The waxed paper market is demonstrating steady growth. Demand is being driven by expanding applications across food packaging, wrapping, and industrial sectors. Current dynamics reflect increasing consumer preference for sustainable, biodegradable materials as industries shift away from synthetic packaging.

Advancements in coating technology and paper processing are improving the moisture resistance, strength, and printability of waxed paper products. Manufacturers are optimizing production efficiency and expanding capacity to meet growing demand from foodservice chains and bakeries. The market outlook remains positive as regulatory bodies encourage the use of eco-friendly packaging materials.

Rising adoption of recyclable and compostable packaging solutions is further strengthening market positioning Growth rationale is supported by continuous innovation in material formulation, enhanced barrier properties, and cost-effective production processes Strategic partnerships and distribution expansions across developing economies are expected to enhance market penetration and ensure long-term revenue stability for producers operating within this segment.

| Metric | Value |

|---|---|

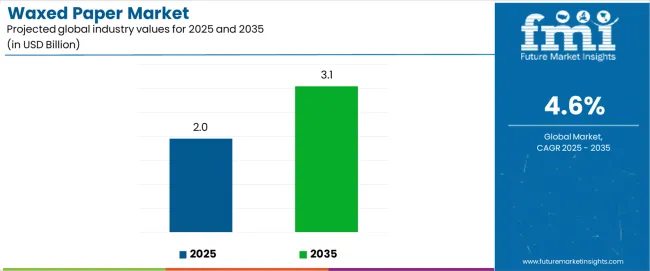

| Waxed Paper Market Estimated Value in (2025 E) | USD 2.0 billion |

| Waxed Paper Market Forecast Value in (2035 F) | USD 3.1 billion |

| Forecast CAGR (2025 to 2035) | 4.6% |

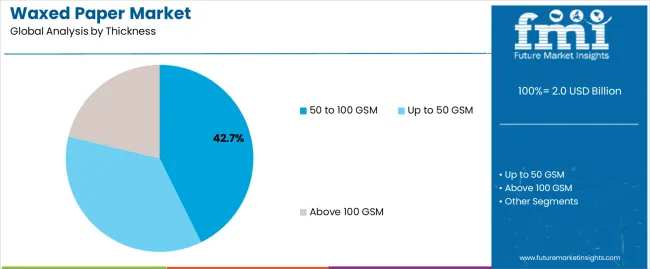

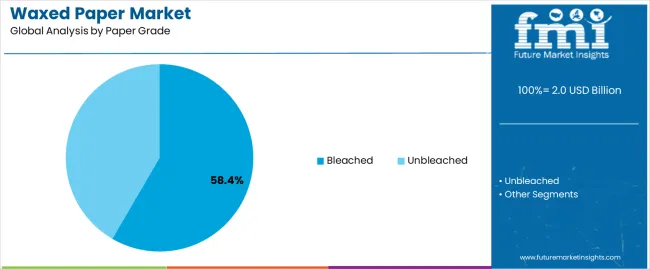

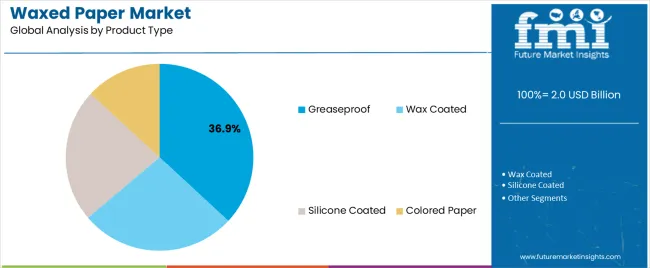

The market is segmented by Thickness, Paper Grade, Product Type, End-use, and Application and region. By Thickness, the market is divided into 50 to 100 GSM, Up to 50 GSM, and Above 100 GSM. In terms of Paper Grade, the market is classified into Bleached and Unbleached. Based on Product Type, the market is segmented into Greaseproof, Wax Coated, Silicone Coated, and Colored Paper. By End-use, the market is divided into Food and Other Industrial. By Application, the market is segmented into Packaging and Printing. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 50 to 100 GSM segment, accounting for 42.70% of the thickness category, has emerged as the leading range due to its versatility in both food and industrial applications. Its balanced weight provides optimal strength and flexibility, making it suitable for packaging baked goods, confectionery, and deli products.

Manufacturers prefer this thickness range as it offers improved print compatibility and durability without compromising on eco-friendly performance. Consistent demand from the foodservice and retail sectors has reinforced the dominance of this segment.

Process innovations enabling enhanced wax coating uniformity and surface smoothness are contributing to quality improvements As global food packaging regulations emphasize sustainability and hygiene, this segment is expected to maintain its market leadership and experience steady growth in line with increasing demand for functional and biodegradable packaging materials.

The bleached segment, representing 58.40% of the paper grade category, has been leading due to its clean, aesthetic appearance and suitability for food-contact applications. Its enhanced brightness and smooth surface make it ideal for premium packaging and branding purposes.

Manufacturers are adopting bleached paper for its superior print clarity and ability to support high-quality graphics, which strengthens brand presentation in retail environments. Compliance with food safety standards and non-toxic processing methods has further boosted adoption across bakery, confectionery, and meat packaging applications.

The segment’s dominance is reinforced by consistent product innovation and improved wax impregnation techniques, which enhance resistance to grease and moisture With the rising trend toward sustainable yet visually appealing packaging, the bleached segment is projected to sustain its leadership position over the forecast period.

The greaseproof segment, holding 36.90% of the product type category, has established its position as the leading product type owing to its superior resistance to oil and moisture. Its widespread use in wrapping baked items, fast food, and processed foods has supported strong demand from the foodservice industry.

The material’s ability to preserve freshness and prevent leakage has made it indispensable for takeaway and quick-service restaurants. Technological improvements in wax formulation and coating consistency are enhancing the functional performance of greaseproof paper.

Growing environmental awareness and preference for compostable packaging alternatives are driving replacement of plastic-coated materials with waxed greaseproof paper This segment is expected to continue leading the market, supported by regulatory encouragement for sustainable food packaging and expanding consumption across both developed and emerging economies.

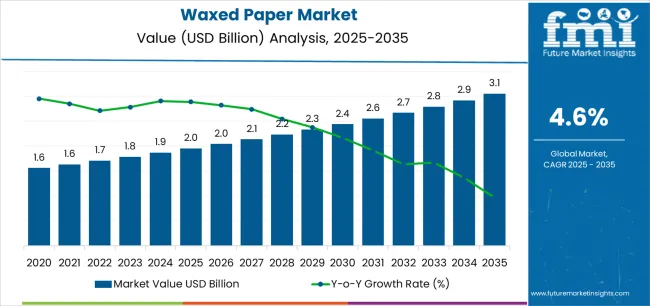

From 2020 to 2025, the global waxed paper market experienced a CAGR of 1.8%.

The table presents the expected CAGR for waxed paper market over several semi-annual periods spanning from 2025 to 2035. In the first half (H1) of the decade from 2025 to 2035, the market is predicted to surge at a CAGR of 4.9%, followed by a slightly lower growth rate of 4.2% in the second half (H2) of the same decade.

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to increase to 5.1% in the first half and lower growth rate at 4.4% in the second half.

| Particular | Value CAGR |

|---|---|

| H1 | 4.9% (2025 to 2035) |

| H2 | 4.2% (2025 to 2035) |

| H1 | 5.1% (2025 to 2035) |

| H2 | 4.4% (2025 to 2035) |

The table below shows the anticipated growth rates of several countries. India, Japan, and South Africa are expected to record high CAGRs of 8.2%, 7.0%, and 7.1%, respectively, through 2035.

| Countries | Value-based CAGR (2025 to 2035) |

|---|---|

| United States | 4.2% |

| Canada | 5.3% |

| Brazil | 4.4 % |

| Mexico | 5.1% |

| Germany | 2.4% |

| France | 3.9% |

| United Kingdom | 4.7% |

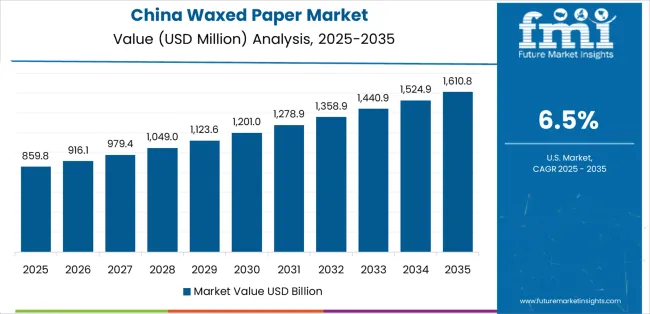

| China | 6.6% |

| India | 8.2% |

| Japan | 7.0% |

| GCC Countries | 5.0% |

| South Africa | 7.1% |

The waxed paper industry in the United States is expected to expand at a CAGR of 4.2%. Key factors supporting the market growth are:

The waxed paper market in Germany is expected to surge at a CAGR of 2.4% through 2035. This is attributable to a combination of factors, including:

South Africa is expected to surge at 7.1% CAGR through 2035. Top factors supporting the market expansion in the country include:

The waxed paper market in China is expected to surge at a CAGR of 6.6% by 2035. Emerging patterns in China are as follows:

India's waxed paper market is projected to surge at an 8.2% CAGR during the forecast period. Key factors driving the market growth are as follows:

The section offers profound insights into leading segments in the global waxed paper market. Based on product type, the greaseproof segment currently dominates the global market and is expected to surge at 3.9% CAGR through 2035. In terms of end-use, the food segment is anticipated to register a steady CAGR of 4.6% through 2035.

| Segment | Value CAGR (2025 to 2035) |

|---|---|

| Food (End-use) | 4.6% |

| Greaseproof (Product Type) | 3.9% |

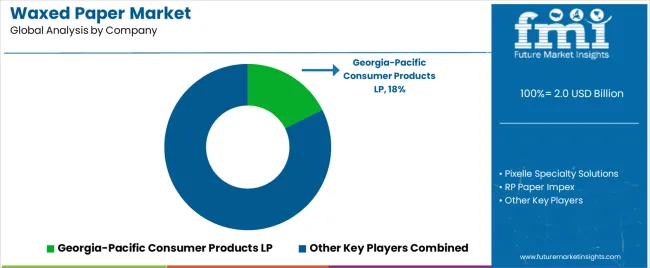

Leading companies are embracing sustainability by incorporating recyclable and biodegradable features in waxed paper. They are adhering to global environmental trends to meet increasing demand for eco-friendly packaging. Key market players emphasize customization services such as custom printing, embossing, or branding on waxed paper products.

Leading companies also focus on developing innovative wax coatings with safe coating materials and enhanced properties. They are researching and developing proprietary coating technologies that provide superior performance.

Recent activities and developments implemented by leading players in the market

The global waxed paper market is estimated to be valued at USD 2.0 billion in 2025.

The market size for the waxed paper market is projected to reach USD 3.1 billion by 2035.

The waxed paper market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in waxed paper market are 50 to 100 gsm, up to 50 gsm and above 100 gsm.

In terms of paper grade, bleached segment to command 58.4% share in the waxed paper market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Waxed Paper Packaging Market

Cold Waxed Paper Cups Market Size and Share Forecast Outlook 2025 to 2035

Assessing Cold Waxed Paper Cups Market Share & Industry Trends

Paperboard Partition Market Size and Share Forecast Outlook 2025 to 2035

Paper Box Market Size and Share Forecast Outlook 2025 to 2035

Paper Edge Protector Market Size and Share Forecast Outlook 2025 to 2035

Paper Cup Lids Market Size and Share Forecast Outlook 2025 to 2035

Paper Pallet Market Size and Share Forecast Outlook 2025 to 2035

Paper and Paperboard Packaging Market Forecast and Outlook 2025 to 2035

Paper Wrap Market Size and Share Forecast Outlook 2025 to 2035

Paper Cups Market Size and Share Forecast Outlook 2025 to 2035

Paper Core Market Size and Share Forecast Outlook 2025 to 2035

Paper Bags Market Size and Share Forecast Outlook 2025 to 2035

Paper Processing Resins Market Size and Share Forecast Outlook 2025 to 2035

Paper Tester Market Size and Share Forecast Outlook 2025 to 2035

Paper Napkin Converting Lines Market Size and Share Forecast Outlook 2025 to 2035

Paper Packaging Tapes Market Size and Share Forecast Outlook 2025 to 2035

Paper Napkins Converting Machines Market Size and Share Forecast Outlook 2025 to 2035

Paper Coating Binders Market Size and Share Forecast Outlook 2025 to 2035

Paper Core Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA