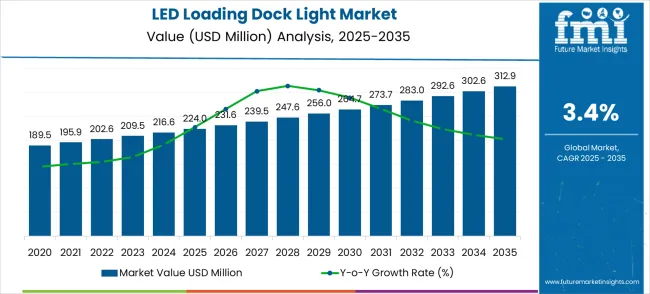

The global LED loading dock light market is valued at USD 224 million in 2025. It is slated to reach USD 312.9 million by 2035, recording an absolute increase of USD 88.9 million over the forecast period. This translates into a total growth of 39.7%, with the market forecast to expand at a compound annual growth rate (CAGR) of 3.4% between 2025 and 2035. The overall market size is expected to grow by nearly 1.40X during the same period, supported by increasing demand for energy-efficient lighting solutions, growing adoption of LED technology in industrial applications, and rising focus on worker safety across diverse loading dock operations.

Between 2025 and 2030, the LED loading dock light market is projected to expand from USD 224 million to USD 264.7 million, resulting in a value increase of USD 40.7 million, which represents 45.8% of the total forecast growth for the decade. This phase of development will be shaped by increasing warehouse automation, rising adoption of energy-efficient lighting systems, and growing demand for enhanced visibility solutions in loading and unloading operations. Logistics facilities and warehouse operators are expanding their LED lighting installations to address the growing demand for operational efficiency and worker safety improvements.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 224million |

| Forecast Value in (2035F) | USD 312.9 million |

| Forecast CAGR (2025 to 2035) | 3.4% |

The telecommunication industry is the largest contributor, accounting for 40-45%, as the demand for mobile data, 5G networks, and fiber-optic communication systems grows. LC adapters play a crucial role in ensuring seamless optical connections in telecommunication infrastructure. The data center sector follows with 25-30%, as the need for faster data transfer and reliable connections in cloud computing and high-performance computing environments boosts the demand for LC fiber optic adapters, which are widely used in server racks, switches, and routers. The IT and networking industry contributes 15-18%, with LC adapters being integral to networking equipment like switches, routers, and patch panels, enabling low-loss signal transmission across networks. The industrial and manufacturing sector adds 10-12%, as more industries adopt LC fiber optic adapters for automation and control systems that require high-speed, reliable communication for operational efficiency. The military and defense sector accounts for 5-8%, where LC fiber optic adapters are used for secure communication in tactical networks, surveillance systems, and communication hubs.

The LED loading dock light market presents substantial growth opportunities driven by the convergence of energy efficiency mandates, warehouse automation trends, and safety enhancement requirements. With the market projected to expand from USD 224.0 million in 2025 to USD 312.9 million by 2035, stakeholders can capitalize on multiple value creation pathways that address evolving operational needs across ports, logistics facilities, and industrial warehouses globally.

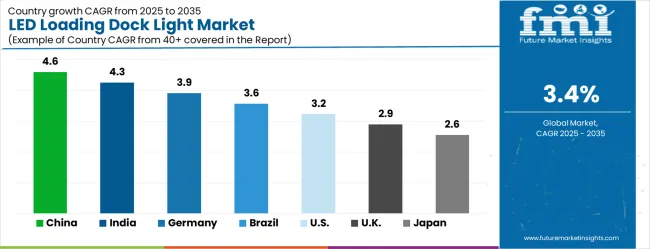

The shift toward operations, coupled with rising energy costs and stringent safety regulations, is creating favorable conditions for LED adoption. Geographic expansion opportunities in high-growth markets like China (4.6% CAGR) and India (4.3% CAGR), combined with technology advancement pathways in smart controls and IoT integration, offer compelling routes for market participants to capture both volume growth and margin expansion.

The integration of intelligent controls, motion sensors, and wireless connectivity represents a high-margin opportunity as facility operators seek automated lighting management and energy optimization. Smart LED systems with predictive maintenance capabilities, occupancy-based activation, and remote monitoring can command 25-40% price premiums over standard LED solutions. This pathway addresses growing demand for operational efficiency and energy management across modern warehouse operations. Expected revenue pool: USD 35-50 million.

Developing specialized LED dock lights for port applications with enhanced corrosion resistance, IP67+ ratings, and extended operating temperature ranges captures the dominant ports segment demand. These premium solutions address critical requirements for durability in maritime environments while reducing maintenance costs. Port operators increasingly prefer lighting systems that withstand salt air, extreme weather, and heavy-duty operations without performance degradation. Revenue opportunity: USD 45-65 million.

Strategic market entry and localization in Asia-Pacific markets, particularly China and India, offer substantial volume growth potential. Local manufacturing capabilities, distribution partnerships, and region-specific product adaptations can capture the 4.3-4.6% growth rates in these markets. This includes developing products that meet local electrical standards, price points, and specific application requirements for emerging logistics infrastructure. Expected upside: USD 75-110 million.

Creating comprehensive retrofit packages that simplify the transition from traditional lighting to LED systems addresses the massive installed base of conventional dock lighting. Offering turnkey solutions, including electrical upgrades, installation services, and financing options, removes barriers to adoption while capturing service revenue streams. This pathway is particularly valuable in mature markets like North America and Europe, where existing facilities seek energy efficiency improvements. Pool: USD 40-60 million.

Forming strategic alliances with loading dock equipment manufacturers (dock levelers, seals, shelters) creates bundled solution opportunities and preferred supplier relationships. Integrated offerings that combine LED lighting with dock equipment provide one-stop procurement convenience while ensuring optimal lighting placement and performance. This pathway leverages existing customer relationships and distribution channels of established dock equipment suppliers. Revenue lift: USD 30-45 million.

Developing LED-as-a-Service offerings where customers pay for lighting performance rather than equipment ownership addresses capital expenditure constraints while ensuring recurring revenue streams. This includes energy savings guarantees, maintenance contracts, and performance monitoring services. Such models are particularly attractive to logistics operators seeking to improve facilities without major capital investments. Expected pool: USD 25-40 million.

Targeting niche applications like cold storage facilities, hazardous material handling, and automated storage systems with specialized LED solutions commands premium pricing. These applications require specific certifications, temperature ratings, or explosion-proof designs that create competitive moats. Custom engineering services for unique facility requirements also generate high-margin project revenue beyond standard product sales. Revenue opportunity: USD 20-35 million.

Market expansion is being supported by the increasing global demand for energy-efficient warehouse operations and the corresponding need for reliable lighting solutions that can ensure worker safety, enhance operational visibility, and reduce energy consumption across various loading dock applications. Modern facility managers and warehouse operators are increasingly focused on implementing lighting solutions that can minimize operational costs, improve safety conditions, and provide consistent illumination in challenging loading dock environments. LED loading dock lights' proven ability to deliver superior energy efficiency, extended lifespan, and enhanced visibility makes them essential components for contemporary warehouse and logistics facility operations.

The growing focus on workplace safety and operational efficiency is driving demand for LED loading dock lights that can support hazard prevention, improve loading accuracy, and enable round-the-clock operations. Warehouse operators' preference for lighting solutions that combine energy savings with operational reliability and minimal maintenance requirements is creating opportunities for innovative LED lighting implementations. The rising influence of energy conservation regulations is also contributing to increased adoption of LED loading dock lights that can provide effective illumination without compromising environmental objectives or operational costs.

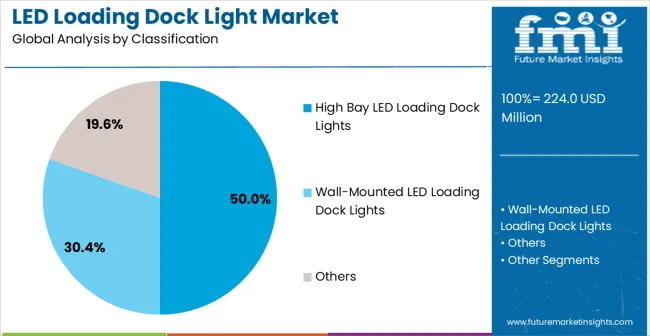

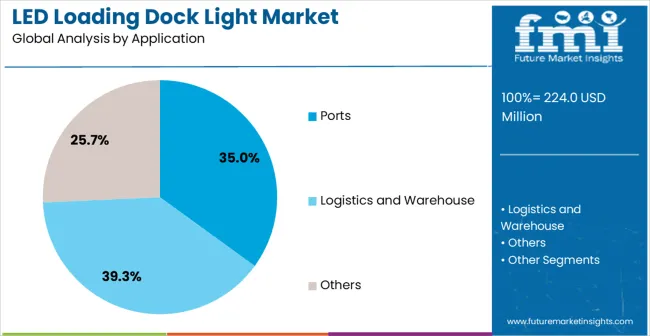

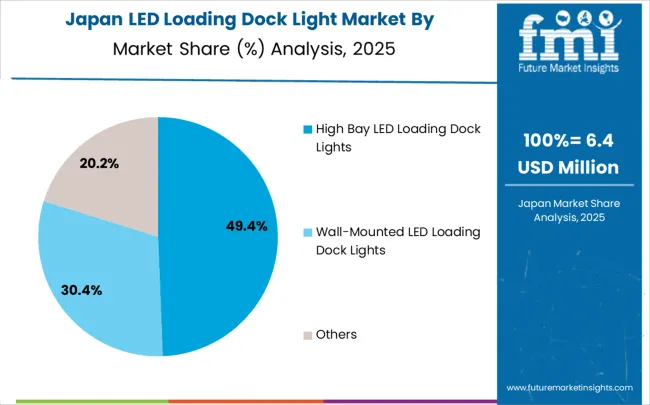

The market is segmented by dock light, application, and region. By dock light, the market is divided into high bay LED loading dock lights, wall-mounted LED loading dock lights, and others. Based on application, the market is categorized into ports, logistics and warehouses, and others. Regionally, the market is divided into Asia Pacific, North America, Europe, Latin America, and the Middle East & Africa.

The high bay LED loading dock lights segment is projected to maintain its leading position in the LED loading dock light market in 2025, capturing 50% of the market share. Warehouse operators and facility managers increasingly rely on high bay LED loading dock lights for their superior illumination coverage, energy efficiency, and versatile installation capabilities across various dock heights and configurations. High bay LED lighting provides advanced optical design and consistent light output, addressing the industrial need for improved visibility and safety in large-scale loading dock operations. As the backbone of modern warehouse lighting infrastructure, these systems are essential for meeting operational efficiency and worker safety requirements. Continued investments in high bay LED lighting solutions further strengthen their adoption, making them the central component in comprehensive dock lighting strategies.

The ports application segment is projected to represent the largest share of LED loading dock light demand in 2025, capturing 35% of the market. Port operators favor LED loading dock lights for their durability in harsh maritime environments, comprehensive illumination capabilities, and ability to enhance operational safety while minimizing energy consumption and maintenance. These lights are critical for cargo handling in port terminals, offering both operational benefits and performance advantages. The segment is driven by continuous innovation in marine-grade lighting solutions and the growing availability of corrosion-resistant LED systems that enhance durability and weather resistance. Port operators are investing in lighting upgrades to meet large-scale cargo handling requirements and boost operational efficiency. As port operations become more complex and safety standards become stricter, the ports application will continue to dominate the market, driving advanced lighting solutions for optimal operational performance.

The LED loading dock light market is advancing steadily due to increasing demand for energy-efficient warehouse operations and growing adoption of LED technology that provides enhanced illumination quality and reduced operating costs across diverse loading dock applications. However, the market faces challenges, including higher initial installation costs compared to traditional lighting, the need for electrical infrastructure upgrades, and technical complexity in retrofit applications. Innovation in smart lighting controls and wireless connectivity continues to influence product development and market expansion patterns.

The growing adoption of intelligent lighting systems and IoT-enabled controls is enabling warehouse operators to achieve superior energy management, automated lighting schedules, and remote monitoring capabilities for enhanced operational efficiency. Smart lighting systems provide improved energy optimization while allowing more flexible lighting control and consistent illumination across various loading dock operations and time periods. Manufacturers are increasingly recognizing the competitive advantages of smart lighting capabilities for operational differentiation and energy cost reduction.

Modern LED loading dock light manufacturers are incorporating motion detection technologies and automated control systems to enhance energy efficiency, extend equipment lifespan, and ensure optimal lighting activation based on operational requirements. These technologies improve operational efficiency while enabling new applications, including occupancy-based lighting control and predictive maintenance capabilities. Advanced control integration also allows facility operators to support comprehensive energy management and lighting optimization beyond traditional fixed lighting operations.

| Country | CAGR (2025-2035) |

|---|---|

| China | 4.6% |

| India | 4.3% |

| Germany | 3.9% |

| Brazil | 3.6% |

| USA | 3.2% |

| UK | 2.9% |

| Japan | 2.6% |

The LED loading dock light market is experiencing moderate growth globally, with China leading at a 4.6% CAGR through 2035, driven by the expanding logistics infrastructure, growing e-commerce sector, and significant investment in warehouse modernization and port facility development. India follows at 4.3%, supported by rapid industrial development, increasing warehouse construction, and growing demand for efficient cargo handling facilities. Germany shows growth at 3.9%, focusing on energy efficiency standards and advanced warehouse automation technologies. Brazil records 3.6%, focusing on logistics infrastructure development and port modernization initiatives. The USA demonstrates 3.2% growth, supported by an established logistics industry and a focus on energy efficiency improvements. The UK exhibits 2.9% growth, focusing on warehouse operations and energy conservation initiatives. Japan shows 2.6% growth, supported by precision logistics and advanced facility management technologies.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

The LED loading dock light market in China is projected to grow at a CAGR of 4.6% from 2025 to 2035. The country’s robust manufacturing sector and the ongoing expansion of logistics and e-commerce industries are key drivers of the increasing demand for energy-efficient, durable lighting solutions in loading docks. As China continues to enhance its logistics infrastructure, particularly in urban and industrial zones, the need for advanced lighting solutions that improve operational efficiency and safety becomes crucial. LED loading dock lights offer significant advantages over traditional lighting due to their energy-saving properties, longer lifespan, and enhanced brightness. China’s rapid adoption of automation and smart warehouse technologies further supports the demand for advanced lighting solutions. As distribution networks become more integrated with technology, there is a growing need for lighting systems that align with modernized operations and logistics hubs.

The LED loading dock light market in India is forecasted to grow at a CAGR of 4.3% from 2025 to 2035. With the rise in industrial activities and the ongoing boom in the e-commerce sector, the demand for efficient and reliable lighting solutions is increasing. India’s logistics sector, which includes warehousing, transportation, and distribution, is expanding rapidly, fueled by an increasing number of businesses seeking modern and cost-effective solutions. LED loading dock lights are becoming a popular choice due to their energy efficiency, lower maintenance costs, and ability to provide bright, clear illumination in high-traffic areas. Government initiatives to improve transportation infrastructure and promote energy-efficient technologies are pushing the adoption of LED lighting in industrial setups. The increasing focus on automation in warehouses and logistics centers also drives the demand for smart lighting systems that align with modern operational needs. Logistics sector growth driving demand for advanced lighting solutions

The LED loading dock light market in Germany is expected to grow at a CAGR of 3.9% from 2025 to 2035. As the leading economy in Europe, Germany has a highly developed industrial sector, including manufacturing, logistics, and distribution, all of which require high-performance lighting solutions. With the growth of e-commerce and increased demand for fast and reliable delivery, there is a rising need for efficient lighting systems in loading docks and distribution centers. LED lights are becoming the go-to solution due to their energy efficiency, longer lifespan, and environmental benefits. Germany’s commitment to improving its infrastructure and reducing carbon emissions supports the adoption of energy-saving technologies like LED lighting. As industries focus on enhancing operational efficiency, automation and digitalization in warehouses are driving the demand for smart lighting systems. Germany’s logistics industry is also expanding to cater to regional and global distribution, making LED lighting a vital part of the country’s evolving industrial landscape.

The LED loading dock light market in Brazil is growing at a CAGR of 3.6% from 2025 to 2035. As Brazil remains one of the largest economies in Latin America, its logistics, transportation, and retail sectors are rapidly evolving, driving the demand for reliable and efficient lighting systems. With growing competition in the retail and manufacturing sectors, there is a stronger push toward improving operational efficiency and energy savings. LED lighting offers a significant advantage, with lower power consumption and longer lifespan compared to traditional lighting systems. The government’s focus on reducing energy usage across industries is encouraging the adoption of LED lighting solutions in loading docks and warehouses. The development of distribution centers and the push toward automating industrial processes are contributing to the market's growth. Brazil’s expanding infrastructure and increased investment in modernized industrial facilities are expected to provide ample opportunities for LED lighting suppliers in the coming years.

The LED loading dock light market in the USA is expected to expand at a CAGR of 3.2% from 2025 to 2035. The United States is a global leader in e-commerce, manufacturing, and logistics, with vast distribution networks requiring efficient lighting systems to ensure smooth operations. The demand for LED loading dock lights is growing due to their energy efficiency, cost-effectiveness, and ability to provide bright, focused lighting for high-traffic areas. The country’s focus on reducing energy consumption and minimizing environmental impact in industrial operations further supports the adoption of energy-saving solutions like LEDs. The rapid expansion of automated warehouses and the increasing use of IoT technologies are creating opportunities for the integration of smart LED lighting systems that enhance operational efficiency and safety. As more industries invest in modern infrastructure and automation, the LED loading dock light market in the USA will continue to expand.

The LED loading dock light market in the UK is expanding at a CAGR of 2.9% from 2025 to 2035. The UK’s logistics and industrial sectors are undergoing a transformation, and there is an increasing focus on adopting energy-efficient and long-lasting lighting solutions. LED lighting provides key benefits such as reduced energy consumption, lower maintenance costs, and improved illumination in warehouses, loading docks, and distribution centers. As demand for fast delivery increases, particularly in e-commerce, the need for reliable lighting solutions to facilitate smoother operations becomes paramount. The UK’s commitment to enhancing energy efficiency and reducing carbon emissions has further accelerated the transition to LED lighting. With increasing automation in warehouses and growing smart logistics infrastructure, LED dock lights are expected to play a significant role in improving operational efficiency and safety.

The LED loading dock light market in Japan is projected to grow at a CAGR of 2.6% from 2025 to 2035. Japan’s advanced industrial and logistics sectors are increasingly adopting modern lighting solutions to improve warehouse operations. The country’s commitment to energy efficiency and reducing environmental impact plays a significant role in pushing the demand for LED lighting in loading docks and distribution centers. Japan’s e-commerce and automotive industries are key contributors to the demand for high-performance lighting systems, which are necessary to improve visibility and safety in high-traffic areas. Moreover, the expansion of automated systems in logistics facilities is driving the need for advanced, smart lighting solutions. As Japan’s infrastructure continues to modernize, the adoption of LED lighting in industrial environments is expected to grow steadily over the coming decade.

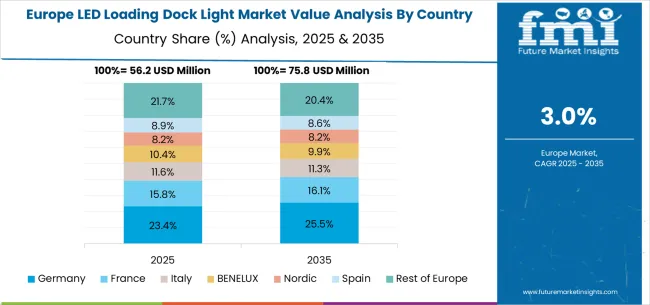

The LED loading dock light market in Europe is projected to grow from USD 83.9 million in 2025 to USD 118.5 million by 2035, registering a CAGR of 3.5% over the forecast period. Germany is expected to maintain its leadership position with a 24.0% market share in 2025, moderating slightly to 23.8% by 2035, supported by its strong logistics industry, advanced warehouse automation sector, and comprehensive energy efficiency infrastructure serving major European markets.

The United Kingdom follows with 20.0% in 2025, projected to reach 19.8% by 2035, driven by established logistics operations, warehouse initiatives, and comprehensive distribution network infrastructure. France holds 18.0% in 2025, rising to 18.2% by 2035, supported by logistics hub development and growing adoption of energy-efficient warehouse technologies. Italy commands 14.0% in 2025, projected to reach 14.1% by 2035, while Spain accounts for 10.0% in 2025, expected to reach 10.2% by 2035. The Netherlands maintains a 5.5% share in 2025, growing to 5.6% by 2035. The Rest of Europe region, including Nordic countries, Eastern Europe, and other markets, is anticipated to maintain its position, holding its collective share at 8.5% by 2035, attributed to increasing warehouse modernization and growing logistics infrastructure development across emerging markets implementing advanced lighting standards.

The LED loading dock light market is characterized by competition among established industrial lighting manufacturers, specialized dock equipment suppliers, and integrated facility solution providers. Companies are investing in advanced LED technology research, smart lighting development, energy efficiency optimization, and comprehensive product portfolios to deliver reliable, efficient, and cost-effective LED loading dock lighting solutions. Innovation in smart controls, wireless connectivity, and marine-grade durability is central to strengthening market position and competitive advantage.

Rite-Hite leads the market with comprehensive loading dock solutions, offering advanced LED lighting systems with a focus on safety enhancement and operational efficiency. Phoenix Lighting provides specialized industrial lighting products with an emphasis on energy efficiency and durability in harsh environments. Tri Lite Inc. delivers innovative LED lighting solutions with a focus on dock-specific applications and installation flexibility. Pentalift specializes in loading dock equipment and integrated lighting systems for material handling operations. Kelley focuses on dock equipment and comprehensive facility solutions with emphasis on safety and efficiency. Vestil Manufacturing Company offers industrial equipment and lighting solutions with a focus on operational reliability and worker safety.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 224 million |

| Dock Light | High Bay LED Loading Dock Lights, Wall-Mounted LED Loading Dock Lights, Others |

| Application | Ports, Logistics and Warehouse, Others |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, Middle East & Africa |

| Countries Covered | China, India, Germany, Brazil, the United States, the United Kingdom, Japan, and 40+ countries |

| Key Companies Profiled | Rite-Hite, Phoenix Lighting, Tri Lite Inc., Pentalift, Kelley, and Vestil Manufacturing Company |

| Additional Attributes | Dollar sales by dock light and application category, regional demand trends, competitive landscape, technological advancements in LED lighting systems, smart control development, energy efficiency innovation, and facility optimization |

Asia Pacific

North America

Europe

Latin America

Middle East & Africa

The global LED loading dock light market is estimated to be valued at USD 224.0 million in 2025.

The market size for the LED loading dock light market is projected to reach USD 312.9 million by 2035.

The LED loading dock light market is expected to grow at a 3.4% CAGR between 2025 and 2035.

The key product types in LED loading dock light market are high bay LED loading dock lights, wall-mounted LED loading dock lights and others.

In terms of application, ports segment to command 35.0% share in the LED loading dock light market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

LED Digital Speed Limit Sign Market Size and Share Forecast Outlook 2025 to 2035

LED Control Unit Market Size and Share Forecast Outlook 2025 to 2035

LED Lamp Market Size and Share Forecast Outlook 2025 to 2035

LED Tube Market Size and Share Forecast Outlook 2025 to 2035

LEDPackaging Market Size and Share Forecast Outlook 2025 to 2035

LED Driver IC Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

LED Phosphor Material Market

LED Driver Market

LED Modular Display Market

LED Tester Market

LED Cable Market

LED Light Market Size and Share Forecast Outlook 2025 to 2035

LED Light Tower Market Size and Share Forecast Outlook 2025 to 2035

LED Light Bar Market Analysis - Trends, Growth & Forecast 2025 to 2035

LED Lighting Controllers Market

LED Backlight Driver Market Size and Share Forecast Outlook 2025 to 2035

LED Backlight Display Driver ICs Market – Growth & Forecast 2025 to 2035

LED Neon Lights Market Size and Share Forecast Outlook 2025 to 2035

LED Grow Lights Market Analysis by Product, Installation Type, Application and Region Through 2035

LED and OLED lighting Products and Display Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA