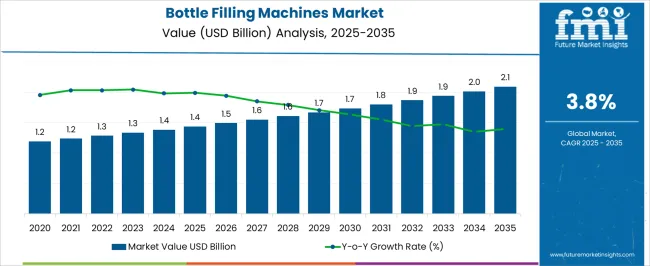

The Bottle Filling Machines Market is estimated to be valued at USD 1.4 billion in 2025 and is projected to reach USD 2.1 billion by 2035, registering a compound annual growth rate (CAGR) of 3.8% over the forecast period.

| Metric | Value |

|---|---|

| Bottle Filling Machines Market Estimated Value in (2025 E) | USD 1.4 billion |

| Bottle Filling Machines Market Forecast Value in (2035 F) | USD 2.1 billion |

| Forecast CAGR (2025 to 2035) | 3.8% |

The bottle filling machines market is expanding steadily as industries prioritize automation, efficiency, and compliance with stringent hygiene standards. Rising demand for packaged food and beverages, pharmaceuticals, and personal care products is driving widespread adoption of advanced filling technologies. Growing consumer preference for bottled products and the surge in e commerce distribution channels are further supporting market growth.

Manufacturers are investing in precision filling solutions that minimize product wastage, enhance speed, and ensure consistent quality. Technological advances in servo driven systems, clean in place mechanisms, and digital monitoring are enabling operational flexibility and higher productivity.

Regulatory pressures related to food safety and packaging integrity are also reinforcing the need for reliable and automated filling systems. The outlook remains positive as industries continue to embrace automation and eco efficient packaging solutions to meet increasing production demands and evolving consumer expectations.

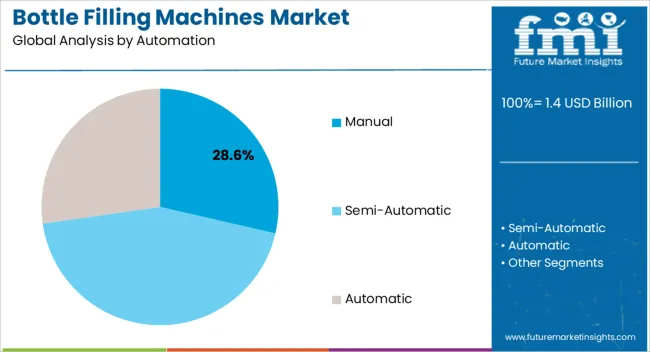

The manual automation segment is projected to account for 28.60% of total revenue by 2025 within the automation category. This share is supported by the cost effectiveness and ease of deployment of manual systems, which remain attractive to small and medium sized enterprises.

Manual machines are preferred in low volume production settings and in industries where customization and flexibility are prioritized. Their low maintenance requirements and affordability compared to fully automated systems have strengthened their relevance in emerging economies and start up manufacturing facilities.

Despite the rise of automation, manual machines continue to serve as an accessible entry point for businesses scaling their production capabilities.

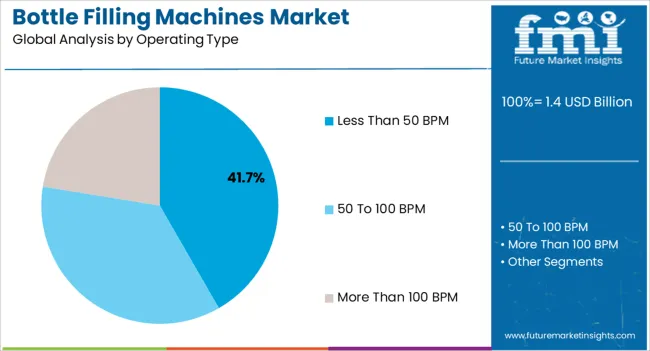

The less than 50 BPM operating type segment is expected to capture 41.70% of market revenue by 2025 within the operating type category. This dominance is driven by its suitability for small scale and mid scale operations where production volumes are moderate.

The ability to balance output efficiency with lower operational costs has supported its widespread adoption. Additionally, manufacturers in industries such as craft beverages, niche cosmetics, and pharmaceuticals often opt for this operating type due to its manageable speed, precise filling control, and adaptability to varied product viscosities.

Its role in enabling cost effective and flexible production has established this segment as a key contributor to market expansion.

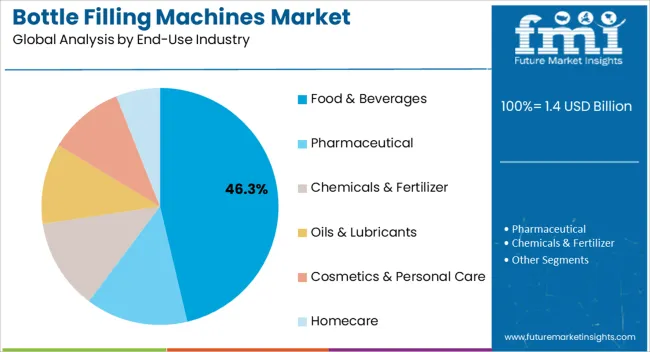

The food and beverages segment is anticipated to hold 46.30% of total revenue by 2025 under the end use industry category, making it the most dominant sector. This growth is fueled by the rising consumption of bottled water, carbonated drinks, juices, and functional beverages worldwide.

Stringent food safety standards and consumer demand for high quality packaging have further reinforced the deployment of advanced filling technologies in this sector. The ability of filling machines to deliver precision, maintain hygiene, and support high throughput production aligns with the operational needs of food and beverage manufacturers.

With increasing global demand for convenient and ready to consume packaged products, the food and beverages industry continues to drive the largest share of adoption in the bottle filling machines market.

Increasing Consumption of Cosmetic Products Boosting Sales of Bottle Filling Machines

Over the years, rising disposable income and changing lifestyles have resulted in a surge in cosmetics consumption across the world. People are spending large amounts on cosmetic products like perfumes, shampoos, skin moisturizers, and hair oils. As these cosmetic products are mostly packed and stored in bottles and other containers, a rise in their production and consumption is expected to continue triggering sales of bottle filling machines.

Leading cosmetics manufacturers are increasingly employing bottle filling machines in their facilities to facilitate the filing of various products in bottles and other containers.

Demand for bottle machines is especially rising across European countries like Germany and France due to the booming cosmetics and personal care industry. For instance, according to Cosmetic Europe, the European cosmetics and personal care industry reached a valuation of USD 1.4 billion in 2024, and this number is expected to further surge during the forthcoming years. This is projected to create strong demand for bottle filling machines in the region.

The global demand for bottle machines is projected to grow at a CAGR of 4% between 2025 and 2035, in comparison to the 3.3% CAGR registered from 2020 to 2025. Growing usage of bottle filling machines across diverse industries, including food & beverages and pharmaceuticals, is a key factor driving growth in the global bottle filling machines market.

Bottle filling machines offer various benefits, such as higher accuracy, optimal filling speed, less power consumption, and better hygiene. As a result, they are being increasingly installed across various industries to improve overall productivity.

The rapid expansion of industries like food & beverages, pharmaceuticals, chemicals & fertilizer, oils & lubricants, cosmetics & personal care, etc., due to the rapidly growing population, changing lifestyles, and an economic boom is expected to create lucrative opportunities for bottle filling machines manufacturers during the forecast period.

Growing Adoption of Advanced Technologies Pushing Sales of Bottle Filling Machines in the United States

| Country | The United States |

|---|---|

| Market Value USD (2035) | USD 2.1 million |

| CAGR % (2025 to 2035) | 3.2% |

Over the years, the United States has become one of the most dominating bottle filling machine markets. This trend is projected to continue over the forecast period as well.

As per FMI, the United States bottle filling machines market size is expected to reach USD 2.1 million by 2035, exhibiting a CAGR of 3.2% during the forecast period. Growth in the United States bottle machine market is driven by the rising consumption of beverages like wine, the growing adoption of advanced technologies, and the strong presence of leading bottle filling machine manufacturers.

As per data estimates by the Wine Institute of the United States, the wine business generates about USD 1.4 billion in economic activity annually and employs a total of about 800,000 Americans. Furthermore, the average consumption per American resident was about 12 bottles in 2024. This rise in wine consumption is prompting manufacturers to employ bottle filling machines to improve their productivity as well as to reduce labor costs.

Rapid Expansion of End-use Industries Pushing Demand for Bottle Filling Machines in India

| Country | China |

|---|---|

| Market Value USD (2035) | USD 57.75 million |

| CAGR % (2025 to 2035) | 5% |

As per FMI, demand for bottle filling machines is expected to expand robustly at a CAGR of 5% across India during the forecast period from 2025 and 2035. This can be credited to the robust expansion of end-use sectors like food & beverages, chemicals & fertilizers, and pharmaceuticals, booming export business, and rising penetration of automation.

Similarly, increasing production of cooking oils like mustard oil is projected to boost sales of bottle filling machines in India during the forecast period.

By the end of 2035, the Indian bottle filling machines industry is anticipated to create an incremental $ opportunity of around USD 57.75 million.

Faster Speed and Error Free Nature of Automatic Bottle Filling Machines Pushing Their Sales

| Segment | Automatic |

|---|---|

| Market Value USD (2035) | USD 2.1 million |

| CAGR % (2025 to 2035) | 5% |

Based on operating type, demand for automatic bottle filling machines is likely to grow at a significant CAGR of 5% over the estimated period, totaling approximately USD 2.1 million by 2035. This can be ascribed to the increasing end-user proclivity for automatic machines on account of their various benefits, including faster nature and error reduction.

Automatic bottle filling machines can fill more than 100 bottles per minute and can thus save time as well as reduce labor costs.

Majority of the Bottle Filling Machines Sales to Remain Concentrated in Food & Beverages Industry

| Segment Name | Food and Beverage |

|---|---|

| Market Value USD (2035) | USD 639.89 million |

| Market CAGR % (2025 to 2035) | 4.9% |

As per FMI, the food & beverages segment is projected to continue leading the global bottle filling machines industry during the assessment period. This is owing to the surging adoption of bottle filling machines across the food and beverage industry.

Most of the food and beverage manufacturers today employ bottle filling machines to increase their productivity and cut labor costs. Thus, the rapid expansion of the food and beverage industry due to the increasing consumption of processed foods, beverages, and other products is anticipated to continue supporting the growth of the bottle filling machines market over the next decade.

The food & beverages segment is projected to register a CAGR of 4.9% between 2025 and 2035, generating market revenue of worth USD 639.89 million by 2035.

Bottle filling machines industry is fragmented in nature. Due to the large number of regional and local players, the market is extremely competitive. Firms are using diverse strategies to increase their income streams and income generation. Key strategies to have an upper hand in the market include:

New Developments in the Market:

Key Players in the Market are:

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 1.4 billion |

| Projected Market Size (2035) | USD 2.1 billion |

| Anticipated Growth rate (2025 to 2035) | 3.8% |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD million/ billion, Volume in Units, and CAGR from 2025 to 2035 |

| Segment Covered | Automation, Operating Type, End-use Industry, Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania; Middle East and Africa (MEA) |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, Italy, France, The United Kingdom, Spain, Russia, China, Japan, India, GCC Countries, Australia |

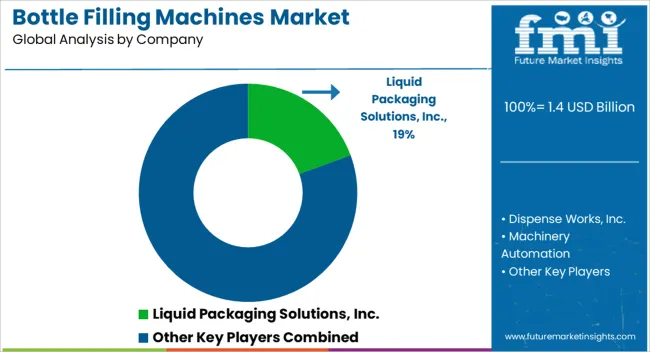

| Key Companies Profiled | Liquid Packaging Solutions, Inc.; Dispense Works, Inc.; Machinery Automation; Preach; Filamatic; Acasi; APACKS; Co.Mac srl; PACK’R; KBW Packaging; THE ADELPHI GROUP OF COMPANIES; SP Filling Systems Ltd; Flow Tronix; Carbonation Techniques; Countec Co., Ltd.; Siddhivinayak Automation; Asset Packaging Machines’ PTY LTD; HongKong SINBON Industrial Limited; COZZOLI MACHINES COMPANY; Nichrome Packaging Solutions. |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global bottle filling machines market is estimated to be valued at USD 1.4 billion in 2025.

The market size for the bottle filling machines market is projected to reach USD 2.1 billion by 2035.

The bottle filling machines market is expected to grow at a 3.8% CAGR between 2025 and 2035.

The key product types in bottle filling machines market are manual, semi-automatic and automatic.

In terms of operating type, less than 50 bpm segment to command 41.7% share in the bottle filling machines market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bottle Sealing Wax Market Size and Share Forecast Outlook 2025 to 2035

Bottle Shippers Market Size and Share Forecast Outlook 2025 to 2035

Bottled Water Packaging Market Size and Share Forecast Outlook 2025 to 2035

Bottle Sticker Labelling Machine Market Size and Share Forecast Outlook 2025 to 2035

Bottle Dividers Market Size and Share Forecast Outlook 2025 to 2035

Bottle Jack Market Size and Share Forecast Outlook 2025 to 2035

Bottles Market Analysis - Growth & Forecast 2025 to 2035

Bottle Capping Machine Market Analysis by Automation, Operating Speed, Machine Type, End-use Industry, and Region Forecast Through 2035

Market Share Distribution Among Bottle Dividers Suppliers

Bottle Carrier Market Trends – Growth & Forecast 2024-2034

Bottle Cap Market Analysis & Industry Forecast 2024-2034

Bottled Water Processing Equipment Market Trends – Growth & Industry Forecast 2025-2035

Bottle Pourers Market

RTD Bottled Cocktail Market - Size, Share, and Forecast Outlook 2025 to 2035

PET Bottles Market Demand and Insights 2025 to 2035

PCR Bottles Market Growth - Demand, Innovations & Outlook 2024 to 2034

Asia & MEA PET Bottle Market Trends & Industry Forecast 2024-2034

Foam Bottle Technology Market Size and Share Forecast Outlook 2025 to 2035

Beer Bottles Market Size and Share Forecast Outlook 2025 to 2035

Wine Bottle Sterilizer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA