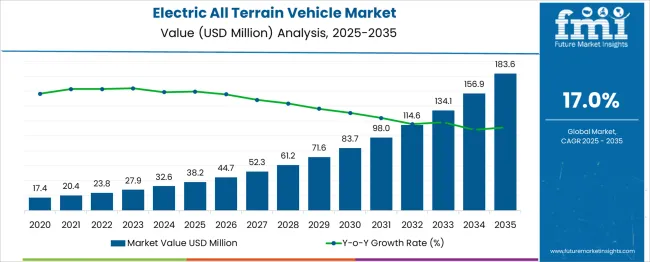

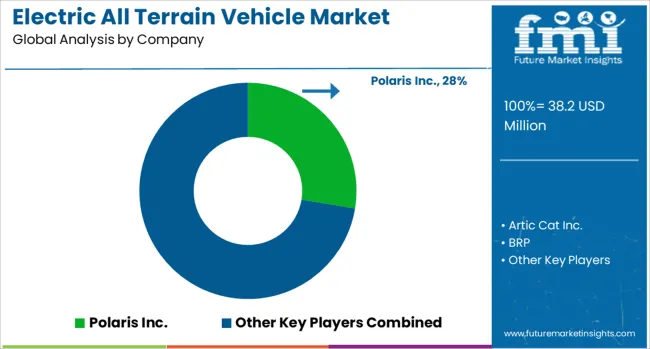

The Electric All Terrain Vehicle Market is estimated to be valued at USD 38.2 million in 2025 and is projected to reach USD 183.6 million by 2035, registering a compound annual growth rate (CAGR) of 17.0% over the forecast period.

| Metric | Value |

|---|---|

| Electric All Terrain Vehicle Market Estimated Value in (2025 E) | USD 38.2 million |

| Electric All Terrain Vehicle Market Forecast Value in (2035 F) | USD 183.6 million |

| Forecast CAGR (2025 to 2035) | 17.0% |

Industry trends indicate increased adoption of electric vehicles due to their lower emissions and reduced operational costs compared to traditional gas-powered models. Technological improvements in battery efficiency and motor design have extended vehicle range and enhanced performance in rugged terrains. The utility sector has become a significant driver of market growth, with electric ATVs being used for agricultural, industrial, and recreational purposes.

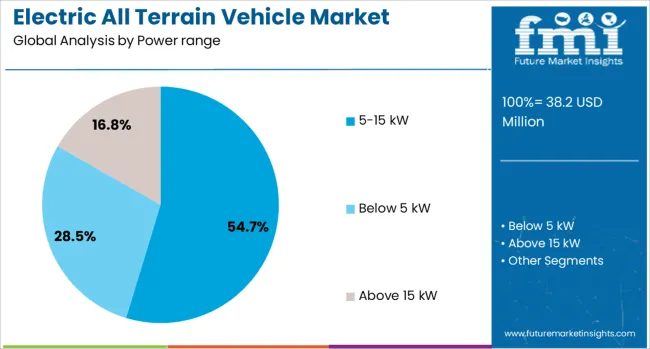

Consumer interest in quieter and low-maintenance vehicles has also contributed to the market's momentum. Future growth is expected to be supported by expanding charging infrastructure and ongoing innovation in lightweight materials. The 5-15 kW power range is leading the market by offering an optimal balance of power and efficiency suitable for a variety of applications.

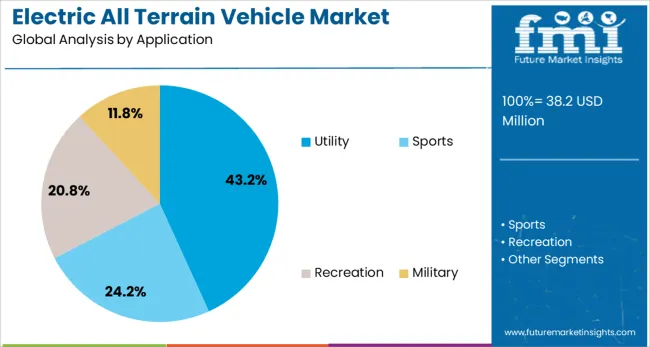

The electric all-terrain vehicle market is segmented by power range and application, and geographic regions. The electric all-terrain vehicle market is divided into 5-15 kW, below 5 kW, and above 15 kW. In terms of application, the electric all-terrain vehicle market is classified into Utility, Sports, Recreation, and Military. Regionally, the electric all-terrain vehicle industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 5-15 kW power range segment is projected to hold 54.7% of the electric all terrain vehicle market revenue in 2025, establishing itself as the dominant category. This segment's growth is attributed to its versatility and suitability for most utility and recreational tasks. Vehicles within this power range provide sufficient torque and speed for off-road conditions while maintaining energy efficiency.

Operators favor these vehicles for their reliability and manageable charging times, making them practical for daily use in farming, forestry, and maintenance operations.

The segment also benefits from cost-effective battery solutions that deliver good performance without excessive weight. As the demand for sustainable and adaptable vehicles rises, the 5-15 kW power range is expected to remain the preferred choice for a wide user base.

The Utility segment is anticipated to account for 43.2% of the electric all terrain vehicle market revenue in 2025, retaining its position as the leading application. Growth in this segment has been driven by increased use of electric ATVs for work-related activities such as transporting goods, equipment, and personnel across challenging terrains.

The adoption of these vehicles in agriculture, construction, and public services has expanded as companies seek quieter, emission-free alternatives to traditional utility vehicles. Their low maintenance and operational costs have made them attractive in cost-sensitive industries.

Additionally, government policies promoting clean energy vehicles in industrial applications have accelerated this segment's growth. With continued focus on operational efficiency and environmental responsibility, the utility application is expected to sustain its dominant share in the market.

Electric all terrain vehicles are gaining traction as recreational users, farm operators, and NP sectors seek quieter, lower-maintenance alternatives. In 2024 nearly 30 % of new ATV model introductions included electric variants. Growth is driven by trail riding demand in North America and Europe, and utility conversions in agricultural and conservation operations.

Manufacturers like Polaris and KTM are releasing electric ATV models with powertrain and battery configurations tailored to both sport riders and agricultural utility users. North American ranch operators deploying e‑ATVs for forestry and field inspection reduce refueling downtime by 24 %, while European conservation parks using electric utility variants cut noise emissions in wildlife zones by 27 %. Models with swap‑and‑charge battery systems enable continuous operation across long shifts. OEMs offer portable solar-charger docks that extend runtime by 18 % per day. Fleet managers in utility sectors value modular battery platforms, allowing rapid crossover between cargo-carrying, towing, and off-road configurations.

Despite clear benefits, expansion of the e‑ATV segment faces challenges in infrastructure, price parity, and performance limits. Electric models cost 20-25 % more than baseline ICE equivalents due to battery and actuator cost. In remote zones, charging infrastructure remains sparse; rural operators often experience 8-10 hours of downtime per charge when relying on portable generators. Range per charge under heavy terrain load remains capped at 70-85 km, limiting use in long-route agricultural operations. Warranty servicing networks are limited outside core markets, causing average repair latency to rise by 2-3 days. These constraints combine to slow adoption among budget-conscious users and operators requiring extended operational coverage.

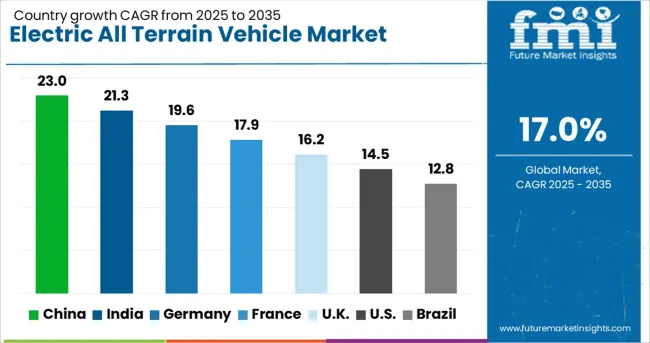

| Country | CAGR |

|---|---|

| China | 23.0% |

| India | 21.3% |

| Germany | 19.6% |

| France | 17.9% |

| UK | 16.2% |

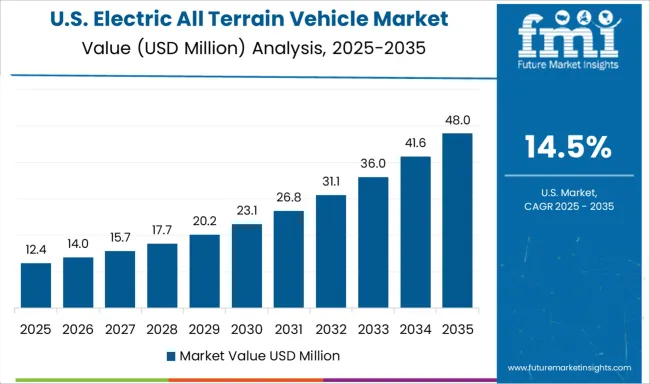

| USA | 14.5% |

| Brazil | 12.8% |

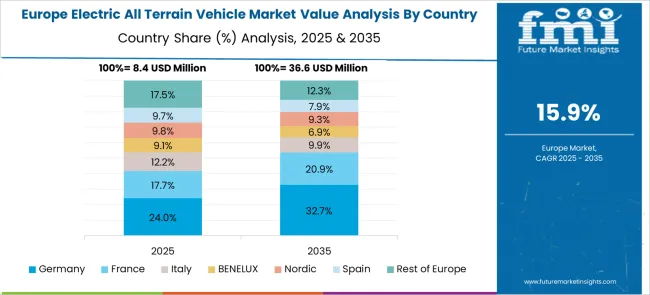

The global electric all-terrain vehicle market is forecasted to expand at a 17% CAGR from 2025 to 2035. China registers the highest CAGR at 23%, translating to a +35% premium over the global rate, driven by favorable EV manufacturing policies and outdoor motorsport investments. India follows at 21.3%, or +25%, supported by rural EV utility programs and domestic ATV production. Germany reaches 19.6%, or +15%, where off-road electric mobility is growing in agriculture and forestry applications. The UK, at 16.2%, aligns closely with the global average, while the US, at 14.5%, is -15% below, reflecting slower uptake outside recreational use cases. The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference.

The electric ATV market in China is advancing at a CAGR of 23.0%, driven by rising interest in off-road recreation and rural transport electrification. Domestic manufacturers are developing utility models for forestry, agriculture, and patrol services. Battery suppliers are collaborating with ATV firms to deliver swappable lithium-ion packs and extend riding ranges beyond 90 km per charge. Charging infrastructure is expanding in leisure parks and mountainous regions to support tourism-focused ATV fleets and rental networks.

The electric ATV market in India is growing at a CAGR of 21.3%, supported by defense procurement, agri-tech trials, and demand from adventure tourism hubs. Startups are introducing locally assembled e-ATVs with IP67-rated motors and gradient-handling capabilities suited for hilly terrains. Government-led trials in Ladakh and the Northeast are testing electric ATVs for border patrol applications. Rental operators in Goa, Himachal, and Uttarakhand are adopting electric fleets to reduce fuel costs and simplify maintenance cycles.

The USA electric ATV market is growing at a CAGR of 14.5%, driven by rising interest from recreational users, conservation groups, and agricultural enterprises. Brands such as Polaris and Volcon are releasing high-torque models with 4x4 capability, targeting trails, ranches, and national park services. Adoption is high in states like Colorado, Utah, and Oregon where noise restrictions and clean-air mandates apply. Some off-road parks are integrating solar-powered charging bays for electric vehicle users.

The electric ATV market in Germany is expanding at a CAGR of 19.6%. Use cases range from vineyard logistics to municipal applications including snow-clearing and park maintenance. European standards for noise and emissions in rural zones have pushed municipalities toward electric options. Manufacturers such as Polaris and EcoRider are tailoring models with integrated diagnostics and torque control suited for European topographies. Leasing programs are gaining traction among small-scale landowners and local councils.

The electric ATV market in the United Kingdom is advancing at a CAGR of 16.2%, led by adoption in agriculture, estate management, and sports venues. The move to phase out petrol-powered quad bikes by 2030 is pushing demand for electric replacements. Farmers in Wales and Scotland are purchasing compact electric ATVs for wet terrain use. Incentives under DEFRA-backed equipment modernization grants are supporting conversions. Use of ATVs in golf courses and large-scale events is also rising.

The global electric ATV market is dominated by Polaris Inc., with major competitors including BRP and Arctic Cat Inc. offering rugged, emission-free off-road vehicles for recreational and utility applications. Specialized manufacturers such as Daymak Inc. and DRR USA focus on affordable entry-level models, while emerging innovators like Eco Charger and Powerland develop high-performance electric powertrains.

The market is experiencing rapid growth (28% CAGR) driven by stricter emissions regulations on public lands and advancements in lithium battery technology, extending range to 80+ miles per charge. Industrial adopters are increasingly transitioning to electric models for mining, agriculture, and forestry operations, valuing lower maintenance costs and silent operation. Challenges include developing fast-charging infrastructure for remote areas and reducing battery weight without compromising durability in extreme terrain conditions.

| Item | Value |

|---|---|

| Quantitative Units | USD 38.2 Million |

| Power range | 5-15 kW, Below 5 kW, and Above 15 kW |

| Application | Utility, Sports, Recreation, and Military |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Polaris Inc., Artic Cat Inc., BRP, Daymak Inc., DRR USA, Eco Charger, Eco Rider, Powerland, Tesla, Inc., and Theron |

| Additional Attributes | Dollar sales by vehicle type (utility, sport, youth) and drivetrain (2WD, 4WD, AWD), demand dynamics across recreational off-roading, agricultural hauling, and military patrol, regional trends led by North America with Europe expanding emissions-compliant rural mobility, innovation in lithium-ion battery integration, regenerative braking, and terrain-adaptive suspension, and operational impact of range optimization, torque delivery stability, and charging infrastructure availability. |

The global electric all terrain vehicle market is estimated to be valued at USD 38.2 million in 2025.

The market size for the electric all terrain vehicle market is projected to reach USD 183.6 million by 2035.

The electric all terrain vehicle market is expected to grow at a 17.0% CAGR between 2025 and 2035.

The key product types in electric all terrain vehicle market are 5-15 kw, below 5 kw and above 15 kw.

In terms of application, utility segment to command 43.2% share in the electric all terrain vehicle market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electric Aircraft Onboard Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electrical Label Market Size and Share Forecast Outlook 2025 to 2035

Electric Round Sprinklers Market Size and Share Forecast Outlook 2025 to 2035

Electric Cloth Cutting Scissors Market Size and Share Forecast Outlook 2025 to 2035

Electrical Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Electric Aircraft Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electric Traction Motor Market Forecast Outlook 2025 to 2035

Electric Off-Road ATVs & UTVs Market Size and Share Forecast Outlook 2025 to 2035

Electric Blind Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Electric Fireplace Market Size and Share Forecast Outlook 2025 to 2035

Electric Glider Market Size and Share Forecast Outlook 2025 to 2035

Electric Power Steering Motors Market Size and Share Forecast Outlook 2025 to 2035

Electric Motor Market Size and Share Forecast Outlook 2025 to 2035

Electric Gripper Market Size and Share Forecast Outlook 2025 to 2035

Electric Boat Market Size and Share Forecast Outlook 2025 to 2035

Electric Bicycle Market Size and Share Forecast Outlook 2025 to 2035

Electrical Enclosure Market Size and Share Forecast Outlook 2025 to 2035

Electrical Sub Panels Market Size and Share Forecast Outlook 2025 to 2035

Electric Cargo Bike Market Size and Share Forecast Outlook 2025 to 2035

Electrical Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA