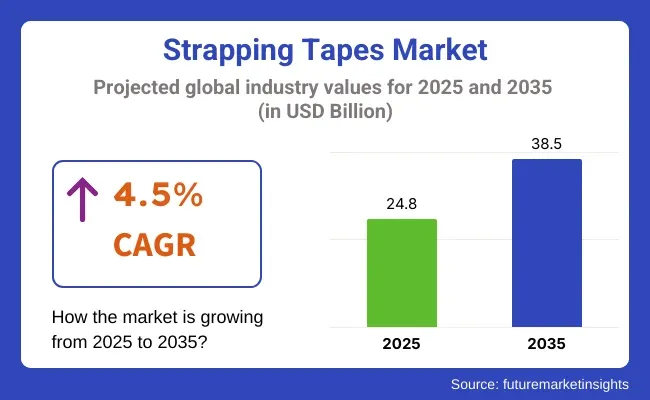

The strapping tapes market is projected to grow from USD 24.8 billion in 2025 to USD 38.5 billion by 2035, registering a CAGR of 4.5% during the forecast period. Sales in 2024 reached USD 23.5 billion, driven by steady demand from the logistics, construction, and automotive sectors.

This demand is supported by increased volumes of palletized shipments and rising emphasis on cargo security. E-commerce growth and global trade expansion have reinforced market expansion. Diverse applications in bundling, unitizing, and edge reinforcement have fueled further adoption.

In response to sustainability priorities, key manufacturers have introduced recyclable and bio-based strapping tape formats. Investments have been directed toward low-emission adhesive technologies and liner-free dispensing formats. "Innovation and sustainability are inseparably linked at tesa.

Through technological advances and targeted investments, we strive not only for environmental responsibility but also for economic success setting standards in our industry," emphasizes tesa CEO Dr. Norman Goldberg.

Innovation in adhesive coating and backing technology has produced strapping tapes that withstand extreme temperatures, UV exposure, and humidity variations. High-tack tapes with consistent shear strength are being utilized in industrial packaging and construction paneling. Reinforced strapping tapes with fiberglass filaments are gaining traction in heavy-duty applications, especially in the automotive and appliance sectors.

Product customization has become a key market differentiator. Colored and pre-printed tapes are increasingly used by logistics firms and retailers for branding, handling instructions, and tamper evidence. Tamper-evident strapping tapes with destructible features are being adopted by electronics manufacturers and medical device shippers.

Automation-readiness has also been prioritized. Strapping tapes compatible with high-speed dispensers are being deployed in fulfilment centres and production lines to improve turnaround time. Roll dimensions, unwind consistency, and low-friction liners are optimized to reduce machine stoppages and improve operator efficiency.

Looking forward, growth will be shaped by increasing regulatory pressure on plastic usage, stricter product safety norms, and rising labor costs. Companies that align with ISO and ASTM performance standards, while offering LCA-certified low-impact tape solutions, are expected to lead. Adoption will be driven by solutions that balance tensile strength, sustainability, and application ease. Through 2035, strapping tapes will remain essential to secure, traceable, and cost-effective packaging systems across industries.

Polypropylene-based strapping tapes are projected to lead the global strapping tapes market by 2025, accounting for an estimated 38.1% market share cumulatively. Packaging and logistics industries respond to demand for high-tensile, recyclable, and lightweight securing solutions.

These materials are widely used by third-party logistics providers, FMCG distribution hubs, and heavy machinery OEMs for bundling pallets, securing cartons, and unitizing irregular loads. Their high-performance tensile strength and compatibility with steel replacement applications align well with industry shifts toward cost reduction and plastic down-gauging strategies.

One of the key advantages of polypropylene strapping tapes lies in their resistance to elongation and environmental stress, making them ideal for export-grade securing. Additionally, their smooth surface finish and chemical resistance support reliable printability for handling instructions, batch codes, and barcoding.

With a rising number of manufacturers certifying tapes under ISO 22301 and ASTM D3950 compliance frameworks, these plastic strapping tapes are being positioned as high-performance, recyclable alternatives to metal bands and PVC strips.

As industrial packaging standards evolve, product safety and traceability performance are being improved through the use of water-based and UV-cured printing inks. Tamper-evident layers and destructible overlays are being adopted in pharmaceutical, electronics, and cross-border shipments to reduce product manipulation. Strapping tapes are also being integrated with digital serial numbers and variable QR coding, enabling traceability and real-time tracking within ERP and WMS systems.

The food and beverages segment is projected to account for a significant share of 59.5% of the global strapping tapes market by 2025, fueled by growing volumes of packaged food exports, just-in-time distribution systems, and heightened focus on contamination-resistant, secure packaging. Strapping tapes are widely used across this sector for bundling corrugated secondary packaging, stabilizing shrink-wrapped pallets, and securing multi-pack beverage trays.

Both polypropylene (PP) and polyethylene terephthalate (PET) tapes are being increasingly adopted by food processors, bottlers, and warehouse operators due to their lightweight, hygienic, and rust-free properties.The ability of plastic strapping tapes to withstand moisture, refrigeration cycles, and high-humidity transport conditions without delamination has made them a preferred alternative to metal strapping.

In dairy, bottled water, and carbonated beverage applications, reinforced tapes ensure tamper-resistance while enabling faster turnaround on packaging lines. With the growth of direct-to-retail shipments and e-commerce grocery delivery, demand for tamper-evident and pre-printed strapping solutions has surged.

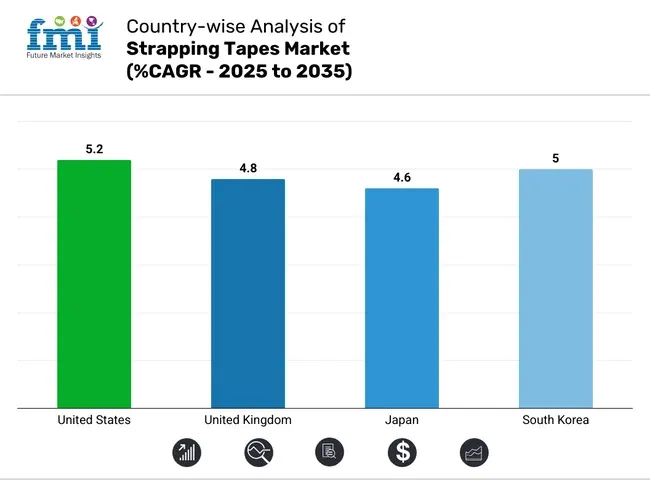

The USA dominates the market for products due to mounting demand for strong, tamper-evident, and budget-friendly packaging products in various industries like logistics, construction, and automotive. The demand for strong, pressure-sensitive, and weather-resistant products has motivated manufacturers to come up with reinforced and high-bond adhesive solutions that increase product security and load stability.

Further, government regulations for sustainable and recyclable packaging materials are driving companies to switch to eco-friendly and biodegradable strapping tapes. In addition, innovation in high-tensile polyester, fiberglass-reinforced, and water-resistant tapes is enhancing performance in industrial applications. Companies are also discovering intelligent tracking technologies, like RFID-embedded strapping tapes, to maximize inventory control and supply chain security.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.2% |

UK strapping tape market is growing as companies focus on sustainability, regulation, and efficiency in securing packaged products. Growing demand for products that are high strength, moisture-proof, and recyclable has resulted in its wider adoption in various industries, such as logistics, retail packaging, and industry usage.

Government programs for plastic reduction and circular economy packaging are further compelling companies to adopt bio-based, compostable, and fiber-reinforced strapping tape solutions. Further, developments in solvent-free adhesives and UV-resistant tapes are increasingly making these solutions appealing for long-term storage and transport purposes.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.8% |

Japan's strapping tape market is developing gradually with the rising demand for high-precision, strong, and lightweight packaging solutions in electronics, automotive, and industrial segments.

Businesses are creating products with specific tensile strength, chemical resistance, and anti-static features to enhance durability and safety. With stringent laws on waste disposal and green packaging, companies are shifting towards recyclable, low-emission, and biodegradable strapping tapes. Improvements in high-adhesion, heat-resistant, and reinforced tapes are also creating demand in uses where increased load stability is needed.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.6% |

South Korea's market is witnessing remarkable growth because of the rising demand for strong, tamper-proof, and high-tensile packaging materials for logistics, heavy machinery, and export packaging.

The demand for cost-effective and high-adhesion tapes has resulted in manufacturers producing reinforced fiber tapes, hot-melt adhesive tapes, and tension-retaining packaging solutions. Regulatory push towards eco-friendly and plastic-free packaging further helps fuel market growth.

Further, companies are also embracing smart labeling and digital tracing technologies like RFID-enabled products to gain better visibility of the supply chain. Increased use of lightweight and shock-resistant tapes in e-commerce, warehousing, and automated logistics further helps drive adoption.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.0% |

The market is influenced by rising demand in logistics, construction, and e-commerce applications. The market is witnessing innovation through new material formulations, such as high-strength polymer adhesives, moisture-resistant coatings, and tamper-evident features, addressing concerns about performance, sustainability, and efficiency.

In addition, AI-driven supply chain tracking and autonomous manufacturing are further shaping industry trends. Increasing demand for eco-friendly packaging solutions is also driving business growth. Along with this, increased investments in green tape-making technologies are improving product effectiveness and boosting marketplace opportunities. Increasing numbers of businesses are also investing in hybrid strapping tape solutions combining both recyclability and sustainability for better industrial use.

The overall market size for the Strapping Tapes Market is USD 24.8 Billion in 2025.

The Market is expected to reach USD 38.5 Billion in 2035.

The market will be driven by increasing demand from logistics, construction, and e-commerce industries. Sustainability trends, innovations in adhesive materials, and improvements in packaging durability will further propel market expansion.

Key challenges include fluctuating raw material costs, environmental regulations regarding plastic-based adhesives, and limited recyclability of certain strapping tapes. However, advancements in sustainable materials and innovative manufacturing processes are helping to mitigate these issues.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Adhesive Type, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Adhesive Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by End User, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Adhesive Type, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Adhesive Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Adhesive Type, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Adhesive Type, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Adhesive Type, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Adhesive Type, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Adhesive Type, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Adhesive Type, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Adhesive Type, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Adhesive Type, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by End User, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Adhesive Type, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Adhesive Type, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by End User, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Adhesive Type, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Adhesive Type, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Adhesive Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Adhesive Type, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Adhesive Type, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Adhesive Type, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Adhesive Type, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 21: Global Market Attractiveness by Material Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Adhesive Type, 2023 to 2033

Figure 23: Global Market Attractiveness by End User, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Adhesive Type, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Adhesive Type, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Adhesive Type, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Adhesive Type, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Adhesive Type, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 45: North America Market Attractiveness by Material Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Adhesive Type, 2023 to 2033

Figure 47: North America Market Attractiveness by End User, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Adhesive Type, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Adhesive Type, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Adhesive Type, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Adhesive Type, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Adhesive Type, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Material Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Adhesive Type, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Adhesive Type, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Adhesive Type, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Adhesive Type, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Adhesive Type, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Adhesive Type, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Material Type, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Adhesive Type, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by End User, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Adhesive Type, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Adhesive Type, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Adhesive Type, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Adhesive Type, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Adhesive Type, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Material Type, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Adhesive Type, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by End User, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Adhesive Type, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by End User, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Adhesive Type, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Adhesive Type, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Adhesive Type, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Adhesive Type, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Material Type, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Adhesive Type, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by End User, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Adhesive Type, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Adhesive Type, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Adhesive Type, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Adhesive Type, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Adhesive Type, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Material Type, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Adhesive Type, 2023 to 2033

Figure 167: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Adhesive Type, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by End User, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Adhesive Type, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Adhesive Type, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Adhesive Type, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Adhesive Type, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Material Type, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Adhesive Type, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by End User, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Key Companies & Market Share in the Strapping Tapes Sector

Sealing And Strapping Packaging Tapes Market Size and Share Forecast Outlook 2025 to 2035

Strapping Materials Market Size and Share Forecast Outlook 2025 to 2035

Strapping Machine Market Size and Share Forecast Outlook 2025 to 2035

Strapping Supplies Market Analysis - Demand & Growth Forecast 2025 to 2035

Strapping and Banding Equipment Market – Key Trends & Growth Outlook 2025 to 2035

Strapping Devices Market Trends - Size, Growth & Forecast 2025 to 2035

Strapping Equipment Market Insights – Growth & Demand 2024-2034

Steel Strapping Market Size and Share Forecast Outlook 2025 to 2035

Pallet Strapping Machines Market

Vertical Strapping Machines Market

Sealing & Strapping Packaging Tape Market Forecast 2024-2034

Horizontal Strapping Machine Market Trends and Forecast 2025 to 2035

Ergonomic Pallet Strapping Market Analysis Size and Share Forecast Outlook 2025 to 2035

Tapes Market Insights – Growth & Demand 2025 to 2035

UV Tapes Market Growth - Trends & Forecast 2025 to 2035

PVC Tapes Market Size and Share Forecast Outlook 2025 to 2035

Leading Providers & Market Share in PVC Tapes Industry

ESD Tapes and Labels Market from 2025 to 2035

USA Tapes Market Analysis – Growth & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA