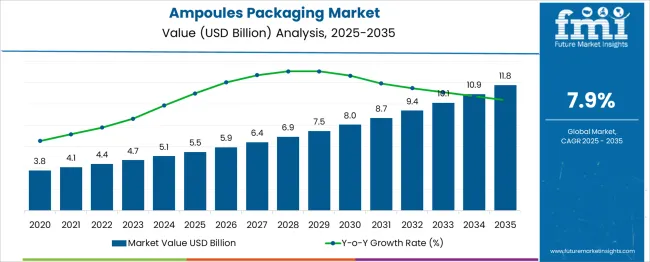

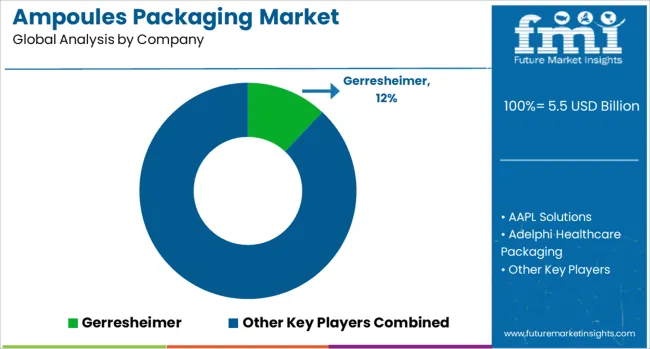

The Ampoules Packaging Market is estimated to be valued at USD 5.5 billion in 2025 and is projected to reach USD 11.8 billion by 2035, registering a compound annual growth rate (CAGR) of 7.9% over the forecast period. Between 2025 and 2030, the market expands by USD 2.2 billion, from USD 5.5 billion to USD 7.5 billion, signaling steady market growth during the initial phase. This period highlights a consistent market share gain, driven by growing demand in the pharmaceutical sector, particularly for vaccines, injectables, and biopharmaceuticals.

The latter half of the forecast period (2030 to 2035) sees more accelerated growth, with the market increasing by USD 4.3 billion, from USD 7.5 billion to USD 11.8 billion. This portion of the forecast indicates a strong market share gain, reflecting the growing adoption of ampoules packaging solutions as industries adapt to stricter regulations and new drug packaging innovations.

The total increase of USD 6.3 billion over the 10-year period showcases robust expansion, with the market capitalizing on rising healthcare needs, new formulations, and advancements in packaging technology. This steady growth and net gain in market share suggest that the market will continue to benefit from expanding pharmaceutical production and innovations in packaging safety, reliability, and efficiency.

| Metric | Value |

|---|---|

| Ampoules Packaging Market Estimated Value in (2025 E) | USD 5.5 billion |

| Ampoules Packaging Market Forecast Value in (2035 F) | USD 11.8 billion |

| Forecast CAGR (2025 to 2035) | 7.9% |

The ampoules packaging market is witnessing sustained growth, supported by increasing demand for sterile, tamper-proof pharmaceutical packaging and evolving regulatory standards for parenteral drug delivery. Rising cases of chronic diseases, coupled with an expanding aging population and vaccine requirements, have led to higher injectable drug production volumes globally.

Manufacturers are responding by investing in advanced filling lines and materials that preserve product stability while ensuring integrity across the supply chain. Growth in biologics and personalized therapies is further pushing demand for small-dose packaging formats with high barrier protection.

Additionally, automation in ampoule sealing and labeling systems is enhancing throughput while reducing contamination risk. With governments tightening packaging compliance and traceability mandates, the market is expected to evolve rapidly toward high-purity materials and digital-enabled serialization solutions.

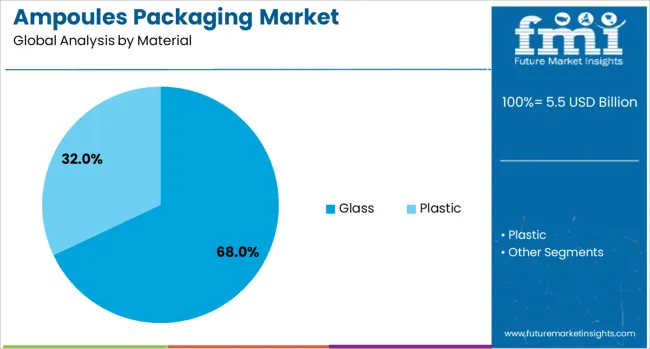

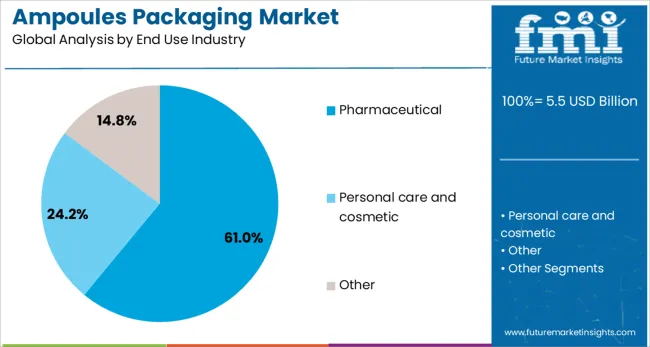

The ampoules packaging market is segmented by material, end-use industry, and geographic regions. The packaging material for ampoules is divided into Glass and Plastic. In terms of end-use industry, the ampoules packaging market is classified into Pharmaceutical, Personal care and cosmetic.

Regionally, the ampoules packaging industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Glass is expected to dominate the ampoules packaging market with a 68.0% revenue share in 2025, making it the leading material choice. This dominance is driven by its superior chemical resistance, non-reactivity, and transparency—critical attributes for injectable drug packaging.

Glass ampoules provide a hermetically sealed environment that protects contents from microbial contamination and oxidation. Their compatibility with heat sterilization processes and inert nature ensures product integrity during storage and transport.

Regulatory preference for Type I borosilicate glass in pharmaceutical packaging continues to reinforce demand. As drug formulations become more sensitive and storage stability becomes paramount, glass remains the material of choice for parenteral solutions requiring precise barrier performance.

The pharmaceutical industry is projected to contribute 61.0% of the total revenue in the ampoules packaging market by 2025, maintaining its position as the dominant end-use segment. This leadership stems from the increasing production of vaccines, injectables, and biologic therapies requiring unit-dose delivery formats.

Stringent industry regulations around drug safety, sterility, and tamper evidence have driven adoption of ampoules as a reliable primary packaging solution. Pharmaceutical companies prefer ampoules for their ability to offer fixed dosages, eliminate cross-contamination risks, and ensure patient compliance.

Expansion of pharmaceutical manufacturing in emerging markets and growing investments in cold chain logistics are further reinforcing ampoule packaging as a critical enabler of safe drug distribution.

Rising demand for injectable drugs, vaccines, and biopharmaceutical products is driving the growth of the ampoules packaging sector. Ampoules are preferred for their ability to protect sensitive drugs from contamination and provide effective barriers against light and air. However, high production costs and limited material options pose challenges. Technological advancements, such as the adoption of smart packaging and alternative materials, present significant growth opportunities. Additionally, the increasing trend toward eco-friendly packaging solutions and the expansion of biologic drug development contribute to the market's continued evolution.

The growing demand for injectable drugs, vaccines, and biologics is a key driver for the ampoules packaging market. These products, particularly vaccines and biologics, require specialized storage and protection, making ampoules an ideal solution due to their ability to preserve the integrity of sensitive materials. As the prevalence of chronic diseases rises globally, so does the demand for pharmaceuticals, increasing the need for safe, reliable packaging options. The trend toward single-dose packaging in healthcare systems has further fueled this demand, offering convenience, reducing the risk of contamination, and ensuring dosage accuracy. Additionally, the shift towards biologics and personalized medicine, which require precise handling and storage, is also contributing to the market’s growth. Ampoules provide a secure, efficient solution for these high-value products, making them a popular choice in the pharmaceutical and biotechnology sectors.

Despite the growth of the ampoules packaging sector, several challenges remain. High production costs are one of the primary hurdles, as manufacturing these specialized packaging solutions requires the use of costly materials like high-quality glass or plastic. The intricate design and precision required for ampoules further add to the production expenses. Additionally, the limited variety of materials, primarily glass and plastic, restricts manufacturers from exploring cost-effective alternatives or innovations in material design. While glass provides excellent protection, its disposal raises environmental concerns, adding pressure to find more sustainable solutions. The complexity of packaging requirements, including the need for sterilization and safety compliance, also adds operational challenges. These factors contribute to the high cost of ampoules, limiting widespread adoption, particularly in price-sensitive markets or for smaller companies with limited resources.

Technological advancements in packaging and materials offer significant opportunities for growth in the ampoules packaging sector. The development of pre-filled, ready-to-use ampoules and the integration of smart packaging solutions are reshaping the industry. Smart packaging technologies, such as RFID tags and real-time monitoring systems, provide greater control over the condition of sensitive drugs, enhancing safety and efficiency.The adoption of alternative, eco-friendly materials like biodegradable plastics is gaining traction, responding to the increasing demand for eco-friendly packaging solutions. The expansion of biologics, personalized medicine, and home healthcare provides new growth avenues for ampoules, as these industries require high-performance packaging to store and deliver sensitive drugs. Furthermore, advancements in manufacturing processes, like automation and 3D printing, can improve production efficiency and reduce costs, allowing for greater scalability and flexibility in the market.

The ampoules packaging market is seeing significant trends in the adoption of smart packaging technologies. These innovations, such as RFID tags and integrated sensors, allow for real-time monitoring of temperature, humidity, and other factors that can affect the integrity of the drug. This trend is particularly important in sectors such as biopharmaceuticals and vaccines, where maintaining the proper storage conditions is crucial. Alongside technological advancements, there is a strong shift towards eco-friendly alternatives. The use of recyclable and biodegradable plastics is becoming more common, driven by environmental concerns and consumer demand for sustainable products. Manufacturers are increasingly adopting green packaging materials to align with regulations and industry expectations. These trends are transforming the ampoules packaging market, making it more efficient, secure, and environmentally conscious, all while meeting the evolving needs of healthcare providers and consumers.

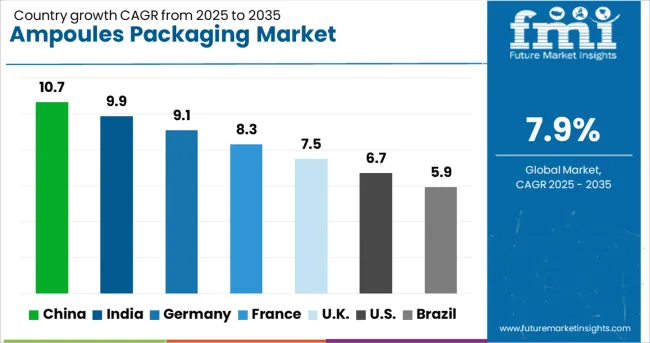

| Country | CAGR |

|---|---|

| China | 10.7% |

| India | 9.9% |

| Germany | 9.1% |

| France | 8.3% |

| UK | 7.5% |

| USA | 6.7% |

| Brazil | 5.9% |

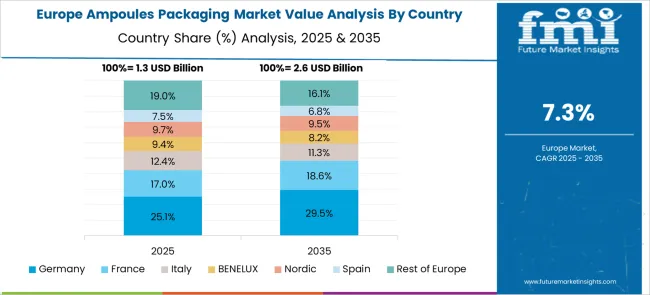

The ampoules packaging market is projected to grow at a CAGR of 7.9% from 2025 to 2035. Among the top markets, China leads at 10.7%, followed by India at 9.9%, while France posts 8.3%, the United Kingdom records 7.5%, and the United States stands at 6.7%. These growth rates indicate stronger demand in developing markets such as China and India, where the pharmaceutical and healthcare sectors are expanding rapidly. Meanwhile, mature markets in Europe and North America exhibit steady growth driven by the demand for secure, tamper-proof, and sterile packaging solutions. The analysis spans over 40 countries, with the leading markets detailed below.

China is projected to grow at a CAGR of 10.7% through 2035, supported by rapid growth in its pharmaceutical and biotechnology sectors. The increasing demand for injectable drugs, vaccines, and biologics drives the market for ampoules packaging in China. As one of the largest pharmaceutical manufacturers in the world, China’s domestic market continues to expand, along with an increase in the export of pharmaceutical products. China’s focus on healthcare reforms and expanding access to medicines further boosts the demand for secure and reliable packaging solutions. Additionally, rising health concerns, an aging population, and growing incidences of chronic diseases are contributing to the increasing demand for ampoules packaging solutions in both the domestic and export markets.

India is expected to grow at a CAGR of 9.9% through 2035, driven by a rapidly expanding pharmaceutical industry, increased demand for injectables, and rising healthcare needs. The growing prevalence of chronic diseases and the rising adoption of biologics and vaccines are major factors pushing demand for secure and high-quality packaging solutions. Ampoules are used widely in India for packaging injectables, as they offer better protection against contamination, ensure sterility, and provide ease of use for healthcare providers. India’s strong manufacturing base for pharmaceutical products further supports the demand for ampoules packaging, particularly for domestic use and export. The government’s initiatives to expand healthcare access and improve medical infrastructure also contribute to market growth.

France is projected to grow at a CAGR of 8.3% through 2035, driven by the continued expansion of the pharmaceutical and healthcare sectors. With increasing demand for injectables and biologics, the market for ampoules packaging is seeing steady growth in France. The country’s robust pharmaceutical industry and its role as a hub for biotech research and development contribute to the steady rise in packaging demand. The growing need for sterile and secure packaging for vaccines, biologics, and parenteral drugs drives the expansion of the ampoules packaging market. Additionally, as part of the EU, France adheres to stringent regulatory standards for pharmaceutical packaging, which further supports the adoption of high-quality packaging solutions.

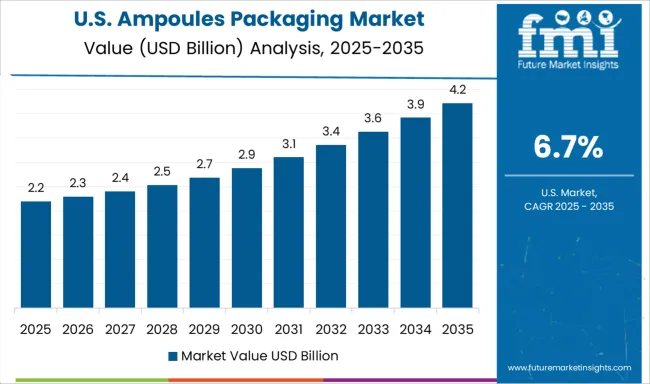

The United States is expected to grow at a CAGR of 6.7% through 2035, with demand driven by the continuous growth in the healthcare sector, particularly in injectables, biologics, and vaccines. The USA remains one of the largest markets for pharmaceutical products, and the increasing focus on patient safety and drug efficacy is pushing the demand for high-quality ampoules packaging. The market is influenced by regulatory requirements for tamper-proof, sterile packaging solutions and advancements in packaging technologies that offer better protection and ease of use. Additionally, the shift toward biologic drug therapies and increasing healthcare expenditure further bolsters the demand for ampoules.

The United Kingdom is expected to grow at a CAGR of 7.5% through 2035, supported by increasing demand for injectables, vaccines, and biologics in the healthcare and pharmaceutical industries. The UK market is witnessing rising demand for ampoules packaging solutions as part of the global trend toward safer, tamper-proof packaging for injectables. The growing healthcare expenditure and the rising number of healthcare applications requiring injectable drugs contribute to the expansion of the market. Additionally, with the UK’s strong regulatory framework and focus on patient safety, the demand for high-quality ampoules packaging solutions continues to rise. The transition toward biologics, vaccines, and advanced drug therapies is a significant factor in the market’s growth.

The ampoules packaging market is driven by global leaders in pharmaceutical packaging, specializing in glass and plastic ampoules used for packaging injectable drugs, vaccines, and biologics. Gerresheimer is a market leader, offering a wide range of glass ampoules for the pharmaceutical industry, focusing on innovation in sterilization and quality control.

SCHOTT Pharma and Stevanato Group are key players known for their high-quality glass ampoules that meet stringent regulatory requirements and provide safe packaging solutions for sensitive pharmaceutical products.

Borosil and DWK Life Sciences also hold significant market shares, providing glass ampoules with robust mechanical properties and enhanced break resistance for global pharmaceutical applications. AAPL Solutions, Alphial, and Adelphi Healthcare Packaging offer comprehensive ampoules packaging solutions, focusing on the customization of ampoules in terms of volume, design, and material to meet the specific needs of pharmaceutical and biotechnological companies.

ESSCO Glass, James Alexander, and Kapoor Glass India cater to niche markets, focusing on high-quality glass ampoules with specialized applications in the healthcare and injectable drugs sector. Nipro and PG Pharma supply ampoules as part of their broader packaging portfolios, serving large pharmaceutical companies.

Sandfire Scientific and SFAM focus on eco-friendly ampoules and packaging solutions, while SGD Pharma and Shandong Pharmaceutical Glass offer a wide range of glass ampoules with improved chemical resistance and compatibility for biologics. TA Instruments provides specialized solutions for ampoule sealing and analysis, ensuring consistent packaging quality

Recent Development

| Item | Value |

|---|---|

| Quantitative Units | USD 5.5 Billion |

| Material | Glass and Plastic |

| End Use Industry | Pharmaceutical, Personal care and cosmetic, and Other |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Gerresheimer, AAPL Solutions, Adelphi Healthcare Packaging, Alphial, Borosil, DWK Life Sciences, ESSCO Glass, James Alexander, Kapoor Glass India, NAFVSM, Namicos, Nipro, PG Pharma, Sandfire Scientific, SCHOTT Pharma, SFAM, SGD Pharma, Shandong Pharmaceutical Glass, Shiotani Glass, Stevanato Group, and TA Instruments |

| Additional Attributes | Dollar sales by ampoule type (glass, plastic) and end-use segments (pharmaceuticals, vaccines, biologics, clinical trials). Demand dynamics are driven by the increasing use of injectables, vaccines, and biologic drugs, along with the rising focus on product safety, tamper-proof features, and high-quality standards. Regional trends show strong growth in North America and Europe due to stringent regulatory frameworks and increasing vaccine production, while Asia-Pacific is expanding rapidly due to rising pharmaceutical manufacturing and increasing healthcare infrastructure. |

The global ampoules packaging market is estimated to be valued at USD 5.5 billion in 2025.

The market size for the ampoules packaging market is projected to reach USD 11.8 billion by 2035.

The ampoules packaging market is expected to grow at a 7.9% CAGR between 2025 and 2035.

The key product types in ampoules packaging market are glass and plastic.

In terms of end use industry, pharmaceutical segment to command 61.0% share in the ampoules packaging market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Packaging Supply Market Size and Share Forecast Outlook 2025 to 2035

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Packaging Labels Market Size and Share Forecast Outlook 2025 to 2035

Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Packaging Resins Market Size and Share Forecast Outlook 2025 to 2035

Packaging Inspection Systems Market Size and Share Forecast Outlook 2025 to 2035

Packaging Design And Simulation Technology Market Size and Share Forecast Outlook 2025 to 2035

Packaging Suction Cups Market Size and Share Forecast Outlook 2025 to 2035

Packaging Straps and Buckles Market Size and Share Forecast Outlook 2025 to 2035

Packaging Coating Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Testing Equipment Market Analysis & Growth 2025 to 2035

Packaging Bins Market Trends - Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA