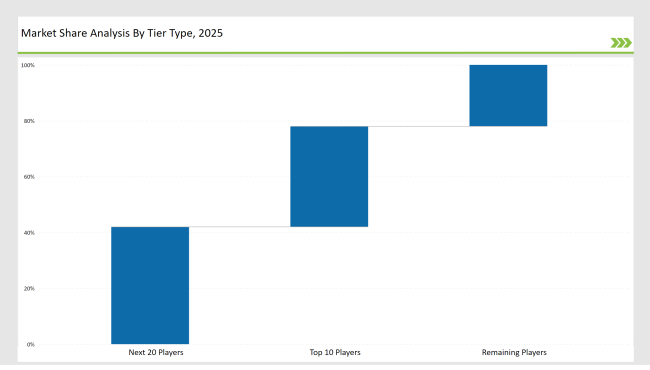

The global ampoule sticker labeling machine market is highly competitive and segmented. Companies are divided into Tier 1, Tier 2, and Tier 3 based on their market presence and strategic positioning. Tier 1 players dominate the market, with Herma, Accutek Packaging, and Quadrel Labeling Systems holding a 36% market share.

Such companies maintain leadership through cutting-edge automation, precision engineering, and expansive distribution networks. Their emphasis on rapid labeling, precision, and regulatory compliance gives them a precise base in offering solutions to pharmaceuticals, biotech, and cosmetics companies effectively.

Tier 2 players like Krones AG, MPI Label Systems contribute roughly 42% of the market. They emphasize cost-effective and bespoke labeling solutions that mid-sized pharmaceuticals producers and contract packaging companies see usage in. Further operational efficiency along with additional new product lines only enhances their position in growth markets.

Regional manufacturers and start-ups account for 22% of the market share, tier 3 players. They have a focus on niche applications, like biodegradable labels, compact labeling units, for small-scale production and are localized with budget-friendly solutions catering to such needs. Tier 3 companies can respond more agilely to gaps in the industry and are not afraid of sacrificing price margins for it.

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Herma, Accutek Packaging, Quadrel Labeling Systems) | 18% |

| Rest of Top 5 (Krones AG, MPI Label Systems) | 10% |

| Next 5 of Top 10 (Weiler Labeling Systems, ProMach, ALTech, Pack Leader USA, Universal Labeling Systems) | 8% |

The ampoule sticker labeling machine market serves industries such as

Vendors offer specialized products to meet evolving industry needs

Manufacturers incorporate automation and AI-driven quality control to enhance efficiency, while sustainability remains a major driver for eco-friendly labeling solutions.

This section highlights the key players that drove innovation and growth in the ampoule sticker labeling machine market in 2025. Companies launched advanced labeling systems with increased speed and precision. Manufacturers invested in AI-driven defect detection to improve labeling accuracy. Firms expanded production capacity to meet the growing demand for automated labeling. Businesses integrated smart tracking technology to enhance supply chain efficiency.

Year on Year Leaders

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Herma, Accutek Packaging, Quadrel Labeling Systems |

| Tier 2 | Krones AG, MPI Label Systems |

| Tier 3 | Weiler Labeling Systems, niche startups |

| Manufacturer | Latest Developments |

|---|---|

| Herma | In January 2024, launched AI-powered defect detection in labeling systems. |

| Accutek Packaging | In March 2024, introduced compact high-speed labeling solutions. |

| Quadrel Labeling Systems | In June 2024, expanded its modular labeling machine portfolio. |

| Krones AG | In February 2024, deployed IoT-enabled smart tracking for pharmaceutical labels. |

| MPI Label Systems | In July 2024, developed sustainable label adhesives with low carbon footprint. |

The industry is advancing with AI-driven automation, smart tracking, and sustainable label solutions. Manufacturers are optimizing high-speed production lines to enhance efficiency. Companies integrate advanced defect detection systems to improve labeling accuracy.

Engineers develop new adhesive technologies for better sustainability. Firms enhance supply chain tracking with IoT-based monitoring solutions. Emerging innovations will drive further investments in next-generation labeling technologies.

Herma, Accutek Packaging, Quadrel Labeling Systems, Krones AG, and MPI Label Systems lead the market.

The top 10 players collectively hold about 36% of the global market.

Tier-3 companies account for 22%, focusing on niche and regional markets.

AI-based defect detection, IoT integration, and demand for sustainable labeling solutions drive innovation.

Smart tracking enhances supply chain visibility, reduces errors, and ensures compliance with industry regulations.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ampoules Packaging Market Size and Share Forecast Outlook 2025 to 2035

Ampoule Sticker Labeling Machine Market Size and Share Forecast Outlook 2025 to 2035

Vaccine Ampoules Market

Cryogenic Ampoules Market Size and Share Forecast Outlook 2025 to 2035

Analyzing Cryogenic Ampoules Market Share & Industry Leaders

Closed Funnel Ampoules Market

Pharmaceutical Ampoules Market

Plastic Vials and Ampoules Market Size and Share Forecast Outlook 2025 to 2035

Leading Providers & Market Share in Plastic Vials and Ampoules Industry

Bottle Sticker Labelling Machine Market Size and Share Forecast Outlook 2025 to 2035

3D-Printed Stickers & Labels Market Growth – Trends & Forecast 2024-2034

Market Share Breakdown of 3D-Printed Stickers & Labels Manufacturers

Infant Fever Stickers Market Size and Share Forecast Outlook 2025 to 2035

Bio-Magnetic Ear Stickers Market Analysis – Growth & Forecast 2025 to 2035

Moisture Detection Stickers Market Size and Share Forecast Outlook 2025 to 2035

Sales Analysis of Tourism Industry in the Middle East Size and Share Forecast Outlook 2025 to 2035

Semen Analysis Systems Market Size and Share Forecast Outlook 2025 to 2035

Stone Analysis Software Market – Trends & Forecast 2025 to 2035

Water Analysis Instrumentation Market Analysis – Size, Share, and Forecast 2025 to 2035

Spend Analysis Software Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA