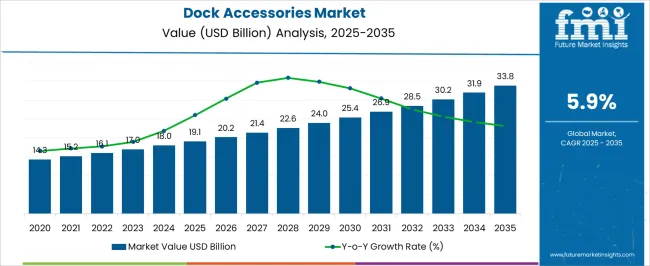

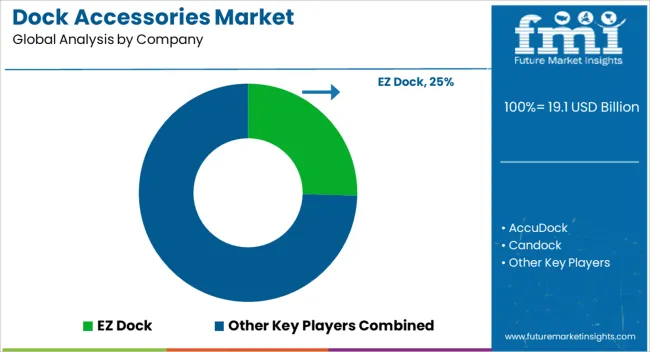

The dock accessories market is estimated to be valued at USD 19.1 billion in 2025 and is projected to reach USD 33.8 billion by 2035, registering a compound annual growth rate (CAGR) of 5.9% over the forecast period.

The dock accessories sector is projected to increase from USD 19.1 billion in 2025 to USD 33.8 billion in 2035, recording a CAGR of 5.9%. The CAGR curve highlights consistent expansion, with values progressing from 19.1 billion in 2025 to 22.6 billion in 2028 and 25.4 billion by 2030. This trajectory reflects the growing role of dock equipment, lifts, bumpers, and safety gear in ensuring efficiency and reliability across marine, logistics, and commercial applications. Analysts argue that the CAGR curve points to dependable growth, where replacement cycles and infrastructure upgrades reinforce steady demand. The industry outlook is widely viewed as resilient. By 2031, values are expected to reach 26.9 billion, advancing to 30.2 billion in 2033 and closing at 33.8 billion by 2035.

The CAGR progression suggests stability supported by continuous investment in ports, warehouses, and waterway facilities. Observers suggest that the curve underscores the importance of dock accessories as long-term assets, with product durability, safety compliance, and operational adaptability driving purchases. The expansion pattern confirms that while growth is incremental, it is firmly grounded in consistent use across diverse end users. The CAGR outlook reflects confidence in dock accessories as indispensable components of global trade and marine operations.

| Metric | Value |

|---|---|

| Dock Accessories Market Estimated Value in (2025 E) | USD 19.1 billion |

| Dock Accessories Market Forecast Value in (2035 F) | USD 33.8 billion |

| Forecast CAGR (2025 to 2035) | 5.9% |

The dock accessories segment is estimated to contribute nearly 15% of the marine equipment market, about 12% of the waterfront infrastructure market, close to 18% of the boating and recreational marine market, nearly 10% of the cargo and port handling equipment market, and around 9% of the coastal construction materials market. Collectively, this equals an aggregated share of approximately 64% across its parent categories. This proportion highlights the indispensable role of dock accessories in ensuring functionality, safety, and durability of waterfront facilities, whether for leisure marinas, commercial shipping docks, or coastal infrastructure projects. Their importance is evident in applications such as ladders, bumpers, fenders, cleats, and anchoring systems, which provide structural stability and operational reliability. Analysts view dock accessories not as peripheral additions but as essential enablers of marine infrastructure efficiency, directly influencing safety compliance and user experience. Demand has been reinforced by the expansion of recreational boating, modernization of port facilities, and ongoing investments in waterfront development. Their share within parent markets reflects how dock accessories bridge both commercial and leisure applications, creating consistent demand across industries. The segment is therefore considered a cornerstone in marine infrastructure planning, shaping procurement strategies and influencing construction designs. As a result, dock accessories remain integral to broader marine and waterfront markets, consolidating their role as a category that delivers both operational necessity and value-driven differentiation.

The market is experiencing sustained expansion, supported by the growing demand for waterfront infrastructure and the rising popularity of recreational boating activities. The current market scenario is shaped by increased investments in marina development, residential waterfront properties, and commercial docking facilities.

Advancements in material engineering, design innovation, and product customization have enhanced the durability and functionality of dock accessories, making them more adaptable to diverse environmental conditions. The future outlook is driven by the need for safer docking solutions, aesthetic enhancements, and long-lasting products that can withstand heavy usage and weather exposure.

The market is also benefiting from a surge in water-based tourism, the modernization of port facilities, and a shift toward eco-friendly materials As consumer preferences lean toward quality, safety, and long-term value, manufacturers are focusing on modular, easily installable solutions that can be upgraded or replaced with minimal disruption, thereby ensuring continuous growth potential.

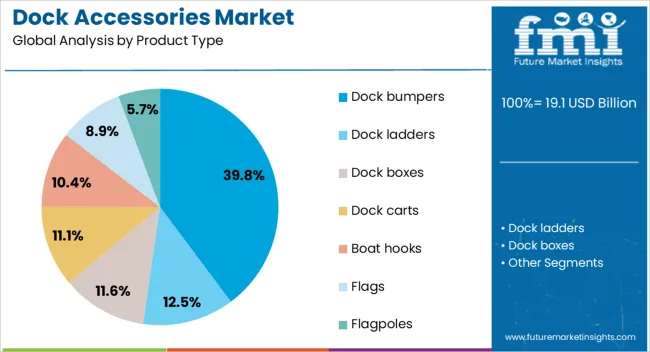

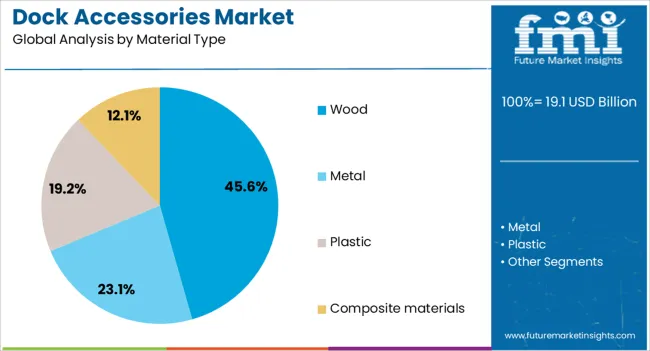

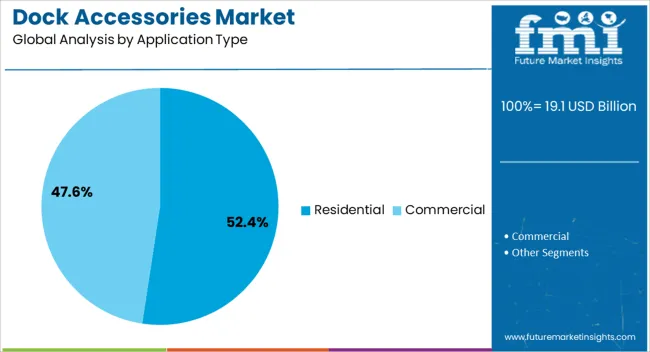

The dock accessories market is segmented by product type, material type, application type, and geographic regions. By product type, dock accessories market is divided into dock bumpers, dock ladders, dock boxes, dock carts, boat hooks, flags, and flagpoles. In terms of material type, dock accessories market is classified into wood, metal, plastic, and composite materials. Based on application type, dock accessories market is segmented into residential and commercial. Regionally, the dock accessories industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The dock bumpers segment is projected to account for 39.8% of the dock accessories market revenue in 2025, making it the leading product type. This dominance is being attributed to the critical role dock bumpers play in protecting vessels and dock structures from impact damage.

The high adoption rate is supported by their necessity in both residential and commercial docking environments, where frequent docking activities occur. Their ability to extend the lifespan of docks and reduce maintenance costs has increased their preference among dock owners.

The availability of various designs, sizes, and materials to suit different vessel types and environmental conditions has further supported demand With growing awareness of preventive maintenance and property protection, dock bumpers have become a standard installation across new and upgraded docks, reinforcing their strong position in the market.

The wood material segment is expected to capture 45.6% of the market revenue in 2025, making it the largest material type category. This leadership is being driven by the traditional preference for wood in dock construction due to its natural appearance, structural strength, and ease of customization.

Wood offers a blend of durability and aesthetic value, which aligns well with residential and recreational waterfront environments. The availability of treated wood options that resist rot, pests, and water damage has further enhanced its appeal.

Additionally, wood remains cost-effective compared to certain synthetic alternatives, making it a practical choice for a broad range of buyers The continued use of wood in both new dock builds and renovations has sustained its demand, particularly in markets where natural materials are favored for environmental integration and visual harmony with surrounding landscapes.

The residential application segment is anticipated to hold 52.4% of the market revenue in 2025, representing the largest share by application. This prominence is being fueled by the increasing number of private waterfront properties and the rising trend of residential boat ownership.

Homeowners are investing in dock accessories to improve safety, functionality, and visual appeal for personal use and to enhance property value. The demand is further supported by the popularity of leisure boating, fishing, and water sports in residential communities.

Customizable and easy-to-install dock accessories have enabled homeowners to tailor their docks to specific needs without significant construction work As disposable incomes rise and lifestyle preferences shift toward water-oriented recreation, the residential segment is expected to maintain its leading position through continued adoption of high-quality, aesthetically pleasing, and durable dock accessories.

The dock accessories market is projected to expand steadily, supported by increasing investments in waterfront infrastructure, marinas, and recreational boating facilities. Demand is reinforced by the need for durable, weather-resistant equipment such as ladders, bumpers, cleats, and mooring systems. Opportunities are emerging in modular dock solutions, premium materials, and customization for leisure and commercial applications. Trends highlight floating docks, eco-compliant coatings, and digital monitoring systems for dock safety. However, challenges such as high maintenance costs, raw material volatility, and seasonality in recreational boating continue to influence adoption patterns worldwide.

Demand for dock accessories has been reinforced by the growth of recreational boating and the expansion of commercial waterfront facilities. Marinas, harbors, and private docks increasingly require reliable accessories such as ladders, fenders, and mooring cleats to ensure safety and ease of use. Opinions suggest that demand is strongest in regions with established boating cultures, such as North America and Europe, where leisure activities drive significant spending. Commercial shipping docks also contribute to demand, particularly for heavy-duty accessories that withstand constant usage. The replacement cycle of dock equipment has further supported steady consumption, as owners prioritize durability and safety. With recreational boating gaining momentum in emerging economies, demand for high-quality dock accessories is becoming more globalized, reflecting their role as indispensable components of both leisure and commercial waterfront infrastructure.

Opportunities in the dock accessories market are expanding through modular dock systems, premium material usage, and customized solutions. Modular docks allow flexibility for marinas and private owners to expand or reconfigure layouts according to changing needs. Opinions highlight that premium materials such as aluminum, stainless steel, and composite plastics are creating opportunities for suppliers targeting long-term durability and low maintenance. Customization, including tailored designs for luxury waterfront properties and resorts, is opening niche growth avenues. Growth in emerging markets with rising tourism is also providing opportunities for dock accessory suppliers. Aftermarket services, including seasonal maintenance and upgrades, represent an additional revenue stream. These opportunities illustrate how suppliers who innovate with modularity, durability, and customization can secure competitive advantages in a market that values both functionality and aesthetics.

Trends in the dock accessories market emphasize material innovation, floating dock adoption, and enhanced safety features. Composite and recycled materials are trending as alternatives to traditional wood, offering better resistance to corrosion, rot, and marine growth. Floating docks are gaining popularity due to their adaptability to changing water levels and ease of installation. Opinions suggest that safety-driven accessories such as non-slip ladders, dock bumpers, and illuminated cleats are trending strongly in both residential and commercial applications. Digital monitoring systems, including water-level sensors and smart lighting, are also gaining traction as marina operators seek efficiency and safety improvements. The integration of dock accessories into broader marina management solutions is another visible trend. These shifts highlight how dock accessories are evolving from basic utility items into advanced, safety-focused, and design-oriented infrastructure components.

Challenges in the dock accessories market revolve around raw material price volatility, high maintenance costs, and seasonality in recreational boating. Steel, aluminum, and polymer price fluctuations directly affect manufacturing margins, making cost management difficult for suppliers. Opinions emphasize that maintenance costs remain high, as dock accessories are exposed to constant wear from saltwater, UV radiation, and heavy usage. Seasonality poses another challenge, with demand peaking in summer months and declining in off-seasons, particularly in colder regions. Smaller suppliers face intense competition from established brands offering diversified product ranges and stronger warranties. Regulatory hurdles concerning marine safety standards and environmental restrictions also complicate adoption in certain regions. These constraints underline that while demand for dock accessories is consistent, long-term growth depends on overcoming cyclical demand patterns, improving product durability, and managing supply chain challenges effectively.

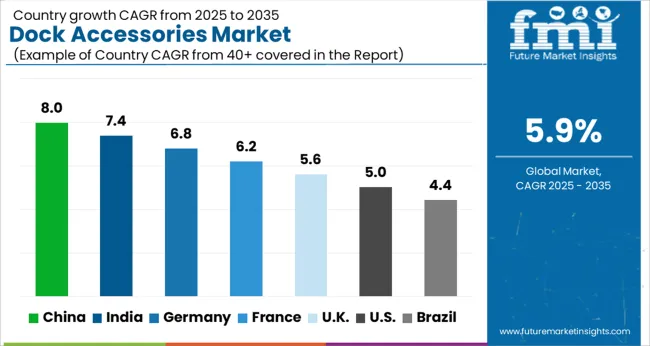

| Country | CAGR |

|---|---|

| China | 8.0% |

| India | 7.4% |

| Germany | 6.8% |

| France | 6.2% |

| U.K. | 5.6% |

| U.S. | 5.0% |

| Brazil | 4.4% |

The global dock accessories market is projected to expand at a CAGR of 5.9% from 2025 to 2035. China leads at 8.0%, followed by India at 7.4% and France at 6.2%. The United Kingdom is expected to grow at 5.6%, while the United States records the slowest growth at 5.0%. Expansion is driven by demand for marine infrastructure upgrades, recreational boating activities, and safety compliance in docking facilities. Asia dominates due to cost competitive manufacturing and expanding port infrastructure, while Europe emphasizes quality standards, customization, and environmentally safe materials. The U.S. reflects steady but slower progress, where growth is shaped by replacement cycles, marina modernization, and adoption of durable, corrosion resistant accessories. This report includes insights on 40+ countries; the top markets are shown here for reference.

The dock accessories market in China is forecast to grow at a CAGR of 8.0%. Growth is supported by rising investments in port modernization, expansion of marinas, and strong domestic production of marine hardware. Chinese manufacturers provide competitively priced accessories including ladders, cleats, bumpers, and decking solutions for both domestic and export markets. Recreational boating activities are increasing in coastal provinces, reinforcing demand for high quality dock equipment. Government backed infrastructure projects in inland waterways also create steady opportunities. With large scale manufacturing and rising consumption, China is positioned as the global leader in dock accessories.

The dock accessories market in India is projected to expand at a CAGR of 7.4%. Growth is influenced by development of coastal infrastructure, expansion of fishing harbors, and rising popularity of water sports and recreational boating. Domestic production capacity is increasing, with local firms offering cost effective accessories tailored for varied climatic conditions. Government initiatives to boost tourism and strengthen maritime trade create additional opportunities. While industrial docks drive large scale demand, leisure boating infrastructure steadily contributes to growth. India’s strong coastline and growing marine economy reinforce its emerging role in the global dock accessories landscape.

The dock accessories market in France is expected to grow at a CAGR of 6.2%. Expansion is shaped by demand for marina upgrades, recreational boating activities, and compliance with EU safety standards. French consumers prioritize durable and premium quality dock accessories, including composite decking, cleats, and fenders. Growth is also supported by coastal tourism, which drives investments in modern docking facilities. Domestic manufacturers emphasize eco friendly and corrosion resistant materials to meet consumer expectations. France’s long coastline and vibrant recreational boating culture secure steady adoption of dock accessories across both domestic and tourist driven markets.

The dock accessories market in the UK is forecast to grow at a CAGR of 5.6%. Growth is supported by refurbishment of existing marina infrastructure, expansion of leisure boating, and rising demand for modular docking solutions. Imports play a significant role, as UK distributors source advanced and premium grade accessories from European suppliers. Rising coastal tourism and steady use of small craft and sailing boats reinforce market momentum. Safety standards and compliance with marine regulations ensure consistent adoption of high quality accessories. While slower compared to Asia and France, the UK maintains stable demand driven by leisure and marina upgrades.

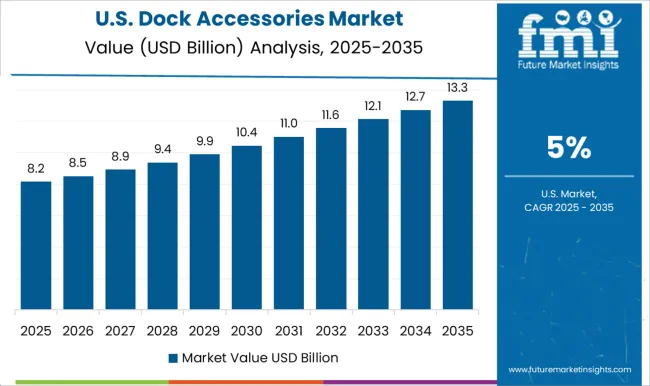

The dock accessories market in the US is projected to grow at a CAGR of 5.0%. Growth is moderate, shaped by a mature marine infrastructure, but steady adoption is supported by replacement cycles and modernization of marinas. Rising consumer interest in recreational boating and waterfront properties maintains consistent demand. Domestic manufacturers emphasize durable, corrosion resistant, and weather resilient products tailored for diverse coastal and inland waterways. While growth lags Asia and Europe, steady consumer demand and marina upgrades position the U.S. as a stable market for premium dock accessories.

Competition in dock accessories has been anchored on how brochures frame durability, modularity, and ease of installation. EZ Dock, Candock, and PolyDock Products present catalogues that emphasize floating modular sections, slip-resistant surfaces, and low-maintenance polyethylene builds. Shoremaster and Pier Pleasure highlight brochures showing sectional docks with aluminum frames, adjustable legs, and integrated lift systems, positioning flexibility as a selling point. AccuDock and Ingemar stress customization in brochures, offering layouts for marinas, residential docks, and commercial waterfronts. Dock Edge, Taylor Made Products, and Permafloat showcase accessories such as bumpers, cleats, ladders, and floats, with brochures detailing UV resistance, marine-grade polymers, and tested load ratings.

Great Northern Docks and Marine Dock & Lift compete through brochures highlighting regional craftsmanship and heavy-duty frames suited for harsh climates. Each brochure acts as both a specification manual and a visual guide, balancing technical assurances with lifestyle imagery of waterfront leisure. Strategy has revolved around brochure clarity that reduces complexity for buyers ranging from homeowners to marina operators. Brochures present tables with buoyancy ratings, anchoring methods, connector systems, and warranty terms, making comparison easy. Ironwood Pacific, Dock Builders Supply, and HarborWare position brochures around specialized accessories, stressing quick-install kits, corrosion resistance, and compatibility with multiple dock systems.

Tiger Docks and Voyager Dock market brochures focused on turnkey packages for commercial projects, emphasizing scalability and safety certifications. PlayPower Inc. extends competition by integrating dock accessories into recreation-focused catalogues, blending functionality with leisure branding. Competitive advantage is secured when brochures demonstrate resilience under varying water conditions, provide transparent installation instructions, and outline long-term value. In this market, brochures decide the contest by turning technical data, visual layouts, and accessory reliability into clear, trusted purchase guidance.

| Item | Value |

|---|---|

| Quantitative Units | USD 19.1 billion |

| Product Type | Dock bumpers, Dock ladders, Dock boxes, Dock carts, Boat hooks, Flags, and Flagpoles |

| Material Type | Wood, Metal, Plastic, and Composite materials |

| Application Type | Residential and Commercial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | EZ Dock, AccuDock, Candock, Delidocks, Dock Builders Supply, Dock Doctor, Dock Edge, Great Northern Docks, HarborWare, Ingemar, Ironwood Pacific, Marine Dock & Lift, Permafloat, Pier Pleasure, PlayPower Inc., PolyDock Products, Shoremaster, Taylor Made Products, Tiger Docks, and Voyager Dock |

| Additional Attributes | Dollar sales by product type (ladders, bumpers, cleats, dock boxes, fenders, lighting), Dollar sales by application (residential docks, commercial marinas, industrial waterfronts), Trends in demand for modular, corrosion-resistant, and UV-stable dock accessories, Role of accessories in improving safety, durability, and functionality of docking systems, Growth driven by recreational boating, marina expansions, and waterfront infrastructure upgrades, Regional consumption patterns across North America, Europe, and Asia Pacific. |

The global dock accessories market is estimated to be valued at USD 19.1 billion in 2025.

The market size for the dock accessories market is projected to reach USD 33.8 billion by 2035.

The dock accessories market is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in dock accessories market are dock bumpers, dock ladders, dock boxes, dock carts, boat hooks, flags and flagpoles.

In terms of material type, wood segment to command 45.6% share in the dock accessories market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Docketing Solution Market Size and Share Forecast Outlook 2025 to 2035

Docking Station Market Analysis - Size, Share, and Forecast 2025 to 2035

Dock Fender Market

Haddock Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Floating Docks Market Size and Share Forecast Outlook 2025 to 2035

Marine & Dock Gangways Market Size and Share Forecast Outlook 2025 to 2035

LED Loading Dock Light Market Size and Share Forecast Outlook 2025 to 2035

Car Accessories Market Size and Share Forecast Outlook 2025 to 2035

Bar Accessories Market

Jack Accessories Market Size and Share Forecast Outlook 2025 to 2035

Golf Accessories Market Size and Share Forecast Outlook 2025 to 2035

Apple Accessories Market Report – Demand, Trends & Forecast 2025–2035

Cable Accessories Market Growth - Trends & Forecast 2025 to 2035

Laptop Accessories Market Size and Share Forecast Outlook 2025 to 2035

E-Bike Accessories Market Size and Share Forecast Outlook 2025 to 2035

Travel Accessories Market Analysis by Product Type, Material, Distribution Channel, End-User and Region 2025 to 2035

Key Players & Market Share in Laptop Accessories Market

Camera Accessories Market Trends - Growth & Forecast 2024 to 2034

Fashion Accessories Packaging Market Size and Share Forecast Outlook 2025 to 2035

Smoking Accessories Market Analysis – Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA