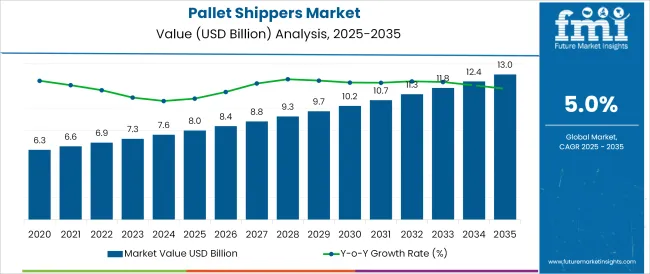

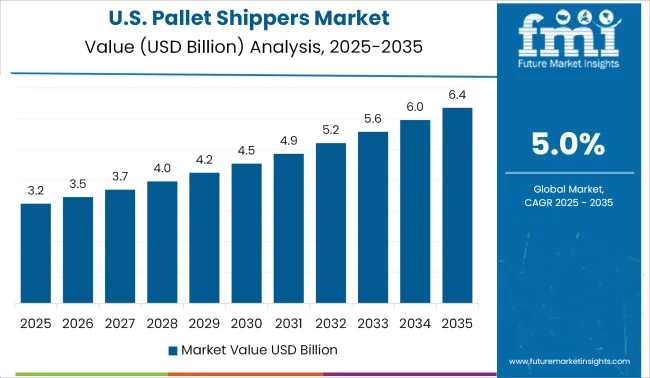

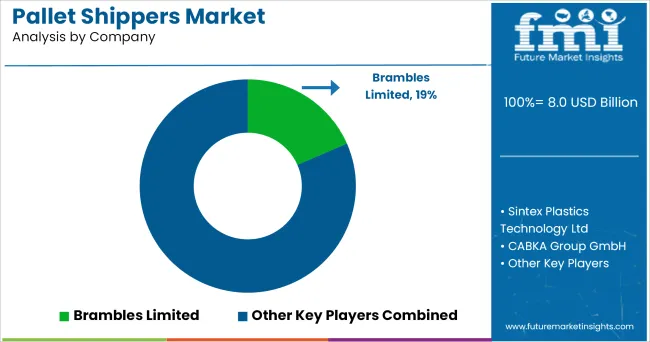

The Pallet Shippers Market is estimated to be valued at USD 8.0 billion in 2025 and is projected to reach USD 13.0 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

The pallet shippers market is undergoing a steady transformation fueled by global trade growth, expanding cold chain logistics, and rising demand for temperature-sensitive and bulk shipments. As manufacturers and logistics providers prioritize efficiency and product safety, pallet shippers are increasingly adopted for their durability, stability, and compatibility with various transport modes.

Shippers designed to minimize product movement, reduce contamination risks, and support automation have gained traction across both developed and emerging economies. Sustainability goals have encouraged innovations in recyclable and reusable pallet solutions, especially within perishable and pharmaceutical logistics. Furthermore, disruptions in global supply chains have spotlighted the importance of reliable, high-capacity packaging formats that reduce handling and ensure product integrity throughout transit.

Regulatory emphasis on hygiene standards and traceability in food and pharmaceutical sectors is also driving the shift toward standardized pallet-based shipping systems. With increasing reliance on temperature control and bulk logistics, the market outlook remains strong, supported by strategic investments in smart materials and reusable pallet infrastructure.

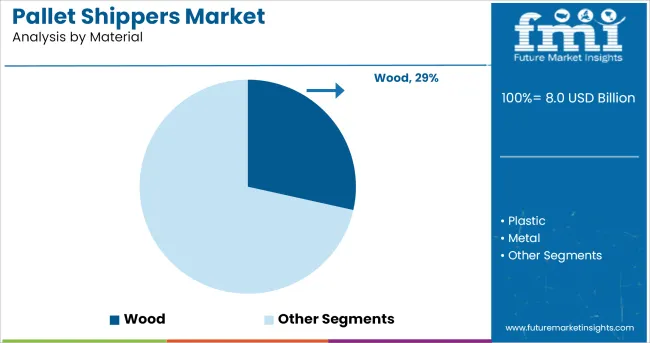

It has been observed that wood accounts for 28.50% of the total market revenue under the material segment, marking it as the leading sub-category. This dominance is driven by the material's high load-bearing capacity, widespread availability, and low manufacturing costs.

Wooden pallet shippers are preferred in both domestic and international logistics due to their robustness and adaptability to custom configurations. Their structural rigidity supports bulk loads while allowing easy integration with forklifts and warehouse systems.

Although concerns around environmental impact and phytosanitary compliance persist, advancements in heat treatment and sourcing from certified forests have mitigated risks. As a result, wood continues to maintain a significant market share, particularly where strength, cost-efficiency, and widespread acceptance are prioritized.

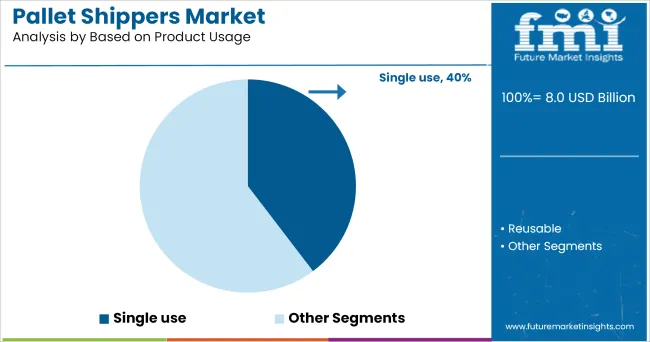

It is noted that single-use pallet shippers comprise 39.70% of the total revenue, representing the leading segment in terms of product usage. This preference is primarily influenced by the need for contamination-free, compliant, and logistics-ready packaging formats, especially in industries with strict hygiene and regulatory standards.

Single-use formats are commonly adopted in global food exports, pharmaceuticals, and medical supply chains where cross-contamination and product integrity are critical. Their appeal is further supported by operational simplicity, consistent quality assurance, and reduced reverse logistics complexity.

In addition, supply chain disruptions and unpredictable return logistics have reinforced the reliance on disposable shippers for one-way routes. The combination of regulatory compliance, ease of disposal, and safety assurance continues to sustain the dominance of this sub-segment.

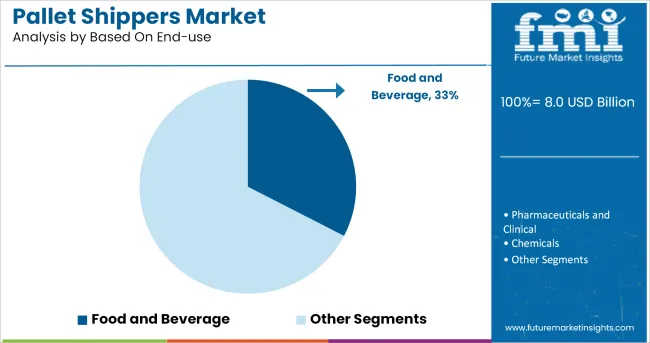

The food and beverage industry holds 32.60% of the total market revenue, positioning it as the top end-use segment in the pallet shippers market. This leadership is attributed to stringent food safety regulations, rising demand for cold chain logistics, and the globalization of fresh and processed food exports.

Pallet shippers provide structural protection, temperature stability, and efficient stacking making them highly suitable for transporting perishable items such as dairy, meat, seafood, and beverages. Additionally, increased consumer expectations for freshness and quality have prompted brands and suppliers to invest in packaging formats that minimize damage and preserve shelf life during long transits.

Regulatory compliance with HACCP and FDA guidelines has further encouraged adoption. As food supply chains become more time-sensitive and geographically dispersed, the food and beverage sector continues to anchor the growth trajectory of pallet shipper applications.

Plastic pallet shippers are far more long-lasting and easier to maintain than wood pallets, and this latter advantage is a huge catalyst for food and pharmaceutical manufacturing companies to choose a plastic shipping platform. Plastic pallet shippers are an excellent food-grade pallet that can assist food producers in meeting, if not exceeding, Food Safety Modernization Act standards for the sanitary shipping of food and feed.

Plastic pallets that are reusable and recyclable have several advantages over woodblock pallets. They are lighter, more long-lasting, have more coherent dimensions, and are more hygienic. These advantages will contribute to increasing sales of pallet shippers market over the forecasted period.

Pallet shippers are widely used in North American countries such as the United States and Canada. Pallet shippers are widely used in the pharmaceutical and life science industry sectors, which both require temperature-sensitive commodities to be transported securely around the world. Generally, when it comes to shipping medications like vaccines and other biologics derived from biological cells, manufacturers' timeframes and temperature markers are critical.

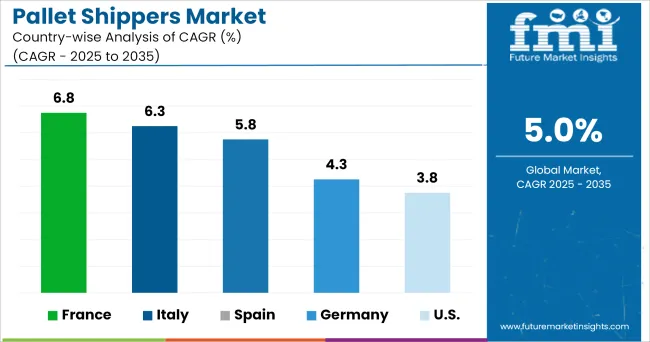

Europe is one of the key markets for pallet shippers. The European pallet shippers market is to witness a notable growth rate during the assessment period 2024 to 2035.

The increased emphasis on sustainable packaging and pallets is also expected to drive market growth. The majority of pallets in use today are made of wood, and they are one of the largest contributors to municipal solid waste (MSW). Furthermore, the waste wooden pallets are high in energy, which is typically lost during MSW disposal. As a result, manufacturers are now implementing reuse techniques to reduce wood waste in pallet shippers’ industrial production.

For instance, businesses such as Brambles, Ltd. and CABKA Group GmbH in Germany, are working toward the manufacturing of completely recyclable or 100% reusable wooden and plastic pallet shippers.

Some key manufacturers functioning in business in Pallet Shippers market includes

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides an in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The global pallet shippers market is estimated to be valued at USD 8.0 billion in 2025.

The market size for the pallet shippers market is projected to reach USD 13.0 billion by 2035.

The pallet shippers market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in pallet shippers market are wood, plastic and metal.

In terms of based on product usage, single use segment to command 39.7% share in the pallet shippers market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Palletizer Market Size and Share Forecast Outlook 2025 to 2035

Pallet Displays Market Size and Share Forecast Outlook 2025 to 2035

Pallet Wraps Market Size and Share Forecast Outlook 2025 to 2035

Pallet Pooling Market Forecast and Outlook 2025 to 2035

Palletizing Robot Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Palletizing Robots Market Size and Share Forecast Outlook 2025 to 2035

Pallet Stretch Wrapping Machine Market Size and Share Forecast Outlook 2025 to 2035

Pallet Box Market Size and Share Forecast Outlook 2025 to 2035

Pallet Labelling System Market Size and Share Forecast Outlook 2025 to 2035

Pallet Labeler Market Size and Share Forecast Outlook 2025 to 2035

Pallet Wrap Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Pallet Jacks Market Size and Share Forecast Outlook 2025 to 2035

Pallet Drum Filler Capper Market Size and Share Forecast Outlook 2025 to 2035

Pallets Market Analysis - Size, Share, and Forecast 2025 to 2035

Pallet Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pallet Racking Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Pallet Banding Machine Market Analysis - Growth & Forecast 2025 to 2035

Palletizing Machines Market Growth & Demand 2025 to 2035

Pallet Corner Boards Market from 2025 to 2035

Pallet Truck Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA