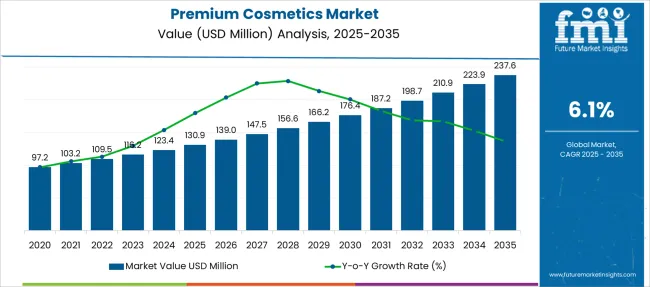

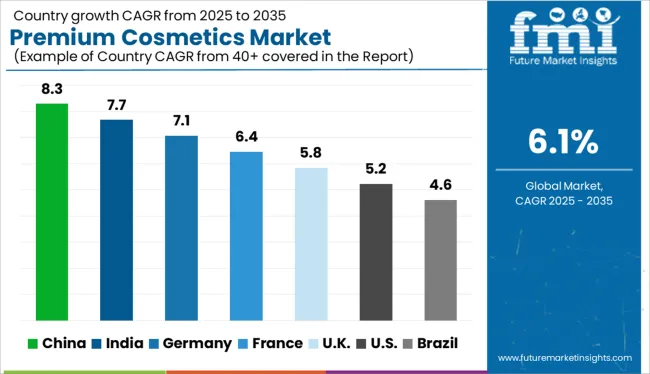

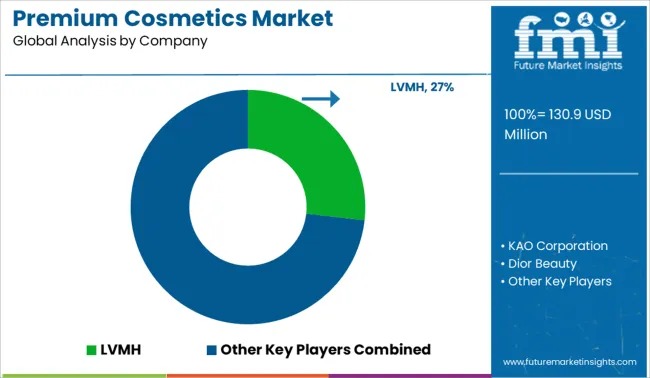

The Premium Cosmetics Market is estimated to be valued at USD 130.9 million in 2025 and is projected to reach USD 237.6 million by 2035, registering a compound annual growth rate (CAGR) of 6.1% over the forecast period.

| Metric | Value |

|---|---|

| Premium Cosmetics Market Estimated Value in (2025 E) | USD 130.9 million |

| Premium Cosmetics Market Forecast Value in (2035 F) | USD 237.6 million |

| Forecast CAGR (2025 to 2035) | 6.1% |

The premium cosmetics market is experiencing robust growth as consumers increasingly prioritize quality, ingredient transparency, and personalized skincare and grooming solutions. Rising disposable incomes, urban lifestyle shifts, and growing awareness around self care have contributed to a higher demand for luxury beauty products.

Global brands are investing in advanced formulations, clean beauty innovations, and exclusive product experiences to differentiate in a highly competitive space. Social media influence and celebrity endorsements continue to shape consumer preferences, while e commerce has expanded access to premium cosmetic lines across geographies.

Regulatory support for clean labeling and the growing demand for cruelty free and sustainable beauty options are further accelerating the market's momentum. The outlook remains strong as brands focus on authenticity, performance, and ethical production to align with evolving consumer values.

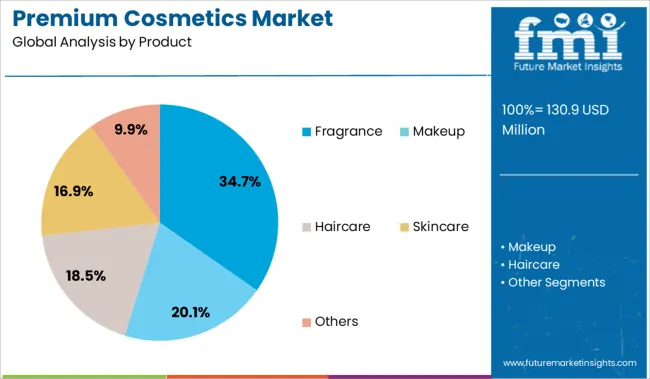

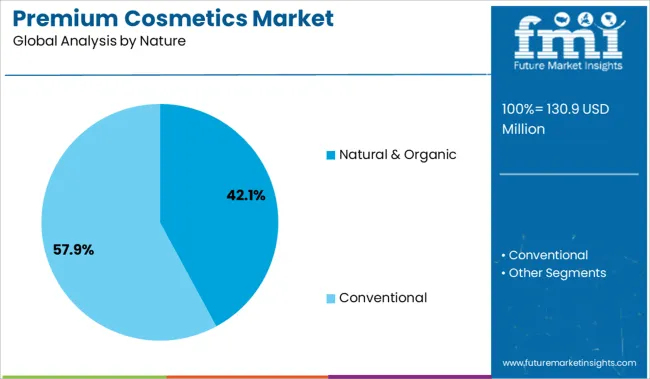

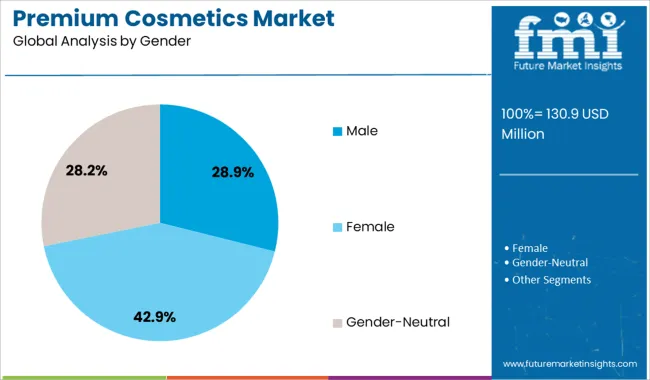

The market is segmented by Product, Nature, Gender, and Distribution Channel and region. By Product, the market is divided into Fragrance, Makeup, Haircare, Skincare, and Others. In terms of Nature, the market is classified into Natural & Organic and Conventional. Based on Gender, the market is segmented into Male, Female, and Gender-Neutral. By Distribution Channel, the market is divided into Online and Offline. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The fragrance segment is projected to hold 34.70% of total market revenue by 2025, making it the leading product category within premium cosmetics. This is due to increasing consumer interest in personal scent identity, luxury scent layering, and artisanal fragrance experiences.

Fragrances are perceived as both a lifestyle and emotional statement, prompting consumers to invest in high end and niche offerings. Premium fragrance houses are leveraging heritage storytelling, natural ingredients, and long lasting compositions to build brand loyalty.

The growth of travel retail and limited edition product launches has also contributed to this segment’s expansion. Fragrance continues to command a significant share due to its aspirational positioning and consistent demand across demographics.

The natural and organic segment is expected to capture 42.10% of market revenue by 2025 within the nature category, establishing itself as the leading preference among consumers. This growth is being fueled by rising health consciousness, transparency in ingredient sourcing, and growing concerns over synthetic chemicals in skincare and beauty products.

Consumers are increasingly seeking formulations that are plant based, ethically sourced, and free from harmful additives. Premium cosmetic brands are aligning with these values by offering certified organic products, sustainable packaging, and eco responsible supply chains.

As clean beauty becomes a mainstream expectation, the natural and organic segment is driving innovation and differentiation in premium offerings, solidifying its position as a market leader.

The male consumer segment is projected to account for 28.90% of market revenue by 2025 within the gender category, reflecting its growing influence in the premium cosmetics space. Shifts in cultural norms, increased grooming awareness, and targeted marketing have contributed to a surge in demand for high quality skincare, haircare, and fragrance products tailored to male preferences.

The expansion of male focused product lines, combined with the normalization of skincare routines for men, has supported category growth. Digital channels and influencer marketing have also played a critical role in engaging male consumers and breaking traditional stereotypes.

As men continue to embrace wellness and self presentation, the segment is expected to witness sustained investment and innovation, making it a pivotal contributor to overall market growth.

The industry's day-to-day operations, product development, and marketing for the companies with the best-selling prestige cosmetics line are led by key players. These players have developed an art out of knowing their consumer base as early adopters of social media platforms. They offer a bold, self-regulating method for client retention in which items are evaluated and commented on in real-time by millions of enthralled followers who demand top-performing formulations and forward-thinking trends.

Hence, the demand for premium cosmetics is likely to rise as market players emerge as the industry's first line of contact, engaging directly with social media followers and influencers to deliver cutting-edge, industry-defining items to the customer. The lipstick market has long been dominant, and the latest trend of unusual color ranges and finishes has swept the globe by storm. End users are contemplating unusual, one-of-a-kind hues such as blue, black, and neon colors, as well as various finishes such as liquid matte, metallic, glitter, opaque gloss, sheer gloss, and so on.

In recent years, the luxury cosmetics industry's principal purpose has been to highlight diversity which contributes to the global premium cosmetics market growth. This involves creating cosmetic products that are safe for persons with sensitive skin and cater to multiple skin tones and hues. As a result, the global color cosmetics sector has emphasized the importance of shaping consumer culture by balancing fashion and art.

Premium cosmetics that are customizable are also available in the market. These items include custom-blend options, which include a mixing palette and a variety of color selections to create hues based on the consumer's preferences. These are particularly developed to fit different skin tones and have become a new customer favorite. Furthermore, these cosmetics are made using technology that analyses skin tones and combines a product to perfection.

The implementation of this color-matching technology, which also allows end users to match their created colors with their clothing to meet current trends, is predicted to enhance the applications of premium cosmetics, contributing to the rise of the global premium cosmetics market growth. A lot of these premium brands also donate a portion of their revenues to various charities related to animals, children, vulnerable women, old age homes, the LGBTQIA+ community, etc.

Furthermore, luxury cosmetic manufacturers place an emphasis on product packaging. They prefer, for example, to make lipstick bullets with a push-up lid or a magnetic clasp, which provides a robust and luxurious feel and touch. These factors are projected to boost demand for high-end cosmetics. All these factors are anticipated to surge product demand and expand the global premium cosmetics market size.

Rising use of personal care and beauty products for visual appeal by the younger generation, as well as individuals checking and purchasing products online while on the go due to an increase in the usage of smartphones and rising Internet penetration, are expected to spark innovations in the premium cosmetics market trends, during the forecast period.

With many products dedicated to various physical and facial attributes, men's grooming products are dominating the market. Moreover, consumers throughout the world are gravitating toward organic personal care products as the demand for organic ingredients grows, which is likely to fuel market growth.

The statistics accumulated by Future Market Insights reveal the global forum of premium cosmetics, which has witnessed an unprecedented surge over the past few years. The key providers in the market are in conjunction with the increasing demand for premium cosmetics. There has been a gradual rise from a CAGR of 6.1% registered during the period of 2020 to 2025, and it is likely to expand at a massive 6.14% in the forecast period.

People used to love conventional cosmetic goods like lipstick and eyeliner. However, in recent years, consumers have been more likely to purchase a cosmetic product designed for every facial feature, including the brows, nose, and jawline. The significant increase in the market size can be attributable to the rising customer desire to enhance physical characteristics using various cosmetic items.

Skin aging is increasing in tandem with the world’s aging population. According to the USA Census Bureau, more than 54 Million individuals in the country are 65 or older, accounting for around 16.5% of the total population. Consumer desire for mini-sized cosmetic goods is also increasing. Moreover, the increasing desire for men for cosmetics is also one of the market's primary development factors. Owing to these factors, the premium cosmetics market size is estimated to expand in the forecast period.

By product type, the market is segmented into fragrance, makeup, haircare, skincare, and others. It has been studied by the analysts at Future Market Insights that the skincare segment is estimated to hold a major market share, through the forecast period.

The pivotal aspects determining the momentum of this segment are:

By distribution channel type, the market is segmented into online and offline. It has been studied by the analysts at Future Market Insights that the online segment is estimated to hold a major market share, through the forecast period.

Increased awareness about the dangers of chemicals and synthetic ingredients is likely to boost the adoption of premium cosmetics. The majority of customers choose to purchase items with natural or organic labeling, which is fueling market growth. Furthermore, consumer preference is evolving away from traditional or mass-produced cosmetics and toward premium cosmetics as they become more aware of the benefits of luxury ingredients.

Digitalization is one of the primary forces expected to influence the premium cosmetics market growth. The increasing prevalence of social media and the internet serves as an important medium for brand recognition. In addition, personalization in cosmetics is a growing consumer trend, along with the production of items to satisfy individual requirements and lifestyles, in conjunction with professional services, aided by the torrent of information available online.

Premium cosmetics for conditions such as age spots, acne, and pigmentation are likely to drive the premium cosmetics market growth. In addition, the need for active components and products with proven efficacy, and the availability of a large selection of products, are increasing product sales. Additionally, consumer preferences for imported and branded cosmetics are influenced mostly by brand name, product safety, and price.

The availability of counterfeit cosmetic products, as well as stricter government regulations on cosmetics, are projected to impede the growth of the global premium cosmetics market growth during the forecast period. Moreover, the remarkably high cost of premium products is further expected to be a major challenge for the market.

On the contrary, product variety is increasing, with gender-neutral and luxury cosmetics for males gaining momentum. In addition, brand endorsements and product placements by celebrities, as well as social media beauty influencers, are anticipated to generate creative market opportunities during the forecast period.

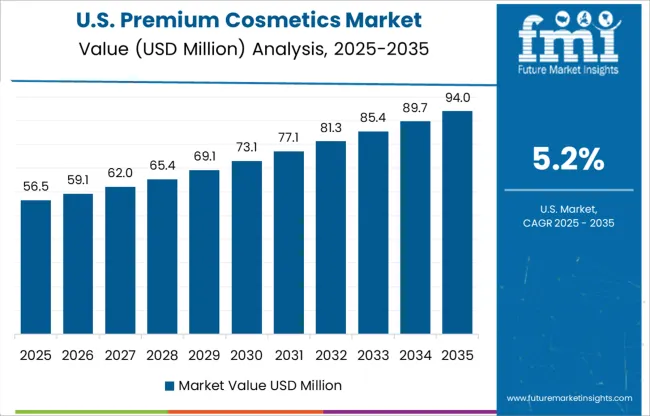

North America is the largest premium cosmetics market with remarkable potential. This is owing to the preference of most people to enhance their aesthetic appeal and the availability of innovative cosmetics and beauty products.

Furthermore, major players are providing cutting-edge cruelty-free cosmetics as animal sensitivity gains popularity. The majority of the key companies are focused on revolutionizing luxury cosmetics through revolutionary formulas, cutting-edge performance, and enticing packaging. Furthermore, they are committed to animal welfare, having developed the industry's first vegan substitute for carmine. They also collaborate with artists and cosmetic package designers to develop innovative, robust, and attractive packaging.

This region has seen the introduction of AI-powered mobile applications, which is attributable to the advancement of innovative technologies. MatchCo, for instance, is a smartphone app that allows consumers to buy bespoke foundations from the comfort of their own homes. The beauty app scans, analyses, and custom mix foundation to match each individual's skin tone. This is an all-in-one hydrating foundation (full coverage + primer + moisturizer) that nourishes the face while also providing an even skin tone.

Recently, social media influencers have been collaborating with certain premium brands. These brands achieve this by delivering PR packages, including their newest product launches, to influencers so that they may review the items before they are launched. Similarly, they may offer discount coupons affiliated with a certain influencer to their audience in exchange for endorsement and revenue.

Europe is a growing premium cosmetics market, with most of the luxury brands originating from countries such as the United Kingdom, France, Italy, and Spain. This is owing to increased awareness regarding personal care, the existence of well-established players, and the desire for online purchasing.

For decades, key players in the United Kingdom have been formulating and perfecting their product portfolio, culminating in the launch of their high-performance cosmetics while setting global beauty trends. Moreover, they further elevate the art of makeup within the fashion industry's most demanding environments, such as backstage at runway presentations for the most iconic couturiers and coveted international brands.

There are products available for consumers, whether they are looking for pure and natural cosmetics or choose to spend their money on skincare products. Key players aim to curate products that enhance the skin with brightness, moisture, and attractive bursts of color. Furthermore, consumers' preferences have shifted toward sweatproof, humidity-proof, waterproof, and transfer-resistant luxury cosmetic products, which are anticipated to generate market opportunities.

South Korea is a booming market for premium cosmetics with extensive creative opportunities. Consumers in the country prefer makeup that is infused with skincare since they favor the concept of minimal makeup. Moreover, top brands use expensive ingredients to manufacture these products, which are likely to hike up their prices in the market, dubbing them as premium.

To keep their businesses relevant, premium cosmetic industry participants are heavily relying on digital marketing techniques and social media promotions. They maintain their standing in nations such as South Korea by dealing with e-commerce platforms and online shopping apps.

Cosmetics marketed in appealing and fascinating packaging are becoming increasingly popular. Customers are more inclined to purchase beauty items that have a theme linked with them, according to research. Furthermore, businesses are producing cosmetics infused with skincare elements in response to the growing demand for goods created with natural and useful ingredients.

India is a growing premium cosmetics market with the proliferation of several new local luxury brands. Furthermore, millennials are growing increasingly concerned about the consequences of cosmetics on their skin. Moreover, their skincare and cosmetics habits affect leading manufacturers to develop creative prospects.

The proliferation of online shopping applications such as Nykaa, Purplle, HokMakeup, Amazon India, and others has expanded premium cosmetics sales in India. Furthermore, the market growth might be linked to customers' capacity to compare products across numerous distribution channels.

Since synthetic beauty cosmetics include hazardous and harsh ingredients, consumers are increasingly opting for greener options. These products are likely to be premium since the brands employ high-quality ingredients rather than artificial or synthetic additions.

Premium cosmetics are expanding over the world as people's desire to beautify their facial characteristics grows. Hence, the growing trend of utilizing cosmetics to improve one's appearance is generating creative chances for both leading manufacturers and start-up companies in the premium cosmetics market share to create unique formulas, and product designs, and launch e-commerce websites to sell and advertise premium products.

Market players in the premium cosmetics market share are introducing new product releases to extend their product portfolio. They are strengthening their global footprint through expansion strategies such as mergers, partnerships, and acquisitions. They also use digital marketing methods and social media platforms to acquire customers and develop a digital presence. To achieve a competitive advantage, some of the players are cooperating with e-commerce behemoths such as Amazon, eBay, and others.

Recent developments in the premium cosmetics market are:

The global premium cosmetics market is estimated to be valued at USD 130.9 million in 2025.

The market size for the premium cosmetics market is projected to reach USD 237.6 million by 2035.

The premium cosmetics market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in premium cosmetics market are fragrance, makeup, haircare, skincare and others.

In terms of nature, natural & organic segment to command 42.1% share in the premium cosmetics market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Premium Bottled Water Market Size and Share Forecast Outlook 2025 to 2035

Premium Outdoor Apparel Market Size and Share Forecast Outlook 2025 to 2035

Premium Electric Motorcycle Market Size and Share Forecast Outlook 2025 to 2035

Premium Spirits Glass Bottle Market Size and Share Forecast Outlook 2025 to 2035

Premium Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Premium Alcoholic Beverage Market - Size, Share, and Forecast 2025 to 2035

Premium Chocolate Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Premium Lager Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Premium Wine Cooler Market Analysis - Growth & Forecast 2025 to 2035

Premium Cigarette Market Growth – Demand & Industry Outlook to 2035

Premium Bicycle Market Analysis by Type, Usage Type, End-user, and Region Forecast Through 2035

A2P & P2A Messaging – AI-Driven Communication & Security

Demand for Lactoferrin Premiumization in Immune SKUs in EU

Cosmetics ODM Market Analysis – Size, Trends & Forecast 2025-2035

Pet Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Nutricosmetics Market Analysis - Growth, Trends & Forecast 2025 to 2035

Market Share Breakdown of Nutricosmetics Manufacturers

Halal Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Japan Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Vegan Cosmetics Market Analysis - Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA