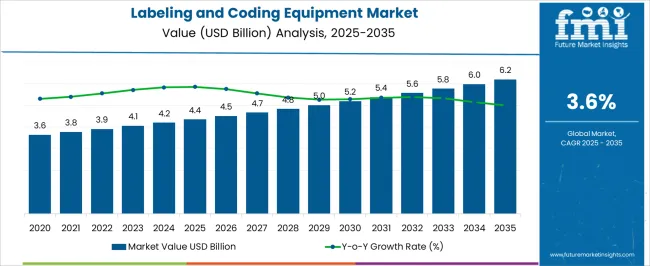

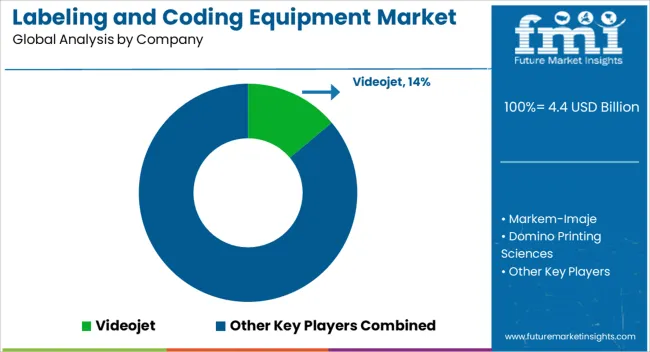

The labeling and coding equipment market, valued at USD 4.4 billion in 2025 and projected to reach USD 6.2 billion by 2035 with a CAGR of 3.6%, demonstrates a gradual yet consistent expansion across the forecast period. The cost structure within this market is largely influenced by machinery manufacturing, software integration, and installation services, with machinery production accounting for the largest share due to the high precision and technology-intensive nature of labeling and coding equipment.

Components such as print heads, conveyor systems, and sensors significantly contribute to overall costs, while ongoing R&D investments support enhancements in automation, speed, and accuracy.

The value-chain encompasses multiple stages including raw material sourcing, equipment manufacturing, software and hardware integration, distribution, and after-sales services. Suppliers of electronic and mechanical components play a critical role in ensuring operational reliability and efficiency, while system integrators and OEMs add value through customization and compatibility with existing production lines.

Distributors and channel partners bridge the gap between manufacturers and end-users, enabling timely deployment across various sectors, including food and beverage, pharmaceuticals, and consumer goods. Service and maintenance segments further enhance value by extending equipment lifespan and ensuring compliance with labeling regulations. Margins at each stage of the chain are influenced by technological sophistication, regional demand, and competitive pricing strategies. The moderate CAGR indicates steady growth driven by incremental adoption of automation and regulatory compliance requirements, reflecting a balanced cost structure and value-chain alignment.

| Metric | Value |

|---|---|

| Labeling and Coding Equipment Market Estimated Value in (2025 E) | USD 4.4 billion |

| Labeling and Coding Equipment Market Forecast Value in (2035 F) | USD 6.2 billion |

| Forecast CAGR (2025 to 2035) | 3.6% |

The labeling and coding equipment market represents a specialized segment within the global packaging machinery and industrial automation industry, emphasizing product identification, traceability, and regulatory compliance. Within the broader packaging machinery sector, it accounts for about 6.0%, driven by demand from food and beverage, pharmaceutical, and consumer goods manufacturers. In the industrial automation and production equipment segment, its share is approximately 5.4%, reflecting the need for precise coding, serialization, and batch tracking. Across the pharmaceutical and healthcare packaging market, it holds around 4.8%, supporting adherence to strict labeling and serialization standards. Within the food and beverage processing category, it represents 4.3%, highlighting applications in date marking, batch coding, and quality assurance. In the broader logistics and supply chain solutions sector, the market contributes nearly 3.9%, emphasizing integration with inspection, sorting, and smart packaging systems. Recent developments in the market have focused on digital integration, high-speed performance, and multi-functional capabilities. Innovations include thermal transfer, inkjet, laser, and robotic labeling systems with vision-guided inspection for enhanced accuracy.

Key players are collaborating with software providers and equipment manufacturers to integrate IoT-enabled monitoring, predictive maintenance, and real-time reporting solutions. Adoption of modular, flexible machines capable of handling multiple product formats and packaging types is gaining momentum. The compliance with serialization requirements, automation-driven data capture, and eco-friendly inks are shaping equipment development.

The labeling and coding equipment market is experiencing consistent expansion, driven by rising automation in packaging operations and the increasing emphasis on traceability, regulatory compliance, and brand differentiation across industries. Demand is being influenced by the growing need for high-speed, accurate, and reliable labeling and coding solutions that can integrate seamlessly with modern production lines. Sectors such as food and beverages, pharmaceuticals, personal care, and logistics are increasingly relying on labeling and coding technologies to enhance supply chain visibility and prevent counterfeiting.

Advancements in print technology, smart sensors, and machine integration are improving equipment efficiency while reducing operational downtime and maintenance costs. Regulatory pressures requiring clear and permanent identification for safety, traceability, and expiration tracking are further contributing to increased adoption.

As manufacturers strive to optimize packaging efficiency and maintain quality assurance, investments in smart labeling systems are expected to rise With growing focus on sustainability and digitalization, the market is poised for sustained growth, supported by a shift toward automated, software-driven equipment solutions that can adapt to diverse packaging needs.

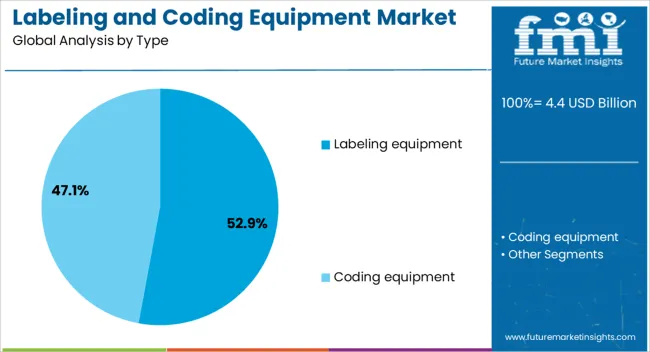

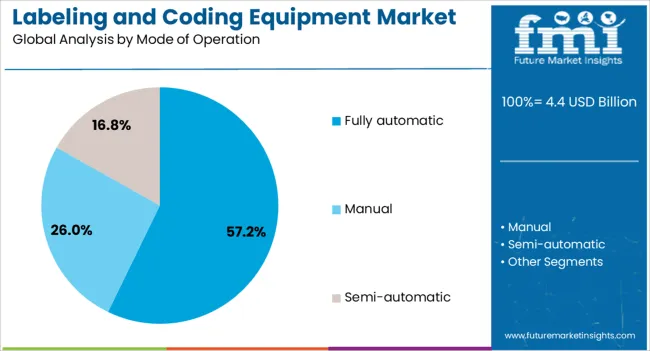

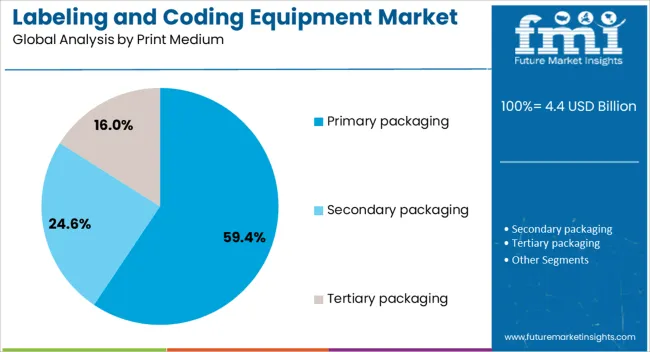

The labeling and coding equipment market is segmented by type, mode of operation, print medium, end use industry, distribution channel, and geographic regions. By type, labeling and coding equipment market is divided into Labeling equipment and Coding equipment. In terms of mode of operation, labeling and coding equipment market is classified into Fully automatic, Manual, and Semi-automatic. Based on print medium, labeling and coding equipment market is segmented into Primary packaging, Secondary packaging, and Tertiary packaging.

By end use industry, labeling and coding equipment market is segmented into Food and beverages, Pharmaceutical, Cosmetics and personal care, Electronics, Logistics and retail, and Others. By distribution channel, labeling and coding equipment market is segmented into Direct sales and Indirect sales. Regionally, the labeling and coding equipment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The labeling equipment segment is projected to hold 52.9% of the labeling and coding equipment market revenue share in 2025, making it the leading equipment type. Its dominance is being driven by the high demand for fast and accurate label application across a wide range of industries, particularly in food and beverage, pharmaceuticals, and consumer goods. Labeling equipment offers a combination of speed, precision, and versatility, allowing manufacturers to handle a variety of packaging formats and label types with minimal manual intervention.

Increased regulatory focus on proper labeling, including nutrition facts, safety information, and batch identification, has reinforced the need for advanced labeling systems. This segment is further benefiting from the rise of product personalization, SKU diversification, and promotional labeling, all of which require dynamic, adaptable equipment.

The ability to integrate with high-speed production lines and software-based control systems supports greater production efficiency and real-time quality checks As brands emphasize traceability, aesthetics, and compliance, labeling equipment continues to be a critical component of the packaging process, reinforcing its leadership in the market.

The fully automatic segment is expected to capture 57.2% of the labeling and coding equipment market revenue share in 2025, positioning it as the dominant mode of operation. This leadership is being supported by the ongoing automation trend in manufacturing, where operational speed, precision, and cost control are top priorities. Fully automatic systems eliminate manual intervention, allowing for continuous operation with minimal supervision while significantly reducing human error and labor costs.

These systems are favored in high-throughput environments such as food and beverage processing, pharmaceutical packaging, and industrial manufacturing, where consistent product labeling and marking are essential. The ability to integrate with enterprise software systems, conveyor lines, and quality assurance modules enhances their efficiency and real-time traceability.

Demand is also being fueled by the rising need for compliance with international packaging standards, which require accurate, legible, and permanent coding As manufacturers look to scale production while maintaining quality and traceability, fully automatic systems are being increasingly adopted for their high reliability and adaptability to various packaging formats and materials.

The primary packaging segment is anticipated to account for 59.4% of the labeling and coding equipment market revenue share in 2025, establishing itself as the leading print medium. This leadership is being reinforced by the growing need to mark directly on product containers and immediate packaging layers, where visibility, regulatory compliance, and product information are critical. Coding on primary packaging ensures that vital data such as expiration dates, batch numbers, and regulatory identifiers are printed directly onto the product or its first layer of packaging.

This reduces the risk of label misplacement or detachment and helps ensure traceability across the supply chain. The segment’s dominance is being supported by industries such as pharmaceuticals, personal care, and food and beverages, where strict regulations govern direct product labeling.

Advancements in inkjet and laser marking technologies are further enhancing precision and durability of prints on various surfaces, including plastic, glass, metal, and flexible films As product-level traceability and anti-counterfeiting measures gain importance, printing on primary packaging remains essential for both compliance and brand protection.

The market has grown steadily due to increasing demand for product identification, traceability, and brand visibility across packaging industries. Manufacturers in food and beverage, pharmaceuticals, personal care, and logistics sectors require accurate and high-speed labeling solutions to meet regulatory standards and improve operational efficiency. Advancements in automation, digital printing, and inkjet technologies have enabled precise marking on diverse packaging substrates. Growing adoption of serialized codes, QR codes, and barcodes ensures product authenticity and inventory management.

Modern labeling and coding equipment integrates automation to enhance production line efficiency and minimize manual intervention. Systems such as automatic label applicators, conveyor-integrated coders, and vision inspection units reduce errors and downtime while ensuring consistent application. High-speed inkjet, thermal transfer, and laser marking technologies allow rapid coding on various materials including plastics, glass, and cardboard. Real-time monitoring and diagnostics capabilities provide alerts for maintenance needs and process deviations. Automation ensures precise placement, high throughput, and reduced operational costs, making equipment suitable for both small and large-scale manufacturers. These technological innovations are driving adoption across industries that require efficient, high-volume, and traceable labeling solutions.

Regulatory requirements in pharmaceuticals, food, and beverage industries emphasize traceability, batch coding, and expiration date marking, which have propelled the adoption of labeling and coding equipment. Compliance with standards such as FDA, ISO, and GS1 ensures accurate product information and reduces recall risks. Serialization and anti-counterfeit measures are increasingly implemented through advanced coding systems, protecting brand integrity and enhancing consumer confidence. Companies are investing in equipment capable of applying variable data, track-and-trace codes, and tamper-evident labels. These features support efficient inventory management, logistics tracking, and quality control. Regulatory-driven adoption continues to encourage upgrades from manual labeling to automated, data-driven solutions that can handle complex compliance requirements.

The integration of labeling and coding equipment with digital platforms and Industry 4.0 technologies has enhanced operational visibility and process control. IoT-enabled machines allow remote monitoring, predictive maintenance, and performance analytics, optimizing production efficiency and reducing downtime. Software-controlled systems enable seamless integration with enterprise resource planning (ERP) and manufacturing execution systems (MES), ensuring synchronization across production lines. Vision-based inspection and real-time error detection improve product quality and reduce waste. Smart labeling solutions with connected interfaces support data-driven decision-making and enable rapid adaptation to changing production demands. The fusion of hardware and digital intelligence is making labeling and coding equipment increasingly indispensable in modern, automated manufacturing facilities.

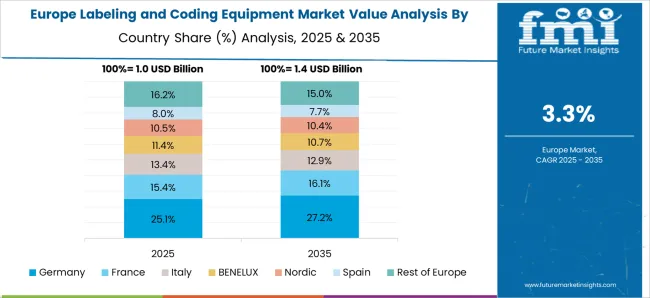

Asia Pacific leads the market due to expanding manufacturing activities, e-commerce growth, and rising demand for packaged goods. North America and Europe exhibit strong adoption of high-precision and automated labeling systems driven by regulatory compliance and brand protection initiatives. Key players focus on innovation in printing technology, automation, and integration with digital systems. Strategic partnerships with packaging machinery manufacturers and software providers enhance market penetration. Continuous investment in R&D, customization options, and aftersales services further differentiates market offerings. Regional dynamics are influenced by manufacturing expansion, rising consumer expectations for traceable and compliant products, and increasing efficiency demands across the packaging and logistics sectors.

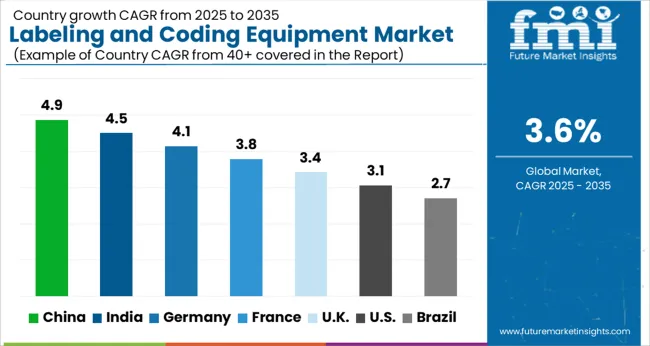

| Country | CAGR |

|---|---|

| China | 4.9% |

| India | 4.5% |

| Germany | 4.1% |

| France | 3.8% |

| U.K. | 3.4% |

| U.S. | 3.1% |

| Brazil | 2.7% |

The market is projected to grow at a CAGR of 3.6% from 2025 to 2035. China emerged at 4.9%, driven by expansion in manufacturing and packaging automation. India accounted for 4.5%, reflecting the rising adoption of coding technologies in the food and pharmaceutical sectors. Germany contributed 4.1%, supported by precision labeling standards and industrial automation initiatives. The United Kingdom reached 3.4%, with growth linked to modernization of packaging lines. The United States stood at 3.1%, emphasizing incremental upgrades in labeling and tracking systems across industries. These nations are actively scaling, deploying, and innovating labeling and coding solutions to enhance operational efficiency and product traceability. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to grow at a CAGR of 4.9%, supported by strong demand from the pharmaceutical, food, and beverage packaging industries. Increasing adoption of automated labeling and coding systems ensures accurate traceability, compliance, and brand visibility. Domestic manufacturers are focusing on high-speed, compact, and versatile equipment suitable for small and large production lines. Collaborations with international technology providers enhance precision, reliability, and integration with packaging lines. Rising e-commerce packaging and logistics requirements further boost market adoption.

India is expected to grow at a CAGR of 4.5%, driven by expansion of pharmaceuticals, FMCG, and beverage sectors. Manufacturers and contract packers are increasingly adopting automated systems to enhance accuracy, reduce production errors, and ensure regulatory compliance. Compact and cost-effective equipment designed for small and mid-sized packaging units sees strong adoption. Distribution networks and e-commerce channels facilitate accessibility across urban and semi-urban regions.

Germany, with a CAGR of 4.1%, demonstrates steady demand due to high regulatory standards and premium packaging requirements. Food, beverage, and pharmaceutical industries adopt automated systems to ensure traceability, quality assurance, and compliance with EU labeling regulations. Advanced digital coding, printing, and verification systems are prioritized by manufacturers. Integration with production line automation enhances efficiency and reduces downtime.

The United Kingdom is forecast to grow at a CAGR of 3.4%, shaped by demand in pharmaceutical, food, and beverage sectors. Small and medium packaging units increasingly adopt automated labeling and coding solutions to improve efficiency, minimize human error, and comply with stringent regulations. Import of high-precision European equipment dominates supply. Emphasis on flexible, easy-to-install solutions supports growing interest among SMEs.

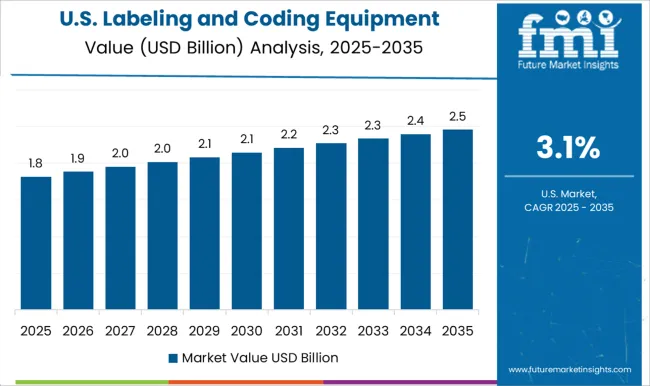

The United States, growing at a CAGR of 3.1%, is characterized by steady adoption in food, beverage, and pharmaceutical industries. Large-scale manufacturers and contract packers prioritize high-speed, automated systems with integrated verification and traceability. Increasing focus on serialization, compliance with FDA regulations, and integration with ERP systems drives demand. Smart, modular, and energy-efficient solutions are gaining preference.

The market is characterized by intense competition among global leaders and specialized regional players offering advanced printing, marking, and labeling solutions for industrial and consumer products. Videojet, Markem-Imaje, Domino Printing Sciences, and ProMach dominate the market with extensive portfolios of continuous inkjet, thermal transfer, laser, and high-speed coding systems. Their strategies focus on technological innovation, reliability, compliance with global regulatory standards, and providing comprehensive after-sales service to ensure uninterrupted production lines. Regional and niche players such as Hitachi IESA, Squid Ink, CVC Technologies, HERMA, Ambrose Packaging, Sneed Coding Solutions, Leibinger, Pack Leader USA, PrintJet Corporation, BellatRx, and BW Integrated Systems compete by offering cost-efficient, compact, and customized solutions tailored for small to medium enterprises and emerging markets. These companies often emphasize rapid deployment, local support, and flexibility in equipment configuration to meet specific client requirements. The market is highly dynamic, with competition driven by automation integration, IoT-enabled smart labeling, and sustainable consumables. Collaborations with packaging solution providers and software developers are increasingly shaping competitive advantage. As global demand for faster, error-free, and traceable labeling solutions grows, manufacturers prioritize product innovation, digital integration, and customer-centric services to secure market leadership.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.4 Billion |

| Type | Labeling equipment and Coding equipment |

| Mode of Operation | Fully automatic, Manual, and Semi-automatic |

| Print Medium | Primary packaging, Secondary packaging, and Tertiary packaging |

| End Use Industry | Food and beverages, Pharmaceutical, Cosmetics and personal care, Electronics, Logistics and retail, and Others |

| Distribution Channel | Direct sales and Indirect sales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Videojet, Markem-Imaje, Domino Printing Sciences, ProMach, Hitachi IESA, Squid Ink, CVC Technologies, HERMA, Ambrose Packaging, Sneed Coding Solutions, Leibinger, Pack Leader USA, PrintJet Corporation, BellatRx, and BW Integrated Systems |

| Additional Attributes | Dollar sales by equipment type and application, demand dynamics across food, beverage, pharmaceutical, and consumer goods sectors, regional trends in packaging automation adoption, innovation in printing precision, speed, and integration with production lines, environmental impact of energy use and material waste, and emerging use cases in traceability, smart packaging, and high-speed labeling operations. |

The global labeling and coding equipment market is estimated to be valued at USD 4.4 billion in 2025.

The market size for the labeling and coding equipment market is projected to reach USD 6.2 billion by 2035.

The labeling and coding equipment market is expected to grow at a 3.6% CAGR between 2025 and 2035.

The key product types in labeling and coding equipment market are labeling equipment, _pressure-sensitive labelers, _print-and-apply labeling systems, _sleeve labelers, _others (roll-fed labelers etc.), coding equipment, _inkjet coding machine, _thermal transfer coders, _laser coders and _others (thermal inkjet printers etc.).

In terms of mode of operation, fully automatic segment to command 57.2% share in the labeling and coding equipment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Labeling Software Market Growth - Trends & Forecast through 2034

Labeling Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Competitive Breakdown of Labeling Equipment Providers

Slide Labeling Machine Market Size and Share Forecast Outlook 2025 to 2035

Protein Labeling Market

Automated Labeling Machines Market Size and Share Forecast Outlook 2025 to 2035

Integrated Labeling System Market Size and Share Forecast Outlook 2025 to 2035

Shrink Sleeve Labeling Machine Size and Share Forecast Outlook 2025 to 2035

Shrink Sleeve Labeling Equipment Market

Ampoule Sticker Labeling Machine Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Ampoule Sticker Labeling Machine Suppliers

Pressure Sensitive Labeling Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Weigh Price Labeling Machine Market Size and Share Forecast Outlook 2025 to 2035

Android Automotive OS (AAOS) Market Size and Share Forecast Outlook 2025 to 2035

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Andersen-Tawil Syndrome Treatment Market Trends - Growth & Future Prospects 2025 to 2035

Andro Supplements Market

Candle Filter Cartridges Market Size and Share Forecast Outlook 2025 to 2035

Handheld Electrostatic Meter Market Size and Share Forecast Outlook 2025 to 2035

Hand Towel Automatic Folding Machine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA