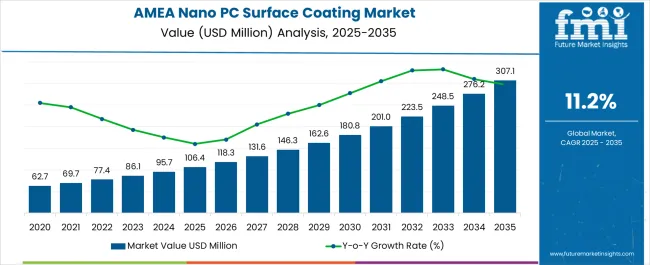

The Nanotechnology Photocatalysis Surface Coating Industry Analysis in AMEA is estimated to be valued at USD 106.4 million in 2025 and is projected to reach USD 307.1 million by 2035, registering a compound annual growth rate (CAGR) of 11.2% over the forecast period.

| Metric | Value |

|---|---|

| Nanotechnology Photocatalysis Surface Coating Industry Analysis in AMEA Estimated Value in (2025 E) | USD 106.4 million |

| Nanotechnology Photocatalysis Surface Coating Industry Analysis in AMEA Forecast Value in (2035 F) | USD 307.1 million |

| Forecast CAGR (2025 to 2035) | 11.2% |

The nanotechnology photocatalysis surface coating market in AMEA is expanding steadily. Growth is being driven by rising demand for advanced functional coatings, increasing emphasis on self-cleaning and antimicrobial properties, and the integration of sustainable surface technologies across industries. Current dynamics are defined by rising adoption in construction, automotive, and consumer applications, supported by research advancements that enhance durability and cost-effectiveness.

Regulatory frameworks promoting eco-friendly technologies and initiatives encouraging reduced chemical usage are strengthening adoption. The future outlook is anchored on increasing urbanization, expansion of industrial infrastructure, and consumer inclination toward sustainable products with extended lifespans.

Market growth rationale rests on the ability of photocatalytic coatings to improve energy efficiency, reduce maintenance costs, and provide value-added surface functionality Expanding production capacities, rising investments in nanotechnology innovation, and broader regional distribution networks are expected to sustain momentum and consolidate the market’s role as a transformative material technology within the AMEA region.

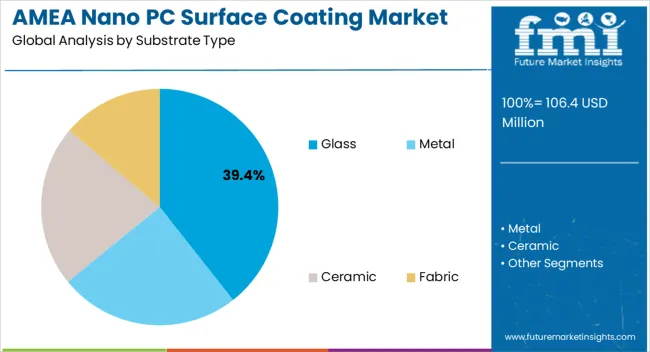

The glass substrate segment, holding 39.40% of the substrate type category, has been leading due to its widespread adoption in architectural and automotive applications where transparency, durability, and photocatalytic functionality are critical. Demand growth has been sustained by the ability of glass substrates to integrate seamlessly with titanium dioxide and other nanomaterials, enhancing performance in self-cleaning and anti-pollution applications.

Regulatory initiatives promoting green building standards have strengthened the use of glass-based coatings in construction, while the automotive industry has driven adoption through demand for scratch-resistant and easy-maintenance surfaces. Improvements in coating uniformity, adhesion, and durability have further reinforced market confidence.

Continuous R&D focused on extending efficiency under low-light conditions is expected to enhance application scope, enabling the glass segment to maintain its leadership position across both established and emerging markets in AMEA.

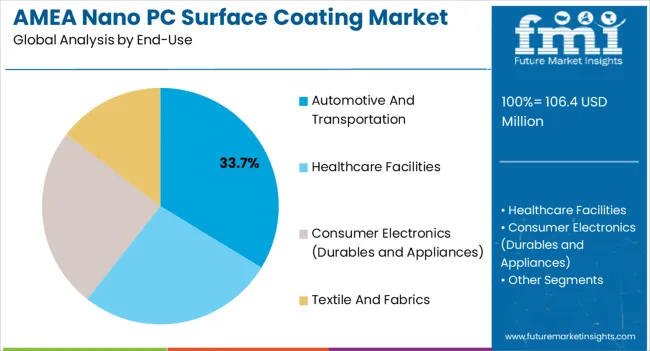

The automotive and transportation segment, representing 33.70% of the end-use category, has emerged as the leading sector due to the increasing requirement for durable, self-cleaning, and environmentally resilient coatings. The segment’s growth has been supported by the integration of photocatalytic coatings in vehicle exteriors, mirrors, and windshields to improve safety, reduce cleaning frequency, and extend product life cycles.

Adoption has been reinforced by consumer demand for low-maintenance vehicles and OEM strategies aimed at incorporating advanced surface technologies to differentiate product offerings. Transportation infrastructure projects, including rail and public transit, have further contributed to segment growth by requiring resilient coatings for high-contact surfaces.

Technological advancements in nanostructured materials that improve UV resistance and weather durability are strengthening adoption Future demand is expected to be shaped by rising vehicle production, stricter sustainability requirements, and continued innovation in smart and functional coating technologies across the AMEA automotive landscape.

Saudi Arabia is expected to rise substantially in the AMEA nanotechnology photocatalysis surface coating business during the forecast period. It is set to hold around 18.4% of the share in 2035. This is attributed to the following factors:

Growing Industrialization: Saudi Arabia's rapid industrial expansion has led to an increased demand for titanium dioxide (TiO2) surface coatings, which are known for their antimicrobial properties. These coatings find applications in several sectors, including healthcare, where sterile surfaces are paramount.

Vision 2035 Initiative: The Saudi Vision 2035 initiative's focus on economic diversification and sustainability aligns well with the use of TiO2 coatings. Their ability to provide antimicrobial surfaces contributes to a cleaner and healthier environment, which is crucial in healthcare settings.

Investment in Research and Development: Government-backed investments in research and development specifically for TiO2 coatings would drive innovation and the local manufacturing of these coatings with enhanced antimicrobial features.

Strategic Geographic Location: Saudi Arabia's strategic geographic location allows it to serve not only its domestic business but also neighboring regions, meeting the increasing demand for antimicrobial surfaces in healthcare, automotive and transportation, textile, and other sectors.

As per the report, healthcare facilities are expected to dominate the Asia and Middle East and Africa nanotechnology photocatalysis surface coating business with a volume share of around 47.0% in 2025. This is attributable to the rising usage of these coatings in healthcare settings due to their essential role in infection control, reduced healthcare-associated infections, and enhanced surface durability.

The growing adoption of TiO2 antimicrobial surface coatings is further anticipated to boost business expansion. These coatings are set to play a crucial role in maintaining clean and self-sustaining vehicle exteriors and interiors, reducing maintenance costs, and enhancing energy efficiency. These TiO2 coatings offer valuable solutions for the automotive and transportation business, contributing to the surging demand.

Sales of nanotechnology photocatalysis surface coatings in AMEA grew at a CAGR of 0.3% between 2020 and 2025. Total revenue reached USD 106.4 million in 2025. In the forecast period, the AMEA nanotechnology photocatalysis surface coating business is set to thrive at a CAGR of 11.7%.

| Historical CAGR (2020 to 2025) | 0.3% |

|---|---|

| Forecast CAGR (2025 to 2035) | 11.7% |

The Asia and Middle East and Africa nanotechnology photocatalysis surface coating business witnessed slow growth between 2020 and 2025. This was due to several factors, including limited awareness about the potential benefits of these coatings and the initial cost barrier associated with adopting new technologies. The need for further education and demonstration of their effectiveness in real-world applications also contributed to gradual growth.

As the awareness of their advantages for environmental sustainability, energy efficiency, and health benefits increased, along with evolving regulatory standards, the space began to experience accelerated growth. It is projected to set the stage for substantial expansion in the forecast period.

The ecosystem experienced a decline in 2024, primarily due to the disruptions caused by the COVID-19 pandemic. It led to economic uncertainties, supply chain interruptions, and a shift in priorities toward healthcare and safety measures.

Over the forecast period, nanocoatings demand in Asia, Middle East, Africa is poised to exhibit healthy growth, totaling a valuation of USD 307.1 million by 2035. This is due to the increasing awareness of the coatings' benefits for environmental sustainability and health.

The growing emphasis on eco-friendly technologies and compliance with stringent regulations would further spur demand. Ongoing research and innovations in the field, coupled with the need for advanced surface treatments, would help drive the adoption of these coatings, underpinning their remarkable growth.

| Attributes | Key Factors |

|---|---|

| Latest Trends |

Corporate Firms Shift toward Hygienic Practices A hygienic and safe workplace fosters greater employee well-being and productivity, which is a priority for corporate firms aiming to maximize the potential of their workforce. TiO2 photo-catalysis coatings reduce the use of harmful chemical disinfectants, decrease waste generated, and support a greener corporate image. The demand for TiO2 photo-catalysis surface coatings is being significantly driven by the corporate sector's commitment to maintaining hygienic and safe environments.Government Initiatives Promoting TiO2 Coatings Government initiatives promoting the adoption of titanium dioxide (TiO2) photo-catalysis surface coatings in public parks and spaces serve as a powerful driver for the technology's increased use. In urban areas where air quality is a concern, this contributes to cleaner and healthier public spaces. TiO2's self-cleaning properties reduce the need for labor-intensive maintenance and cleaning, leading to cost savings and more efficient use of public funds.Increasing Life Span of Potential Devices Titanium dioxide serves as a highly effective UV absorber and photo-catalyst. When used as a protective coating in devices, coatings, or films, it acts as a shield against UV rays, preventing them from penetrating and causing damage to devices, materials, and surfaces. |

| Upcoming Opportunities |

Increasing Use in Public Transport Titanium dioxide usage in public transport as a photo-catalysis surface coating is being driven by several factors, making it a prominent driver in the transportation business. TiO2's self-cleaning properties decrease the need for frequent cleaning and maintenance of public transport interiors. This, in turn, results in cost savings for transport authorities and operators. |

| Challenges |

Lack of Skilled Labor The application of TiO2 coatings can be intricate, involving the proper selection of coating materials and equipment and the adjustment of environmental factors. A lack of skilled labor can result in suboptimal coating quality, reducing its effectiveness. Applying TiO2 coatings effectively requires a deep understanding of the technology, including factors such as surface preparation, coating application techniques, and post-coating quality control. Several sectors and regions lack individuals with the necessary expertise.Lack of Awareness Public awareness campaigns and educational programs have been limited, leaving people uninformed about its potential applications and advantages. A handful of individuals can perceive TiO2 coatings as expensive due to the advanced nature of the technology, which can deter their interest without a clear understanding of the long-term economic benefits. |

The table below highlights key countries’ nanotechnology photocatalysis surface coating business revenues. China, India, and Saudi Arabia are expected to remain the top three consumers of nanotechnology photocatalysis surface coatings, with expected valuations of USD 307.1.0 million, USD 29.4 million, and USD 47.0 million, respectively, in 2035.

| Countries | Projected Revenue (2035) |

|---|---|

| China | USD 307.1.0 million |

| Saudi Arabia | USD 47.0 million |

| Japan | USD 29.7 million |

| India | USD 29.4 million |

| South Korea | USD 19.3 million |

| United Arab Emirates | USD 6.9 million |

The table below shows the estimated growth rates of the top five countries. Malaysia, Saudi Arabia, and Indonesia are set to record leading CAGRs of 14.8%, 13.9%, and 13.2%, respectively, through 2035.

| Countries | Value-based CAGR (2025 to 2035) |

|---|---|

| Malaysia | 14.8% |

| Saudi Arabia | 13.9% |

| Indonesia | 13.2% |

| South Korea | 13.0% |

| Bahrain | 11.8% |

Saudi Arabia's nanotechnology photocatalysis surface coating business is on a trajectory of significant growth, with a projected size of USD 47.0 million by 2035. The expanding healthcare and infrastructure sectors are serving as potent catalysts, driving demand for these coatings at a 13.9% CAGR during the assessment period.

A key driving force behind this growth is the burgeoning healthcare sector. The need for sterile and hygienic environments in healthcare facilities is non-negotiable.

Nanotechnology photocatalysis surface coatings, with their antimicrobial properties, play an instrumental role in reducing the risk of healthcare-associated infections. They ensure cleanliness, enhance patient safety, and help healthcare institutions maintain stringent hygiene standards.

Saudi Arabia's ambitious infrastructure development projects are further propelling demand for these coatings. From smart cities to mega construction ventures, these initiatives need the durability and sustainability that nanotechnology photocatalysis surface coatings provide. Their ability to reduce maintenance costs and enhance the longevity of structures aligns perfectly with the goals of these projects.

As the healthcare and infrastructure sectors continue to expand in Saudi Arabia, the demand for nanotechnology photocatalysis surface coatings is set to surge. This is set to make them an integral part of the country's growth and development.

China is poised to remain at the epicenter of growth for nanotechnology photocatalysis surface coatings, driven by several pivotal factors. The country has been placing a growing emphasis on sustainability, environmental protection, and technological advancement, making these coatings a focal point of innovation and business development.

The primary driver is China's commitment to environmental stewardship. The coatings' remarkable ability to purify air and water by breaking down contaminants aligns perfectly with the nation's efforts to combat pollution and enhance environmental quality. This technology is a valuable tool in addressing air and water pollution issues, particularly in densely populated urban areas.

China's rapid urbanization has created a rising demand for self-cleaning and low-maintenance surfaces, which is a niche that nanotechnology photocatalysis surface coatings expertly fulfill. These coatings can help maintain cleaner and aesthetically pleasing urban environments, reducing the burden on city maintenance and enhancing the quality of life.

The country's dedication to technological advancement and research further fosters the adoption of these coatings. As China invests in research and development and encourages innovation, it is propelling the creation of cutting-edge coating solutions and manufacturing capabilities. These advancements contribute significantly to the coatings' growth and leadership.

Sales of nanotechnology photocatalysis surface coatings in China are projected to soar at a CAGR of 10.6% during the assessment period. Total valuation in the country is anticipated to reach USD 307.1.0 million by 2035.

Japan stands as a promising and mature space for the nanotechnology photocatalysis surface coating business, given its pioneering history in the utilization of TiO2 as an antimicrobial coating. Japan was the first nation to embrace this technology, making it a testament to the potential and efficacy of these coatings.

The country continues to experience a growing demand for these coatings due to several compelling factors. Japan's aging population places a heightened emphasis on healthcare and infection control. The antimicrobial properties of these coatings are invaluable in healthcare settings, reducing the risk of healthcare-associated infections and ensuring sterile environments in hospitals and other medical facilities.

Japan's strong focus on technological innovation and sustainability aligns well with the attributes of nanotechnology photocatalysis surface coatings. These coatings contribute to cleaner air and water, reduced maintenance costs, and energy efficiency, all of which are in line with Japan's commitment to environmental protection and resource efficiency.

The coatings are also applied in several businesses, including construction, automotive, and electronics, benefiting from Japan's advanced manufacturing capabilities. Their use in these sectors enhances durability, reduces maintenance, and contributes to a healthier and more sustainable living environment.

The nanotechnology photocatalysis surface coating business value in Japan is anticipated to total USD 29.7 million by 2035. Over the forecast period, nanotechnology photocatalysis surface coatings demand in the country is set to increase at a robust CAGR of 11.4%.

India’s nanotechnology photocatalysis surface coating business is primed for robust growth, with an expected CAGR of 10.2%, leading to a valuation of USD 29.3 million by 2035. Several dynamic factors are projected to drive this expansion, making India's growth story in this sector compelling.

The burgeoning commercial building sector in India is a pivotal catalyst for growth. As urbanization and economic development continue, there is an escalating need for innovative solutions that enhance the longevity and sustainability of commercial structures. Nanotechnology photocatalysis surface coatings present an efficient way to achieve this by reducing maintenance costs and ensuring cleaner, longer-lasting building interiors and exteriors.

India's evolving corporate sector stands out as the most cognizant segment regarding the benefits of these coatings. Corporations are increasingly adopting these coatings to maintain clean and aesthetically pleasing office spaces while adhering to sustainability goals, which aligns well with their corporate social responsibility and environmental stewardship.

In tandem with this, the growing environmental awareness across the nation has significantly accelerated the adoption of these coatings. They play a pivotal role in reducing pollution, enhancing air and water quality, and harmonizing with eco-friendly practices, which resonate strongly with both consumers and regulatory bodies.

South Korea’s nanotechnology photocatalysis surface coating business is expected to reach a substantial size of USD 19.3 million by 2035. Over the assessment period, the demand for these coatings in South Korea is projected to surge at a remarkable 13.0% CAGR. The surging demand can be attributed to the escalating usage of nanotechnology photocatalysis surface coatings at several key public places.

One of the primary drivers is the increased adoption of these coatings in public spaces such as transportation hubs, educational institutions, and recreational areas. As public health and hygiene concerns continue to take center stage, these coatings offer an effective solution for maintaining clean and sterile environments.

Their antimicrobial properties are particularly crucial in reducing the risk of infections and ensuring the safety of individuals in these high-traffic areas. As these coatings find increasing application in several public settings, they are set to play a pivotal role in enhancing the quality of life and public health in South Korea.

The below section highlights the demand for nanotechnology photocatalysis surface coating based on end-use and substrate type. Based on substrate type, the metal segment is forecast to thrive at a 10.0% CAGR between 2025 and 2035. Based on end-use, the consumer electronics (durables and appliances) segment is anticipated to exhibit a CAGR of 13.3% during the forecast period.

| Top Segment | Predicted CAGR (2025 to 2035) |

|---|---|

| Consumer Electronics [Durables and Appliances] (End-use) | 13.3% |

| Metal (Substrate Type) | 10.0% |

The prevalence of metal substrates in the AMEA nanotechnology photocatalysis surface coating business is attributed to multiple key factors. Firstly, metal surfaces are ubiquitous in several businesses, including automotive, construction, and healthcare, where the application of nanotechnology photocatalysis surface coatings is particularly advantageous. The ability of these coatings to enhance the durability, corrosion resistance, and hygiene of metal surfaces makes them indispensable in such settings.

The versatility of metal substrates accommodates a wide array of applications. Metal surfaces are commonly found in automotive exteriors, architectural structures, and medical equipment, making them ideal candidates for nanotechnology photocatalysis surface coatings that offer self-cleaning, antimicrobial, and pollution-reducing properties.

It is anticipated to hold a significant volume share of 43.3% in 2025. Over the forecast period, demand for metal substrates is predicted to rise at a CAGR of 10.0% CAGR. By 2025, the target segment is estimated to reach USD 32.6 million.

The sustained demand for nanotechnology photocatalysis surface coatings in the realm of consumer electronics is influenced by several compelling factors. The consumer electronics business is characterized by constant innovation and fierce competition.

Manufacturers are continuously seeking ways to enhance the functionality and aesthetics of their products. Nanotechnology photocatalysis surface coatings provide a solution that aligns perfectly with these objectives.

New coatings offer several benefits for consumer electronics, such as self-cleaning and antimicrobial properties, making them attractive to consumers who value cleanliness, durability, and product hygiene. In an era where personal devices and home appliances have become integral parts of daily life, the importance of these coatings in maintaining a healthy living environment cannot be overstated.

As per the AMEA nanotechnology photocatalysis surface coating analysis, the consumer electronics (durables and appliances) segment is projected to thrive at a 13.3% CAGR during the forecast period. It is set to attain a valuation of USD 307.1 million by 2035.

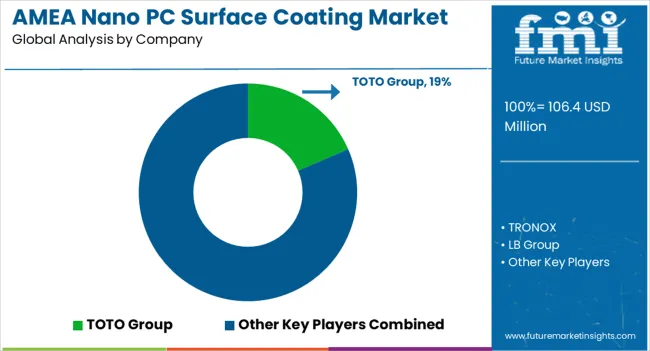

The Asia and Middle East and Africa nanotechnology photocatalysis surface coating business is fragmented, with leading players accounting for about 20% to 25% share. TRONOX, TOTO Group, LB Group, Chemours (Ti-Pure), Ishihara Sangyo Kaisha, Höganäs AB, GB Neuhaus GmbH, and Green Millennium, Inc. are the leading manufacturers and suppliers of nanotechnology photocatalysis surface coatings listed in the report.

Key nanotechnology photocatalysis surface coatings companies are investing in continuous research for producing new products and increasing their production capacity to meet end-user demand. They are also showing an inclination toward adopting strategies, including acquisitions, partnerships, mergers, and facility expansions, to strengthen their footprint.

For instance,

| Attribute | Details |

|---|---|

| Estimated AMEA Nanotechnology Photocatalysis Surface Coating Business Revenue (2025) | USD 106.4 million |

| Projected AMEA Nanotechnology Photocatalysis Surface Coating Business Size (2035) | USD 307.1 million |

| Value-based CAGR (2025 to 2035) | 11.2% |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Value (USD million) and Volume (tons) |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Substrate Type, End-use, Region |

| Regions Covered | Saudi Arabia; Other GCC Countries; Asia; Africa |

| Key Countries Covered | Central Kingdom of Saudi Arabia, Eastern Kingdom of Saudi Arabia, Western Kingdom of Saudi Arabia, Northern Kingdom of Saudi Arabia, Southern Kingdom of Saudi Arabia, Oman, Qatar, United Arab Emirates, Bahrain, Kuwait, China, Japan, South Korea, India, Malaysia, Indonesia, Rest of Asia, South Africa, Other African Unions |

| Key Companies Profiled | TRONOX; TOTO Group; LB Group; Chemours (Ti-Pure); Ishihara Sangyo Kaisha; Höganäs AB; Hangzhou Harmony Chemical Co., Ltd.; Guangdong Sky Bright Group Co., Ltd; Nanofilm Ltd.; Inter-China Chemicals; TOR Specialty Minerals; Nilima Nanotechnologies; Vetro Sol; GB Neuhaus GmbH; Green Millennium, Inc |

The global nanotechnology photocatalysis surface coating industry analysis in amea is estimated to be valued at USD 106.4 million in 2025.

The market size for the nanotechnology photocatalysis surface coating industry analysis in amea is projected to reach USD 307.1 million by 2035.

The nanotechnology photocatalysis surface coating industry analysis in amea is expected to grow at a 11.2% CAGR between 2025 and 2035.

The key product types in nanotechnology photocatalysis surface coating industry analysis in amea are glass, metal, ceramic and fabric.

In terms of end-use, automotive and transportation segment to command 33.7% share in the nanotechnology photocatalysis surface coating industry analysis in amea in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Advanced Aerospace Coatings Industry Analysis in Europe - Size, Share, and Forecast 2025 to 2035

Surface Contact Wire Rope Market Size and Share Forecast Outlook 2025 to 2035

Surface Water Sports Equipment Market Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Outbound Tourism in Germany Size and Share Forecast Outlook 2025 to 2035

Surface Protection Service Market Size and Share Forecast Outlook 2025 to 2035

Surface Protection Film Market Forecast and Outlook 2025 to 2035

Industry Analysis of Syringe and Needle in GCC Size and Share Forecast Outlook 2025 to 2035

Surface printed Film Market Size and Share Forecast Outlook 2025 to 2035

Industry Analysis Non-commercial Acrylic Paint in the United States Size and Share Forecast Outlook 2025 to 2035

Surface Treatment Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Surface Mounting Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Medical Device Packaging in Southeast Asia Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Paper Bag in North America Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Lidding Film in the United States Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Last-mile Delivery Software in Japan Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Automotive Lightweight Body Panel in the United States Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Electronic Skin in Japan Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Electronic Skin in Korea Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Electronic Skin in Western Europe Size and Share Forecast Outlook 2025 to 2035

Coating Pretreatment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA