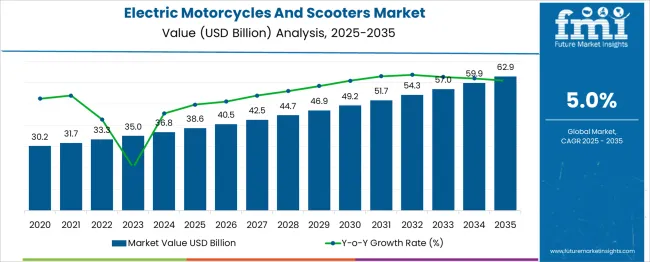

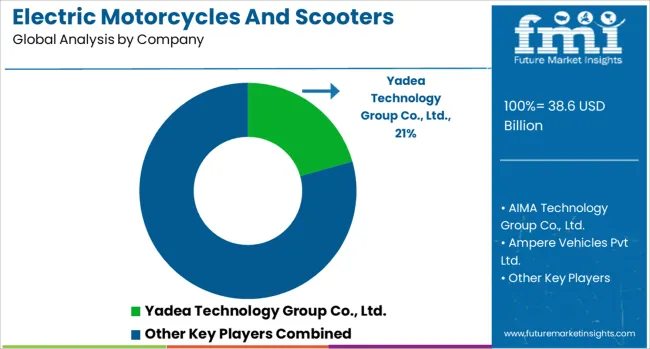

The Electric Motorcycles And Scooters Market is estimated to be valued at USD 38.6 billion in 2025 and is projected to reach USD 62.9 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

| Metric | Value |

|---|---|

| Electric Motorcycles And Scooters Market Estimated Value in (2025 E) | USD 38.6 billion |

| Electric Motorcycles And Scooters Market Forecast Value in (2035 F) | USD 62.9 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

Growing environmental awareness and government incentives have encouraged consumers to switch to electric vehicles, particularly in densely populated cities. Technological advancements in battery technology have enhanced vehicle range and performance, making electric scooters and motorcycles more practical and appealing. The rise of shared mobility services and last-mile delivery applications has further propelled market expansion.

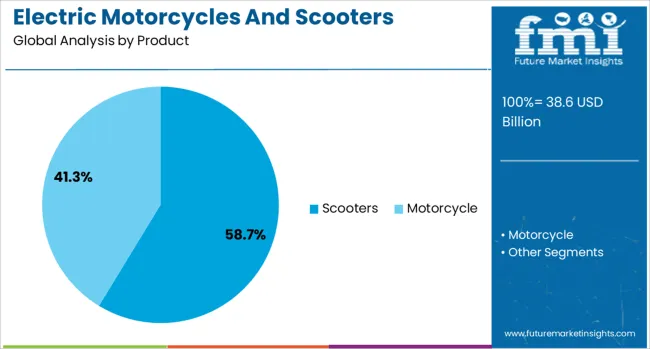

Additionally, improvements in charging infrastructure and reductions in battery costs have lowered entry barriers for consumers. The market is expected to maintain its upward trajectory as innovations continue to enhance vehicle efficiency and affordability. Segmental growth is anticipated to be led by scooters as the dominant product type, lithium-ion batteries as the preferred power source, and 48V systems favored for their balance of power and energy efficiency.

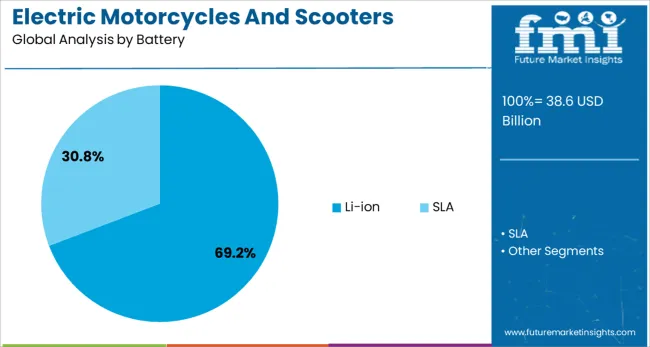

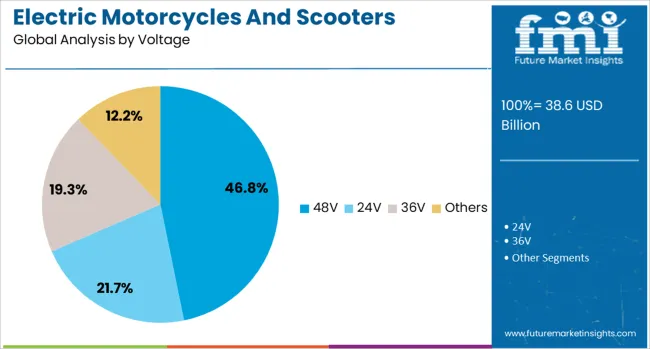

The electric motorcycles and scooters market is segmented by product, battery, and voltage and geographic regions. The electric motorcycles and scooters market is divided into Scooters and motorcycles. In terms of the battery of the electric motorcycles and scooters market, it is classified into Li-ion and SLA. Based on the voltage of the electric motorcycles and scooters market, it is segmented into 48V, 24V, 36V, and Others. Regionally, the electric motorcycles and scooters industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The scooters segment is projected to hold 58.7% of the market revenue in 2025, remaining the largest product category. This is due to scooters’ popularity for urban commuting, offering compact design, ease of use, and affordability. Their suitability for congested city environments has made them the preferred choice among commuters seeking efficient and eco-friendly transportation.

The growing trend of electric scooter sharing programs has also increased demand for these vehicles. Manufacturers have focused on lightweight and durable designs tailored to urban mobility needs.

As cities adopt stricter emission standards, scooters are expected to continue dominating due to their accessibility and practicality.

The lithium-ion battery segment is expected to account for 69.2% of the market revenue in 2025, dominating due to its high energy density, longer life cycle, and faster charging capabilities. These attributes have made lithium-ion batteries the preferred choice for electric two-wheelers, enabling extended driving ranges and improved vehicle performance.

The declining cost of lithium-ion technology has also made electric motorcycles and scooters more affordable for a wider consumer base. Ongoing advancements in battery management systems and safety features continue to enhance reliability, further driving adoption.

Lithium-ion’s scalability and compatibility with various vehicle models support its continued leadership in this market.

The 48V segment is projected to hold 46.8% of the market revenue in 2025, leading due to its optimal balance between power output and energy efficiency. This voltage level is widely adopted in electric scooters and motorcycles because it provides sufficient torque for urban riding while keeping battery size and cost manageable.

The 48V system supports faster acceleration and better hill-climbing capabilities compared to lower voltage alternatives. Additionally, compatibility with existing charging infrastructure and regulatory standards has contributed to its preference.

As manufacturers seek to enhance vehicle performance without significantly increasing costs, the 48V segment is expected to maintain its dominant position.

Demand for electric two-wheelers is soaring, driven by urban mobility shifts, low-emission incentives, and cost-efficiency goals. Sales of high-performance electric motorcycles and urban scooters are expanding rapidly, with notable traction in Asia Pacific, Europe, and Latin America, particularly within shared and last mile transport networks.

Demand for electric motorcycles surged by 35% in 2025, especially among urban riders seeking performance and sustainability. Models in the 40 to 80 kW class gained traction for their instant torque, premium feel, and connected features. Urban enthusiasts and leisure commuters reported 27% fewer fuel-related disruptions and praised near-silent riding. OEMs offering adaptive modes, digital dashboards, and fast charging are gaining share. Growth remains strongest in Europe and North America where policy incentives and rider lifestyle preferences support adoption.

Sales of electric scooters climbed 42% year-over-year in 2025, becoming essential in dense cities and shared fleets. Models in the 2 to 6 kW category are ideal for short trips, offering up to 120 km per charge and speeds near 60 km/h. Shared operators report 24% lower maintenance costs and 18% better ride uptime than ICE alternatives. Emission-free zone mandates and rising demand for touchless, eco-friendly commuting are supporting growth in Southeast Asia, Latin America, and urban European markets.

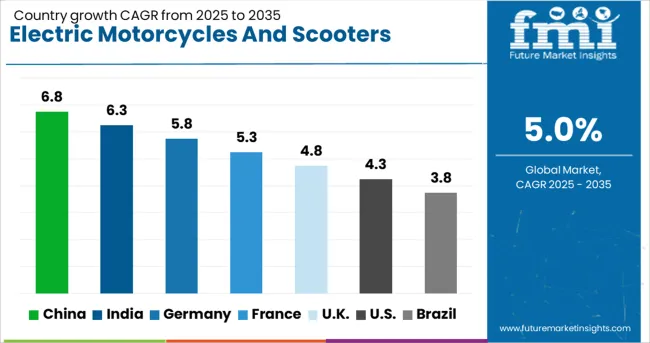

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

The global market is forecast to expand at a CAGR of 5.0% from 2025 to 2035. China dominates with a 6.8% CAGR, driven by aggressive EV adoption policies, subsidies, and an extensive charging infrastructure. India follows at 6.3%, where rising fuel costs and state incentives under FAME-II and PM-eBus schemes are increasing demand. Germany, at 5.8%, is benefiting from eco-conscious urban mobility trends and integration of two-wheeled EVs in fleet services. The UK is expected to grow at 4.8%, supported by congestion charges, zero-emission zones, and rising youth interest in electric two-wheelers. The USA, growing at 4.3%, sees expansion in states like California and New York through incentive programs and growing popularity of e-scooter sharing platforms. The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

China is projected to grow at a 6.8% CAGR, maintaining its lead through extensive government subsidies, aggressive EV targets, and dense charging infrastructure development. Domestic manufacturers dominate production, leveraging cost competitiveness and advanced battery technologies. High penetration of e-scooters in urban centers is complemented by increasing adoption in suburban regions for short-distance commuting. Integration of connected features, swappable battery systems, and digital payment platforms in vehicle ecosystems enhances convenience. Export potential remains strong as Chinese OEMs target Southeast Asia and European markets for two-wheeled electric mobility solutions.

India is expected to grow at a 6.3% CAGR, driven by surging fuel prices and financial incentives under schemes such as FAME-II and PM e-Mobility initiatives. Rapid growth in shared mobility and last-mile delivery services is increasing adoption of electric two-wheelers in urban corridors. Battery leasing models introduced by startups reduce upfront costs, making electric scooters accessible to cost-sensitive consumers. State-level tax rebates and zero-registration fee policies strengthen demand in Tier 1 and Tier 2 regions. Domestic OEMs focus on improving battery performance and expanding fast-charging infrastructure to address range concerns.

Germany is forecast to grow at a 5.8% CAGR, supported by urban mobility programs and increased focus on low-emission transportation. Premium e-motorcycles and scooters integrated with advanced safety and connectivity features dominate sales in metropolitan areas. Fleets for rental and corporate mobility services are incorporating electric two-wheelers as part of green transition strategies. German manufacturers are emphasizing modular battery systems and enhanced powertrains for extended range performance. Consumer preference for compact, lightweight EVs in densely populated cities accelerates adoption. Partnerships between automakers and mobility tech firms aim to expand smart charging and telematics-driven services.

The United Kingdom is projected to grow at a 4.8% CAGR, driven by zero-emission zones, congestion charge policies, and rising youth interest in electric two-wheelers. E-scooter trials for shared mobility are gaining traction, particularly in London and regional transport hubs. Government-backed purchase grants for electric two-wheelers improve affordability, while increasing battery-swapping infrastructure addresses range limitations. Premium scooter brands are launching digitally connected models with app-based diagnostics and integrated GPS navigation. Growth in micro-mobility services and food delivery fleets further supports market penetration across urban areas.

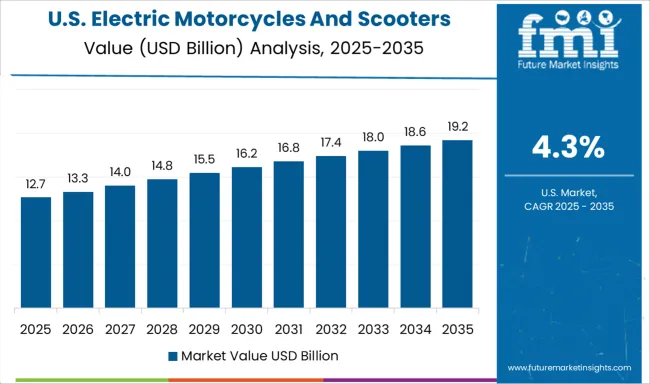

The United States is expected to post a 4.3% CAGR, supported by e-mobility adoption in states like California, New York, and Texas. Government rebate programs and tax incentives reduce entry barriers for personal and fleet users. Growth in shared e-scooter platforms in metropolitan areas is expanding access for short-distance commuting. Manufacturers are investing in lightweight designs and high-performance lithium-ion batteries to meet consumer expectations for speed and durability. Strategic collaborations between OEMs and ride-sharing firms are enhancing infrastructure for fleet-based deployments. The rising trend of electrification in recreational two-wheelers also contributes to steady growth.

Yadea Technology Group Co., Ltd. leads the market with a significant share, leveraging scale advantages and expansion in Latin America and Europe. AIMA Technology Group and Niu Technologies follow with strong urban scooter portfolios. Indian players like Hero Electric and Ampere Vehicles are investing in low-cost smart scooters for mass adoption. In North America and Europe, premium brands such as Harley Davidson and Energica are targeting high-performance motorcycle segments. Strategies include modular platform design, swappable battery systems, and IoT-enabled service platforms to capture evolving urban mobility demand.

In June 2025, Hero MotoCorp unveiled the Vida VX2, an affordable electric scooter positioned below the existing Vida V2 range. Launching on July 1, 2025, the VX2 is expected to strengthen Hero’s presence in India’s mass-market segment, supporting broader adoption with budget-friendly pricing and nationwide availability.

| Item | Value |

|---|---|

| Quantitative Units | USD 38.6 Billion |

| Product | Scooters and Motorcycle |

| Battery | Li-ion and SLA |

| Voltage | 48V, 24V, 36V, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Yadea Technology Group Co., Ltd., AIMA Technology Group Co., Ltd., Ampere Vehicles Pvt Ltd., Energica Motor Company S.p.A, GOVECS AG, Harley Davidson, Hero Electric, Jiangsu Xinri E-vehicle Co., Ltd., KTM Sport motorcycle GmbH, Niu Technologies, SUNRA, Tailing Electric Vehicle Co., Ltd., Terra Motors Corporation, and Vmoto Limited |

| Additional Attributes | Dollar sales by vehicle type (e‑scooters vs electric motorcycles) and battery category (lead‑acid, lithium‑ion, swappable), demand dynamics across personal, delivery‑fleet, and EV‑rental segments, regional leadership in Asia‑Pacific and high-growth in Africa, innovation in battery swapping, fast‑charging, IoT connectivity, and environmental impact via emissions reduction and recycling. |

The global electric motorcycles and scooters market is estimated to be valued at USD 38.6 billion in 2025.

The market size for the electric motorcycles and scooters market is projected to reach USD 62.9 billion by 2035.

The electric motorcycles and scooters market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in electric motorcycles and scooters market are scooters and motorcycle.

In terms of battery, li-ion segment to command 69.2% share in the electric motorcycles and scooters market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electrical Label Market Size and Share Forecast Outlook 2025 to 2035

Electric Round Sprinklers Market Size and Share Forecast Outlook 2025 to 2035

Electric Cloth Cutting Scissors Market Size and Share Forecast Outlook 2025 to 2035

Electrical Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Electric Aircraft Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electric Traction Motor Market Forecast Outlook 2025 to 2035

Electric Vehicle Sensor Market Forecast and Outlook 2025 to 2035

Electric Vehicle Motor Market Forecast and Outlook 2025 to 2035

Electric Off-Road ATVs & UTVs Market Size and Share Forecast Outlook 2025 to 2035

Electric Blind Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Electric Fireplace Market Size and Share Forecast Outlook 2025 to 2035

Electric Glider Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Battery Conditioners Market Size and Share Forecast Outlook 2025 to 2035

Electric Power Steering Motors Market Size and Share Forecast Outlook 2025 to 2035

Electric Motor Market Size and Share Forecast Outlook 2025 to 2035

Electric Gripper Market Size and Share Forecast Outlook 2025 to 2035

Electric Boat Market Size and Share Forecast Outlook 2025 to 2035

Electric Bicycle Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Transmission Market Size and Share Forecast Outlook 2025 to 2035

Electrical Enclosure Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA