The global pallet truck market is projected to witness steady growth between 2025 and 2035 due to the continued growth of e-commerce over the coming years, increasing warehousing activities, and growing adoption of material handling solutions. The expanding demand for efficient and safe cargo handling in warehouses and distribution centers is driving the adoption of pallet trucks due to their dependability, affordability, and versatility. Electric and semi-electric pallet trucks- Key industries like retail, manufacturing, and logistics are all investing in upgraded material handling equipment to improve productivity and minimize downtime. Renew and Resilience Because data sceptre is used for many purposes, such as their reliability. Further elevating the market’s growth prospects are enhanced durability and better load-handling capacity, which are integrated with warehouse management systems.

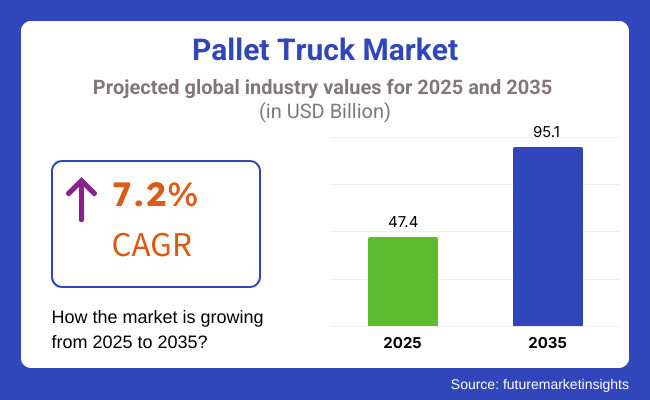

The projected growth rate of 7.2% CAGR between 2025 and 2035 for the market indicates the rising demand for electric and automated pallet trucks around various sectors. Another growth factor is ongoing investment in smart warehousing, and AGVs employ smart pallet trucks to increase their throughput and inventory management capabilities. Key Insights & Findings from the Report: Improved material handling technologies coupled with the rising adoption of electric models in both developed and emerging markets support the positive market outlook. Moreover, the increasing number of third-party logistics (3PL) providers and growing cross-border trade are among the factors expected to facilitate the demand for pallet trucks with enhanced efficiency, reliability, and performance.

Pallet truck demand in North America continues to dominate by volume with a strong logistics foundation along with an established e-commerce network. Moreover, this growth is driven by factors such as rising investment from various companies in the United States and Canada in warehouse automation and advanced material handling equipment, including electric and semi-electric pallet trucks in both countries. As industries look for ways to cut their carbon emissions, the move toward cleaner, greener alternatives like lithium ion-powered pallet trucks is being prioritized. Beyond the growing e-commerce, the increased importance of cold chain logistics is boosting demand for specialized pallet trucks that can handle temperature-critical goods. In general, due to their reliance on advanced technology and their ability to manage supply chains effectively, North America is one of the prominent contributors to market growth.

The European pallet truck market is dominated by strict environmental policies, large warehousing networks, and a strong emphasis on workplace safety. Germany, France, and the UK are leading the shift from conventional internal combustion engine (ICE) trucks to electric-powered trucks. Meeting rigorous standards imposed by government incentives and EU directives for lowering carbon emissions has forced manufacturers to get to work producing environmentally friendly pallet trucks. Moreover, the use of autonomous and remotely controlled pallet trucks is rapidly becoming a trend among European companies focused on operational efficiency, worker safety, and direct compatibility with intelligent warehouse management systems. With growing demand for electric and hybrid models, as well as technological advances, Europe is a vibrant space for market development.

The pallet truck market in the Asia-Pacific region is expected to grow at the fastest pace as a result of industrialization, urbanization, and the penetration of e-commerce. As major manufacturing centers, China and India are experiencing a boom in warehousing and logistics. Large-scale distribution centres and online retail giants are employing more electric pallet trucks and semi-automated solutions, particularly in these countries. Further, Japan and South Korea are at the forefront of the innovation path for technology solutions like autonomous pallet trucks and intelligent material handling. The growing focus on automation in the region, coupled with the government efforts to promote sustainable and power-efficient equipment, will be a boost to market growth. Competitive pricing, product variety availability, and ongoing infrastructure expansion in the Asia-Pacific region are likely to sustain the strong growth momentum.

Challenges

Market challenges such as high initial investment costs, limited acceptance of advanced models in cost-sensitive markets, and the requirement for regular maintenance and repairs restrict the growth of the pallet truck market. Electric pallet trucks and autonomous models certainly have their benefits in the long run, but the high upfront costs may put smaller businesses off purchasing these models. Furthermore, it can cause operational breakdowns and workplace accidents due to safety issues caused by the use of outdated or improperly maintained pallet trucks. A weak infrastructure and lack of trained persons may make the penetration further difficult in the developing regions. Moreover, changing raw material prices and disruptions in the supply chain exacerbated by global economic uncertainties become key challenges for manufacturers and end-users alike.

Opportunities

Challenges may persist with the distribution of pallet trucks in vulnerable regions to unintended global displacement. Another prominent growth opportunity comes from the increasing demand for automated guided vehicles (AGVs) and autonomous pallet trucks in scale boxes. Enhanced battery technologies such as lithium-ion power systems offer extended run times, rapid charging, and reduced maintenance requirements, making electric pallet trucks more appealing to an even broader customer base. In addition, the increasing emphasis on sustainability and green warehousing operations is creating a demand for energy-efficient and recyclable pallet trucks as global supply chains continue to integrate. These untapped markets across Africa, the Middle East, and Latin America present opportunities for expansion. Finally, IoT and warehouse management systems based on advanced technology are seamlessly integrating pallet trucks into smart warehousing ecosystems that enhance overall productivity and efficiency.

From 2020 to 2024, the pallet truck market experienced remarkable expansion, driven by the expansion of e-commerce, warehouse automation, and supply chain optimization. The growth in sales was largely driven by the growth of distribution centers, 3PL, and the increasing material handling needs in the industries. Market dynamics were impacted by variables such as supply chain delays, fluctuations in raw material costs, and availability of workforce. Companies responded with the adoption of semi-automated pallet trucks, investing in fleet management solutions, and redesigning ergo for greater worker safety and performance.

From 2025 to 2035, the pallet truck market is expected to evolve with Artificial Intelligence (AI) and IoT-enabled tracking, in addition to the complete autonomous material handling system replacing it. The companies also claim that the use of lithium-ion battery technology, sustainability initiatives, and advanced fleet telematics will improve operational efficiency. The industry will aim for energy-efficient, low-maintenance, smart-connected pallet trucks that meet the demand for carbon-neutral logistics solutions through overall automation in the industry.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance to occupational safety standards, emission regulations, and ergonomic guidelines. |

| Warehouse and Logistics Trends | The growth of e-commerce and 3PL activities increased demand for hand and semi-automatic pallet trucks. |

| Industry Adoption | Shift towards electric and lithium-ion-driven pallet trucks for improved efficiency and sustainability. |

| Power and Battery Technology | Use of lead-acid batteries in electric pallet trucks, with growing application of lithium-ion variants. |

| Market Competition | Presence of traditional pallet truck producers and the advent of automated guided vehicle (AGV) solutions. |

| Market Growth Drivers | Growing requirements from warehousing, retail, and manufacturing industries for efficient material handling. |

| Sustainability and Energy Efficiency | The initial shift towards eco-friendly electric pallet trucks and energy-efficient fleet management. |

| Integration of Smart Tracking | Limited adoption of RFID and GPS-based fleet tracking solutions. |

| Advancements in Material Handling Solutions | Development of compact, high-load capacity pallet trucks with improved maneuverability. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter carbon emission regulations, mandatory use of energy-efficient electric pallet trucks, and increased focus on automation safety standards. |

| Warehouse and Logistics Trends | Expansion of fully automated warehouses, AI-driven inventory management, and autonomous pallet trucks in logistics operations. |

| Industry Adoption | Widespread adoption of IoT-enabled, AI-driven smart pallet trucks with real-time tracking and automated route optimization. |

| Power and Battery Technology | Dominance of lithium-ion and hydrogen fuel cell-powered pallet trucks, offering longer runtimes and faster charging. |

| Market Competition | The emergence of AI-powered robotic pallet trucks increased competition from autonomous logistics technology providers. |

| Market Growth Drivers | Surge in demand for autonomous material handling solutions, robotics integration, and sustainability-driven innovations. |

| Sustainability and Energy Efficiency | Large-scale adoption of carbon-neutral material handling equipment powered by renewable energy sources. |

| Integration of Smart Tracking | Expansion of AI-driven predictive maintenance, cloud-based fleet management, and real-time telematics integration. |

| Advancements in Material Handling Solutions | Evolution of fully autonomous, AI-assisted material transport systems for optimized warehouse and logistics operations. |

The USA is one of the leading pallet truck markets globally, with the growth of logistics, warehousing, and retail industries in particular driving demand. Market growth is driven by the rising demand for material handling solutions from the manufacturing industry and e-commerce fulfillment centers. Further, innovations in electric and automated pallet trolleys, as well as the installation of IoT-based tracking systems, are altering warehouse processes. The adoption of pallet trucks across different industries is further strengthened by the presence of diverse logistical players and distribution centers. Salvaging, storing, and recycling resources for sustainable material handling solutions are also fuelling the demand for battery-powered and hydrogen fuel cell pallet trucks. Moreover, the growing trend of Omni channel retailing has created a dire need for enhanced warehouse efficiency, which is pushing the adoption of automated pallet trucks integrated with AI and machine learning.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 7.5% |

Growing automated warehouses, increasing online retail penetration, and rapid growth of the food & beverage segment are the key factors fuelling demand for pallet trucks in the UK market. The increasing use of electric and smart pallet trucks, coupled with the integration of AI-driven logistics solutions, is propelling market adoption. Moreover, government regulations and initiatives for sustainable supply chains and reduced carbon emissions are further encouraging businesses to invest in eco-friendly pallet truck solutions. Also playing a prominent role in warehouse transformation is the growth of investment in robotics and automation throughout logistics hubs. In addition, due to an increasing emphasis on minimizing workplace injuries and an evolution in ergonomically engineered handling equipment, the country is moving towards the usage of advanced pallet trucks with superior safety features.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.9% |

Germany, France, and Italy have dominated the European pallet truck market, and the growth of logistics, retail, and automotive sectors will help retain their position in this market. Due to the focus on automation and green energy solutions in the European Union, there is a progressive switch from manual to electric and semi-automated pallet trucks. Increasing investments in e-commerce promotions by businesses to capture a larger segment of customers have led to a rising market demand for smart pallet trucks with predictive maintenance and real-time data tracking, which is set to boost the expansion of the smart pallet truck market. New initiatives focusing on circular economy principles have also created a demand for sustainable and durable pallet trucks consisting of recyclable components. Moreover, the impetus to digitize warehouses, as well as the introduction of robotic palletization in manufacturing and distribution industries, are streamlining industrial processes and minimizing the reliance on manual labor. European companies are investing in high-performance pallet trucks optimized for heavy loads and extended working hours, with their growth driven by increasing volume through cross-border trade within the EU.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 7.1% |

Japan is at the forefront of robotics, automation, and high-tech manufacturing, and this is contributing to the expansion of Japan's pallet truck market. This is assisting in driving the growth of advanced pallet trucks, as businesses in every industry, from automotive to electronics and from pharmaceuticals to warehouses, are looking more and more for materials-handling solutions that can handle these kinds of issues. Warehouse automation with the aid of compact electric pallet trucks & AGVs (Automated Guided Vehicles) is a trend transforming the market. This drive toward labour minimization and operational efficiency is also compelling businesses to invest in automated pallet truck solutions. Japan's high population density, along with limited warehouse or storage space, is increasing demand for compact and multi-functional pallet trucks, which enhance space utilization. Further, there is an increase in demand for autonomous material handling systems with a combination of AI, robotics, and IoT for operation in the country’s logistics industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.0% |

The South Korean pallet truck market is expanding owing to the growth of e-commerce, logistics, and smart warehouses in the countries. Leading manufacturing companies are implementing AI-based material handling solutions, which are fuelling the demand for electric and autonomous pallet trucks. The second generation of pallet trucks, equipped with energy-efficient and AI-driven technologies, is being used in various sectors due to government investments in industrial automation and smart logistics hubs, which is driving innovation and adoption. The booming semiconductor and electronics sectors in the country necessitate high-precision logistics solutions, leading to further adoption of advanced material handling equipment. Additionally, South Korea's investment in smart city projects is propelling the development of intelligent warehousing solutions, such as self-navigating pallet trucks with LiDAR and real-time data analytics. Warehousing solutions like self-guiding pallet trucks equipped with LiDAR and real-time data analysis.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.3% |

The manual and electric pallet truck segments maintain a leading share in the pallet truck industry as businesses continually look for cost-effective, efficient, and scalable material handling options. These pallet trucks are a key driver of warehouse logistics efficiency, operational performance, and elimination of manual labor strain, hence a must-have for manufacturing plants, distribution warehouses, retail warehouses, and logistics firms.

Manual Pallet Trucks Remain Essential for Cost-Effective and Flexible Operations

Affordable, easy to use, and low maintenance machines; manual pallet trucks are still generally used. These pallet trucks are used in small-scale warehouses, small retail stores, and other small distribution centers to transport materials over short distances. Manual pallet trucks don't need battery charging or fuel like powered alternatives do so they are perfect for businesses where their handling needs are limited and budget is an issue.

Accordingly, the greater demand for durable, ergonomic, and lightweight manual pallet trucks continues to drive the growth of the market, especially as several industries need flexibility in confined storage areas. For instance, manufacturers are focusing on investing more in innovations, including hydraulic lifting mechanisms, stronger fork designs, and wheels that make it easier and more efficient to move.

While they offer cost savings and operational simplicity, manual pallet trucks suffer from issues like operator fatigue, limited weight capacity, and decreasing efficiency in large-scale warehouses. But innovations such as ergonomic handle designs, load stability improvements, and AI-enabled load monitoring systems are pushing efficiency, safety, and ease of operations, thus ensuring market demand for hand-operated pallet trucks will continue across all geographies.

Electric pallet trucks have made a considerable mark on sectors with high-volume logistics, providing an uninterrupted material lift experience that reduces the strain of manual labour whilst maximising productivity in the warehouse. It is not an ordinary manual pallet truck; these manual pallet trucks are electrically powered by a rechargeable battery, allowing for higher speed transportation of goods while even reducing the effort for a worker to move them.

A notable increase in the number of e-commerce fulfillment centers, high-volume distribution centers for small and medium-sized businesses (SMEs), and automated warehouses has fostered the rapid adoption of electric pallet trucks. Research shows that more than 60% of high-volume warehouses are now choosing electric pallet trucks as top priorities to increase the efficiency of the operation, reducing any downtime and maximizing supply chain execution.

The increased market demand for lithium-ion-powered electric pallet trucks, enhanced with rapid charging, extended operational hours and AI-integrated fleet management, has bolstered the market's potential for better adaptability to industrial environment and improved performance.

While they offer benefits like faster operations, automation, and less reliance on labour, electric pallet truck models come with disadvantages like upfront expense, battery maintenance, and less efficiency in outdoor and uneven surface applications. However, evolving technologies related to energy-efficient batteries, fast-growing lightweight solutions, and AI-led predictive maintenance will escalate operational sustainability and ensure cost-effectiveness and reliability, which will sustain market growth for electric pallet trucks globally.

The standard and weighing pallet truck markets account for a strong market share because companies value efficiency, precision, and dependability in their material handling processes. The pallet truck types serve to meet a wide variety of industries, including retail and warehousing, food processing, and manufacturing.

Standard Pallet Trucks Maintain Market Leadership in Industrial Applications

Standard pallet trucks will continue to take over the market next due to their great versatility, durability, and easy operation. They are commonly used in manufacturing plants, logistics centers, and retail supply chains to move heavy loads more efficiently. While there are certainly more advanced pallet trucks that have a specific expert application, the standard pallet truck is the all-around ideal solution in most material handling scenarios, providing the best balance between performance and cost.

High-quality, reinforced, and ergonomically designed standard pallet trucks have increased demand in high-traffic environments, which has propelled market growth significantly. To do this, manufacturers are concentrating on innovations like corrosion-resistant materials, improved maneuverability of wheels and increased stability of loads.

Standard pallet trucks, though, much-needed for their sturdiness and reliability, do come with unforeseen obstacles, including poor adaptability to specialized industrial applications, lowered efficiency in precision-biased sectors, and unsatisfactory operations in automated warehouses. Nonetheless, innovations in the industry, such as AI-enabled load-tracking, smart pallet-compatible features, and ergonomic adjustments, are making pallet trucks more usable, thus increasing their use amongst players across the logistics industry, leading to steady demand for standard pallet trucks around the world.

Weighing Pallet Trucks Gain Popularity as Precision and Efficiency Become Key Priorities

Various industries such as logistics, agriculture, and food processing have adopted weighing pallet trucks due to the specific need for close measures of load. Standard pallet trucks do not typically have this feature and weigh the cargo visually as operators often rely on their experience to assess the weight capacity the equipment can support, while weighing models come equipped with built-in scales to allow operators to measure cargo weight with precision in real-time, ensuring compliance with load capacity regulations; these systems are also beneficial for inventory management and improvement of operation processes.

To gain a better understanding of the market, primarily due to the increasing demand for integrated weighing and another weighing solution and the development of advanced systems with digital display panels, wireless connectivity, and automated data logging. Research suggests that more than 55% of warehouses are already handling perishable goods or bulk and consequently make use of weighing pallet trucks able to monitor the weight of goods either inline or on dispatch, ensuring both compliance with regulations and optimization of supply chain management.

Weighing pallet trucks has its benefits with respect to accuracy, efficiency, and regulatory compliance. Still, it also faces drawbacks in terms of higher fees, additional maintenance requirements, and potential calibration issues. Nonetheless, recent innovations in the Internet of Things (IoT) enabled weight monitoring, machine-driven load distribution analysis, and real-time digital inventory tracking are all contributing to improved accuracy, automation, and reliability, assuring sustainable growth in the global market for weighing pallet trucks.

The growing demand for efficient material handling solutions, the increasing need for warehouse automation, and the growing logistics market are a few of the factors that are driving the pallet truck market. Warehouse operations is challenged when it comes to minimizing labour costs and maximizing productivity, which is where electric and manual pallet trucks have an important role to play. Taiwan-based manufacturers offer some of the highest quality trucks in the industry as the country's substance and topography demand ergonomic designs.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Toyota Material Handling | 12-16% |

| KION Group (Linde, STILL) | 10-14% |

| Jungheinrich AG | 8-12% |

| Hyster-Yale Materials Handling | 6-10% |

| Crown Equipment Corporation | 4-8% |

| Other Companies (combined) | 45-55% |

Key Company Offerings and Activities

| Company Name | Key Offerings/Activities |

|---|---|

| Toyota Material Handling | Offers advanced electric pallet trucks with IoT integration and enhanced safety features. |

| KION Group (Linde, STILL) | Designs intelligent pallet trucks with automation and energy-efficient solutions. |

| Jungheinrich AG | Offers lithium-ion powered pallet trucks with ergonomic designs for efficient warehouse operations. |

| Hyster-Yale Materials Handling | Materials Handling Experts in rugged manual and electric pallet trucks with industrial and retail uses. |

| Crown Equipment Corporation | Designs connectivity-based pallet trucks with real-time fleet monitoring. |

Toyota Material Handling (12-16%)

Toyota leads the pallet truck industry with cutting-edge electric models, IoT-enabled fleet solutions, and high-efficiency material handling technology.

KION Group (Linde, STILL) (10-14%)

KION Group provides automation-instrumented pallet truck solutions, reducing costs of operations and enhancing efficiency in warehouse management.

Jungheinrich AG (8-12%)

Jungheinrich enhances logistics productivity with lithium-ion-powered pallet trucks, ensuring sustainability and ergonomic operation.

Hyster-Yale Materials Handling (6-10%)

Hyster-Yale provides versatile manual and electric pallet trucks designed for durability, safety, and heavy-duty applications.

Crown Equipment Corporation (4-8)

Crown combines connectivity solutions, providing fleet tracking and real-time analytics to enhance material handling efficiency.

Other Key Players (45-55% Combined)

Numerous companies contribute to the pallet truck market by developing innovative, cost-effective, and technologically advanced solutions. These include:

The pallet truck market continues to grow with the advancement of automation, connectivity, and sustainable power solutions, driving efficiency across warehouses and industrial supply chains.

The overall market size for Pallet Truck Market was USD 47.4 Billion in 2025.

The Pallet Truck Market expected to reach USD 95.1 Billion in 2035.

The demand for the pallet truck market will be driven by the rapid expansion of e-commerce, increasing warehouse automation, growing logistics and supply chain activities, and the rising need for efficient material handling solutions. Additionally, advancements in electric and smart pallet trucks will further boost market growth during the forecast period.

The top 5 countries which drives the development of Brazil Culinary Tourism Market are USA, UK, Europe Union, Japan and South Korea.

Electric Pallet Trucks Market drives growth to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Control, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Control, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Load Capacity, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Load Capacity, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by End-Use Industry, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by End-Use Industry, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Control, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Control, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Load Capacity, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Load Capacity, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by End-Use Industry, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by End-Use Industry, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Control, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Control, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Load Capacity, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Load Capacity, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by End-Use Industry, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by End-Use Industry, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Control, 2018 to 2033

Table 34: Western Europe Market Volume (Units) Forecast by Control, 2018 to 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 36: Western Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Load Capacity, 2018 to 2033

Table 38: Western Europe Market Volume (Units) Forecast by Load Capacity, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by End-Use Industry, 2018 to 2033

Table 40: Western Europe Market Volume (Units) Forecast by End-Use Industry, 2018 to 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Control, 2018 to 2033

Table 44: Eastern Europe Market Volume (Units) Forecast by Control, 2018 to 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 46: Eastern Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by Load Capacity, 2018 to 2033

Table 48: Eastern Europe Market Volume (Units) Forecast by Load Capacity, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by End-Use Industry, 2018 to 2033

Table 50: Eastern Europe Market Volume (Units) Forecast by End-Use Industry, 2018 to 2033

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Control, 2018 to 2033

Table 54: South Asia and Pacific Market Volume (Units) Forecast by Control, 2018 to 2033

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 56: South Asia and Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by Load Capacity, 2018 to 2033

Table 58: South Asia and Pacific Market Volume (Units) Forecast by Load Capacity, 2018 to 2033

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by End-Use Industry, 2018 to 2033

Table 60: South Asia and Pacific Market Volume (Units) Forecast by End-Use Industry, 2018 to 2033

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 63: East Asia Market Value (US$ Million) Forecast by Control, 2018 to 2033

Table 64: East Asia Market Volume (Units) Forecast by Control, 2018 to 2033

Table 65: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 66: East Asia Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 67: East Asia Market Value (US$ Million) Forecast by Load Capacity, 2018 to 2033

Table 68: East Asia Market Volume (Units) Forecast by Load Capacity, 2018 to 2033

Table 69: East Asia Market Value (US$ Million) Forecast by End-Use Industry, 2018 to 2033

Table 70: East Asia Market Volume (Units) Forecast by End-Use Industry, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Control, 2018 to 2033

Table 74: Middle East and Africa Market Volume (Units) Forecast by Control, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 76: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by Load Capacity, 2018 to 2033

Table 78: Middle East and Africa Market Volume (Units) Forecast by Load Capacity, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by End-Use Industry, 2018 to 2033

Table 80: Middle East and Africa Market Volume (Units) Forecast by End-Use Industry, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Control, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Load Capacity, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by End-Use Industry, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Control, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by Control, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Control, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Control, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Load Capacity, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by Load Capacity, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Load Capacity, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Load Capacity, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by End-Use Industry, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by End-Use Industry, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by End-Use Industry, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by End-Use Industry, 2023 to 2033

Figure 26: Global Market Attractiveness by Control, 2023 to 2033

Figure 27: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 28: Global Market Attractiveness by Load Capacity, 2023 to 2033

Figure 29: Global Market Attractiveness by End-Use Industry, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Control, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Load Capacity, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by End-Use Industry, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Control, 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by Control, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Control, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Control, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Load Capacity, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by Load Capacity, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Load Capacity, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Load Capacity, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by End-Use Industry, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by End-Use Industry, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by End-Use Industry, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by End-Use Industry, 2023 to 2033

Figure 56: North America Market Attractiveness by Control, 2023 to 2033

Figure 57: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 58: North America Market Attractiveness by Load Capacity, 2023 to 2033

Figure 59: North America Market Attractiveness by End-Use Industry, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Control, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Load Capacity, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by End-Use Industry, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Control, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Control, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Control, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Control, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Load Capacity, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by Load Capacity, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Load Capacity, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Load Capacity, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by End-Use Industry, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by End-Use Industry, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by End-Use Industry, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by End-Use Industry, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Control, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Load Capacity, 2023 to 2033

Figure 89: Latin America Market Attractiveness by End-Use Industry, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Control, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by Load Capacity, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by End-Use Industry, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Control, 2018 to 2033

Figure 101: Western Europe Market Volume (Units) Analysis by Control, 2018 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Control, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Control, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 105: Western Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by Load Capacity, 2018 to 2033

Figure 109: Western Europe Market Volume (Units) Analysis by Load Capacity, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Load Capacity, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Load Capacity, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by End-Use Industry, 2018 to 2033

Figure 113: Western Europe Market Volume (Units) Analysis by End-Use Industry, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by End-Use Industry, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by End-Use Industry, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Control, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by Load Capacity, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by End-Use Industry, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Control, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by Load Capacity, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by End-Use Industry, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Control, 2018 to 2033

Figure 131: Eastern Europe Market Volume (Units) Analysis by Control, 2018 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Control, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Control, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 135: Eastern Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by Load Capacity, 2018 to 2033

Figure 139: Eastern Europe Market Volume (Units) Analysis by Load Capacity, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Load Capacity, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Load Capacity, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by End-Use Industry, 2018 to 2033

Figure 143: Eastern Europe Market Volume (Units) Analysis by End-Use Industry, 2018 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by End-Use Industry, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by End-Use Industry, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Control, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by Load Capacity, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by End-Use Industry, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Control, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by Load Capacity, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by End-Use Industry, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Control, 2018 to 2033

Figure 161: South Asia and Pacific Market Volume (Units) Analysis by Control, 2018 to 2033

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Control, 2023 to 2033

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Control, 2023 to 2033

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 165: South Asia and Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by Load Capacity, 2018 to 2033

Figure 169: South Asia and Pacific Market Volume (Units) Analysis by Load Capacity, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by Load Capacity, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Load Capacity, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by End-Use Industry, 2018 to 2033

Figure 173: South Asia and Pacific Market Volume (Units) Analysis by End-Use Industry, 2018 to 2033

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by End-Use Industry, 2023 to 2033

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End-Use Industry, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Control, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by Load Capacity, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by End-Use Industry, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Control, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by Load Capacity, 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by End-Use Industry, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Control, 2018 to 2033

Figure 191: East Asia Market Volume (Units) Analysis by Control, 2018 to 2033

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Control, 2023 to 2033

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Control, 2023 to 2033

Figure 194: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 195: East Asia Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 198: East Asia Market Value (US$ Million) Analysis by Load Capacity, 2018 to 2033

Figure 199: East Asia Market Volume (Units) Analysis by Load Capacity, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by Load Capacity, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by Load Capacity, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by End-Use Industry, 2018 to 2033

Figure 203: East Asia Market Volume (Units) Analysis by End-Use Industry, 2018 to 2033

Figure 204: East Asia Market Value Share (%) and BPS Analysis by End-Use Industry, 2023 to 2033

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by End-Use Industry, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Control, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 208: East Asia Market Attractiveness by Load Capacity, 2023 to 2033

Figure 209: East Asia Market Attractiveness by End-Use Industry, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Control, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by Load Capacity, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by End-Use Industry, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Control, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (Units) Analysis by Control, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Control, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Control, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by Load Capacity, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (Units) Analysis by Load Capacity, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Load Capacity, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Load Capacity, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by End-Use Industry, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (Units) Analysis by End-Use Industry, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by End-Use Industry, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-Use Industry, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Control, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Load Capacity, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by End-Use Industry, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Rider Pallet Truck Market Forecast and Outlook 2025 to 2035

Stand-Up Rider Pallet Truck Market Size and Share Forecast Outlook 2025 to 2035

Low-Level Order Picker Pallet Truck Market Size and Share Forecast Outlook 2025 to 2035

Demand for Stand-Up Rider Pallet Truck in USA Size and Share Forecast Outlook 2025 to 2035

Truck with Mast Market Size and Share Forecast Outlook 2025 to 2035

Pallet Displays Market Size and Share Forecast Outlook 2025 to 2035

Palletizer Market Size and Share Forecast Outlook 2025 to 2035

Pallet Wraps Market Size and Share Forecast Outlook 2025 to 2035

Pallet Pooling Market Forecast and Outlook 2025 to 2035

Palletizing Robot Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Palletizing Robots Market Size and Share Forecast Outlook 2025 to 2035

Pallet Stretch Wrapping Machine Market Size and Share Forecast Outlook 2025 to 2035

Pallet Box Market Size and Share Forecast Outlook 2025 to 2035

Pallet Labelling System Market Size and Share Forecast Outlook 2025 to 2035

Truck Mounted Cranes Market Size and Share Forecast Outlook 2025 to 2035

Pallet Labeler Market Size and Share Forecast Outlook 2025 to 2035

Trucks Market Size and Share Forecast Outlook 2025 to 2035

Pallet Wrap Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Pallet Jacks Market Size and Share Forecast Outlook 2025 to 2035

Truck Loader Crane Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA