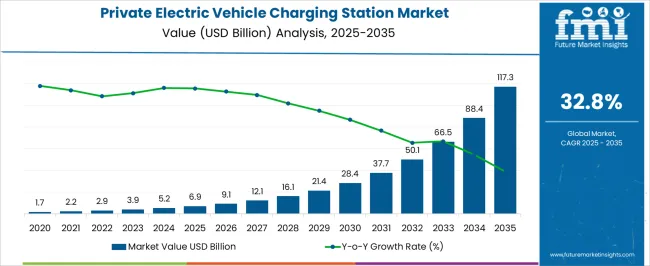

The private electric vehicle charging station market is expected to grow from USD 6.9 billion in 2025 to USD 117.3 billion in 2035, with a remarkable CAGR of 32.8%. During the early adoption phase (2020–2024), growth was gradual, rising from USD 1.7 billion to USD 6.9 billion as pilot installations, localized networks, and initial consumer acceptance began taking shape. This phase focused on testing business models, expanding service coverage in key regions, and educating early users.

By 2025, the market will reach a critical size, setting the stage for broader uptake and establishing patterns that define the sector’s future trajectory. Between 2025 and 2035, the market moves through rapid scaling (2025–2030) and into consolidation (2030–2035). By 2030, the market exceeds USD 21.4 billion, driven by a surge in installations and growing adoption among private vehicle owners. In the consolidation phase, growth continues but at a slightly moderated pace, reaching USD 117.3 billion by 2035, as major providers establish dominant networks and standardize service offerings. The 32.8% CAGR underscores the market’s accelerated expansion, reflecting both increasing coverage and a shift from experimental adoption to a mainstream, structured ecosystem.

| Metric | Value |

|---|---|

| Private Electric Vehicle Charging Station Market Estimated Value in (2025 E) | USD 6.9 billion |

| Private Electric Vehicle Charging Station Market Forecast Value in (2035 F) | USD 117.3 billion |

| Forecast CAGR (2025 to 2035) | 32.8% |

The private electric vehicle charging station market is shaped by several interconnected sectors, each contributing differently to growth. The global electric vehicle market drives roughly 30%, as rising EV adoption directly fuels demand for private charging solutions. Residential infrastructure development accounts for 20%, reflecting the expansion of home charging points and supportive building designs.

Renewable energy generation influences around 15%, given the integration of clean electricity into private charging networks. Automotive services and maintenance contribute 10%, supporting installation, upkeep, and performance monitoring of charging equipment. Smart grid and energy management systems make up 8%, ensuring efficient load distribution and cost optimization for private users. Real estate and property management represent 7%, facilitating access to dedicated parking and charging spaces. Consumer electronics and battery storage solutions influence 5%, enabling integration of home energy storage with charging units. Lastly, digital platforms and mobile applications account for 5%, allowing users to locate, schedule, and monitor charging sessions conveniently.

The market’s current landscape is characterized by a rising number of private EV owners who seek convenient, reliable, and fast charging options within residential and commercial properties. Government incentives, environmental regulations, and increasing awareness about carbon emissions have collectively accelerated demand for private charging infrastructure.

The future outlook remains strong, with technological advancements enhancing charging speed, interoperability, and user experience. Continued investments in renewable energy integration and smart grid technologies are expected to complement the growth of private charging stations.

Market players are focusing on expanding product portfolios to include more efficient direct current chargers, better user interfaces, and seamless payment options. As electric vehicle penetration deepens, private charging stations will become an essential component of urban mobility ecosystems, supporting sustainable transportation goals.

The private electric vehicle charging station market is segmented by current, and geographic regions. By current, private electric vehicle charging station market is divided into DC and AC. Regionally, the private electric vehicle charging station industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The DC charging segment is projected to hold 64.5% of the overall Private Electric Vehicle Charging Station market revenue in the current period, marking it as the leading charging type. This dominant share is attributed to the ability of DC chargers to deliver high power output and significantly reduce charging time, which aligns well with consumer expectations for convenience and speed.

The segment’s growth is further supported by increasing investments in fast charging technologies and the rising availability of EV models capable of utilizing DC charging infrastructure. DC chargers are preferred in private settings where time efficiency is critical, such as in multi-family residential complexes and workplace parking areas.

Additionally, advancements in power electronics and cooling technologies have improved the reliability and lifespan of DC chargers, encouraging adoption. The segment benefits from compatibility with evolving battery technologies and is poised to maintain leadership as EV ownership grows and fast charging becomes a standard expectation among users.

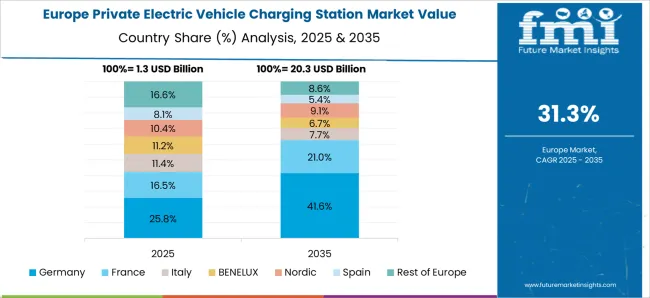

The private electric vehicle (EV) charging station market is expanding as EV adoption rises among residential, commercial, and fleet users. North America and Europe lead due to government incentives, high EV penetration, and smart grid infrastructure. Asia-Pacific is growing rapidly, driven by urban EV adoption, residential development, and green mobility policies. Manufacturers differentiate through charging speed, connector types, smart monitoring, and energy efficiency. Regional variations in electricity infrastructure, regulatory support, and consumer behavior influence adoption, deployment strategies, and competitive positioning globally.

Private EV charging station adoption heavily depends on charging speed and connector compatibility. North America and Europe emphasize fast and ultra-fast Level 2 and DC chargers compatible with multiple EV models, supporting high-end residential installations and home fleet solutions. Asia-Pacific often adopts cost-effective Level 1 or Level 2 chargers in urban apartments and single-family homes where affordability and basic functionality take precedence. Differences in charging speed and connector standards influence user convenience, vehicle compatibility, and energy management. Leading manufacturers provide multi-standard, high-speed units with smart features for premium segments, while regional producers focus on reliable, accessible, and economical options. Charging performance contrasts shape consumer adoption, satisfaction, and long-term deployment strategies across global EV markets.

Integration of smart monitoring, app-based control, and energy management is increasingly critical for private EV charging stations. North America and Europe favor units with remote monitoring, scheduling, dynamic load management, and grid integration to optimize efficiency and reduce electricity costs. Asia-Pacific adoption is growing, with emerging markets often prioritizing basic smart functions or simple timers due to cost constraints. Differences in smart feature integration affect operational efficiency, user experience, and total cost of ownership. Premium suppliers deliver advanced, app-enabled chargers with energy optimization, while regional producers offer functional, user-friendly models. Smart capability contrasts drive adoption, influence consumer choice, and shape competitive positioning in residential EV infrastructure markets globally.

Government policies, incentives, and subsidies significantly impact the private EV charging station market. Europe and North America offer tax credits, rebates, and net-metering benefits for residential charging, accelerating adoption and encouraging integration with renewable energy sources. Asia-Pacific policies vary widely; developed nations provide incentives for urban residential installations, while emerging economies focus on cost-effective solutions without extensive subsidy programs. Differences in regulatory support affect purchasing decisions, project ROI, and installation timelines. Suppliers offering certified, incentive-eligible chargers gain higher adoption rates, while regional producers focus on affordability and compliance with local electricity standards. Regulatory contrasts shape deployment speed, market access, and strategic positioning across global residential EV charging markets.

Ease of installation, maintenance, and after-sales support are critical for private EV charging station adoption. North America and Europe rely on professional installation services, OEM support, and extended warranty programs, ensuring safety, reliability, and user confidence for residential and small commercial users. Asia-Pacific markets often depend on local electricians, online support, and modular kits for installation, prioritizing cost-effectiveness and accessibility. Differences in installation and service infrastructure affect operational reliability, customer satisfaction, and repeat purchases. Leading suppliers combine installation expertise with long-term service agreements, while regional players focus on affordability and accessibility. Contrasts in installation and support shape adoption rates, market penetration, and competitive positioning in the global private EV charging station sector.

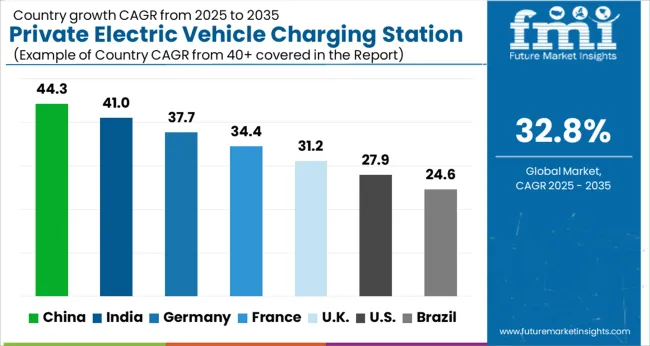

| Country | CAGR |

|---|---|

| China | 44.3% |

| India | 41.0% |

| Germany | 37.7% |

| France | 34.4% |

| UK | 31.2% |

| USA | 27.9% |

| Brazil | 24.6% |

The global private electric vehicle charging station market was projected to grow at a 32.8% CAGR through 2035, driven by demand in residential, commercial, and workplace EV infrastructure. Among BRICS nations, China recorded 44.3% growth as large-scale installation and manufacturing facilities were commissioned and compliance with electrical and safety standards was enforced, while India at 41.0% growth saw expansion of production and deployment units to meet rising regional demand. In the OECD region, Germany at 37.7% maintained substantial output under strict industrial and operational regulations, while the United Kingdom at 31.2% relied on moderate-scale operations for private and commercial EV charging solutions. The USA, expanding at 27.9%, remained a mature market with steady demand across residential and workplace charging segments, supported by adherence to federal and state-level quality and safety standards. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The private electric vehicle charging station market in China is growing at a CAGR of 44.3% driven by increasing adoption of electric vehicles and supportive government policies promoting clean mobility. Urban households and commercial properties are investing in home and private charging stations to ensure convenient vehicle charging. Manufacturers and service providers are offering fast charging, smart monitoring, and app controlled stations tailored to consumer needs. Expansion of the EV market, coupled with rising environmental awareness, has boosted demand for residential charging solutions. Online sales channels and partnerships with real estate developers are facilitating wider distribution. Consumers are prioritizing convenience, safety, and compatibility with multiple EV models. China’s growing electric vehicle population and government incentives for charging infrastructure are making it a leading global market for private EV charging stations.

India’s private EV charging station market is expanding at a CAGR of 41.0% due to rising electric vehicle adoption and government initiatives supporting clean energy mobility. Urban households and commercial property owners are increasingly investing in private charging infrastructure to meet daily charging requirements. Providers are offering smart, app controlled, and fast charging stations that ensure compatibility with multiple EV models. Partnerships with real estate developers, vehicle manufacturers, and online platforms are improving accessibility. Rising environmental awareness and incentives for electric vehicle ownership are driving demand for convenient and reliable private charging solutions. Indian consumers prioritize safety, efficiency, and flexibility in selecting charging stations. The country is emerging as a significant market for residential and private EV charging infrastructure due to rapid growth in electric vehicle adoption and supportive government policies.

Germany’s private EV charging station market is growing at a CAGR of 37.7% supported by high electric vehicle penetration and government incentives for residential charging infrastructure. Consumers are increasingly installing home charging stations equipped with smart controls, safety features, and compatibility with multiple EV brands. Energy providers and manufacturers are collaborating to expand availability and ensure reliable service. Digital platforms are enabling easy purchase, installation, and monitoring of private charging stations. Adoption is driven by environmental consciousness, urban commuters, and residential property owners seeking convenient charging options. Germany remains a key European market with high demand for technologically advanced, safe, and efficient private EV charging infrastructure. Consumers are prioritizing performance, flexibility, and integration with renewable energy solutions.

The United Kingdom market is expanding at a CAGR of 31.2% with growing electric vehicle adoption and government incentives encouraging installation of private charging stations. Homeowners and commercial property owners are seeking convenient, fast, and safe charging solutions. Manufacturers provide app controlled and smart charging stations that are compatible with multiple EV models. Partnerships between vehicle makers, energy providers, and real estate developers are increasing accessibility and adoption. Consumers are emphasizing convenience, efficiency, and reliability when choosing charging infrastructure. Rising awareness of environmental benefits and cost savings from home charging are supporting market growth. The United Kingdom continues to see strong adoption of private EV charging solutions among urban and suburban households with a focus on ease of use and safety.

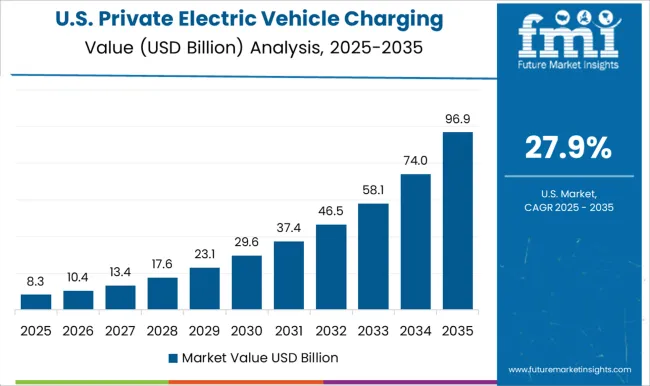

The United States market is growing at a CAGR of 27.9% driven by rising electric vehicle ownership and interest in home charging infrastructure. Urban and suburban households are increasingly installing private EV charging stations to ensure daily convenience and reduce dependency on public charging networks. Providers are offering fast, smart, and app controlled charging stations that support multiple EV models. Partnerships with energy providers, vehicle manufacturers, and online platforms are expanding availability and awareness. Consumers prioritize safety, reliability, and performance when selecting residential charging solutions. Growing environmental awareness and federal incentives are encouraging adoption. The United States remains a key global market for private EV charging stations due to high EV adoption rates and focus on residential convenience.

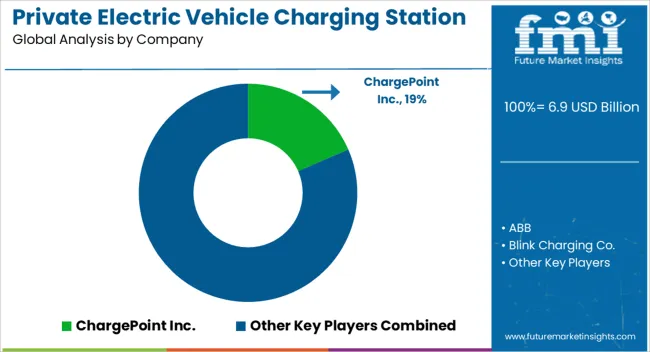

The private electric vehicle (EV) charging station market is experiencing rapid growth, fueled by increasing adoption of electric vehicles, rising environmental awareness, and government incentives encouraging sustainable transportation. Key market suppliers include ChargePoint Inc., ABB, Blink Charging Co., CHAEVI, Delta Electronics, Inc., Eaton, Elli, EVBox, Leviton Manufacturing Co., Inc., Nissan Motor Co., Ltd., Schneider Electric, Siemens, SK Signet, Volta, and Zunder. These companies provide comprehensive solutions encompassing hardware, software, connectivity, and installation services for residential and private commercial applications, enabling efficient and convenient EV charging. ChargePoint Inc. is a global leader offering cloud-connected smart charging stations for homes, workplaces, and private garages. EVBox emphasizes sustainable, scalable charging solutions, with modular designs and energy monitoring features. Blink Charging Co. focuses on home and commercial EV stations, catering to urban and suburban areas to reduce range anxiety among vehicle owners. Leading engineering and technology providers like ABB, Siemens, and Schneider Electric provide high-performance, fast-charging systems integrated with renewable energy and smart grid solutions, making them suitable for residential complexes or private business premises. Delta Electronics, Leviton, and Eaton deliver compact, user-friendly, and easily installable home charging units, addressing the growing demand for accessible and reliable charging infrastructure. Beyond hardware, software and connectivity are critical differentiators. Platforms allow users to remotely monitor charging, manage energy consumption, and access payment solutions. Companies like SK Signet, Volta, and Zunder are integrating IoT connectivity, mobile apps, and automated load balancing into their systems, enhancing operational efficiency and customer convenience. Smart solutions optimize energy usage, reduce operational costs, and improve user experience, which is essential for growing EV penetration. The increasing number of electric vehicles worldwide is boosting demand for private EV charging stations. Government incentives, sustainability initiatives, and technological innovation are driving both adoption and investment in this market. By offering integrated hardware and software solutions, the leading suppliers ensure a seamless charging experience for residential and commercial users, contributing to the global transition toward electric mobility. The private EV charging market continues to expand rapidly, with technological innovation, smart energy management, and accessibility at the forefront. These suppliers are shaping a robust ecosystem that supports efficient, reliable, and sustainable charging solutions worldwide, ensuring long-term growth in line with the global shift to cleaner transportation.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.9 Billion |

| Current | DC and AC |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ChargePoint Inc., ABB, Blink Charging Co., CHAEVI, Delta Electronics, Inc., Eaton, Elli, EVBox, Leviton Manufacturing Co., Inc., Nissan Motor Co., Ltd., Schneider Electric, Siemens, SK Signet, Volta, and Zunder |

| Additional Attributes | Dollar sales vary by charger type, including Level 1, Level 2, and DC fast chargers; by application, such as residential garages, private parking lots, and workplaces; by end-use, spanning individual EV owners, commercial establishments, and property developers; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising EV adoption, government incentives, and demand for convenient home and private charging infrastructure. |

The global private electric vehicle charging station market is estimated to be valued at USD 6.9 billion in 2025.

The market size for the private electric vehicle charging station market is projected to reach USD 117.3 billion by 2035.

The private electric vehicle charging station market is expected to grow at a 32.8% CAGR between 2025 and 2035.

The key product types in private electric vehicle charging station market are dc, _dc fast, _others, ac, _level 1 and _level 2 .

In terms of , segment to command 0.0% share in the private electric vehicle charging station market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Private Security Market Size and Share Forecast Outlook 2025 to 2035

Private Tutoring Market Forecast and Outlook 2025 to 2035

Private Label Pet Food Market Size and Share Forecast Outlook 2025 to 2035

Private 5G Network Market Size and Share Forecast Outlook 2025 to 2035

Private office-based clinics Market Size and Share Forecast Outlook 2025 to 2035

Private LTE Market Size and Share Forecast Outlook 2025 to 2035

Private Cloud Services Market by Services, Type, Industry Vertical, and Region – Growth, Trends, and Forecast through 2025 to 2035

Virtual Private Cloud Market Size and Share Forecast Outlook 2025 to 2035

Virtual Private Network VPN Market Size and Share Forecast Outlook 2025 to 2035

Virtual Private Server Market Size and Share Forecast Outlook 2025 to 2035

5G Enterprise Private Network Market Size and Share Forecast Outlook 2025 to 2035

Demand for Hybrid Protein Blends in Private Label Formulations in CIS Size and Share Forecast Outlook 2025 to 2035

Electric Aircraft Onboard Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electrical Label Market Size and Share Forecast Outlook 2025 to 2035

Electric Round Sprinklers Market Size and Share Forecast Outlook 2025 to 2035

Electric Cloth Cutting Scissors Market Size and Share Forecast Outlook 2025 to 2035

Electrical Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Electric Aircraft Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electric Traction Motor Market Forecast Outlook 2025 to 2035

Electric Off-Road ATVs & UTVs Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA