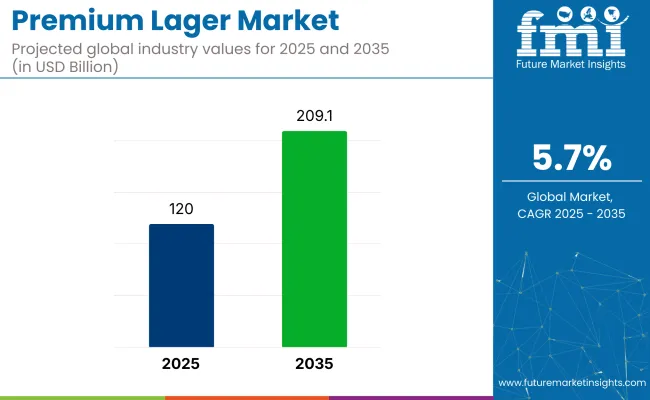

The global premium lager market is projected to increase from USD 120 billion in 2025 to USD 209.1 billion by 2035 at a CAGR of 5.7% during the forecast period. This trend is driven by the growing demand for premium and craft beers as consumers increasingly seek unique flavors, artisanal brewing, and high-quality ingredients.

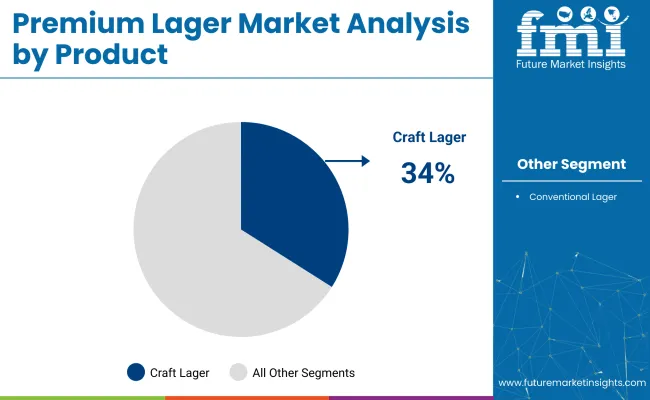

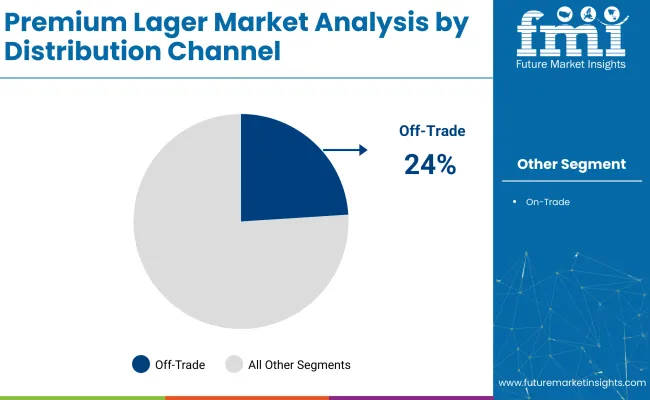

Craft lager is expected to dominate the product segment, capturing 34% of the industry share in 2025. This segment is benefitting from the rise of microbreweries and craft beer culture, with consumers seeking distinctive, locally brewed products. Additionally, off-trade distribution, which includes retail and online sales, will hold a significant share of the industry, accounting for 24% in 2025. This reflects the growing convenience of purchasing lager from supermarkets, liquor stores, and e-commerce platforms.

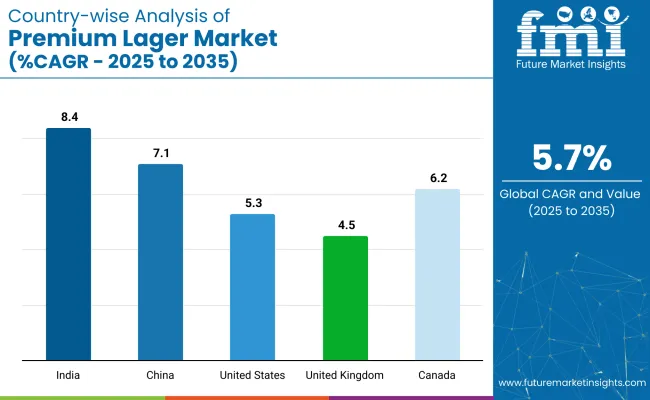

India, with its rapidly growing middle class and changing consumption patterns, is expected to be a key growth region. The country’s growing affinity for premium and imported alcoholic beverages is driving demand for premium lagers, with a projected CAGR of 8.4%. Asia Pacific, particularly India, presents a massive opportunity for global lager brands.

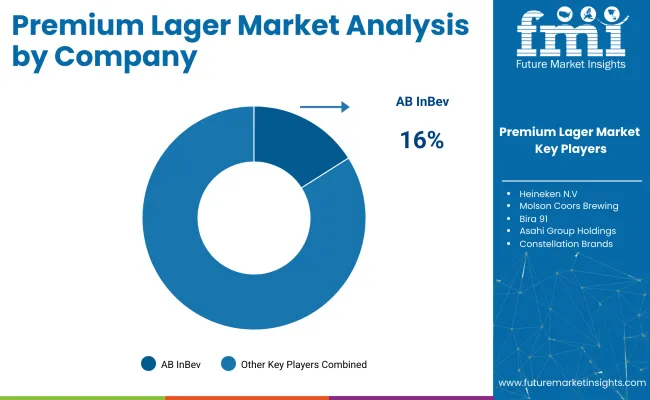

The industry remains highly competitive, with major players like Anheuser-Busch InBev, Heineken N.V., and Tsingtao Brewery Group leading the industry. As competition intensifies, these companies are expanding their product portfolios and strengthening their distribution networks to maintain industry leadership. Tsingtao Brewery collaborated with fashion brand DAWANG to launch an innovative Fall/Winter 2024 collection, merging the worlds of beer and fashion to celebrate Qingdao's rich culture and heritage.

The global industry is projected to grow through 2035. In 2025, craft lager will hold 34% of the industry share, and off-trade distribution will capture 24% of the distribution segment. Key players include AB InBev, Heineken, and Carlsberg.

The craft lager segment is projected to capture 34% of the industry share in 2025.

Off-trade distribution is expected to hold 24% of the industry share in 2025.

The industry is expanding due to increasing consumer demand for high-quality, craft-style beers. However, high production costs and competition from global beer brands create challenges for industry growth.

Rising consumer preference for premium and craft-style beers

High production costs and competition from global beer brands

The industry is experiencing substantial growth globally, driven by increasing consumer demand for high-quality beers and evolving consumer preferences toward premium, craft, and international brews. Countries like India, China, the United States, the United Kingdom, and Canada are leading this trend, contributing significantly to the industry expansion.

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 8.4% |

| China | 7.1% |

| United States | 5.3% |

| United Kingdom | 4.5% |

| Canada | 6.2% |

The industry in India is projected to grow at a CAGR of 8.4% from 2025 to 2035, driven by the growing preference for higher-quality alcoholic beverages among younger consumers.

The industry in China is expected to grow at a CAGR of 7.1% from 2025 to 2035, driven by a shift in consumer preferences toward premium and craft beers.

The United States industry is projected to grow at a CAGR of 5.3% from 2025 to 2035, supported by the growing popularity of craft beers and the evolving demand for premium alcoholic beverages.

The industry in the United Kingdom is expected to grow at a CAGR of 4.5% from 2025 to 2035, driven by changing consumer preferences and the increasing popularity of craft beers and international premium brands.

Canada’s industry is projected to grow at a CAGR of 6.2% from 2025 to 2035, fueled by increasing demand for higher-quality beers, particularly among younger demographics.

The global industry is characterized by a blend of dominant multinational corporations and emerging regional players. Prominent players include industry giants such as Anheuser-Busch InBev, Heineken N.V., China Resources Snow Breweries, Carlsberg Breweries A/S, Molson Coors Beverage Company, Tsingtao Brewery Group, Asahi Group Holdings, and Constellation Brands, who command significant industry share through their extensive portfolios and global distribution networks.

Key players comprise companies like Bira 91, B9 Beverages Pvt. Ltd., and The Beijing Yanjing Beer Group Corporation, which, while smaller in scale, have established strong regional presences and cater to niche industries. Despite the dominance of leading suppliers, the industry remains moderately fragmented, driven by the increasing demand for diverse and premium beer offerings.

Recent Premium Lager Industry News

| Report Attributes | Key Insights |

|---|---|

| Estimated Industry Value (2025) | USD 120 billion |

| Projected Industry Value (2035) | USD 209.1 billion |

| CAGR (2025 to 2035) | 5.7% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD billion |

| Product Type | Conventional Lager, Craft Lager |

| Distribution Channel | Off-trade, On-trade |

| Region | Latin America, Asia Pacific, the Middle East & Africa, North America, Europe |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players | Anheuser-Busch InBev , Heineken N.V., China Resources Snow Breweries, Molson Coors Brewing, Tsingtao Brewery Group, Bira 91, Asahi Group Holdings, Constellation Brands, B9 Beverages Pvt. Ltd., Carlsberg Breweries A/S |

| Additional Attributes | Dollar sales rising with craft lager segment, consumer preference shifting towards premium offerings, growth in global demand for craft beer, off-trade sales driving industry growth, premiumization trend accelerating |

Conventional lager and craft lager.

Off-trade and on-trade.

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, Middle East and Africa (MEA).

The industry is projected to reach USD 120 billion in 2025.

The industry is expected to grow to USD 209.1 billion by 2035.

The industry is expected to grow at a CAGR of 5.7% from 2025 to 2035.

Craft lager is projected to dominate, holding a 34% industry share in 2025.

India is forecasted to be the fastest-growing industry with an 8.4% CAGR.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Premium Bottled Water Market Size and Share Forecast Outlook 2025 to 2035

Premium Outdoor Apparel Market Size and Share Forecast Outlook 2025 to 2035

Premium Electric Motorcycle Market Size and Share Forecast Outlook 2025 to 2035

Premium Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Premium Spirits Glass Bottle Market Size and Share Forecast Outlook 2025 to 2035

Premium Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Premium Alcoholic Beverage Market - Size, Share, and Forecast 2025 to 2035

Premium Chocolate Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Premium Cigarette Market Growth – Demand & Industry Outlook to 2035

Premium Wine Cooler Market Analysis - Growth & Forecast 2025 to 2035

Premium Bicycle Market Analysis by Type, Usage Type, End-user, and Region Forecast Through 2035

A2P & P2A Messaging – AI-Driven Communication & Security

Demand for Lactoferrin Premiumization in Immune SKUs in EU

Lager Market Trends - Brewing Innovations & Consumer Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA