The Premium Spirits Glass Bottle Market is estimated to be valued at USD 7.7 billion in 2025 and is projected to reach USD 12.1 billion by 2035, registering a compound annual growth rate (CAGR) of 4.6% over the forecast period.

The premium spirits glass bottle market expansion corresponds to a growth multiplier of 1.57x, supported by a steady CAGR of 4.6%, reflecting consistent demand from luxury alcoholic beverage segments and the rise of premiumization trends globally.

Phase-wise analysis shows that the first five years (2025–2030) will see the market advance from USD 7.7 billion to approximately USD 9.6 billion, generating an incremental gain of USD 1.9 billion, which represents 43% of the total growth opportunity. This phase is largely driven by increased consumption of high-end spirits in mature markets, personalized bottle designs, and the expansion of duty-free retail channels.

The second phase (2030–2035) contributes USD 2.5 billion, accounting for 57% of the total growth, reflecting stronger gains as emerging markets embrace premium spirits and brands invest in limited-edition glass packaging to enhance consumer experience. Demand for embossed, textured, and lightweight designs will further accelerate adoption. Producers focusing on sustainable glass manufacturing, customization, and partnerships with luxury spirit brands will be best positioned to capture this USD 4.4 billion incremental market opportunity.

| Metric | Value |

|---|---|

| Premium Spirits Glass Bottle Market Estimated Value in (2025 E) | USD 7.7 billion |

| Premium Spirits Glass Bottle Market Forecast Value in (2035 F) | USD 12.1 billion |

| Forecast CAGR (2025 to 2035) | 4.6% |

The premium spirits glass bottle market holds a significant yet specialized position within the broader packaging and alcoholic beverage sectors. In the alcoholic beverage packaging market, it accounts for around 15–18%, driven by the dominance of glass bottles in premium spirits compared to cans or PET bottles. Within the glass packaging market, its share is approximately 8–10%, as this segment also serves beer, wine, food, and pharmaceutical applications.

In the luxury packaging market, premium spirits glass bottles contribute about 12–14%, reflecting strong demand for customized designs, embossing, and high-end finishes. For the spirits and liquor packaging market, the share is highest at nearly 35–40%, since premium spirits rely heavily on distinctive glass packaging to reinforce brand identity. In the food and beverage packaging market, its share is relatively small at 3–4%, as it includes diverse categories such as dairy, snacks, and ready meals.

Growth in this niche is supported by rising global demand for premium alcoholic beverages, brand differentiation strategies, and the popularity of limited-edition collections. Manufacturers are investing in innovative designs, sustainable glass production, and lightweight bottles without compromising aesthetics. As premiumization trends strengthen across mature and emerging markets, the premium spirits glass bottle segment is poised to increase its influence within these parent markets.

The premium spirits glass bottle market is progressing steadily, driven by growing consumer preference for premium and craft spirits, heightened brand emphasis on aesthetic packaging, and the rising influence of sustainability in packaging decisions. Producers are increasingly leveraging high quality glass bottles as a means to convey authenticity, luxury, and brand differentiation.

Regulatory trends encouraging recyclable and reusable materials are further supporting this shift toward glass over alternative substrates. The market outlook remains positive as premiumization in spirits consumption continues across emerging and developed markets, and as producers collaborate with glass manufacturers to develop distinctive designs that enhance shelf appeal.

Advances in decoration techniques, customization capabilities, and lightweighting initiatives are paving the way for innovation and expanded adoption across mid and high-tier product categories.

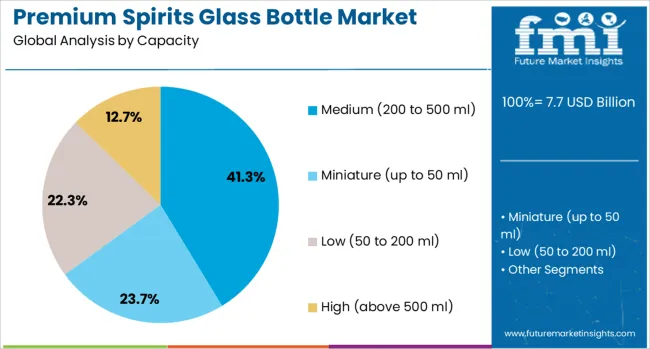

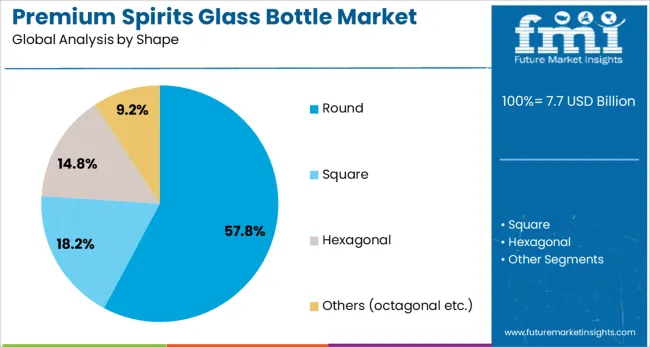

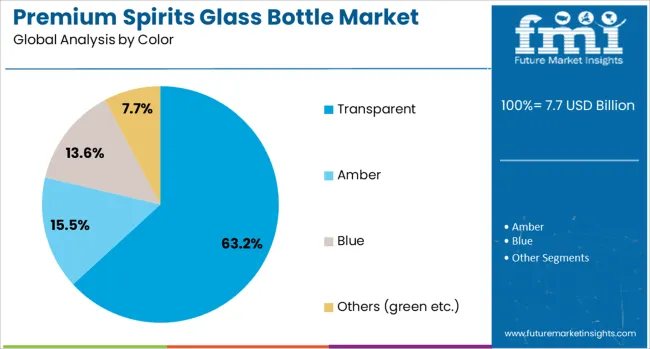

The premium spirits glass bottle market is segmented by capacity, shape, color, application, distribution channel, and geographic regions. The premium spirits glass bottle market is divided by capacity into Medium (200 to 500 ml), Miniature (up to 50 ml), Low (50 to 200 ml), and High (above 500 ml). In terms of shape, the premium spirits glass bottle market is classified into Round, Square, Hexagonal, and Others (octagonal, etc.). Based on the color of the premium spirits glass bottle, the market is segmented into Transparent, Amber, Blue, and Others (green, etc.).

By application, the premium spirits glass bottle market is segmented into Whiskey, Vodka, Gin, Bourbon, and Others (tequila, etc.). The distribution channel of the premium spirits glass bottle market is segmented into Direct sales and Indirect sales. Regionally, the premium spirits glass bottle industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by capacity, the medium 200 to 500 ml category is projected to account for 41.30% of the market revenue in 2025, making it the leading capacity segment. This prominence is attributed to its balance between portion control and premium presentation, which aligns well with consumer trends favoring moderate consumption and gifting.

Glass manufacturers have optimized this format to meet both operational efficiency and visual appeal, enabling producers to maintain premium positioning while catering to retail and hospitality requirements. The medium capacity is also preferred for limited edition and craft spirits, as it supports higher margins and perceived exclusivity without significantly increasing production costs.

Its compatibility with intricate closures and decorative elements has further strengthened its market share, solidifying its dominance in premium and specialty product lines.

Segmented by shape, the round category is expected to hold 57.8% of the premium spirits glass bottle market revenue in 2025, establishing itself as the most dominant shape. The round form has maintained its leadership due to its traditional association with spirits packaging and its ability to facilitate efficient filling, labeling, and handling processes.

Its ergonomic design enhances consumer convenience while offering a large printable surface area for branding and decorative embellishments. Manufacturers have continued to innovate within this shape, offering subtle variations and premium finishes that enhance shelf differentiation without sacrificing production efficiency.

The round shape’s compatibility with automated bottling lines and its timeless aesthetic appeal have been instrumental in maintaining its widespread preference across both mass and craft segments.

When segmented by color, the transparent category is forecast to capture 63.2% of the premium spirits glass bottle market revenue in 2025, securing its position as the leading color segment. This leadership has been reinforced by consumer desire to visually engage with the product, as transparency communicates purity, authenticity, and premium quality.

Producers have capitalized on this preference by designing bottles that showcase the natural hues of the spirits, enhancing perceived value and trustworthiness. Transparent glass also allows for greater creativity in label and closure design, making it a preferred choice for brands aiming to maximize visual impact.

In addition, its recyclability and ease of decoration have supported its continued dominance, ensuring alignment with sustainability goals while retaining strong aesthetic appeal.

The premium spirits glass bottle market is expanding due to rising demand for premium drink packaging, craft spirits proliferation, and enhanced e‑commerce channel growth. Opportunities are arising in lightweight bottle innovation and limited‑edition designs. Trends such as embossed decoration, NFC integration, and recycled glass content are shaping supplier strategies.

Restraints include increased packaging taxes, raw material price volatility, and competition from alternative formats. Brands investing in design differentiation, lightweight engineering, and supply partnerships are seen as better positioned for growth through 2025–2026.

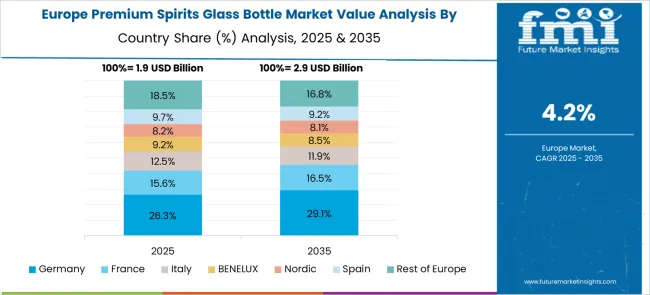

Growth in the premium spirits glass bottle market is being driven by rising consumer preference for luxury presentation and collectible design among whiskey, gin, tequila, and vodka brands. The market was valued at about USD 7.4 billion in 2024 and is expected to exceed USD 7.7 billion by 2025, expanding at approximately 4.6 percent annually. Elevated premium spirits consumption in North America and Europe, combined with rising middle‑class spend in Asia, is believed to be underpinning procurement of high‑quality glass bottles seen as status symbols and brand statements.

Opportunities are observed in bottle lightweighting and bespoke bottle formats for limited releases and craft spirits. In 2024 Diageo introduced the world’s lightest whisky bottle weighing only 180 g for Johnnie Walker Blue Label Ultra, designed to reduce transport emissions and offer visual impact. This engineering has been extended to other variants such as JW 18‑Year and JW Blue Label standard bottles. It is considered that premium brands leveraging lightweight structures and artisanal bottle shapes are likely to attract consumer attention and command price premiums.

Decorative embossing, NFC or QR code incorporation, and recycled‑glass content are emerging as key trends in bottle design. In 2025 brands and bottle makers began embedding interactive tags to tell brand stories and verify authenticity at point of purchase. Enhanced embossing and premium printing techniques are being adopted to reinforce luxury positioning, especially for limited‑edition spirits. It is widely viewed that these enhancements deliver both functional anti‑counterfeit features and experiential value perceived by consumers willing to pay more.

Restraints in the premium spirits glass bottle market include increasing packaging levies and glass feedstock price volatility. In 2025 the UK’s extended producer responsibility levy is expected to raise spirits bottle costs by approximately £0.11 per unit, prompting concern among smaller producers. Fluctuations in raw material pricing and energy costs for glass furnaces are compressing bottle makers’ margins. It is believed that smaller suppliers without economies of scale or vertical integration face higher exposure to cost pressure and regulatory burdens.

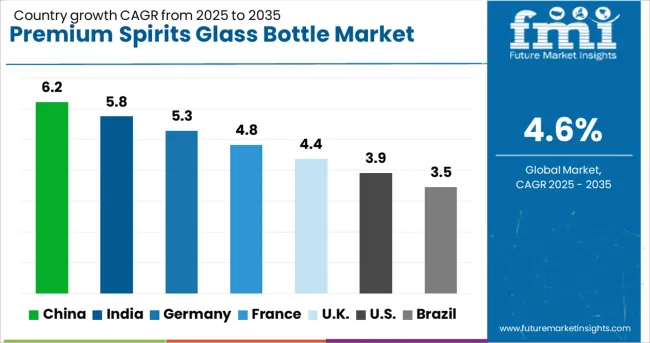

| Country | CAGR |

|---|---|

| China | 6.2% |

| India | 5.8% |

| Germany | 5.3% |

| France | 4.8% |

| UK | 4.4% |

| USA | 3.9% |

| Brazil | 3.5% |

The global premium spirits glass bottle market is projected to grow at a CAGR of 4.6% from 2025 to 2035. China leads with 6.2%, followed by India at 5.8% and Germany at 5.3%. France records 4.8%, while the United Kingdom posts 4.4%. Growth is driven by rising demand for luxury alcoholic beverages, increasing investment in customized packaging, and consumer preference for sustainable glass materials. China and India dominate due to strong spirits consumption and premiumization trends, while Germany focuses on recyclable glass designs. France and the UK emphasize aesthetic enhancements and artisanal bottle crafting for high-end brands.

The premium spirits glass bottle market in China is projected to grow at 6.2%, fueled by robust demand for luxury alcoholic beverages and gifting culture. Custom-shaped glass bottles dominate high-end product segments. Manufacturers invest in advanced decoration techniques such as UV embossing and metallic finishes. Strategic partnerships with leading spirits brands strengthen the premium packaging ecosystem.

The premium spirits glass bottle market in India is expected to grow at 5.8%, driven by rising consumption of premium whiskey and craft spirits. Thick-walled bottles dominate high-end product lines for premium appeal. Manufacturers focus on introducing eco-friendly glass variants with reduced weight for cost efficiency. Growing e-commerce distribution channels boost demand for protective yet stylish glass packaging.

The premium spirits glass bottle market in Germany is forecast to grow at 5.3%, supported by consumer demand for artisanal spirits and sustainable packaging designs. Frosted and engraved bottles dominate niche luxury segments. Manufacturers develop recyclable glass with high-clarity finishes for premium aesthetics. Collaboration with craft distilleries further enhances customization opportunities in the European market.

The premium spirits glass bottle market in France is forecast to grow at 4.8%, driven by the strong tradition of luxury spirits like cognac and champagne. Embossed bottles dominate exclusive product lines for heritage branding. Manufacturers innovate with multi-color glass techniques to enhance product differentiation. Increased investment in automated decoration processes ensures consistency for high-volume production.

The premium spirits glass bottle market in the UK is projected to grow at 4.4%, driven by growing demand for limited-edition spirits and collectible packaging. Square and decanter-style bottles dominate high-end launches. Manufacturers integrate sustainable raw materials and advanced UV printing for luxury branding. Growth in premium gin exports further accelerates high-value glass bottle adoption.

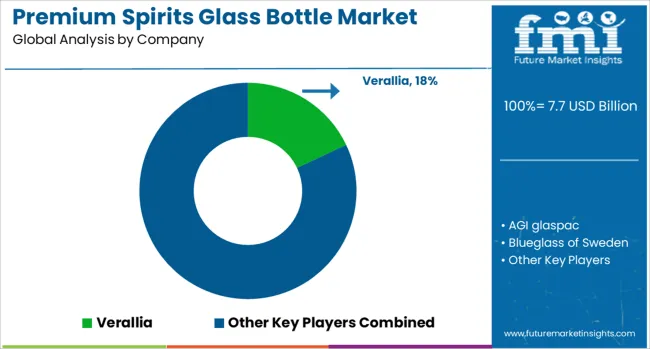

The premium spirits glass bottle market is moderately consolidated, with Verallia recognized as a leading player through its extensive manufacturing capabilities, innovative design solutions, and global distribution network. The company focuses on high-quality, customizable glass bottles for premium liquor brands, offering advanced decorative finishes and sustainable production practices.

Key players include AGI glaspac, Blueglass of Sweden, Deco Glas, Estal Packaging, Gallo Glass, PGP Glass, Rawlings & Son (Bristol), Roetell, Saverglass, Sklarny Moravia, Stoelzle Glass, TricorBraun, United Bottles and Packaging, and Vidrala. These companies specialize in producing high-end glass bottles featuring premium aesthetics, embossing, and unique closures tailored to the luxury spirits segment, including whiskey, vodka, gin, and cognac.

Market growth is being driven by the rising demand for premium and ultra-premium alcoholic beverages, brand differentiation through packaging, and the increasing adoption of sustainable glass manufacturing processes. Manufacturers are investing in advanced glass-forming technologies, lightweight designs, and innovative decorative techniques such as metallization, engraving, and screen printing.

Additionally, collaborations with luxury spirits brands and expansion into emerging markets are shaping competitive strategies. Europe remains a dominant region due to established premium spirits consumption, while Asia-Pacific is witnessing rapid growth fueled by premiumization trends and increasing disposable income among consumers.

In December 2024, Spearhead Global partnered with Italy’s Vetreria Etrusca to launch a co‑branded catalog of eco‑friendly glass bottle designs. The collaboration combines Italian craftsmanship with sustainability innovations, enhancing premium spirits packaging solutions and reinforcing brand identity through environmentally conscious and aesthetic bottle creations.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.7 Billion |

| Capacity | Medium (200 to 500 ml), Miniature (up to 50 ml), Low (50 to 200 ml), and High (above 500 ml) |

| Shape | Round, Square, Hexagonal, and Others (octagonal etc.) |

| Color | Transparent, Amber, Blue, and Others (green etc.) |

| Application | Whiskey, Vodka, Gin, Bourbon, and Others (tequila etc.) |

| Distribution Channel | Direct sales and Indirect sales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Verallia, AGI glaspac, Blueglass of Sweden, Deco Glas, Estal Packaging, Gallo Glass, PGP Glass, Rawlings & Son (Bristol), Roetell, Saverglass, Sklarny Moravia, Stoelzle Glass, TricorBraun, United Bottles and Packaging, and Vidrala |

| Additional Attributes | Dollar sales segmented by bottle size (miniature, medium 200–500 ml, large >500 ml) and spirit type (whiskey, vodka, gin, rum), with North America holding ~80% share and Asia-Pacific showing fastest growth. Competitive landscape includes Ardagh Group, Owens-Illinois, Saverglass, and Saint-Gobain. Buyers favor premium aesthetics, sustainable lightweight glass, embossing/engraving, and embedded NFC/QR for authentication. |

The global premium spirits glass bottle market is estimated to be valued at USD 7.7 billion in 2025.

The market size for the premium spirits glass bottle market is projected to reach USD 12.1 billion by 2035.

The premium spirits glass bottle market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in premium spirits glass bottle market are medium (200 to 500 ml), miniature (up to 50 ml), low (50 to 200 ml) and high (above 500 ml).

In terms of shape, round segment to command 57.8% share in the premium spirits glass bottle market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Premium Outdoor Apparel Market Size and Share Forecast Outlook 2025 to 2035

Premium Electric Motorcycle Market Size and Share Forecast Outlook 2025 to 2035

Premium Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Premium Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Premium Alcoholic Beverage Market - Size, Share, and Forecast 2025 to 2035

Premium Chocolate Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Premium Lager Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Premium Cigarette Market Growth – Demand & Industry Outlook to 2035

Premium Wine Cooler Market Analysis - Growth & Forecast 2025 to 2035

Premium Bicycle Market Analysis by Type, Usage Type, End-user, and Region Forecast Through 2035

A2P & P2A Messaging – AI-Driven Communication & Security

Premium Bottled Water Market Size and Share Forecast Outlook 2025 to 2035

Demand for Lactoferrin Premiumization in Immune SKUs in EU

Spirits Market Industry Analysis from 2025 to 2035

Spirits Miniatures Market Analysis by Capacity, Material, End Use, and Region through 2035

Bottle Sealing Wax Market Size and Share Forecast Outlook 2025 to 2035

Bottle Filling Machines Market Size and Share Forecast Outlook 2025 to 2035

Bottle Shippers Market Size and Share Forecast Outlook 2025 to 2035

Bottled Water Packaging Market Size and Share Forecast Outlook 2025 to 2035

Bottle Sticker Labelling Machine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA