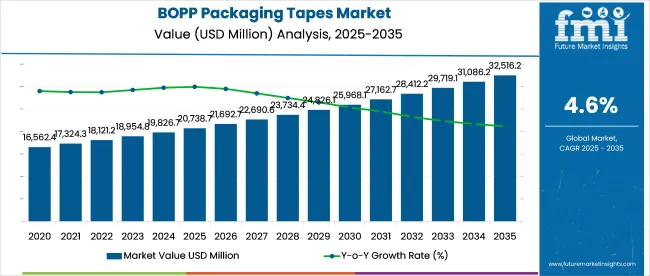

The BOPP Packaging Tapes Market is estimated to be valued at USD 20.7 billion in 2025 and is projected to reach USD 32.5 billion by 2035, registering a compound annual growth rate (CAGR) of 4.6% over the forecast period.

| Metric | Value |

|---|---|

| BOPP Packaging Tapes Market Estimated Value in (2025 E) | USD 20.7 billion |

| BOPP Packaging Tapes Market Forecast Value in (2035 F) | USD 32.5 billion |

| Forecast CAGR (2025 to 2035) | 4.6% |

The BOPP packaging tapes market is expanding steadily due to rising demand for efficient sealing solutions in logistics, e commerce, and industrial packaging. Increased trade volumes and the rapid growth of online retail have significantly boosted consumption of durable and cost effective adhesive tapes.

Advancements in tape manufacturing, including improved tensile strength, moisture resistance, and ease of printing for branding purposes, are supporting adoption across diverse industries. The growing focus on sustainable and recyclable packaging materials is also influencing product development strategies in this market.

Regulatory emphasis on eco friendly packaging practices combined with the need for secure product transit has further strengthened market adoption. The outlook remains positive as manufacturers continue to innovate in terms of adhesive formulations, product thickness variations, and customization options to meet the evolving requirements of high growth end use sectors.

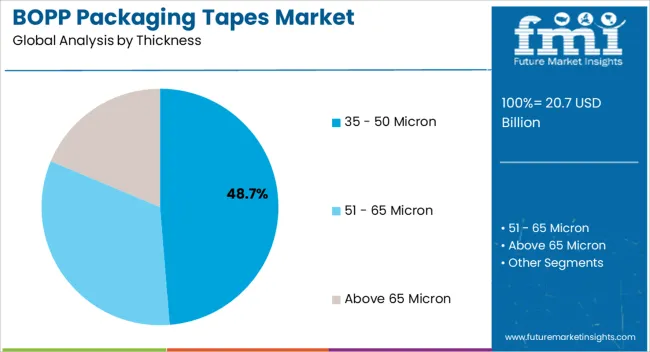

The 35 to 50 micron thickness segment is projected to account for 48.70% of market revenue by 2025, establishing it as the leading segment in the thickness category. This dominance is supported by its optimal balance between strength, flexibility, and cost effectiveness, making it widely preferred for medium to heavy duty packaging.

Its suitability for carton sealing in logistics, warehousing, and e commerce sectors has reinforced demand. The ability to deliver reliable performance under varying environmental conditions further enhances its adoption.

As businesses continue to prioritize secure and economical packaging solutions, this segment remains the most prominent in the thickness category.

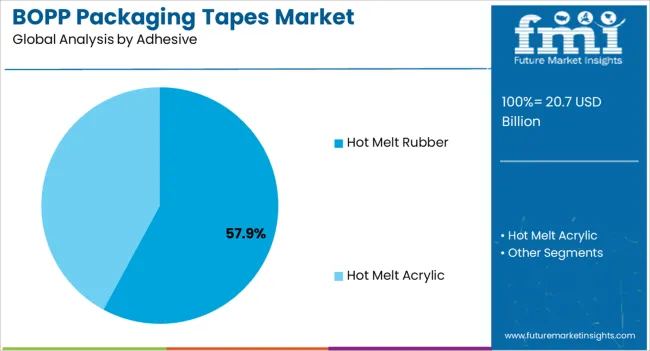

The hot melt rubber adhesive segment is expected to contribute 57.90% of overall market revenue by 2025 within the adhesive category, positioning it as the dominant choice. Its superior bonding strength, quick tack properties, and ability to adhere effectively to a wide range of surfaces have been key factors in driving growth.

Industries engaged in high volume packaging operations have increasingly adopted hot melt rubber adhesives for their consistency and reliability in automated carton sealing systems. Additionally, this adhesive type performs well across different climatic conditions, ensuring product security during long distance transit.

These performance advantages have solidified its leadership position within the adhesive segment.

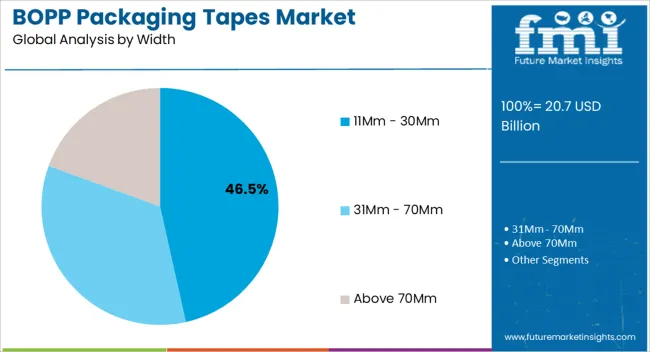

The 11mm to 30mm width segment is forecasted to hold 46.50% of the total revenue share by 2025 under the width category, making it the most prominent width choice. This segment has gained preference for its versatility in sealing medium sized cartons and packages while maintaining cost efficiency.

Its compatibility with both manual and automated taping equipment has expanded its utility across multiple industries including retail, logistics, and manufacturing. The balance of usability, affordability, and efficiency has reinforced its adoption in large scale packaging operations.

As demand for secure and practical packaging solutions continues to grow, the 11mm to 30mm width segment is positioned as the leading category within the width segment.

Sale, manufacture, stocking, import, distribution, and use of single-use plastic, such as polystyrene and expanded polystyrene commodities is being banned. This has burdened manufacturers to look for alternatives to BOPP packaging tapes that are sustainable in nature.

Manufacturers are constantly trying to win over any challenges that come their way. However, the risks imposed by the restriction of single-use plastic should be considerably weighed in by producers, in order to achieve success in market.

Large players are introducing recycled versions of the tape, taking into account the widespread demand for sustainable packaging solutions. For instance, in August 2025, Tesla unveiled recycled PET packaging tape.

The tape is projected to become a sustainable alternative to filmic tapes. The company claims that the tape is as effective as biaxially oriented polypropylene (BOPP) or PVC tapes. The new 60412 Recycled PET packaging tape can hold up to 30kg packages and is suitable for automatic and manual dispensers.

In India, Ajit Industries Private Limited, has brought a distinct shift from plastic-based to green packaging products. Mr. Ajit Gupta, CMD of the company, has been accredited for this remarkable contribution.

The company has introduced a wide range of biodegradable and recyclable alternatives across the packaging industry. In a nutshell, the company’s product portfolio consists of high potential tapes and die cuts. Recyclable BOPP tape is part of the wide-ranging tapes that are made of biodegradable and recyclable materials.

| Attributes | Details |

|---|---|

| BOPP Packaging Tapes Market Size (2020) | USD 15,584.5 million |

| BOPP Packaging Tapes Market Size (2025) | USD 18,121.2 million |

| Projected BOPP Packaging Tapes Industry Value (2025) | USD 18,954.8 million |

| Forecast BOPP Packaging Tapes Market Value (2035) | USD 29,719.2 million |

| Global Market Growth Rate (2025 to 2035) | 4.6% CAGR |

| Collective Value Share: Top 5 Companies (2025E) | 17.20% |

The BOPP packaging tapes industry generated a total revenue of USD 15,584.5 million in 2020, and has since reached USD 18,121.2 million in 2025. The market is projected to reach 3.8% from 2020 to 2025.

BOPP packaging tapes are among the most cost-efficient and effective components in packaging solutions. Their versatility is making them useful in multiple applications.

The basic structure of BOPP packaging tapes comprises a thermoplastic polymer. In other words, BOPP packaging tapes can be used in both - cool and hot temperatures.

The BOPP packaging tapes have a rugged structure that provides high tensile strength for packaging. Properties like these, render uniqueness to BOPP packaging tapes, thereby keeping the cash registers ringing for the BOPP packaging tapes market.

Usage of BOPP packaging tapes is easy, which makes it feel its presence in sealing and packaging in the manufacturing & warehousing verticals.

Over the forecast period, the market is set to expand at 4.6% CAGR. In 2025, the market is set to attain USD 18,954.8 million, and by 2035, USD 29,719.2 million market value.

The future of BOPP packaging tapes looks promising. This can be attributed to the surging demand for eco-friendly and sustainable packaging solutions. The key reason behind BOPP packaging tapes’ bright future is its recyclability. These tapes can be easily recycled, making them a sustainable option.

Another reason behind BOPP tapes’ popularity is its versatility. These tapes can be customized to cater to the particular packaging needs of various industries and products. Customization allows businesses to develop packaging that is aesthetically pleasing, functional, and aligns with their branding.

The third crucial factor bolstering the market growth includes the surge of e-commerce sector. Since consumers are increasingly shopping online, there is a rising demand for packaging materials that can tackle the rigours of handling and shipping.

BOPP packaging tapes are a reliable option to package products due to their resistance to tears and punctures.

| Category | Adhesive |

|---|---|

| Segment | Hot Melt Rubber |

| Value Share in 2025 | 66.8% |

| Category | End Use |

|---|---|

| Segment | Manufacturing & Warehousing |

| Value Share in 2025 | 62.4% |

The rise in disposable income has motivated individuals to spend more. This has led to an increase in online shopping as it not only saves time for consumers but also opens window to a wide range of products at a single click. This has accelerated the e-Commerce market at a substantial rate.

The awareness among the manufacturers has boosted the online websites’ revenue as they are helpful in direct sales of their manufactured products, thereby saving their distribution costs.

Emerging economies have started relying more on e-Commerce platforms than a conventional methodology to increase their revenue as the involvement of distributors’ margin is out of the question.

The manufacturing and warehousing segment held 62.4% market share over the forecast period. These days, customers are more fascinated by the packaging of the product.

Moreover, customization is being welcomed all over. Therefore, customized BOPP printed packaging tapes are being deployed to pack and seal products printed with company’s brand name. This move has pushed the demand for BOPP packaging tapes in the market.

Prominent restaurants have initiated customization of tapes for their takeaway food for packaging, thereby augmenting their brand image among customers.

The retail market for emerging economies has recently adopted customized BOPP packaging tapes for packaging, which is bound to keep the hopes high for the BOPP packaging tapes market.

| Country/Region | Value Share (2025) |

|---|---|

| North America | 20.8% |

| Europe | 28.8% |

| The United States | 18.8% |

| Germany | 3.9% |

| Japan | 2.2% |

| Australia | 1.2% |

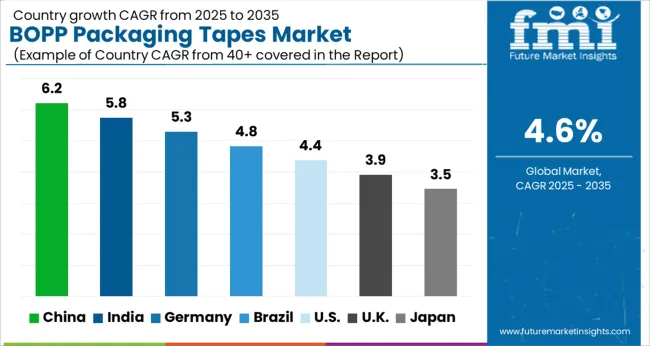

| Countries | CAGR (2025 to 2035) |

|---|---|

| The United Kingdom | 1.6% |

| China | 1.6% |

| India | 6.9% |

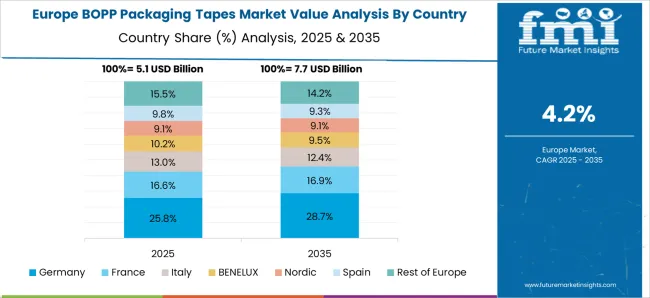

The Europe region is projected to maintain its precedence in the BOPP packaging tapes market.

FMI has estimated the region to account for more than 28.8% market share over the forecast period. Surging demand for BOPP packaging tapes from the packaging applications like consumer goods, pharmaceuticals, and electronics industry is propelling the market growth.

High discretionary income, particularly among consumers of age between 25 to 44 years, is also a key factor driving the BOPP packaging tapes industry. The importance of adhesive tapes is growing across the packaging industry due to its key role in green innovation.

This is resulting in an increase in innovations in the market. For instance, in September 2024, Monta Klebebandwerk GmbH, a German tape manufacturer, has created a self-adhesive tape, which is based on industrial plastic waste.

Monta reTec 831, the new self-adhesive tape, is made of post-industrial recycled polypropylene (rPP). Attributes Details 1.1. 1.2. 1.3. 1.4. 1.5.

The availability of cost-effective raw materials and labor has influenced multinational companies to move their production plants to the Asian region. This is expected to, thus, put the Asian market into the limelight.

Surge in the production of corrugated sealing tapes in Taiwan is projected to contribute toward regional growth. Additionally, India’s robust performance is also expected to keep the market growth at an all time high. India is forecast to expand at 6.9% CAGR over the forecast period.

Top manufacturers of BOPP packaging tapes are setting up their production base in this region due to the reasons mentioned above.

The demand for corrugated boxes in the Asian market grew by 20% in the year 2025. This is indicative of the demand for BOPP packaging tapes in the region and this streak is expected to continue all through 2035 as well.

Key participants in the BOPP packaging tapes market are introducing sustainable options to meet the sustainability goals of end use industries. For instance, in September 2025, Tesa SE created a new packaging tape made of recycled post-consumer PET.

The new tesa® 60412 contains high recycled content. The packaging tape features solid performance and perfectly handles up to 30 kg weight. Therefore, the company is enlarging its product offering of high-performance packaging tapes, made partly of bio-based raw materials and recycled materials.

For several industries like pharmaceutical industry, food and beverage industry, or the logistics sector, tesa® 60412 is a suitable alternative to BOPP packaging tapes.

Increasing innovations to reduce environmental pollution is projected to be a key strategy among top players to gather more market share. Additionally, companies are constantly researching and introducing advanced products in the market.

General market share enhancing strategies like acquisition and mergers, collaborations/ partnerships are being employed by the key players.

| Company’s Name | 3M |

|---|---|

| About the Company | The company is an American MNC, operating in the field of worker safety, consumer goods, and healthcare. The firm provides dependable and high-quality solutions for shipment, packaging, and fulfilment to help optimize sales and productivity. One such example is of 3M™ Industrial Box Sealing Tape. This tape is an industrial packaging tape, used for box sealing, recouperage, splicing, and other packaging applications. The BOPP film support has a hot melt synthetic rubber adhesive. |

| Company’s Name | Tesa SE |

|---|---|

| About the Company | Tesa SE is a German based company that manufactures adhesive products. The company is synonymous with adhesive tape in Germany. The high bond tapes offered by the company have new dimensions like secure, aesthetical pleasant, constructive, and fast bonds. |

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD million/billion for Value |

| Key Regions Covered | North America; Latin America; Europe; South Asia; East Asia; Oceania; and the Middle East & Africa |

| Key Countries Covered | The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Italy, Spain, Benelux, Russia, China, Japan, South Korea, India, Thailand, Indonesia, Malaysia, Singapore, China, Japan, South Korea, Australia, New Zealand, Egypt, North Africa, South Africa, and GCC Countries |

| Key Market Segments Covered | Thickness, Adhesive, Width, End-user, Region |

| Key Companies Profiled | Bolex Shenzen Adhesive Products Co. Ltd.; Intertape Polymer Group Inc.; Vibac Group S.p.A; 3M Company; Delphon Industries LLC, and; Tesa SE. |

| Pricing | Available upon Request |

The global BOPP packaging tapes market is estimated to be valued at USD 20.7 billion in 2025.

The market size for the BOPP packaging tapes market is projected to reach USD 32.5 billion by 2035.

The BOPP packaging tapes market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in BOPP packaging tapes market are 35 - 50 micron, 51 - 65 micron and above 65 micron.

In terms of adhesive, hot melt rubber segment to command 57.9% share in the BOPP packaging tapes market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industry Share & Competitive Positioning in BOPP Packaging Tapes

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Global Packaging Tapes Market Share Analysis – Size, Growth & Forecast 2025–2035

Paper Packaging Tapes Market Size and Share Forecast Outlook 2025 to 2035

Sealing And Strapping Packaging Tapes Market Size and Share Forecast Outlook 2025 to 2035

BOPP Laminated Woven Sacks Market Size and Share Forecast Outlook 2025 to 2035

BOPP Coated Sacks Market Size and Share Forecast Outlook 2025 to 2035

Packaging Supply Market Size and Share Forecast Outlook 2025 to 2035

BOPP Bag Market Size and Share Forecast Outlook 2025 to 2035

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

BOPP Dielectric Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Labels Market Size and Share Forecast Outlook 2025 to 2035

Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA