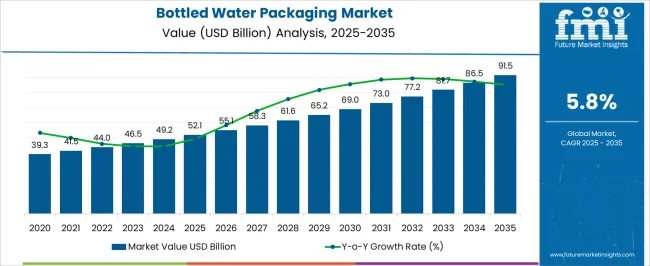

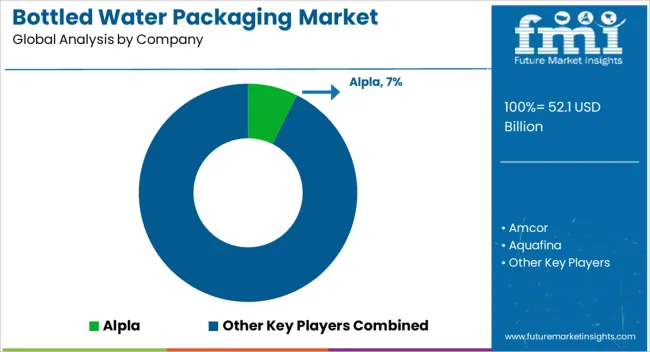

The bottled water packaging market is estimated to be valued at USD 52.1 billion in 2025 and is projected to reach USD 91.5 billion by 2035, registering a compound annual growth rate (CAGR) of 5.8% over the forecast period.

The bottled water packaging market is valued at USD 52.1 billion in 2025 and is expected to reach USD 91.5 billion by 2035, with a CAGR of 5.8%. From 2021 to 2025, the market grows from USD 39.3 billion to USD 52.1 billion, passing through intermediate values of USD 41.5 billion, 44.0 billion, 46.5 billion, and 49.2 billion. This early growth phase is characterized by steady demand driven by increasing consumer preference for bottled water due to health benefits, convenience, and hydration needs. With the rising awareness of healthy living, the market experiences steady growth in both bottled water consumption and packaging innovations.

Between 2026 and 2030, the market continues to expand, moving from USD 52.1 billion to USD 69.0 billion, with values passing through USD 55.1 billion, 58.3 billion, 61.6 billion, and 65.2 billion. The inflection point in this phase is influenced by heightened demand for sustainable packaging solutions, such as biodegradable and recyclable bottles, driven by growing environmental concerns and regulatory pressure on plastic use. From 2031 to 2035, the market reaches USD 91.5 billion, progressing through USD 73.0 billion, 77.2 billion, 81.7 billion, and 86.5 billion. The market continues to evolve, with technological advancements in packaging material and increased consumer preference for eco-friendly options playing a key role in driving growth in the latter years.

| Metric | Value |

|---|---|

| Bottled Water Packaging Market Estimated Value in (2025 E) | USD 52.1 billion |

| Bottled Water Packaging Market Forecast Value in (2035 F) | USD 91.5 billion |

| Forecast CAGR (2025 to 2035) | 5.8% |

The beverage packaging market is the largest contributor, accounting for approximately 35-40%, as bottled water is one of the most consumed beverages globally. The increasing demand for bottled beverages drives the growth of this segment. The plastic packaging market follows with around 30-35%, as plastic, particularly PET bottles, remains the dominant material used for bottled water. The demand for lightweight, cost-effective, and recyclable plastic bottles continues to propel the growth of bottled water packaging. The eco-friendly packaging market contributes about 15-18%, with growing consumer preferences for packaging materials that are environmentally responsible, such as recyclable and reusable options. This shift influences packaging choices in the bottled water industry.

The food and beverage market accounts for approximately 10-12%, as bottled water is a major sub-segment within this industry. The demand for convenient, on-the-go beverages continues to grow, supporting the need for packaging solutions in this sector. The e-commerce packaging market contributes around 8-10%, driven by the rise of online grocery shopping and direct-to-consumer sales. Packaging solutions that ensure durability during shipping while maintaining product integrity are increasingly important in this sector.

The bottled water packaging market is witnessing sustained growth due to rising global demand for safe, portable drinking water and increasing consumer awareness about health and hydration. Urbanization, a growing on-the-go lifestyle, and the expansion of retail and convenience store networks have further reinforced bottled water consumption.

As consumption patterns shift towards smaller and more frequently purchased packaging, manufacturers are focusing on innovations in lightweight materials and sustainable packaging solutions. Although environmental concerns regarding plastic usage persist, industry efforts around recyclability and biodegradable alternatives are mitigating negative sentiment.

The future outlook remains positive, supported by rising consumption in emerging markets and the premiumization of bottled water brands. Advances in manufacturing automation and packaging design are also expected to enhance operational efficiency and visual shelf appeal, contributing to the market’s upward trajectory

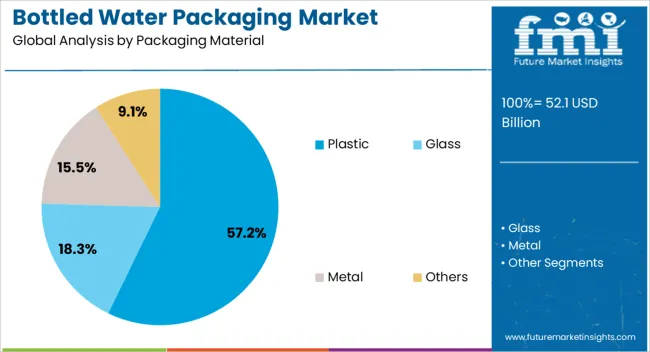

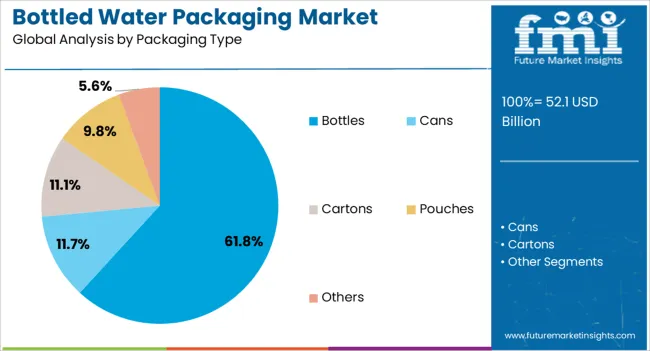

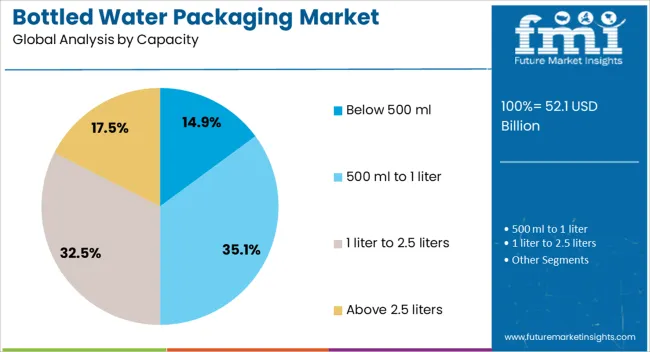

The bottled water packaging market is segmented by packaging material, packaging type, capacity, application, and geographic regions. By packaging material, bottled water packaging market is divided into plastic, glass, metal, and others. In terms of packaging type, bottled water packaging market is classified into bottles, cans, cartons, pouches, and others. Based on capacity, bottled water packaging market is segmented into Below 500 ml, 500 ml to 1 liter, 1 liter to 2.5 liters, and above 2.5 liters. By application, bottled water packaging market is segmented into still water, carbonated water, flavored water, functional water, and others. Regionally, the bottled water packaging industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The plastic segment dominates the packaging material category with a 57.2% market share, owing to its lightweight nature, affordability, and durability. Plastic materials, particularly PET, are widely preferred by manufacturers for their cost-effectiveness and compatibility with high-speed bottling lines.

The segment continues to benefit from advancements in recyclable and rPET technologies aimed at reducing environmental impact without compromising functionality. Plastic's flexibility in molding and customization supports diverse bottle designs, making it the material of choice for both standard and premium water brands.

While regulatory and consumer pressure is pushing toward sustainable alternatives, the scalability and efficiency of plastic packaging keep it at the forefront. Ongoing investments in circular economy initiatives and closed-loop recycling systems are expected to support the continued dominance of plastic in the bottled water packaging landscape

Bottles remain the leading packaging type with a 61.8% market share, reflecting their widespread use across all segments of the bottled water industry. Their convenience, reusability, and ability to accommodate various capacities and designs have cemented their status as the preferred format among consumers and retailers alike.

Technological improvements in blow molding and material engineering have enhanced the performance and sustainability profile of bottles, enabling lighter weights and reduced plastic usage per unit. The dominance of bottles is further reinforced by brand marketing strategies that prioritize ergonomic design and aesthetic differentiation.

In both retail and foodservice environments, bottles offer unmatched portability and visibility. Despite growing interest in alternative formats such as cartons and pouches, the bottle segment is expected to maintain its leadership due to its entrenched distribution infrastructure and consumer familiarity

The 500 ml to 1 liter capacity segment holds a 35.1% share of the bottled water packaging market, driven by its strong positioning as the standard daily hydration size for a wide base of consumers. This segment is particularly popular among working professionals, students, and fitness enthusiasts who value a balance between portability and sufficient volume.

Medium pack sizes are widely distributed across supermarkets, hypermarkets, gyms, and retail outlets, making them a staple in both bulk household purchases and individual consumption. Manufacturers are increasingly targeting this segment with functional packaging designs, resealable closures, and premium water variants such as mineral and alkaline options.

While offering higher per-unit margins than smaller bottles, this segment also benefits from economies of scale in mass production and distribution efficiency. As health consciousness and active lifestyles continue to expand globally, the 500 ml to 1 liter category is expected to maintain robust growth, supported by innovations in sustainable packaging, brand differentiation, and targeted wellness-oriented marketing strategies.

Packaging plays a key role in maintaining the freshness and quality of bottled water while also providing an attractive solution for branding. The market is driven by consumer preferences for bottled water over sugary beverages and the growing trend for on-the-go consumption. Challenges include concerns over plastic waste, regulatory pressures for reducing packaging impact, and fluctuations in raw material costs. Opportunities are emerging in the development of alternative packaging materials, such as biodegradable plastics and glass, and advancements in packaging technology. Companies that focus on reducing material use, offering efficient packaging solutions, and meeting regulatory requirements are best positioned for success in this growing market.

The demand for bottled water is driven by increasing consumer preference for convenient, healthy hydration options. As more people become aware of the health risks associated with sugary drinks, bottled water is viewed as a healthier alternative. The rise of on-the-go lifestyles, particularly in urban areas and among working professionals, has contributed to the growing popularity of bottled water, with single-serve bottles becoming the standard. In both developed and emerging markets, bottled water continues to be the go-to option for staying hydrated. As consumers prioritize hydration and wellness, the bottled water packaging market is poised for further expansion, with packaging innovations providing an opportunity to meet this demand.

The bottled water packaging market faces challenges related to the environmental impact of packaging waste and increasing regulatory pressures. Plastic bottles, in particular, have come under scrutiny due to their contribution to global plastic pollution. As regulations become stricter, companies are being urged to adopt packaging solutions that minimize waste and increase recyclability. Fluctuations in raw material costs, such as plastic and glass, can also affect packaging costs and the overall competitiveness of bottled water products. These challenges require manufacturers to find alternatives to traditional packaging materials and adopt technologies that reduce waste while maintaining product quality.

Opportunities in the bottled water packaging market are emerging with the introduction of alternative packaging materials and innovations in packaging design. Companies are exploring options such as plant-based plastics, glass bottles, and lightweight containers that reduce material usage. Furthermore, innovations in packaging functionality, such as easier-to-open caps, tamper-evident features, and ergonomic designs, are enhancing the consumer experience. The growing focus on packaging efficiency and functionality offers companies the chance to differentiate their brands in a competitive market. With consumers increasingly concerned about product impact and looking for practical solutions, the adoption of innovative packaging options will be key to meeting market demand.

The bottled water packaging market is seeing a growing trend toward premium packaging as companies differentiate their products through distinctive designs. Premium water brands are utilizing elegant glass bottles, custom labeling, and high-end packaging materials to create a luxurious experience for consumers. This trend is particularly prominent in markets where consumers are willing to pay a premium for unique packaging that complements their lifestyle. Additionally, packaging serves as a critical tool for branding, with companies utilizing packaging to enhance shelf appeal and connect with health-conscious consumers. As branding becomes more integral to consumer purchasing decisions, companies are leveraging packaging to communicate their brand story and attract loyalty.

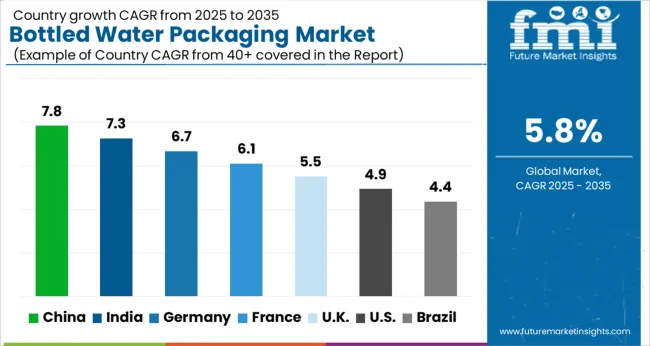

| Country | CAGR |

|---|---|

| China | 7.8% |

| India | 7.3% |

| Germany | 6.7% |

| France | 6.1% |

| UK | 5.5% |

| USA | 4.9% |

| Brazil | 4.4% |

The global bottled water packaging market is expected to grow at a CAGR of 5.8% from 2025 to 2035. China leads with the highest growth rate of 7.8%, followed by India at 7.3% and Germany at 6.7%. The UK and USA show more moderate growth rates of 5.5% and 4.9%, respectively. Key drivers of growth include increasing health awareness, the shift towards premium bottled water, and the demand for convenient, portable hydration solutions. The rise in demand for eco-friendly and recyclable packaging is also significantly shaping the market. The analysis includes over 40+ countries, with the leading markets detailed below.

The bottled water packaging market in China is projected to grow at a CAGR of 7.8% from 2025 to 2035. The country’s increasing population, urbanization, and rising disposable income levels are contributing significantly to the demand for bottled water and its packaging. As health-consciousness grows among consumers, bottled water is increasingly seen as a safer, healthier alternative to sugary beverages. The convenience and portability of bottled water also make it a preferred choice for busy urban dwellers. Furthermore, the Chinese government’s focus on improving public health and promoting clean drinking water is supporting this trend. The demand for eco-friendly packaging solutions is also rising, with both consumers and brands pushing for innovations in biodegradable and recyclable materials. With e-commerce and modern retail channels expanding rapidly, the availability of bottled water products continues to grow, boosting packaging needs.

The bottled water packaging market in India is expected to grow at a CAGR of 7.3% from 2025 to 2035. The growing urban population, rising income levels, and increasing awareness of health and hydration are key factors driving the demand for bottled water and its packaging. With water scarcity issues affecting several regions in India, bottled water has become a staple for many households. The market is also being influenced by the rise in disposable income, particularly among the middle class, which has increased the demand for premium bottled water products. In addition, the increasing popularity of bottled water as a healthy and convenient option for on-the-go consumption has further spurred growth. The demand for environmentally friendly packaging, such as recyclable and biodegradable materials, is also rising, with both consumers and brands focusing on sustainability.

The bottled water packaging market in Germany is projected to grow at a CAGR of 6.7% from 2025 to 2035. The country has seen consistent demand for bottled water driven by health trends and growing awareness about water purity. Consumers are increasingly prioritizing bottled water for its perceived health benefits, with more people opting for premium and flavored bottled water varieties. Germany’s strong environmental focus has resulted in a rising demand for sustainable and recyclable packaging solutions. The increasing trend of bottled water consumption in both urban and rural areas, combined with growing preferences for eco-friendly packaging, is pushing manufacturers to innovate and offer environmentally conscious solutions. As the market continues to grow, the demand for lightweight, durable, and recyclable packaging is also increasing.

The UK bottled water packaging market is expected to grow at a CAGR of 5.5% from 2025 to 2035. The demand for bottled water in the UK is being driven by increasing health-consciousness among consumers, as well as the growing popularity of bottled water as a safer, healthier alternative to sugary drinks. The convenience of bottled water, along with its ability to provide hydration on the go, makes it a preferred choice for busy lifestyles. The shift towards eco-conscious living is pushing both manufacturers and consumers to focus on sustainable packaging. Biodegradable and recyclable packaging solutions are gaining traction in the market, with many companies investing in eco-friendly alternatives. The rise in premium bottled water consumption, including flavored and functional waters, further boosts packaging demand. Retailers and online platforms are increasingly adopting bottled water packaging solutions to cater to the diverse preferences of consumers.

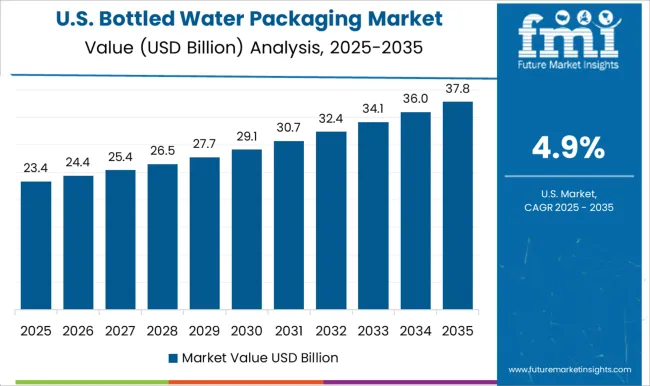

The USA bottled water packaging market is projected to grow at a CAGR of 4.9% from 2025 to 2035. In the USA, bottled water has become the go-to beverage for health-conscious consumers, as many are opting for water over sugary drinks. The demand for bottled water packaging is fueled by this increasing preference for healthy hydration, coupled with a fast-paced lifestyle that demands convenience. In recent years, consumers have shown a growing interest in premium and flavored bottled water, contributing to packaging innovation. This includes the adoption of recyclable, biodegradable, and lightweight materials to meet consumer demands for environmentally responsible options. Online retail and convenience stores are expected to become increasingly important channels for bottled water distribution, further driving packaging needs.

The bottled water packaging market is characterized by fierce competition among key players aiming to provide innovative and practical solutions for consumers. Alpla and Amcor dominate with their diverse packaging options, offering plastic, glass, and aluminum bottles. Alpla focuses on lightweight and cost-effective designs, while Amcor targets high-performance packaging that extends shelf life and improves product protection. Both companies cater to a wide range of bottled water brands, offering flexibility in design and materials to meet various market needs.

Aquafina and Ball stand out by focusing on high-volume, consumer-friendly packaging. Aquafina leverages PepsiCo's extensive distribution network, ensuring that its water bottles remain consistent in quality and convenient for mass-market consumers. Ball, known for its aluminum packaging, emphasizes the strength and lightweight nature of its bottles, appealing to both eco-conscious and cost-sensitive consumers. On the other hand, premium water brands like Crystal Geyser and Gerolsteiner target niche markets by offering high-quality glass packaging, which is marketed as a premium, luxurious experience. Their strategy is to enhance the perception of purity and refinement, offering a distinctive visual appeal. Graham Packaging and Greif compete by providing efficient, durable, and customizable packaging solutions.

Graham Packaging is known for its innovative plastic bottles designed to reduce leakage and improve transport efficiency. Greif, on the other hand, specializes in bulk water packaging and custom solutions, focusing on functionality and long-lasting durability for industrial-scale operations. Product brochures from these companies emphasize key selling points such as ease of use, strength, and protection against contaminants. Many brochures highlight the innovative features designed to improve packaging ergonomics, with special attention to tamper-proof designs, ease of carrying, and transportation efficiency. Packaging solutions are presented as both practical and aesthetically appealing to enhance the consumer experience.

| Items | Values |

|---|---|

| Quantitative Units | USD 52.1 billion |

| Packaging Material | Plastic, Glass, Metal, and Others |

| Packaging Type | Bottles, Cans, Cartons, Pouches, and Others |

| Capacity | Below 500 ml, 500 ml to 1 liter, 1 liter to 2.5 liters, and Above 2.5 liters |

| Application | Still water, Carbonated water, Flavored water, Functional water, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Alpla, Amcor, Aquafina, Ball, Crystal Geyser, Gerolsteiner, Graham Packaging, Greif, Ice Mountain, Kinley, Nestle Waters, O-I Glass, Sabic, Sidel, Tetra Pak, Vetropack, Vidrala, and Westrock |

| Additional Attributes | Dollar sales of bottled water packaging span plastic, glass, aluminum, and carton, across single-serve and multi-serve formats. Growth is driven by sustainability, health focus, and rising demand in North America, Europe, and Asia-Pacific. |

The global bottled water packaging market is estimated to be valued at USD 52.1 billion in 2025.

The market size for the bottled water packaging market is projected to reach USD 91.5 billion by 2035.

The bottled water packaging market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in bottled water packaging market are plastic, glass, metal and others.

In terms of packaging type, bottles segment to command 61.8% share in the bottled water packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bottled Water Processing Equipment Market Trends – Growth & Industry Forecast 2025-2035

RTD Bottled Cocktail Market - Size, Share, and Forecast Outlook 2025 to 2035

Premix Bottled Cocktails Market Trends - Growth & Consumer Shifts 2025 to 2035

Premium Bottled Water Market Size and Share Forecast Outlook 2025 to 2035

Sparkling Bottled Water Market Growth - Demand & Trends 2025 to 2035

Water and Waste Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Water-cooled Walk-in Temperature & Humidity Chamber Market Size and Share Forecast Outlook 2025 to 2035

Waterless Bathing Solution Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Waterborne UV Curable Resin Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Water Adventure Tourism Market Forecast and Outlook 2025 to 2035

Water Soluble Bag Market Size and Share Forecast Outlook 2025 to 2035

Water Leak Sensors Market Size and Share Forecast Outlook 2025 to 2035

Water Leak Detection System for Server Rooms and Data Centers Market Size and Share Forecast Outlook 2025 to 2035

Water and Wastewater Treatment Equipment Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Water Underfloor Heating Thermostat Market Size and Share Forecast Outlook 2025 to 2035

Water Activity Meter Market Size and Share Forecast Outlook 2025 to 2035

Water Leakage Tester Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA