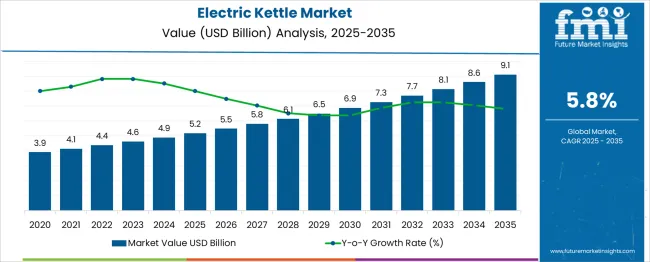

The Electric Kettle Market is estimated to be valued at USD 5.2 billion in 2025 and is projected to reach USD 9.1 billion by 2035, registering a compound annual growth rate (CAGR) of 5.8% over the forecast period. Analyzing the acceleration and deceleration pattern reveals that the early phase (2025–2030) shows strong acceleration, with the market rising from USD 5.2 billion to USD 6.9 billion, contributing USD 1.7 billion or nearly 44% of total growth. This momentum is driven by increasing adoption of energy-efficient kettles, the rising popularity of premium models with variable temperature control, and e-commerce expansion across emerging markets. Manufacturers focus on ergonomic designs, rapid-boil features, and enhanced safety systems to meet evolving consumer expectations. In the later phase (2030–2035), the market adds USD 2.2 billion, reaching USD 9.1 billion, indicating a mild deceleration as penetration in developed regions approaches saturation and price competition intensifies. However, growth continues to be fueled by innovations such as smart kettles with IoT connectivity, app-based controls, and sustainable materials, along with heightened demand from hospitality and office segments. Companies emphasizing digital integration, energy optimization, and customization features will capture premium segments, as the market shifts from volume-driven expansion to technology-led differentiation and replacement demand in its mature stage.

| Metric | Value |

|---|---|

| Electric Kettle Market Estimated Value in (2025 E) | USD 5.2 billion |

| Electric Kettle Market Forecast Value in (2035 F) | USD 9.1 billion |

| Forecast CAGR (2025 to 2035) | 5.8% |

The electric kettle segment shows measurable penetration across multiple parent markets. Within kitchen appliances and consumer electronics, it represents about 5–7%, as it competes with other small appliances yet enjoys consistent demand for boiling convenience. In the small cooking and beverage preparation segment, its share increases to 8–10%, offering speed and precision over traditional stovetop methods.

Within the home convenience and fast-cooking category, the contribution reaches 10–12%, driven by growing consumer preference for quick beverage preparation and instant meals. In the smart kitchen and connected appliance market, electric kettles account for 6–8%, supported by app-enabled models featuring variable temperature control. For the energy efficient household appliance category, its share is 7–9%, positioned as a low-consumption alternative to gas boiling and conventional heating. Demand is accelerated by rising single-person households, busy urban lifestyles, and health-conscious beverage trends. Technological enhancements such as insulated stainless steel construction, rapid-boil elements, automatic shutoff, and digital temperature settings are improving safety, energy performance, and user convenience, making electric kettles a core product in both standard and connected home environments.

The Electric Kettle market is gaining significant momentum due to increasing consumer preference for convenient, energy-efficient kitchen appliances. Rising demand for quick boiling solutions and the growing influence of urban lifestyles are shaping the direction of market expansion. The integration of smart features, such as auto shut-off and variable temperature control, is reinforcing the appeal of electric kettles in both residential and commercial environments.

Manufacturers are focusing on aesthetic design, safety standards, and durable materials to cater to changing consumer preferences. E-commerce growth and retail innovation have further enhanced product accessibility and visibility. In developing regions, rising disposable income and a shift toward modular kitchen solutions are accelerating the adoption of electric kettles.

Simultaneously, health-conscious consumers are opting for safer and BPA-free materials, prompting innovation in material technologies. As sustainability and energy efficiency continue to influence purchasing decisions, the electric kettle market is expected to maintain steady growth with further product differentiation and regional expansion..

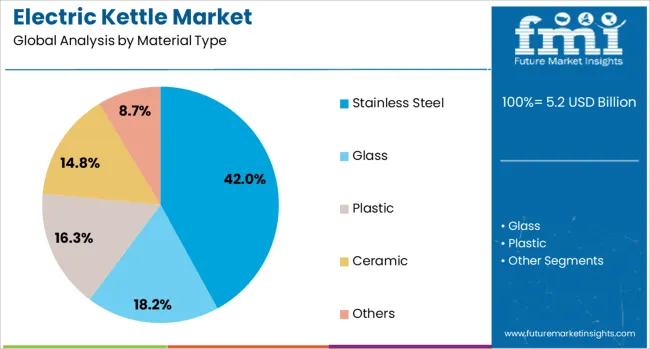

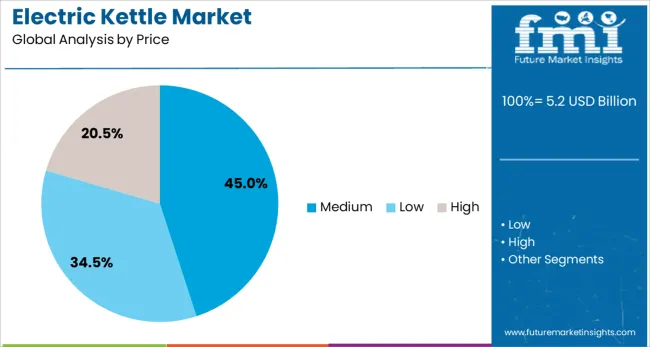

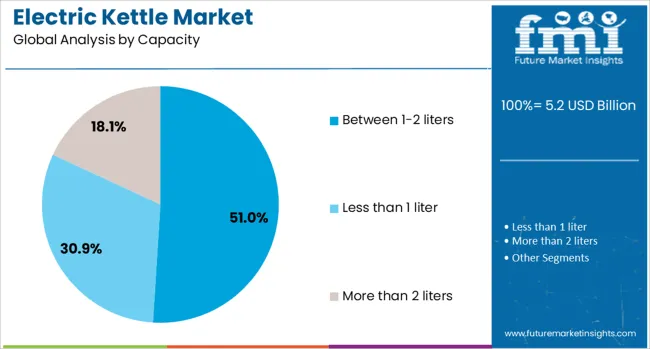

The electric kettle market is segmented by material type, price, capacity, application, distribution channel, and geographic regions. The electric kettle market is divided by material type into Stainless Steel, Glass, Plastic, Ceramic, and Others. In terms of price, the electric kettle market is classified into Medium, Low, and High. The capacity of the electric kettle market is segmented into between 1-2 liters, Less than 1 liter, and More than 2 liters. The electric kettle market is segmented into Residential and Commercial. The distribution channel of the electric kettle market is segmented into Offline and Online. Regionally, the electric kettle industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The stainless steel material type segment is projected to account for 42% of the Electric Kettle market revenue share in 2025, making it the dominant material category. This preference has been supported by the superior durability, corrosion resistance, and high-temperature tolerance associated with stainless steel. Consumers have shown increasing interest in long-lasting appliances that do not compromise on health safety or performance.

The non-reactive nature of stainless steel ensures purity of water taste and minimizes risks associated with plastic leaching, which has been a growing concern among health-aware buyers. Its ability to retain heat effectively contributes to improved energy efficiency and consistent boiling results.

The aesthetic appeal and premium positioning of stainless steel products have also contributed to increased demand in mid to high-end consumer segments. As environmental and health considerations become more prominent, the use of stainless steel has gained widespread acceptance as a safe and sustainable material for electric kettles..

The medium price segment is expected to command 45% of the Electric Kettle market revenue share in 2025, establishing it as the leading pricing tier. This segment has been preferred by consumers seeking a balance between quality, features, and affordability. Products within this range often offer essential safety functionalities, satisfactory durability, and competitive aesthetics without significantly increasing cost.

The rapid expansion of the middle-class population, particularly in emerging markets, has contributed to increased spending in this category. Retailers have responded by expanding offerings in this price range to cater to both value-driven and aspirational customers.

The medium price segment also benefits from strong performance in both offline and online channels, with bundled features like fast boiling, cordless operation, and automatic shut-off becoming standard. This tier's ability to meet functional expectations while maintaining cost-efficiency has solidified its dominance in the evolving consumer electronics landscape..

The between 1 to 2 liters capacity segment is anticipated to capture 51% of the Electric Kettle market revenue share in 2025, leading the capacity segmentation. This segment has gained preference due to its optimal balance between portability and utility, making it suitable for individual and small family use. Consumers have favored this capacity range for its energy efficiency, faster boiling time, and minimal counter space requirement.

The segment addresses the needs of both residential and office environments, where moderate quantities of hot water are frequently required. Manufacturers have increasingly introduced advanced models within this capacity bracket, integrating features such as boil-dry protection, ergonomic designs, and variable temperature settings.

The growing adoption of electric kettles among students, working professionals, and small households has further propelled demand in this segment. Its dominance has also been supported by affordability, convenience, and ease of maintenance, positioning it as the most versatile and widely accepted capacity in the market..

Electric kettles are countertop appliances designed to heat water rapidly using internal heating elements. These appliances are widely used in households, hospitality, offices, and foodservice venues. Adoption has been supported by demand for quick boiling, precise temperature control, and energy efficiency. Brands offering kettles with rapid boil systems, preset temperature settings, boil-dry protection, and cordless designs remain favored. Models offering quick-heat performance, ergonomic design, and safety features continue to influence purchase decisions among consumers and institutional buyers seeking reliable and convenient heating solutions.

Adoption of electric kettles has been driven by consumer preference for fast boiling and minimal wait time. Early morning routines and beverage preparation benefit from rapid heating that outpaces stovetop methods. Features such as temperature presets for tea or coffee, auto shut-off, and quiet boil cycles enhance convenience. Compact and cordless models offer countertop flexibility and portability between kitchen and desk use. Energy-conscious users have also embraced kettles with insulated walls or rapid boil efficiency. Institutional buyers like offices or lodging facilities have favored models with consistent performance and safety certifications, supporting dependable daily use at scale.

Growth has been constrained by concerns over build durability and potential safety issues such as overheating or leakage. Use of poor-quality heating elements or plastic liners may lead to scale buildup or future component failure. Variance in certification standards across regions has created confusion over product safety and material compliance. Consumer perception of safety risk is heightened when auto shut-off or boil-dry protection is missing. Water scale and mineral accumulation require frequent descaling in hard-water areas, impacting reliability. Limited clarity about BPA or plastic exposure also affects trust in budget models, particularly in markets with evolving food-safety expectations.

Opportunities exist in development of smart-connected kettle models supporting app-based control, temperature scheduling, or boil completion alerts. Integration with voice assistants or smart home systems delivers hands-free operation. Premium designs offering double-wall insulation, filtered spouts, and multi-temperature presets support tiered user segments. Collaboration with beverage brands or hospitality chains for co-branded designs can enhance visibility. Subscription or bundled services such as replacement filter packs or descaling solutions provide recurring engagement. The development of fast-boil systems promising energy savings and time reduction supports consumer appeal, especially among busy households and office environments.

Current trends include kettles featuring LED displays, programmable temperature memory, and touch-sensitive control panels. Glass or stainless-steel bodies with clean minimalist finishes have replaced dated plastic aesthetics in premium models. Modular kettle designs with detachable base units and compact storage options support user flexibility. Growing demand for low-noise boiling mechanisms and ergonomic handles is shaping comfort-led design. Smart kettle lines offering brew timer sync with coffee machines or tea infusers are gaining traction. Transparent window gauges and improved water-level visibility aid ease of use. Enhanced safety features such as auto shut-off, boil-dry protection, and thermal cutout systems continue to differentiate credible products.

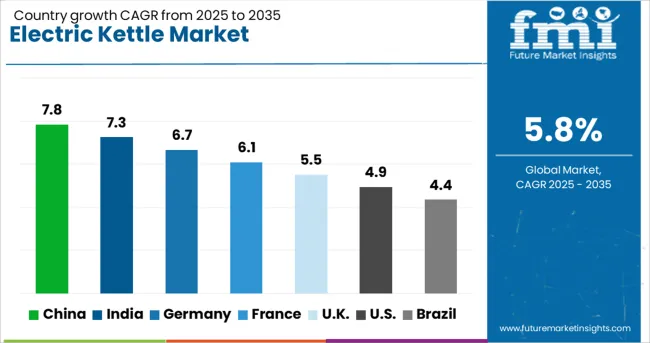

| Country | CAGR |

|---|---|

| China | 7.8% |

| India | 7.3% |

| Germany | 6.7% |

| France | 6.1% |

| UK | 5.5% |

| USA | 4.9% |

| Brazil | 4.4% |

The electric kettle market is expected to grow at a CAGR of 5.8% from 2025 to 2035, driven by increasing preference for quick-heating appliances, rising tea and coffee consumption, and product innovations in temperature control features. China leads with 7.8%, supported by strong e-commerce penetration and high demand for smart kitchen appliances. India follows at 7.3%, fueled by a growing middle-class population and increased home beverage preparation. Among developed economies, France posts 6.1%, while the United Kingdom records 5.5% and the United States 4.9%, driven by energy-efficient models and premium design innovations. The analysis includes over 40 countries, with the top five detailed below.

China is projected to achieve a CAGR of 7.8% through 2035, driven by rapid growth in smart electric kettles featuring digital controls and multi-temperature settings. The surge in online retail platforms enhances accessibility and drives product innovation across premium and mid-range categories. Manufacturers are prioritizing app-enabled control systems, energy-efficient heating, and double-wall insulation for user convenience. Increased tea consumption and a growing preference for at-home beverage preparation further strengthen demand. Domestic brands dominate the market by leveraging cost efficiency, while international players focus on aesthetics and advanced features to compete in the high-end segment.

India is forecasted to grow at a CAGR of 7.3% through 2035, supported by increasing demand for convenient appliances across urban and semi-urban households. Consumers prefer compact, portable, and low-energy designs, making electric kettles popular among small families and working professionals. The integration of rapid-boil features, auto cut-off systems, and durable stainless-steel designs is driving competitive differentiation. Domestic brands offer cost-effective models, while premium international brands cater to lifestyle-oriented buyers. Online sales dominate product availability across regions, while traditional retail remains strong in tier-II and tier-III cities, creating a balanced distribution network for manufacturers.

France is expected to post a CAGR of 6.1% through 2035, driven by the adoption of aesthetic and energy-efficient electric kettles in modern kitchens. Consumers prioritize products featuring temperature presets, insulated designs, and glass or stainless-steel finishes for durability and elegance. The rise in specialty tea and coffee consumption supports demand for kettles with precision heating controls. Manufacturers are introducing eco-friendly models and recyclable materials to appeal to environmentally conscious consumers. Growth in online sales, supported by showroom-based retail, ensures market penetration across multiple demographics, reinforcing France’s position in the premium appliance segment.

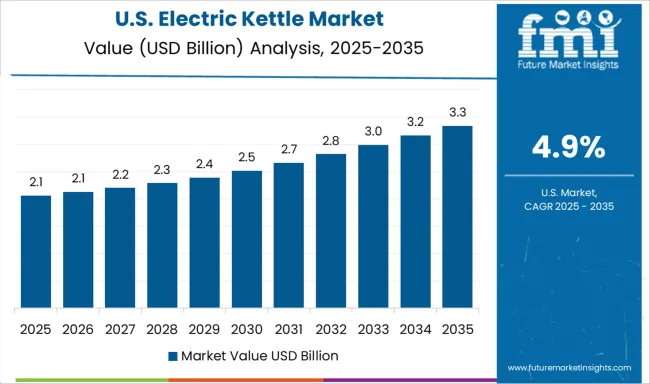

The United States is forecasted to grow at a CAGR of 4.9% through 2035, supported by demand for compact, multi-functional, and connected electric kettles in households and workplaces. Consumers prioritize digital control panels, cordless systems, and precision temperature options for beverage customization. Smart-enabled kettles integrated with voice assistants and mobile apps are gaining traction in tech-savvy households. Growth is reinforced by health and lifestyle trends favoring home brewing for coffee and herbal teas. Manufacturers are also emphasizing BPA-free materials, eco-friendly finishes, and ergonomic designs, ensuring compliance with safety standards and consumer preferences.

The United Kingdom is projected to record a CAGR of 5.5% through 2035, driven by the country’s strong tea culture and preference for premium designs with integrated filters and smart controls. Rising awareness of energy conservation has boosted demand for kettles with auto shut-off features and low-energy heating elements. Online platforms dominate premium product distribution, while traditional stores remain influential in rural and semi-urban regions. Consumers increasingly favor variable-temperature models, catering to diverse tea varieties and health-conscious preferences. This demand for advanced and stylish kettles ensures steady market growth over the forecast period.

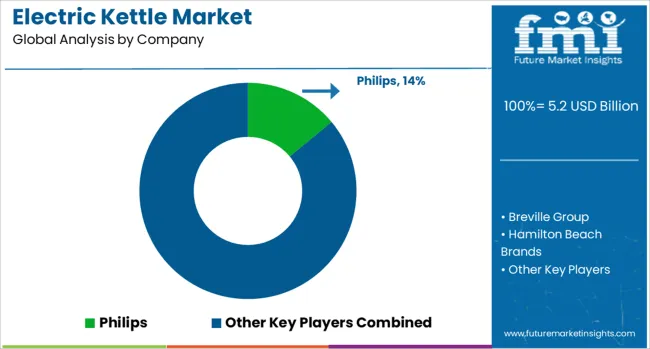

The electric kettle market is competitive, featuring global and regional brands such as Philips, Breville Group, Hamilton Beach Brands, Cuisinart, Morphy Richards, Prestige, Xiaomi, and Kenwood. Philips leads with a strong presence in multiple geographies, offering kettles that combine energy efficiency, rapid boiling technology, and user-friendly features. Breville Group focuses on premium designs with advanced temperature control and durable stainless-steel construction, appealing to consumers who prioritize precision brewing for tea and coffee. Hamilton Beach and Cuisinart target mid-range segments, emphasizing versatility, safety features like auto shut-off, and stylish aesthetics for modern kitchens. Morphy Richards and Prestige dominate in emerging markets with affordable, compact designs tailored for everyday use. Xiaomi differentiates itself through smart electric kettles integrated with app-based temperature control and IoT-enabled features, catering to tech-savvy consumers, while Kenwood maintains strong brand equity through durable, high-capacity products suitable for both household and light commercial usage.

Competitive advantages are driven by design innovation, material durability, smart functionality, and safety compliance. Barriers to entry remain moderate, with success relying on strong distribution networks, branding, and after-sales service. Strategies among leading players include expanding product portfolios to include variable temperature models, energy-saving designs, and cordless kettles with 360-degree swivel bases. Online retail channels and direct-to-consumer models are increasingly significant for market penetration, particularly in the Asia-Pacific region.

On January 28, 2025, Williams Sonoma launched the exclusive Breville Brass Collection, featuring premium countertop appliances with brass accents in Damson Blue, Olive Tapenade, and Sea Salt finishes. Combining Breville’s advanced technology with luxury design, the collection elevates kitchen aesthetics across multiple appliance categories.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.2 Billion |

| Material Type | Stainless Steel, Glass, Plastic, Ceramic, and Others |

| Price | Medium, Low, and High |

| Capacity | Between 1-2 liters, Less than 1 liter, and More than 2 liters |

| Application | Residential and Commercial |

| Distribution Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Philips, Breville Group, Hamilton Beach Brands, Cuisinart, Morphy Richards, Prestige, Xiaomi, and Kenwood |

| Additional Attributes | Dollar sales by product type (standard kettles, variable temperature kettles, smart IoT-enabled kettles) and application (residential, commercial), with demand fueled by convenience-driven lifestyles and tea and coffee consumption trends. Regional dynamics show Europe and North America as established markets, while Asia-Pacific demonstrates rapid growth due to urbanization and rising disposable incomes. Innovation trends include integration of smart controls with mobile apps, advanced insulation for energy efficiency, fast-boil heating elements, and aesthetic finishes designed to complement modern kitchen interiors. |

The global electric kettle market is estimated to be valued at USD 5.2 billion in 2025.

The market size for the electric kettle market is projected to reach USD 9.1 billion by 2035.

The electric kettle market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in electric kettle market are stainless steel, glass, plastic, ceramic, others, _copper and _aluminum.

In terms of price, medium segment to command 45.0% share in the electric kettle market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electric Aircraft Onboard Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electrical Label Market Size and Share Forecast Outlook 2025 to 2035

Electric Round Sprinklers Market Size and Share Forecast Outlook 2025 to 2035

Electric Cloth Cutting Scissors Market Size and Share Forecast Outlook 2025 to 2035

Electrical Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Electric Aircraft Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electric Traction Motor Market Forecast Outlook 2025 to 2035

Electric Vehicle Sensor Market Forecast and Outlook 2025 to 2035

Electric Vehicle Motor Market Forecast and Outlook 2025 to 2035

Electric Off-Road ATVs & UTVs Market Size and Share Forecast Outlook 2025 to 2035

Electric Blind Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Electric Fireplace Market Size and Share Forecast Outlook 2025 to 2035

Electric Glider Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Battery Conditioners Market Size and Share Forecast Outlook 2025 to 2035

Electric Power Steering Motors Market Size and Share Forecast Outlook 2025 to 2035

Electric Motor Market Size and Share Forecast Outlook 2025 to 2035

Electric Gripper Market Size and Share Forecast Outlook 2025 to 2035

Electric Boat Market Size and Share Forecast Outlook 2025 to 2035

Electric Bicycle Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Transmission Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA