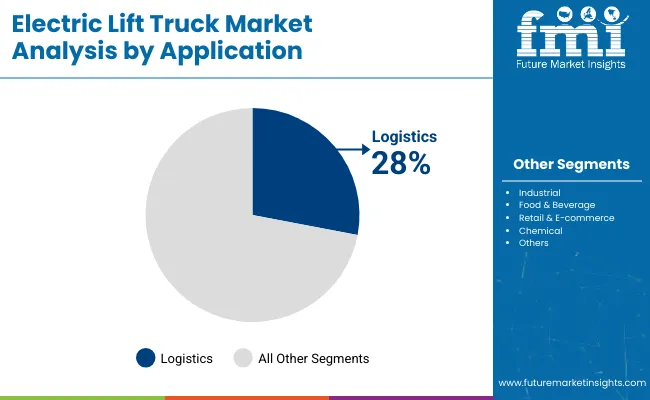

The electric lift truck market in 2025 is anchored by counterbalanced trucks with 40% share, preferred for broad load handling in various industries. Class II trucks hold 38%, valued for aisle navigation and warehouse efficiency. Logistics leads applications at 28%, fueled by e-commerce growth.

Reach trucks at 25% serve high-density storage needs. Industrial and food & beverage sectors contribute 24% and 18%, reflecting specialized operational demands. Market investment focuses on extending battery life, enhancing safety systems, and integrating automation for improved material flow and cost management.

Counterbalanced trucks represent 40% of the product segment, favored for handling uneven or bulky loads due to their rear counterweight design. Their versatility supports loading dock operations and outdoor yard movements, increasing operational scope by nearly 25%. These trucks are often equipped with regenerative braking systems that recover up to 10% of energy during deceleration, improving overall efficiency. Modern models offer modular battery options enabling fast swapping, minimizing downtime during shifts. Their robust chassis design helps reduce maintenance frequency by about 15%, lowering lifecycle costs.

Class II trucks secure 38% market share, optimized for compact warehouse layouts. Their smaller turning radius, reduced by 12% compared to standard forklifts, allows easier navigation in tight spaces. These trucks often include digital load sensors that prevent overloading by alerting operators when exceeding safe thresholds, reducing equipment damage risk. Class II models typically feature enhanced battery management systems that extend battery lifespan by 20%. Their quiet operation, producing 30% less noise, makes them ideal for indoor environments like retail warehouses and food storage facilities.

Logistics uses account for 28% of the market, driven by the need for rapid pallet handling across distribution networks. Electric lift trucks in this sector can operate continuously for 10+ hours with optimized battery usage, supporting multiple shifts. Integration with warehouse management software allows real-time inventory tracking, reducing pick errors by up to 18%. Trucks designed for logistics often have enhanced telematics to monitor operator behavior, which can improve safety compliance by 22%. Their adaptability to various pallet sizes increases operational flexibility across heterogeneous goods.

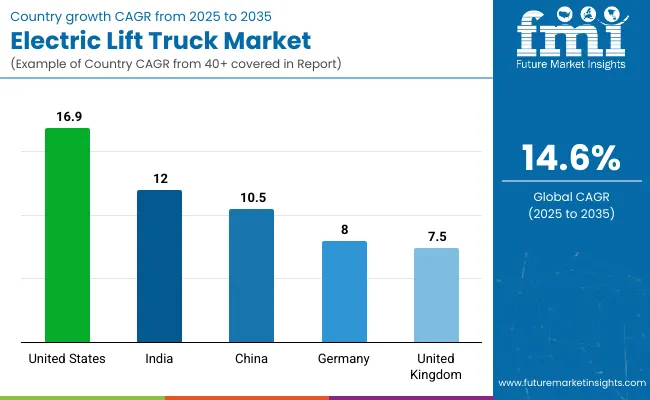

The market is projected to grow at a CAGR of 14.6% from 2025 to 2035. The United States leads with a CAGR of 16.9%, exceeding the global average by +16%. India follows with 12.0%, trailing the global rate by -18%. China records a CAGR of 10.5%, which is -28% below the global figure. Germany and the United Kingdom show more moderate growth at 8.0% and 7.5%, respectively, both significantly below the global benchmark by -45% and -49%.

Growth in the United States is supported by rapid adoption of green warehouse technologies within the OECD, while BRICS countries such as India and China advance through expanding industrial automation. ASEAN regions are anticipated to contribute indirectly through rising demand for efficient material handling solutions. These variations highlight differing market maturity levels and investment focuses across developed and emerging economies.

The electric lift truck market in the United States is forecast to expand at a CAGR of 16.9%, driven by increased adoption in warehousing, logistics, and manufacturing sectors. Companies prioritize energy-efficient and low-emission equipment to reduce operating costs and comply with environmental standards. Technological advances such as longer battery life and fast-charging capabilities improve operational uptime. Leasing programs help small and medium enterprises access modern electric lift trucks without heavy upfront investments. Rising e-commerce demand fuels warehouse automation, further accelerating market growth.

The demand of electric lift truck in India is expected to grow at a CAGR of 12.0%, supported by expanding industrial infrastructure and logistics modernization. Increasing focus on reducing emissions and improving workplace safety encourages adoption of electric models over diesel alternatives. Local manufacturers are developing cost-effective electric lift trucks tailored to Indian operating conditions. Government incentives for clean energy equipment facilitate wider use. Growth in organized retail and e-commerce sectors drives demand for material handling solutions with low maintenance and operational costs.

The electric lift truck market in China is forecast to grow at a CAGR of 10.5%, propelled by expanding manufacturing output and warehouse automation. The government promotes electric vehicles to reduce urban pollution, encouraging fleet electrification. Leading manufacturers invest heavily in battery technology and integrated telematics systems to improve performance and fleet management. Large-scale logistics hubs incorporate electric lift trucks to meet environmental regulations and increase operational efficiency. Battery swapping infrastructure is gradually improving, supporting extended operational hours.

The electric lift truck market in Germany is projected to grow at a CAGR of 8.0%, supported by stringent emission standards and automation trends in manufacturing. Industrial operators prefer electric lift trucks equipped with advanced safety features and energy recovery systems. Integration with digital warehouse management systems enhances productivity and reduces energy waste. Incentives for electric vehicle adoption contribute to steady market expansion. Focus on ergonomics and operator comfort supports longer shift durations with reduced fatigue.

The United Kingdom electric lift truck market is forecast to grow at a CAGR of 7.5%, driven by growing warehouse automation and environmental regulations. Operators are adopting electric lift trucks to reduce carbon footprints and operating expenses. Increasing investment in battery technology enhances charge cycles and reduces charging times. Rental and leasing models help lower entry barriers for smaller companies. Enhanced safety protocols and operator training programs improve workplace safety and efficiency.

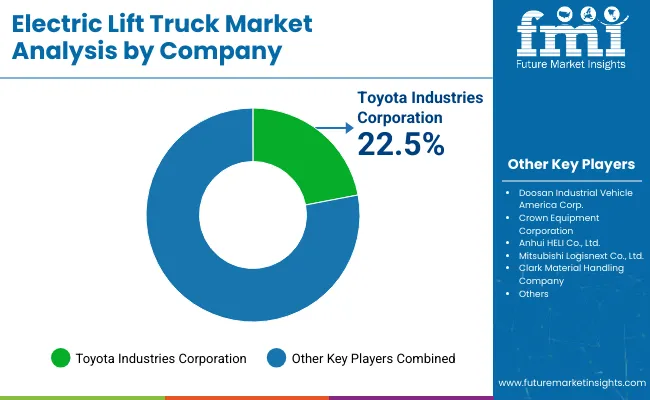

Leading Player - Toyota Industries Corporation holding 22.5% industry share.Leading electric lift truck manufacturers, suppliers, and distributors employ various strategies to strengthen their positions in a competitive market. Doosan Industrial Vehicle America Corp. focuses on expanding its electric forklift range with models offering enhanced battery life and operator comfort. Crown Equipment Corporation invests heavily in research and development to improve energy efficiency and introduce smart control systems, recently launching a series of electric forklifts suited for diverse warehouse applications.

Anhui HELI Co., Ltd. leverages large-scale production capabilities and competitive pricing to capture growing demand in emerging markets. Mitsubishi Logisnext Co., Ltd. enhances its product portfolio through incremental improvements in maneuverability and safety features, targeting logistics and manufacturing sectors.

Clark Material Handling Company emphasizes durability and service support, introducing new electric lift trucks designed for heavy-duty operations. Konecranes and Combilift Material Handling Solutions focus on specialized equipment, including multi-directional electric forklifts, tailored to unique operational challenges. Godrej and Boyce Group and Hangcha Group Co., Ltd. expand through new product launches and strengthened distribution networks in Asia.

HubtexMaschinenbau GmbH & Co. KG and KION GROUP AG offer customized solutions and modular designs to meet specific customer needs. Komatsu Ltd. and Lonking Holdings Limited prioritize expanding electric forklift ranges with enhanced safety features. Hyster-Yale Materials Handling, Inc., Manitou Group, Paletrans Forklifts, and Toyota Industries Corporation maintain their presence through continuous product upgrades, improved ergonomics, and aftersales support. Emerging players concentrate on cost-effective, locally adapted models to gain market share across different regions.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 57 billion |

| Projected Market Size (2035) | Exceeding USD 263 billion |

| CAGR (2025 to 2035) | 14.6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and relevant volume units |

| Product Types Analyzed (Segment 1) | Counterbalanced, Pallet Trucks, Reach Trucks, Pallet Stackers, Others |

| Classes Analyzed (Segment 2) | Class I, Class II, Class III, Others |

| Applications Analyzed (Segment 3) | Chemical, Food & Beverage, Industrial, Logistics, Retail & E-commerce, Others |

| Regions Covered | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Countries Covered | United States, Germany, China, India, Brazil, United Kingdom, Mexico, South Africa, UAE |

| Key Players Influencing the Market | Doosan Industrial Vehicle America Corp., Crown Equipment Corporation, Anhui HELI Co., Ltd., Mitsubishi Logisnext Co., Ltd., Clark Material Handling Company, Konecranes, Combilift Material Handling Solutions, Godrej and Boyce Group, Hangcha Group Co., Ltd., Hubtex Maschinenbau GmbH & Co. KG, KION GROUP AG, Komatsu Ltd., Lonking Holdings Limited, Hyster -Yale Materials Handling, Inc., Manitou Group, Paletrans Forklifts, Toyota Industries Corporation |

| Additional Attributes | Dollar sales by lift truck type and load capacity, demand trends across warehousing, manufacturing, and logistics, regional adoption in North America, Europe, Asia-Pacific, innovation in battery technology, automation, and safety features, environmental impact of energy use and emissions, and new uses in smart warehouses. |

The market is expected to exceed USD 263 billion by 2035.

The CAGR is projected at 14.6% during this period.

Counterbalanced trucks hold 40% of the market share by product.

Toyota Industries Corporation holds approximately 22.5% of the industry share.

Logistics accounts for 28% of the market share by application.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electric Aircraft Onboard Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electrical Label Market Size and Share Forecast Outlook 2025 to 2035

Electric Round Sprinklers Market Size and Share Forecast Outlook 2025 to 2035

Electric Cloth Cutting Scissors Market Size and Share Forecast Outlook 2025 to 2035

Electrical Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Electric Aircraft Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electric Traction Motor Market Forecast Outlook 2025 to 2035

Electric Vehicle Sensor Market Forecast and Outlook 2025 to 2035

Electric Vehicle Motor Market Forecast and Outlook 2025 to 2035

Electric Off-Road ATVs & UTVs Market Size and Share Forecast Outlook 2025 to 2035

Electric Blind Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Electric Fireplace Market Size and Share Forecast Outlook 2025 to 2035

Electric Glider Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Battery Conditioners Market Size and Share Forecast Outlook 2025 to 2035

Electric Power Steering Motors Market Size and Share Forecast Outlook 2025 to 2035

Electric Motor Market Size and Share Forecast Outlook 2025 to 2035

Electric Gripper Market Size and Share Forecast Outlook 2025 to 2035

Electric Boat Market Size and Share Forecast Outlook 2025 to 2035

Electric Bicycle Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Transmission Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA