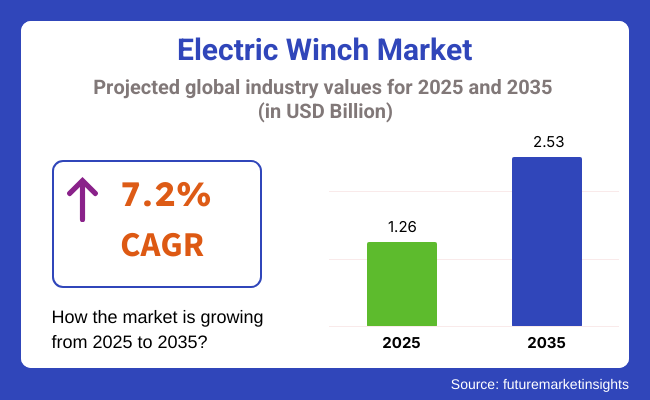

The industry is expected to expand over the coming decade, with its estimated valuation of USD 1.26 billion in 2025 and anticipated to rise to USD 2.53 billion by 2035 at a CAGR of around 7.2%. This expansion is being fueled by increasing demand across construction, automotive, marine, and industrial use cases.

One of the major drivers for growth is increased demand for recreational and off-road vehicles. These winches are a must-have accessory for use in trucks, ATVs, SUVs, and utility vehicles in outdoor environments to recover the car, go around obstacles, and handle payloads in remote or rough terrain.

The construction and infrastructure sector is another sector with high demand. Winches are used to hoist scaffolding, move equipment, and transport materials vertically within restricted or temporary spaces. Flexibility and easy installation render them suitable in city and modular building schemes where saving time and space is the top priority.Industrial applications are also observing increasing usage.

Winches are used in assembly lines, warehouses, mines, and material transfer systems. As automation is growing and there is smart manufacturing, winches are being networked with remote controls, wireless systems, and programmable parameters to enable safer and more precise operations.

Asia Pacific dominates globally through high-speed infrastructure growth, an increase in automotive manufacturing, and increased industrialization. North America and Europe are next in line, with immense demand from recreational vehicle consumers, commercial fleets, and safety-driven construction companies.

There is tremendous growth in the industry as thedemand for construction, automotive, maritime, and mining increases. These winches provide control along with safety measures, lowering accident risks and injury occurrence in commercial environments.

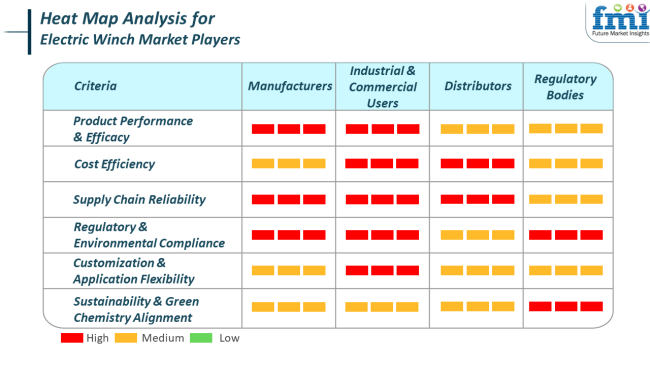

There is a lot of diversity when it comes to types of products in the industry as they have to cater to applications, user industries, and geographic spread.Manufacturers focus on developing high-performance winches that meet the stringent requirements of industrial and commercial users. They invest in sustainable production methods and aim to ensure a reliable supply chain to cater to the growing global demand.

Industrial and commercial users, such as industries like construction, automotive, marine, and mining, value cost-efficient and dependable solutions that provide maximum performance in a wide range of applications. They desire very effective products that are environmentally friendly and could be tailored according to certain operational needs.

Distributors emphasize the importance of having a stable supply chain in order to serve the needs of industrial and business customers. They target offering multiple products appealing to diverse applications while ensuring timely delivery and affordability.

Between 2020 and 2024, there was a stable demand from the industry, largely driven by growth in automotive off-roading, marine transport, and industrial material handling applications. Recreational vehicle owners and off-road enthusiasts, in particular, contributed to the increased uptake of compact, battery-powered winches.

The marine industries use winches for anchor handling and towing small vessels because they are easy to operate and reliable. However, product drawbacks like overheating in heavy usage and low torque in compact units created problems. In this phase, innovation emphasized safety features like automatic load-holding brakes and wireless remotes to attract recreational as well as professional users.

From 2025 to 2035, the industry will become increasingly performance-oriented and digitally connected. Improvements in motor efficiency, thermal management systems, and power-to-weight ratios will extend the application of winches into more demanding rescue and industrial operations.

Vehicle and vessel electronic control system integration will improve safety and functionality. In addition, greater use of electric commercial ships and boats is likely to enhance demand for economical winching systems designed specifically for these fleets. Sustainability is going to contribute more as producers start using recyclable materials and production processes that maximize energy efficiency.

A Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Growth in off-road vehicles, marine use, and light industrial applications. | Electrification of boats and vehicles is needed, as well as intelligent integrated and energy-saving systems. |

| Small battery-operated versions for recreational and light-duty uses. | High-power winches with sophisticated control systems and wider industrial use. |

| Wireless remotes, auto-shut-off, and minimal overload protection are in focus. | Improved motor cooling, digital load control, and vehicle/vessel electronics integration. |

| Off-road users, small boat/marine users, and utility maintenance personnel adopt it mainly. | Wider application by marine, construction, and logistics industries looking for reliable electric substitutes for hydraulic systems. |

| Limited consideration of sustainability; very low consideration of recyclable materials. | Greater sustainability in design, recyclable parts, and energy-efficient motor technologies. |

| Strong demand in North America and some areas of Europe because of recreation and infrastructure markets. | Penetration of Asia-Pacific and Latin America as a result of expanding transportation and maritime sectors. |

The industry finds demand in construction, marine, auto recovery, and industrial handling operations, and it is enjoying steady demand, but some risks still dictate its future. One major issue in 2024 is the high initial cost of sophisticated winch systems, especially heavy-duty types equipped with digital control interfaces and wireless connectivity. For small- and medium-scale businesses, this capitalization constitutes a major uptake barrier, especially in developing economies.

Operation and maintenance of the advanced winches also necessitate skilled technicians. An insufficiently skilled workforce could lead to ineffectiveness during operation, more equipment downtime, and increased maintenance costs.

The sector is also vulnerable to supply chain disruptions-motor, cable, control system, or gearing component delivery delays can significantly impact manufacturing schedules and customer order fulfillment when manufacturing is highly localized in a particular region. The sector will be vulnerable to technology and regulation threats that may reconfigure consumption patterns.

Intense innovation in electric motor construction and automation is likely to subject the current lineup of models to the risk of premature obsolescence and force manufacturers into constant R&D expenditures to be competitive.

Increasingly strict environmental and efficiency regulations in the North American and European regions will possibly necessitate redesigns or reengineering at considerable expense in order to fit the winch systems into conformity specifications.

Another burgeoning risk comes in the form of increased winch integration with smart load-monitoring or remote diagnostic platforms, which, as good as they are for fleet management, brings associated cybersecurity risks. Wireless or cloud-based interfaces exposing systems could face unauthorized access or data breach threats, especially where sensitive industrial or defense applications are involved.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 6.5% |

| UK | 5.8% |

| France | 5.6% |

| Germany | 6.2% |

| Italy | 5.3% |

| South Korea | 5.1% |

| Japan | 4.8% |

| China | 7.4% |

| Australia-NZ | 5.5% |

The USA will register a growth of 6.5% CAGR during the study period. The increasing adoption of winches in off-road vehicles, industrial applications, marine applications, and utility services is fueling the industry's growth. Strong demand from construction and logistics sectors, especially in remote and hilly areas, facilitates the consistent uptake of winching systems.

Increasing demand for electric and remote-controlled winches is gaining momentum across the commercial and recreational vehicle sectors. Focusing on occupational safety through regulations also compels industries to make a transition towards electric systems from hydraulic or manual alternatives.

The UK is growing at an estimated rate of 5.8% CAGR during the study period. The reason for the growth is the increasing installation of winching systems in emergency recovery, utility repair, and recreational towing. Growing sales are being driven by the UK's active automobile aftermarket and emphasis on vehicle safety accessories.

Customers are adopting winches due to ease of operation and lower maintenance requirements over hydraulic winches. The commercial and farming transport sectors are also adopting winches to enhance equipment performance. Innovation in products, particularly wireless control and weather-resistant designs, is attracting an increasing number of users. The active off-road and outdoor consumer base across rural areas also guarantees product usefulness continues.

France will grow at 5.6% CAGR during the study period. The country's shipping and manufacturing industries are contributing significantly to the increased demand for heavy-duty winching systems. Offshore operations development and port infrastructure upgrades are influencing the use of advanced winching technology.

Apart from industrial uses, automotive and recovery vehicle installations are in increasing demand, especially in snow-covered and hilly regions. Manufacturers design compact, high-torque winches with enhanced load-handling capacity for personal and business applications.

Germany is expected to grow at a 6.2% CAGR during the forecast period. Technological innovation and a strong industrial base allow Germany to lead the application of high-performance winches. Automotive, engineering, and defense are the three key areas in which electric winching solutions are increasingly being adopted.

The need for precision and automation in heavy-duty applications has fueled the call for intelligent winch systems with digital control and safety features incorporated into them. Additionally, developments in material science have enabled us to have even more compact and corrosion-resistant forms appropriate to different weather and working conditions. Forestry and agricultural use lead to a demand that subsequently fuels revenue growth.

Italy will record a 5.3% CAGR during the forecast period. The transportation, marine, and small-scale industry segments largely supplement demand. The use of electric winches in vineyard machinery, fishing boats, and rescue operations is remarkable. Italy's sea-based trade, in addition to a strong focus on ergonomics and safety, underwrites the adoption of these winches to take the place of mechanical manual setups.

Small enterprises and contractors are adopting portable adjustable electric winch units. Specialized cars used in city maintenance and logistics work also contribute to a demand for lightweight, adjustable power winching systems that are adjustable-mountable.

South Korea is anticipated to expand at 5.1% CAGR over the forecast period. Growth is driven by rapid industrialization and the increasing use of electric-powered machinery. Electric winches are finding increased application in material handling, dockyard operations, and vehicle conversions. With the country continuing to develop automobile technology, the installation of efficient winching systems in recreational and utility vehicles is increasingly becoming important.

South Korean consumers prefer miniaturization, energy efficiency, and intelligence, such as remote control. Domestic businesses are leveraging advancements in motor technology to offer winches for private and commercial applications.

Japan will increase CAGR by 4.8% during the study period. Lightweight, space-saving winches with superior performance are encouraging innovation. The demand is being placed both in the industrial and recreational segments with a focus on product precision and safety.

Electric winches are being installed in vehicles without diminishing fuel efficiency or space. An active aftermarket for automotive accessories coupled with ongoing investment in disaster recovery infrastructure fuels the sales growth.

China will expand at a 7.4% CAGR during the study period. China dominates the winch production industry due to its high manufacturing capacity and demand from heavy industries. Infrastructure development projects, mining activities, and logistic growth drive winch adoption.

The government supports safety upgrading within the transportation and construction sectors. Cost competitiveness, product diversity, and fast innovation give local manufacturers strong strength. Moreover, as individuals use recreational vehicles, these winches are becoming a standard part of car modifications and specialty vehicle use.

The Australia-New Zealand region will grow at 5.5% CAGR during the study period. The industry is characterized by extensive application in off-road cars, agricultural machinery, and rescue recovery vehicles. In Australia, harsh terrains and isolated areas necessitate the services of reliable winches for utility and rescue operations.

New Zealand's maritime and timber industries also utilize the winches to increase efficiency and labor benefits. Expansion is promoted by an established aftermarket support base and increasing demand from consumers for DIY installation. In addition, favorable local regulations promoting workplace safety encourage companies to invest in high-tech winching systems.

The segmentation isinto light-duty and heavy-duty categories. Heavy-duty winches are projected to dominate with a revenue share of approximately 56.5%, while light-duty winches will hold the remaining 43.5%.

Heavy-duty winches are primarily used in industrial, marine, and construction sectors due to their superior load-bearing capacity and rugged construction. These winches are engineered to handle extreme conditions, such as hauling heavy machinery, marine anchoring, or vehicle recovery in mining and off-road terrains.

Companies like Ramsey Winch and Superwinch have a stronghold in this segment. For instance, Ramsey Winch offers heavy-duty planetary winches designed for oilfield trucks and large wreckers, commonly used by logistics and utility providers. Similarly, Superwinch's Talon Series targets commercial applications in towing and recovery.

Warn Industries, a leading name in winching systems supplies heavy-duty winches for military-grade vehicles and off-road expeditions. Its ZEON Platinum series offers high-pull capacity, wireless control, and IP68-rated waterproofing-critical for users in defense and expeditionary roles.

In contrast, Light winches are favored for recreational and consumer applications, such as ATVs, UTVs, small boats, and personal trailers. These winches are lightweight, easy to install, and budget-friendly. Companies like Smittybilt and Champion Power Equipment cater to this segment.

Smittybilt's XRC series is popular among off-road hobbyists and Jeep owners, offering reliable performance for weekend adventures. Champion Power Equipment provides compactwinches tailored for utility trailers and light-duty towing, appealing to homeowners and small businesses.

As outdoor recreation and DIY automotive modification grow, light-duty winches are expected to see increased adoption. Meanwhile, infrastructure expansion and commercial fleet demand continue to solidify the role of heavy-duty winches in industrial applications.

By gear type,planetary gears account for 48.2%, and worm gears account for 34.7%. Each gear type has performance characteristics that are suitable for those customers.

Planetary gear systems are sufficiently compact, offer very high torque, and transmit through an efficient power train. Such gears are ideal for speed and continuous pulling applications. An example is Warn Industries, which integrates this technology in many of its ZEON and VR series winches, which of the market's enthusiasm and commercial sales for vehicle recovery, particularly in the Jeep and truck communities, have followed them. Therefore, the recovery lines, with the fast operation of the gears, are now being considered more time-critical.

Runva Winch is a prominent brand. The company manufactures the world's best planetary gears for its 4x4 and industrial winches. EWX Series features three-stage planetary gears that operate very smoothly and efficiently in both recreational and industrial applications.

However, worm gear winches occupy 34.7% of the share and are most suitable for applications that demand higher load-holding requirements and precise operation. The worm gears differ from the planetary gears in the sense that they are self-locking, which means that they can be recommended for use in vertical lifting or in conditions that require safety against rollback. For these reasons, they occupy prime positions in marine and hoisting applications.

Fulton and Superwinch wear worm gear winches in their trailer and utility winch lines. An example is Fulton's XLT series, which utilizes worm gear mechanisms to do heavy marine trailer winching with highly precise control in slippery dock environments.

Planetary gears will dominate, offering speed and torque advantages across all mobile and utility applications. In the case of worm gears, they will take the lead in critical safety load-holding applications, ensuring both gears play their respective vital roles in the industry.

The industry is highly competitive among industrial and automotive winch manufacturers, involving innovations, reliability, and load-bearing capabilities. Leaders such as WARN Industries, Ramsey Winch, and Ingersoll-Rand derive their expertise from off-road vehicles to industrial and marine applications through the use of their heavy-duty winches. These companies spend large amounts on robust motor technologies with enlarged cable durability to satisfy professional and recreational users.

Technological advancements have made advances in the creation of wireless control and remote control winches. One such company that brought out these winches is Harken Inc. Taiwan Winch Industrial Co. Ltd. introduced winches that utilize smart controls to improve usability and safety. Dowellcrane Machinery Group and Henan Hengyuan Crane Machinery stress heavy-duty, high-capacity winches designed specifically for strong-lifting applications in construction and mining.

Strategic alliances and acquisitions are some key strategies to expand reach. Advancing in partnerships with visionary automotive and utility vehicle manufacturers strengthens WARN Industries' distribution channels. At the same time, Friedrich Koster GmbH & Co. KG has been introduced into several areas in Europe with their highly precision-enabled winches.

KA-Winch and Westin Automotive Inc., on the other hand, are into developing winches mainly for off-road and military applications, ensuring high durability and performance under severe conditions.

Geographical expansion is a major strategy for most players, reaching out to more customers in emerging markets, and it is one approach all the players in Asia-Pacific and Latin America are using to broaden their footprints.

Henan Hengyuan Crane Machinery and Dowellcrane Machinery Group compete with the best, as they spend huge investments in low-budget production schemes and optimized supply chains. However, continuing established brands such as Ramsey Winch and Ingersoll-Rand spend a fortune on producing premium, high-torque winches that dominate the North American and European markets.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| WARN Industries Inc. | 20-25% |

| Ramsey Winch Inc. | 15-20% |

| Ingersoll-Rand plc | 12-17% |

| Taiwan Winch Industrial Co. Ltd. | 8-12% |

| Henan Hengyuan Crane Machinery Group | 5-9% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| WARN Industries Inc. | Develops high-durability off-road winches with advanced wireless control. |

| Ramsey Winch Inc. | Specializes in heavy-duty industrial and commercial winches. |

| Ingersoll-Rand plc | Offers precision-engineered electric winches for construction and manufacturing. |

| Taiwan Winch Industrial Co. Ltd. | Focuses on compact, high-torque winches with smart control integration. |

| Henan Hengyuan Crane Machinery Group | Produces large-capacity electric winches for industrial and maritime applications. |

Key Company Insights

WARN Industries Inc. (20-25%)

WARN Industries leads the industry with advanced off-road winches featuring remote control operation, high torque, and durable synthetic ropes.

Ramsey Winch Inc. (15-20%)

Ramsey Winch specializes in rugged electric winches designed for heavy-duty industrial applications, maintaining a strong presence in North America.

Ingersoll-Rand plc (12-17%)

Ingersoll-Rand offers innovative electric winches for construction, mining, and marine applications, incorporating high-efficiency motors and corrosion-resistant materials.

Taiwan Winch Industrial Co. Ltd. (8-12%)

Taiwan Winch Industrial focuses on compact and portable electric winches, integrating smart controls for improved ease of use.

Henan Hengyuan Crane Machinery Group (5-9%)

Henan Hengyuan Crane Machinery dominates the industrial electric winch segment, providing high-capacity solutions for lifting and heavy transport applications.

Other Key Players (30-40% Combined)

The segmentation is into Light Duty Winch and Heavy Duty Winch.

The segmentation is into Planetary Gears, Worm Gears, and Spur Gears.

The segmentation is into line types, including Wire Rope, Strap/Web, and Chain.

The segmentation is into Automotive, Construction, Industrial Manufacturing, Military, Marine, Mining, Railway, and Oil & Gas.

Geographically, the report covers North America, Latin America, Europe, South Asia & Pacific, East Asia, and the Middle East & Africa.

The industry valuation is estimated to reach USD 1.26 billion by 2025.

The valuation is projected to grow to USD 2.53 billion by 2035, reflecting strong demand across industrial and automotive applications.

China is anticipated to grow at a 7.4% CAGR, indicating expanding manufacturing and infrastructure sectors.

The heavy-duty segment dominates, particularly in construction, mining, and utility applications.

Key players include WARN Industries Inc., Ramsey Winch Inc., Ingersoll-Rand plc, Taiwan Winch Industrial Co. Ltd., Henan Hengyuan Crane Machinery Group, Friedrich Koster GmbH & Co. KG, Dowellcrane Machinery Group, Harken Inc., KA-Winch, Westin Automotive Inc., and Thern Inc.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electric Off-Road ATVs & UTVs Market Size and Share Forecast Outlook 2025 to 2035

Electric Blind Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Electric Fireplace Market Size and Share Forecast Outlook 2025 to 2035

Electric Glider Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Battery Conditioners Market Size and Share Forecast Outlook 2025 to 2035

Electric Power Steering Motors Market Size and Share Forecast Outlook 2025 to 2035

Electric Motor Market Size and Share Forecast Outlook 2025 to 2035

Electric Gripper Market Size and Share Forecast Outlook 2025 to 2035

Electric Boat Market Size and Share Forecast Outlook 2025 to 2035

Electric Bicycle Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Transmission Market Size and Share Forecast Outlook 2025 to 2035

Electrical Enclosure Market Size and Share Forecast Outlook 2025 to 2035

Electrical Sub Panels Market Size and Share Forecast Outlook 2025 to 2035

Electric Cargo Bike Market Size and Share Forecast Outlook 2025 to 2035

Electrical Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Electric Sub-meter Market Size and Share Forecast Outlook 2025 to 2035

Electric Light Commercial Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Fluid Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle E-Axle Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle On-Board Charger Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA