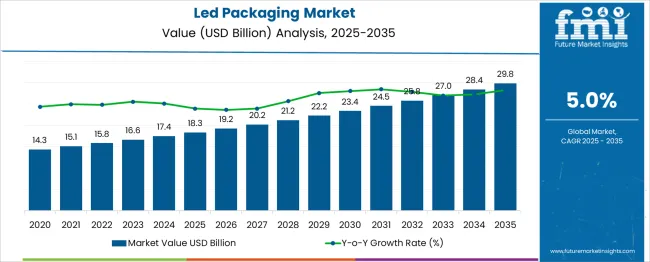

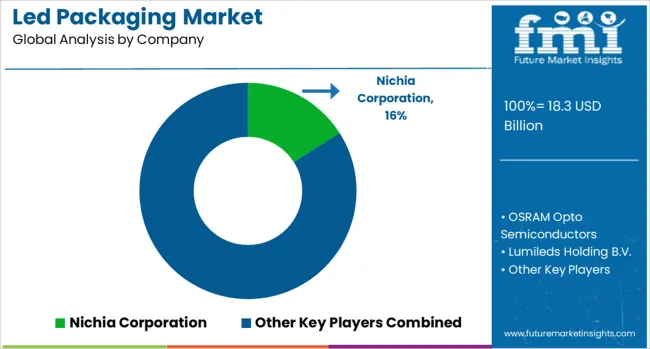

The LED packaging market is estimated to be valued at USD 18.3 billion in 2025 and is projected to reach USD 29.8 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period. A rolling CAGR analysis reveals consistent but gradually moderating growth over the forecast period. From 2025 to 2030, the market expands from USD 18.3 billion to USD 23.4 billion, reflecting a five-year CAGR of approximately 5.0%. This phase is characterized by demand in general lighting, automotive applications, and mobile device displays, driven by cost-efficiency and performance improvements in mid-power LED packaging.

From 2026 to 2031, the market grows from USD 19.2 billion to USD 24.5 billion, showing a slightly lower five-year CAGR of around 4.9%. As the base value increases, rolling CAGR values show minor tapering, with figures between 4.7% and 5.0% across overlapping windows. The final five-year span, 2030 to 2035, sees the market grow from USD 23.4 billion to USD 29.8 billion, yielding a rolling CAGR of approximately 5.0%. Throughout the period, the rolling CAGR remains within a tight band, with no sharp deviation. This stability confirms the market’s maturity, driven by sustained demand across display backlighting, architectural lighting, and commercial applications with steady product replacement cycles and moderate innovation turnover.

| Metric | Value |

|---|---|

| LED Packaging Market Estimated Value in (2025 E) | USD 18.3 billion |

| LED Packaging Market Forecast Value in (2035 F) | USD 29.8 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The LED packaging market derives around 30% of demand from chip production, where packaging ensures thermal performance, electrical contact, and optical alignment. Close to 28% is tied to lighting fixture and module assembly, supporting downlights, streetlights, and architectural lighting products. Consumer electronics, including TVs, smartphones, and backlit panels, drive approximately 22% of packaging needs for integrated LEDs.

The automotive industry accounts for about 12%, using LED packages in headlights, brake lights, and interior lighting under stringent durability standards. The remaining 8% comes from specialty areas such as medical devices, horticultural lighting, and industrial signaling systems. The market is evolving rapidly due to demand for energy‑efficient lighting devices and compact high‑performance modules in automotive displays, consumer electronics, and smart lighting systems.

Key market shapers include Nichia Corporation, ams-OSRAM AG, Samsung Electronics, Lumileds, and Seoul Semiconductor. These innovators drive growth with chip-scale packaging, flip-chip and chip-on-board developments that enhance thermal management and luminous efficacy. Trends include miniaturized flexible packages, IoT-enabled smart packaging for real‑time monitoring, and phosphor encapsulation innovations for improved color accuracy. Asia‑Pacific leads deployment through mass production in China and India, while Europe emphasizes sustainable material usage and thermal efficiency in high-end lighting segments.

The LED packaging market is undergoing a significant expansion, supported by the increasing penetration of LED technology across multiple lighting and display applications. A rising focus on energy efficiency, sustainability, and smart lighting infrastructure is accelerating the adoption of LEDs in both commercial and residential environments.

Advancements in packaging technologies have enabled better thermal management, improved optical performance, and reduced form factors, which are contributing to the broader integration of LEDs in compact and high-performance systems. Governments and regulatory bodies across major economies are promoting energy-saving initiatives, which have encouraged large-scale replacement of conventional lighting with LED-based systems.

Continuous innovation in mid-power and surface mount packaging has enabled mass production at lower costs, fostering affordability and accessibility. As demand for intelligent and connected lighting solutions grows, the LED packaging market is expected to benefit from ongoing R&D efforts, strong manufacturing investments, and the expanding role of LEDs in automotive, consumer electronics, horticulture, and industrial applications..

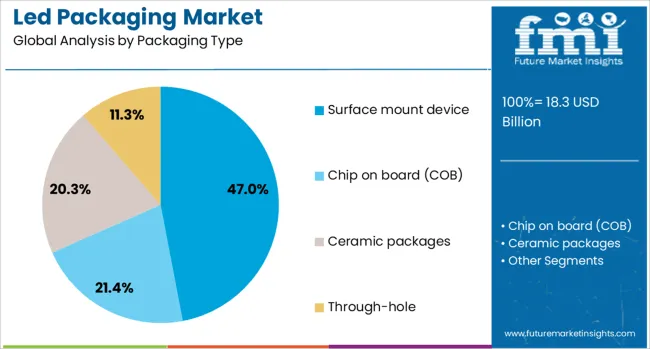

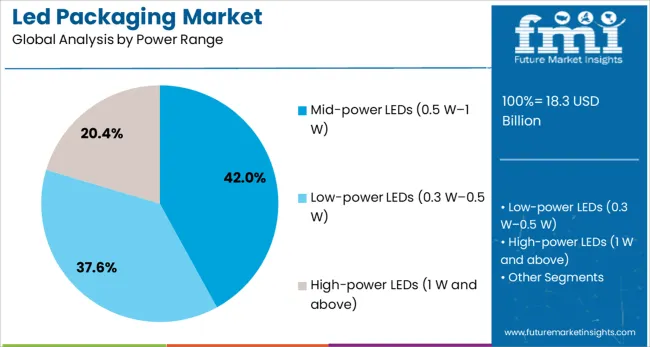

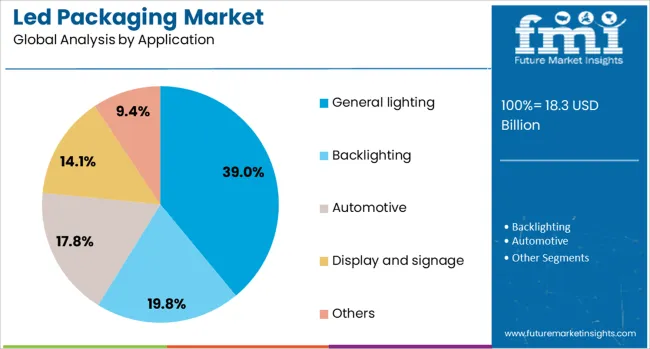

The LED packaging market is segmented by packaging type, power range, application, and geographic regions. By packaging type, the LED packaging market is divided into Surface Mount Device (SMD), Chip on Board (COB), Ceramic packages, and Through-hole. In terms of power range, the LED packaging market is classified into Mid-power LEDs (0.5 W–1 W), Low-power LEDs (0.3 W–0.5 W), and High-power LEDs (1 W and above). Based on the application, the LED packaging market is segmented into General lighting, Backlighting, Automotive, Display and signage, and Others. Regionally, the LED packaging industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The surface mount device segment is projected to account for 47% of the LED Packaging market revenue share in 2025, making it the most dominant packaging type. This segment’s growth has been driven by the increasing preference for compact, high-density configurations in lighting and display assemblies. Surface-mount devices have been favored for their superior thermal performance, ease of integration into automated assembly lines, and reduced manufacturing footprint.

Their compatibility with various circuit board types and suitability for both backlighting and general illumination applications has further reinforced their relevance. As the demand for slim and lightweight lighting systems continues to rise, particularly in consumer electronics and automotive applications, surface mount packaging has gained considerable momentum.

Furthermore, their ability to support high brightness levels while maintaining energy efficiency has made them a reliable choice for high-volume, cost-sensitive production. The versatility, performance stability, and low-profile design of surface mount devices have contributed to their sustained leadership in the packaging type category..

The mid-power LEDs segment is expected to hold 42% of the LED Packaging market revenue share in 2025, securing its position as the leading power range. This dominance has been facilitated by the balance it offers between performance, cost, and energy efficiency. Mid-power LEDs in the range of 0.5 W to 1 W have been increasingly adopted in applications requiring moderate brightness levels, such as indoor lighting, task lighting, and architectural illumination.

Their ability to provide consistent lumen output with lower thermal stress has contributed to longer operating lifespans and greater system reliability. Manufacturers have scaled production of mid-power LEDs to meet rising demand in emerging economies where affordability and energy efficiency remain key purchasing criteria.

In addition, the packaging of mid-power LEDs has evolved to support better thermal conductivity and optical control, allowing broader design flexibility. These features have positioned mid power LEDs as the preferred choice for both retrofitting and new installations across residential and commercial sectors..

The general lighting segment is anticipated to represent 39% of the LED Packaging market revenue share in 2025, making it the most prominent application area. The segment’s growth has been fueled by rapid urbanization, smart city projects, and global initiatives aimed at reducing carbon emissions through energy-efficient lighting solutions. General lighting applications have increasingly adopted LED technology due to its superior energy efficiency, long operational life, and decreasing cost trends.

Commercial buildings, residential complexes, and municipal infrastructure have driven consistent demand for packaged LEDs that offer high luminous efficacy with minimal maintenance. Software-compatible lighting systems that integrate with building automation have further strengthened the need for flexible, efficient packaging solutions.

As governments across regions continue to phase out incandescent and fluorescent lighting, the uptake of LEDs for ambient, task, and decorative lighting purposes is expected to accelerate. The ability of LED packages to support tunable white lighting and color rendering requirements has also solidified their dominance in general illumination applications..

The LED packaging market has expanded due to rising demand in lighting, automotive, display, and horticultural sectors. In 2024, over 43 % of new general lighting fixtures incorporated flip‑chip or COB LED packages due to enhanced luminous efficacy and thermal performance. High‑density packaging formats supported by miniaturization demands captured approximately 38 % of the packaged LED unit volumes. Growth was concentrated in the Asia Pacific and North America, followed by Europe. Transparent packaging materials for UV and infrared LEDs were adopted in 22 % of photonic device assemblies. Market expansion was facilitated by a design shift toward multi-die arrays and board-level integration supporting compact, high-power configurations.

Driver technologies such as flip-chip die attachments, ceramic submounts, and advanced phosphor coatings have boosted efficacy levels. In over 48 % of current installations, thermal resistance has been reduced by up to 20 % through copper substrates and integrated heatsinks. High‑throughput manufacturing using chip-on-board techniques enabled tighter optical density and higher lumen per watt, which exceeded 160 lm/W in nearly 35 % of high‑end lighting applications. Multi‑chip packages within compact footprints have been widely specified in automotive headlamp arrays and area lighting. Performance improvements in early life lumen maintenance and color stability have reinforced reliability expectations for premium packaging.

Raw material expenses associated with GaN die, ceramic substrates, and phosphor blending have increased package cost by around 28 % over plastic‑over‑board formats. During 2024, assembly complexity contributed to longer cycle times, increasing manufacturing lead times by approximately 18 %. High‑precision die bonding and wire‑bonding controls required certified labor and tool calibration, resulting in elevated yield thresholds. Package warpage and thermal mismatch issues were reported in 7 % of deployed units, particularly in compact high‑power designs. Assembly constraints also limited adoption among small-scale producers and in ultra-low‑cost lighting offerings, where simpler SMD packages remained preferred.

Opportunities are being created by integration of multi‑chip LED arrays with embedded drivers and digital interfaces. Smart modules accommodating dimming, color tuning, and sensor integration captured 31 % of new lighting module specifications in 2024. Human-centric lighting, horticultural LED arrays, and UV‑C disinfection lamp segments have adopted specialized packaged forms with customized phosphor and optical lensing. Automotive adaptive headlights and rear indicator clusters now deploy PCB-mounted LED arrays from modular packaging platforms. Emerging LED mid-power modules with board-level integrability allowed faster time-to-market and simplified product design, particularly in commercial building retrofit and architectural lighting installations.

Smart LED packaging lines featuring automated optical glue dispensing, tape-lift inspection, and real-time thermal imaging were deployed in 36% of new production plants. Recyclable ceramic and substrate materials are being specified in 22% of newer assemblies to support circular economy goals. Traceability via QR-linked batch data and inspection logs has become standard in approximately 27% of premium lighting product lines. Firmware-driven thermal derating profiles and adaptive current limits are embedded in smart modules in 24% of the latest lighting controllers. And digital quality control systems enabling defect classification and yield optimization are being adopted across 29% of high-volume packaging platforms.

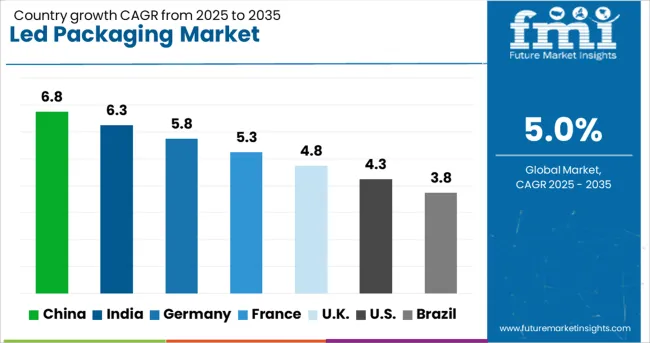

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

The LED packaging market is expanding globally at a CAGR of 5%, with several countries outpacing this average. China is experiencing a 6.8% growth rate, which is approximately 1.36 times higher than the global pace, driven by high domestic demand and robust local manufacturing ecosystems. India follows with a 6.3% CAGR, about 1.26 times above the global average, supported by government incentives and increasing LED adoption in urban infrastructure. Germany's 5.8% CAGR places it slightly above the global benchmark, led by industrial upgrades and energy-efficient lighting. The UK and the US are growing below the global rate, at 4.8% and 4.3% respectively, reflecting relatively mature markets with slower adoption in newer applications. The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference.

China has sustained its lead in LED packaging capacity as vertically integrated manufacturers continue to scale wafer-to-package value chains. Growth has been driven by increased demand from mini-LED and micro-LED display applications, especially in large-format TVs and automotive backlighting. Shenzhen and Suzhou have remained manufacturing hubs where chip-on-board (COB) and surface mount device (SMD) packaging are being developed with higher thermal efficiency. Government-backed localization efforts and capital-intensive MOCVD expansions have supported consistent unit-level growth. Chinese suppliers have increasingly invested in wafer-level packaging and silicon-based substrates to improve optical density and longevity.

In India, the LED packaging segment has progressed through small-to-mid-scale capacity additions by domestic electronics and lighting OEMs. Increasing adoption of LED modules in smart city lighting and localized automotive segments has influenced growth in epoxy encapsulation and wire bonding packaging methods. The Electronics Manufacturing Clusters (EMC) scheme has accelerated localized investment in automated packaging infrastructure in states such as Tamil Nadu and Uttar Pradesh. Emphasis has been placed on UV-stable lens packages for outdoor fixtures and high CRI (Color Rendering Index) products for indoor retail illumination.

Germany has maintained focus on high-efficiency LED packaging for medical, industrial, and automotive sectors. Growth has been underpinned by innovations in thermal conductive materials and ceramic substrates for extended product lifespans. Industrial-grade LEDs for automation and robotic vision systems have boosted demand for phosphor-coated and multi-die packages. Domestic manufacturers have prioritized precision packaging technologies such as flip-chip and wafer-level CSPs for UV and IR diode applications. Environmental compliance mandates and higher color consistency thresholds have driven demand for photometrically stable packaging methods.

The United Kingdom has witnessed moderate growth in LED packaging driven by retrofit programs in public lighting and commercial refurbishment. British firms have focused on optical-grade encapsulants and high-reliability thermal interface materials to support longer LED lifespans. Hybrid SMT solutions have been favored in low- to mid-power applications, while flip-chip packages are being selectively applied to architectural and theatre lighting. Investments in packaging process automation have remained limited, but interest in photonics packaging for niche segments has increased in Oxfordshire and Cambridgeshire.

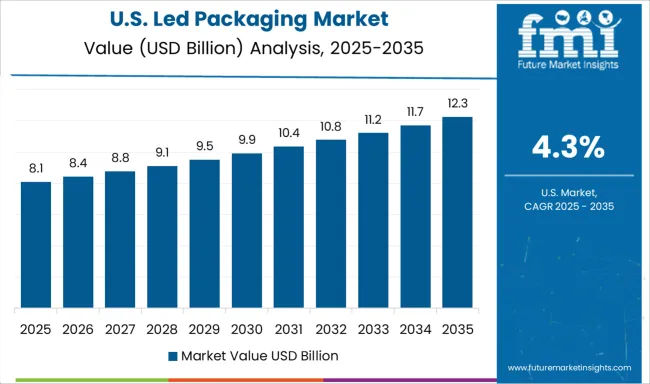

The United States has seen stable demand for LED packaging in high-reliability sectors such as defense, aerospace, and industrial automation. Domestic suppliers have advanced toward chip-scale packaging (CSP) and phosphor-in-ceramic formats to meet stringent durability and thermal requirements. Market activity has been largely driven by growth in horticulture lighting and UV sanitization modules, requiring wavelength-specific packages with high lumen density. OEMs have also deployed customized packaging formats for LED arrays in transportation signage and large-scale entertainment installations.

The LED packaging market involves manufacturers specializing in the production of LED components that enable efficient light emission for applications across automotive, general lighting, and display sectors. Nichia Corporation is a leading supplier recognized for its high-brightness LEDs and advanced phosphor technology, serving automotive headlamps and industrial lighting segments. Their products are widely adopted for performance and longevity. OSRAM Opto Semiconductors delivers packaged LEDs featuring optimized thermal management and compact designs, targeting applications in automotive, consumer electronics, and signage. Lumileds Holding B.V. focuses on high-power LED packages designed for street lighting and horticulture, with an emphasis on energy efficiency and modularity.

Samsung Electronics offers versatile LED packaging solutions incorporating chip-scale packages for mobile devices and commercial lighting, supporting miniaturization and improved luminous efficacy. Seoul Semiconductor Co., Ltd. develops specialized packaging tailored for UV and infrared LED markets, serving medical, industrial, and security sectors. Cree LED (Smart Global Holdings) supplies robust LED modules aimed at architectural and commercial lighting applications, emphasizing thermal performance and color consistency. Market competition centers on thermal dissipation efficiency, package size, optical performance, and compatibility with automated assembly lines. Innovations in materials and surface mounting technologies continue to influence supplier positioning across regional and application-specific demand.

Between 2023 and 2025, the LED packaging market advanced through strategic product releases, targeted R&D, and regional manufacturing scale-ups by key players. Nichia introduced compact chip-scale packages for microLED and automotive forward lighting. OSRAM Opto enhanced RGB laser modules for AR applications, focusing on smaller footprint light engines.

Lumileds expanded its COB and SMD portfolio to address lumen density requirements in commercial lighting. Samsung Electronics launched performance-optimized 5050 packages to capture the outdoor and industrial segments. Seoul Semiconductor upgraded its WICOP platform with pixel-level tuning for display integration.

Cree LED, under Smart Global Holdings, maintained high-intensity offerings for horticulture and specialty fixtures. Asia-Pacific remained the production base, while North America and Europe emphasized automotive and architectural deployments.

| Item | Value |

|---|---|

| Quantitative Units | USD 18.3 Billion |

| Packaging Type | Surface mount device, Chip on board (COB), Ceramic packages, and Through-hole |

| Power Range | Mid-power LEDs (0.5 W–1 W), Low-power LEDs (0.3 W–0.5 W), and High-power LEDs (1 W and above) |

| Application | General lighting, Backlighting, Automotive, Display and signage, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Nichia Corporation, OSRAM Opto Semiconductors, Lumileds Holding B.V., Samsung Electronics, Seoul Semiconductor Co., Ltd., and Cree LED (Smart Global Holdings) |

| Additional Attributes | Dollar sales by package type (COB, SMD, DIP) and application (general lighting, automotive, backlighting), demand dynamics across smart lighting, automotive illumination, and display tech, regional trends led by Asia‑Pacific with North America catching up, innovation in phosphor adaptation for higher CRI, thermal management and miniaturized high-lumen packages, and environmental impact through energy-efficient lighting, lower operational emissions, and support for sustainable building certifications. |

The global led packaging market is estimated to be valued at USD 18.3 billion in 2025.

The market size for the led packaging market is projected to reach USD 29.8 billion by 2035.

The led packaging market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in led packaging market are surface mount device, chip on board (cob), ceramic packages and through-hole.

In terms of power range, mid-power leds (0.5 w–1 w) segment to command 42.0% share in the led packaging market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sealed Wax Packaging Market Size and Share Forecast Outlook 2025 to 2035

Chilled Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Chilled Food Packaging Manufacturers

Bottled Water Packaging Market Size and Share Forecast Outlook 2025 to 2035

Recycled PET Packaging Market Size, Share & Forecast 2025 to 2035

Recycled Paper Packaging Market Size and Share Forecast Outlook 2025 to 2035

Recycled Glass Packaging Market Trends & Growth Forecast 2024-2034

Recycled Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Recycled Aluminum Packaging Market Trends & Growth Forecast 2024-2034

Recycled Materials Packaging Market Size and Share Forecast Outlook 2025 to 2035

Recycled Ocean Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Controlled Intelligent Packaging Market

Nano-enabled Packaging Market Trends & Industry Forecast 2024-2034

Vacuum-Sealed Packaging Market Size, Share & Forecast 2025 to 2035

Pre-assembled Packaging Market

Center Sealed Pouch Packaging Market Size and Share Forecast Outlook 2025 to 2035

Temperature Controlled Packaging Solution Market - Size, Share, and Forecast Outlook 2025 to 2035

Market Share Breakdown of Temperature Controlled Packaging Solutions

Analyzing Post-Consumer Recycled Packaging Market Share & Industry Leaders

Temperature Controlled Packaging Boxes Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA