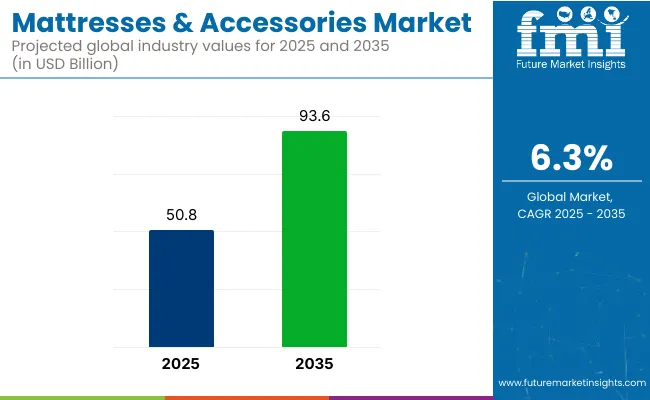

The global mattresses & accessories market is valued at USD 50.8 billion in 2025 and is anticipated to reach USD 93.6 billion by 2035, reflecting a CAGR of 6.3%. This growth is being propelled by increasing consumer focus on sleep health, urbanization, and rising disposable incomes across both developed and emerging economies.

| Metric | Value |

|---|---|

| Estimated Size (2025) | USD 50.8 billion |

| Projected Value (2035) | USD 93.6 billion |

| CAGR (2025 to 2035) | 6.3% |

The market is seeing strong traction for memory foam and hybrid mattresses due to their ability to offer pressure relief, motion isolation, and temperature regulation. Additionally, innovations in smart mattresses, AI-powered customization, and sustainable bedding materials are redefining consumer expectations.

Technological advancements and rising wellness awareness are driving innovations in the mattresses & accessories market. Smart mattresses with AI-enabled sleep tracking and adjustable firmness are gaining popularity for personalized comfort. Cooling technologies like gel infusions and phase-change materials are enhancing sleep quality.

Eco-friendly materials such as bamboo and natural latex are being increasingly used to meet sustainability goals. Hybrid designs with zoned support and modular construction are expected to dominate the market as demand for customized and ergonomic sleep solutions continues to grow.

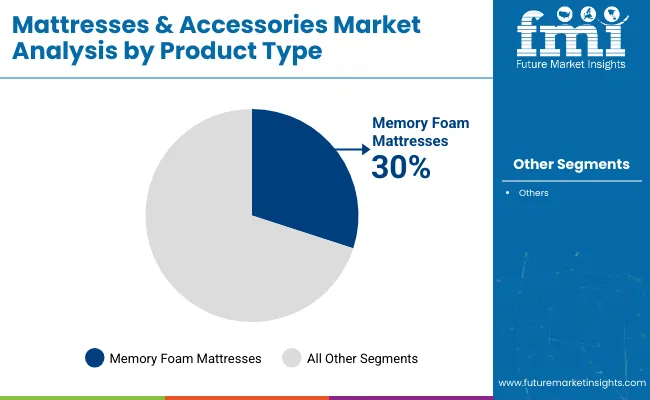

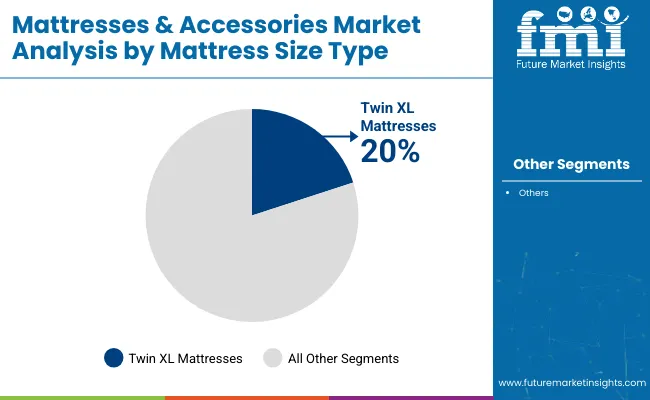

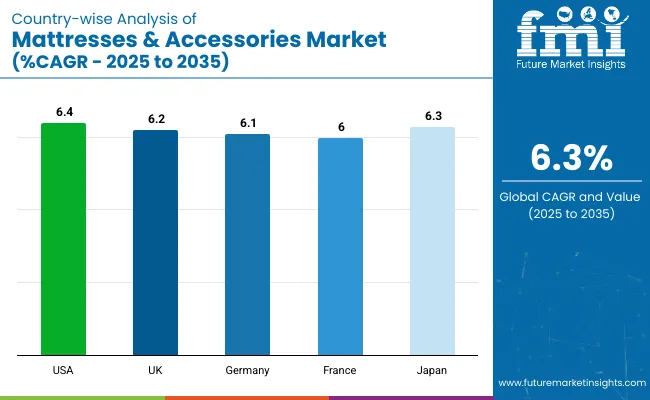

Memory foam mattresses are projected to dominate with over 30% market share by 2025, driven by demand for ergonomic support. Twin XL size mattresses are expected to capture over 20% of the market, growing at a CAGR of 6.7% due to their popularity in dormitories and compact living spaces. The USA is forecasted to grow at 6.4% CAGR, while the UK and Germany follow closely at 6.2% and 6.1%, respectively. Tempur Sealy and Sleep Number continue to lead with smart and sustainable innovations.

The global mattresses & accessories market is segmented by product type and mattress size type. By product type, the market is segmented into memory foam mattress, hybrid mattress, innerspring mattress, latex mattress, and others (waterbed mattress, air filled mattress, and gel filled mattress).

Based on mattress size type, the market is categorized into twin or single size mattress, twin XL size mattress, full or double size mattress, queen size mattress, king size mattress, and others (California king, crib, RV short queen, Olympic queen). Regionally, the market is divided into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and Middle East and Africa.

Memory foam mattresses are expected to hold the largest share of the product type segment with over 30% share in 2025.

Twin XL mattresses are expected to capture over 20% share of the mattress size segment by 2025.

The global mattresses & accessories market is experiencing robust growth, fueled by rising awareness of sleep health, demand for ergonomic bedding, and innovations in smart mattress technology. However, the market also encounters challenges such as high product costs, recycling difficulties, and uneven adoption across emerging economies.

Recent Trends in the Mattresses & Accessories Market

Key Challenges in the Mattresses & Accessories Market

The mattresses & accessories market in the USA is projected to grow at a CAGR of 6.4% from 2025 to 2035. The growth is fueled by increasing demand for premium and tech-integrated bedding products, backed by high disposable income and strong e-commerce penetration. Brands are investing heavily in AI-powered smart beds, sleep analytics, and sustainable materials. Direct-to-consumer models are disrupting traditional retail, offering faster delivery and customized experiences.

The UK mattresses & accessories market is forecasted to expand at a CAGR of 6.2% between 2025 and 2035, driven by consumer preference for high-quality, sustainable sleep products. Eco-conscious consumers are favoring mattresses made from organic latex and plant-based foams. The popularity of bed-in-a-box subscription models is also increasing, offering convenience and affordability. Retailers are integrating AI-based customization tools to help consumers select mattresses based on sleep data and ergonomic needs.

Germany’s mattresses & accessories market is expected to grow at a CAGR of 6.1% from 2025 to 2035. Known for its precision manufacturing and environmental regulations, the country emphasizes recyclable materials, toxin-free foams, and locally sourced fabrics. The hospitality sector is adopting ergonomic, pressure-relieving sleep systems, contributing to demand for high-end hybrid and memory foam mattresses.

France’s mattresses & accessories market is projected to grow at a CAGR of 6% during the forecast period, driven by urban lifestyle shifts and rising health consciousness. French consumers are gravitating toward breathable, hypoallergenic mattresses, especially those designed with plant-based foam and natural fabrics. Retailers are blending traditional aesthetics with modern performance by offering multi-layered mattresses with antimicrobial properties and personalized firmness.

Japan’s mattresses & accessories market is set to grow at a CAGR of 6.3% from 2025 to 2035, led by demand for space-saving, ergonomic, and tech-enhanced bedding. The cultural preference for futons and compact sleep setups continues, but there's a rising trend toward hybrid and smart mattresses. Japanese consumers are adopting antimicrobial, AI-powered bedding systems that track sleep cycles and adjust temperature.

The mattresses & accessories market is moderately consolidated, led by major players like Tempur Sealy, Sleep Number, Serta Simmons, Spring Air, and Kingsdown. These companies dominate revenue through advanced product innovation, smart technology integration, and sustainable material usage.

Competition is intensifying with the rise of Direct-to-Consumer (DTC) models, enabling brands to strengthen customer relationships and introduce subscription-based services. Leading firms are integrating AI, IoT, and biometric sensors into smart mattresses to provide real-time sleep tracking and temperature control. Notably, Sleep Number focuses on personalized sleep analytics, while Tempur Sealy expanded its footprint by acquiring Mattress Firm for retail consolidation.

Recent Mattresses & Accessories Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 50.8 billion |

| Projected Market Size (2035) | USD 93.6 billion |

| CAGR (2025 to 2035) | 6.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billions/ Volume in Units |

| By Product Type | Memory Foam Mattress, Hybrid Mattress, Innerspring Mattress, Latex Mattress, Others (Water Bed, Air Filled, Gel Filled Mattresses) |

| By Mattress Size Type | Twin or Single Size, Twin XL Size, Full or Double Size, Queen Size, King Size, Others (California King, Crib, RV Short Queen, Olympic Queen) |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East and Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | Tempur Sealy International Inc., Sleep Number Corporation, Serta Simmons Bedding LLC, Spring Air International, Kingsdown Inc., Southerland Inc., Relyon Limited, McRoskey Mattress Company, Corsicana Mattress Company |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis |

The mattresses & accessories market is projected to reach USD 93.6 billion by 2035.

The mattresses & accessories market is anticipated to grow at a CAGR of 6.3% during 2025 to 2035.

Memory foam mattresses are expected to hold over 30% of the market share in 2025.

Twin XL mattresses are projected to capture over 20% of the market share by 2025.

The USA leads with a 6.4% CAGR from 2025 to 2035 in the mattresses & accessories market.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Car Accessories Market Size and Share Forecast Outlook 2025 to 2035

Bar Accessories Market

Jack Accessories Market Size and Share Forecast Outlook 2025 to 2035

Dock Accessories Market Size and Share Forecast Outlook 2025 to 2035

Golf Accessories Market Size and Share Forecast Outlook 2025 to 2035

Apple Accessories Market Report – Demand, Trends & Forecast 2025–2035

Cable Accessories Market Growth - Trends & Forecast 2025 to 2035

Camera Accessories Market Size and Share Forecast Outlook 2025 to 2035

Laptop Accessories Market Size and Share Forecast Outlook 2025 to 2035

E-Bike Accessories Market Size and Share Forecast Outlook 2025 to 2035

Travel Accessories Market Analysis by Product Type, Material, Distribution Channel, End-User and Region 2025 to 2035

Key Players & Market Share in Laptop Accessories Market

Fashion Accessories Packaging Market Size and Share Forecast Outlook 2025 to 2035

Smoking Accessories Market Analysis – Growth & Forecast 2025 to 2035

Industry Share Analysis for Fashion Accessories Packaging Companies

Air Fryer Accessories Market Size and Share Forecast Outlook 2025 to 2035

Stretcher Accessories Market Size and Share Forecast Outlook 2025 to 2035

Drinkware Accessories Market

Watercraft Accessories Market Growth - Trends & Forecast 2025 to 2035

Spark Plug Accessories Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA