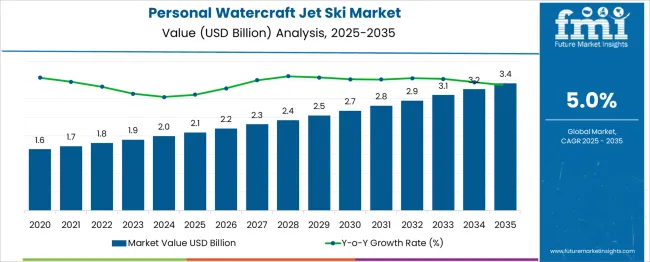

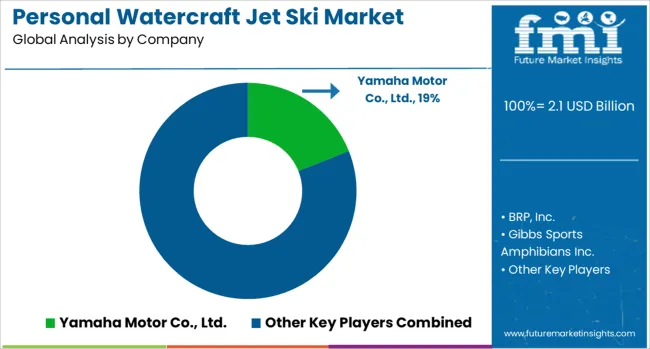

The Personal Watercraft Jet Ski Market is estimated to be valued at USD 2.1 billion in 2025 and is projected to reach USD 3.4 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

While the dataset reflects absolute growth across the forecast horizon, a market share erosion or gain analysis requires assessing this trajectory relative to broader marine recreation and powersports segments. If the overall marine leisure sector grows at a slower pace, typical of mature boating categories, Jet Skis are positioned for market share gain, as their projected USD 1.3 billion absolute increase represents a faster-than-average expansion. The period from 2025–2030 shows consistent annual increments of USD 0.1–0.2 billion, supported by replacement purchases, rental fleet upgrades, and expanding participation in coastal tourism. This stability helps maintain or marginally increase share in the short term. The 2030–2035 phase accelerates slightly, adding USD 0.5 billion over five years, driven by lightweight electric models, improved fuel efficiency, and rising adoption in inland water destinations. If competitive segments such as cabin cruisers or sailboats grow more slowly, Jet Skis could command a larger proportion of marine leisure revenues. The predictable and steady upward curve, the data indicates a gradual market share gain scenario, contingent on outperforming the broader marine leisure category’s growth rate.

| Metric | Value |

|---|---|

| Personal Watercraft Jet Ski Market Estimated Value in (2025 E) | USD 2.1 billion |

| Personal Watercraft Jet Ski Market Forecast Value in (2035 F) | USD 3.4 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The personal watercraft jet ski market is viewed as a niche yet steadily expanding category within its parent industries. It is estimated to account for about 1.7% of the global marine recreational vehicles market indicating rising interest in personal leisure vessels. Within the recreational boating market, a share of approximately 2.4% is assessed driven by purchases of jet skis and personal watercraft. In the powersports equipment industry about 3.1% is observed reflecting demand for high performance and branded watercraft.

Within the outdoor and lifestyle leisure goods sector around 2.0% is calculated supported by tourism and rental business segments. In the electric and hybrid marine propulsion systems market a share of roughly 1.3% is evaluated as electrified personal watercraft gain attention. Trends in this market have been shaped by rising demand for high powered and high speed models with integrated safety features. Innovations have been focused on electric personal watercraft variants featuring battery packs and zero emission propulsion. Interest has increased in connected watercraft with digital dashboards GPS based navigation and app enabled maintenance alerts. The North America region has been observed to lead demand while Asia Pacific has shown rapid adoption of electric formats. Strategic initiatives have included collaborations between jet ski manufacturers and battery technology firms to deliver electric jet ski models with modular battery swap and fast charging systems.

The personal watercraft (jet ski) market is witnessing steady growth, driven by the expanding recreational boating sector, higher disposable incomes, and increased interest in adventure marine sports. Rising awareness of coastal tourism, coupled with improved water infrastructure and rental ecosystems, has spurred adoption among occasional users and tourists.

Jet skis are increasingly seen as versatile vessels for both leisure and sport, supported by innovations in design, safety features, and fuel efficiency. Furthermore, governmental support for marine tourism and the establishment of jet ski training centers across coastal regions are enabling new consumer segments to participate.

Technological advancements in maneuverability, eco-conscious engines, and ergonomic seating are further enhancing the customer experience, supporting long-term market momentum.

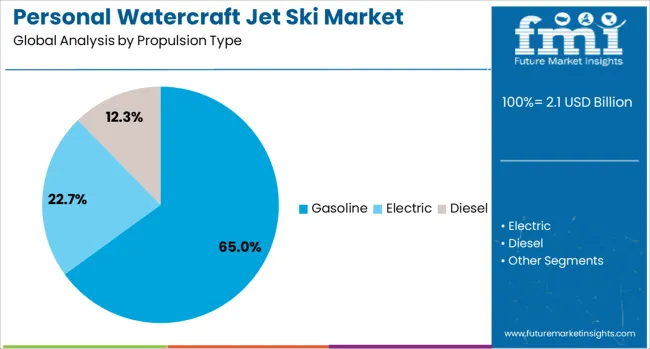

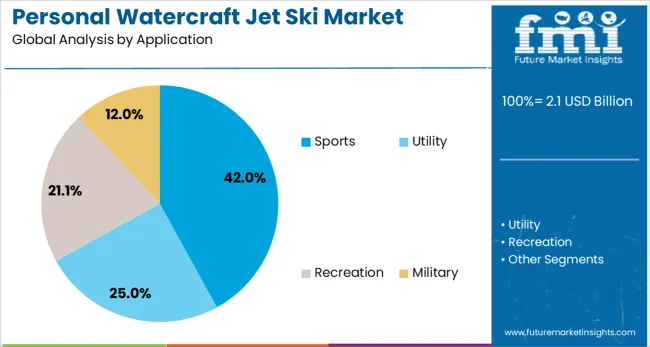

The personal watercraft jet ski market is segmented by propulsion type, application, and geographic regions. By propulsion type, the personal watercraft jet ski market is divided into Gasoline, Electric, and Diesel. In terms of application, the personal watercraft jet ski market is classified into Sports, Utility, Recreation, and Military. Regionally, the personal watercraft jet ski industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Gasoline-powered personal watercraft are projected to dominate the propulsion segment with a 65.00% market share in 2025. This dominance is attributed to their high power output, extended range, and wide consumer familiarity.

Despite environmental concerns, gasoline engines remain the preferred choice for performance enthusiasts and rental operators due to their superior speed, rapid acceleration, and established maintenance networks. Manufacturers continue to improve engine efficiency and emissions standards compliance, balancing regulatory demands with rider expectations.

Additionally, the lower upfront cost compared to electric alternatives further cements gasoline’s position in mass-market usage, particularly in recreational and sporting contexts.

The sports segment is forecast to account for 42.00% of the personal watercraft market by 2025, making it the leading application type. This growth is driven by the surge in water-based adventure activities, growing participation in jet ski racing events, and rising popularity of performance-based riding experiences.

Consumers are increasingly seeking agile, powerful craft capable of sharp turns and high-speed operations. Product innovations such as enhanced hull designs, digital control systems, and sports-specific customization options are boosting the appeal of sports-focused models.

Furthermore, the influence of water sports influencers, YouTube content, and tourism packages that include performance riding options are accelerating segment demand.

Personal watercraft jet ski demand has been increasing in recreational boating, marine tourism, and water sports rental businesses due to their maneuverability, speed, and compact design. These vessels are being used for both leisure and light-duty rescue operations in coastal areas. Growth has been supported by expanding marine leisure infrastructure and wider product availability in multiple engine capacities. Manufacturers have been introducing models with improved fuel efficiency, advanced safety features, and rider comfort enhancements. Seasonal tourism peaks and rental fleet expansions have driven consistent unit sales in key markets.

The expansion of marine tourism activities and organized water sports events has boosted the adoption of personal watercraft jet skis. Rental service providers in coastal destinations such as Florida, the Mediterranean, and Southeast Asia have been adding larger fleets to meet seasonal surges in visitor numbers. Lightweight designs and intuitive controls have enabled operators to cater to beginners as well as experienced riders. Jet skis with seating for two or three passengers have been preferred for family and group use in rental operations. Reliability, ease of maintenance, and fuel economy have been important considerations for fleet operators seeking to maximize return on investment. Promotional packages that combine guided tours with jet ski rental have also increased usage rates. Tourism authorities have noted that the availability of well-maintained rental fleets enhances destination appeal, reinforcing demand for new and upgraded units among commercial operators.

Personal watercraft models have incorporated advanced technologies to improve rider experience, fuel efficiency, and operational safety. Manufacturers in Japan, the United States, and Europe have introduced electronic braking systems, variable trim controls, and smart throttle responses to enable better handling in varied water conditions. Hull designs have been optimized for stability at high speeds while maintaining agility for sharp maneuvers. GPS-enabled navigation and theft-prevention systems have been integrated into premium models. Fuel-efficient four-stroke engines have replaced older two-stroke designs in many markets, reducing emissions and maintenance needs. Some models have been equipped with eco-mode settings to optimize fuel use during cruising. Rider safety features, such as reboarding steps and adjustable handlebars, have been prioritized to cater to diverse user groups. These advancements have contributed to strong consumer confidence in the latest generation of personal watercraft.

Demand for personal watercraft jet skis has extended beyond tourism rentals to include private ownership for leisure and competitive sports. Enthusiasts have been purchasing high-performance models for racing events, freestyle tricks, and offshore endurance rides. Recreational buyers have been drawn to compact storage needs and ease of transport on trailers. Clubs and sports associations have organized regional competitions, creating additional exposure for the segment. Lifestyle marketing by manufacturers showcasing coastal adventure and marine exploration has resonated with younger demographics seeking outdoor experiences. Entry-level models have been positioned to attract first-time buyers, while premium performance models target experienced riders. This diversification of applications across leisure and sport has broadened the consumer base, reinforcing steady demand even in off-peak tourism seasons.

The market for personal watercraft jet skis has been constrained by high initial purchase costs, seasonal usage patterns, and operational restrictions in certain waterways. Premium models with advanced features can be prohibitively expensive for individual buyers, limiting adoption to higher-income segments. In colder climates, the short operational season reduces annual usage, affecting purchase justification for private owners. Environmental and noise regulations in some coastal and inland waterways have restricted jet ski operation or required compliance with stricter emission standards, adding to ownership costs. Insurance requirements, storage fees, and maintenance expenses have also deterred budget-conscious consumers. Without broader access to affordable models, year-round usage opportunities, and harmonized regulatory frameworks, adoption in certain regions may remain focused on tourism rentals and niche enthusiast segments rather than mass-market penetration.

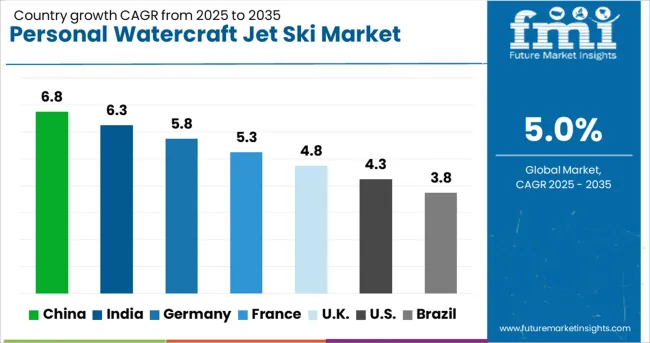

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

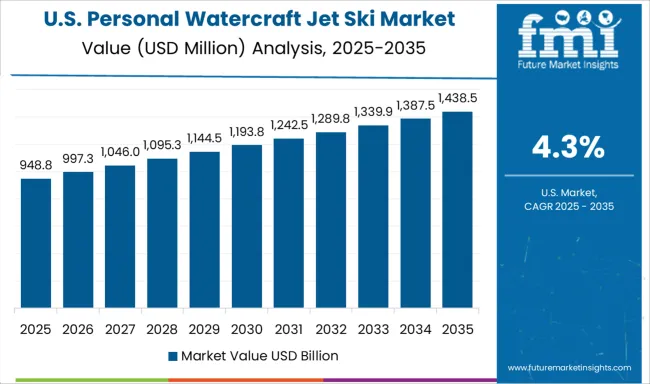

| USA | 4.3% |

| Brazil | 3.8% |

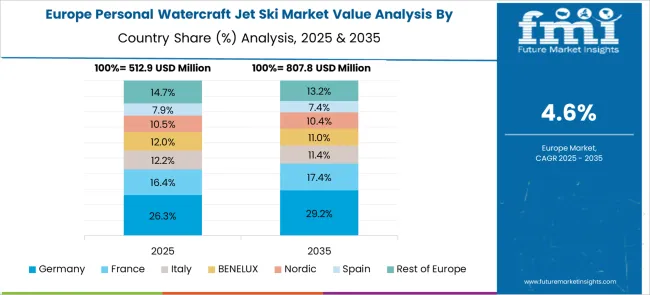

The personal watercraft jet ski market is expected to grow at a global CAGR of 5.0% between 2025 and 2035, supported by rising recreational water sports activities, tourism sector growth, and product innovations in performance and safety. China leads with a 6.8% CAGR, driven by expanding domestic manufacturing and increasing coastal leisure infrastructure. India follows at 6.3%, fueled by growing water adventure tourism and marina developments. Germany, at 5.8%, benefits from advanced engineering and high-quality exports. The UK, projected at 4.8%, sees growth from rising demand in coastal holiday destinations. The USA, at 4.3%, reflects steady recreational boating and rental service adoption. The report provides insights for 40+ countries, with the five below highlighted for their strategic importance and growth outlook.

China is projected to grow at a CAGR of 6.8% from 2025 to 2035 in the personal watercraft jet ski market, supported by rising interest in marine leisure activities and expansion of coastal tourism hubs. Manufacturers such as Jieshun Boat Manufacturing and Haidex Group are introducing high-performance, fuel-efficient models tailored for both recreational and rental segments. Growth in luxury coastal resorts in Hainan and Guangdong is fueling demand for premium jet skis. Import partnerships with brands like Yamaha and Kawasaki are expanding product variety, while domestic production capacity is also increasing to meet rising consumer demand.

India is expected to achieve a CAGR of 6.3% from 2025 to 2035, driven by growth in coastal tourism, water sports festivals, and resort-based leisure facilities. Key players such as Aquarius Watercrafts and Aqua Motors are introducing entry-level jet skis targeting rental operators and individual buyers. Goa, Kerala, and Andaman Islands are emerging as major hotspots for personal watercraft activities. Increasing participation in adventure tourism packages that include jet ski rides is driving sales, while collaborations with international brands are enhancing product availability in the domestic market.

Germany is projected to post a CAGR of 5.8% from 2025 to 2035, supported by growing popularity of inland lake and river water sports. Dealers and distributors of brands like Sea-Doo and Yamaha are offering advanced electric and hybrid-powered jet skis, catering to eco-conscious consumers. Demand is also increasing for high-torque models used in professional sporting events. Enhanced safety features and GPS tracking systems are becoming standard in new models, meeting the requirements of regulated waterways. The rental segment in Bavaria and Mecklenburg Lake District continues to be a significant revenue driver.

The United Kingdom is forecasted to record a CAGR of 4.8% from 2025 to 2035, driven by growth in marine leisure tourism and private watercraft ownership. Suppliers such as Boats.co.uk and Gibbs Sports are expanding offerings of luxury and performance-focused jet skis. Popular water sports destinations like Cornwall, Dorset, and the Scottish coast are seeing increased rental fleet deployments. Demand for models with enhanced stability and fuel efficiency is on the rise, as they cater to both beginners and experienced riders. The presence of seasonal marine festivals is also boosting short-term demand.

The United States is expected to grow at a CAGR of 4.3% from 2025 to 2035, supported by strong recreational boating culture and an extensive network of lakes and coastal waterways. Major brands such as Yamaha, Kawasaki, and BRP Sea-Doo dominate the market with diverse model ranges targeting both high-performance enthusiasts and family leisure riders. States like Florida, California, and Texas lead in jet ski registrations and rentals. Increasing demand for tow-sport-compatible personal watercraft is also contributing to market growth. Aftermarket customization for speed, aesthetics, and comfort is becoming a popular trend among owners.

The personal watercraft (PWC) jet ski market is led by globally recognized powersports and marine mobility brands offering a wide range of models for recreational, sport, and utility use. Yamaha Motor Co., Ltd. and Kawasaki Corporation remain dominant with extensive portfolios covering entry-level, performance, and luxury PWC models, supported by dealer networks and continuous model refreshes. BRP, Inc., under its Sea-Doo brand, leads in design innovation and user-focused features such as intelligent braking and reverse systems, appealing to both leisure and competitive riders.

Honda Motor Co., Ltd. maintains a presence with durable, fuel-efficient PWC models, while Polaris, Inc. has expanded its offerings with watercraft designed for versatility and towing capabilities. Gibbs Sports Amphibians Inc. occupies a niche with amphibious personal watercraft that operate both on land and water. Kymco and Mar Sea serve regional markets with cost-competitive options targeting new entrants into the PWC segment. Redline Performance Products focuses on high-performance units tailored for racing and specialized applications.

Manufacturers employ strategies including partnerships with marine sports events, expansion of after-sales service networks, and incremental technology upgrades in hull design, propulsion systems, and onboard electronics. Competitive positioning is influenced by brand reputation, dealer coverage, and the ability to deliver performance enhancements year over year. Entry into the market is challenged by high R&D costs, stringent marine safety compliance requirements, and entrenched customer loyalty to established brands.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.1 Billion |

| Propulsion Type | Gasoline, Electric, and Diesel |

| Application | Sports, Utility, Recreation, and Military |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Yamaha Motor Co., Ltd., BRP, Inc., Gibbs Sports Amphibians Inc., Honda Motor Co., Ltd., Kawasaki Corporation, Kymco, Mar Sea, Polaris, Inc., and Redline Performance Products |

The global personal watercraft jet ski market is estimated to be valued at USD 2.1 billion in 2025.

The market size for the personal watercraft jet ski market is projected to reach USD 3.4 billion by 2035.

The personal watercraft jet ski market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in personal watercraft jet ski market are gasoline, electric and diesel.

In terms of application, sports segment to command 42.0% share in the personal watercraft jet ski market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Personal Fitness Training Software Market Size and Share Forecast Outlook 2025 to 2035

Personal Emergency Response System (PERS) Market Size and Share Forecast Outlook 2025 to 2035

Personal Care Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Personal Protective Equipment Market Size and Share Forecast Outlook 2025 to 2035

Personality Assessment Solution Market Size and Share Forecast Outlook 2025 to 2035

Personalized Immunotherapy Market Size and Share Forecast Outlook 2025 to 2035

Personal Care Appliances Market Size and Share Forecast Outlook 2025 to 2035

Personal Navigation Devices Market Size and Share Forecast Outlook 2025 to 2035

Personal Genome Testing Market Size and Share Forecast Outlook 2025 to 2035

Personalized Packaging Market Size and Share Forecast Outlook 2025 to 2035

Personalized Toys Market Size and Share Forecast Outlook 2025 to 2035

Personal Care Wipes Market Size and Share Forecast Outlook 2025 to 2035

Personalized Nutrition Market - Size, Share, and Forecast Outlook 2025 to 2035

Personal Mobility Devices Market Analysis - Trends, Growth & Forecast 2025 to 2035

Personalized Beauty Devices Market Trends - Growth & Forecast 2025 to 2035

Personalized Bakery Products Market Analysis by Product Type, Price Range, Sales Channel, End-User and Region 2025 to 2035

Personal CRM Market Report - Growth & Forecast 2025 to 2035

Personal Care and Cosmetics Microalgae Market - Beauty & Skincare Trends 2025 to 2035

Personalized Medicine Market is segmented by Personalized Medicine Diagnostics, Medicine Therapeutics, and Medical Care from 2025 to 2035

Personal Fitness Trainer Market - Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA