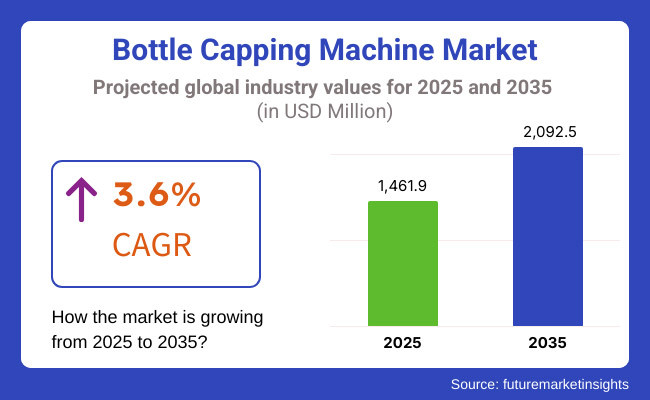

The bottle capping machine market is anticipated to be valued at USD 1,461.9 million in 2025. It is expected to grow at a CAGR of 3.6% during the forecast period and reach a value of USD 2,092.5 million in 2035.

A bottle capping machine is mostly used to seal the bottle tightly with chicken or a different cap to protect the product inside and to avoid regulatory interactions. It is applied extensively in food & beverage, pharmaceutical, cosmetic, and chemical industries to boost packaging efficiency, avoid contamination, and extend shelf life through high-speed, precise sealing.

The market for bottle-capping machines is increasing owing to an upsurge in demand for automation, efficiency, and safety packaging in the food & beverages, pharmaceutical, and cosmetics segments. The growth is driven by rising beverage consumption, e-commerce, regulatory norms, technology changes, and trends for sustainability, as industries switch towards automated, flexible, and sustainable capping options for improving productivity.

| 2020 to 2024 Trends | 2025 to 2035 Trends |

|---|---|

| Steady growth due to rising packaging demands in food & beverage, pharmaceuticals, and cosmetics. | Automation, sustainability efforts, and increasing e-commerce fueled fast growth. |

| Increased adoption of semi-automatic and automatic machines. | Advanced robotics, AI-driven capping, and fully automated lines dominate. |

| Focus on reducing plastic waste and energy consumption. | Shift toward biodegradable materials and energy-efficient smart machines. |

| Strong demand in North America, Europe, and Asia-Pacific. | Strong growth in developing economies as a result of urbanization and industrialization. |

| Transition from manual to automatic capping machines. | Widespread use of AI-powered, high-speed automation with minimal human intervention. |

| Basic customization options for different cap sizes and materials. | Highly flexible and modular designs to accommodate varying packaging needs. |

| Stringent safety and hygiene regulations driving machine innovations. | Even stricter compliance with global sustainability and health safety regulations. |

| Strong influence from the pharmaceutical and food & beverage sectors. | Expanding applications in biotechnology, personal care, and smart packaging. |

| Initial investment continues to be a challenge for small businesses. | Lower costs as a result of economies of scale and technology. |

| High initial costs, maintenance concerns, and skill gaps. | Managing AI-integrated systems, supply chain disruptions, and environmental mandates. |

Rise of Automation and Smart Technologies

The market is witnessing a significant shift toward automation and smart technologies as manufacturers prioritize efficiency and precision. Organizations are actively adopting sophisticated robotics, IoT-based surveillance systems, and AI-enabled quality control systems to automate production processes and minimize physical labor. Food & beverage and pharmaceutical industries are increasingly favoring mechanical automation, as it improves speed, maintains consistent seals and reduces risks of contamination.

Growing Focus on Sustainability

Sustainability has emerged as a core driver of innovation in capping solutions for bottles. Businesses are creating environmentally friendly capping technologies that promote recyclable materials and energy-efficient processes to meet environmental regulations worldwide.

Consumers and businesses both desire solutions that reduce waste and lower the carbon footprint, which has led to manufacturers adopting sustainable methods while ensuring high performance standards of capping efficiency.

| Attributes | Details |

|---|---|

| Top Machine Type | Screw Capping Machine |

| Market Share in 2025 | 5.2% |

The segment of the screw capping machine dominated at a CAGR of 5.2%. These machines are most sought after as they ensure airtight caps, thus product safety, in various industries like food & beverages, pharmaceuticals, and cosmetics. They became an essential part of automated packaging line, screw capping machines demonstrated their worthiness in terms of reducing contamination and sustaining product integrity.

Available in automatic and semi-automatic models, screw capping machines are designed to address different production scales. Automatic screw cappers improve production speed and consistency while lowering labor costs and human error.

In contrast, this type of semi-automatic screw cappers requires operator action, giving more versatility to small scale productions while maintaining high precision and dependability. An increasing trend to automation and efficiency is further anticipated to drive market growth in this segment.

| Attributes | Details |

|---|---|

| Top End-use Industry | Food & Beverage |

| Market Share in 2025 | 4.2% |

As per FMI analysis, the market for bottle capping machines will be fueled by the food & beverage industry at a 4.2% CAGR. Increased consumption of packaged drinks and ready-to-drink foods and higher demand for extended shelf-life packaging solutions are among the driving factors that fuel the usage of automated capping machines. As manufacturers are concentrated on optimizing the efficiency of their production processes and reducing waste, the demand for advanced capping solutions keeps increasing.

Strict food safety guidelines and sustainability practices also influence technological developments in bottle capping solutions. Most manufacturers are incorporating intelligent automation and AI-based quality control systems to ensure uninterrupted operations and regulatory compliance.

The automated segment is expected to lead the bottle capping machine market, driven by increasing demand for high-speed production and efficiency. Some people emphasize the productivity targets that industrialization can achieve through automation, and in that context, automated capping machines indeed provide effective contributions to consistent, precise, and minimal wastage application.

Advancing smart manufacturing and AI-based quality control has paved the way for developing automated capping solutions that would have had to comply with stringent industry regulations. A major benefit of their application is the simplification of procedures towards enhanced product safety and compatibility with various cap types, hence making automated capping an ideal application in specific fields such as food and beverages, pharmaceutical, and cosmetics.

| Countries | CAGR |

|---|---|

| USA | 3.2% |

| Germany | 5.3% |

| UK | 2.6% |

| Japan | 3.4% |

| China | 5.8% |

| India | 6.3% |

The USA is projected to expand at a CAGR of approximately 3.2% during the period 2025 to 2035. Rising demand for packaged drinks, medicines, and cosmetics will propel the market. The growth in technology in automation and robotics will continue to enhance efficiency and minimize dependence on labor.

The use of intelligent bottle-capping technology will grow, enhancing production capacity and reducing mistakes. Sustainability trends will provoke manufacturers to create environmentally friendly capping machines. Increase in regulatory requirements and consumer awareness toward sustainable packaging will compel firms to adopt energy-saving and recyclable packaging materials, lending support to consistent market growth in the coming ten years.

Germany is expected to grow at a CAGR of 5.3% for the period 2025 to 2035. In the country, the increasing past of precision engineering and automation, bottling machines (largely and small) are in massive demand. The pharmaceutical in addition to food sectors continues to be the important contributors to the demand for very high-speed, sterile, as well as efficient capping solutions with regards to ideal quality standards.

Integration of Industry 4.0 technologies will change the industry by optimizing production processes. On the other hand, the green initiatives would compel manufacturers to make machines compatible with biodegradable and recyclable materials. With increasing government regulations towards sustainable manufacturing, the Germany market will continuously be the pioneer in Europe regarding the innovation and adoption of bottle-capping technologies.

The UK is anticipated to grow at a CAGR of 2.6% between 2025 and 2035. The growth in the beverage and pharmaceutical industries will drive demand for bottle capping machines. The move toward sustainable packaging will prompt companies to create capping machines that support green materials and low waste.

Automation and digitalization will gain traction in the UK market, increasing efficiency in manufacturing. Companies will invest in smart capping solutions integrating AI and IoT for real-time monitoring. The emphasis on reducing carbon footprints will push manufacturers toward energy-efficient machines, shaping the market’s direction over the forecast period.

Japan is anticipated to develop at a CAGR of 3.4% during 2025 to 2035. The demand for bottle-capping machines in the country will increase as a result of growing automation in the food and beverage sector. Demand for safe, high-speed, and contamination-free capping will propel manufacturers to invest in innovative sealing technologies.

Japan's technical know-how will facilitate the incorporation of robotics and artificial intelligence in capping solutions to increase productivity. Sustainability will be a prominent trend where companies create solutions that advocate for reusable and recyclable materials. Rising consumer preference for sustainable packaging will shape innovations in Japan’s bottle-capping machine market in the coming years.

China is projected to grow at a CAGR of 5.8% from 2025 to 2035. The booming growth in the food and beverage sectors, in addition to that of the pharmaceutical industry, could see bottle capping machines recording a very bright future in demand. Efficiency is evidently determined by high-end automation and intelligent features, which are meant to maximize production speed while minimizing human intervention during the manufacturing process.

In addition, sustainability initiatives will contribute to developing greener capping alternatives. A very vigorous manufacturing setup in China will allow it to be among the leading countries with the most promising bottle-capping technologies. The local manufacturers would adapt to the impacts of the government's regulations favoring recyclable packaging materials and promote further innovations and market growth in the next decade.

India is likely to register a CAGR of 6.3% during 2025 to 2035, making it the global leader in the market. The demand for sustainable packaging will fuel innovation in capping technology. Growing environmental consciousness and government initiatives promoting sustainable solutions will speed up the uptake of green capping machines.

The fast-expanding food and pharma industries will drive investment in automated capping technology. Firms will focus on productivity and savings by incorporating intelligent technology into manufacturing lines.

The leading commercial enterprises in the bottle-capping machine domain have remained predominant owing to high-end automation, precision engineering, and a significant presence in international markets. Furthermore, their dominance will be augmented with continuous innovation in smart manufacturing in all the industries, which will make processes much more efficient, reliable, and responsive. By making use of better technology and maximized manufacturing abilities, these companies provide benchmarks that even smaller players cannot match.

This enables them to lock long-term contracts with big pharmaceutical, food, and beverage companies, big spenders on research and development using AI-based diagnostics, real-time monitoring, and high-tech robotics to gain operational efficiency and minimize downtime. This technology edge is a significant hurdle to entry.

Developed relationships with significant customers further reinforce their leadership since industries that need precision and dependability always seek established suppliers. These companies offer tailored solutions suited to high-volume and specialty manufacturing requirements, integrating smoothly with established manufacturing lines.

By offering a comprehensive predictive maintenance program combined with remote monitoring, companies enhance customer retention while mitigating risks associated with operations. Their strategic acquisitions and partnerships with component manufacturers provide an avenue for technological advancement and enhancement of the faster capping, tamper-evident sealing, and multifunctional variants.

These leaders continue to enhance their know-how and introduce appropriate changes into their product portfolio to meet the growing demands and ensure competitiveness and perhaps scalability into production.

With strong intellectual property safeguards and high capital investment needs, industry entrants must overcome tremendous challenges in taking market share. Dominance of leaders is not substantially eroded as they set efficiency, sustainability, and innovation agendas. With foresight in perceiving upcoming trends, their continued leadership ensures there is limited opportunity for challengers to displace them from the competitive landscape.

The high-competitive bottle capping machine market involves a combination of international leaders and regional competitors competing for market leadership. Across food & beverages, pharmaceutical, cosmetics, and chemical industries, demand for automated, high-speed capping solutions is on the rise. Players emphasize technological innovation, customization, and sustainability to boost efficiency as well as comply with regulations.

Among the major players, Accutek Packaging Equipment, Closure Systems International (CSI), E-PAK Machinery, Acasi Machinery, and Liquid Packaging Solutions hold a significant share. These companies compete on innovation, service quality, and machine versatility. Other prominent makers, such as KWT Machine Systems, TORQ Packaging USA, Kinex Cappers, and ZALKIN AMERICAS LLC, add to the competitive landscape with customized solutions and widening product portfolios.

Accutek Packaging Equipment has established itself as a market leader through turnkey packaging solutions with automated and modular capping systems. Its strategy is based on scalability and efficiency, catering to high-speed manufacturing requirements of industries. Closure Systems International (CSI), however, focuses on precision and sustainability, using energy-efficient cap designs to reduce material loss and enhance sealing performance.

E-PAK Machinery provides capping machines that are built to customer specifications, with the ability to offer flexibility to small and mid-size manufacturers. Its machines accommodate a variety of bottle types and closure styles to provide flexibility in dynamic production conditions.

Acasi Machinery specializes in economical, high-speed capping solutions, thus making its equipment suitable for large-scale manufacturing operations. Liquid Packaging Solutions is differentiated by its changeover capabilities, which are beneficial to industries with constant changes to their packaging lines.

The innovation of products is thus going to be the promising factor for competition in the market. Accutek has brought an intelligent torque-based capping system, which has doubled the precision and reduced the cap waste for capping bottles.

The cap system designed and released by CSI is a lightweight, tamper-evident device that secures the content while using plastics minimally. Developed by E-PAK Machinery, this system is a servo-driven capper powered to allow real-time adjustment, ensuring perfect operation during capping. KWT Machine Systems has now integrated an AI-enabled cap sorting technology for full optimization of production flow, thus reducing down-time.

The market evolves focusing sharply on automation, regulatory compliance, and sustainability. More and more manufacturers are adopting AI-driven systems, smart sensors, and energy-efficient machines to remain competitive.

There is a growing demand for customizable and multifunctional capping solutions as industry strives for greater flexibility and efficiency. Obviously, this stark shift toward biodegradable and eco-friendly packaging materials will compel companies to keep modifying their capping technology.

The market is segmented by automation into automated, semi-automated, and manual.

Based on the operating speed, the market is segmented into 50 bottles/minute, 50-250 bottles/minute, 250-500 bottles/minute, and above 500 bottles/minute.

The market are categories based on machine type, including screw capping machine, snap-on capping machine, ROPP capping machine, and crown capping machine.

Based on end-use industry, the market is segmented into food & beverage, pharmaceuticals, cosmetics & personal care, chemicals, automotive, and household.

The market is segmented by region into North America, Latin America, Western Europe, South Asia & Pacific, East Asia, Middle East, and Africa.

The bottle capping machine market is expected to reach USD 2,092.5 million by 2035, growing at a CAGR of 3.6% from USD 1,461.9 million in 2025.

The future prospects for bottle capping machine sales are strong, driven by automation, sustainability initiatives, e-commerce growth, and increasing demand from food & beverage, pharmaceutical, and cosmetics industries.

Key manufacturers include Accutek Packaging Equipment, Closure Systems International, E-PAK Machinery, Acasi Machinery, Liquid Packaging Solutions, and KWT Machine Systems, among others.

India (CAGR 6.3%) and China (CAGR 5.8%) are expected to generate the most lucrative opportunities due to rapid industrialization, automation adoption, and growing demand for packaged goods.

Table 01: Global Market Value (US$ million) Analysis, By Automation, 2018 to 2033

Table 02: Global Market Volume (Units) Analysis, By Automation, 2018 to 2033

Table 03: Global Market Value (US$ million) Analysis, by Operating Speed, 2018 to 2033

Table 04: Global Market Volume (Units) Analysis, by Operating Speed, 2018 to 2033

Table 05: Global Market Value (US$ million) Analysis, By Machine Type, 2018 to 2033

Table 06: Global Market Volume (Units) Analysis, By Machine Type, 2018 to 2033

Table 07: Global Market Value (US$ million) Analysis, by End-use Industry, 2018 to 2033

Table 08: Global Market Volume (Units) Analysis, by End-use Industry, 2018 to 2033

Table 079: Global Market Value (US$ million) Analysis, by Region, 2018 to 2033

Table 10: Global Market Volume (Units) Analysis, by Region, 2018 to 2033

Table 11: North America Market Value (US$ million) Analysis, By Automation, 2018 to 2033

Table 12: North America Market Volume (Units) Analysis, By Automation, 2018 to 2033

Table 13: North America Market Value (US$ million) Analysis, by Operating Speed, 2018 to 2033

Table 14: North America Market Volume (Units) Analysis, by Operating Speed, 2018 to 2033

Table 15: North America Market Value (US$ million) Analysis, By Machine Type, 2018 to 2033

Table 16: North America Market Volume (Units) Analysis, By Machine Type, 2018 to 2033

Table 17: North America Market Value (US$ million) Analysis, by End-use Industry, 2018 to 2033

Table 18: North America Market Volume (Units) Analysis, by End-use Industry, 2018 to 2033

Table 19: North America Market Value (US$ million) Analysis, by Region, 2018 to 2033

Table 20: North America Market Volume (Units) Analysis, by Region, 2018 to 2033

Table 21: Latin America Market Value (US$ million) Analysis, By Automation, 2018 to 2033

Table 22: Latin America Market Volume (Units) Analysis, By Automation, 2018 to 2033

Table 23: Latin America Market Value (US$ million) Analysis, by Operating Speed, 2018 to 2033

Table 24: Latin America Market Volume (Units) Analysis, by Operating Speed, 2018 to 2033

Table 25: Latin America Market Value (US$ million) Analysis, By Machine Type, 2018 to 2033

Table 26: Latin America Market Volume (Units) Analysis, By Machine Type, 2018 to 2033

Table 27: Latin America Market Value (US$ million) Analysis, by End-use Industry, 2018 to 2033

Table 28: Latin America Market Volume (Units) Analysis, by End-use Industry, 2018 to 2033

Table 29: Latin America Market Value (US$ million) Analysis, by Region, 2018 to 2033

Table 30: Latin America Market Volume (Units) Analysis, by Region, 2018 to 2033

Table 31: East Asia Market Value (US$ million) Analysis, By Automation, 2018 to 2033

Table 32: East Asia Market Volume (Units) Analysis, By Automation, 2018 to 2033

Table 33: East Asia Market Value (US$ million) Analysis, by Operating Speed, 2018 to 2033

Table 34: East Asia Market Volume (Units) Analysis, by Operating Speed, 2018 to 2033

Table 35: East Asia Market Value (US$ million) Analysis, By Machine Type, 2018 to 2033

Table 36: East Asia Market Volume (Units) Analysis, By Machine Type, 2018 to 2033

Table 37: East Asia Market Value (US$ million) Analysis, by End-use Industry, 2018 to 2033

Table 38: East Asia Market Volume (Units) Analysis, by End-use Industry, 2018 to 2033

Table 39: East Asia Market Value (US$ million) Analysis, by Region, 2018 to 2033

Table 40: East Asia Market Volume (Units) Analysis, by Region, 2018 to 2033

Table 41: South Asia & Pacific Market Value (US$ million) Analysis, By Automation, 2018 to 2033

Table 42: South Asia & Pacific Market Volume (Units) Analysis, By Automation, 2018 to 2033

Table 43: South Asia & Pacific Market Value (US$ million) Analysis, by Operating Speed, 2018 to 2033

Table 44: South Asia & Pacific Market Volume (Units) Analysis, by Operating Speed, 2018 to 2033

Table 45: South Asia & Pacific Market Value (US$ million) Analysis, By Machine Type, 2018 to 2033

Table 46: South Asia & Pacific Market Volume (Units) Analysis, By Machine Type, 2018 to 2033

Table 47: South Asia & Pacific Market Value (US$ million) Analysis, by End-use Industry, 2018 to 2033

Table 48: South Asia & Pacific Market Volume (Units) Analysis, by End-use Industry, 2018 to 2033

Table 49: South Asia & Pacific Market Value (US$ million) Analysis, by Region, 2018 to 2033

Table 50: South Asia & Pacific Market Volume (Units) Analysis, by Region, 2018 to 2033

Table 51: Western Europe Market Value (US$ million) Analysis, By Automation, 2018 to 2033

Table 52: Western Europe Market Volume (Units) Analysis, By Automation, 2018 to 2033

Table 53: Western Europe Market Value (US$ million) Analysis, by Operating Speed, 2018 to 2033

Table 54: Western Europe Market Volume (Units) Analysis, by Operating Speed, 2018 to 2033

Table 55: Western Europe Market Value (US$ million) Analysis, By Machine Type, 2018 to 2033

Table 56: Western Europe Market Volume (Units) Analysis, By Machine Type, 2018 to 2033

Table 57: Western Europe Market Value (US$ million) Analysis, by End-use Industry, 2018 to 2033

Table 58: Western Europe Market Volume (Units) Analysis, by End-use Industry, 2018 to 2033

Table 59: Western Europe Market Value (US$ million) Analysis, by Region, 2018 to 2033

Table 60: Western Europe Market Volume (Units) Analysis, by Region, 2018 to 2033

Table 61: Eastern Europe Market Value (US$ million) Analysis, By Automation, 2018 to 2033

Table 62: Eastern Europe Market Volume (Units) Analysis, By Automation, 2018 to 2033

Table 63: Eastern Europe Market Value (US$ million) Analysis, by Operating Speed, 2018 to 2033

Table 64: Eastern Europe Market Volume (Units) Analysis, by Operating Speed, 2018 to 2033

Table 65: Eastern Europe Market Value (US$ million) Analysis, By Machine Type, 2018 to 2033

Table 66: Eastern Europe Market Volume (Units) Analysis, By Machine Type, 2018 to 2033

Table 67: Eastern Europe Market Value (US$ million) Analysis, by End-use Industry, 2018 to 2033

Table 68: Eastern Europe Market Volume (Units) Analysis, by End-use Industry, 2018 to 2033

Table 69: Eastern Europe Market Value (US$ million) Analysis, by Region, 2018 to 2033

Table 70: Eastern Europe Market Volume (Units) Analysis, by Region, 2018 to 2033

Table 71: Central Asia Market Value (US$ million) Analysis, By Automation, 2018 to 2033

Table 72: Central Asia Market Volume (Units) Analysis, By Automation, 2018 to 2033

Table 73: Central Asia Market Value (US$ million) Analysis, by Operating Speed, 2018 to 2033

Table 74: Central Asia Market Volume (Units) Analysis, by Operating Speed, 2018 to 2033

Table 75: Central Asia Market Value (US$ million) Analysis, By Machine Type, 2018 to 2033

Table 76: Central Asia Market Volume (Units) Analysis, By Machine Type, 2018 to 2033

Table 77: Central Asia Market Value (US$ million) Analysis, by End-use Industry, 2018 to 2033

Table 78: Central Asia Market Volume (Units) Analysis, by End-use Industry, 2018 to 2033

Table 79: Central Asia Market Value (US$ million) Analysis, by Region, 2018 to 2033

Table 80: Central Asia Market Volume (Units) Analysis, by Region, 2018 to 2033

Table 81: Russia & Belarus Market Value (US$ million) Analysis, By Automation, 2018 to 2033

Table 82: Russia & Belarus Market Volume (Units) Analysis, By Automation, 2018 to 2033

Table 83: Russia & Belarus Market Value (US$ million) Analysis, by Operating Speed, 2018 to 2033

Table 84: Russia & Belarus Market Volume (Units) Analysis, by Operating Speed, 2018 to 2033

Table 85: Russia & Belarus Market Value (US$ million) Analysis, By Machine Type, 2018 to 2033

Table 86: Russia & Belarus Market Volume (Units) Analysis, By Machine Type, 2018 to 2033

Table 87: Russia & Belarus Market Value (US$ million) Analysis, by End-use Industry, 2018 to 2033

Table 88: Russia & Belarus Market Volume (Units) Analysis, by End-use Industry, 2018 to 2033

Table 89: Russia & Belarus Market Value (US$ million) Analysis, by Region, 2018 to 2033

Table 90: Russia & Belarus Market Volume (Units) Analysis, by Region, 2018 to 2033

Table 91: Balkan & Baltic Countries Market Value (US$ million) Analysis, By Automation, 2018 to 2033

Table 92: Balkan & Baltic Countries Market Volume (Units) Analysis, By Automation, 2018 to 2033

Table 93: Balkan & Baltic Countries Market Value (US$ million) Analysis, by Operating Speed, 2018 to 2033

Table 94: Balkan & Baltic Countries Market Volume (Units) Analysis, by Operating Speed, 2018 to 2033

Table 95 Balkan & Baltic Market Value (US$ million) Analysis, By Machine Type, 2018 to 2033

Table 96: Balkan & Baltic Market Volume (Units) Analysis, By Machine Type, 2018 to 2033

Table 97: Balkan & Baltic Countries Market Value (US$ million) Analysis, by End-use Industry, 2018 to 2033

Table 98: Balkan & Baltic Countries Market Volume (Units) Analysis, by End-use Industry, 2018 to 2033

Table 99: Balkan & Baltic Countries Market Value (US$ million) Analysis, by Region, 2018 to 2033

Table 100: Balkan & Baltic Countries Market Volume (Units) Analysis, by Region, 2018 to 2033

Table 101: Middle East & Africa Market Value (US$ million) Analysis, By Automation, 2018 to 2033

Table 102: Middle East & Africa Market Volume (Units) Analysis, By Automation, 2018 to 2033

Table 103: Middle East & Africa Market Value (US$ million) Analysis, by Operating Speed, 2018 to 2033

Table 104: Middle East & Africa Market Volume (Units) Analysis, by Operating Speed, 2018 to 2033

Table 105: Middle East & Africa Market Value (US$ million) Analysis, By Machine Type, 2018 to 2033

Table 106: Middle East & Africa Market Volume (Units) Analysis, By Machine Type, 2018 to 2033

Table 107: Middle East & Africa Market Value (US$ million) Analysis, by End-use Industry, 2018 to 2033

Table 108: Middle East & Africa Market Volume (Units) Analysis, by End-use Industry, 2018 to 2033

Table 109: Middle East & Africa Market Value (US$ million) Analysis, by Region, 2018 to 2033

Table 110: Middle East & Africa Market Volume (Units) Analysis, by Region, 2018 to 2033

Figure 01: Global Market Share Analysis by Automation 2023 to 2033

Figure 02: Global Market Share Analysis by Operating Speed 2023

Figure 03: Global Market Share Analysis by Machine Type 2023

Figure 04: Global Market Attractiveness Analysis by End-use Industry 2023 to 2033

Figure 05: North America Market Share Analysis by Automation2023 to 2033

Figure 06: North America Market Share Analysis by Operating Speed 2023

Figure 07: North America Market Share Analysis by Machine Type 2023

Figure 08: North America Market Attractiveness Analysis by End-use Industry 2023 to 2033

Figure 09: Latin America Market Share Analysis by Automation2023 to 2033

Figure 10: Latin America Market Share Analysis by Operating Speed 2023

Figure 11: Latin America Market Share Analysis by Machine Type 2023

Figure 12: Latin America Market Attractiveness Analysis by End-use Industry 2023 to 2033

Figure 13: East Asia Market Share Analysis by Automation 2023 to 2033

Figure 14: East Asia Market Share Analysis by Operating Speed 2023

Figure 15: East Asia Market Share Analysis by Machine Type 2023

Figure 16: East Asia Market Attractiveness Analysis by End-use Industry 2023 to 2033

Figure 17: South Asia & Pacific Market Share Analysis by Automation2023 to 2033

Figure 18: South Asia & Pacific Market Share Analysis by Operating Speed 2023

Figure 19: South Asia & Pacific Market Share Analysis by Machine Type 2023

Figure 20: South Asia & Pacific Market Attractiveness Analysis by End-use Industry 2023 to 2033

Figure 21: Western Europe Market Share Analysis by Automation 2023 to 2033

Figure 22: Western Europe Market Share Analysis by Operating Speed 2023

Figure 23: Western Europe Market Share Analysis by Machine Type 2023

Figure 24: Western Europe Market Attractiveness Analysis by End-use Industry 2023 to 2033

Figure 25: Eastern Europe Market Share Analysis by Automation 2023 to 2033

Figure 26: Eastern Europe Market Share Analysis by Operating Speed 2023

Figure 27: Eastern Europe Market Share Analysis by Machine Type 2023

Figure 28: Eastern Europe Market Attractiveness Analysis by End-use Industry 2023 to 2033

Figure 29: Central Asia Market Share Analysis by Automation 2023 to 2033

Figure 30: Central Asia Market Share Analysis by Operating Speed 2023

Figure 31: Central Asia Market Share Analysis by Machine Type 2023

Figure 32: Central Asia Market Attractiveness Analysis by End-use Industry 2023 to 2033

Figure 33: Russia & Belarus Market Share Analysis by Automation2023 to 2033

Figure 34: Russia & Belarus Market Share Analysis by Operating Speed 2023

Figure 35: Russia & Belarus Market Share Analysis by Machine Type 2023

Figure 36: Russia & Belarus Market Attractiveness Analysis by End-use Industry 2023 to 2033

Figure 37: Balkan & Baltic Countries Market Share Analysis by Automation2023 to 2033

Figure 38: Balkan & Baltic Countries Market Share Analysis by Operating Speed2023

Figure 39: Balkan & Baltic Countries Market Share Analysis by Machine Type2023

Figure 40: Balkan & Baltic Countries Market Attractiveness Analysis by End-use Industry 2023 to 2033

Figure 41: Middle East & Africa Market Share Analysis by Automation 2023 to 2033

Figure 42: Middle East & Africa Market Share Analysis by Operating Speed 2023

Figure 43: Middle East & Africa Market Share Analysis by Machine Type 2023

Figure 44: Middle East & Africa Market Attractiveness Analysis by End-use Industry 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bottle Sealing Wax Market Size and Share Forecast Outlook 2025 to 2035

Bottle Shippers Market Size and Share Forecast Outlook 2025 to 2035

Bottled Water Packaging Market Size and Share Forecast Outlook 2025 to 2035

Bottle Dividers Market Size and Share Forecast Outlook 2025 to 2035

Bottle Jack Market Size and Share Forecast Outlook 2025 to 2035

Bottles Market Analysis - Growth & Forecast 2025 to 2035

Market Share Distribution Among Bottle Dividers Suppliers

Bottle Carrier Market Trends – Growth & Forecast 2024-2034

Bottle Cap Market Analysis & Industry Forecast 2024-2034

Bottled Water Processing Equipment Market Trends – Growth & Industry Forecast 2025-2035

Bottle Pourers Market

Bottle Filling Machines Market Size and Share Forecast Outlook 2025 to 2035

Bottle Sticker Labelling Machine Market Size and Share Forecast Outlook 2025 to 2035

RTD Bottled Cocktail Market - Size, Share, and Forecast Outlook 2025 to 2035

PET Bottles Market Demand and Insights 2025 to 2035

PCR Bottles Market Growth - Demand, Innovations & Outlook 2024 to 2034

Asia & MEA PET Bottle Market Trends & Industry Forecast 2024-2034

Foam Bottle Technology Market Size and Share Forecast Outlook 2025 to 2035

Beer Bottles Market Size and Share Forecast Outlook 2025 to 2035

Wine Bottle Sterilizer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA