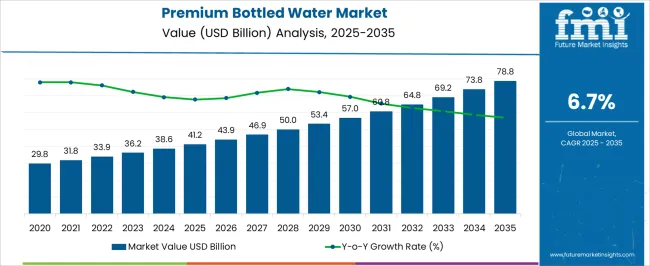

The premium bottled water market is expected to grow from USD 41.2 billion in 2025 to USD 78.8 billion by 2035, registering a 6.7% CAGR and generating an absolute dollar opportunity of USD 37.6 billion. Growth is driven by increasing consumer preference for high-quality, mineral-rich, and branded bottled water products, rising health consciousness, and the expansion of retail and e-commerce channels globally. Innovations in packaging, premiumization, and functional enhancements, such as added electrolytes or vitamins, further boost market adoption.

Rolling CAGR analysis provides insight into annual variations in growth over the forecast period. From 2025 to 2028, rolling CAGR remains slightly below the long-term average as growth is largely volume-driven in North America and Europe, where established consumption patterns and brand loyalty support steady adoption. Between 2029 and 2032, rolling CAGR rises above the average as Asia Pacific, Latin America, and the Middle East accelerate demand, fueled by urbanization, rising disposable income, and lifestyle shifts toward premium beverage consumption.

From 2033 to 2035, rolling CAGR moderates as mature markets reach higher penetration, with incremental revenue increasingly derived from premium product launches, functional bottled water variants, and brand differentiation. Overall, the USD 37.6 billion opportunity reflects a combination of volume expansion and value-based growth, highlighting the sustained and consistent trajectory of the premium bottled water market between 2025 and 2035.

| Metric | Value |

|---|---|

| Premium Bottled Water Market Estimated Value in (2025 E) | USD 41.2 billion |

| Premium Bottled Water Market Forecast Value in (2035 F) | USD 78.8 billion |

| Forecast CAGR (2025 to 2035) | 6.7% |

The premium bottled water market is driven by five primary parent markets with specific shares. Packaged beverages lead with 40%, as premium water brands cater to health- and lifestyle-conscious consumers. Hospitality and tourism account for 25%, supplying luxury hotels, resorts, and airlines. Retail and supermarkets contribute 20%, providing accessibility to high-end bottled water for households and on-the-go consumers. Fitness and wellness represent 10%, integrating mineral- and electrolyte-rich water for sports and health applications. Foodservice and events hold 5%, offering premium options for catering, conferences, and special occasions. These sectors collectively define global demand and influence branding and packaging innovation. Recent developments in the premium bottled water market focus on sustainability, product differentiation, and consumer experience.

Manufacturers are introducing mineral-enhanced, flavored, and functional water variants to attract health-conscious consumers. Eco-friendly packaging, including recyclable bottles and reduced plastic usage, is gaining importance. Branding strategies emphasize purity, source, and luxury positioning to appeal to niche markets. E-commerce and direct-to-consumer sales are expanding reach and convenience. Growth in wellness trends, luxury hospitality, and lifestyle-oriented consumption is driving adoption.

The premium bottled water market is gaining momentum as consumers increasingly prioritize health, wellness, and quality over price in their beverage choices. Perceptions of purity, mineral content, and sustainable sourcing are driving demand for premium offerings, particularly in urban centers and among health-conscious demographics.

The market is further supported by rising disposable incomes, premiumization trends in the food and beverage sector, and growing awareness around hydration benefits. Environmental considerations and brand transparency have prompted a shift toward eco-friendly packaging and ethically sourced water, adding value to premium brands.

Looking forward, the market is expected to expand as brands leverage artisanal marketing, origin-based differentiation, and innovative packaging to appeal to evolving consumer expectations. The focus on clean-label products, functional benefits, and luxury positioning continues to reinforce premium bottled water’s appeal across global markets.

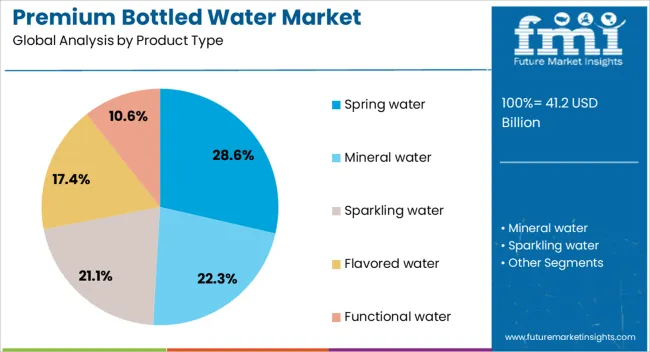

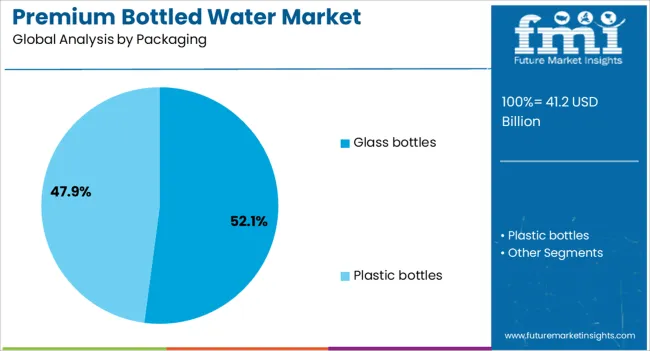

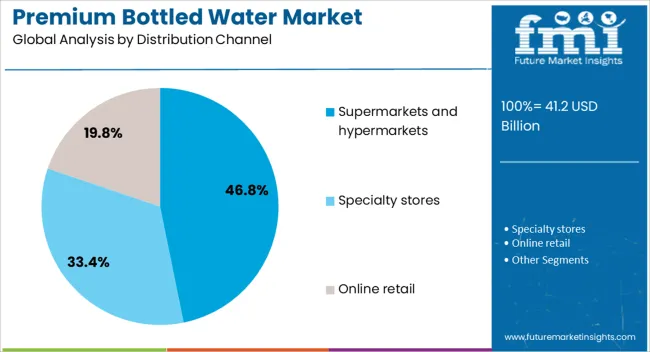

The premium bottled water market is segmented by product type, packaging, distribution channel, and geographic regions. By product type, premium bottled water market is divided into Spring water, Mineral water, Sparkling water, Flavored water, and Functional water. In terms of packaging, premium bottled water market is classified into Glass bottles and Plastic bottles. Based on distribution channel, premium bottled water market is segmented into Supermarkets and hypermarkets, Specialty stores, and Online retail. Regionally, the premium bottled water industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The spring water segment commands a 29% share within the product type category, attributed to its positioning as a naturally sourced, chemical-free hydration option. Consumers associate spring water with freshness, mineral richness, and purity, which enhances its appeal in the premium segment.

Its traceable source and minimal processing align with clean-label preferences and health-driven purchase behavior. Brands capitalizing on protected, remote spring sources have found strong resonance in markets where authenticity and origin matter.

This segment is further supported by rising demand for unadulterated hydration and the perception that spring water is superior in taste and quality compared to processed alternatives. Continued consumer emphasis on wellness and natural sourcing is expected to bolster the spring water segment’s contribution to the premium bottled water market.

Glass bottles account for 52% of the premium bottled water market’s packaging segment, driven by consumer preference for sustainable, non-toxic, and aesthetically appealing containers. Glass is widely regarded as a premium packaging material due to its ability to preserve taste, resist contamination, and project a high-end image.

This segment has benefitted from rising environmental consciousness, as glass is recyclable and aligns with low-carbon packaging goals. Premium brands increasingly adopt elegant, reusable glass designs that cater to luxury markets and eco-aware consumers.

The tactile and visual appeal of glass also supports brand differentiation on retail shelves and in hospitality settings. With growing regulation on plastic usage and the rising prominence of sustainable packaging in consumer decision-making, the glass bottles segment is poised to retain its leading position in premium product delivery.

Supermarkets and hypermarkets dominate the distribution landscape with a 47% share, reflecting their broad accessibility, shelf visibility, and capacity to support impulse purchases. These channels provide consumers with convenient access to a wide range of premium bottled water brands, enabling comparison based on origin, mineral composition, and packaging appeal.

Promotional placements and in-store branding also enhance consumer engagement and influence purchasing decisions within this channel. Retailers increasingly collaborate with premium brands to highlight artisanal water options and support health-focused marketing campaigns.

This segment’s leadership is reinforced by strong foot traffic, robust supply chain infrastructure, and the ability to accommodate premium pricing strategies. As consumer interest in premium hydration grows, supermarkets and hypermarkets are expected to remain a primary distribution platform, supported by strategic placement and expanding product assortments.

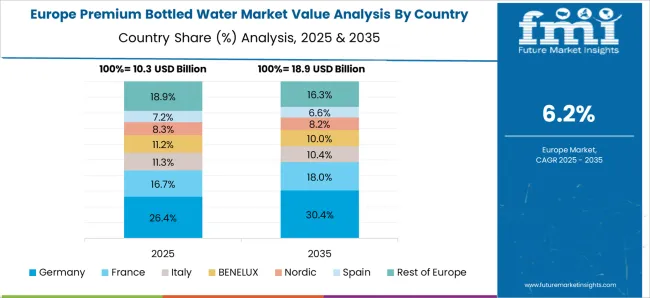

The global premium bottled water market is expanding due to rising consumer demand for high-quality, mineral-rich, and aesthetically packaged water. Europe accounts for over 35% of consumption, led by France, Italy, and Germany, while North America focuses on functional, vitamin-enriched, and sustainable bottled water. Asia Pacific shows growing adoption in urban centers due to rising disposable incomes and lifestyle awareness. Technological advancements in purification, packaging, and labeling enhance brand differentiation. Increasing health consciousness, on-the-go consumption, and hospitality sector growth are creating measurable opportunities for global market expansion.

The premium bottled water market is driven by increasing consumer awareness about hydration, mineral content, and water purity. Bottled water enriched with electrolytes, antioxidants, and natural minerals is gaining traction among health-conscious consumers, with annual growth of 6–8% globally. North America emphasizes functional and vitamin-infused water, while Europe favors naturally sourced mineral waters from protected springs. Urban consumers in Asia Pacific are shifting from carbonated soft drinks to premium water due to lifestyle changes. Retail chains, hospitality sectors, and fitness centers are expanding product placements, while convenience packaging in PET and glass bottles facilitates on-the-go consumption, further driving adoption in commercial and consumer segments.

Opportunities in the premium bottled water market arise from functional ingredients, flavor innovations, and eco-friendly packaging. Infused waters with vitamins, minerals, and botanicals are experiencing 8–10% annual growth due to demand for functional beverages. Manufacturers are investing in biodegradable bottles, recyclable PET, and glass packaging to meet sustainability standards in North America and Europe. Asia Pacific presents strong opportunities with premium water offerings in urban retail, food service, and luxury hotels. Expansion in flavored and sparkling waters, coupled with digital marketing and e-commerce distribution, enables access to health-conscious and millennial consumers. Companies providing innovative, functional, and sustainable water options can capture significant market share globally.

Key trends in the premium bottled water market include product premiumization, flavor and mineral differentiation, and online retail expansion. Sparkling, flavored, and naturally sourced mineral waters are gaining popularity, with Europe leading in mineral water consumption. Asia Pacific is adopting functional and luxury water brands in urban centers, while North America focuses on wellness-oriented formulations. E-commerce platforms, subscription models, and home delivery services are enhancing accessibility and brand visibility. Packaging innovations, including embossed bottles, ergonomic designs, and limited-edition collections, cater to luxury and gifting segments. Digital marketing campaigns and influencer endorsements are reinforcing brand positioning, reflecting a trend toward aspirational, health-focused, and convenient bottled water consumption worldwide.

Despite growth, the premium bottled water market faces challenges from high retail prices, raw material costs, and supply chain limitations. PET and glass bottles, water sourcing, and mineral testing contribute to production costs 15–25% higher than standard bottled water. Seasonal variations in spring and mineral water availability can impact production consistency. Strict regulatory compliance for water quality, labeling, and environmental standards increases operational complexity. Transportation and cold chain management further add to costs, especially for long-distance distribution. Manufacturers must optimize sourcing, packaging, and logistics while maintaining quality and branding to overcome price sensitivity and ensure consistent global market adoption.

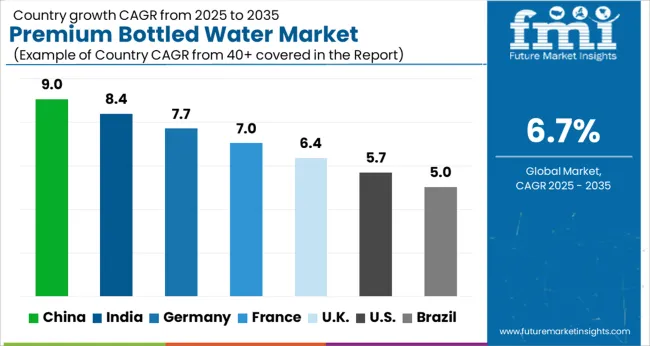

| Country | CAGR |

|---|---|

| China | 9.0% |

| India | 8.4% |

| Germany | 7.7% |

| France | 7.0% |

| UK | 6.4% |

| USA | 5.7% |

| Brazil | 5.0% |

The premium bottled water market is expected to expand at a global CAGR of 6.7% through 2035, supported by rising consumer preference for health-conscious beverages, urban lifestyle changes, and increasing disposable incomes. China leads at 9.0%, a 1.35× multiple of the global benchmark, driven by BRICS-focused urban consumption, retail expansion, and brand penetration. India follows at 8.4%, a 1.25× multiple, reflecting growing awareness of bottled water quality, urbanization, and retail availability. Germany records 7.7%, a 1.15× multiple, shaped by OECD-backed innovation in premium packaging, quality standards, and sustainability initiatives. The United Kingdom posts 6.4%, slightly below the global rate, with adoption concentrated in health-conscious and premium segments. The United States stands at 5.7%, 0.85× the benchmark, supported by steady consumption in lifestyle and convenience-oriented segments. BRICS markets drive volume growth, OECD regions focus on quality and branding, while ASEAN markets contribute through expanding retail networks and consumer demand. This report includes insights on 40+ countries; the top markets are shown here for reference.

The premium bottled water market in China is projected to grow at a CAGR of 9.0%, driven by rising consumer preference for high-quality, mineral-rich, and imported water products. Urban and semi-urban regions are witnessing increasing adoption of eco-friendly packaging and premium brands. Companies such as Nongfu Spring, Watsons Water, and Evian are expanding product portfolios, introducing functional and flavored variants to cater to health-conscious consumers. Retail channels including supermarkets, convenience stores, and e-commerce platforms are contributing to distribution growth. Marketing campaigns emphasizing purity, natural mineral content, and lifestyle appeal are strengthening consumer engagement. Rising tourism and business travel further support demand for portable premium water options.

The premium bottled water market in India is expected to expand at a CAGR of 8.4%, supported by urbanization, growing health awareness, and increasing disposable income. Companies such as Bisleri, Kinley, and Evian are introducing premium variants, including mineral, alkaline, and flavored water. Retail distribution is concentrated through modern trade outlets, convenience stores, and online platforms. Marketing efforts focus on purity, natural mineral content, and lifestyle positioning. Rising adoption among young adults, corporate consumers, and fitness enthusiasts is accelerating growth. Regional expansion into tier-2 and tier-3 cities is enhancing market reach. Demand for eco-friendly packaging and functional water variants is increasing, driving innovation and product differentiation.

The premium bottled water market in Germany is projected to grow at a CAGR of 7.7%, driven by strong demand for mineral-rich, sparkling, and naturally sourced bottled water. Companies including Gerolsteiner, Evian, and Vittel are focusing on functional and flavored variants to cater to health-conscious consumers. Distribution is primarily through supermarkets, retail chains, and online platforms. Technological trends include sustainable packaging, premium labeling, and enhanced mineral composition. Consumer preference for high-quality, clean-label products is reinforcing adoption. Tourism, hospitality, and fitness segments are significant contributors to demand. German consumers are increasingly opting for imported and organic bottled water products, creating opportunities for niche brands and specialized offerings.

The premium bottled water market in the United Kingdom is forecast to grow at a CAGR of 6.4%, supported by demand for functional, mineral-rich, and flavored water products. Leading companies such as Highland Spring, Evian, and Volvic are expanding product portfolios, including natural mineral and alkaline water variants. Retail distribution spans supermarkets, convenience stores, online grocery platforms, and hospitality channels. Marketing emphasizes purity, natural sourcing, and lifestyle appeal to attract health-conscious consumers. Consumer preference for sustainable packaging and premium labeling is shaping product offerings. Growing adoption in urban areas and among young professionals contributes to market growth, while partnerships with foodservice chains reinforce reach.

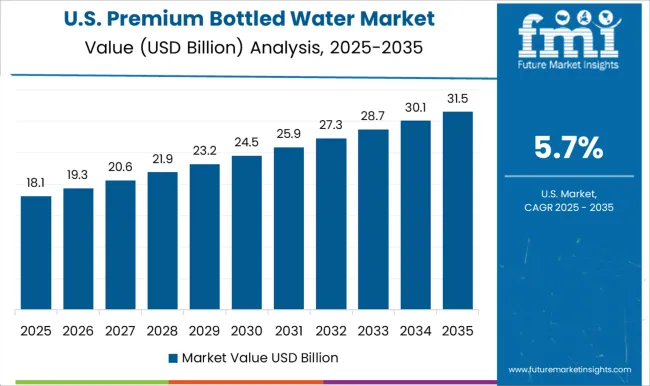

The premium bottled water market in the United States is projected to grow at a CAGR of 5.7%, driven by consumer demand for mineral-rich, flavored, and alkaline water. Companies such as Nestle Pure Life, Fiji, and Evian are introducing premium variants targeting health-conscious and urban consumers. Distribution spans supermarkets, convenience stores, online platforms, and fitness outlets. Marketing emphasizes purity, premium quality, and lifestyle positioning. Growth is fueled by rising awareness of hydration benefits, increased spending on wellness products, and adoption in hospitality and travel segments. Technological developments in sustainable packaging and flavor innovation are shaping consumer preferences.

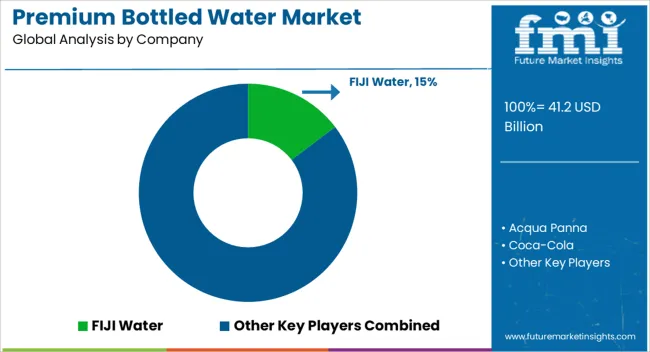

Competition in the premium bottled water sector is driven by brand recognition, water source quality, and innovative packaging. FIJI Water emphasizes natural artesian sourcing and unique square bottles to differentiate its product in international markets. Acqua Panna focuses on Tuscany-sourced spring water with mineral balance tailored for fine dining and lifestyle positioning. Coca-Cola markets premium variants alongside mainstream beverages, leveraging global distribution and strong branding to capture a broad audience.

Danone offers Evian and other premium lines emphasizing purity, taste consistency, and sustainability in sourcing practices. Gerolsteiner Brunnen highlights naturally carbonated mineral water with a health-oriented mineral composition, catering to wellness-conscious consumers. Nestlé provides diverse premium water products that combine regional sourcing with advanced purification technologies. PepsiCo distributes premium brands such as Aquafina and Bubly, integrating brand campaigns with lifestyle marketing. Perrier emphasizes sparkling water heritage, flavor variants, and premium packaging aesthetics. San Pellegrino leverages Italian heritage and sparkling mineral content to appeal to fine dining and luxury markets. Tata Global Beverages and Voss Water focus on niche marketing, including premium bottle design, limited editions, and exclusive retail partnerships.

Leaders in this segment compete through consistent quality, global distribution networks, and visually appealing, functional packaging that reinforces brand prestige while meeting consumer expectations for taste, purity, and convenience.

| Item | Value |

|---|---|

| Quantitative Units | USD 41.2 Billion |

| Product Type | Spring water, Mineral water, Sparkling water, Flavored water, and Functional water |

| Packaging | Glass bottles and Plastic bottles |

| Distribution Channel | Supermarkets and hypermarkets, Specialty stores, and Online retail |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | FIJI Water, Acqua Panna, Coca-Cola, Danone, Evian, Gerolsteiner Brunnen, Nestle, PepsiCo, Perrier, San Pellegrino, Tata Global Beverages, and Voss Water |

| Additional Attributes | Dollar sales by water type and end use, demand dynamics across retail, hospitality, and foodservice, regional trends in health and wellness adoption, innovation in packaging, purification, and mineral content, environmental impact of plastic use and recycling, and emerging use cases in functional, flavored, and luxury water segments. |

The global premium bottled water market is estimated to be valued at USD 41.2 billion in 2025.

The market size for the premium bottled water market is projected to reach USD 78.8 billion by 2035.

The premium bottled water market is expected to grow at a 6.7% CAGR between 2025 and 2035.

The key product types in premium bottled water market are spring water, mineral water, sparkling water, flavored water and functional water.

In terms of packaging, glass bottles segment to command 52.1% share in the premium bottled water market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bottled Water Packaging Market Size and Share Forecast Outlook 2025 to 2035

Bottled Water Processing Equipment Market Trends – Growth & Industry Forecast 2025-2035

Sparkling Bottled Water Market Growth - Demand & Trends 2025 to 2035

Water Vapor Permeability Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Water and Waste Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Water-cooled Walk-in Temperature & Humidity Chamber Market Size and Share Forecast Outlook 2025 to 2035

Waterless Bathing Solution Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Waterborne UV Curable Resin Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Water Adventure Tourism Market Forecast and Outlook 2025 to 2035

Water Packaging Market Forecast and Outlook 2025 to 2035

Water Soluble Bag Market Size and Share Forecast Outlook 2025 to 2035

Water Leak Sensors Market Size and Share Forecast Outlook 2025 to 2035

Water-soluble Packaging Market Size and Share Forecast Outlook 2025 to 2035

Water Leak Detection System for Server Rooms and Data Centers Market Size and Share Forecast Outlook 2025 to 2035

Water and Wastewater Treatment Equipment Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Water Underfloor Heating Thermostat Market Size and Share Forecast Outlook 2025 to 2035

Water Activity Meter Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA