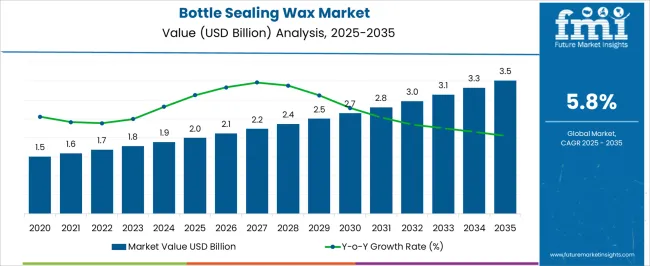

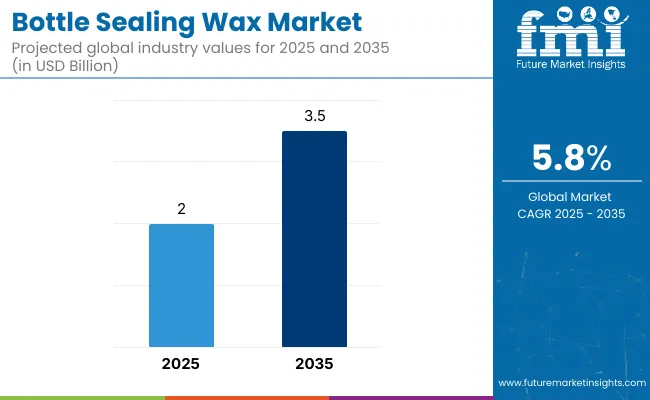

The Bottle Sealing Wax Market is estimated to be valued at USD 2.0 billion in 2025 and is projected to reach USD 3.5 billion by 2035, registering a compound annual growth rate (CAGR) of 5.8% over the forecast period.

| Metric | Value |

|---|---|

| Bottle Sealing Wax Market Estimated Value in (2025 E) | USD 2.0 billion |

| Bottle Sealing Wax Market Forecast Value in (2035 F) | USD 3.5 billion |

| Forecast CAGR (2025 to 2035) | 5.8% |

The Bottle Sealing Wax market is witnessing steady expansion, supported by the growing demand for premium packaging solutions that enhance both product aesthetics and functionality. Increasing adoption of sealing wax in industries such as beverages, cosmetics, and specialty food packaging is being driven by its role in improving shelf appeal and ensuring tamper evidence. Consumer preference for artisanal and luxury packaging has also boosted demand, with sealing wax being used to convey exclusivity and heritage branding.

Technological advancements in wax formulation, including greater resistance to temperature variations and improved durability, are enhancing its suitability for diverse applications. Additionally, eco-friendly and natural wax variants are gaining traction as sustainability emerges as a key purchasing criterion.

The use of sealing wax for personalization, including embossing and color customization, is further driving adoption among small and large-scale producers As premiumization trends continue to influence consumer choices and brand strategies, the Bottle Sealing Wax market is expected to grow consistently, underpinned by both functional and aesthetic value propositions.

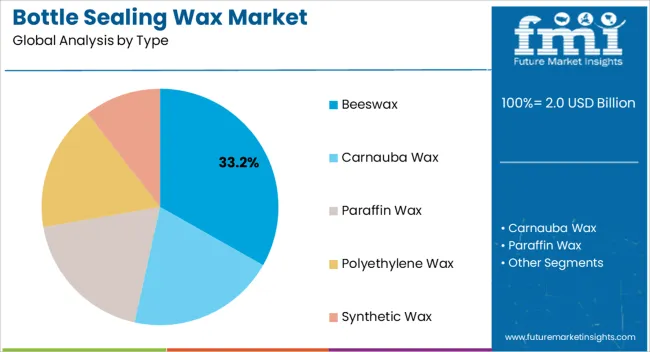

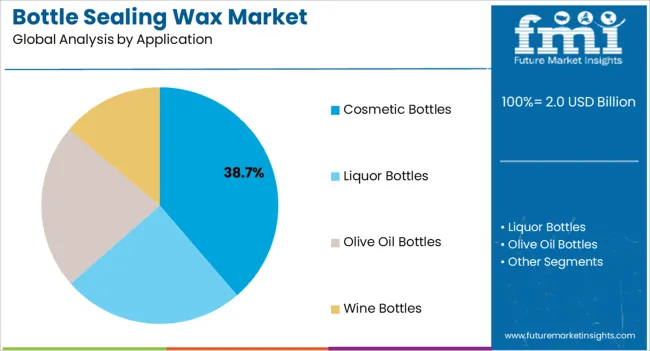

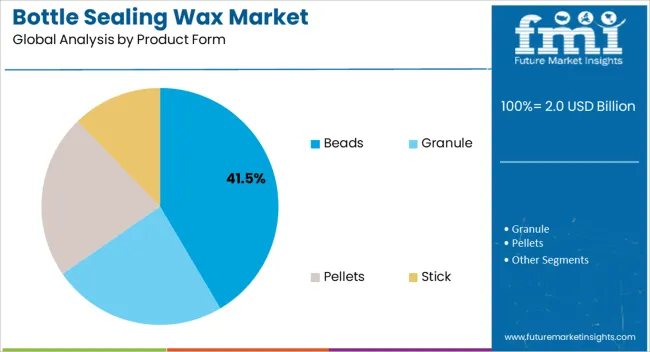

The bottle sealing wax market is segmented by type, application, product form, distribution channel, end use, and geographic regions. By type, bottle sealing wax market is divided into Beeswax, Carnauba Wax, Paraffin Wax, Polyethylene Wax, and Synthetic Wax. In terms of application, bottle sealing wax market is classified into Cosmetic Bottles, Liquor Bottles, Olive Oil Bottles, and Wine Bottles. Based on product form, bottle sealing wax market is segmented into Beads, Granule, Pellets, and Stick. By distribution channel, bottle sealing wax market is segmented into Offline, Retail, Wholesale, Online, Direct Website, and E-Commerce Platforms. By end use, bottle sealing wax market is segmented into Commercial, Industrial, and Residential. Regionally, the bottle sealing wax industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The beeswax type segment is expected to hold 33.2% of the Bottle Sealing Wax market revenue in 2025, establishing itself as a leading product type. Its dominance is attributed to growing consumer preference for natural and sustainable materials that align with eco-conscious purchasing behaviors. Beeswax is highly valued for its non-toxic, biodegradable, and versatile characteristics, making it suitable for a range of sealing applications, particularly in food and beverage packaging.

Its flexibility, smooth finish, and aesthetic appeal also contribute to its increasing use in premium packaging, where both visual impact and product safety are critical. Furthermore, rising demand for natural ingredients in cosmetic packaging is strengthening its position.

The resurgence of traditional packaging formats in artisanal and craft industries has also supported the adoption of beeswax sealing As sustainability becomes a defining trend across packaging sectors, the natural origin and environmental benefits of beeswax are expected to secure its continued growth and maintain its leadership in the Bottle Sealing Wax market.

The cosmetic bottles application segment is projected to account for 38.7% of the market revenue in 2025, making it the largest application area. Growth in this segment is primarily being driven by the premiumization of cosmetic products, where packaging plays a significant role in influencing consumer purchase decisions. Sealing wax is being increasingly used by cosmetic brands to enhance luxury appeal, provide tamper evidence, and support brand differentiation in a competitive market.

The ability to customize wax colors and finishes for aesthetic consistency with brand identity has further encouraged adoption. Additionally, sealing wax contributes to the preservation and secure closure of cosmetic bottles, aligning with consumer expectations of quality and safety.

The growth of online sales channels for cosmetics has also highlighted the need for tamper-proof packaging, further strengthening demand With consumer preference shifting toward premium, eco-friendly, and visually striking packaging solutions, sealing wax is expected to remain a preferred choice for cosmetic bottles, driving sustained growth in this segment.

The beads product form segment is anticipated to hold 41.5% of the Bottle Sealing Wax market revenue in 2025, making it the leading form type. The preference for beads is largely due to their convenience, consistent melting properties, and ease of use in both small-scale and industrial applications. Beads allow precise measurement and efficient handling, ensuring uniform sealing results that improve both productivity and quality.

Their suitability for customization in terms of colors and finishes also makes them appealing for brands aiming to create distinctive packaging designs. Growing use in the beverage industry, particularly for sealing wine and spirits bottles, has reinforced demand for bead-form wax due to its consistency and professional finish.

Additionally, their compatibility with automated and manual sealing processes provides flexibility across applications, further strengthening adoption As producers seek cost-effective, versatile, and user-friendly sealing materials, beads are expected to maintain their leadership, supported by strong demand in premium packaging sectors where visual appeal and operational efficiency are critical.

The global bottle sealing wax market is projected to grow from USD 2.0 billion in 2025 to USD 3.5 billion by 2035, registering a CAGR of 5.8% during the forecast period. Sales in 2025 were recorded at USD 1.8 billion. This impressive growth is primarily driven by the increasing use of wax seals in premium packaging for wine, spirits, gourmet food, and specialty personal care products.

Bottle sealing wax provides an artisanal touch and tamper-evident functionality, making it highly attractive to small-batch producers and luxury brands. Unlike standard closures, wax seals enable differentiation, storytelling, and aesthetic appeal that resonate with discerning consumers and gift buyers alike.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 2.0 billion |

| Industry Value (2035F) | USD 3.5 billion |

| CAGR (2025 to 2035) | 5.8% |

Innovation in the bottle sealing wax market is driven by the convergence of sustainability, aesthetics, and production efficiency. Manufacturers are introducing biodegradable wax blends, paraffin-free formulas, and fast-dip low-drip coatings for seamless use on automated and manual sealing lines. Premium finishes including metallic, pearlized, and soft-matte coatings are being developed for enhanced shelf appeal. These product enhancements are accompanied by improvements in adhesion, printability, and temperature resistance, expanding their utility in both alcoholic and non-alcoholic premium beverages, as well as in high-end olive oils, vinegars, and syrups.

The market is witnessing robust traction in Europe, where heritage wine and spirit brands use wax sealing as a mark of authenticity and craftsmanship. Countries like France, Italy, and Spain remain key demand centers due to strong cultural ties to wax-sealed packaging. In North America, growth is driven by the expansion of the craft distillery movement and the adoption of wax seals in boutique food brands.

Asia Pacific is emerging as an opportunity-rich region, with a rising number of premium product launches in Japan, Australia, and India. The expanding use of wax sealing in gifting, e-commerce-ready packaging, and luxury private labels is expected to further diversify the market landscape.

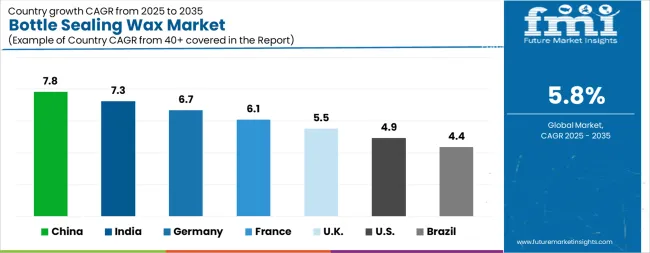

| Country | CAGR |

|---|---|

| China | 7.8% |

| India | 7.3% |

| Germany | 6.7% |

| France | 6.1% |

| UK | 5.5% |

| USA | 4.9% |

| Brazil | 4.4% |

The Bottle Sealing Wax Market is expected to register a CAGR of 5.8% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 7.8%, followed by India at 7.3%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 4.4%, yet still underscores a broadly positive trajectory for the global Bottle Sealing Wax Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 6.7%. The USA Bottle Sealing Wax Market is estimated to be valued at USD 735.6 million in 2025 and is anticipated to reach a valuation of USD 1.2 billion by 2035. Sales are projected to rise at a CAGR of 4.9% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 101.6 million and USD 52.6 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.0 Billion |

| Type | Beeswax, Carnauba Wax, Paraffin Wax, Polyethylene Wax, and Synthetic Wax |

| Application | Cosmetic Bottles, Liquor Bottles, Olive Oil Bottles, and Wine Bottles |

| Product Form | Beads, Granule, Pellets, and Stick |

| Distribution Channel | Offline, Retail, Wholesale, Online, Direct Website, and E-Commerce Platforms |

| End Use | Commercial, Industrial, and Residential |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

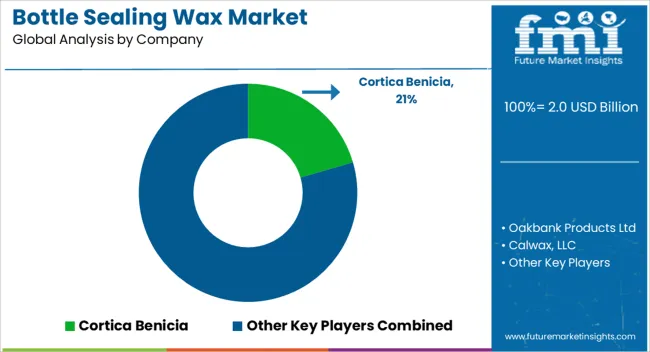

| Key Companies Profiled | Cortica Benicia, Oakbank Products Ltd, Calwax, LLC, Darent Wax Co. Ltd., The British Wax Refining Co. Ltd, Australian Wax Company, and Southwest Wax LLC |

The global bottle sealing wax market is estimated to be valued at USD 2.0 billion in 2025.

The market size for the bottle sealing wax market is projected to reach USD 3.5 billion by 2035.

The bottle sealing wax market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in bottle sealing wax market are beeswax, carnauba wax, paraffin wax, polyethylene wax and synthetic wax.

In terms of application, cosmetic bottles segment to command 38.7% share in the bottle sealing wax market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sealing & Strapping Packaging Tape Market Size and Share Forecast Outlook 2025 to 2035

Waxed Paper Market Size and Share Market Forecast and Outlook 2025 to 2035

Waxing Base Paper Market Size and Share Forecast Outlook 2025 to 2035

Bottle Filling Machines Market Size and Share Forecast Outlook 2025 to 2035

Sealing Agent for Gold Market Size and Share Forecast Outlook 2025 to 2035

Wax Injector Market Size and Share Forecast Outlook 2025 to 2035

Bottle Shippers Market Size and Share Forecast Outlook 2025 to 2035

Bottled Water Packaging Market Size and Share Forecast Outlook 2025 to 2035

Sealing And Strapping Packaging Tapes Market Size and Share Forecast Outlook 2025 to 2035

Bottle Sticker Labelling Machine Market Size and Share Forecast Outlook 2025 to 2035

Wax Paper Medicine Pots Market Size and Share Forecast Outlook 2025 to 2035

Bottle Dividers Market Size and Share Forecast Outlook 2025 to 2035

Bottle Jack Market Size and Share Forecast Outlook 2025 to 2035

Bottles Market Analysis - Growth & Forecast 2025 to 2035

Wax Boxes Market Insights - Growth & Demand Forecast 2025 to 2035

Bottle Capping Machine Market Analysis by Automation, Operating Speed, Machine Type, End-use Industry, and Region Forecast Through 2035

Market Share Distribution Among Bottle Dividers Suppliers

Bottle Carrier Market Trends – Growth & Forecast 2024-2034

Bottle Cap Market Analysis & Industry Forecast 2024-2034

Bottled Water Processing Equipment Market Trends – Growth & Industry Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA