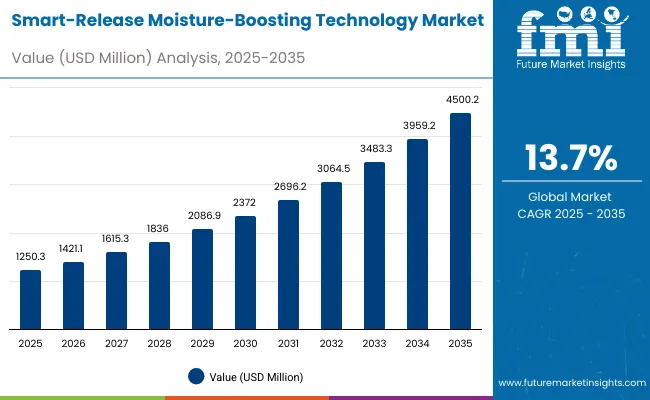

The Smart-Release Moisture-Boosting Technology Market is expected to record a valuation of USD 1,250.3 million in 2025 and USD 4,500.2 million in 2035, with an increase of USD 3,249.9 million, which equals a growth of 193% over the decade. The overall expansion represents a CAGR of 13.7% and nearly a 2X increase in market size.

Smart-Release Moisture-Boosting Technology Market Key Takeaways

| Metric | Value |

|---|---|

| Smart-Release Moisture-Boosting Technology Market Estimated Value in (2025E) | USD 1,250.3 million |

| Smart-Release Moisture-Boosting Technology Market Forecast Value in (2035F) | USD 4,500.2 million |

| Forecast CAGR (2025 to 2035) | 13.7% |

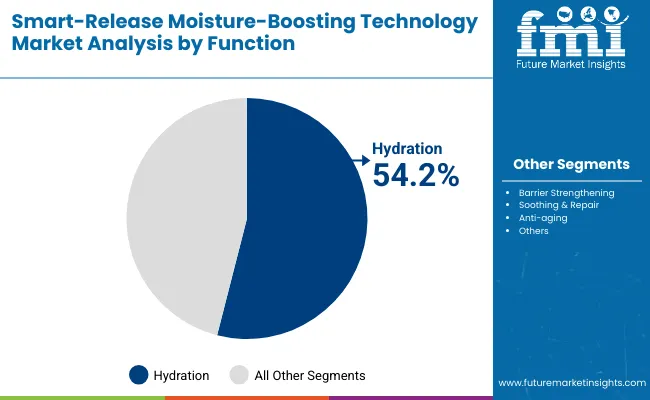

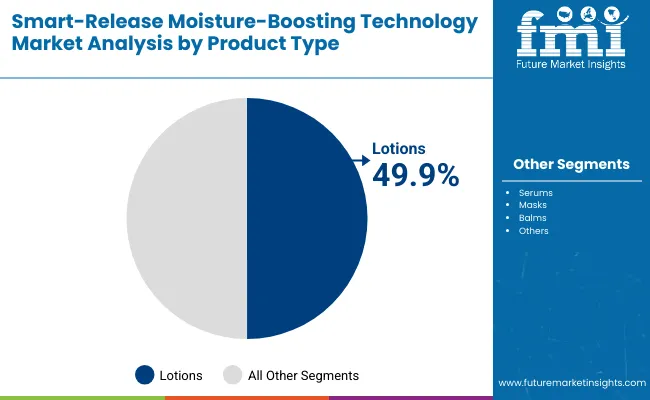

During the first five-year period from 2025 to 2030, the market increases from USD 1,250.3 million to USD 2,372.0 million, adding USD 1,121.7 million, which accounts for 34.5% of the total decade growth. This phase records steady adoption in hydration-focused skincare, dermatology clinics, and clean-label personal care, driven by clinical validation and consumer trust in safe formulations. Lotions lead this period, with nearly 49.9% share, supported by hydration as the top function at 54.2% share in 2025.

The second half from 2030 to 2035 contributes USD 2,128.2 million, equal to 65.5% of total growth, as the market jumps from USD 2,372.0 million to USD 4,500.2 million. This acceleration is powered by enzyme-responsive and microencapsulation technologies entering mass retail and e-commerce, alongside increased adoption of vegan and dermatologist-tested claims.

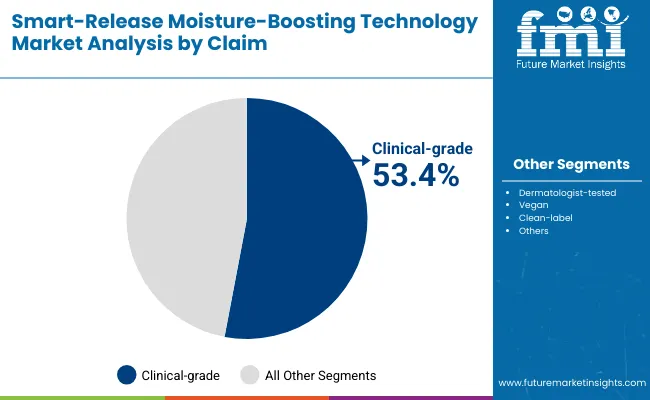

Asia-Pacific, led by China and India, dominates in expansion, while Europe and North America remain innovation hubs. By 2035, advanced delivery platforms and multifunctional peptide blends ensure clinical-grade products account for over 53% of category revenues, cementing their role as the industry’s backbone.

From 2020 to 2024, the Smart-Release Moisture-Boosting Technology Market expanded steadily, supported by microencapsulation and lipid-layered release technologies, reaching new adoption across dermatology clinics and premium skincare channels.

Early adoption was led by Europe-based ingredient suppliers, with equipment and formulation leaders controlling nearly 70-75% of revenue. Differentiation relied on encapsulation stability, release timing, and cost efficiency, while mass retail adoption lagged.

By 2025, market demand is forecast to hit USD 1,250.3 million, with a visible shift in the revenue mix as clinical-grade and clean-label products gain prominence. Growth is propelled by software-driven product personalization, AI-enabled skincare diagnostics, and subscription-based digital beauty platforms.

Traditional leaders are pivoting toward hybrid models, integrating formulation expertise with advanced delivery systems. Emerging entrants focusing on vegan, dermatologist-tested, and AR/VR skincare trials are gaining share. The competitive edge is now transitioning from ingredient innovation alone to ecosystem strength, personalization, and recurring value-added services.

The market is expanding due to advancements in lipid-layered and enzyme-responsive release systems, which allow controlled hydration at multiple skin depths. Unlike traditional moisturizers that provide surface-level relief, these technologies deliver actives in sequenced layers, ensuring long-lasting hydration and barrier reinforcement.

This precision-driven delivery has gained traction in dermatology clinics and premium skincare, where clinical validation and efficacy benchmarks are critical. As consumers shift toward functional products with proven outcomes, these innovations are accelerating demand for smart moisture-boosting formulations.

Growth is also driven by the rising fusion of smart-release systems with clinical-grade peptides and ceramides. By embedding biomimetic actives into encapsulated carriers, brands are bridging cosmetic appeal with pharmaceutical-level performance.

This integration is especially valued in post-procedure skincare and sensitive skin categories, where tolerability and sustained release reduce irritation while enhancing therapeutic effects. The credibility of dermatologist-tested claims further boosts adoption across pharmacies and professional channels, positioning smart-release products as both treatment-oriented and cosmetic-grade solutions.

The Smart-Release Moisture-Boosting Technology Market is segmented by technology, function, product type, channel, claim, and region. Technologies include microencapsulation, lipid-layered release, pH-triggered systems, and enzyme-responsive release, representing the core innovations driving targeted delivery.

Functions span hydration, barrier strengthening, soothing & repair, and anti-aging, catering to diverse skincare needs. Product types encompass lotions, serums, masks, and balms, each offering unique consumer applications.

Channels cover e-commerce, pharmacies, mass retail, and dermatology clinics, shaping accessibility and distribution. Claims range across clinical-grade, dermatologist-tested, vegan, and clean-label positioning. Regionally, the scope extends across North America, Latin America, Western and Eastern Europe, Asia-Pacific, and the Middle East & Africa.

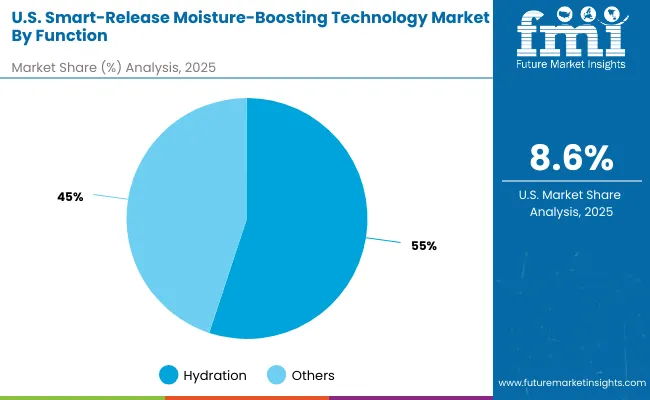

| Function | Value Share % 2025 |

|---|---|

| Hydration | 54.2% |

| Others | 45.8% |

The hydration segment is projected to contribute 54.2% of the Smart-Release Moisture-Boosting Technology Market revenue in 2025, making it the dominant functional category. This leadership reflects rising consumer demand for solutions addressing dryness and moisture retention as a foundation for healthy skin. Advanced delivery systems like microencapsulation and lipid-layered release are being optimized for prolonged hydration, enhancing product effectiveness.

The segment’s growth is reinforced by its role as a primary claim across lotions, serums, and balms, particularly in clinical-grade and clean-label formulations. With hydration positioned as a universal skincare need, it continues to anchor brand portfolios, ensuring steady demand. This dominant positioning ensures hydration remains the cornerstone of functional innovation in the Smart-Release Moisture-Boosting Technology Market through 2035.

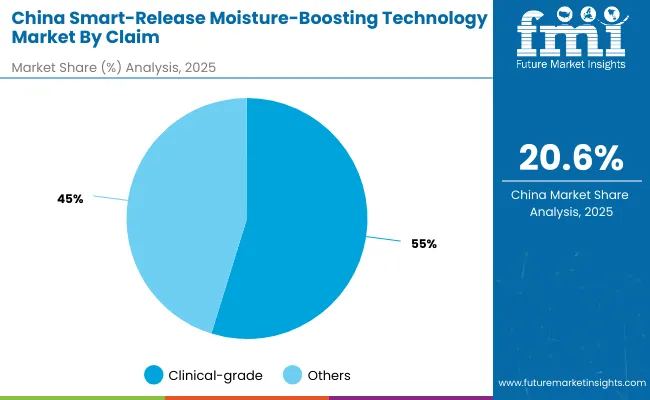

| Claim | Value Share % 2025 |

|---|---|

| Clinical-grade | 53.4% |

| Others | 46.6% |

The clinical-grade segment is projected to hold 53.4% of the Smart-Release Moisture-Boosting Technology Market revenue in 2025, making it the leading claim category. Its dominance stems from growing consumer trust in dermatologist-tested, lab-validated formulations that promise measurable efficacy and safety. Clinical-grade positioning also aligns with the surge in premium skincare, where scientifically backed ingredients and advanced release mechanisms differentiate products from mass-market alternatives.

Adoption is particularly strong in dermatology clinics, pharmacies, and specialist beauty channels, where credibility drives purchase decisions. Companies are enhancing clinical-grade offerings with innovations in microencapsulation and enzyme-responsive delivery, ensuring sustained hydration and targeted repair. As consumers increasingly demand proof-based skincare, this segment is expected to remain the cornerstone of product development and brand trust in the coming decade.

| Product Type | Value Share % 2025 |

|---|---|

| Lotions | 49.9% |

| Others | 50.1% |

The lotions segment is projected to account for 49.9% of the Smart-Release Moisture-Boosting Technology Market revenue in 2025, making it the dominant product category. Lotions are highly favored due to their versatility, fast absorption, and ability to deliver sustained hydration across a wide range of skin types. They serve as the most accessible format for incorporating smart-release technologies such as lipid-layered and microencapsulation systems, ensuring continuous moisture delivery throughout the day.

Consumer preference for lightweight yet functional skincare formats has bolstered the growth of lotions, especially within mass retail and pharmacy channels. Their ability to blend hydration, barrier-strengthening, and anti-aging claims into one format makes them the preferred choice for both daily skincare routines and clinical-grade applications. As innovation advances, lotions are expected to remain the core vehicle for smart-release formulations, ensuring balanced growth across premium and mainstream markets.

Advanced Microencapsulation Adoption

In 2025, the cosmetic industry has been rapidly adopting microencapsulation technology to enhance stability and prolong the release of active moisturizing agents. This innovation ensures that peptides, lipids, and hyaluronic acid derivatives remain potent until applied, improving efficacy and consumer satisfaction.

Brands are investing heavily in R&D to refine encapsulation methods, supporting long-lasting hydration claims. The result is a strong competitive edge for premium skincare ranges, where microencapsulation positions products as both innovative and clinically superior in maintaining hydration.

Surge in Dermatology Clinic Demand

Growing reliance on dermatology clinics for medically guided skincare solutions is fueling demand for clinical-grade smart-release formulations. With patients increasingly seeking treatments combining hydration, anti-aging, and barrier-repair benefits, clinics are prescribing advanced lotions and serums with controlled-release properties.

This creates recurring demand for formulations that integrate hydration with therapeutic credibility. By 2035, dermatology-backed adoption will not only legitimize the technology but also push mass-market players to align with dermatologist-tested claims, strengthening growth across both clinical and consumer-facing skincare channels.

High Production Costs of Smart-Release Systems

Despite growing consumer interest, the production costs of smart-release mechanisms like lipid-layered systems and enzyme-responsive carriers remain significantly higher than conventional formulations. The need for specialized processing, stability testing, and premium raw materials increases unit prices, limiting accessibility in price-sensitive markets.

Smaller brands often struggle to scale due to high R&D expenditure and regulatory approval processes. Unless costs are optimized, the market could face adoption delays in mass retail segments, restricting growth largely to premium and clinical-grade product categories in the near term.

Integration of AI in Personalized Skincare

A defining trend is the integration of AI-driven diagnostics with smart-release moisture-boosting products. Beauty-tech devices and apps analyze skin hydration, barrier health, and elasticity, then recommend personalized formulations using smart-release peptides and encapsulated actives.

This trend connects digital skin profiling with targeted product delivery, creating an ecosystem where technology and formulations complement each other. By 2030, companies integrating AI with smart-release technologies will lead personalization, offering consumers tailored solutions that evolve dynamically with seasonal and lifestyle-related changes in hydration needs.

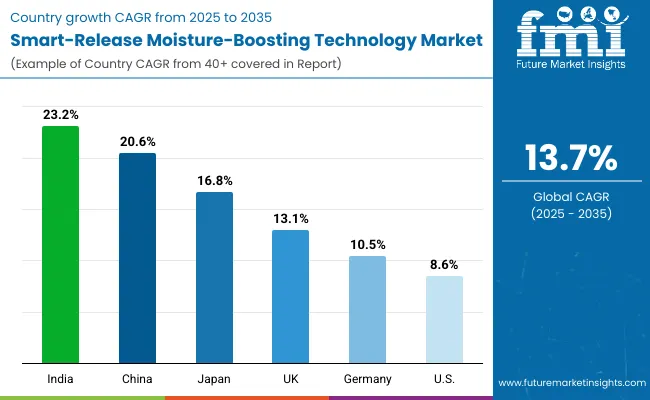

| Country | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 20.6% |

| USA | 8.6% |

| India | 23.2% |

| UK | 13.1% |

| Germany | 10.5% |

| Japan | 16.8% |

The global Smart-Release Moisture-Boosting Technology Market shows a pronounced regional disparity in adoption speed, strongly influenced by scientific innovation, dermatology-led validation, and consumer preference for clinically tested skincare solutions.

Asia-Pacific emerges as the fastest-growing region, anchored by China at 20.6% CAGR and India at 23.2% CAGR. This acceleration is driven by strong investments in clinical-grade peptide formulations, rapid urbanization fueling premium skincare consumption, and local innovation in smart encapsulation systems.

China’s emphasis on clean-label, dermatologist-tested formulations supports broad uptake across mass retail and luxury segments. India’s growth reflects heightened adoption in tier-2 and tier-3 cities, supported by MSME-driven product launches and increased penetration in e-commerce channels.

Europe maintains a strong growth profile, led by Germany at 10.5% CAGR and the UK at 13.1% CAGR, supported by regulatory alignment with EU standards and demand for vegan, clean-label peptide products. European dermatology clinics and cosmetic research institutions are spearheading adoption, positioning the region as a hub for innovation in lipid-layered and enzyme-responsive release technologies.

North America shows moderate expansion, with the USA at 8.6% CAGR, reflecting a mature skincare market where consumer demand is driven by personalization and premium offerings rather than mass adoption. Growth here is fueled by digital skincare platforms, dermatologist-backed brands, and strong uptake of subscription-based beauty models.

Japan, at 16.8% CAGR, highlights Asia’s advanced consumer base, with rising demand for multifunctional formulations combining hydration, anti-aging, and repair. Japan’s consumer preference for technology-integrated skincare further strengthens adoption, aided by innovation in pH-triggered smart-release systems.

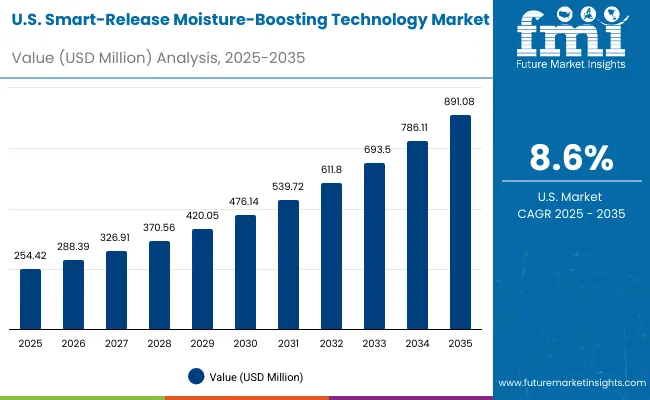

| Year | USA Smart-Release Moisture-Boosting Technology Market (USD Million) |

|---|---|

| 2025 | 254.42 |

| 2026 | 288.39 |

| 2027 | 326.91 |

| 2028 | 370.56 |

| 2029 | 420.05 |

| 2030 | 476.14 |

| 2031 | 539.72 |

| 2032 | 611.80 |

| 2033 | 693.50 |

| 2034 | 786.11 |

| 2035 | 891.08 |

The Smart-Release Moisture-Boosting Technology Market in the United States is projected to grow at a CAGR of 8.6%, reaching USD 891.08 million by 2035 from USD 254.42 million in 2025. Growth is primarily driven by rising consumer preference for hydration-focused and clinical-grade formulations, which are becoming the cornerstone of premium skincare portfolios. Demand is further reinforced by dermatology-backed product launches and retail expansion across both pharmacies and specialty beauty stores.

The USA market reflects a balance between lotions (49.9% share in 2025) and emerging formats such as serums and balms, which are favored for layering in multi-step skincare routines. Clinical-grade claims dominate, with 53.4% value share in 2025, highlighting growing consumer trust in dermatologist-tested products. The e-commerce channel is also reshaping the sales landscape, providing visibility for niche brands and fueling subscription-based models.

The Smart-Release Moisture-Boosting Technology Market in the United Kingdom is expected to grow at a CAGR of 13.1%, driven by strong adoption in hydration-focused skincare and premium dermatology-backed formulations.

Consumer demand is shifting toward lotions (49.9% share in 2025) and emerging formats like serums, supported by clinical-grade positioning that accounts for 53.4% of sales in 2025. UK consumers increasingly prefer products validated by dermatologists and clean-label claims, reflecting rising awareness of safety and scientific efficacy.

Expansion is supported by pharmacies and specialty beauty stores, which remain the leading retail channels, while e-commerce continues to scale through direct-to-consumer subscription models. Government-backed funding for cosmetic research, along with collaborations between universities and private labs, is fueling innovation in encapsulation and pH-triggered release systems. Public awareness campaigns around skin barrier health and hydration are also accelerating adoption, making the UK one of Europe’s most dynamic markets for smart skincare solutions.

India is witnessing rapid expansion in the Smart-Release Moisture-Boosting Technology Market, projected to grow at a CAGR of 23.2% through 2035, the highest among key countries. Growth is anchored by strong adoption in tier-2 and tier-3 cities, where cost-effective product launches and localized innovations are making hydration, barrier-strengthening, and repair-focused solutions more accessible.

Rising consumer awareness of skin health, coupled with the popularity of clinical-grade and clean-label claims, is fueling demand across both mass retail and premium segments.

A parallel driver comes from the pharmaceutical and dermatology clinic channels, which are increasingly prescribing microencapsulation and lipid-layered technologies for sustained hydration and advanced skin repair.

Additionally, India’s education sector is fostering digital awareness by embedding cosmetic science and smart skincare research into university and vocational programs. Public-sector initiatives in wellness and preventive healthcare are also boosting adoption, particularly in urban areas. Together, these trends position India as the most dynamic growth hub in Asia-Pacific.

The Smart-Release Moisture-Boosting Technology Market in China is expected to grow at a CAGR of 20.6%, the highest among leading economies. This growth is propelled by a combination of domestic innovation and large-scale adoption across both consumer and institutional channels. Local firms are driving affordability in serums, lotions, and balms that incorporate lipid-layered and microencapsulation technologies, making advanced hydration solutions accessible across mass retail and e-commerce.

Industrial demand for clinical-grade and dermatology-endorsed formulations is rising in hospitals, wellness clinics, and premium skincare chains, supported by China’s regulatory focus on science-backed beauty products.

Municipal wellness campaigns and public-private partnerships are further boosting adoption of clean-label and vegan claims. Additionally, the strong presence of global brands, combined with competitive domestic players, has created a robust ecosystem where innovation cycles are rapid and consumer loyalty is tied to efficacy and value. This cross-sector acceleration cements China as a leader in the Asia-Pacific growth trajectory.

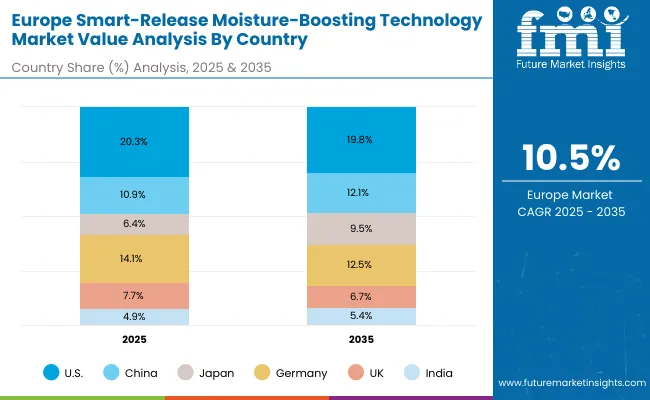

| Country | 2025 Share (%) |

|---|---|

| USA | 20.3% |

| China | 10.9% |

| Japan | 6.4% |

| Germany | 14.1% |

| UK | 7.7% |

| India | 4.9% |

| Country | 2035 Share (%) |

|---|---|

| USA | 19.8% |

| China | 12.1% |

| Japan | 9.5% |

| Germany | 12.5% |

| UK | 6.7% |

| India | 5.4% |

The Smart-Release Moisture-Boosting Technology Market in Germany is projected to grow at a CAGR of 10.5%, supported by the country’s strong tradition of scientific skincare innovation and regulatory leadership within Europe. German brands are advancing lipid-layered release systems and pH-triggered technologies that appeal to consumers demanding functional, dermatologist-tested, and clean-label products.

Premium cosmetics and therapeutic skincare categories are leading adoption, backed by Germany’s robust R&D ecosystem and collaborations between dermatology clinics, pharmaceutical labs, and cosmetic formulators.

Adoption is further supported by the country’s focus on sustainability and regulatory compliance under EU frameworks, where companies must align with eco-labeling and clean formulation standards. This has driven higher demand for vegan, clinical-grade, and dermatologically tested claims.

Distribution channels such as specialty beauty stores and pharmacies dominate sales, while e-commerce platforms continue to expand reach among younger, digitally savvy consumers. Germany’s balanced consumer basevaluing science, transparency, and sustainabilitymakes it a key European hub for smart-release technologies.

| USA by Function | Value Share % 2025 |

|---|---|

| Hydration | 55.1% |

| Others | 44.9% |

The Smart-Release Moisture-Boosting Technology Market in the United States is projected to expand steadily, with hydration-focused products contributing 55.1% of market value in 2025, underscoring strong consumer preference for long-lasting moisturization.

Growth is being fueled by advanced microencapsulation and lipid-layered release systems, which are increasingly featured in mass retail skincare, dermatology clinics, and premium beauty brands. USA consumers’ heightened awareness of skin barrier repair and hydration retention is further amplifying demand across both over-the-counter and clinical-grade product lines.

Innovation-driven players are focusing on customizable release mechanisms, targeting consumer needs such as climate-adaptive hydration and multifunctional anti-aging benefits. E-commerce and specialty beauty channels are becoming dominant, as digital-savvy consumers seek science-backed formulations with clean-label and vegan claims.

The integration of dermatologist-tested standards has enhanced product credibility, positioning the USA as a competitive hub for clinical-grade smart-release innovations in North America.

| China by Claim | Value Share % 2025 |

|---|---|

| Clinical-grade | 54.8% |

| Others | 45.2% |

The Smart-Release Moisture-Boosting Technology Market in China is projected to expand rapidly, with clinical-grade products leading at 54.8% share in 2025, valued at USD 74.3 million, compared to others holding 45.2% with USD 61.41 million. This dominance reflects Chinese consumers’ strong preference for dermatologist-tested and scientifically validated skincare solutions, especially in urban markets where skin sensitivity and pollution concerns are higher.

Domestic beauty brands are investing in microencapsulation and lipid-layered release systems that improve hydration and barrier function, making premium-grade offerings more accessible across mid-range price categories. Additionally, e-commerce channels are accelerating consumer access to clinical-grade innovations, supported by government-backed R&D initiatives that emphasize safe, lab-tested cosmetic formulations.

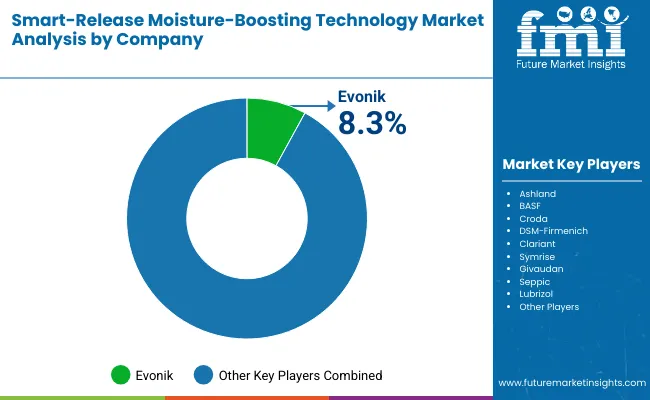

| Company | Global Value Share 2025 |

|---|---|

| Evonik | 8.3% |

| Others | 91.7% |

The Smart-Release Moisture-Boosting Technology Market is moderately fragmented, with global leaders, mid-sized innovators, and niche-focused specialists shaping competition across functional skincare categories. Major players such as Evonik, BASF, and Croda hold a strong foothold due to their advanced R&D in microencapsulation, lipid-layered systems, and pH-triggered release formulations. Their strategies emphasize clinical validation, biotech collaborations, and sustainable ingredient sourcing to enhance product efficacy and consumer trust.

Mid-sized firms, including Ashland, Clariant, and Seppic, are expanding portfolios in clean-label, vegan, and dermatologist-tested solutions, leveraging partnerships with cosmetic brands to co-develop formulations tailored to specific consumer claims like hydration, barrier repair, and soothing properties.

Specialized companies such as Symrise, Givaudan, and Lubrizol focus on high-performance, niche applications in luxury skincare and dermatology clinics. Their strengths lie in fragrance integration, sensorial delivery systems, and multifunctional peptides embedded into smart-release technologies.

Competitive differentiation is shifting toward integration of biotech innovation, digital skin testing platforms, and sustainability-driven ingredient sourcing. This move is driving consumer loyalty beyond traditional moisturizing benefits, positioning the market at the intersection of science, personalization, and clean beauty innovation.

Key Developments in Smart-Release Moisture-Boosting Technology Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1,250.3 Million |

| Technology | Microencapsulation, Lipid-layered release, pH-triggered systems, Enzyme-responsive release |

| Function | Hydration, Barrier strengthening, Soothing & repair, Anti-aging |

| Product Type | Lotions, Serums, Masks, Balms |

| Channel | E-commerce, Pharmacies, Mass retail, Dermatology clinics |

| Claim | Clinical-grade, Dermatologist-tested, Vegan, Clean-label |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Evonik , Ashland, BASF, Croda , DSM- Firmenich , Clariant , Symrise , Givaudan , Seppic , Lubrizol |

| Additional Attributes | Dollar sales by technology type and product categories, adoption trends in hydration, barrier strengthening, and soothing & repair functions, rising demand for clinical-grade and clean-label formulations, sector-specific growth in dermatology clinics, specialty beauty stores, and e-commerce, revenue segmentation across serums, lotions, masks, and balms, integration with biotech-driven delivery systems and AI-based skin diagnostics, regional trends influenced by premium skincare uptake and regulatory benchmarks, and innovations in microencapsulation, lipid-layered release, pH-triggered systems, and enzyme-responsive delivery platforms. |

The global Smart-Release Moisture-Boosting Technology Market is estimated to be valued at USD 1,250.3 million in 2025.

The market size for the Smart-Release Moisture-Boosting Technology Market is projected to reach USD 4,500.2 million by 2035.

The Smart-Release Moisture-Boosting Technology Market is expected to grow at a 13.7% CAGR between 2025 and 2035.

The key product types in the Smart-Release Moisture-Boosting Technology Market are lotions, serums, masks, and balms.

In terms of claims, the clinical-grade segment is projected to command the significant share in 2025, holding 54.8% of the market.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

4K Technology Market Size and Share Forecast Outlook 2025 to 2035

5G technology market Analysis by Technology Type, Application, Vertical, and Region – Growth, trends and forecast from 2025 to 2035

8K Technology Market

Nanotechnology Photocatalysis Surface Coating Industry Analysis in AMEA Size and Share Forecast Outlook 2025 to 2035

Nanotechnology Packaging Market Size and Share Forecast Outlook 2025 to 2035

Key Players & Market Share in GDS Technology Market

GDS Technology Market Insights - Growth & Forecast 2025 to 2035

Nanotechnology for food packaging Market

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Smart-Technology Anti-Wrinkle Peptides Market Size and Share Forecast Outlook 2025 to 2035

Laser Technology Market Size and Share Forecast Outlook 2025 to 2035

Green Technology And Sustainability Market Size and Share Forecast Outlook 2025 to 2035

Camera Technology Market Analysis – Trends & Forecast 2025 to 2035

Battery Technology Market Size and Share Forecast Outlook 2025 to 2035

Airline Technology Integration Market Size and Share Forecast Outlook 2025 to 2035

Food Biotechnology Market Size and Share Forecast Outlook 2025 to 2035

IO-Link technology Market Size and Share Forecast Outlook 2025 to 2035

Scaffold Technology Market Size and Share Forecast Outlook 2025 to 2035

Ablation Technology Market Size, Share, and Forecast Outlook 2025 to 2035

Sapphire Technology Market Trends – Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA