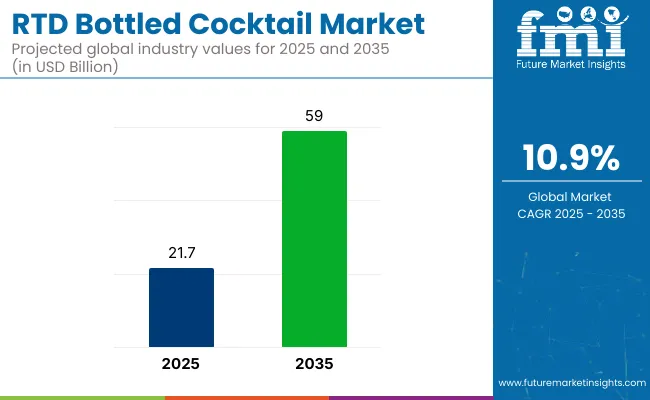

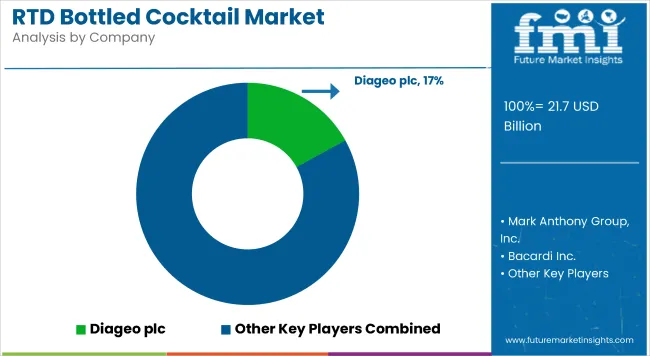

The global RTD bottled cocktail market is valued at USD 21.7 billion in 2025 and is poised to reach USD 59.0 billion by 2035, reflecting a CAGR of 10.9%. Growth is being driven by a shift in consumer preference toward convenience, increased interest in premium beverages, and the proliferation of social gatherings and home entertainment.

| Metric | Value |

|---|---|

| Market Size (2025) | USD 21.7 billion |

| Projected Market Size (2035) | USD 59.0 billion |

| CAGR (2025 to 2035) | 10.9% |

Additionally, innovations in flavor profiles and sustainable packaging have been contributing to greater market appeal across demographics.

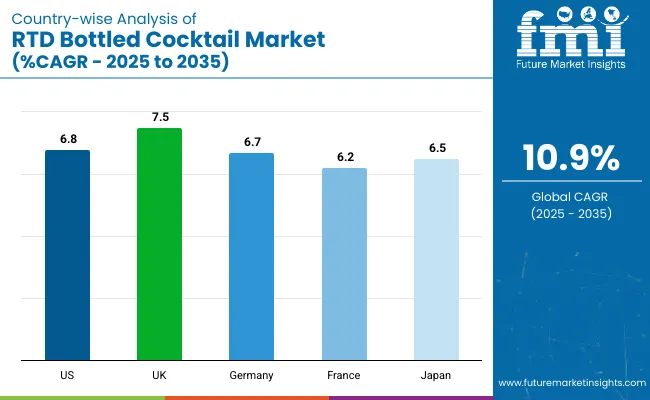

The USA, the UK, and Germany are projected to be among the top-performing markets for RTD bottled cocktails, with CAGRs of 6.8%, 7.5%, and 6.7%, respectively, over the forecast period. These countries are experiencing steady growth due to increasing demand for convenience-based alcoholic beverages, rising interest in premium drinks, and frequent product innovations catering to local preferences.

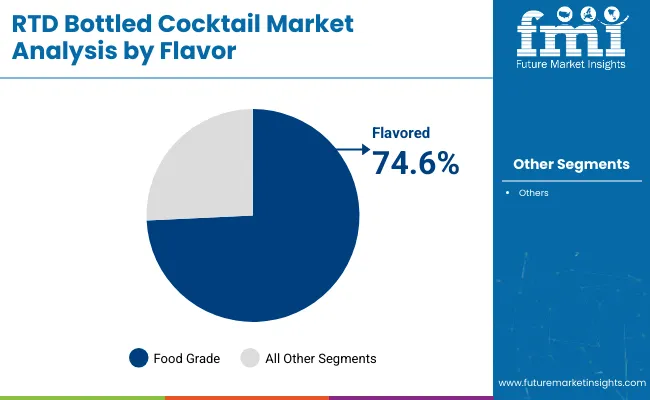

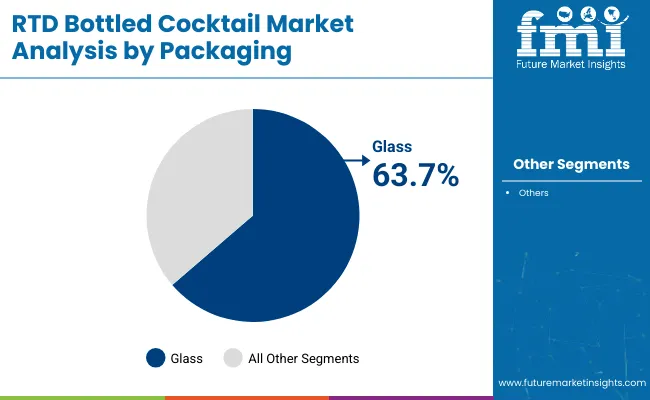

In terms of segment performance, flavored RTD cocktails are expected to dominate the market with a commanding share of 74.6%, owing to their broad appeal across various taste profiles. Glass will lead the packaging segment with 63.7% share in 2025.

Recent innovations in the RTD bottled cocktail market include eco-friendly packaging, botanical-infused flavors, and premium wine-based cocktails. Brands are expanding through eCommerce and direct-to-consumer channels.

On the regulatory side, stricter labeling and alcohol content laws are being enforced in North America and Europe to enhance consumer safety. Sustainability regulations are also prompting manufacturers to use recyclable materials and reduce carbon emissions, driving environmentally responsible production across the RTD cocktail industry.

The market holds an estimated 12-15% share of the broader ready-to-drink beverages market, driven by growing demand for convenience and premiumization. It accounts for approximately 3-5%, as traditional spirits and beer still dominate.

In the flavored alcoholic drinks market, RTD bottled cocktails contribute around 10-12%, supported by the popularity of fruit-infused and botanical variants. Its share in the convenience food & beverage market remains modest at 2-3%, while in the beverage packaging market, its impact is indirect but rising due to demand for sustainable, portable packaging solutions.

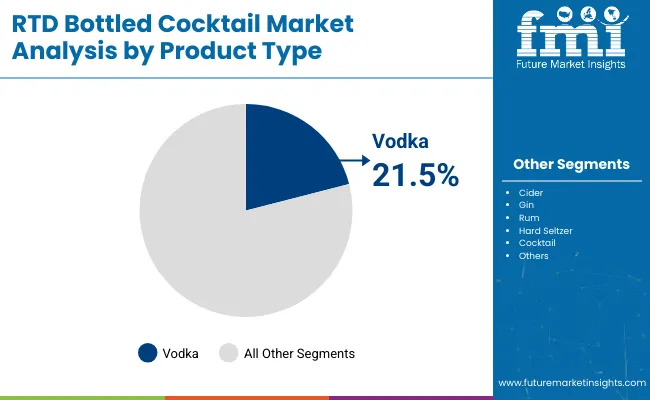

The market segments include product type, flavour, price range, sales channel, packaging, and region. The product type segment covers cider, gin, vodka, wine, whiskey, rum, hard seltzer, and cocktail. The flavour segment includes natural/unflavoured and flavoured, with flavoured further segmented into citrus, ginger, apple, vanilla, berry, tropical, coconut, jerk, plantain, and mixed fruits.

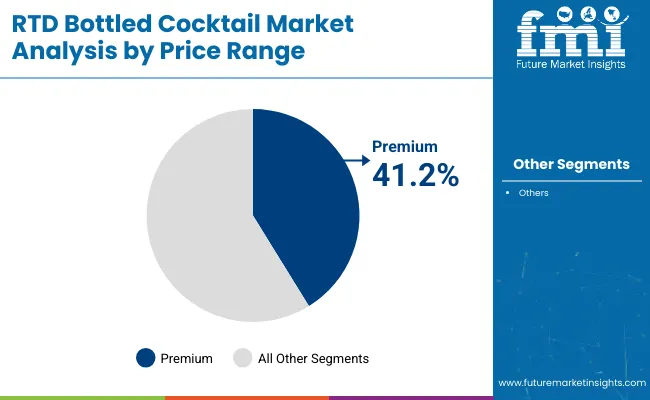

The price range segment comprises economic, mid-range, and premium. The sales channel segment includes on-trade/food service, institutional sale, retail (hypermarket/supermarket, convenience store, specialty stores, liquor shop/beverage exclusive, airport retail), and online retail.

The packaging segment includes glass and plastic. The regional segment includes North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East & Africa.

Vodka-based RTD cocktails are expected to be the most lucrative segment and are likely to hold 21.5% market share in 2025.

Flavoured RTD cocktails account for 74.6% market share globally, driven by rising consumer interest in diverse taste profiles, convenience, and premium drinking experiences.

Premium RTD bottled cocktails account for 41.2% market share globally, driven by growing consumer demand for high-quality ingredients, artisanal craftsmanship, and visually appealing packaging.

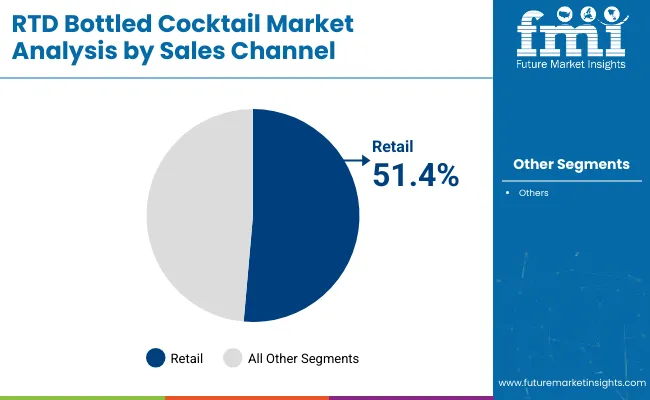

Retail accounts for a 51.4% market share globally in the RTD bottled cocktail market, making it the dominant sales channel.

Glass packaging accounts for a 63.7% market share globally in the RTD bottled cocktail market.

The market is growing rapidly, driven by rising consumer demand for convenient and premium alcoholic beverages, increasing popularity of social drinking at home, and continuous innovations in flavor profiles, packaging formats, and digital retail strategies.

Recent Trends in the RTD Bottled Cocktail Market

Challenges in the RTD Bottled Cocktail Market

Among the top five countries, the UK is projected to lead the market with the highest CAGR of 7.5% from 2025 to 2035, driven by rising at-home consumption and a strong demand for premium offerings. Japan follows with a CAGR of 6.5%, supported by its compact, convenience-focused market.

Germany and the USA are close behind, recording CAGRs of 6.7% and 6.8% respectively, due to innovation in packaging and flavor formats. France lags slightly with a 6.2% CAGR, yet remains strong owing to its café culture and shift toward fashionable cocktails among younger consumers.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The USA RTD bottled cocktail market is projected to grow at a CAGR of 6.8% from 2025 to 2035, fueled by innovation in flavors and packaging formats.

Sales of RTD bottled cocktail market in the UK are anticipated to expand at a CAGR of 7.5% from 2025 to 2035, supported by a growing culture of at-home consumption and preference for ready-to-drink formats.

Germany’s RTD bottled cocktail revenue is expected to grow at a CAGR of 6.7% from 2025 to 2035, driven by demand for on-the-go and convenience-based beverage options.

Sales of RTD bottled cocktail market in France are estimated to witness a CAGR of 6.2% from 2025 to 2035, as younger consumers shift from traditional wine to flavored and fashionable cocktail alternatives.

Japan's RTD bottled cocktail revenue is forecasted to register a CAGR of 6.5% from 2025 to 2035, led by high consumer demand for compact, single-serve alcoholic beverages.

The market is moderately consolidated, with a mix of global beverage giants and emerging craft players shaping the competitive landscape. Leading suppliers like Diageo plc, Bacardi Inc., and Pernod Ricard SA hold significant market share through extensive brand portfolios and global distribution networks.

Top companies in this market are actively competing through premium product launches, pricing strategies tailored for mid- and high-end consumers, and strong retail and online distribution expansion. Innovation in flavor profiles, sustainable packaging, and collaborations with mixologists or celebrities are also key tactics.

Recent RTD Bottled Cocktail Industry News

In September 2024, Bacardi announced a major partnership with The Coca-Cola Company to launch “BACARDÍ Mixed with Coca-Cola” RTD bottled cocktail, with initial rollout in select European markets and Mexico in 2025.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 21.7 billion |

| Projected Market Size (2035) | USD 59.0 billion |

| CAGR (2025 to 2035) | 10.9% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billion/Volume in million units |

| By Product Type | Cider, Gin, Vodka, Wine, Whiskey, Rum, Hard Seltzer, Cocktail |

| By Flavour | Natural/ Unflavoured, Flavoured (Citrus, Ginger, Apple, Vanilla, Berry, Tropical, Coconut, Jerk, Plantain, Mixed Fruits) |

| By Price Range | Economic, Mid-Range, Premium |

| By Sales Channel | On-Trade/Food Service, Institutional Sale, Retail (Hypermarket/Supermarket, Convenience Store, Specialty Stores, Liquor Shop/Beverage Exclusive, Airport Retail), and Online Retail |

| By Packaging | Glass, Plastic |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | Bottoms Up Cocktail, Diageo plc, Brown-Forman, Bacardi Inc., RTM Beverages Ltd., The Kraken, Mark Anthony Group Inc., High West Distillery, Pernod Ricard SA, and Suntory Holdings Limited |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis |

The market is valued at USD 21.7 billion in 2025.

It is expected to reach USD 59.0 billion by 2035.

The market is projected to grow at a CAGR of 10.9% from 2025 to 2035.

Flavoured RTD cocktails hold the largest share, with 74.6% in 2025.

UK is projected to be the fastest-growing market, with a CAGR of 7.5% from 2025 to 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

RTD Coffee Market Size and Share Forecast Outlook 2025 to 2035

RTD Temperature Sensors Market Growth - Trends & Forecast 2025 to 2035

RTD Cocktail Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

RTD Cocktail Shots Market Analysis by Type, Packaging Type, and Distribution Channel Through 2035

RTD Canned Cocktail Market Growth - Convenience & Mixology Trends 2025 to 2035

Pre-mixed/RTD Alcoholic Drink Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Demand for RTD Whey Deployments for Shelf-stable Drinks in CIS Size and Share Forecast Outlook 2025 to 2035

Dairy-Free RTD Coffee Products Market

Low-calorie RTD Beverages Market Analysis by Product Type, Flavor, Distribution Channel and Region through 2035

Non Alcoholic RTD Beverages Market Size and Share Forecast Outlook 2025 to 2035

Ready to Drink (RTD) Packaging Market Size and Share Forecast Outlook 2025 to 2035

Ready To Drink (RTD) Tea Market Trends - Functional & Refreshing Beverage Growth 2025 to 2035

Demand of Heat Stable Whey for RTD Performance Drinks in EU Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Whey-plus-Prebiotic Stacks for RTD Shakes in CIS Analysis Size and Share Forecast Outlook 2025 to 2035

Bottled Water Packaging Market Size and Share Forecast Outlook 2025 to 2035

Bottled Water Processing Equipment Market Trends – Growth & Industry Forecast 2025-2035

Premix Bottled Cocktails Market Trends - Growth & Consumer Shifts 2025 to 2035

Premium Bottled Water Market Size and Share Forecast Outlook 2025 to 2035

Sparkling Bottled Water Market Growth - Demand & Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA