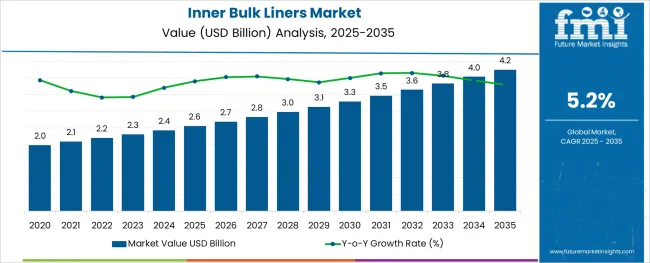

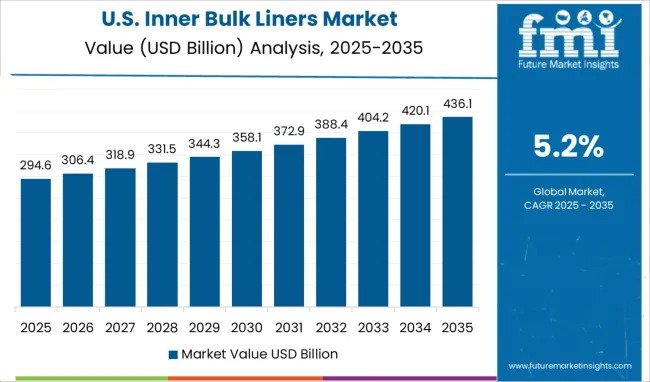

The Inner Bulk Liners Market is estimated to be valued at USD 2.6 billion in 2025 and is projected to reach USD 4.2 billion by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period.

The inner bulk liners market is undergoing steady expansion as global logistics systems increasingly prioritize contamination-free handling of high-volume goods. The food and beverage sector, in particular, is adopting these liners to comply with stringent hygiene regulations and to maintain product integrity during storage and long-haul transport.

Inner bulk liners are being favored for their compatibility with intermediate bulk containers, reduced cleaning requirements, and ability to prevent cross-contamination. Technological advancements in film strength, multi-layer barrier properties, and anti-static materials are improving their performance across both dry and liquid applications.

In addition, the market is responding to growing demand for recyclable and food-grade compliant materials, aligning with sustainability mandates. Future growth is expected to be propelled by increased automation in bulk packaging lines, expanding food export volumes, and operational cost savings linked to reduced product loss and liner reusability. These dynamics are positioning inner bulk liners as a preferred solution across food, chemical, and pharmaceutical logistics.

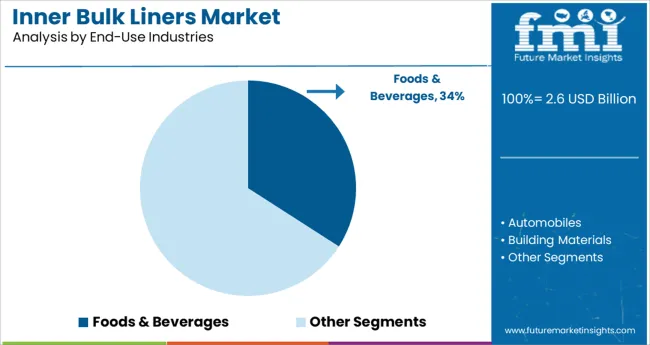

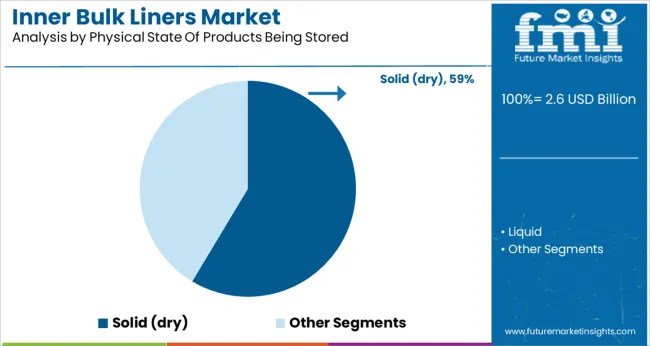

The market is segmented by End-Use Industries, Physical State Of Products Being Stored, and Products and region. By End-Use Industries, the market is divided into Foods & Beverages, Automobiles, Building Materials, and Chemicals. In terms of Physical State Of Products Being Stored, the market is classified into Solid (dry) and Liquid.

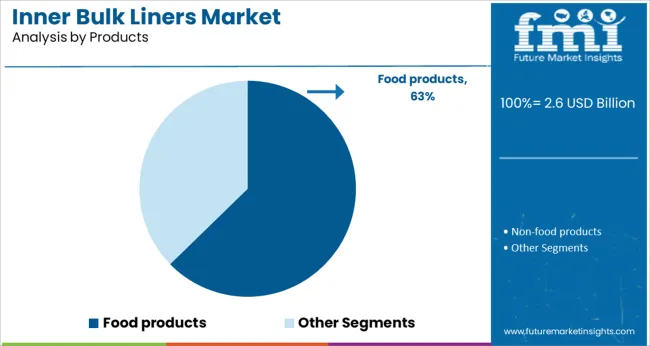

Based on Products, the market is segmented into Food products and Non-food products. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The foods and beverages segment is projected to account for 34.1% of the overall inner bulk liners market revenue in 2025, establishing it as the largest end-use industry. This leadership is driven by rising demand for safe and contamination-free transportation of grains, spices, sweeteners, and other bulk food commodities.

Inner bulk liners are being widely used by food processors and exporters to meet stringent global food safety standards and regulatory requirements. The liners offer critical protection against moisture, pests, and air exposure, preserving product quality during long-haul shipments.

In addition, the rise in demand for flexible intermediate bulk containers in dry food logistics has fueled liner usage. The food and beverage industry’s growing reliance on export logistics, coupled with increasing emphasis on product traceability and cleanliness, has reinforced its dominance within the end-use category.

The solid dry segment is anticipated to hold a 58.6% share of the market in 2025 based on the physical state of products being stored. This prominence is attributed to the widespread use of inner bulk liners for transporting and storing bulk solids such as flour, starch, sugar, cocoa powder, and specialty ingredients.

Dry solids require effective dust control and moisture protection, making high-barrier liners an operational necessity. The ease of filling and discharging solid products, as well as compatibility with various container types, has contributed to increased adoption.

Additionally, rising automation in bulk material handling and growing cross-border food and chemical trade have amplified demand for liner systems designed specifically for dry solids. Reduced product waste and improved sanitation outcomes have made solid-state applications the most commercially viable segment.

Food products are forecast to capture 62.7% of total market revenue by 2025 under the products segment, making it the largest product category for inner bulk liners. The consistent growth in global demand for packaged and processed foods has increased the need for hygienic and efficient storage and transportation solutions.

Inner bulk liners are being used extensively to handle dry food ingredients and bulk edible goods, supporting operational efficiency in both domestic distribution and international trade. Their role in ensuring product purity, minimizing contamination risk, and reducing manual handling is particularly valued in food-grade environments.

Furthermore, the integration of tamper-evident features and anti-static properties into liner designs has enhanced safety and compliance. As regulatory scrutiny over food logistics tightens and global food shipments rise, food products will continue to dominate usage of inner bulk liners across supply chains.

The global demand for customized packaging solutions is propelling the expansion of the inner bulk liners market. The liberalization of numerous closed economies' international trade laws, together with increased exports and imports of FMCG & FMCD products (fast-moving consumer goods and fast-moving consumer durables), is also contributing to the rapid expansion of the inner bulk liners market.

The proliferation of e-commerce firms around the world necessitates safe and timely logistic services. Inner bulk lines improve product safety in fast-moving vehicles as well as during the loading and unloading of goods, increasing market growth. Because of the greater humidity management of the inner bulk liners, it is suitable for water transport of commodities and thereby contributes to global market growth.

Inner bulk liners have been a significant advancement in the business. These liners have been widely utilized in the plastics sector to prevent leakage from drums and other containers. These liners allow hazardous materials to be transported and stored. The liners help minimize spills and leaks while being processed at a plant, creating positive chances for market growth.

The difficulty in recycling inner bulk liners is limiting the market's expansion. Inner bulk liners are composed of nonmaterials, making it difficult to reduce the pollution caused by them.

Inner bulk liners assist both buyers and vendors in lowering overall packaging costs; hence, they have great growth potential; since practically all firms throughout the world strive to reduce costs in order to preserve and enhance profit margins.

Also, because this container may only be used for a particular type of material rather than various contents, the appropriate type of liners must be installed within the container. This issue will limit market expansion and pose further challenges to the inner bulk liners industry.

Liners for dry bulk containers are constructed of polypropylene, polyethylene, and other plastics. Dry bulk container liners are a low-cost option for interim storage and dry freight transit. Dry bulk container liners establish a barrier against any type of contamination between the interior of the container and reduce the risks of product damage, hence avoiding cargo contamination.

Dry bulk container liners reduce packaging waste because they are simple to install and can be reused. These liners are utilized in a variety of industries as a replacement for plastic containers and corrugated boxes. Such advancements are projected to drive the global market for inner bulk liners in the future.

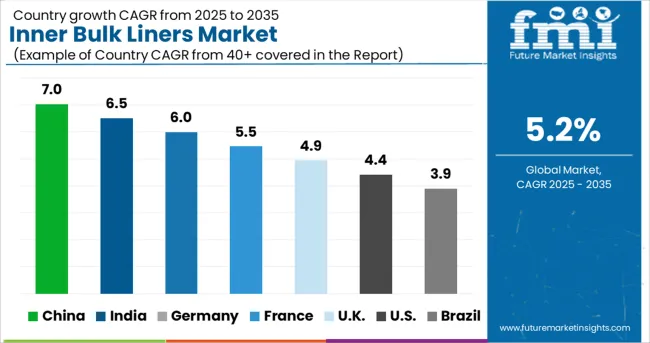

In terms of market share and revenue, the North American market is expected to grow steadily during the projection period of 2025 to 2035. The analysts at Future Market Insights predict that by 2025, the market of Inner bulk liners in North America is expected to acquire a global market size of 21%.

North America is predicted to grow rapidly in terms of market share and revenue share in the global inner bulk liners market during the forecast period. This is due to the region's increasing demand for inner bulk liners. Because of the increasing demand for automation in the food and beverage industries in this region, this region dominates this market.

By 2025, Europe will hold approximately 26% of the global market share. This region is expected to be the fastest growing market in terms of revenue during the forecast period, 2025 to 2035.

Dry bulk container liners are a low-cost option for interim storage and dry freight transit. Dry bulk container liners establish a barrier against any type of contamination between the interior of the container and reduce the risks of product damage, hence avoiding cargo contamination.

Dry bulk container liners also reduce packaging waste because they are simple to install and can be reused. Such factors are going to boost the overall market demand in European countries.

Rising urbanization and industrialization in developing economies such as Asia-Pacific have resulted in the growth of the chemical and food and beverage industries. Countries such as India, Japan, and South Korea are rapidly growing their food and chemical industries.

The use of storage equipment is expanding as the food and beverage industry expands rapidly. Manufacturers have increased their production capacity by implementing automation in their production facilities in response to rising demand.

Packaged food is convenient, particularly for the working population, and hence the demand for storage of such food goods has grown over time. The market's producers have invested in the development of inner bulk liners that can be employed in automated lines.

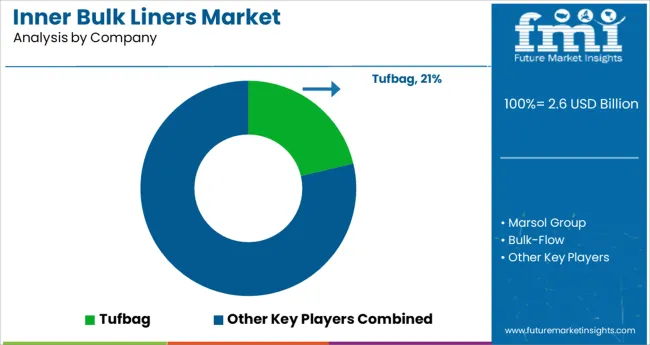

The leading competitors in the global intermediate bulk container (IBC) liners market are now focused on strategies such as product innovations, mergers and acquisitions, new advancements, collaborations, joint ventures, and partnerships to strengthen their market position.

The key players in this market include Tufbag, Marsol Group, Bulk-Flow, Thrace Group, and Vishakha PolyFab Pvt. Ltd.

Start-up companies all across the world are vying for market share by seizing current opportunities. As a result, the majority of new corporations today choose product supply to promote ongoing industrialization and urbanization in order to get a competitive advantage over other organizations.

| Report Attribute | Details |

|---|---|

| Growth Rate | 5.2% CAGR |

| Market value in 2025 | USD 2,196.1 Million |

| Market value in 2035 | USD 3,645.9 Million |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | USD Million for Value |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Type, Physical state, End-user, Region |

| Regions Covered | North America; Latin America; Europe; Asia Pacific; Middle East & Africa |

| Key Countries Profiled | United States of America, Canada, Mexico, Brazil, Germany, Italy, France, United Kingdom, Rest of L.A, Nordic countries, Belgium, Netherlands, Luxembourg, Poland, Russia, Rest Of Eastern Europe, China, India, ASIAN, Australia, New Zealand, Japan, GCC Countries, S. Africa, N. Africa, Rest of the Middle East and Africa |

| Key Companies Profiled | Tufbag; Marsol Group; Bulk-Flow; Thrace Group; Vishakha PolyFab Pvt. Ltd. |

| Customisation Scope | Available on Request |

The global inner bulk liners market is estimated to be valued at USD 2.6 billion in 2025.

It is projected to reach USD 4.2 billion by 2035.

The market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types are foods & beverages, automobiles, building materials and chemicals.

solid (dry) segment is expected to dominate with a 58.6% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Innerspring Mattresses Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dinner Ready-to-Eat (RTE) Food Market - Trends & Consumer Insights 2025 to 2035

Spinner Flask Market Size and Share Forecast Outlook 2025 to 2035

Takeout Dinner Market Trends - Convenience & Gourmet Expansion 2025 to 2035

Cigarette Inner Liner Market Size and Share Forecast Outlook 2025 to 2035

Maternity Innerwear Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Epoxy Paint Thinner Market Growth - Trends & Forecast 2025 to 2035

Container Mouth Inner Seal Market

Bulk Bag Market Forecast and Outlook 2025 to 2035

Bulk Terminal Market Forecast and Outlook 2025 to 2035

Bulk Molding Compounds Market Size and Share Forecast Outlook 2025 to 2035

Bulk Bag Unloaders Market Size and Share Forecast Outlook 2025 to 2035

Bulk Bag Divider Market Size and Share Forecast Outlook 2025 to 2035

Bulk Container Packaging Market Size, Share & Forecast 2025 to 2035

Bulk Liquid Transport Packaging Market from 2025 to 2035

Bulk Chemical Packaging Market Trends and Growth 2025 to 2035

Bulk Food Ingredients Market Growth – Industry Insights & Trends 2025 to 2035

Bulk Material Handling System Market Growth - Trends & Forecast 2025 to 2035

Market Share Breakdown of Bulk Container Packaging Industry

Competitive Overview of Bulk Bag Divider Companies

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA