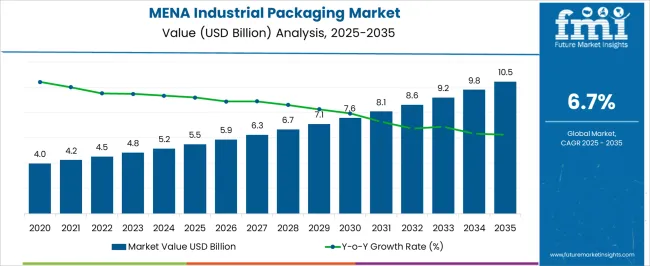

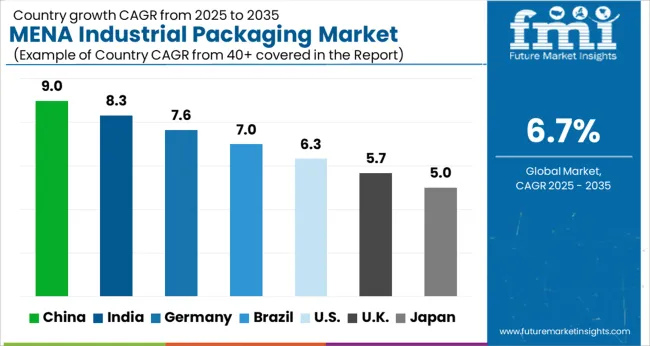

The MENA Industrial Packaging Market is estimated to be valued at USD 5.5 billion in 2025 and is projected to reach USD 10.5 billion by 2035, registering a compound annual growth rate (CAGR) of 6.7% over the forecast period.

| Metric | Value |

|---|---|

| MENA Industrial Packaging Market Estimated Value in (2025 E) | USD 5.5 billion |

| MENA Industrial Packaging Market Forecast Value in (2035 F) | USD 10.5 billion |

| Forecast CAGR (2025 to 2035) | 6.7% |

The MENA Industrial Packaging market is witnessing robust growth, driven by increasing industrialization, expanding manufacturing activities, and rising trade across the region. Growing demand for efficient and durable packaging solutions to ensure safe storage and transportation of goods is supporting market expansion. Plastic-based materials and rigid packaging solutions are being increasingly adopted due to their strength, reusability, and cost-effectiveness.

Investments in e-commerce, retail logistics, and food and beverage sectors are further accelerating the adoption of standardized industrial packaging solutions. Technological advancements in material processing, recycling, and lightweight packaging are enhancing operational efficiency and sustainability. Regulatory emphasis on safe material handling, waste reduction, and environmental compliance is also shaping market dynamics.

As companies in the MENA region continue to modernize supply chains and adopt scalable packaging infrastructure, demand for high-performance packaging solutions is expected to increase The market is positioned for sustained growth, with opportunities emerging from industrial expansion, infrastructure development, and the growing preference for durable, reusable, and eco-friendly packaging options.

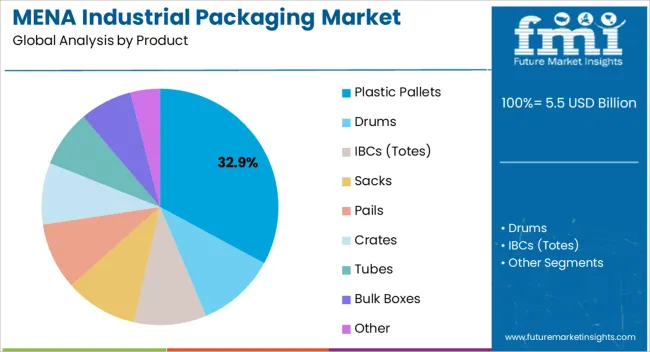

The plastic pallets segment is projected to hold 32.9% of the market revenue in 2025, establishing it as the leading product type. Growth in this segment is being driven by the durability, lightweight design, and chemical resistance of plastic pallets, which make them ideal for industrial storage and transportation. Plastic pallets offer operational efficiencies by supporting automation and mechanized handling, reducing labor costs and minimizing damage to goods during transit.

Their reusability and compatibility with standardized racking systems further enhance adoption. Additionally, the ability to clean, sterilize, and recycle plastic pallets improves hygiene and sustainability for industries such as food and pharmaceuticals.

Increasing e-commerce activities, global trade, and industrial modernization in the MENA region are strengthening demand The combination of cost-effectiveness, operational efficiency, and environmental benefits ensures that plastic pallets remain the preferred choice for businesses seeking scalable, durable, and reliable packaging solutions, maintaining their leading position in the market.

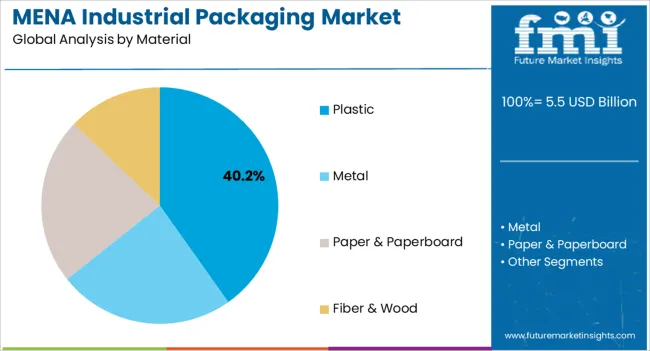

The plastic material segment is expected to account for 40.2% of the market revenue in 2025, making it the dominant material category. Adoption is being driven by the material’s durability, versatility, and cost-effectiveness, which enable protection of goods during storage and transportation while reducing operational losses. Plastic offers high resistance to moisture, chemicals, and physical impact, ensuring the safety of diverse industrial products.

Ease of molding and shaping into various forms allows for scalable packaging solutions, including pallets, containers, and bins, that meet specific logistical requirements. The growing emphasis on lightweight and reusable materials enhances efficiency across supply chains, reducing fuel consumption and overall transportation costs.

Rising demand from manufacturing, food and beverage, and retail sectors in the MENA region is further supporting the growth of plastic materials As companies increasingly prioritize sustainability, efficiency, and compliance with safety regulations, plastic is expected to maintain its leading share, offering versatile and reliable solutions for industrial packaging applications.

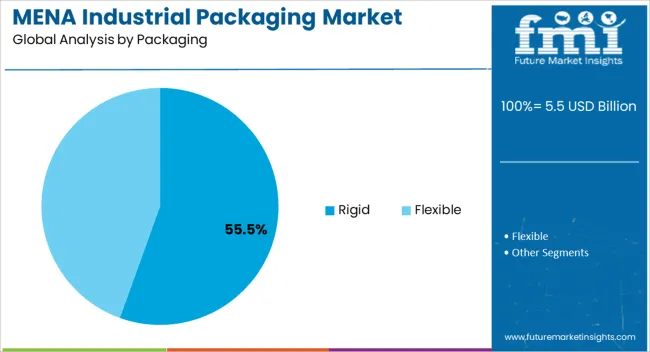

The rigid packaging segment is projected to hold 55.5% of the market revenue in 2025, establishing it as the leading packaging type. Its growth is being driven by the need for robust and durable solutions capable of protecting goods during long-distance transportation and heavy industrial handling. Rigid packaging ensures minimal deformation, high load-bearing capacity, and consistent protection of products, which is essential for maintaining quality standards and reducing damage-related losses.

Adoption is further supported by compatibility with automated handling systems and efficient stacking in warehouses and transport vehicles. Industries such as chemicals, food and beverage, and manufacturing benefit from rigid packaging due to its structural integrity and ability to withstand repeated use.

Increasing industrial production, e-commerce expansion, and modernization of supply chain infrastructure in the MENA region are contributing to higher adoption rates As demand for reliable, long-lasting, and reusable packaging continues to rise, rigid packaging is expected to maintain its market dominance, driven by operational efficiency, safety, and durability advantages.

The global demand for MENA industrial packaging is projected to increase at a CAGR of 3.2% during the forecast period between 2020 and 2025, reaching a total of USD 10.5 billion in 2035.

According to Future Market Insights, a market research and competitive intelligence provider, the MENA industrial packaging market was valued at USD 5.5 billion in 2025.

The MENA region is witnessing a significant shift towards automation in industrial packaging processes, driven by several factors. One of the key drivers is the need to improve packaging efficiency and productivity. Automation allows for faster and more precise packaging operations, reducing the time required for packaging tasks and increasing overall throughput, which enables companies to meet growing customer demands and optimize their production capacity.

Automation also plays a crucial role in reducing labor costs. With rising labor costs in the MENA region, businesses are turning to automated packaging solutions to streamline operations and minimize reliance on manual labor. Companies can reduce labor costs, allocate human resources to more value-added activities, and improve overall operational efficiency, by automating repetitive and labor-intensive tasks.

Another significant benefit of automation in industrial packaging is the enhancement of product safety and quality. Automated packaging lines ensure consistency in packaging processes, reducing the risk of human error and variability. Automated systems can precisely measure and dispense materials, apply labels and seals accurately, and conduct quality control checks. The level of precision and consistency minimizes the potential for packaging defects, ensures product integrity, and enhances customer satisfaction.

Automation in industrial packaging enables better traceability and compliance with regulatory requirements. Automated systems can track and record packaging data, including batch numbers, expiration dates, and labeling information. The level of traceability is crucial for industries such as food and pharmaceuticals, where product safety and regulatory compliance are of utmost importance. Automated packaging solutions can also facilitate the integration of serialization and track-and-trace systems, enabling efficient supply chain management and product authentication.

Growing eCommerce Sector is Likely to be Beneficial for Market Growth

The MENA region is witnessing a rapid expansion of the e-commerce sector, fueled by factors such as increasing internet penetration, widespread smartphone usage, and changing consumer behavior. Consumers are increasingly turning to online platforms for their shopping needs, seeking convenience, a wide product selection, and competitive prices. The surge in e-commerce activities has significant implications for the industrial packaging market.

One of the key drivers for the industrial packaging market in the context of e-commerce is the need for efficient and secure packaging solutions. E-commerce companies are faced with the challenge of ensuring that products are adequately protected during transit, as they pass through various stages of the supply chain, including warehousing, sorting, and last-mile delivery. Industrial packaging plays a crucial role in safeguarding products from damage, preventing breakage, and minimizing the risk of theft or tampering.

Customized packaging solutions tailored to the specific requirements of e-commerce fulfillment have emerged as a major trend. The solutions focus on optimizing packaging dimensions to reduce shipping costs and improve operational efficiency. Companies can achieve cost savings and environmental sustainability, by developing packaging designs that maximize space utilization and minimize void fill materials. Customized packaging solutions also enhance branding opportunities, allowing e-commerce companies to create a positive unboxing experience for customers and build brand loyalty.

The growth of the e-commerce sector necessitates the development of packaging solutions that are compatible with automated sorting and fulfillment processes. Automated systems in e-commerce warehouses and fulfillment centers require packaging that is easily handled, processed, and sorted. Industrial packaging companies are responding to this demand by offering solutions such as pre-printed barcodes, integrated labeling systems, and packaging designs optimized for automated handling. The advancements contribute to improved operational efficiency and reduce the risk of errors or delays in order processing.

Customization & Branding Opportunities to Fuel the Market Growth

Customization and branding have become critical aspects of industrial packaging as businesses recognize the value of using packaging as a marketing tool. In today's competitive market, where consumers are inundated with various products and choices, creating a unique and memorable brand identity is essential for businesses to stand out and capture customer attention. Customization and branding in industrial packaging enable companies to achieve this differentiation and effectively communicate their brand values.

One of the key elements of customization in industrial packaging is the ability to print logos, branding elements, and product information on packaging materials, which allows businesses to create a visual representation of their brand that is consistent across all their packaging. Companies can reinforce brand recognition and build brand recall among consumers, by incorporating brand elements such as logos, colors, and taglines. Printing essential product information, such as instructions, warnings, and ingredient lists, directly on the packaging helps consumers make informed purchasing decisions and enhances product transparency.

Customization offers businesses the flexibility to design packaging that aligns with their brand aesthetics and target audience. Packaging design plays a crucial role in shaping consumer perception and influencing purchasing decisions. Businesses can create a cohesive brand experience that resonates with their target customers, by customizing packaging materials, which can be achieved through various customization options, including choosing specific packaging shapes, sizes, and materials that reflect the brand's values, personality, and product positioning.

Branding through industrial packaging goes beyond visual elements. It extends to the overall customer experience and the emotions associated with a brand. Packaging can evoke positive feelings, such as excitement, anticipation, and trust, which can enhance the perceived value of the product and create a connection between the brand and the consumer. For instance, packaging that is thoughtfully designed, innovative, or eco-friendly can leave a lasting impression and foster a sense of loyalty and affinity towards the brand.

IBC to Take the Lion’s Share

Based on the product, the IBC segment holds the largest share of the market. The targeted segment is anticipated to hold around 40% of the market share in 2025, owing to its higher preference for the storage of chemicals and various solvents. The segment is anticipated to be the major area of industrial packaging consumption, and is expected to hold a CAGR of 6.9% during the forecast period.

Plastic to Take the Lion’s Share

Based on material, plastic is estimated to remain the leading segment among the others and is expected to grow at a CAGR of 5.5% during the forecast period. The segment is estimated to hold around 54% of the market share in 2025. Factors such as low cost and light weight are leading to the growth of plastic industrial packaging in end users throughout the forecast period.

Chemical & Pharma to Take the Lion’s Share

As per research experts, although the oil & lubricant and chemical & pharma industries are capturing nearly 1/5th value share individually in the MENA industrial packaging market, chemical, and pharma are estimated to increase two times by 2035, than what it was in the past five years. The segment is expected to create an incremental opportunity of USD 10.5 million, by the end of 2035. The segment is expected to hold a CAGR of 6.8% during the forecast period.

Rise in Industrial Sector to Boost the Market Growth

The South African industrial packaging market is estimated to expand at a CAGR of 5.9% during the forecast period. The demand for MENA industrial packaging is anticipated to propel during the forecast period, with the penetration of the various industrial sector.

According to the International Energy Agency (IEA), upstream oil and gas operations lead to more than three-quarters of total emissions, with the downstream segment accounting for the remaining share. In 2024, the crude oil production was 448.0 TJ units in South Africa, which indicated that the growing oil industry in South Africa increases the demand for MENA industrial packaging.

Growing Proliferation of Food Delivery Services to Boost the Market Growth

Saudi Arabia is estimated to hold a market share of 42% in the MENA industrial packaging market by 2025. Saudi Arabia holds a major part of the GCC country's industrial packaging market which accounts for the largest share of the market.

According to the Saudi Arabian General Authority for Investment (SAGIA) forecasts, the spending on food services is expected to grow by 6% per annum over the next five years, with food consumption reaching USD 5.5 billion by the end of 2025. Saudi Arabian consumers are increasingly becoming savvy regarding food and beverages as their demand for new products with a stronger health focus is growing.

Online shopping of food combined with the growing proliferation of food delivery services is expected to accelerate the demand for sacks, folding cartons, and liquid cartons. The country is expected to hold a CAGR of 6.9% over the analysis period.

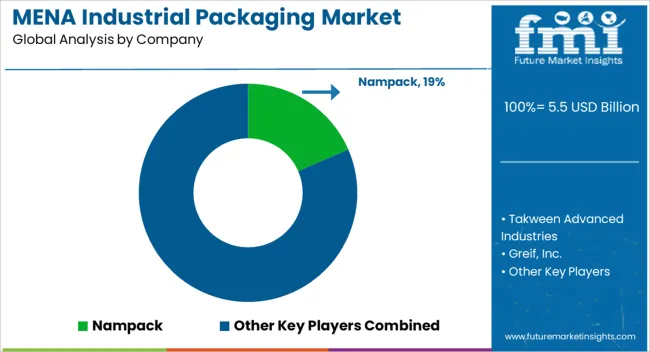

Key players in the MENA industrial packaging market are strongly focusing on profit generation from their existing product portfolios along while exploring potential new applications. The players are emphasizing on increasing their MENA industrial packaging production capacities, to cater to the demand from numerous end use industries. Prominent players are also pushing for geographical expansion to decrease the dependency on imported MENA industrial packaging.

Recent Developments:

| Attribute | Details |

|---|---|

| Expected Value in 2025 | USD 5.5 billion |

| Anticipated Value in 2035 | USD 10.5 billion |

| Projected CAGR from 2025 to 2035 | 6.7% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD Million for Value |

| Key Countries Covered | GCC Countries, North Africa, South Africa, Israel |

| Key Segments Covered | Product, Material, Packaging, End-Use Industry, Country |

| Key Companies Profiled | Nampack; Takween Advanced Industries; Greif, Inc.; PETRO Industrial Pty Ltd.; Time Technoplast Ltd.; Mauser Group B.V.; Gulf Plastic Industries Company SAOG; Clouds Drums L.L.C. |

| Report Coverage | Market Forecast, brand share analysis, competition intelligence, DROT analysis, Market Dynamics and Challenges, Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global MENA industrial packaging market is estimated to be valued at USD 5.5 billion in 2025.

The market size for the MENA industrial packaging market is projected to reach USD 10.5 billion by 2035.

The MENA industrial packaging market is expected to grow at a 6.7% CAGR between 2025 and 2035.

The key product types in MENA industrial packaging market are plastic pallets, drums, ibcs (totes), sacks, pails, crates, tubes, bulk boxes and other.

In terms of material, plastic segment to command 40.2% share in the MENA industrial packaging market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industrial Chemical Packaging Market Size and Share Forecast Outlook 2025 to 2035

Market Positioning & Share in Industrial Chemical Packaging

Industrial Electronics Packaging Market Forecast and Outlook 2025 to 2035

Industrial Electronics Packaging Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Rigid Industrial Packaging Market Size, Share & Forecast 2025 to 2035

Competitive Overview of Industrial Electronics Packaging Companies

Japan Industrial Electronics Packaging Market Analysis by Material Type, Packaging Type, Product Type, and City through 2035

Korea Industrial Electronics Packaging Market Analysis by Material Type, Product Type, Packaging Type, and Province through 2035

Latin America Rigid Industrial Packaging Market Size and Share Forecast Outlook 2025 to 2035

Industrial Grade Electrochemical CO Sensor Market Size and Share Forecast Outlook 2025 to 2035

Industrial Bench Scale Market Size and Share Forecast Outlook 2025 to 2035

Industrial Low Profile Floor Scale Market Size and Share Forecast Outlook 2025 to 2035

Industrial Sand Mill Market Size and Share Forecast Outlook 2025 to 2035

Industrial Control Network Modules Market Size and Share Forecast Outlook 2025 to 2035

Industrial Precision Oven Market Size and Share Forecast Outlook 2025 to 2035

Industrial Water Chiller for PCB Market Size and Share Forecast Outlook 2025 to 2035

Industrial & Commercial HVLS Fans Market Size and Share Forecast Outlook 2025 to 2035

Industrial Robot Controller Market Size and Share Forecast Outlook 2025 to 2035

Industrial Wired Routers Market Size and Share Forecast Outlook 2025 to 2035

Packaging Supply Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA