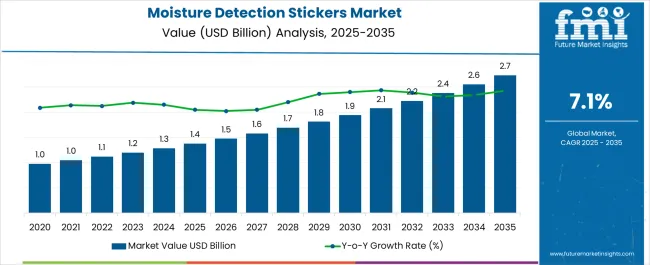

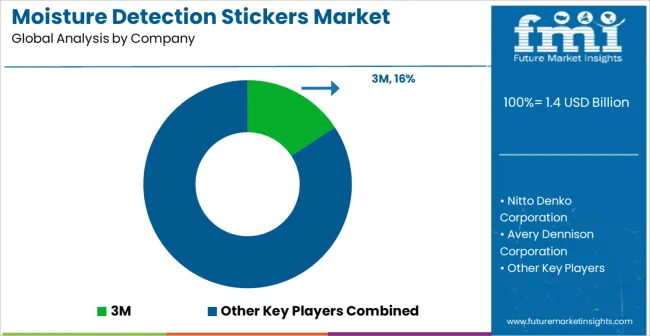

The Moisture Detection Stickers Market is estimated to be valued at USD 1.4 billion in 2025 and is projected to reach USD 2.7 billion by 2035, registering a compound annual growth rate (CAGR) of 7.1% over the forecast period.

| Metric | Value |

|---|---|

| Moisture Detection Stickers Market Estimated Value in (2025 E) | USD 1.4 billion |

| Moisture Detection Stickers Market Forecast Value in (2035 F) | USD 2.7 billion |

| Forecast CAGR (2025 to 2035) | 7.1% |

The Moisture Detection Stickers market is witnessing strong growth, supported by rising demand from electronics, healthcare, and consumer goods industries where safeguarding sensitive components against water damage is critical. These stickers are widely adopted as an effective, low-cost solution for indicating exposure to moisture, enabling manufacturers and consumers to identify warranty claims, assess product condition, and prevent fraudulent returns. Growing miniaturization of electronic devices such as smartphones, laptops, and wearables has increased the risk of internal damage caused by even minimal moisture, further boosting demand.

Advancements in sticker materials, adhesives, and color-change technologies are improving sensitivity, durability, and usability, thereby enhancing their effectiveness in real-world applications. Increasing regulatory focus on safety and product reliability across electronics and medical devices is also driving adoption.

Furthermore, rising consumer awareness about moisture-related product failures and the availability of moisture detection stickers through multiple distribution channels are expanding their market presence As industries emphasize preventive maintenance and improved warranty management, the global market for moisture detection stickers is expected to sustain long-term growth, supported by innovation in detection sensitivity and integration into high-value product ecosystems.

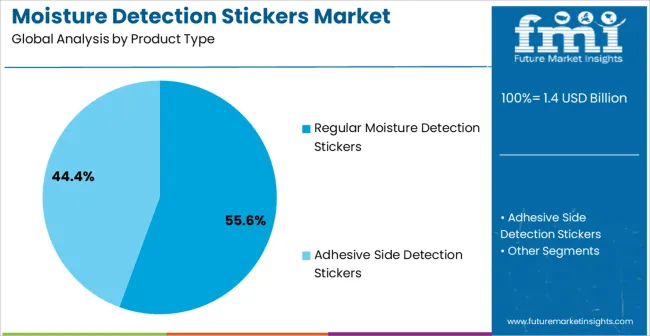

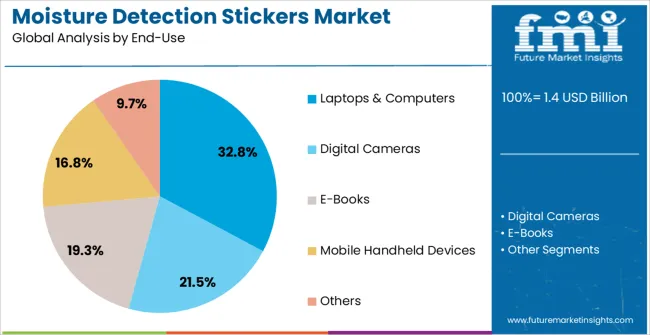

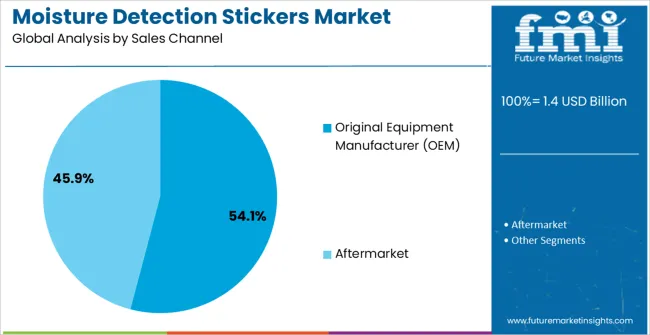

The moisture detection stickers market is segmented by product type, end-use, sales channel, and geographic regions. By product type, moisture detection stickers market is divided into Regular Moisture Detection Stickers and Adhesive Side Detection Stickers. In terms of end-use, moisture detection stickers market is classified into Laptops & Computers, Digital Cameras, E-Books, Mobile Handheld Devices, and Others. Based on sales channel, moisture detection stickers market is segmented into Original Equipment Manufacturer (OEM) and Aftermarket. Regionally, the moisture detection stickers industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The regular moisture detection stickers segment is projected to hold 55.6% of the market revenue share in 2025, establishing itself as the dominant product type. This leadership position is being driven by their affordability, ease of manufacturing, and widespread applicability across consumer electronics, healthcare, and industrial goods. Regular stickers provide a simple and effective way to monitor product exposure to moisture, making them a preferred choice for manufacturers focused on cost efficiency and scalability.

Their ability to indicate exposure without requiring complex sensors or electronic components ensures adoption across both premium and mass-market devices. Additionally, advancements in color-change indicators and adhesives are improving the durability and accuracy of these stickers, enabling reliable performance across a variety of environmental conditions.

As electronic devices and medical instruments continue to shrink in size, the need for compact, reliable, and inexpensive moisture detection tools is growing The strong balance of cost-effectiveness, ease of use, and proven effectiveness in detecting moisture is expected to reinforce the continued dominance of the regular sticker segment in the market.

The laptops and computers end-use segment is expected to account for 32.8% of the market revenue share in 2025, highlighting its leading role within the industry. Growth in this segment is being driven by the rising prevalence of portable computing devices and the increasing risks of accidental spills, humidity exposure, and environmental moisture during daily usage. Manufacturers of laptops and desktops are integrating moisture detection stickers into devices to ensure warranty compliance and reduce fraudulent claims associated with water damage.

These stickers provide immediate, visible evidence of exposure, enabling better accountability between consumers and manufacturers. As work-from-home trends, digital learning, and enterprise reliance on computing devices continue to expand, safeguarding electronic components from moisture damage becomes increasingly critical.

Moreover, the growing consumer expectation for durability and longevity in personal electronics is encouraging manufacturers to incorporate preventive tools such as moisture detection stickers The segment’s growth is further supported by advancements in device design and rising demand for cost-effective, non-intrusive safety solutions that enhance customer satisfaction and minimize after-sales service costs.

The original equipment manufacturer (OEM) sales channel is projected to secure 54.1% of the market revenue share in 2025, making it the leading distribution channel for moisture detection stickers. OEM integration is becoming the preferred approach as device manufacturers embed stickers directly into their products during assembly, ensuring consistent quality control and reducing aftermarket installation requirements. This practice strengthens consumer trust while simultaneously enhancing warranty management and reducing service disputes.

The OEM channel also ensures large-scale procurement, allowing manufacturers to benefit from economies of scale and consistent supply chains. Furthermore, collaboration between sticker producers and device manufacturers is driving innovation in customization, enabling stickers to be designed to fit seamlessly into specific device architectures. As electronic devices and medical instruments demand higher reliability, manufacturers are prioritizing embedded moisture protection as a standard feature.

The ability of OEM channels to ensure wide coverage, seamless integration, and adherence to product safety standards is solidifying their market leadership With growing reliance on preventive maintenance and durable consumer electronics, OEMs are expected to remain the primary driver of sales in this market.

Moisture detection stickers are thick, self-adhesive and printable products that exhibit long lasting, area specific indication of contact with water/moisture. Moisture detection stickers are designed to withstand humidity & heat aging and once the product comes in contact with water, it rapidly changes it color from white to red.

Moisture detection stickers usually do not get triggered at high humidity. However, if water vapor is allowed to condense, then the condensed water on moisture detection stickers triggers these stickers. Furthermore, moisture detection stickers find major applications where the desire for positive indication of aqueous solution is high and in portable or handheld devices, such as MP3 players, CD players, laptops, video cameras, cell phones and many other devices.

Integration of advanced technologies into new devices helps to laminate the extra cost and the hassles offered by secondary forms of water protection, which is extremely important to both the consumers as well as manufacturers. Moreover, cellphones have three fitted - one near charging circuit, one in the mainboard and one in the battery compartment. Notebooks type devices may have many moisture detection stickers fitted.

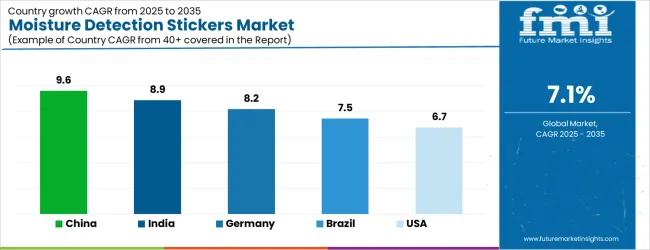

| Country | CAGR |

|---|---|

| China | 9.6% |

| India | 8.9% |

| Germany | 8.2% |

| Brazil | 7.5% |

| USA | 6.7% |

| UK | 6.0% |

| Japan | 5.3% |

The Moisture Detection Stickers Market is expected to register a CAGR of 7.1% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 9.6%, followed by India at 8.9%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 5.3%, yet still underscores a broadly positive trajectory for the global Moisture Detection Stickers Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 8.2%. The USA Moisture Detection Stickers Market is estimated to be valued at USD 482.2 million in 2025 and is anticipated to reach a valuation of USD 482.2 million by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 63.8 million and USD 39.5 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.4 Billion |

| Product Type | Regular Moisture Detection Stickers and Adhesive Side Detection Stickers |

| End-Use | Laptops & Computers, Digital Cameras, E-Books, Mobile Handheld Devices, and Others |

| Sales Channel | Original Equipment Manufacturer (OEM) and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | 3M, Nitto Denko Corporation, Avery Dennison Corporation, Brady Corporation, Honeywell International Inc., Henkel AG & Co. KGaA, Zebra Technologies Corporation, CCL Industries Inc., Checkpoint Systems, Inc., Smartrac N.V., Alien Technology Corporation, SATO Holdings Corporation, and Identiv, Inc. |

The global moisture detection stickers market is estimated to be valued at USD 1.4 billion in 2025.

The market size for the moisture detection stickers market is projected to reach USD 2.7 billion by 2035.

The moisture detection stickers market is expected to grow at a 7.1% CAGR between 2025 and 2035.

The key product types in moisture detection stickers market are regular moisture detection stickers and adhesive side detection stickers.

In terms of end-use, laptops & computers segment to command 32.8% share in the moisture detection stickers market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Moisture-resistant Packaging Market Size, Share & Forecast 2025 to 2035

Moisture Meter Market

Moisture Analyzer Market Growth – Trends & Forecast 2019-2027

OWD Moisture Meter Market Size and Share Forecast Outlook 2025 to 2035

Soil Moisture Sensor Market Size and Share Forecast Outlook 2025 to 2035

Heat Moisture Exchanger Market Size and Share Forecast Outlook 2025 to 2035

Wood Moisture Tester Market Size and Share Forecast Outlook 2025 to 2035

Plant Moisture Tester Market Size and Share Forecast Outlook 2025 to 2035

TDLAS Moisture Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Paper Moisture Meter Market Growth – Trends & Forecast 2025 to 2035

Pharma Moisture Barrier Film Coating Market Size and Share Forecast Outlook 2025 to 2035

Portable NIR Moisture Meter Market Forecast and Outlook 2025 to 2035

Smart-Release Moisture-Boosting Technology Market Size and Share Forecast Outlook 2025 to 2035

Revolutionary Moisture Locking Systems Market Size and Share Forecast Outlook 2025 to 2035

Ice Detection System Market Trends, Growth & Forecast 2025 to 2035

Gas Detection Equipment Market Growth – Trends & Forecast 2024-2034

Leak Detection Equipment Market Size and Share Forecast Outlook 2025 to 2035

Odor Detection Equipment Market Size and Share Forecast Outlook 2025 to 2035

Bird Detection System Market Size and Share Forecast Outlook 2025 to 2035

Leak Detection Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA