The sealing & strapping packaging tape market is witnessing steady expansion, driven by rising global e-commerce activity, industrial packaging requirements, and advancements in adhesive technologies. Increased emphasis on sustainable and recyclable materials has accelerated the shift toward eco-friendly tape solutions, particularly in paper-based and water-activated products. The market benefits from growing demand across logistics, warehousing, and retail sectors, where consistent sealing performance and strength are essential.

Manufacturers are focusing on lightweight yet durable materials to reduce waste and improve handling efficiency. The integration of acrylic and hot-melt adhesives has enhanced product versatility across temperature ranges and surfaces.

With growing automation in packaging lines and heightened emphasis on operational efficiency, the market is expected to sustain its positive outlook. Future growth will also be supported by expanding demand for recyclable packaging and ongoing innovation in adhesive formulations that align with global sustainability targets.

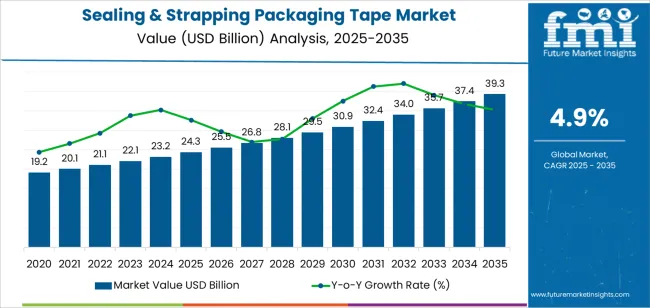

| Metric | Value |

|---|---|

| Sealing & Strapping Packaging Tape Market Estimated Value in (2025 E) | USD 24.3 billion |

| Sealing & Strapping Packaging Tape Market Forecast Value in (2035 F) | USD 39.3 billion |

| Forecast CAGR (2025 to 2035) | 4.9% |

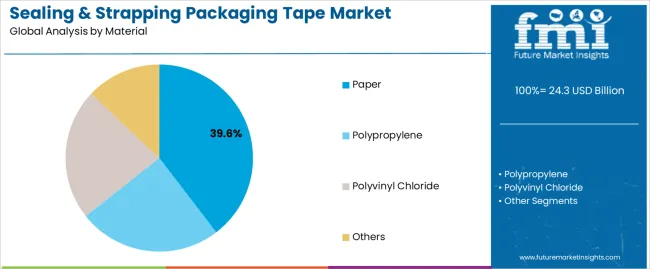

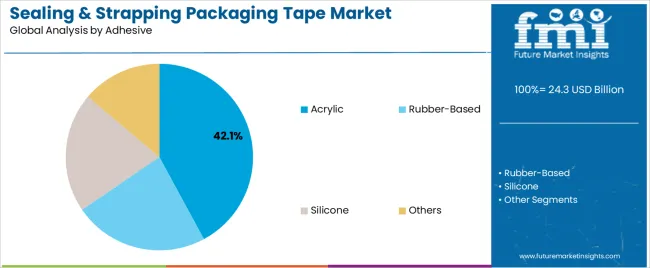

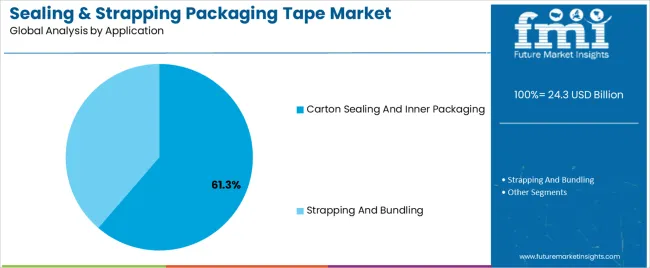

The market is segmented by Material, Adhesive, and Application and region. By Material, the market is divided into Paper, Polypropylene, Polyvinyl Chloride, and Others. In terms of Adhesive, the market is classified into Acrylic, Rubber-Based, Silicone, and Others. Based on Application, the market is segmented into Carton Sealing And Inner Packaging and Strapping And Bundling. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The paper segment leads the material category, accounting for approximately 39.60% share of the sealing & strapping packaging tape market. This dominance is driven by the growing preference for sustainable packaging materials that reduce plastic dependency. Paper tapes are favored for their biodegradability, printability, and compatibility with eco-conscious brand strategies.

Their ability to provide strong adhesion on corrugated surfaces and ease of recycling has enhanced adoption in e-commerce and logistics operations. With increasing regulations targeting plastic waste reduction, demand for paper-based tapes has accelerated across major packaging applications.

Technological advancements in water-activated coatings and fiber reinforcement have further strengthened their performance, positioning the segment as a long-term growth driver. Supported by rising environmental awareness and corporate sustainability commitments, the paper segment is projected to maintain a leading role in the market.

The acrylic segment holds approximately 42.10% share within the adhesive category, driven by its superior clarity, temperature resistance, and long-term bonding stability. Acrylic adhesives offer consistent performance across varied substrates, making them ideal for carton sealing, bundling, and protective packaging.

The segment’s growth is supported by expanding usage in automated packaging lines, where fast application and secure adhesion are critical. Additionally, acrylic formulations provide resistance to UV exposure and aging, enhancing shelf-life and reliability in storage and shipping.

Their solvent-free composition aligns with evolving environmental standards, contributing to market preference over traditional rubber-based adhesives. With ongoing innovation in water-based and low-VOC acrylic systems, the segment is expected to retain its dominance as a preferred adhesive solution across diverse industrial applications.

The carton sealing and inner packaging segment dominates the application category with approximately 61.30% share, reflecting its essential role in product protection and logistics integrity. This segment’s prominence is supported by the exponential growth of e-commerce, global shipping, and fast-moving consumer goods sectors, where reliable sealing ensures tamper resistance and safe transit.

The increasing use of high-speed automated packaging lines has further reinforced the need for tapes that combine high tack and mechanical strength. Demand is particularly strong among fulfillment centers, food processors, and electronics manufacturers, where consistent adhesion and material compatibility are critical.

The segment’s outlook remains positive, supported by continuous industrial expansion and rising packaging standardization worldwide.

Paper is the most commonly used material in the making of sealing and strapping packing tapes. On the other hand, the adhesive most associated with sealing and strapping adhesive tapes is acrylic.

| Attributes | Details |

|---|---|

| Top Material | Paper |

| CAGR (2025 to 2035) | 4.6% |

The paper segment is expected to progress at a CAGR of 4.6% over the forecast period. Factors driving the growth of the segment are:

| Attributes | Details |

|---|---|

| Top Adhesive | Acrylic |

| CAGR (2025 to 2035) | 4.5% |

Acrylic is predicted to register a CAGR of 4.5% over the forecast period. Some of the factors for the growth of the acrylic segment are:

The packaging sector is receiving encouragement from governments in the Asia Pacific region, which is propelling the market. The packaging sector’s advancement is part of the overall drive for industrial upgradation in the region.

The demand for sealing and strapping packaging tapes is surging in the healthcare sector in North America. Meanwhile in Europe, the ever-increasing number of factories is a boon for the market.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 5.2% |

| United Kingdom | 5.5% |

| China | 5.7% |

| Japan | 5.4% |

| South Korea | 7.3% |

The market in South Korea is anticipated to register a CAGR of 7.3% over the forecast period. Some of the factors driving the promising growth of the market in the country are:

The market in Japan is set to expand at a CAGR of 5.4% over the forecast period. Prominent factors driving the growth of the market are:

The market in China is expected to register a CAGR of 5.7% through 2035. Some of the factors driving the growth of the market in China are as follows:

The market in the United Kingdom is set to progress at a CAGR of 5.5% through 2035. Factors influencing the growth of the market in the United Kingdom include:

The market in the United States is expected to register a CAGR of 5.2% through 2035. Some of the reasons for the growth of sealing and strapping packaging tape sales are:

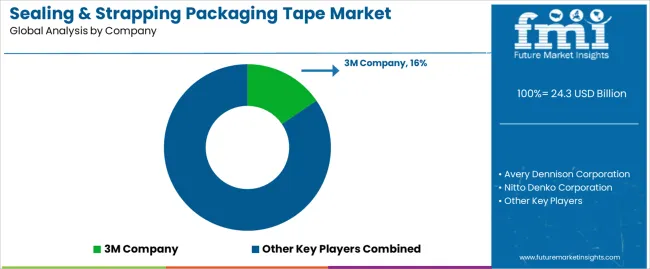

The market for sealing and strapping packaging tape is highly fragmented, with many small outfits dotting the landscape. The manufacture of these tapes is even being achieved by outfits being run from the homes of the properties.

The development of tougher materials and tapes that long last is a priority for market players. With the extensive use of tapes in the export and import of goods, there is scope for geographic expansion for market players.

Recent Developments in the Sealing and Strapping Packaging Tape Market

The global sealing & strapping packaging tape market is estimated to be valued at USD 24.3 billion in 2025.

The market size for the sealing & strapping packaging tape market is projected to reach USD 39.3 billion by 2035.

The sealing & strapping packaging tape market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in sealing & strapping packaging tape market are paper, polypropylene, polyvinyl chloride and others.

In terms of adhesive, acrylic segment to command 42.1% share in the sealing & strapping packaging tape market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sealing And Strapping Packaging Tapes Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Strapping Tapes Market Analysis by Material Type, Adhesive Type, End-User, and Region through 2035

Global Packaging Tapes Market Share Analysis – Size, Growth & Forecast 2025–2035

Key Companies & Market Share in the Strapping Tapes Sector

Heat Sealing Tape Market Size and Share Forecast Outlook 2025 to 2035

BOPP Packaging Tapes Market Size and Share Forecast Outlook 2025 to 2035

Industry Share & Competitive Positioning in BOPP Packaging Tapes

Paper Packaging Tapes Market Size and Share Forecast Outlook 2025 to 2035

Carton Sealing Tape Market

Packaging Supply Market Size and Share Forecast Outlook 2025 to 2035

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Tape Unwinder Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Tape Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA