The watercraft accessories market is set to witness strong and sustained growth between 2025 and 2035, supported by rising recreational boating activities, increasing marine tourism, and advancements in watercraft customization. Estimated at USD 8.2 billion in 2025, the watercraft accessories market is expected to grow to USD 15.7 billion by 2035, growing at a consistent CAGR of 6.1% during the forecast period.

Increased demand for water-based leisure and sporting activities has risen significantly on a global level for both personal and commercial watercraft, and this is also fueling the demand for high-quality accessories. Consumers are willing to invest more and more in safety equipment, electronics, navigation aids, seating, storage, and styling enhancements to upgrade their watercraft experience. Increased disposable incomes, especially in developing countries, and improved access to water bodies have further augmented the industry for recreational boating.

Technological advancements are also significantly contributing to changing the watercraft accessories scenario. From intelligent navigation devices and cutting-edge sonar systems to environmentally friendly materials and solar-powered accessories, companies are emphasizing providing high-performance, green, and consumer-friendly solutions reflecting shifting consumer demand. This movement is also driven by increasing consciousness about environmental preservation in marine ecosystems, which is nudging the industry toward more sustainable options.

Government policies encouraging oceanic infrastructure development, coupled with an increase in yacht clubs, marinas, and boat renting services, is giving extra push to industry growth. Also, websites and e-commerce are facilitating consumers in reaching a vast variety of watercraft accessories, thus driving sales to greater heights. The industry growth have constraints in the form of high startup costs, maintenance charges, and seasonal reliance in cold climates. Despite these challenges, the increasing penetration of advanced technologies, coupled with growing uses in rescue, military, and commercial segments, is poised to create high-value opportunities for manufacturers and players in the next few years.

With evolving consumer tastes and a stark movement towards personalization and innovation, the industry is in for a transformative decade ahead, making it a vibrant and high-growth part of the larger marine industry.

Market Metrics

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 8.2 billion |

| Industry Value (2035F) | USD 15.7 billion |

| CAGR (2025 to 2035) | 6.1% |

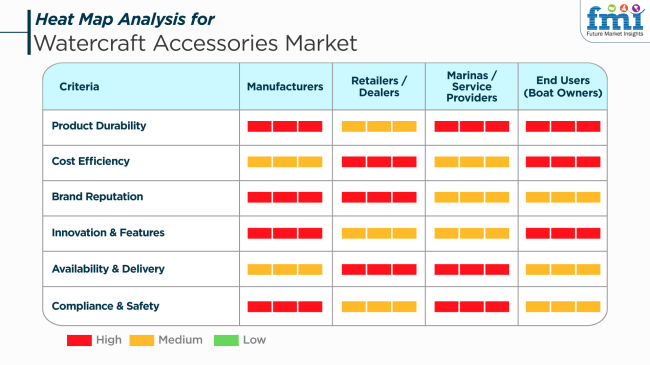

The industry serves a diverse array of stakeholders with differing priorities. Manufacturers focus on product durability, brand reputation, and innovation to maintain a competitive advantage and satisfy quality expectations. Merchants and distributors focus on cost-effectiveness, product stock, and brand validity to maximize inventory turnover and address seasonal demand.

Marinas and providers of service are focused on durability and conformance, since they install and service equipment that is required to adhere to marine safety standards. Durability, style, and customizing to meet personal image, as well as performance improvement and comfort, are desired by end users such as boat owners and enthusiasts for accessories. Fashionable industry requirements include innovation in material, smart technology (e.g., GPS-enabled equipment), and eco-friendly designs.

With recreational boating growing in popularity along coastlines and waterways further inland, demand for stylish and rugged accessories is mounting. Those suppliers and manufacturers who can get the optimal balance between price, durability, and innovation are best positioned to meet evolving industry needs regionally in the GCC and globally.

Consumer Priorities by Segment in the Market

Between 2020 and 2024, the industry witnessed steady growth due to growing participation in recreational boating and water sports. The COVID-19 pandemic caused a surge in outdoor activities, with boating emerging as a socially distanced recreational option. There was increased demand for accessories like life vests, tow ropes, and storage during this period. North America, and America specifically, remained a powerhouse, powered by an immense network of lakes and rivers and a robust culture of boating.

In the coming years, going up to 2025 to 2035, the industry is expected to change with more developed technology and changing customer preferences. There will be greater emphasis on intelligent accessories, including GPS equipment and integrated communication modules. There will be stress on sustainability, and there will be increased demand for eco-friendly products and efficient energy devices. The emerging economies of the Asian-Pacific and Latin America will be a key driver for the growth of the industry because of increasing disposable incomes and increased marine tourism.

Comparative Market Shift Analysis

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Booster for recreational boating spurred by pandemic-fueled outdoor activity | Technological innovation and sustainability drive |

| Basic safety and storage accessories | Higher number of first-time boat buyers demanding fundamental accessories |

| Experienced boat owners looking for advanced and customized solutions | North American industry domination |

| High growth in Asia-Pacific and Latin America industries | Traditional retail and dealer networks |

| Accelerated growth of e-commerce and direct-to-consumer channels | Minimum safety standards |

The industry is experiencing increased demand owing to the increased popularity of leisure boating, marine sports, and recreational tourism. This increase is also bolstered by rising disposable incomes and lifestyle improvements in various regions. However, there could be several threats to the industry's stability and long-term expansion.

One such major threat exists in the discretionary and seasonal nature of the company. Watercraft accessories are strongest in relation to seasonal recreational activity, and thereby sales are very weather- and tourist-dependent. Slowing economies or inflationary forces can also curtail consumer purchases of discretionary recreational goods, resulting in sharp declines in demand.

Another key challenge is supply chain risk. Most accessories rely on globally sourced components-like electronics, composites, and specialty metals. Shipping delays, geopolitical instability, or raw material shortages cause disruptions that create production bottlenecks and elevated manufacturing costs.

Environmental and regulatory pressures are also a threat. As environmental awareness increases, governments and coastal urban centers are increasing regulation on maritime activity and pollution. This could impact the type of material that is used to make accessories and bring in additional compliance costs to manufacturers. Those manufacturers who are not using environmentally sustainable methods can expect to be fined, to receive negative publicity, or to have access to industries withdrawn.

Also, increased competition and saturation of the industry threaten profitability. With numerous competitors crowding the industry, especially in the aftermarket industry, prices have downward pressure exerted upon them. Brands will have to innovate continuously or differentiate through premium features to maintain industry share.

To counteract these risks, companies must invest in sustainable product design, diversify their supply bases, have flexible inventory systems, and look at geographic industries with counter-seasonal demand to balance revenue over the course of a year.

In 2025, the industry will be segmented by type, with life vests and tow ropes holding significant shares. Life vests dominate the industry, accounting for 20%, followed by the tow ropes segment, holding 18% of the industry share.

A significant 20% industry share is occupied by the Life Vest segment, which is primarily based on safety and regulatory compliance. Life vests would be very important in terms of safeguarding watercraft users during emergencies. Such demand continues to increase due to the rising trends in recreational boating, water sports, and general marine activities.

Top players in this industry include O'Neill, Mustang Survival, and Stearns, extending ranges of life vests in relation to comfort, durability, and performance. These are particularly popular in high-performance water sports, such as water skiing and wakeboarding, where safety and mobility tend to count the most. Increased awareness of swimming safety and various regulations mandating life jackets in several regions prompt further industry growth.

Tow Ropes are an important segment referring to the remaining 18% of the industry share closely associated with water sports activities like wakeboarding, waterskiing, and tubing. All tow ropes are designed to maintain speed and control while towing riders behind the watercraft.

Leading companies such as Connelly Skis, Airhead and Hydroslide dominate the industry of tow ropes, manufacturing products that are specifically designed to sustain the high tension and wear that they inevitably face throughout intense water sports activities. This supposed growth of the industry of tow ropes is the result of the rising popularity of adventure water sports across the globe.

One example of that is High-performance ropes built to resist UV damage, which are renowned from Airhead. These ropes are designed to ensure that they endure harsh conditions as much as possible, hence lasting longer. Similarly, Connelly Skis designed ropes engineered for both professional athletes and recreational users, ensuring safety and reliability in every ride.

The industry by end-use in 2025 is primarily segmented into coastal tourism & shipping companies and offshore vessels. Offshore vessels make up about 20% of the share of the industry. The coastal tourism & shipping companies end up at 25% of the industry share.

Growing demand for coastal tourism, recreational boating, and commercial shipping propels the coastal tourism and shipping companies segment to account for 25% of the industry share. Coastal tourism, with cruise lines and boat touring, thrives, and tourists embrace water experiences from sightseeing cruise tours to luxury getaways.

On the other hand, shipping companies expand their reach to meet international trading and passenger transportation demands. Some major companies exporting in this sector include Carnival Corporation, Royal Caribbean, and Norwegian Cruise Line, continuously innovating with sustainable technologies, providing luxury experiences and enhancing the passenger experience. The fast-rising tourism and establishment of port and coastal infrastructure are augmenting the demand for vessels in these sectors.

The offshore vessel segment, taking a share of 20%, provides services to industries requiring specialized vessels for offshore operations. Offshore vessels are utilized in oil and gas exploration, offshore wind energy, and marine research. Modern offshore vessels are specifically designed to withstand hostile conditions, i.e., weather conditions, offshore exploration, energy extraction, and the maintenance of deep-water operations in remote areas.

VARD Group, TechnipFMC, and Seacor Marine are companies manufacturing bespoke offshore vessels to suit these hostile environments and promise durability, safety, and efficiency at an optimal cost. With the `renewable-energy-we-can-do-this' feeling taking root in many countries, especially as far as offshore wind farms are concerned, the demand for special-purpose offshore vessels will increase.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 6.8% |

| UK | 5.9% |

| France | 5.7% |

| Germany | 5.5% |

| Italy | 5.3% |

| South Korea | 6.1% |

| Japan | 5.2% |

| China | 7.4% |

| Australia | 5.8% |

| New Zealand | 5.6% |

The USA industry will see robust growth throughout the forecast period because of high consumer spending on marine recreation and a mature boating industry. The presence of established marine accessory manufacturers and the widespread adoption of sophisticated navigation systems, safety gear, and luxury onboard amenities support steady industry growth.

Demand is further stimulated by growing demand for wake sports and watercraft, which translates to demand for high-performance equipment like towing systems, audio, and GPS-enabled equipment. The innovation of environmentally friendly and intelligent marine accessories also responds to changing environmental needs and consumer attitudes.

Major industry players in the USA, like Brunswick Corporation, Yamaha Motor Corporation USAA., and Garmin Ltd., continue to improve products through innovation and digital technology integration. Developments in marina infrastructure and supportive state-level boat laws also enable the application of sophisticated accessories in commercial and recreational industries.

The UK industry is expected to register steady growth until 2035, driven by a growing boat registration base and increased consumer demand for recreational boating. The nation has a developed maritime culture and an increasing number of charter and yacht hire companies. Growing investments in coastal infrastructure and the use of inland waterways are resulting in the use of safety equipment, mooring systems, and onboard electronics.

UK producers and distributors are prioritizing product customization and technology enhancements to address changing customer demands among boat operators and owners. Spinlock Ltd. and Raymarine are leading the way. Export production and strategic alliances are also adding to overall industry growth. Increased focus on being environmentally friendly and regulatory compliant underlies the usage of energy-efficient light and low-emission propulsive accessories.

France is also positioned to adopt a strong growth pattern in the industry through its long coastline and huge volume of recreational marine traffic. Its maritime tourism sector is the key driver of rising activity in yacht charters and sea cruising. Upmarket marine furnishings, intelligent navigation systems, and efficient anchoring equipment demands by consumers also fuel growth.

Domestic production capacity and robust government support for seaborne infrastructure are key drivers powering the industry. Marina and port infrastructure development and leading industry leaders like Plastimo and Navicom are in charge of developing technologically advanced and regulation-compliant accessories. Marina and port infrastructure development is also driving the industry further by providing greater access to improved boating services and equipment. Higher environmental standards are driving higher adoption of renewable energy-based accessories and green marine technologies.

The German industry is likely to see steady growth as a function of synergy between recreational interest in boating and engineering expertise. The country's inland waterway network, along with growing boating enthusiasm for green ideas, is generating interest in sophisticated fuel systems, batteries, and materials of lighter weight. Quality, durability, and adherence to environmental standards are given the highest priority in the German industry.

Industry leaders like Torqeedo GmbH and BAVARIA Yachtbau GmbH are spearheading industry innovation in the form of electric propulsion and energy management systems. Integration with smart boat apps, such as remote monitoring and automated control systems, is fast becoming more mainstream. Export-driven manufacturing and alliances with global marine accessory manufacturers are fueling growth and establishing Germany as a hub for design and production within the European industry.

Italy's industry is likely to grow steadily with the forces of a strong marine tourism industry and an intense concentration of luxury yacht manufacturers. The nation has a high demand for luxury marine furnishings, design-oriented accessories, and sophisticated electronic systems. Mediterranean coastal tourist seasonal activities boost demands for safety equipment, navigation equipment, and climate control systems.

Italian companies are famous for shipbuilding superiority and interior decoration. A company like Besenzoni and Osculati are generating value for the sector through product differentiation and customization. Global cooperation and export industries are also enhancing Italian companies' competitive positions. Yacht refurbishment and marina redesigns are further enhancing industry potential, especially in the luxury accessory industry.

The South Korean boat accessory industry is likely to develop at a healthy pace with the help of fast-paced developments in marine technology and increasing domestic interest in leisure boating. Government strategic programs for the development of marine tourism and infrastructure are encouraging the implementation of advanced onboard systems and performance-oriented accessories.

Major local industry leaders like Hyundai SeasAll and Wintech Co. Ltd. are making investments in the design of next-generation accessories like hybrid propulsion systems and smart navigation interfaces. Strong production capacity and export competitiveness position South Korea well to meet domestic and global demand. The growing use of automation and digital control solutions for watercraft systems is anticipated to further boost the value proposition of the industry through the coming decade.

Japan's industry is poised for modest but consistent growth, underpinned by a sophisticated marine industry and a high emphasis on innovation. The nation's enthusiasm for small recreational boats and personal watercraft is fueling demand for compact and multi-purpose accessories such as fold-down seats, modular storage, and wireless communication systems.

Top-tier players like Furuno Electric Co., Ltd. and Yamaha Motor Co., Ltd. are initiating technological advancements and fueling complexity in the industry with the implementation of IoT and AI in marine electronics. Even though physical constraints are curbing the growth of big marine infrastructure, city marine recreation facilities are evolving into niche products for accessory purchases. Eco-conservatism is also encouraging environmental and energy-conserving accessories.

China is likely to post the highest CAGR among the ten nations due to growing marine tourism, increasing disposable incomes, and the popularity of recreational boating. Government-organized water sporting events and coastal development projects are driving demand for accessories across a broad range of components, such as safety equipment, leisure systems, and high-end propulsion solutions.

Chinese companies like Weichai Group and Haifei Group are investing in electric drive and automation technology to meet changing industry demands. Joint ventures with foreign marine accessory manufacturers and global collaboration are driving domestic product innovation. With marina development speeding up along the length of major coastlines, demand for sophisticated and specialist accessories is likely to increase exponentially during the forecast period.

The Australian industry for watercraft accessories will also continue to show spectacular growth until 2035 due to the strong culture of marine way of life and extensive coast use. Pleasure boating, eco-tourism, and angling are great drivers of demand for multi-use and weather-proof accessories. Gaining popularity for off-grid and long-distance boating activities is driving the solar-powered systems, navigation gear, and protective gear industry.

The sector gains competitive strength through firm local manufacturing capacity and maritime service sector trading intensity. Firms like Coursemaster Autopilots and Ronstan International play key roles in designing innovative accessory products that are effective enough to facilitate corresponding diverse sea conditions. Its strict regulatory focus towards environmental protection and safety is also conducive to the implementation of compliant, effective accessories into newly built vessels, as well as retrofitting existing ships.

The industry in New Zealand is expected to develop gradually, as it is led by a vibrant yachting culture and a keen emphasis on environmentally friendly marine practices. The geography of the country favors high activity in recreational boating and competitive sailing, thus increasing the demand for light rigging systems, marine electronics, and performance-oriented hardware.

Domestic firms like ENL Group and TruDesign are adding to product innovation, especially corrosion-resistant and low-emission components. Public and private sector investment in marine services and infrastructure is complementing industry growth. Demand for technologically advanced but environmentally compliant accessories will shape industry offerings during the forecast period.

Watercraft accessories have a highly competitive industry, focusing particularly on marine safety, performance enhancement, and durability through leading players. Such established manufacturers include Yamaha Motor Corporation and Bombardier Recreational Products (BRP), which give the industry OEM-grade offerings in navigation systems, safety equipment, and watercraft customization kits. Their strategy is to implement smart technologies, GPS tracking, and advanced material composites in the product line to improve user experience and offer longer vessel value.

Among others, WireCo, Samson Rope Technologies, and TEUFELBERGER manufacture marine rope and mooring solutions, supplying high-performance synthetic as well as steel wire ropes for recreational and commercial vessels. Their focus primarily revolves around innovative materials, corrosion resistance, and durability-increasing their influence through recreational boating-all the way to offshore business.

Alongside this, manufacturers of marine safety and protective gear, such as Covercraft Industries, DAN-FENDER, and the SHEICO group, offer boat covers, fenders, and buoyancy devices. Such manufacturers are at the top with UV-resistant materials, impact absorption, and aerodynamics while leading in protective solutions for watercraft. Emerging brands such as Garware Technical Fibres Ltd. and AXIOM CORDAGES LIMITED are also strengthening their presence in marine ropes and anchoring systems, mainly in developing economies.

Competition in the industry continues to be shaped by smart marine technology, lightweight materials, and increased environmental sustainability. Key players are investing in AI-powered assistance for navigation, eco-friendly materials, and advanced composites for high performance, ensuring that watercraft accessories are suitable for whatever modern recreation or commercial boating may demand.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Yamaha Motor Corporation | 18-22% |

| Bombardier Recreational Products | 14-18% |

| WireCo | 10-14% |

| Samson Rope Technologies | 8-12% |

| Covercraft Industries LLC | 6-10% |

| Combined Others | 30-40% |

| Company Name | Offerings & Activities |

|---|---|

| Yamaha Motor Corporation | OEM watercraft accessories, navigation systems, as well as marine safety gear. |

| Bombardier Recreational Products | Performance-based watercraft accessories, GPS tracking, as well as onboard electronics. |

| WireCo | High-performance synthetic and steel marine ropes for recreational and commercial applications. |

| Samson Rope Technologies | Lightweight, corrosion-resistant mooring and anchor lines with superior load-bearing capacity. |

| Covercraft Industries LLC | UV-resistant boat covers, fenders, and protective marine accessories. |

Key Company Insights

Yamaha Motor Corporation (18-22%)

Yamaha leads the industry with OEM-grade watercraft accessories, integrating advanced navigation, AI-driven safety gear, and high-performance marine components.

Bombardier Recreational Products (14-18%)

BRP focuses on enhanced watercraft performance through smart GPS integration, energy-efficient designs, and durability-focused accessory solutions.

WireCo (10-14%)

WireCo delivers marine-grade synthetic and steel ropes designed for high-tensile strength, corrosion resistance, and long-term durability.

Samson Rope Technologies (8-12%)

Samson specializes in lightweight, high-strength rope solutions tailored for marine applications, including mooring, towing, and anchor support.

Covercraft Industries LLC (6-10%)

Covercraft provides weather-resistant, UV-protected marine covers and fender solutions, enhancing watercraft longevity and protection.

Other Key Players

By type, the industry is categorized into life vest, tow ropes, boat dock line & storage, boat fenders, boat cover, and others.

By end use, he industry is segmented into military & defense, amusement parks, professional & hobbyist, coastal tourism & shipping company, offshore vessel, and cargo logistics.

By sales channel, the industry is divided into online and offline. Offline is further categorized into multi brand store and specialty store.

By region, the industry is segmented into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and Middle East & Africa.

The industry size is estimated to be USD 8.2 billion in 2025.

Sales are projected to reach USD 15.7 billion by 2035, indicating significant growth over the forecast period.

China is expected to grow at a rate of 7.4.

Life vests are a key segment contributing to demand within the watercraft accessories space.

Major players include Yamaha Motor Corporation, Bombardier Recreational Products, WireCo, Samson Rope Technologies, Covercraft Industries LLC, TEUFELBERGER, DAN-FENDER, SHEICO Group, Garware Technical Fibres Ltd., Manson Anchors Limited, AXIOM CORDAGES LIMITED, IRM Offshore and Marine Engineers, BEXCO NV, Kawasaki Motors Corp., Attwood Corporation, Gottifredi Maffioli S.r.l., Gleistein GmbH, and Greenfield Products Inc.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Type, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Type, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Type, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Type, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Type, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 21: Global Market Attractiveness by Type, 2023 to 2033

Figure 22: Global Market Attractiveness by End Use, 2023 to 2033

Figure 23: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 45: North America Market Attractiveness by Type, 2023 to 2033

Figure 46: North America Market Attractiveness by End Use, 2023 to 2033

Figure 47: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Type, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by End Use, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Type, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by End Use, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by End Use, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Type, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by End Use, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by End Use, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 166: East Asia Market Attractiveness by End Use, 2023 to 2033

Figure 167: East Asia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Type, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by End Use, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Type, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by End Use, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by Sales Channel, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Personal Watercraft Jet Ski Market Size and Share Forecast Outlook 2025 to 2035

Personal Watercraft Market Growth - Trends & Forecast 2025 to 2035

Car Accessories Market Size and Share Forecast Outlook 2025 to 2035

Bar Accessories Market

Jack Accessories Market Size and Share Forecast Outlook 2025 to 2035

Dock Accessories Market Size and Share Forecast Outlook 2025 to 2035

Golf Accessories Market Size and Share Forecast Outlook 2025 to 2035

Apple Accessories Market Report – Demand, Trends & Forecast 2025–2035

Cable Accessories Market Growth - Trends & Forecast 2025 to 2035

E-Bike Accessories Market Size and Share Forecast Outlook 2025 to 2035

Travel Accessories Market Analysis by Product Type, Material, Distribution Channel, End-User and Region 2025 to 2035

Key Players & Market Share in Laptop Accessories Market

Camera Accessories Market Trends - Growth & Forecast 2024 to 2034

Laptop Accessories Market Growth – Size, Trends & Forecast 2024-2034

Fashion Accessories Packaging Market Size and Share Forecast Outlook 2025 to 2035

Smoking Accessories Market Analysis – Growth & Forecast 2025 to 2035

Industry Share Analysis for Fashion Accessories Packaging Companies

Air Fryer Accessories Market Size and Share Forecast Outlook 2025 to 2035

Stretcher Accessories Market Size and Share Forecast Outlook 2025 to 2035

Drinkware Accessories Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA