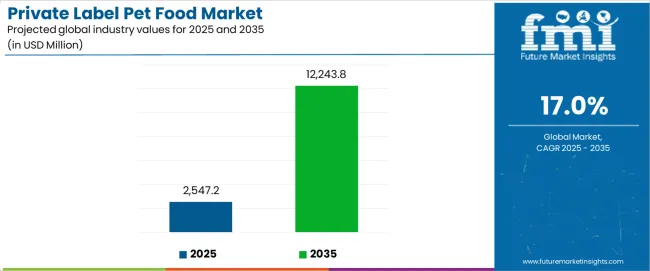

The global private label PET food market, expected to grow from USD 2,547.2 million in 2025 to USD 12,243.8 million by 2035 at a CAGR of 17.0%, highlights manufacturing and co-packing capacity as a critical factor shaping expansion. Retailers generally do not produce pet food themselves, instead relying on contract manufacturers and co-packers to supply private label lines at scale.

A unique feature of the private label PET food market is the distribution of global co-packing hubs. North America and Europe are home to some of the largest established co-packers with experience in premium formulations, certifications, and regulatory compliance. These producers often manage both branded and private label contracts, balancing capacity between high-margin proprietary lines and growing demand for private labels. Asia-Pacific and Latin America, on the other hand, are emerging as competitive supply bases where cost efficiencies, agricultural integration, and flexible production models allow retailers to expand aggressively. Tracking how these regions invest in new capacity highlights potential bottlenecks and supply-side risks.

Technological capability within co-packing operations is another angle. Advanced extrusion, freeze-drying, and wet food canning lines are essential for meeting consumer expectations of quality, nutrition, and packaging. Facilities that can produce grain-free, organic, or functional formulations are strategically positioned, as retailers increasingly demand differentiation in their private label portfolios. Capacity expansion in high-tech facilities often requires significant capital, but it also creates opportunities for long-term supply agreements between retailers and manufacturers. Supply security and resilience also deserve close attention. Raw material volatility in protein sources, fats, and functional additives means co-packers must manage procurement complexity while meeting retailer cost targets. Companies with backward integration into agricultural sourcing or those with strong supplier contracts gain an advantage in maintaining consistent outputs. That element becomes even more important as private label products scale into premium categories where consistency in formulation is critical for brand trust.

Co-packing partnerships are shaping competitive strategies. Some retailers pursue exclusive agreements with dedicated manufacturers to lock in capacity and control quality, while others source from multiple producers to diversify risk. That variation in approach creates distinct models of private label expansion. Retailers with tighter integration often achieve better margins and stronger consumer trust, while those spread across suppliers can scale faster but risk inconsistency.

Between 2025 and 2030, the private label PET food market is projected to expand from USD 2,547.2 million to USD 5,584.5 million, resulting in a value increase of USD 3,037.3 million, which represents 31.3% of the total forecast growth for the decade. This phase of development will be shaped by rising consumer demand for affordable premium PET nutrition options, product innovation in private label formulations and ingredient transparency initiatives, as well as expanding integration with e-commerce platforms and specialty retail expansion strategies. Companies are establishing competitive positions through investment in advanced manufacturing technologies, quality assurance systems, and strategic partnerships with major retailers and online PET food platforms.

From 2030 to 2035, the private label PET food market is forecast to grow from USD 5,584.5 million to USD 12,243.8 million, adding another USD 6,659.3 million, which constitutes 68.7% of the overall ten-year expansion. This period is expected to be characterized by the expansion of specialized private label offerings, including grain-free formulations and functional ingredient systems tailored for specific PET health requirements, strategic collaborations between contract manufacturers and retail chains, and an enhanced focus on sustainability credentials and clean label positioning. The growing emphasis on humanization of PET food and premiumization trends will drive demand for advanced, high-quality private label PET food solutions across diverse retail channels.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 2,547.2 million |

| Market Forecast Value (2035) | USD 12,243.8 million |

| Forecast CAGR (2025-2035) | 17.0% |

The private label PET food market grows by enabling retailers to offer high-quality PET nutrition at competitive price points while capturing higher margins and building customer loyalty through exclusive product offerings. Pet owners face mounting pressure to provide nutritious food options within household budgets, with private label PET food solutions typically providing 25-40% cost savings compared to premium national brands, making retailer-branded products essential for value-conscious consumers seeking quality nutrition. The PET humanization trend's convergence with economic consciousness creates demand for affordable premium alternatives that deliver comparable nutritional profiles and ingredient quality without the brand premium associated with established manufacturers.

Retailer initiatives promoting store brand differentiation and margin enhancement drive adoption across supermarkets, PET specialty stores, and e-commerce platforms, where private label penetration has a direct impact on customer retention and basket profitability. The global shift toward omnichannel retail strategies and direct-to-consumer models accelerates private label PET food demand as retailers seek to compete with traditional PET food brands through quality equivalence and transparent sourcing practices. However, consumer skepticism regarding private label quality standards and limited marketing budgets compared to multinational PET food corporations may limit adoption rates among brand-loyal PET owners and regions with underdeveloped private label acceptance.

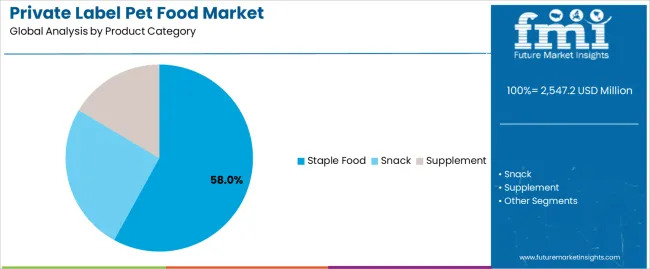

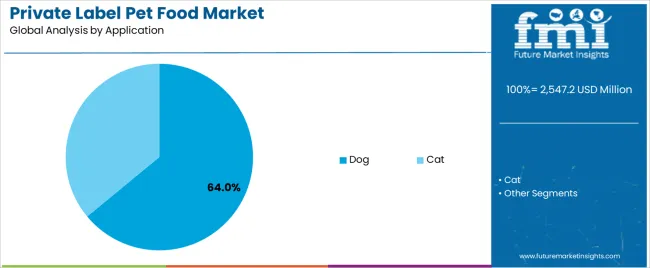

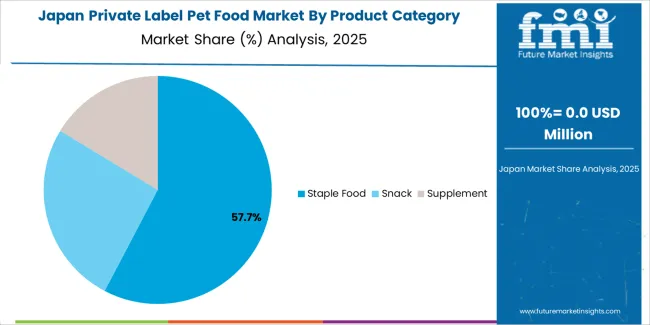

The private label PET food market is segmented by product category, application, and region. By product category, the private label PET food market is divided into staple food, snack, and supplement. Based on application, the private label PET food market is categorized into dog and cat. Regionally, the private label PET food market is divided into Asia Pacific, Europe, North America, Latin America, and the Middle East & Africa.

The staple food segment represents the dominant force in the private label PET food market, capturing approximately 58% of total market share in 2025. This advanced category encompasses formulations featuring dry kibble (35%), wet food (16%), and semi-moist varieties (7%), delivering comprehensive nutritional profiles with balanced macronutrient compositions suitable for daily feeding regimens. The staple food segment's market leadership stems from its essential role in PET nutrition, high purchase frequency driving consistent retailer revenue, and retailer focus on competing directly with branded staple food products that represent the largest share of PET food expenditures.

The snack segment maintains a substantial 28% market share, serving PET owners who seek treat options for training, dental health, and bonding activities through jerky treats (12%), dental chews (9%), and biscuits (7%). The supplement segment accounts for 14% market share, featuring functional products including joint support formulations (6%), digestive health supplements (5%), and skin/coat enhancement products (3%).

Key advantages driving the staple food segment include:

Dog food dominates the private label PET food market with approximately 64% market share in 2025, reflecting the larger PET population of dogs globally, higher average feeding costs per animal, and greater consumer willingness to experiment with private label alternatives in the dog food category. The dog segment's market leadership is reinforced by widespread adoption across life stage formulations including puppy (18%), adult (32%), and senior varieties (14%), which provide comprehensive nutrition options matching branded equivalents while delivering significant cost advantages to PET owners.

The cat segment represents 36% market share through specialized formulations including kitten (10%), adult (20%), and senior cat food (6%). This segment benefits from increasing cat ownership in urban environments, growing premiumization trends in cat nutrition, and retailer strategies targeting cat owners with quality private label alternatives to premium national brands.

Key market dynamics supporting application preferences include:

The private label PET food market is driven by three concrete demand factors tied to consumer behavior and retail dynamics. First, economic value consciousness accelerates private label adoption, with consumer research indicating 45-55% of PET owners actively seeking affordable alternatives to premium brands while maintaining nutritional standards, creating sustained demand for retailer-branded products offering 25-40% price advantages. Second, retailer margin optimization strategies drive private label expansion, with store brands typically delivering 8-12 percentage points higher gross margins compared to national brands, incentivizing retailers to promote private label products through shelf placement, promotional activities, and loyalty program integration. Third, quality perception improvement through ingredient transparency and manufacturing partnerships with reputable contract manufacturers reduces historical quality concerns, with 60-70% of consumers now rating private label PET food quality as equivalent to mid-tier national brands.

Market restraints include brand loyalty persistence among PET owners who associate established brands with proven quality and safety records, particularly following high-profile PET food recalls that heightened consumer sensitivity to manufacturing standards and ingredient sourcing. Limited marketing budgets compared to multinational PET food corporations restrict brand awareness building and consumer education efforts, creating disadvantages in competitive retail environments where shelf presence alone cannot overcome decades of national brand advertising investment. Quality consistency challenges across different contract manufacturers and production facilities pose risks to retailer reputation, as private label products bearing store branding create direct association between product failures and retailer credibility that national brands can compartmentalize through corporate structures.

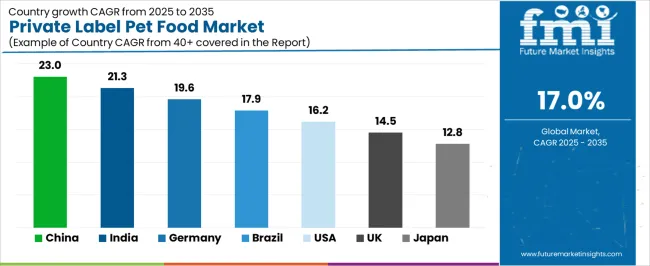

Key trends indicate accelerated adoption in Asia-Pacific markets, particularly China and India, where rapidly expanding PET ownership combines with limited brand loyalty formation and retailer modernization creating fertile ground for private label development. Technology advancement trends toward customized nutrition platforms offering personalized formulations, sustainable packaging solutions addressing environmental concerns, and blockchain traceability systems ensuring ingredient transparency are enabling next-generation product development. However, the private label PET food market thesis could face disruption if direct-to-consumer PET food brands leverage subscription models and social media marketing to capture value-conscious consumers before they consider retail private label alternatives, or if premium national brands successfully defend market share through innovation velocity that private label manufacturers cannot match.

| Country | CAGR (2025-2035) |

|---|---|

| China | 23% |

| India | 21.3% |

| Germany | 19.6% |

| Brazil | 17.9% |

| USA | 16.2% |

| UK | 14.5% |

| Japan | 12.8% |

The private label PET food market is gaining momentum worldwide, with China taking the lead thanks to explosive PET ownership growth and modern retail channel expansion programs. Close behind, India benefits from rising disposable incomes and increasing PET humanization trends, positioning itself as a strategic growth hub in the Asia-Pacific region. Germany shows strong advancement, where established private label acceptance and discount retailer dominance strengthen its role in European PET food supply chains. Brazil demonstrates robust growth through expanding middle-class PET ownership and retail modernization, signaling continued investment in private label development infrastructure. Meanwhile, the USA stands out for its mature retail landscape and quality-focused private label positioning, while the UK and Japan continue to record consistent progress driven by retailer innovation programs and consumer value-seeking behavior. Together, China and India anchor the global expansion story, while established markets build stability and diversity into the private label PET food market's growth path.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

China demonstrates the strongest growth potential in the Private Label Pet Food Market with a CAGR of 23% through 2035. The country's leadership position stems from explosive PET ownership growth, intensive retail modernization programs, and rapidly evolving consumer attitudes toward private label products driving adoption of retailer-branded PET nutrition solutions. Growth is concentrated in major urban regions, including Beijing, Shanghai, Guangzhou, and Shenzhen, where e-commerce platforms, modern supermarket chains, and PET specialty retailers are implementing private label strategies for market differentiation and margin enhancement. Distribution channels through Alibaba's Tmall, JD.com, regional supermarket chains, and emerging PET specialty concepts expand deployment across tier-1 and tier-2 cities with growing PET populations. The country's expanding middle class and premiumization trends in PET care provide strong foundation for private label development, including quality positioning strategies and ingredient transparency initiatives.

Key market factors:

In major metropolitan areas including Mumbai, Delhi, Bangalore, and Hyderabad, the adoption of private label PET food products is accelerating across modern retail formats, online platforms, and emerging PET specialty stores, driven by rising PET ownership and growing consumer acceptance of store-branded products. The private label PET food market demonstrates strong growth momentum with a CAGR of 21.3% through 2035, linked to comprehensive retail modernization and increasing focus on value-for-money PET nutrition solutions. Indian retailers are implementing private label strategies and quality assurance systems to capture growing PET food demand while offering price advantages compared to imported premium brands. The country's expanding organized retail sector creates sustained demand for private label development, while increasing emphasis on PET humanization drives adoption of quality-focused retailer brands.

Germany's mature retail sector demonstrates sophisticated implementation of private label PET food strategies, with documented case studies showing 40-50% private label penetration rates in discount retail channels achieving strong consumer acceptance. The country's retail infrastructure in major regions, including North Rhine-Westphalia, Bavaria, Baden-Württemberg, and Lower Saxony, showcases integration of private label PET food with established discount retail business models, leveraging expertise in private label development and quality management. German retailers emphasize quality standards and transparent sourcing, creating consumer confidence in private label products that support premium positioning strategies within value retail formats. The private label PET food market maintains strong growth through focus on sustainable ingredient sourcing and animal welfare standards, with a CAGR of 19.6% through 2035.

Key development areas:

Brazil's expanding PET care sector demonstrates growing implementation of private label PET food strategies, with increasing focus on value positioning and retailer differentiation supporting rapid market growth. The country shows solid potential with a CAGR of 17.9% through 2035, driven by rising PET ownership and retail channel modernization across major regions, including São Paulo, Rio de Janeiro, Minas Gerais, and Rio Grande do Sul. Brazilian retailers are adopting private label strategies for margin enhancement and customer loyalty building, particularly in supermarket chains and emerging PET specialty formats requiring competitive differentiation. Technology deployment channels through retail partnerships, contract manufacturing relationships, and quality assurance systems expand coverage across diverse retail formats.

Leading market segments:

The USA market leads in advanced private label PET food innovation based on integration with premium positioning strategies and sophisticated nutritional formulations matching national brand specifications. The country shows solid potential with a CAGR of 16.2% through 2035, driven by mature private label acceptance and retailer differentiation strategies across major regions, including California, Texas, Florida, and the Northeast corridor. American retailers are adopting quality-focused private label positioning for competition with premium national brands, particularly in grocery chains, mass merchandisers, and PET specialty retailers requiring margin optimization without quality compromise. Technology deployment channels through contract manufacturing partnerships, nutritional research collaborations, and quality certification programs expand coverage across diverse retail formats.

Leading market segments:

The UK's private label PET food market demonstrates sophisticated implementation focused on quality positioning and sustainable sourcing credentials, with documented integration achieving 45-50% private label penetration in major supermarket chains. The country maintains steady growth momentum with a CAGR of 14.5% through 2035, driven by established consumer acceptance and retailer brand strength supporting premium private label positioning. Major retail regions, including Southeast England, Northwest England, and Scotland, showcase advanced private label implementations where retailer brands achieve quality perception parity with mid-tier national brands through transparent ingredient sourcing and comprehensive quality assurance programs.

Key market characteristics:

Japan's private label PET food market demonstrates sophisticated implementation focused on premium positioning and specialized nutritional formulations, with documented integration achieving quality parity with established national brands in select retail formats. The country maintains steady growth momentum with a CAGR of 12.8% through 2035, driven by consumer quality consciousness and retailer innovation strategies supporting private label acceptance in traditionally brand-loyal markets. Major retail regions, including Kanto, Kansai, and Chubu, showcase careful private label development where retailers emphasize ingredient quality, manufacturing partnerships with reputable producers, and specialized formulations addressing specific PET health concerns.

Key market characteristics:

The private label PET food market in Europe is projected to grow from USD 485.2 million in 2025 to USD 2,334.5 million by 2035, registering a CAGR of 17.0% over the forecast period. Germany is expected to maintain its leadership position with a 31.5% market share in 2025, declining slightly to 30.8% by 2035, supported by its dominant discount retail infrastructure and major consumer centers, including North Rhine-Westphalia, Bavaria, and Baden-Württemberg regions.

The United Kingdom follows with a 24.3% share in 2025, projected to reach 24.6% by 2035, driven by comprehensive supermarket private label programs and strong retailer brand equity. France holds a 16.8% share in 2025, expected to rise to 17.1% by 2035 through retail modernization and private label quality improvement initiatives. Italy commands an 11.2% share in both 2025 and 2035, backed by growing private label acceptance in modern retail formats. Spain accounts for 8.5% in 2025, rising to 8.7% by 2035 on retail channel expansion. The Netherlands maintains 4.2% in 2025, reaching 4.4% by 2035 on specialty retail development. The Rest of Europe region is anticipated to hold 3.5% in 2025, expanding to 4.4% by 2035, attributed to increasing private label adoption in Nordic countries and emerging Eastern European retail modernization programs.

The Japanese private label PET food market demonstrates a mature and quality-focused landscape, characterized by sophisticated integration of retailer-branded products with existing PET food retail infrastructure across supermarket chains, PET specialty stores, and e-commerce platforms. Japan's emphasis on quality excellence and consumer trust drives demand for private label products that match or exceed national brand specifications in nutritional composition and ingredient quality. The private label PET food market benefits from strong partnerships between major retailers and established PET food contract manufacturers, creating comprehensive quality ecosystems that prioritize product consistency and transparent sourcing practices. Retail centers in Tokyo, Osaka, Nagoya, and other major metropolitan areas showcase advanced private label implementations where retailer brands achieve 25-30% category penetration through premium positioning strategies and comprehensive quality assurance documentation.

The South Korean private label PET food market is characterized by emerging retailer presence, with companies maintaining growing positions through comprehensive quality programs and competitive pricing strategies for urban PET owner demographics. The private label PET food market demonstrates increasing emphasis on value-for-money propositions and convenient purchasing options, as Korean retailers increasingly develop private label offerings that compete with established brands through e-commerce integration and subscription service models. Regional retailers are gaining market share through strategic partnerships with contract manufacturers, offering specialized services such as adapting to Korean consumer preferences and positioning premium ingredients for health-conscious pet owners. The competitive landscape shows increasing collaboration between major retail chains and PET food manufacturing specialists, creating hybrid service models that combine retail expertise with manufacturing quality standards and nutritional formulation capabilities.

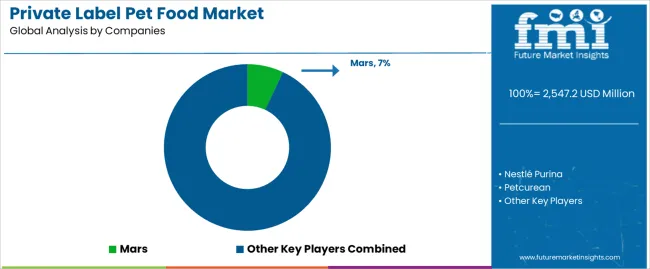

The private label PET food market features approximately 35-45 meaningful players with high fragmentation, where the top three companies control roughly 15-20% of global market share through established contract manufacturing capabilities and relationships with major retail chains worldwide. Competition centers on manufacturing quality consistency, nutritional formulation expertise, and production capacity scalability rather than consumer brand recognition. Mars leads with approximately 7.0% market share through its comprehensive contract manufacturing operations serving major retailers globally.

Market leaders include Mars, Nestlé Purina, and Petcurean, which maintain competitive advantages through world-class manufacturing infrastructure, extensive research and development capabilities in PET nutrition, and proven track records meeting stringent retailer quality standards, creating reliability and consistency advantages with retail partners. These companies leverage formulation expertise in life stage nutrition optimization and ongoing technical support relationships with retail customers to defend market positions while expanding into emerging private label categories including grain-free, limited ingredient, and functional nutrition segments.

Challengers encompass United Petfood and PLB International, which compete through specialized contract manufacturing services and strong regional presence in key retail markets. Product specialists, including Gimborn, Acana, and Nutrience, focus on premium formulation capabilities or specific product categories, offering differentiated capabilities in ingredient sourcing, customization services, and specialized nutritional profiles.

Regional players and emerging contract manufacturers create competitive pressure through cost advantages and localized production capabilities, particularly in high-growth markets including China and India, where proximity to rapidly expanding retail networks provides advantages in logistics costs and rapid product development cycles. Market dynamics favor companies that combine consistent manufacturing quality with comprehensive formulation support services addressing complete product development from concept through launch, enabling retailers to compete effectively with national brands while maintaining acceptable quality standards and competitive pricing structures.

Private label PET food products represent value-oriented nutrition solutions that enable retailers to achieve 8-12 percentage points higher gross margins compared to national brands, delivering competitive pricing advantages and customer loyalty benefits with quality equivalence to mid-tier branded products in demanding retail environments. With the market projected to grow from USD 2,547.2 million in 2025 to USD 12,243.8 million by 2035 at a 17.0% CAGR, these retailer-branded products offer compelling advantages - cost savings, margin enhancement, and brand differentiation - making them essential for dog food applications (64.0% market share), cat food products (36.0% share), and retail operations seeking to compete with established PET food brands through exclusive offerings and value positioning. Scaling market adoption and quality acceptance requires coordinated action across retail strategy, manufacturing partnerships, quality standards, consumer education, and nutritional research institutions.

How Governments Could Spur Local Production and Adoption?

How Industry Bodies Could Support Market Development?

How OEMs and Technology Players Could Strengthen the Ecosystem?

How Suppliers Could Navigate the Shift?

How Investors and Financial Enablers Could Unlock Value?

| Item | Value |

|---|---|

| Quantitative Units | USD 2,547.2 million |

| Product Category | Staple Food, Snack, Supplement |

| Application | Dog, Cat |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, USA, UK, Japan, and 40+ countries |

| Key Companies Profiled | Mars, Nestlé Purina, Petcurean, United Petfood, PLB International, Gimborn, Acana, Nutrience, General Mills, Elmira Pet Products, Schell & Kampeter (Taste of the Wild), Champion Petfoods, Wellness Pet Company, Colgate-Palmolive, Nature's Variety (Instinct), Yantai China Pet Foods, Shandong Gambol Pet Group, Zhejiang Petpal Pet Nutrition Technology, Hangzhou Tianyuan Pet Products, Shandong Luscious Pet Food |

| Additional Attributes | Dollar sales by product category and application segments, regional adoption trends across Asia Pacific, Europe, and North America, competitive landscape with contract manufacturers and retail partnerships, manufacturing facility requirements and quality specifications, integration with retail private label strategies and consumer loyalty programs, innovations in nutritional formulation and ingredient transparency systems, and development of specialized products with enhanced nutritional profiles and sustainability credentials. |

The global private label PET food market is estimated to be valued at USD 2,547.2 million in 2025.

The market size for the private label PET food market is projected to reach USD 12,243.8 million by 2035.

The private label PET food market is expected to grow at a 17.0% CAGR between 2025 and 2035.

The key product types in private label PET food market are staple food, snack and supplement.

In terms of application, dog segment to command 64.0% share in the private label PET food market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Private Electric Vehicle Charging Station Market Size and Share Forecast Outlook 2025 to 2035

Private 5G Network Market Size and Share Forecast Outlook 2025 to 2035

Private office-based clinics Market Size and Share Forecast Outlook 2025 to 2035

Private LTE Market Size and Share Forecast Outlook 2025 to 2035

Private Cloud Services Market by Services, Type, Industry Vertical, and Region – Growth, Trends, and Forecast through 2025 to 2035

Private Tutoring Market Trends – Growth & Forecast 2024-2034

Private Security Market Growth – Trends & Forecast 2024-2034

Virtual Private Cloud Market Size and Share Forecast Outlook 2025 to 2035

Virtual Private Network VPN Market Size and Share Forecast Outlook 2025 to 2035

Virtual Private Server Market Size and Share Forecast Outlook 2025 to 2035

5G Enterprise Private Network Market Size and Share Forecast Outlook 2025 to 2035

Demand for Hybrid Protein Blends in Private Label Formulations in CIS Size and Share Forecast Outlook 2025 to 2035

Label Applicators Market Size and Share Forecast Outlook 2025 to 2035

Labeling and Coding Equipment Market Size and Share Forecast Outlook 2025 to 2035

Labels Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Labels, Tapes And Films Market Size and Share Forecast Outlook 2025 to 2035

Labeling Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Label Printers Market Size, Growth, and Forecast 2025 to 2035

Labelling Machine Market Growth & Industry Trends through 2035

Competitive Overview of Labels Companies

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA