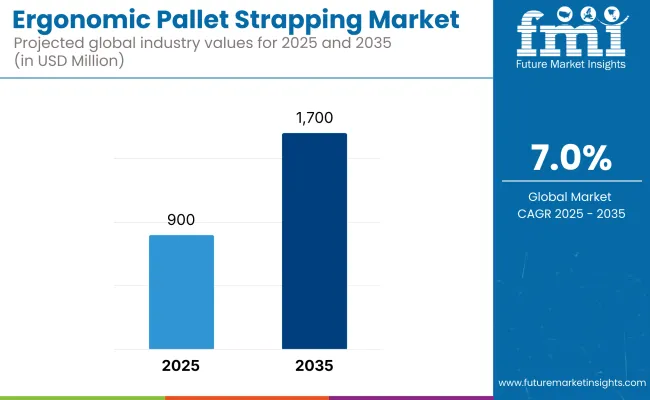

The ergonomic pallet strapping market is anticipated to grow from USD 900 million in 2025 to USD 1,700 million by 2035, marking an increase of USD 800 million over the ten-year period. This reflects a growth of 88.9%, with a compound annual growth rate (CAGR) of 7.0%. Over the forecast timeline, the market nearly doubles in size, expanding by a 1.8 multiple.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 900 million |

| Industry Value (2035F) | USD 1,700 million |

| CAGR (2025 to 2035) | 7.0% |

During the first half of the decade (2025-2030), the market rises from USD 900 million to USD 1,200 million, adding USD 300 million, which accounts for 37.5% of the total decade growth. This phase is shaped by increasing emphasis on manual handling safety, especially in warehousing, distribution centers, and e-commerce packaging hubs. Lightweight, battery-powered tools and strap applicators with ergonomic grips gain favor due to their impact on reducing operator fatigue and enhancing efficiency.

In the second half (2030-2035), the market grows from USD 1,200 million to USD 1,700 million, contributing USD 500 million, or 62.5% of the total decade expansion. The acceleration is fueled by widespread deployment of semi-automatic and robotic strapping stations with ergonomic controls across logistics, automotive, and food processing sectors. Integration of IoT-based diagnostics, height-adjustable applicators, and automated strap feeding systems further boosts value proposition, particularly in regions prioritizing ergonomic compliance and labor productivity.

From 2020 to 2024, the ergonomic pallet strapping market grew from USD 656 million to USD 844 million, driven by hardware-centric adoption in warehousing, logistics, and shipping hubs focused on improving operator safety and reducing repetitive strain injuries. During this period, the competitive landscape was dominated by equipment manufacturers controlling nearly 70% of the market revenue, with leaders such as JiningKeepway Machinery Company, Ltd., ErgoStrap Inc., and Pacovation, Inc. pioneering mobile, semi-automatic, and battery-powered strapping systems optimized for workplace ergonomics.

Competitive differentiation centered around ease of use, tension control, and modularity, while software features such as digital cycle counters or connectivity were typically bundled but not monetized separately. Service-based models such as leasing, maintenance, and remote configuration accounted for less than 10% of total market value, as customers continued to prioritize robust mechanical design and operator comfort.

Demand for ergonomic pallet strapping machines will expand to USD 1700 million in 2035, and the revenue mix will shift as digital assistive tools, remote diagnostics, and performance-based service models grow to over 40% share. Traditional hardware players face increased competition from automation-driven companies offering fatigue-monitoring integration, wireless control interfaces, and AI-powered tension optimization.

Major vendors are pivoting to hybrid models by integrating modular retrofitting kits, ergonomic feedback sensors, and real-time performance dashboards. Emerging players such as FEIFER, Transpak Equipment Corp., and Wulftec International Inc. are gaining share by specializing in compact battery-powered units, operator-first design frameworks, and customization-ready platforms for large-scale distribution centers.

Growing emphasis on workplace safety, labor efficiency, and compliance with ergonomic regulations is driving the growth of the ergonomic pallet strapping market. These solutions are designed to reduce physical strain on operators during load unitization and pallet securing, especially in logistics, warehousing, and industrial packaging sectors. The push for injury reduction and improved operator comfort in high-volume environments has accelerated the demand for ergonomic alternatives to manual or semi-manual strapping tools.

Battery-operated strapping tools, adjustable strap tensioners, and waist-height strapping aids have gained popularity due to their ease of use, portability, and ability to minimize repetitive motion injuries. These systems improve packaging speed while reducing fatigue and musculoskeletal risks associated with traditional methods such as bending, stretching, or overhead application. Integration with automated turntables and low-profile platforms further enhances ergonomic outcomes.

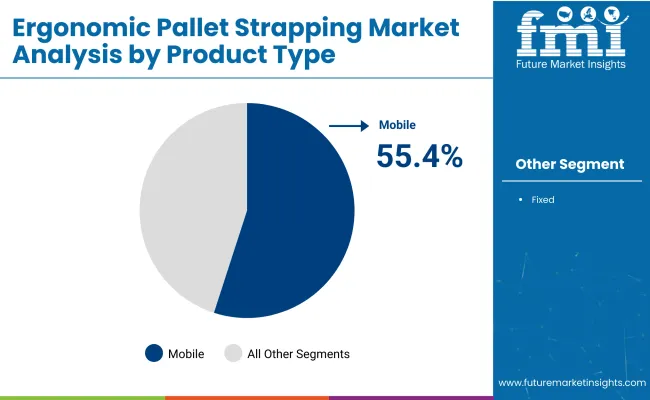

The market is segmented by product type, material, automation level, load height & pallet type, end use, and region. Product type includes mobile ergonomic strapping systems and fixed ergonomic strapping systems, designed to improve operator comfort, reduce injury risk, and enhance strapping efficiency across dynamic or static workstations. Material segmentation comprises plastic (polypropylene [PP], polyester [PET]), steel, nylon, and paper, offering varied performance characteristics in terms of elasticity, load retention, recyclability, and cost-efficiency.

Automation level includes fully automatic strapping systems, semi-automatic systems, and battery-powered options, catering to diverse packaging environments and operational scales. Load height & pallet type segmentation includes low pallets (<800 mm height), standard pallets (800-1600 mm height), tall loads (>1600 mm height), and Euro pallet configurations, enabling compatibility across global warehousing standards and ergonomic requirements.

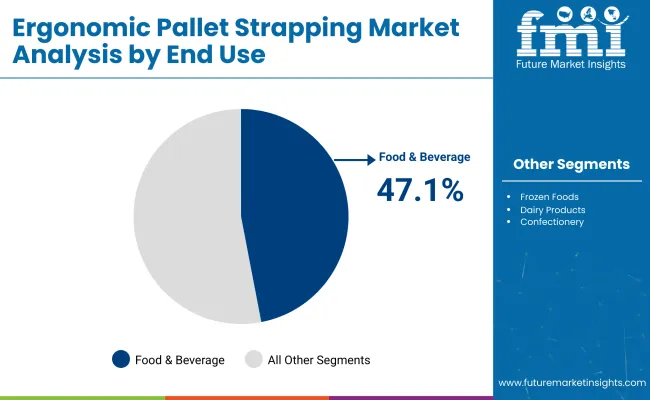

End-use industries include manufacturing; food & beverage (frozen foods, dairy products, confectionery, meat & poultry, processed foods, beverages); healthcare; textiles & apparel; third-party logistics (3PL) providers; retail & e-commerce (small parcel packaging, bulk packaging); industrial & automotive (automotive components, industrial equipment & machinery, consumer electronics); wood/furniture industry; and construction & infrastructure each relying on strapping for product stability, safety, and optimized material handling. Regionally, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

The mobile ergonomic strapping systems segment is projected to lead with a 55.4% share in 2025, reflecting a strong industry pivot toward operator-friendly and portable packaging solutions. These systems are favored in dynamic warehousing and logistics environments where flexibility, reduced physical strain, and time efficiency are critical. Mobile units enable strapping to be performed at the pallet’s location, eliminating the need for product transport to fixed stations, thus lowering risk of damage and improving throughput.

The growing focus on worker health and safety regulations especially in North America and Europe has pushed manufacturers to design mobile strapping units with adjustable tension controls, lightweight frames, and automated strap feeding.

The food & beverage industry is expected to command a 47.1% share in 2025, making it the largest end-use sector in the ergonomic pallet strapping market. This dominance is attributed to the sector’s stringent hygiene standards, high packaging volumes, and diverse pallet formats used for frozen goods, bottled beverages, bulk grains, and ready-to-eat items. Strapping solutions in this sector must balance speed, securement strength, and ergonomic design to maintain output while minimizing injury risks to workers.

As sustainability becomes a central packaging mandate, many food manufacturers are transitioning to recyclable strap materials and battery-powered ergonomic tools that minimize energy use and operational fatigue.

Plastic strapping is forecast to maintain a 34.2% share in 2025, supported by its operational ease, lower cost, and compatibility with automated and battery-powered ergonomic tools. Polypropylene (PP) and polyester (PET) straps dominate the material mix, offering sufficient tensile strength for most retail, beverage, and logistics pallets while ensuring safety in manual and semi-automatic operations. Plastic straps also generate less residue and reduce recoil risks compared to steel alternatives, making them a preferred option for ergonomic applications.

Plastic strapping solutions support sustainability goals as PET is increasingly produced from recycled inputs and reused within circular logistics models.

The battery-powered segment is expected to lead by automation level with a 41.2% share in 2025, owing to its unmatched blend of portability, power, and ergonomic comfort. These tools eliminate the physical strain of manual strapping while offering adjustable tensioning, friction welding, and rapid cycle times. They are particularly favored in mid- to high-throughput facilities where efficiency and labor safety are top priorities.

Battery advancements such as quick charging, longer cycles per charge, and integration with fleet management software are transforming strapping into a smart operation.

Standard pallets with 800-1600 mm load height are projected to hold a 44.1% share in 2025, supported by their prevalence in global shipping, warehousing, and retail logistics systems. These dimensions align with common forklift configurations, racking systems, and transportation containers, making them the default choice for ergonomic pallet strapping solutions. Manufacturers of ergonomic systems design their tools and automation to best serve this size range due to its consistency and lower customization need.

Standardization ensures smoother integration with conveyor belts, shrink wrapping systems, and automated guided vehicles (AGVs).

Machine fatigue, system bulkiness, and inconsistent tensioning limit wider adoption, even as demand rises across logistics, warehousing, and industrial packaging for user-friendly, lightweight strapping tools that reduce operator strain and improve pallet load security.

Worker Safety and Efficiency Demands Driving Ergonomic Tool Adoption

Ergonomic pallet strapping solutions are gaining ground in warehouse, logistics, and industrial settings where repetitive motion injuries and productivity losses are common. These systems often battery-powered or semi-automatic are designed to reduce physical strain during horizontal or vertical strapping operations.

Key features such as balanced tool weight, adjustable tensioning, soft-grip handles, and intuitive control interfaces enhance operator comfort and speed. In high-throughput settings like e-commerce fulfillment centers and distribution hubs, ergonomic tools contribute to faster cycle times while maintaining load stability. As companies prioritize employee well-being and compliance with occupational safety standards, demand for ergonomic strapping solutions is steadily replacing manual or outdated mechanical tools.

System Weight, Power Limitations, and Integration Challenges

Despite their ergonomic appeal, these systems face notable barriers primarily in the form of operational constraints and cost. Many battery-powered tools, though lighter than legacy models, still require frequent charging or battery replacement, which can interrupt workflows. Additionally, achieving consistent strap tension without compromising tool balance remains a design challenge.

Heavier-duty versions often sacrifice ergonomic benefits to accommodate high-tension applications. In automated or semi-automated lines, integration of ergonomic tools with conveyors or robotic palletizers can be difficult without modular compatibility. Initial investment, especially for tools with smart feedback systems or precision tensioning, may deter small warehouses or cost-sensitive operations from upgrading.

Integration of Lightweight Composites and Smart Assist Features

A key trend in the ergonomic pallet strapping market is the shift toward ultra-lightweight, high-strength materials such as reinforced polyamide or carbon-fiber composites, which reduce tool weight while maintaining structural integrity. Manufacturers are also embedding smart assist features like real-time tension monitoring, vibration feedback, and programmable strap settings to enhance accuracy and reduce rework. Bluetooth-enabled diagnostics and usage logs are being used for preventive maintenance and operator training.

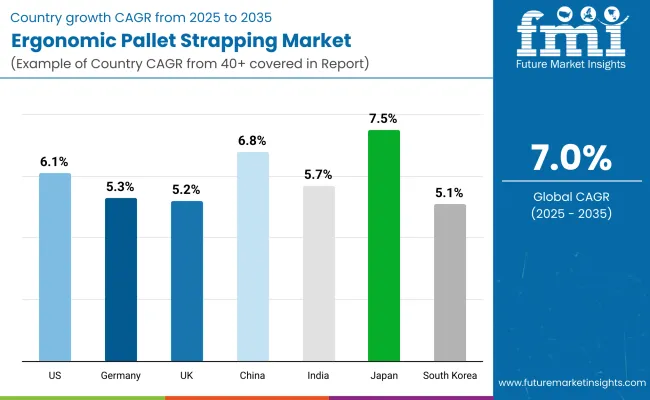

The global ergonomic pallet strapping market is gaining traction with rising demand from warehouse automation, logistics, and industrial packaging sectors. As industries pursue worker safety and faster throughput, ergonomic solutions that reduce strain and improve strapping precision are being prioritized. While developed economies are leading in automation upgrades, emerging markets are adopting ergonomic tools for improved manual efficiency and workplace safety. Japan emerges as the fastest-growing market driven by advanced material handling innovation and robotic integration.

The USA market is projected to grow at a CAGR of 6.1% from 2025 to 2035, driven by modernization of warehousing, fulfillment centers, and 3PL services. Manufacturers are focusing on battery-operated and lightweight ergonomic strapping tools to reduce musculoskeletal injuries and comply with OSHA workplace safety standards.

Germany’s market is expected to expand at a CAGR of 5.3%, supported by automation in manufacturing and strict labor protection laws. Ergonomic battery-powered tensioners and hand-held devices are preferred in automotive, engineering, and FMCG packaging zones. Integration with conveyor-fed pallet systems is also growing.

The UK market is projected to grow at a CAGR of 5.2%, driven by adoption in e-commerce fulfillment, pharmaceuticals, and export packaging sectors. Safety-first practices and efficiency improvement mandates are fueling demand for strapping tools that reduce fatigue and increase cycle consistency.

China is set to grow at a CAGR of 6.8%, backed by industrial expansion and growth in fast-moving logistics. Domestic producers are innovating with low-cost ergonomic hand tools for small-scale operators. Rapid warehousing development and labor safety regulations are further driving transition from conventional to ergonomic strapping systems.

India’s market is forecast to expand at a CAGR of 5.7%, propelled by the rise in organized warehousing, e-commerce fulfillment, and government-led worker safety initiatives. Affordable ergonomic battery-powered systems are being adopted by MSMEs, logistics parks, and food processing units.

Japan stands out with the highest CAGR of 7.5%, driven by strong demand from high-precision industries such as semiconductors, pharma, and robotics. Automated strapping lines with ergonomics-focused interfaces and human-machine safety standards are replacing manual systems. Integration of robotics with ergonomic compliance is shaping the future of pallet handling.

South Korea’s market is expected to grow at a CAGR of 5.1%, backed by demand from export-driven sectors, smart warehouses, and compliance with worker safety protocols. Lightweight ergonomic kits, digital tension calibration, and automation-ready modules are being deployed across logistics zones.

The ergonomic pallet strapping market is moderately fragmented, with automation-focused strapping system manufacturers, industrial packaging specialists, and human-factor design innovators competing across logistics, warehouse automation, and end-of-line packaging operations.

Global and national players such as ErgoStrap Inc., Transpak Equipment Corp., and Wulftec International Inc. hold significant market share, driven by mobile battery-powered units, semi- and fully-automatic strap tensioning systems, and patented ergonomic enhancements that reduce operator strain. Their strategies increasingly emphasize remote-control operations, lithium-ion powered lift assist units, and compatibility with diverse pallet formats across FMCG, food, and third-party logistics sectors.

Established mid-sized players including Pacovation, Inc. and FEIFER are accelerating adoption through compact, operator-friendly tabletop and vertical strapping machines with enhanced mobility, digital tension calibration, and integrated safety features. These companies cater to medium-scale manufacturing and distribution environments looking to improve packaging efficiency without compromising on workforce ergonomics and health standards.

Specialized providers such as Jining Keepway Machinery Company, Ltd. focus on cost-effective, regional-market-specific strapping machines. Their strength lies in custom fabrication, affordability, and scalable automation integration for SMEs and regional distributors aiming to mechanize strapping tasks while improving operator convenience and cycle-time reduction.

Key Development Ergonomic Pallet Strapping Market

| Item | Value |

|---|---|

| Quantitative Units | USD 900 million |

| By Product Type | Mobile Ergonomic Strapping Systems and Fixed Ergonomic Strapping Systems |

| By Material | Plastic, Polypropylene (PP), Polyester (PET), Steel, Nylon, and Paper |

| By Automation Level | Fully Automatic Strapping Systems, Semi-Automatic Strapping Systems, and Battery-Powered |

| By Load Height and Pallet Type | Low Pallets (<800 mm height), Standard Pallets (800-1600 mm height), Tall Loads (>1600 mm height), and Euro Pallet |

| By End Use | Manufacturing, Food and Beverage (Frozen Foods, Dairy Products, Confectionery, Meat and Poultry, Processed Foods, Beverages), Healthcare, Textiles and Apparel, Third-Party Logistics (3PL) Providers, Retail and E-commerce (Small Parcel Packaging, Bulk Packaging), Industrial and Automotive (Automotive Components, Industrial Equipment and Machinery, Consumer Electronics), Wood/Furniture Industry, and Construction and Infrastructure |

| Key Companies Profiled | Jining Keepway Machinery Company, Ltd, ErgoStrap Inc., Pacovation, Inc, FEIFER, Transpak Equipment Corp., and Wulftec International Inc. |

| Additional Attributes | Increasing focus on worker safety and ergonomic compliance in pallet handling, demand growth for mobile strapping systems in 3PL and retail distribution centers, widespread shift to battery-powered units for enhanced mobility, integration of automatic tensioning systems to reduce operator strain, strong market traction in frozen and perishable food logistics, rapid adoption in Euro pallet configurations across European markets, rising preference for lightweight PET and paper strapping alternatives, expanding use in automotive component packaging, demand for strapping machines compatible with varying pallet heights, and growth driven by digital interfaces and smart diagnostics in automated strapping systems |

The global ergonomic pallet strapping market is estimated to be valued at USD 900 million in 2025.

The market size for the ergonomic pallet strapping market is projected to reach USD 1700 million by 2035.

The ergonomic pallet strapping market is expected to grow at a CAGR of 7.0% between 2025 and 2035.

The key system types in the ergonomic pallet strapping market include mobile ergonomic strapping systems, stationary strapping tools, semi-automatic pallet strappers, and fully automated ergonomic solutions.

In terms of system type, the mobile ergonomic strapping systems segment is expected to account for the highest share of 55.4% in the ergonomic pallet strapping market in 2025

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA