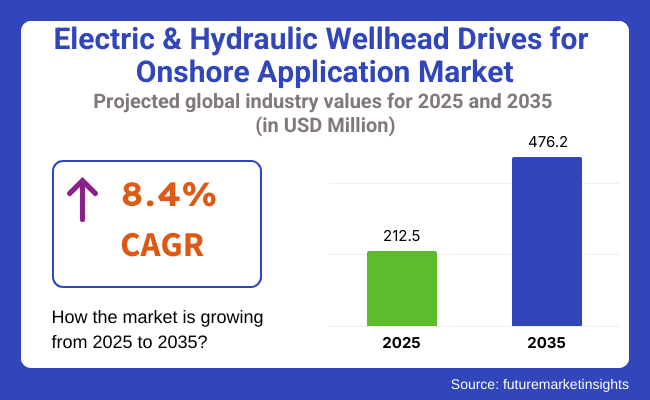

The industry is expected to experience high growth in the future, with an estimated valuation of USD 212.5 million in 2025, which is expected to rise to around USD 476.2 million by 2035, with a CAGR of about 8.4%. This growth is driven by some of the factors, including the trend in the industry towards automation, energy conservation, and optimum production.

One major growth driver is the continued modernization of older onshore wells, especially in regions such as North America, South America, and the Middle East. Producers are replacing traditional beam pumps and gas engines with efficient electric and hydraulic drives, offering programmable control, remote diagnostics, and improved operating precision.

On the other hand, hydraulic wellhead drives are used in applications where high torque, low ground disturbance, and stable performance under changing loads are needed. With their capability to provide consistent rod motion and smooth transmission of power, they are well-suited for unconventional or remote field applications where strength is of primary importance.

One of the key industry trends driving growth is the adoption of the Industrial Internet of Things (IIoT) and data-driven asset management. By integrating sensors and cloud-based analytics, operators can improve uptime, predict failures, and optimize pump performance-making wellhead drive systems more intelligent and independent.

Disadvantages are increased upfront capital costs and the need for specially trained installation and maintenance personnel. Operators in lower-margin environments may be unwilling to transition away from traditional systems. Hydraulic systems also require occasional fluid maintenance and leakage prevention, which can influence environmental compliance and operating costs.

North America is at the top due to advanced shale operations and the high density of artificial lift installations. Latin America, the Middle East, and selected regions in Asia-Pacific will demonstrate strong growth as a result of attempts to revitalize maturing fields and implement next-generation lifting technologies.

The industry witnesses strong growth, fueled by mounting demand for reliable and efficient wellhead solutions in the oil & gas sector. Technology has resulted in more advanced and automated wellhead drive systems, boosting operational efficiency and safety. The industry is growing because of a demand for low-cost solutions capable of working under harsh onshore conditions.

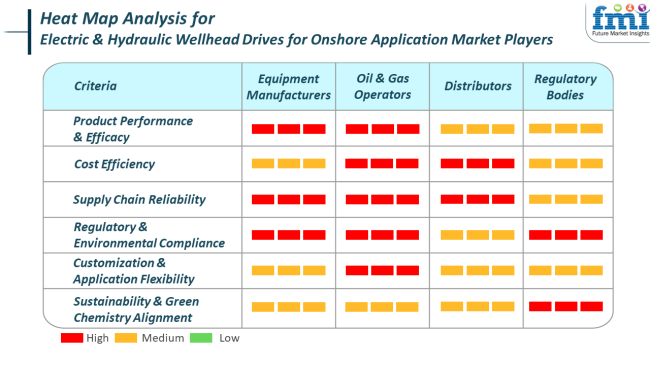

Distributors are keen on preserving a consistent supply chain to sustain the needs of oil and gas operators. Distributors concentrate on providing a diverse product mix covering various applications, along with delivery and cost competitiveness.

Regulatory Bodies enforce compliance with environmental and safety standards, driving the adoption of eco-friendly and sustainable wellhead drive solutions. They shape the industry by enforcing regulations that drive the utilization of green technologies and minimize the environmental impact of industrial activities.

From 2020 to 2024, the industry witnessed notable developments, influenced heavily by fluctuating oil prices and the need for optimized extraction. Meanwhile, oil and gas operators gave high importance to automation and safety in good operations.

Thus, the transition from conventional mechanical drives to more efficient electric and hydraulic options proceeded gradually. Hydraulic drives were usually preferred for their operation in harsh drilling environments, while electric drives started gaining popularity with their lower emissions and suitability for digital control systems.

Also, manufacturers aim to enhance energy efficiency and drive reliability, especially in remote and difficult field operations. However, adoption varied significantly by region depending on infrastructure maturity and investment capability.

From 2025 to 2035, there will be a shift toward electric wellhead drives as part of the global push toward decarbonization and digital oilfield transformation. Operators will increasingly turn to electric drives because they are compatible with renewable energy sources and have a lower environmental impact.

Furthermore, with the increasing popularity of digital oilfields, smart drive systems incorporating IoT sensors and AI-driven monitoring will become the norm, facilitating predictive maintenance and real-time performance tracking.

Modular systems with remote control will also grow in popularity, particularly in areas with high shale content, where deployment speed and operational flexibility are most valued. Over time, more regulatory stress and greater environmental concern will hasten the replacement of less environmentally friendly wellhead drive technologies.

A Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Automation, improved safety, and greater control of onshore drilling needs. Increased digitalization activities in the oilfield. | Increasing needs for emissions reduction, electrification, and connectivity with smart oilfield technology. |

| Hydraulic drive is dominant due to its strong performance; electric drive is becoming popular due to its efficiency. | Bulk conversion to electric drives due to lower emissions, remote control, and compatibility with renewable energy. |

| Initial phase of integration with SCADA and basic remote monitoring. | Increased level integration with IoT, AI, and digital twins with predictive maintenance and smart control systems. |

| Increased use in the Middle East and North America and increased focus on automation. | Increased adoption in the Asia-Pacific, Eastern Europe, and Latin America with further development in infrastructure and digital preparedness. |

| Increased concerns but weak adoption of low-emission systems. | Regulatory push for electrification and reductions in carbon footprints in wellhead operations. |

| Focus on energy-efficient hydraulic systems and improved control interfaces. | Move to fully electric, modular, AI-controlled systems with real-time diagnostics and environmental compliance. |

The industry faces many operational and strategic challenges. Foremost among them is the high capital cost and maintenance cost of installing advanced drive systems. While these technologies offer performance and automation benefits, they are so complex that specialized installation and integration are required, and this could be prohibitively costly to smaller operators.

In the future, there will be mounting pressure from the global energy transition. With tightening regulatory policies and the movement of capital toward cleaner sources of energy, long-term investment in fossil fuel infrastructure, such as wellhead drive systems, can be constrained.

Additionally, new environmental requirements can place additional restrictions on emissions, noise, and hydraulic fluid usage in environmentally sensitive areas-increasing compliance costs for operators employing legacy or non-upgraded systems.

The drive towards increased automation and remote monitoring brings with it an added layer of exposure: cybersecurity. As wellhead systems become more integrated into digital platforms, they are increasingly vulnerable to cyberattacks, system intrusions, and data interception, potentially compromising production control or safety procedures.

CAGR Forecast Table (2025 to 2035)

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 7.1% |

| UK | 5.2% |

| France | 4.5% |

| Germany | 4.8% |

| Italy | 4.6% |

| South Korea | 5.5% |

| Japan | 4.3% |

| China | 7.6% |

| Australia-NZ | 5.1% |

The USA is expected to grow at 7.1% CAGR during the forecast period. With a highly active onshore oil and gas industry, the country is among the largest consumers of electric and hydraulic wellhead drives. Shale gas operations in Texas, North Dakota, and New Mexico are ongoing, supporting the demand for high-performance and efficient artificial lift systems. Operators are shifting rapidly to embrace electric drives to spur sustainability goals and reduce operational emissions.

Demand in the industry is being fueled by high reliability, automation compatibility, and remote monitoring ability. The Permian Basin is particularly witnessing a shift from beam pump systems to high-performance electric drives at lower costs.

USA-based original equipment manufacturers are spearheading the change towards modular systems specifically tailored for unconventional reservoirs. Favorable policy support and investment in smart drilling infrastructure are likely to take the market forward during the forecast period.

The UK will expand at 5.2% CAGR during the study period. The energy strategy for the nation is to maximize onshore oil and gas recovery while making a smooth transition toward low-emission technologies. As onshore production is limited in comparison to offshore, electric and hydraulic wellhead drive usage is picking up in the fields of England and Scotland for efficient artificial lift.

Operators are adopting next-generation drive systems to extend the life of older wells and stimulate marginal fields. Pressure towards automation and digital well monitoring is causing the move from traditional lift systems to low-maintenance, energy-efficient electric models.

Pressure from regulators to reduce methane emissions is another key driver. University-energy company joint R&D is driving the integration of digital control functions in wellhead systems optimized for UK geology.

France is expected to grow at a 4.5% CAGR during the forecast period. Although onshore oil and gas production is relatively modest, France is making selective investments in modernizing wellheads for strategic energy reserves. The national emphasis on industrial innovation and carbon footprint minimization is creating a niche demand for electric wellhead drives.

French power companies are testing hybrid drives that combine hydraulic precision with electric efficiency, especially in pilot projects exploring enhanced oil recovery (EOR) techniques. The country's strong automation and mechatronics industry also supports the supply of smart drive components. Industrial modernization with energy-saving policies is likely to sustain demand in some applications, particularly in research-oriented and high-performance manufacturing processes.

Germany is expected to register a CAGR of 4.8% during the period of study. With a focus on green energy transition, Germany is gradually upgrading its sparsely located onshore wells with advanced artificial lift systems. Electric wellhead drives are adopted considering energy efficiency, environmental compliance, and requirements for data-oriented good operations.

German energy firms are investing in hybrid lift systems with remote diagnostics and predictive maintenance features to minimize downtime. Robust ground-level automation and engineering capabilities are propelling the creation of locally tailored wellhead drive technologies.

While oil production is limited, Germany's industrial leadership in precision control systems is enabling it to tackle niche applications and offer exports to Central and Eastern Europe.

Italy is expected to register a growth of 4.6% CAGR during the period of study. Onshore oilfields in regions such as Basilicata and Sicily are upgrading in a bid to maximize recovery and lower operating costs. The transition from mechanical drives to electric drives is made possible by Italy's environmental goals and by enhancing energy efficiency levels in the hydrocarbon sector.

Wellhead operators desire compact, energy-efficient designs with real-time control and flexibility in a broad range of flow conditions. Italian engineering firms are aiming at modular, scalable drive systems that can be connected to SCADA platforms for smart operations. Growing government interest in decarbonizing the upstream sector is likely to fuel further demand for electrified artificial lift systems over the next decade.

South Korea is expected to expand at 5.5% CAGR during the study. Even though onshore production of oil is limited, South Korea is putting more focus on drive systems in pilot energy recovery and underground storage operations. Domestic manufacturing capabilities of electromechanical systems are allowing the creation of efficient electric wellhead drives suitable for research and specialty industrial applications.

South Korea's policy emphasizes innovation and reliability, which suits the nature of electric and hydraulic drive technologies, offering precise control and automation. The need is also emerging in geotechnical drilling and energy pilot testing for CO₂ sequestration and geothermal resource development. Policy support from the government and R&D expenditure will propel sales growth.

Japan is expected to increase CAGR by 4.3% during the study period. Japan's onshore oil production is low, but high-efficiency wellhead drives demand is growing in geothermal energy and controlled subsurface exploration. Leadership in robotics and automation in Japan is promoting innovation in smart drive technologies for hostile environments.

AI-monitored system-integrated electric wellhead drives are in the process of being field-tested in government-sponsored geothermal developments. Domestic producers manufacture custom-designed solutions that are capable of meeting Japan's high standards of safety and efficiency.

Though the industry size is limited, a focus on sustainability, automation, and minimal environmental impact makes Japan a provider of high-tech, high-quality wellhead drive systems for local uses and exports.

China is expected to grow at 7.6% CAGR during the study period. As one of the leading onshore oil and gas producers, China is heavily investing in artificial lift systems in order to enhance production from conventional and unconventional sources and mature wells. Electric and hydraulic wellhead drives are increasing in popularity in premium basins such as Sichuan, Ordos, and Daqing.

Government initiatives to upgrade oilfield operations and replace gas engines with electric drives are driving adoption. China is also investing in indigenous production and mass implementation of AI-powered drive systems.

Rising energy consumption with cheap domestic supply enables quick implementation in public as well as private operations. The export of mid-range wellhead drives to Africa and Central Asia also helps China's international presence in the business.

The Australia-New Zealand region will record growth at 5.1% CAGR during the study period. Australia, Queensland, and Western Australia are investing in upgrading wellhead equipment to improve recovery rates and reduce environmental footprints. The shift to electric wellhead drives is supported by heightened operational efficiency goals and reducing reliance on diesel-based systems.

New Zealand, albeit on a lesser scale, is also formulating geothermal and oil drilling schemes utilizing advanced drive systems. The industry is reveling in strategic alliances with foreign suppliers and expanding demand for self-controlling, low-maintenance equipment in remote locations.

Both countries are emphasizing hardy systems that are able to work under varying pressures and temperatures, introducing opportunities for advanced hydraulic and electric wellhead technology with integrated analytics.

Casing heads will account for a large revenue share of 35%. Casing spools will account for an expected 25% of the total revenue share. The predominance of these factors is because they are indispensable in rigging continuous casing strings and sealing wellheads during drilling operations for oil and gas.

Casing heads are a composite of wellhead components used during onshore oil-cum-gas production, in which the casing heads provide structural support by connection points for the casing spools at the top of the well casing. These are seen in new wells and applications related to wellbore re-entry.

Leading companies such as National Oilwell Varco or NOV and Schlumberger offer casing heads of very high durability that are capable of withstanding high pressures and extreme temperatures. NOV's DRILLNAY series and Schlumberger's Pressure Control Systems enable wellhead applications for onshore use to be very reliable over the long term.

Casing Spools, which secure the casing head and provide pressure containment, are expected to account for 25% of the overall share. Casing spools provide an external connection to connect the casing head with other wellhead components and seal the system to prevent any hazardous fluid from leaking from the system.

Major companies operating in this segment are Baker Hughes and Weatherford, which manufacture specialized casing spools that are specifically designed to promote efficient oil and gas flow through the wellhead. Baker Hughes Wellhead Systems and Weatherford Wellhead and Completions Solutions provide highly customizable spool designs for various well types that improve performance and safety.

Onshore applications are anticipated to dominate the electric & hydraulic wellhead drives for onshore application market by 2025, accounting for 80% of the expected total revenue share as compared to only 20% for Offshore applications.

It can be interpreted in terms of the higher level of onshore compared to offshore oil and gas exploration and production activities. In contrast, onshore drilling is far more cost-effective and has logistical ease compared to offshore projects.

Demand for electric and hydraulic wellhead drives is primarily driven by onshore applications, of which large numbers of wells are drilled. The wellhead systems are mainly required to control the high pressure and ensure the well's integrity during the drilling and production phases.

Companies like National Oilwell Varco (NOV), Schlumberger, and Baker Hughes have developed wellhead installations with advanced features that are mainly suitable for onshore oilfields. The Hydrostatic Wellhead Systems of NOV and the Pressure Control Solutions of Schlumberger are among the highly praised for onshore operations as they ensure great reliability and are flexible in installation, making them ideal for land-based oil and gas operations.

Offshore applications are likely to account for only 20% of the overall industrial share. Tough and niche wellhead systems are required; however, the number of offshore wells is less compared to the onshore wells. High costs and complexities are generally associated with offshore drilling operations because of the deep marine environment, rough seas, and tough regulations.

Weatherford and TechnipFMC are a few names in the industry providing good offshore wellhead systems, such as wellhead systems from Weatherford's Marine Wellhead Systems and TechnipFMC's Subsea Wellheads, that aim to ensure safety and performance in such conditions.

The electric and hydraulic wellhead drives for the onshore application market include strong competition between well-known oilfield companies already established in the industry and specialized equipment manufacturers. The efforts of these companies are directed towards better drive efficiency, automation and adaptability under diverse well conditions.

Some giants in the industry, such as Schlumberger Limited, GE Electric, and Weatherford International, use their extensive industry presence and technology application to offer advanced wellhead drive solutions, absolutely ensuring reliability and performance optimization.

Product innovation differentiates the companies in the marketplace since they are developing electric and hydraulic drive systems that provide more torque, less maintenance, and better energy efficiency. For example, NETZSCH and National Oilwell Varco talk about their progressive cavity pump (PCP) drive technologies, which improve fluid handling in various reservoir conditions.

Another trend is the ongoing efforts to introduce digital monitoring solutions complemented by predictive maintenance, with industry players investing in AI-driven analytics and remote monitoring capabilities.

Mergers, acquisitions, and strategic partnerships are essential aspects for positioning in the marketplace. ChampionX and Weatherford International have grown their product lines of wellhead drives through a partnership agreement with oilfield operators, thereby ensuring their products will seamlessly integrate with already installed infrastructure.

Even though Rotation Power & Equipment Inc. and Twin Rotors Compression Ltd. are small players, both provide specialized solutions for unconventional as well as high-pressure drilling environments with deployed drive systems suitable for improved operational efficiency.

Regional expansion and service diversification are vital competitive strategies. Major companies like GE Electric and Schlumberger are reinforcing their presence in established oil-producing regions such as North America and the Middle East.

In contrast, companies like Brightling Equipment Ltd. and Cougar Wellhead Services Inc. focus on providing customized solutions for emerging industries. Competitive pricing, technical support, and aftermarket services are essential for securing long-term contracts with oilfield operators.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Schlumberger Limited | 20-25% |

| GE Electric | 15-20% |

| Weatherford International | 12-17% |

| National Oilwell Varco, Inc. | 8-12% |

| ChampionX | 5-9% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Schlumberger Limited | Develops AI-integrated wellhead drives for enhanced automation and predictive maintenance. |

| GE Electric | Provides electric wellhead drives with energy-efficient motor control technology. |

| Weatherford International | Specializes in hybrid wellhead drive systems for high-pressure drilling environments. |

| National Oilwell Varco, Inc. | Offers PCP drive technologies with advanced torque management capabilities. |

| ChampionX | Focuses on low-maintenance hydraulic wellhead drives for unconventional drilling applications. |

Key Company Insights

Schlumberger Limited (20-25%)

Schlumberger is a key leader in AI-powered wellhead drive systems for maximum automation, remote monitoring, and predictive maintenance.

GE Electric (15-20%)

GE Electric uses its knowledge of electric motor technologies to create energy-efficient wellhead drive solutions with less carbon footprint.

Weatherford International (12-17%)

Weatherford offers hybrid wellhead drive systems, combining electric and hydraulic technologies for various drilling conditions.

National Oilwell Varco, Inc. (8-12%)

National Oilwell Varco emphasizes torque-optimized PCP drive systems to increase efficiency and reliability in difficult environments.

ChampionX (5-9%)

ChampionX provides low-maintenance hydraulic wellhead drives, supporting heavy oil and unconventional drilling operations.

Other Key Players (30-40% Combined)

The segmentation is into casing heads, casing spools, tubing adapters, and other related products.

The segmentation is into onshore and offshore applications.

The report covers North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East and Africa.

The electric & hydraulic wellhead drives for onshore application market is estimated to reach USD 212.5 million by 2025.

The electric & hydraulic wellhead drives for onshore application industry is projected to grow to USD 476.2 million by 2035, driven by increased demand for wellhead systems in onshore drilling applications.

China is expected to have a 7.6% CAGR, indicating strong growth in the production and consumption of electric & hydraulic wellhead drives.

The coal-based electric & hydraulic wellhead drives segment is the dominant segment in the market due to its widespread use in energy production.

Key players in the electric & hydraulic wellhead drives for onshore application industry include Schlumberger Limited, GE Electric, Weatherford International, National Oilwell Varco, Inc., ChampionX, NETZSCH, Rotation Power & Equipment Inc., Twin Rotors Compression Ltd., Brightling Equipment Ltd., and Cougar Wellhead Services Inc.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 16: Latin America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 22: Western Europe Market Volume (Units) Forecast by Type, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Western Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 28: Eastern Europe Market Volume (Units) Forecast by Type, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Eastern Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Type, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 40: East Asia Market Volume (Units) Forecast by Type, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 42: East Asia Market Volume (Units) Forecast by Application, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Units) Forecast by Type, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Units) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 9: Global Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 13: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 16: Global Market Attractiveness by Type, 2023 to 2033

Figure 17: Global Market Attractiveness by Application, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 27: North America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 31: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Attractiveness by Type, 2023 to 2033

Figure 35: North America Market Attractiveness by Application, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 45: Latin America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 63: Western Europe Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 67: Western Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Type, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Type, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Type, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 117: East Asia Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 121: East Asia Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 125: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Type, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Type, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electric Aircraft Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electric Traction Motor Market Forecast Outlook 2025 to 2035

Electric Vehicle Sensor Market Forecast and Outlook 2025 to 2035

Electric Vehicle Motor Market Forecast and Outlook 2025 to 2035

Electric Blind Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Electric Fireplace Market Size and Share Forecast Outlook 2025 to 2035

Electric Glider Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Battery Conditioners Market Size and Share Forecast Outlook 2025 to 2035

Electric Power Steering Motors Market Size and Share Forecast Outlook 2025 to 2035

Electric Motor Market Size and Share Forecast Outlook 2025 to 2035

Electric Gripper Market Size and Share Forecast Outlook 2025 to 2035

Electric Boat Market Size and Share Forecast Outlook 2025 to 2035

Electric Bicycle Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Transmission Market Size and Share Forecast Outlook 2025 to 2035

Electrical Enclosure Market Size and Share Forecast Outlook 2025 to 2035

Electrical Sub Panels Market Size and Share Forecast Outlook 2025 to 2035

Electric Cargo Bike Market Size and Share Forecast Outlook 2025 to 2035

Electrical Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Electric Sub-meter Market Size and Share Forecast Outlook 2025 to 2035

Electric Light Commercial Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA