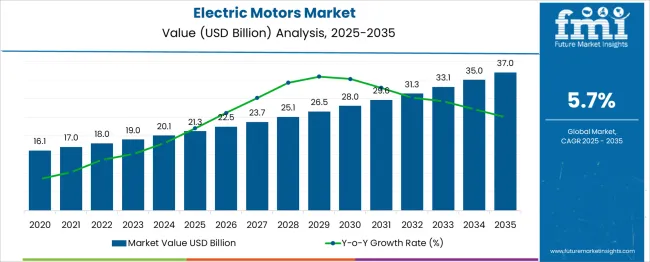

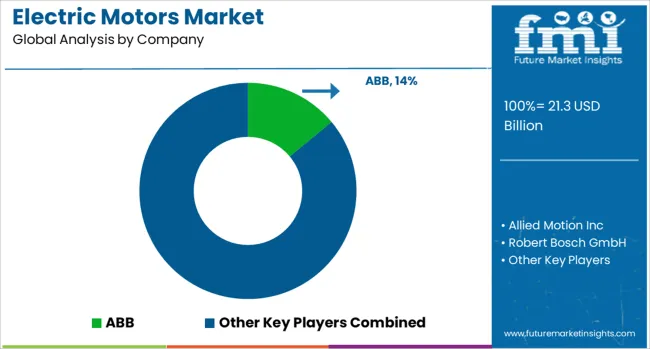

The Electric Motors Market is estimated to be valued at USD 21.3 billion in 2025 and is projected to reach USD 37.0 billion by 2035, registering a compound annual growth rate (CAGR) of 5.7% over the forecast period. A 10-year growth comparison shows a steady and consistent increase in market value over the period. Between 2025 and 2030, the market expands from USD 21.3 billion to USD 26.5 billion, contributing USD 5.2 billion in growth.

This period shows a CAGR of 4.8%, driven by increasing demand for energy-efficient electric motors in industrial automation, electric vehicles (EVs), and renewable energy applications. The next five years (2030 to 2035) see a stronger growth trajectory, with the market moving from USD 26.5 billion to USD 37 billion, adding USD 10.5 billion in value.

This represents a higher CAGR of 6.8%, supported by the rapid adoption of electric vehicles, advancements in motor technology, and growing demand in various end-use industries, including automotive, HVAC, and renewable energy sectors.

The comparison reveals that while the initial phase sees steady growth, the latter half experiences accelerated market expansion, driven by technological advancements, government regulations promoting clean energy solutions, and broader industry shifts toward electrification. The overall growth demonstrates a balanced but progressively stronger market performance, with increasing momentum toward the latter years.

| Metric | Value |

|---|---|

| Electric Motors Market Estimated Value in (2025 E) | USD 21.3 billion |

| Electric Motors Market Forecast Value in (2035 F) | USD 37.0 billion |

| Forecast CAGR (2025 to 2035) | 5.7% |

The electric motors market is experiencing robust expansion, fueled by increasing electrification across industries, growing investments in electric vehicles (EVs), and rising automation in industrial processes. Enhanced regulatory mandates aimed at improving energy efficiency and reducing emissions are compelling OEMs and end-users to adopt high-efficiency motor systems.

Technological advancements in magnetic materials, drive systems, and thermal management have enabled better torque density and improved motor lifespan, making electric motors integral to both automotive and non-automotive sectors. As grid modernization and smart factory concepts gain traction globally, demand for connected, sensor-integrated electric motors is further reinforcing market momentum.

Additionally, surging demand from HVAC, robotics, renewable energy, and medical device applications is expected to drive product innovation and regional diversification in the coming years.

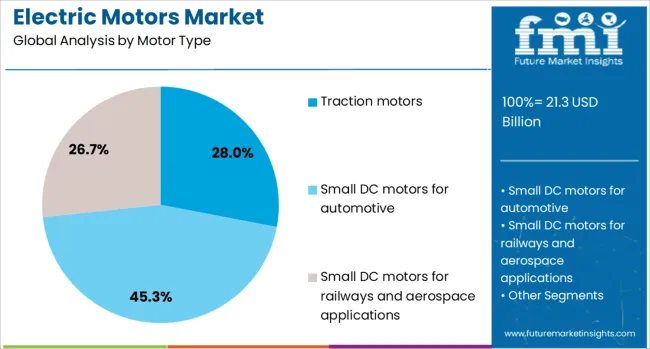

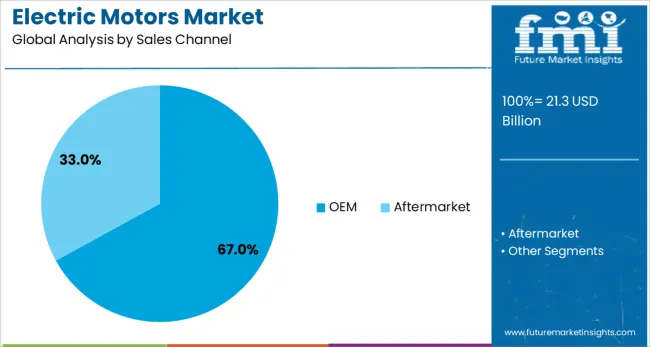

The electric motors market is segmented by motor type, sales channel, and geographic regions. The electric motors market is divided by motor type into Traction motors, Small DC motors for automotive, railways, and aerospace applications. In terms of the sales channel, the electric motors market is classified into OEM and Aftermarket. Regionally, the electric motors industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Traction motors are projected to account for 28.0% of the total electric motors market revenue in 2025, making them the dominant motor type segment. This growth is closely tied to the rapid electrification of transportation, especially in electric passenger cars, buses, and rail systems.

These motors provide the necessary torque and acceleration characteristics for EV propulsion, and their adoption is being supported by advancements in high-power-density motor design, battery integration, and inverter control technologies. Governments incentivizing EV adoption through tax credits and emission standards are further propelling demand.

As EV platforms scale up globally, traction motors are set to remain at the center of drivetrain development, particularly for high-efficiency and regenerative braking systems.

Original Equipment Manufacturers (OEMs) are expected to dominate the electric motors market with a 67.0% revenue share by 2025. This channel’s strength stems from vertically integrated production, where motor units are embedded directly during vehicle or machine assembly.

OEMs benefit from long-term contracts, customization capabilities, and early access to R&D-led innovation, making them the preferred channel for automotive, industrial, and aerospace applications. As electric motors become more specialized and integrated with AI, power electronics, and IoT systems, OEM partnerships ensure compatibility and performance optimization from the design phase onward.

The growing trend of in-house motor production among top-tier EV manufacturers and industrial giants further solidifies OEM dominance in this space.

Increasing demand for energy-efficient solutions is contributing to the growth of the electric motors industry, with key applications across sectors such as automotive, industrial machinery, and consumer electronics. Technological advancements, including the development of brushless and permanent magnet motors, are improving motor efficiency, longevity, and reducing energy consumption. The rise of electric vehicles (EVs) and automation in industrial processes further boosts this market. While high production costs and supply chain limitations present challenges, innovation in motor technology and increased adoption in emerging sectors offer significant growth opportunities.

The demand for electric motors is primarily fueled by the global shift toward energy-efficient technologies across industries. As industries and governments focus on reducing energy consumption and carbon emissions, electric motors have become essential due to their high efficiency. Electric vehicles (EVs) are a significant driver of growth, with electric motors playing a central role in vehicle propulsion. Furthermore, the increasing adoption of renewable energy, including wind and solar power, is creating demand for electric motors in generation and distribution systems. Automation and robotics are also driving growth, as electric motors are crucial components in modern manufacturing processes. These technological shifts in energy, transportation, and manufacturing are propelling the demand for advanced electric motors.

The electric motors industry faces challenges related to the high cost of production, particularly for advanced and high-performance motors used in electric vehicles and renewable energy systems. Key raw materials, such as rare earth metals, copper, and magnets, are critical for motor production but come at a significant cost, impacting the overall price of the motors. Geopolitical factors and fluctuations in raw material supply can lead to price volatility, further complicating manufacturing processes. Additionally, the need for specialized materials and manufacturing techniques increases the production cost, which may slow down adoption, especially in price-sensitive markets. The industry must address these challenges to remain competitive and support wider market penetration.

There are numerous opportunities in the electric motors industry, primarily driven by advancements in motor technologies and the rise of electrification. Innovations such as brushless DC motors, direct drive systems, and high-efficiency permanent magnet motors are enhancing motor performance and reducing costs. The growing adoption of electric vehicles (EVs) presents a key opportunity, as these vehicles require specialized electric motors for efficient performance. Further expansion of electric motors in industrial automation, consumer electronics, and renewable energy applications provides additional growth avenues. The market is also witnessing a surge in demand for smart motors, integrated with IoT systems for real-time performance monitoring, predictive maintenance, and increased operational efficiency.

The integration of electric motors with electric vehicles (EVs) is a prominent trend, driven by the increasing global focus on cleaner transportation. EVs rely heavily on electric motors, making the development of high-efficiency motors crucial for extending range and improving performance. Another trend is the increasing use of electric motors in renewable energy systems, such as wind turbines and solar energy storage. The transition to renewable energy is driving demand for high-performance motors that can efficiently convert energy. In parallel, innovations in motor design, such as lighter and more compact units for consumer electronics, appliances, and automation systems, are gaining momentum. These trends indicate a growing role for electric motors in the clean energy transition and the future of transportation.

| Country | CAGR |

|---|---|

| China | 7.7% |

| India | 7.1% |

| Germany | 6.6% |

| France | 6.0% |

| UK | 5.4% |

| USA | 4.8% |

| Brazil | 4.3% |

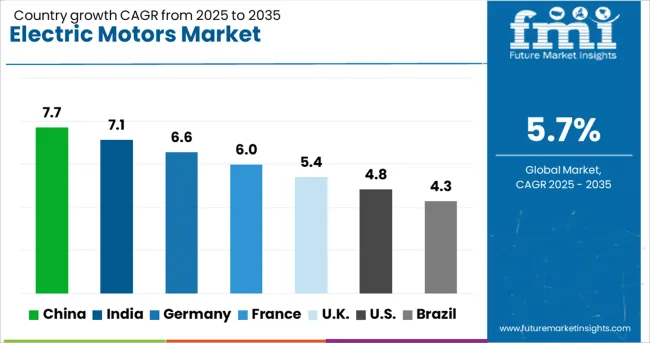

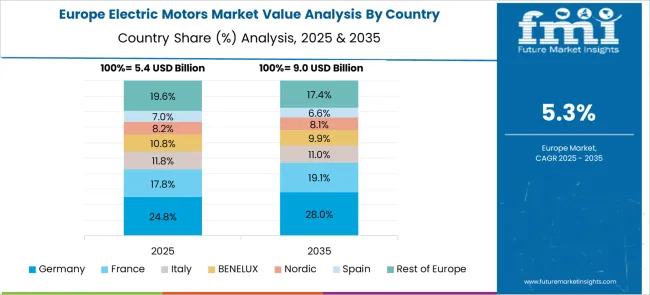

The electric motors market is projected to grow at a CAGR of 5.7% from 2025 to 2035. Among the top five profiled markets, China leads at 7.7%, followed by India at 7.1%, France at 6.0%, the United Kingdom records 5.4%, and the United States stands at 4.8%. These rates reflect strong demand in BRICS countries, particularly China and India, driven by the rising adoption of electric vehicles (EVs), industrial growth, and energy-efficient solutions. Developed economies like France, the UK, and the USA show steady growth, supported by the focus on reducing emissions, improving energy efficiency, and transitioning to electric technologies. The analysis spans over 40 countries, with the top countries shown below.

China is expected to grow at a CAGR of 7.7% through 2035, driven by its leadership in the electric vehicle (EV) market and expanding industrial sector. The country’s automotive industry, the largest in the world, is rapidly adopting electric mobility, significantly increasing the demand for electric motors. China’s ambitious goals to reduce carbon emissions and promote clean energy also drive the demand for energy-efficient motors in various applications, including appliances, machinery, and transportation. Moreover, the government’s incentives for EV manufacturers and renewable energy projects contribute to the market’s robust growth.

India is projected to grow at a CAGR of 7.1% through 2035, fueled by the rapid expansion of its manufacturing sector, particularly in automotive and industrial applications. As the country transitions towards electric mobility, the demand for electric motors in electric vehicles (EVs) is growing rapidly. Government policies promoting green energy, along with the development of charging infrastructure, further drive the adoption of electric vehicles and their components. India's industrial sector is witnessing increasing automation, which boosts the demand for energy-efficient electric motors in manufacturing facilities.

France is projected to grow at a CAGR of 6.0% through 2035, with demand driven by the growing focus on sustainable energy solutions and electric mobility. The French market is witnessing increased adoption of electric vehicles (EVs) and the integration of electric motors in public transportation, industrial automation, and residential applications. The country’s emphasis on reducing its carbon footprint and transitioning to electric solutions supports the demand for energy-efficient motors. The French government’s policies, such as subsidies for EV purchases and investments in renewable energy infrastructure, further drive the growth of the electric motors market.

The United Kingdom is expected to grow at a CAGR of 5.4% through 2035, driven by the growing demand for electric vehicles (EVs) and the country’s transition towards renewable energy. As the UK accelerates its push for net-zero emissions, the demand for electric motors in various applications such as automotive, home appliances, and industrial systems is increasing. The government’s investments in electric vehicle infrastructure and renewable energy technologies further support market growth. The need for energy-efficient solutions across industrial sectors, including manufacturing and automation, is also boosting the demand for electric motors.

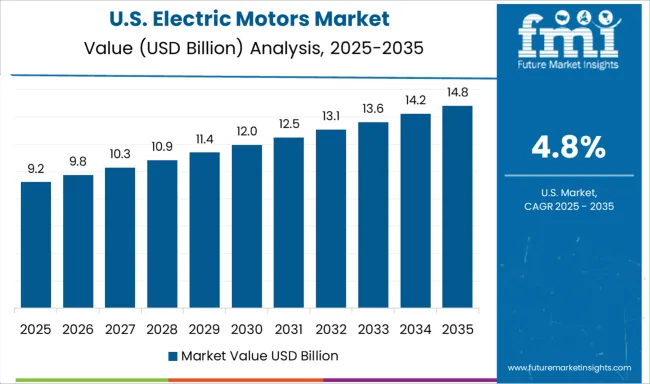

The United States is projected to grow at a CAGR of 4.8% through 2035, supported by the country’s shift towards electric vehicles (EVs) and increasing industrial automation. The demand for electric motors is growing, particularly in the automotive sector, where EVs are gaining market share. The adoption of electric motors in manufacturing processes and green energy projects is increasing. The USA government’s focus on sustainability and carbon reduction, along with incentives for electric vehicle manufacturers and renewable energy projects, is contributing to the steady growth of the electric motors market.

The electric motors market is led by prominent global companies offering innovative solutions for a wide range of industrial, commercial, automotive, and consumer applications. ABB is a market leader with a broad range of electric motors used in industries such as automation, energy, and transportation, focusing on high-efficiency, low-maintenance solutions.

Robert Bosch GmbH and Siemens AG are key players, providing electric motors for automotive, industrial machinery, and HVAC systems, leveraging their extensive research and development capabilities. General Electric is another significant player, offering electric motors for power generation, industrial automation, and consumer goods. Allied Motion Inc., Baldor Electric Company, and Emerson Electric Co. specialize in industrial-grade motors, focusing on reliability, energy efficiency, and performance for sectors such as manufacturing, mining, and HVAC.

Denso Corporation and YASA Limited are notable players in the automotive sector, providing high-performance electric motors for electric vehicles (EVs), with YASA specializing in axial-flux motors for next-generation EVs. Fuji Electric Co., Ltd and Maxon Motor AG cater to high-precision and high-performance electric motors for robotics, medical devices, and aerospace applications.

Bühler Motor GmbH and Lucas TVS offer electric motors for automotive and industrial applications, with an emphasis on durability and cost efficiency. Dongjin Vietnam provides motors for consumer electronics and home appliances, focusing on reliability and low energy consumption. Zytek Automotive/Continental Engineering Services focuses on specialized motors for the EV market, developing high-performance motors and drive systems for hybrid and electric vehicles.

Competitive differentiation is driven by energy efficiency, motor design (e.g., brushless, asynchronous, synchronous), and the ability to integrate smart technologies such as IoT connectivity for predictive maintenance. Barriers to entry include significant investment in R&D, strict regulatory compliance, and technological advancements. Strategic priorities involve expanding electric motor offerings for the growing EV market, improving energy efficiency, and reducing manufacturing costs to compete with lower-cost alternatives.

| Item | Value |

|---|---|

| Quantitative Units | USD 21.3 Billion |

| Motor Type | Traction motors, Small DC motors for automotive, and Small DC motors for railways and aerospace applications |

| Sales Channel | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, Allied Motion Inc, Robert Bosch GmbH, Baldor Electric Company, Bühler Motor GmbH, Dongjin Vietnam, Denso Corporation, Emerson Electric Co, Fuji Electric Co., Ltd, Johnson Electric, General Electric, Lucas TVS, Siemens AG, Maxon Motor AG, WEG, Zytek Automotive/Continental Engineering Services, and YASA Limited |

| Additional Attributes | Dollar sales by motor type (AC motors, DC motors, brushless motors, stepper motors) and end-use segments (industrial machinery, automotive, HVAC, consumer appliances, robotics). Demand dynamics are driven by the rise of electric vehicles, industrial automation, and the increasing adoption of energy-efficient technologies. Regional trends indicate North America and Europe leading the adoption of electric motors for industrial applications and electric vehicles, while Asia-Pacific dominates in manufacturing and consumer electronics. |

The global electric motors market is estimated to be valued at USD 21.3 billion in 2025.

The market size for the electric motors market is projected to reach USD 37.0 billion by 2035.

The electric motors market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in electric motors market are traction motors, small DC motors for automotive, _air suspension motors, _abs motors, _vacuum pump motors, _forklift actuation motors, _cooling fans & blower’s motors, small DC motors for railways and aerospace applications, _high voltage motor, _low voltage motor, _cooling motor and _hvac compressor motors.

In terms of sales channel, oem segment to command 67.0% share in the electric motors market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electric Motors For Conveyor System Market

Electric Power Steering Motors Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Electric Motors Market Size and Share Forecast Outlook 2025 to 2035

Electric Aircraft Onboard Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electrical Label Market Size and Share Forecast Outlook 2025 to 2035

Electric Round Sprinklers Market Size and Share Forecast Outlook 2025 to 2035

Electric Cloth Cutting Scissors Market Size and Share Forecast Outlook 2025 to 2035

Electrical Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Electric Aircraft Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electric Traction Motor Market Forecast Outlook 2025 to 2035

Electric Vehicle Sensor Market Forecast and Outlook 2025 to 2035

Electric Vehicle Motor Market Forecast and Outlook 2025 to 2035

Electric Off-Road ATVs & UTVs Market Size and Share Forecast Outlook 2025 to 2035

Electric Blind Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Electric Fireplace Market Size and Share Forecast Outlook 2025 to 2035

Electric Glider Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Battery Conditioners Market Size and Share Forecast Outlook 2025 to 2035

Electric Motor Market Size and Share Forecast Outlook 2025 to 2035

Electric Gripper Market Size and Share Forecast Outlook 2025 to 2035

Electric Boat Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA