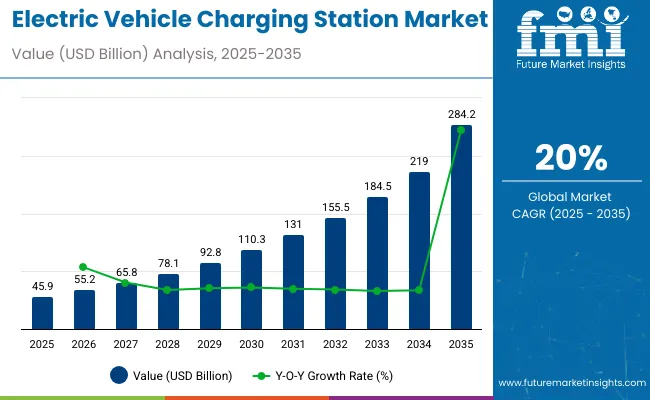

The electric vehicle charging station market is valued at USD 45.9 billion in 2025 and is anticipated to reach USD 284.2 billion by 2035, reflecting a CAGR of 20%. The multiplying factor is about 6.2x, showing that the market in 2035 will be over six times its 2025 base.

A compound absolute growth analysis demonstrates how rapid adoption, technology expansion, and regulatory support drive long-term market expansion. From 2025 to 2028, the market experiences strong initial growth due to increasing electric vehicle penetration, rising government incentives for charging infrastructure, and the expansion of fast-charging networks in urban and intercity corridors. During the mid-decade phase, from 2029 to 2032, growth continues at a slightly moderated pace as early infrastructure reaches maturity, while innovations in smart charging systems, wireless charging, and integrated energy management systems sustain demand.

From 2033 to 2035, the market accelerates again with widespread deployment of high-capacity stations, interoperability improvements, and increasing adoption of electric mobility in emerging regions. The compound absolute growth, combined with a multiplying factor of 6.2x, highlights a robust long-term upward trajectory, providing consistent opportunities for equipment manufacturers, service providers, and technology innovators in the EV ecosystem.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 45.9 billion |

| Industry Value (2035F) | USD 284.2 billion |

| CAGR (2025 to 2035) | 20% |

The market is influenced by several key sectors with varied contributions. The global automotive market accounts for around 34%, driven by rising electric vehicle production and consumer adoption. Energy and utilities make up approximately 26%, supplying electricity, grid integration, and renewable energy support. Industrial manufacturing contributes close to 21%, providing charging hardware, connectors, and installation components.

Information and communication technology (ICT) represents about 11%, enabling smart charging systems, remote monitoring, and data analytics. Transportation infrastructure, including road networks and urban planning, adds roughly 8%, facilitating station placement and accessibility. These sectors collectively support network expansion and EV adoption worldwide.

The EV charging station sector is seeing rapid innovation in fast-charging solutions, digital integration, and collaborative development. Companies like Tesla, ABB, ChargePoint, and Siemens are rolling out high-power chargers, interoperable platforms, and user-friendly interfaces. Integration with solar and energy storage enhances efficiency and reduces grid strain.

Public-private partnerships and policy incentives are driving growth of urban, highway, and commercial charging networks. IoT-enabled monitoring, AI-based energy management, and predictive maintenance are improving reliability and operational efficiency. Expansion of home, workplace, and fleet charging infrastructure continues to accelerate adoption and support the shift toward electric mobility.

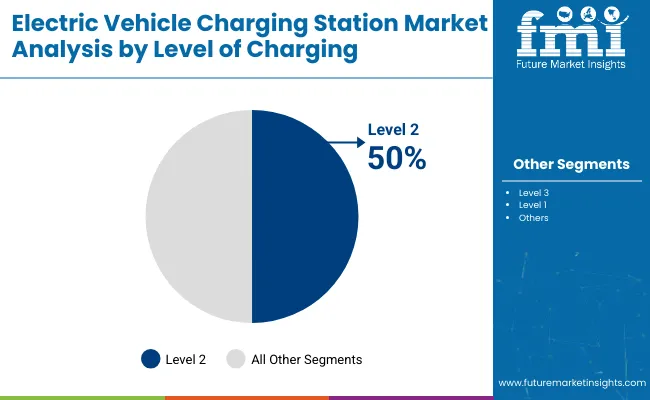

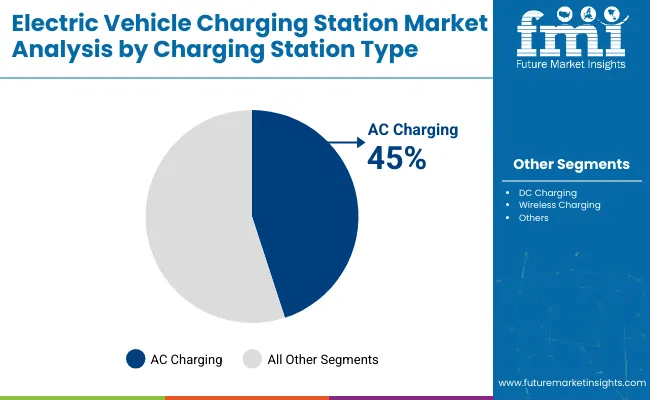

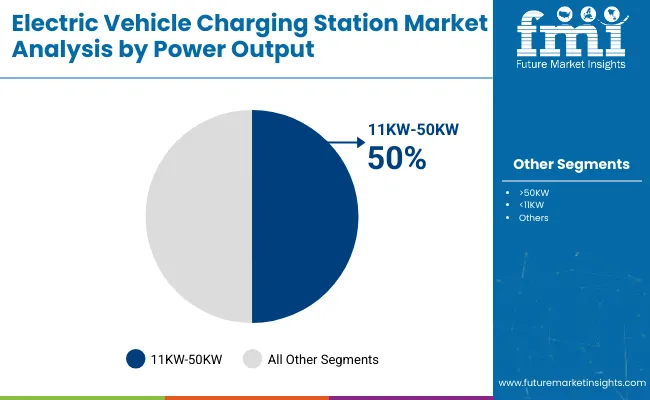

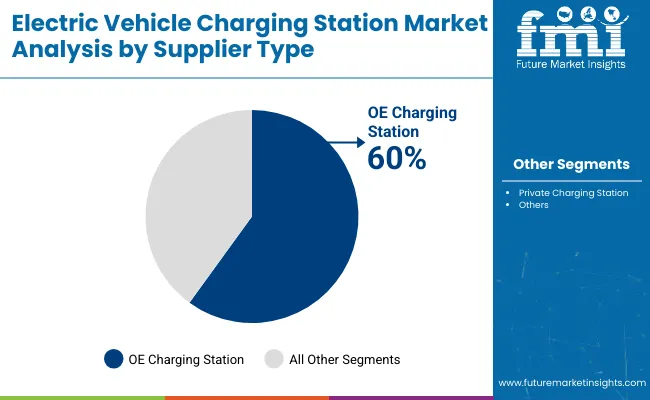

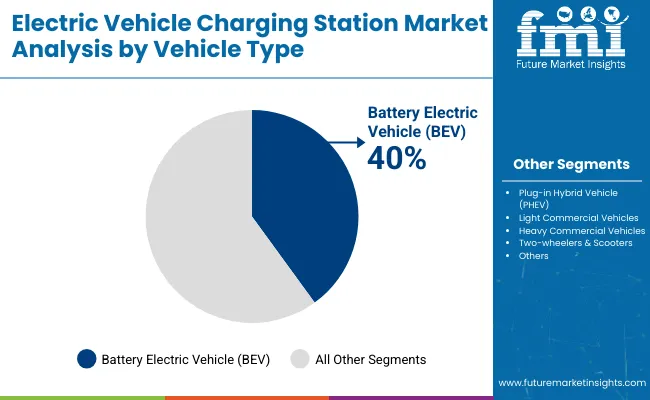

The electric vehicle charging station market is defined by level of charging, station type, power output, supplier, and vehicle type. Level 2 charging dominates with 50% share due to fast charging compatibility with most EVs, while AC charging accounts for 45% and DC 40% for high-speed requirements. Power output between 11KW-50KW leads at 50%. OE charging stations control 60% of supply, serving battery electric and plug-in hybrid vehicles that together represent 65% of demand. Growth is driven by rising EV adoption, infrastructure expansion, and demand for efficient, reliable charging solutions.

Level 2 charging stations account for 50% of market share, preferred for urban and residential EV usage due to moderate speed and compatibility with home and workplace installations. Level 3 fast chargers capture 30%, suited for highway corridors and fleet operations, while Level 1 represents 20% for slow, overnight charging. Manufacturers invest in smart charging technology and integrated payment systems to enhance user convenience. Level 2 stations offer optimal energy consumption per session and maintain cost efficiency for operators while supporting a majority of passenger electric vehicles in daily use.

AC charging stations lead with 45% share due to compatibility with most battery electric vehicles and cost-effective installation. DC charging holds 40%, preferred for fleet depots and high-speed corridors, while wireless charging represents 15% for emerging convenience applications. AC stations benefit from reduced installation complexity and operational stability for urban deployments. OEMs and private operators increasingly focus on hybrid networks combining AC and DC points to ensure flexibility and faster turnaround times. Adoption is rising in residential, commercial, and public parking spaces, supporting broader EV infrastructure expansion globally.

Charging stations offering 11KW-50KW power output capture 50% of market share, supporting medium-speed charging for daily urban commutes. High-power stations over 50KW account for 30%, mainly installed along highways and express routes, while low-power stations below 11KW hold 20% for home and low-traffic areas. Mid-range chargers balance infrastructure cost, energy consumption, and charging speed. Operators and municipal authorities prioritize this segment to maximize accessibility while minimizing grid strain. These stations cater effectively to battery electric vehicles and plug-in hybrids, optimizing user convenience across urban, suburban, and commercial zones.

Original equipment charging stations dominate with 60% share due to integrated EV manufacturer networks, ensuring reliability and customer trust. Private charging operators hold 40%, targeting commercial zones, residential complexes, and retail parking. OE stations offer standardized connectors, software integration, and maintenance support aligned with vehicle warranties.

Growing collaboration between OEMs and governments facilitates wider network coverage, enhancing charging accessibility and supporting long-term adoption. Investment in OE networks drives brand loyalty and consistent service quality while reducing operational downtime and improving utilization efficiency for both urban commuters and long-distance travelers.

Battery electric vehicles account for 40% of demand for charging infrastructure, driven by rapid adoption and longer range requirements. Plug-in hybrid vehicles contribute 25%, while light and heavy commercial vehicles together capture 25%. Two-wheelers and scooters hold 10% of demand, primarily in urban markets. Charging infrastructure aligns with vehicle type, ensuring optimized power delivery and minimal downtime. OE charging networks prioritize BEVs for fleet and personal use, while public and private operators focus on mixed-use solutions. The segment is poised for expansion alongside increasing EV penetration, regulatory support, and urban mobility initiatives.

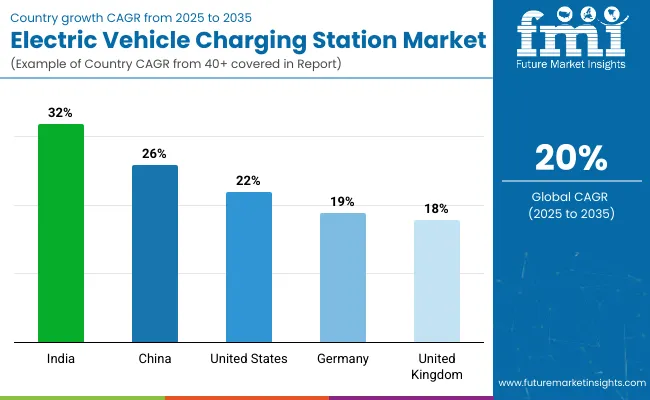

In 2025, the global electric vehicle charging station market is projected to grow at a CAGR of 20% through 2035. India leads at 32%, +60% above the global average, fueled by BRICS and ASEAN-linked initiatives and rapid adoption of electric mobility. China follows at 26%, +30% above the global rate, driven by BRICS-focused infrastructure expansion and government incentives for EV integration.

The United States records 22%, +10% above the global CAGR, reflecting steady OECD-backed deployment across established transport networks. Germany and the United Kingdom stand at 19% and 18%, −5% and −10% relative to the global average, supported by incremental upgrades in OECD charging infrastructure and clean energy programs. The BRICS nations are accelerating faster than OECD peers, with India and China shaping the global trajectory for EV charging networks.

China is projected to grow at a CAGR of 26%, 6% higher than the global 20%. By 2030, China will host approximately 6 million charging stations, nearly 60% of global capacity. Fast chargers are expected to grow at a CAGR of 28%, and smart grid-enabled stations will cover 65% of the network. Investment in rural and semi-urban regions is expected to increase by 20%, supporting network reliability. High domestic EV production, government mandates, and strong local manufacturing drive growth beyond global averages.

India is expanding at a CAGR of 32%, exceeding the global 20% by 12%. The total number of EV charging stations is projected to reach 2.5 million units by 2030. Fast charging infrastructure is expected to grow 35%, solar-powered stations will cover 40% of new installations, and highway corridor deployment will expand 30%. Aggressive FAME scheme rollout, rising electric two-wheeler adoption, and private sector investment explain the higher CAGR compared with global averages. Urban metro cities alone will account for 55% of total station installations by 2030.

The United States is growing at a CAGR of 22%, 2% above the global 20%. The total number of charging stations is projected to reach 1.5 million units by 2030. Fast charging hubs are expected to grow 24%, interoperable stations will cover 60% of new deployments, and grid-integrated smart stations will grow 22%. Higher federal and state funding compared with other Western markets supports growth. California, Texas, and the Northeast will host 50% of new stations, while EV adoption growth of 18% annually sustains higher-than-global CAGR.

Germany is growing at a CAGR of 19%, slightly below the global 20%. By 2030, total charging stations will reach 750,000 units. Ultra-fast charging stations will expand 20%, renewable energy-backed stations will cover 50% of new deployments, and urban plus highway networks will grow 18%. The lower CAGR reflects a mature existing network, high urban coverage, and a controlled expansion approach prioritizing efficiency over rapid scaling. Berlin, Munich, and Hamburg will account for 35% of new installations.

The United Kingdom is growing at a CAGR of 18%, 2% below the global 20%. By 2030, total stations are projected to reach 500,000 units. Fast charging hubs will increase 20%, renewable energy-backed stations will cover 45% of new installations, and urban plus motorway network expansion will grow 17%. Slower adoption of EVs, limited highway coverage, and gradual infrastructure rollout explain the below-global CAGR. London, Manchester, and Birmingham will host 40% of new stations.

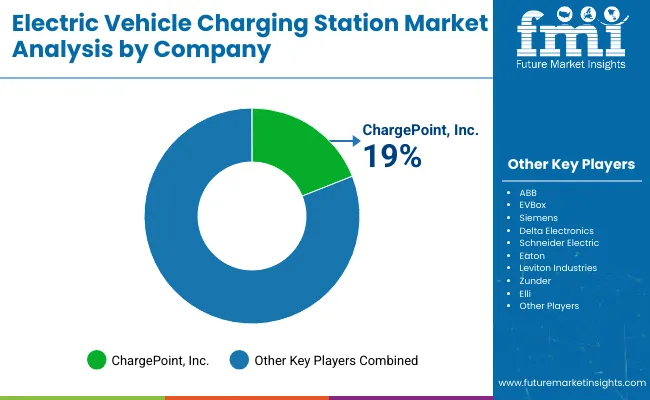

The electric vehicle charging station market is shaped by established manufacturers and emerging players, each employing different strategies to strengthen their position. Blink Charging Co. focuses on expanding its public charging network across North America, frequently launching new fast-charging stations in high-traffic areas. ChargePoint, Inc. emphasizes interoperability and cloud-based management systems, offering solutions for both commercial and residential users.

ABB invests in high-capacity chargers and modular designs, catering to fleet operators and urban mobility projects. EVBox continues to expand globally through partnerships and localized production, while Siemens and Delta Electronics target smart grid integration and high-efficiency chargers. Schneider Electric and Eaton provide energy management solutions that complement their charging stations, improving operational reliability.

Emerging players are also driving innovation and market penetration through targeted strategies. Zunder and Elli focus on user-friendly home and workplace chargers with integrated payment systems. CHAEVI and SIGNET EV emphasize cost-effective charging solutions for smaller fleets and urban centers. Vinfast and EV Top develop proprietary fast-charging infrastructure for their vehicle lines, while Tesla and NIO expand networks to support brand-specific vehicles.

Leviton Industries and Volta Industries Inc. combine hardware development with software management systems to improve user experience. These strategies, including product launches, partnerships, and regional expansion, allow companies to enhance coverage, improve operational efficiency, and maintain competitive positions in the global marketRecent Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 45.9 billion |

| Projected Market Size (2035) | USD 284.2 billion |

| CAGR (2025 to 2035) | 20% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Level of Charging Analyzed (Segment 1) | Level 1, Level 2, Level 3 |

| Charging Station Type Analyzed (Segment 2) | AC Charging, DC Charging, Wireless Charging |

| Power Output Analyzed (Segment 3) | <11KW, 11KW-50KW, >50KW |

| Supplier Type Analyzed (Segment 4) | OE Charging Station, Private Charging Station |

| Vehicle Type Analyzed (Segment 5) | Battery Electric Vehicle (BEV), Plug-in Hybrid Vehicle (PHEV), Heavy Commercial Vehicles, Two-wheelers & Scooters, Light Commercial Vehicles |

| Installation Type Analyzed (Segment 6) | Fixed, Portable, Residential, Commercial |

| Connector Type Analyzed (Segment 7) | Normal Charging, Type 2, CCS, GB/T, CHAdeMO, Tesla SC |

| Application Segments Analyzed (Segment 8) | Private, Public |

| Mounting Type Analyzed (Segment 9) | Wall Mount, Pedestal Mount, Ceiling Mount |

| Charging Service Analyzed (Segment 10) | EV Charging Service, Battery Swapping Service |

| End User Segments Analyzed (Segment 11) | Commercial EV Charging Stations, Commercial Public EV Charging Stations, On-Road Charging, Parking Spaces, Destination Chargers, Commercial Private EV Charging Stations, Fleet Charging, Captive Charging, Residential EV Charging Stations |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, Asia Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, Brazil, Mexico, Germany, United Kingdom, France, Italy, China, Japan, India, UAE, South Africa, others |

| Key Players | Blink Charging Co., Elli, Zunder, ChargePoint, Inc., ABB, EVBox, Siemens, Delta Electronics, CHAEVI, SIGNET EV, JOONGANG CONTROL, Vinfast, EV Top, Tesla, NIO, Schneider Electric, Volta Industries Inc., Eaton, Leviton Industries |

| Additional Attributes | Dollar sales by charger type and location, demand dynamics across residential, commercial, and public charging, regional adoption trends across North America, Europe, and Asia-Pacific, innovation in fast-charging, smart grid integration, environmental impact of renewable energy use, emerging use cases in fleet electrification and highway networks |

The market is expected to reach nearly USD 284.2 billion by 2035.

The market is growing at a CAGR of 20% during this period.

Level 2 charging leads with an estimated 50% market share.

Commercial Public EV Charging Stations hold the largest market share at 40%.

ChargePoint, Inc. holds the leading 19% industry share.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

AC Electric Vehicle Charging Station Market Size and Share Forecast Outlook 2025 to 2035

Private Electric Vehicle Charging Station Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Charging Cable and Plug Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Sensor Market Forecast and Outlook 2025 to 2035

Electric Vehicle Motor Market Forecast and Outlook 2025 to 2035

Electric Vehicle Battery Conditioners Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Transmission Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Fluid Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle E-Axle Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle On-Board Charger Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Plastics Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Finance Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Contactor Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Communication Controller Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Battery Formation and Testing Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Range Extender Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Relays Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle DC Contactor Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Battery Connector Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA