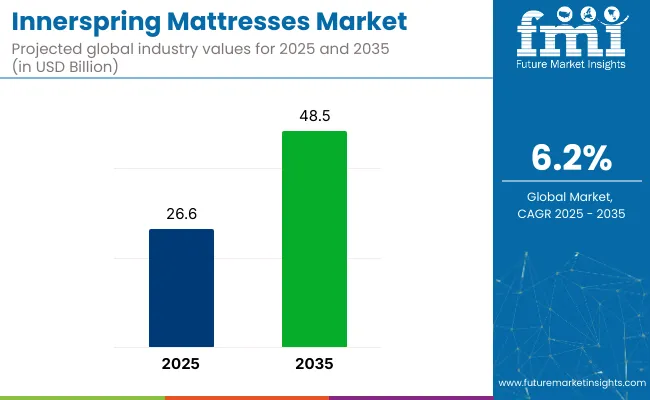

The global innerspring mattresses market is valued at USD 26.6 billion in 2025 and is slated to be worth USD 48.5 billion by 2035, reflecting a steady 6.2% CAGR. Rising demand for affordable, breathable, and durable bedding solutions has been fueling growth across both developed and emerging economies.

Increased focus on spinal alignment and sleep ergonomics, along with a preference for traditional mattress construction, has kept innerspring mattresses relevant despite rising competition from foam and latex variants. This is particularly evident in high-demand countries such as the USA, Germany, and South Korea.

Innovations in the market focus on improving comfort, durability, and sustainability. Advances in coil technology, such as pocketed coils and hybrid systems, are designed to provide better support and motion isolation. Additionally, new materials like memory foam and gel-infused layers are being integrated with traditional innerspring designs to enhance comfort and temperature regulation.

Eco-friendly initiatives are also on the rise, with manufacturers adopting sustainable materials like organic cotton, recycled steel, and plant-based foams. Enhanced durability and longer lifespan are achieved through improved coil systems, while increased customization options, such as adjustable firmness, are also gaining popularity.

Government regulations for the innerspring mattresses market focus on ensuring consumer safety, environmental sustainability, and product quality. In the USA, the Consumer Product Safety Commission (CPSC) sets fire safety standards, particularly for mattress flammability. The Federal Trade Commission (FTC) oversees labeling regulations to ensure accurate product claims. In Europe, the EU imposes strict regulations on the use of chemicals in bedding materials and promotes recycling initiatives.

| Metric | Value |

|---|---|

| Estimated Market Size (2025) | USD 26.6 Billion |

| Projected Market Size (2035) | USD 48.5 Billion |

| CAGR (2025 to 2035) | 6.2% |

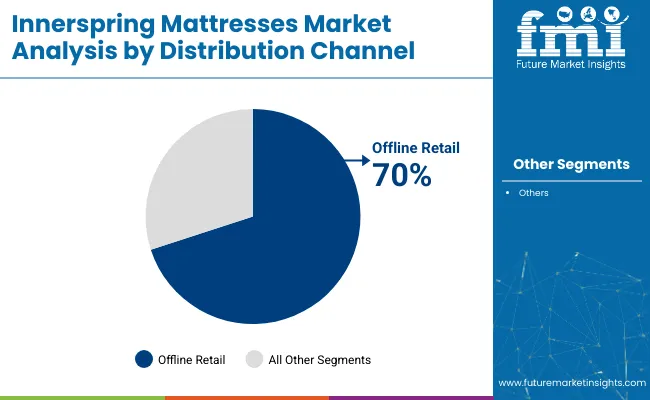

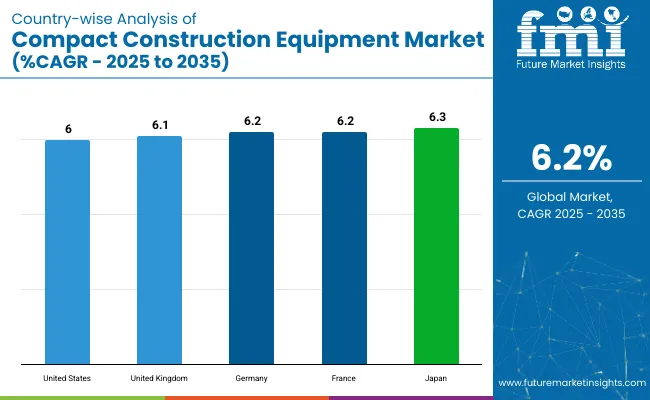

The USA is expected to be the fastest-growing market for innerspring mattresses, with a projected CAGR of 6%. Offline retail will lead the distribution channel segment, accounting for over 70% of the market share in 2025. The household segment will dominate the end-user category with an estimated 85% share. Japan and Germany are anticipated to experience steady growth, with CAGRs of 6.3% and 6.2%, respectively.

The global innerspring mattresses market is segmented by distribution channel, end user, and region. By distribution channel, the market is bifurcated into offline retail and online retail. In terms of end user, the market is divided into household and commercial. Regionally, the market is classified into North America, Latin America, Western Europe, South Asia Pacific, East Asia, Eastern Europe, and Middle East & Africa.

Offline retail is projected to dominate the distribution channel segment, capturing 70% of the global market share in 2025. This dominance has been maintained due to the consumer preference for tactile evaluation and personalized purchase experiences when selecting mattresses.

The household segment is expected to command the largest share of the end-user category, holding approximately 85% of the total market in 2025. Strong consumer emphasis on sleep wellness and ergonomic benefits has sustained demand.

The global innerspring mattresses market is witnessing steady growth, driven by rising demand for affordable, breathable, and supportive sleep solutions. Increased consumer focus on spinal alignment and hybrid innovations are boosting product appeal. However, the market faces headwinds from strong competition with foam and latex alternatives, fluctuating raw material prices, and slower digital adoption in developing regions.

Recent Trends in the Innerspring Mattresses Market

Key Challenges in the Innerspring Mattresses Market

The USA innerspring mattresses market is projected to grow at a CAGR of 6% between 2025 and 2035. Strong demand from the residential renovation sector and hotel upgrades continues to drive volume. With consumers placing emphasis on durability and cost-efficiency, traditional innerspring models remain a preferred choice. The rise of hybrid models and sleep-tech integration is further fueling market expansion in both premium and budget categories.

The UK innerspring mattresses market is expected to grow at a CAGR of 6.1% during the forecast period. Mass-market adoption of innerspring mattresses persists due to their low cost and reliability. Although memory foam models are gaining ground, consumers still value the comfort familiarity of coil-based mattresses. Regulatory support for recycling and sustainability in bedding products is shaping future market strategies.

Germany’s innerspring mattresses market is forecast to register a CAGR of 6.2% between 2025 and 2035. A mature consumer base with strong quality expectations has favored hybrid innerspring models with orthopedic features. Continued investment in sustainable materials and certified eco-labels is influencing purchase decisions, particularly among urban and environmentally conscious buyers.

The French innerspring mattresses market is anticipated to witness market growth at a CAGR of 6.2% through 2035. A mix of growing sleep health awareness and a flourishing hotel industry is driving demand. Innerspring mattresses are viewed as both durable and cost-effective, making them a staple in budget-conscious households and mid-tier hotel chains. The market is also benefiting from increased online availability and seasonal discounts.

Japan’s innerspring mattresses market is set to grow at a CAGR of 6.3% from 2025 to 2035. Aging demographics and space-saving home preferences have encouraged the sale of compact innerspring mattresses. Local manufacturers are leveraging advanced coil technologies and breathable designs to appeal to health-conscious consumers. Integration of antimicrobial fabrics and hypoallergenic materials is a growing trend in product development.

The innerspring mattresses market is moderately fragmented, with numerous global players both branded and private-label competing across diversified regions and segments. Leading firms are competing through pricing strategies, innovation in hybrid and smart mattress designs, strategic partnerships with retailers and sustainability-focused initiatives, and by expanding regional manufacturing footprints.

Top companies are emphasizing innovation (e.g., advanced coil configurations, smart sleep integration), value-based pricing for mass-market reach, and partnerships with hospitality chains and online platforms. Expansion strategies include opening DTC stores and entering emerging markets. Sustainability is also a growing focus, with eco-friendly materials and certifications becoming key differentiators.

Recent Innerspring Mattresses Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 26.6 billion |

| Projected Market Size (2035) | USD 48.5 billion |

| CAGR (2025 to 2035) | 6.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billion/Volume in million units |

| By Distribution Channel | Offline Retail and Online Retail |

| By End User | Household and Commercial |

| Regions Covered | North America, Latin America, Europe, Middle East and Africa, East Asia, South Asia Pacific |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | Hilding Anders AB, Recticel NV/SA, Silentnight Group Limited, Grupo Pikolin LLC, Simmons Bedding Company, Sealy e-Commerce LLC., Breckle GmbH, Magniflex, Kingsdown Inc., KING KOIL |

| Additional Attributes | Dollar sales growth by product type, regional demand trends, competitive landscape, technological innovations. |

The market is valued at USD 26.6 billion in 2025.

The market is forecasted to reach USD 48.5 billion by 2035, reflecting a CAGR of 6.2%.

Offline retail will lead the market by distribution channel with a 70% market share in 2025.

The household segment will dominate the market with an 85% share in 2025.

Japan is projected to grow at the fastest rate, with a CAGR of 6.3% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Mattresses & Accessories Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Down Alternative Mattresses Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA