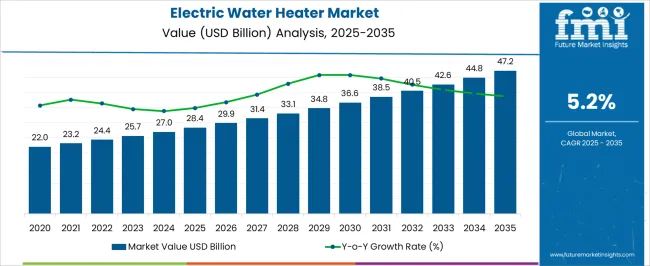

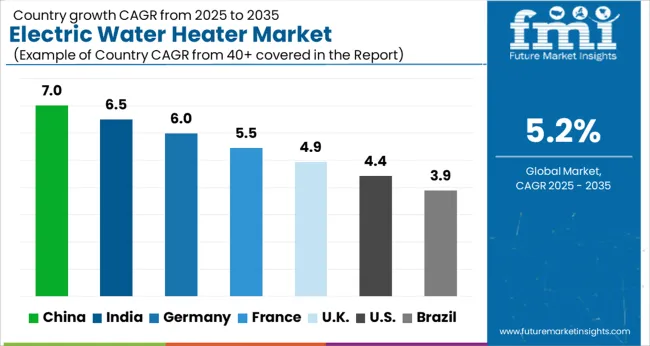

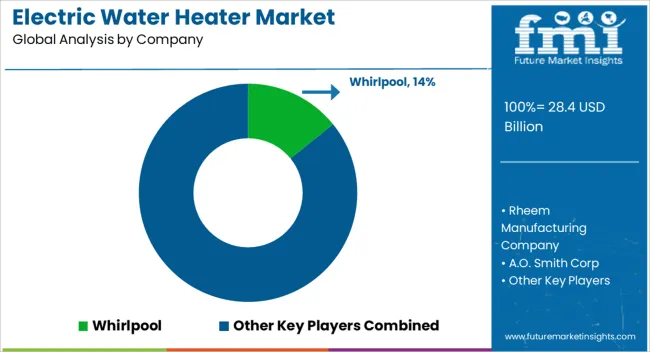

The Electric Water Heater Market is estimated to be valued at USD 28.4 billion in 2025 and is projected to reach USD 47.2 billion by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period.

| Metric | Value |

|---|---|

| Electric Water Heater Market Estimated Value in (2025 E) | USD 28.4 billion |

| Electric Water Heater Market Forecast Value in (2035 F) | USD 47.2 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

The electric water heater market is witnessing sustained growth as end-users increasingly prioritize energy efficiency, digital control systems, and uninterrupted hot water supply in both residential and commercial infrastructures. The expansion of urban middle-class populations and rising housing development projects have amplified the demand for reliable water heating appliances. Key manufacturers are integrating smart control features, Wi-Fi connectivity, and energy-saving modes into their product lines, aligning with modern consumer expectations.

Electrification trends, driven by decarbonization efforts and clean energy transitions in developed and emerging economies, have also positively impacted electric water heater installations. Moreover, policy support promoting energy-efficient appliances, alongside technological advancements in insulation and heating elements, is fostering long-term market growth.

Utility-backed rebate programs and consumer awareness initiatives are further enabling a transition from conventional to energy-efficient water heating technologies Looking ahead, the market is poised to benefit from increasing investments in residential infrastructure, rising per capita income, and the evolving preference for connected appliances that offer both convenience and energy savings.

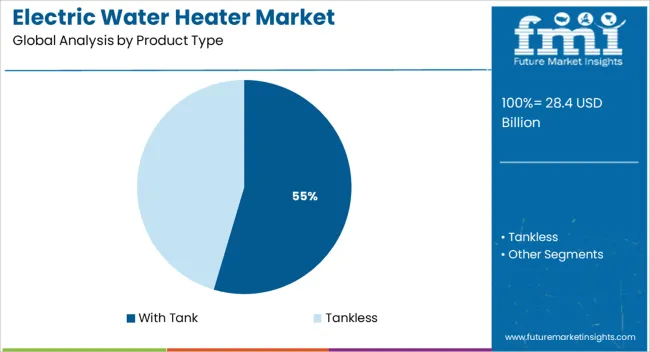

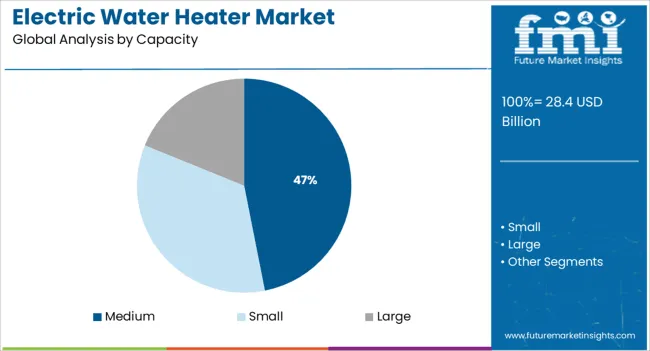

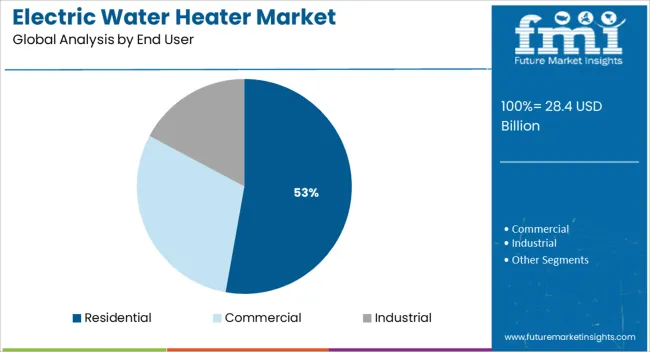

The market is segmented by Product Type, Capacity, and End User and region. By Product Type, the market is divided into With Tank and Tankless. In terms of Capacity, the market is classified into Medium, Small, and Large. Based on End User, the market is segmented into Residential, Commercial, and Industrial. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The with tank segment is expected to account for 54.6% of the electric water heater market revenue share in 2025, positioning it as the dominant product type. This segment’s continued leadership can be attributed to its affordability, widespread availability, and strong consumer familiarity, particularly in developing economies. Storage water heaters are designed to deliver consistent hot water supply, making them suitable for households with regular usage patterns.

Their robust performance in regions with intermittent power supply has further supported their deployment. Enhanced tank insulation technologies have improved thermal retention and reduced standby heat loss, aligning with consumer demand for energy-efficient solutions. Manufacturers have introduced corrosion-resistant tanks and extended warranties, increasing the appeal of these models in both replacement and new installation scenarios.

In addition, integration of digital thermostats and smart energy-saving modes has increased functionality and efficiency, reinforcing their market position The ease of maintenance, coupled with compatibility across diverse plumbing infrastructures, continues to drive the preference for with tank water heaters.

The medium capacity segment is projected to contribute 46.9% of the total revenue in the electric water heater market by 2025, making it the leading capacity category. Its growth is being influenced by its suitability for small to medium-sized families and its optimal balance between energy consumption and storage volume. Medium capacity water heaters are widely adopted in urban households due to their ability to meet daily hot water demands without excessive power usage or storage wastage.

These systems are often chosen for apartments, duplex homes, and compact living spaces where space optimization and utility efficiency are essential. Recent advancements in heating technology have enabled faster heating times and better insulation, further improving user satisfaction in this segment.

As energy efficiency norms tighten across key markets, medium capacity units have emerged as a compliant and cost-effective solution Their favorable pricing, manageable power ratings, and compatibility with smart controls have made them the preferred choice among cost-conscious and sustainability-focused consumers.

The residential segment is anticipated to account for 52.8% of the electric water heater market revenue share in 2025, underscoring its role as the leading end-use sector. The segment’s dominance is being driven by the increasing number of nuclear families, rising residential construction activity, and growing awareness of energy-saving household appliances. Electric water heaters are being adopted across urban and semi-urban regions to ensure consistent access to hot water for bathing, cleaning, and cooking purposes.

Residential consumers are showing a marked preference for digitally enabled, programmable water heaters that offer both energy efficiency and user convenience. The availability of compact models designed for modern living spaces has further stimulated market penetration.

Additionally, smart integration with home automation platforms and support for time-of-use energy tariffs are influencing purchasing behavior in this segment The residential sector's contribution is also bolstered by government incentives for energy-efficient home appliances, and growing consumer sensitivity toward carbon emissions, all of which are shaping long-term demand in favor of electric water heating solutions.

The electric water heaters are one of the biggest energy consuming appliance all around the world. These are used both residentially and industrially for many purposes. The world is suffering from increased energy consumption problem, which might lead to energy depletion and crisis in near future.

As we are facing such grave problem, there is need to redesign the electrical water heaters to reduce energy consumption. Some smart monitors are used in electrical water heaters, regulating the energy consumption.

Many manufacturers are utilising technologies which allows them to utilise solar energy, and people are also giving positive response to them. These innovations are likely to boost the market for electrical water heaters.

The residents all over the world are relying on electrical water heaters for hot water during bath time. Innovative designs and improved infrastructural facilities are likely to boost the use of electrical heaters in households in future.

As the world is going toward energy crisis, electric water heaters are in need of redesign in order to be allowed for use in future. The electrical water heaters are having a big share of electric energy consumption. If we do not find a way to reduce the consumption, the electrical water heaters may face limitation for use or even ban on use.

Development of solar water heaters and its grand success is another negative factor for the electrical water heaters. Solar water heaters use sunlight to heat the water, and they do not consume energy at all. These two factors are making them popular among residential as well as industrial users. But these solar water heaters have drawbacks, mainly as in monsoon seasons, allowing electrical water heaters a place in market.

The energy fluctuations might cause the electrical water heater to malfunction, if proper precautions are not taken. These malfunctions can lead to problems like uneven water temperatures or serious problems like explosions too. Because of such hazards, many people avoid electrical water heaters and use gas operated or solar water heaters. These are a few things that could limit the demand for electric water heaters.

There are lots of innovative technologies introduced worldwide, some being useful and some are just weird concepts becoming reality. In China electrical water faucet with attached showerhead. This innovation is becoming a hit among Chinese household, where there are no solar heaters are used.

This faucet is waterproof, and has safety features like power cut in case of leakages to avoid electrocution. It has a digital temperature control panel, allowing ease is use. This tap only heats water when it is turned on, being an ideal, energy efficient water heating option. Such innovative ideas and designs of electrical water heaters are increasing the market demand, not only in China, but in other countries too.

Indian electrical water heaters require an update, as accidental deaths related to them are increasing. Indian households are using two most common type of electrical water heaters, one being a compact, digital, wall mounted water heater, and other being electrical rods or coils, which are immersed in water.

The first electrical water heater is safe for use, and there are very few accidents related to them, mostly being of water burns, but electrical rods are most common reason of electrocutions in India. Many people switch on the water heaters and immerse them in water, and do not switch off while checking the temperature.

There are chances of electricity leakage and electrocution. Increasing number of deaths due to electric heating rods are likely making Indian users to go for safer options like solar heater or gas geysers, impacting on electrical water heaters market.

Some key players in the Electric Water Heater market are Whirlpool, General Electric Co., Rheem Manufacturing Company, A.O. Smith Corp, Bradford White, Bajaj Electricals, Goodman, Midea Group, Siemens AG, and others

| Attribute | Details |

|---|---|

| Growth Rate | CAGR of ~5.2% from 2025 to 2035 |

| Base year for estimation | 2024 |

| Historical Data Available for | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative units | Revenue in USD Billion, volume in Units, and CAGR from 2025 to 2035 |

| Report coverage | Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends, pricing analysis |

| Segments covered | Product Type, Capacity, End User, Region. |

| Country scope | USA, Canada, Mexico, Germany, UK, France, Italy, Spain, Russia, India, Thailand, China, India, Japan, Australia, Brazil, Argentina, Colombia, Saudi Arabia, UAE, South Africa |

| Key Companies Profiled | Whirlpool; General Electric Co; Rheem Manufacturing Company; A.O. Smith Corp; Bradford white; Goodman; Bajaj Electricals; Midea Group; Siemens AG.; Others |

| Customization scope | Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options | Avail customized purchase options to meet your exact research needs. |

The global electric water heater market is estimated to be valued at USD 28.4 billion in 2025.

The market size for the electric water heater market is projected to reach USD 47.2 billion by 2035.

The electric water heater market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in electric water heater market are with tank and tankless.

In terms of capacity, medium segment to command 46.9% share in the electric water heater market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Electric Water Bottle Market

Gas Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Solar Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Water Glycol Based Electric Drive Unit Market Size and Share Forecast Outlook 2025 to 2035

Bucket Water Heater Market Analysis - Trends, Growth & Forecast 2025 to 2035

Instant Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Storage Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Commercial Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Residential Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electric Water Pump for Engine Cooling Market Size and Share Forecast Outlook 2025 to 2035

Industrial Solar Water Heaters Market Growth – Trends & Forecast 2025 to 2035

Commercial Storage Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Demand for Industrial Solar Water Heaters in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Industrial Solar Water Heaters in USA Size and Share Forecast Outlook 2025 to 2035

Water Vapor Permeability Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Electric Aircraft Onboard Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electrical Label Market Size and Share Forecast Outlook 2025 to 2035

Water and Waste Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Electric Round Sprinklers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA