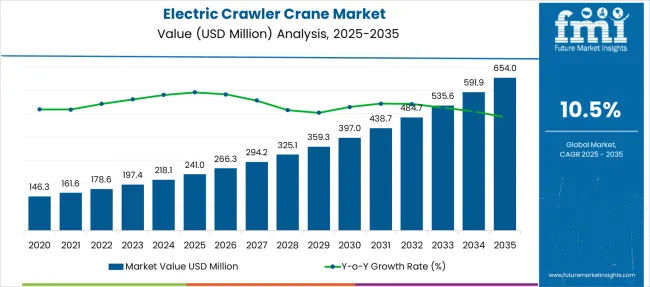

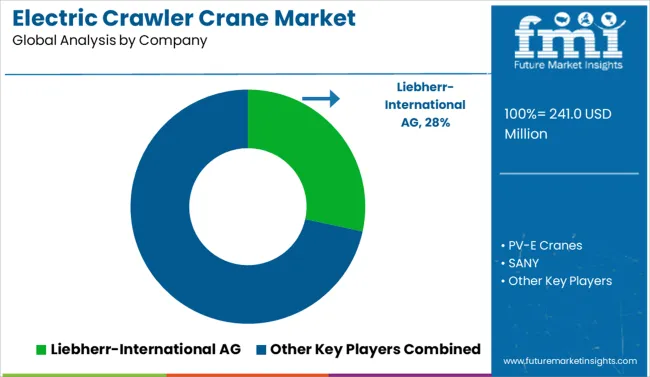

The Electric Crawler Crane Market is estimated to be valued at USD 241.0 million in 2025 and is projected to reach USD 654.0 million by 2035, registering a compound annual growth rate (CAGR) of 10.5% over the forecast period. This equates to a 2.71x market expansion over the ten years, with a CAGR of 10.5%. The first half of the decade, from 2025 to 2030, is likely to reach an estimated USD 397 million, contributing approximately USD 156 million or 37% of total growth. The second half, from 2030 to 2035, is expected to deliver USD 259 million in absolute gain, indicating a stronger growth phase during the later years.

This 10-year growth comparison reflects a staggered acceleration pattern. Early-stage adoption is anticipated to be driven by a regulatory push for low-emission equipment and limited pilot-scale electrification in dense construction zones. The post-2030 phase is likely to benefit from scale deployment in infrastructure and energy projects, where lower operational costs and improved load cycle efficiency will drive broader utility of electric cranes. Manufacturers such as Liebherr and Sany have been advancing battery-electric crawler models with higher duty cycle compatibility and telematics integration. Demand is expected to concentrate in metro development, offshore yards, and tunneling applications, where noise and emission constraints favor electric over diesel variants.

| Metric | Value |

|---|---|

| Electric Crawler Crane Market Estimated Value in (2025 E) | USD 241.0 million |

| Electric Crawler Crane Market Forecast Value in (2035 F) | USD 654.0 million |

| Forecast CAGR (2025 to 2035) | 10.5% |

The electric crawler crane industry contributes roughly 40% of the crawler crane equipment market share, as builders shift toward battery-powered alternatives. About 35% of the electric construction machinery market stems from crawler models, where zero-emission cranes are gaining traction on urban and indoor job sites. Around 25% of the heavy lifting and material handling equipment sector involves electric crawler cranes, given their ability to lift and position loads in tight areas.

It accounts for close to 30% of infrastructure and civil engineering equipment, particularly for bridge, road, and tunnel projects. In the renewable energy deployment equipment market, electric crawler cranes represent approximately 15%, used for assembling wind turbines and solar installations where low-noise, clean operation is preferred.

The market is advancing as demand grows for zero-emission lifting solutions in urban construction, energy infrastructure, and industrial projects. Battery-powered models equipped with high-capacity lithium-ion systems and regenerative braking are replacing diesel-powered alternatives to meet environmental regulations and noise restrictions.

Telematics and IoT-based monitoring allow real-time diagnostics, predictive maintenance, and optimized fleet management. Remote operation, auto-leveling, and safety automation are enhancing site productivity and reducing labor risks. Manufacturers are investing in modular components and lightweight materials to improve energy efficiency and transportability. Adoption is rising across Asia Pacific and Europe, driven by regulatory mandates and growing electrification targets.

The electric crawler crane market is gaining momentum as industries increasingly prioritize sustainability, emissions reduction, and operational efficiency. With tightening global regulations surrounding carbon emissions and noise pollution, electric alternatives to conventional diesel-powered cranes are witnessing heightened adoption, especially in urban infrastructure and industrial projects.

The shift is further supported by improvements in battery technologies and charging infrastructure, enabling longer operating times and reduced downtime. Rental companies are emerging as key growth contributors, recognizing the cost benefits and growing demand for cleaner equipment.

Focus on modular construction and prefabrication across sectors such as energy, transport, and commercial infrastructure is expected to drive steady demand for electric crawler cranes. The market’s future outlook remains positive, as OEMs continue to expand their product portfolios and capabilities, aligning with industry efforts to transition toward environmentally responsible construction practices.

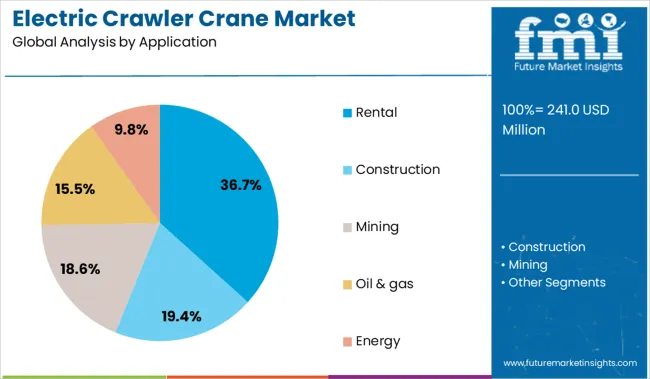

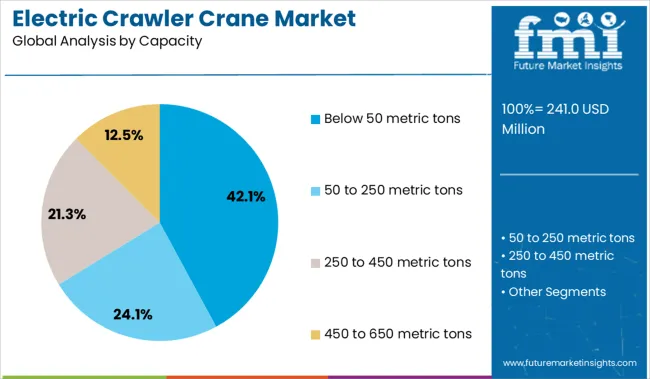

The electric crawler crane market is segmented by application, capacity, and region. By application, the market includes rental, construction, mining, oil and gas, and energy sectors, reflecting its extensive use across industrial and infrastructure projects. In terms of capacity, the segmentation comprises below 50 metric tons, 50 to 250 metric tons, 250 to 450 metric tons, and 450 to 650 metric tons, catering to varied lifting requirements. Regionally, the market covers North America, Latin America, Western and Eastern Europe, Balkan and Baltic countries, Russia and Belarus, Central Asia, East Asia, South Asia and Pacific, and the Middle East and Africa.

The rental segment dominates the application category with a 36.7% market share, reflecting growing contractor preference for flexible and cost-efficient access to electric crawler cranes. As infrastructure and construction projects become increasingly time-bound and budget-sensitive, rental services offer an attractive solution without the capital burden of full equipment ownership.

The rising demand for sustainable machinery across urban job sites and regulated zones has encouraged rental fleet operators to incorporate electric crawler cranes, positioning them as pioneers in green construction support. This trend is further reinforced by short-term project cycles, seasonal fluctuations in equipment use, and the high maintenance cost of ownership.

Rental companies are also expanding their value-added services, including maintenance, operator training, and telematics integration, enhancing user experience and fleet utilization. As ESG compliance becomes integral to procurement decisions, the rental segment is expected to play a sustained and expanding role in the market’s growth.

The below 50 metric tons segment leads the capacity category with a 42.1% market share, driven by its suitability for compact, high-precision lifting tasks in confined or urban construction environments. These smaller capacity cranes are favored for their operational flexibility, ease of transport, and lower energy consumption, making them ideal for inner-city infrastructure projects, utility installations, and modular housing construction.

The segment benefits from rising demand in regions where space constraints and environmental regulations necessitate compact and low-emission equipment. Advancements in battery efficiency, lightweight materials, and energy recovery systems have further enhanced the performance and commercial appeal of these cranes.

Project developers are increasingly selecting low-capacity electric models to meet green building certifications and reduce project lifecycle costs. The below 50 metric tons segment is expected to remain dominant as sustainability mandates intensify and urban development projects continue to expand globally.

The electric crawler crane market is being shaped by infrastructure development and heavy-lift project demands, pushing adoption of energy-efficient lifting equipment. Simultaneously, integration with smart telematics and remote monitoring systems is creating opportunities for performance optimization and predictive maintenance. Manufacturers delivering high-capacity cranes with digital connectivity are positioned to capture a strong market share in the construction and industrial sectors.

The surge in large-scale construction projects has been a critical driver for electric crawler crane demand. In 2024, major transport corridor projects and industrial facility expansions adopted electric cranes for their lifting efficiency and reduced operational interruptions. By 2025, energy-intensive sectors such as mining and port development will have embraced electric crawler cranes to meet regulatory norms and improve site productivity.

These trends suggest that project owners are favoring cranes capable of delivering high-capacity lifts with minimal downtime, establishing electric crawler cranes as a preferred solution for modern infrastructure requirements. Manufacturers focusing on extended duty cycles and reliable powertrain performance are positioned to lead this segment.

In 2024, crane operators began deploying telematics solutions to monitor load charts, operating hours, and energy usage in real-time. By 2025, remote diagnostics and predictive analytics will be embedded into electric crawler cranes, enabling proactive maintenance scheduling and minimizing breakdown risks on critical sites.

These developments show that connectivity-driven control systems can transform cranes from mechanical assets into data-rich equipment, offering value through operational visibility and cost reduction. Manufacturers providing cranes with IoT-enabled modules and cloud-based performance dashboards are likely to secure long-term contracts from contractors seeking efficiency in high-value projects.

| Country | CAGR |

|---|---|

| China | 14.2% |

| India | 13.1% |

| Germany | 12.1% |

| France | 11.0% |

| UK | 10.0% |

| USA | 8.9% |

| Brazil | 7.9% |

| China | 14.2% |

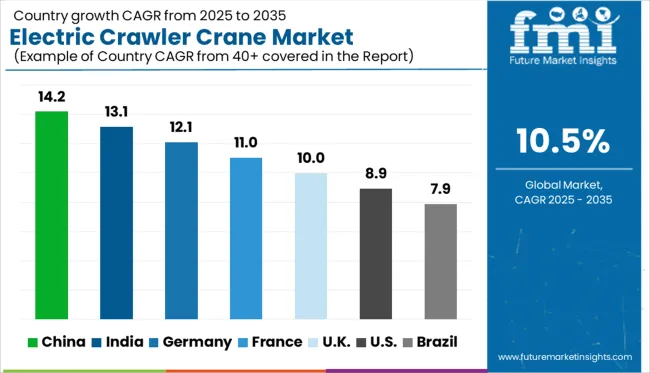

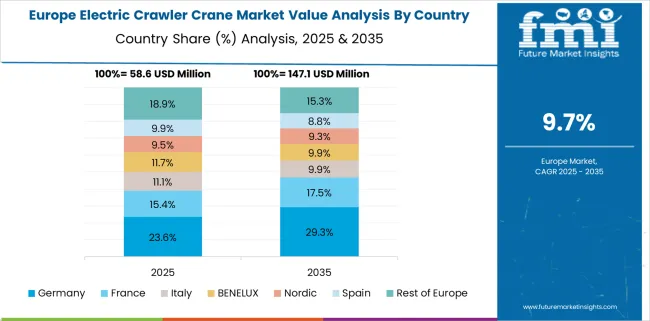

The global electric crawler crane market is projected to grow at a CAGR of 10.5% between 2025 and 2035. China leads with 14.2%, followed by India at 13.1% and Germany at 12.1%. France records 11.0%, while the United Kingdom posts 10.0%. China and India drive growth through large-scale infrastructure projects, renewable energy installations, and government-backed electrification mandates. Germany emphasizes zero-emission construction equipment for sustainability-focused projects, while France prioritizes hybrid and fully electric crane adoption in urban construction. The UK shows consistent growth in utility, industrial, and modular building applications aligned with carbon neutrality commitments.

China is projected to grow at a 14.2% CAGR, driven by rapid infrastructure expansion and renewable energy projects requiring high-capacity lifting. Domestic manufacturers such as XCMG and SANY are scaling production of large electric crawler cranes with energy-efficient drivetrains and lithium-ion battery systems. Integration with telematics platforms enhances performance tracking, while government subsidies accelerate electric equipment adoption across major metro regions.

India is forecast to grow at a 13.1% CAGR, supported by infrastructure development, smart city projects, and offshore wind energy expansion. Contractors are shifting toward electric cranes to meet sustainability targets in government-backed projects. Local distributors partner with global OEMs to introduce modular electric models for confined construction sites. Energy-efficient cranes with regenerative braking systems are becoming a standard specification.

Germany is projected to grow at 12.1% CAGR, driven by strong demand for emission-free construction equipment in renewable energy parks and industrial plant development. Electric crawler cranes with advanced load management and precision control systems are being adopted by major EPC contractors. German OEMs lead innovation in quick-swap battery technology to minimize downtime during large-scale lifting operations.

France is forecast to expand at an 11.0% CAGR, supported by investments in transport infrastructure, wind farms, and urban redevelopment. Contractors prefer electric cranes for noise-sensitive and emission-restricted zones. French rental companies are adding electric crawler cranes to meet sustainability-focused demand in metropolitan construction markets. Government green procurement programs further support this transition.

The UK is projected to grow at 10.0% CAGR, driven by infrastructure renewal, offshore wind projects, and the transition toward low-carbon construction fleets. Demand is strong in high-rise building sites and energy transition projects across Scotland and the North Sea. Manufacturers emphasize crawler cranes equipped with smart energy systems and modular boom configurations for efficiency in congested job sites.

The electric crawler crane market is moderately consolidated, led by Liebherr-International AG. The company holds a dominant position through its extensive range of high-capacity electric crawler cranes, advanced lifting technologies, and strong global distribution and service network. Dominant player status is held exclusively by Liebherr-International AG. Key players include PV-E Cranes, SANY, Marchetti Autogru S.p.A., and MAEDA SEISAKUSHO CO., LTD. These players offer electric crawler crane solutions designed for energy efficiency, precision lifting, and compliance with zero-emission standards in industrial and urban construction projects.

Emerging players are currently limited due to high capital investment and technical expertise required for developing large-scale electric lifting machinery. Market demand is driven by increasing electrification of heavy equipment, regulatory push for low-emission construction equipment, and rising adoption of electric cranes for indoor and noise-sensitive environments.

| Item | Value |

|---|---|

| Quantitative Units | USD 241.0 Million |

| Application | Rental, Construction, Mining, Oil & gas, and Energy |

| Capacity | Below 50 metric tons, 50 to 250 metric tons, 250 to 450 metric tons, and 450 to 650 metric tons |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Liebherr-International AG, PV-E Cranes, SANY, Marchetti Autogru S.p.A., and MAEDA SEISAKUSHO CO., LTD. |

| Additional Attributes | Dollar sales by crane capacity and power type, regional demand trends, competitive landscape, buyer preference for zero-emission and low-noise operations, integration with smart controls, innovations in battery systems and modular designs. |

The global electric crawler crane market is estimated to be valued at USD 241.0 million in 2025.

The market size for the electric crawler crane market is projected to reach USD 654.0 million by 2035.

The electric crawler crane market is expected to grow at a 10.5% CAGR between 2025 and 2035.

The key product types in electric crawler crane market are rental, construction, mining, oil & gas and energy.

In terms of capacity, below 50 metric tons segment to command 42.1% share in the electric crawler crane market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electric Aircraft Onboard Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electrical Label Market Size and Share Forecast Outlook 2025 to 2035

Electric Round Sprinklers Market Size and Share Forecast Outlook 2025 to 2035

Electric Cloth Cutting Scissors Market Size and Share Forecast Outlook 2025 to 2035

Electrical Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Electric Aircraft Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electric Traction Motor Market Forecast Outlook 2025 to 2035

Electric Vehicle Sensor Market Forecast and Outlook 2025 to 2035

Electric Vehicle Motor Market Forecast and Outlook 2025 to 2035

Electric Off-Road ATVs & UTVs Market Size and Share Forecast Outlook 2025 to 2035

Electric Blind Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Electric Fireplace Market Size and Share Forecast Outlook 2025 to 2035

Electric Glider Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Battery Conditioners Market Size and Share Forecast Outlook 2025 to 2035

Electric Power Steering Motors Market Size and Share Forecast Outlook 2025 to 2035

Electric Motor Market Size and Share Forecast Outlook 2025 to 2035

Electric Gripper Market Size and Share Forecast Outlook 2025 to 2035

Electric Boat Market Size and Share Forecast Outlook 2025 to 2035

Electric Bicycle Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Transmission Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA