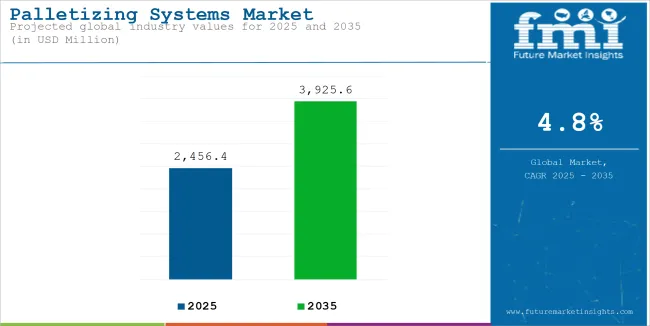

The global sales of palletizing systems are estimated to be worth USD 2,456.4 million in 2025 and are anticipated to reach a value of USD 3,925.6 million by 2035. Sales are projected to rise at a CAGR of 4.8% over the forecast period between 2025 and 2035. The revenue generated by palletizing systems in 2024 was USD 3 million. The industry is anticipated to exhibit a Y-o-Y growth of 3.8% in 2025.

The dehydration of manufacturers has kettle-drum high-speed systems with concurrent IoT and robotics clearing head to operational efficiency demand. The higher productivity of Industry 4.0 with the help of robotics, the Internet of Things, Artificial Intelligence (AI), and smart sensors is a trend that has also been driving the market. The adoption of the automated palletizer has been spurred by the pressing need for reducing labor costs as well as the requirement for better safety of workers in warehouses.

| Attributes | Key Insights |

|---|---|

| Market Value, 2025 | USD 2,456.4 million |

| Market Value, 2035 | USD 3,925.6 million |

| Value CAGR (2025 to 2035) | 4.8% |

This market is anticipated to provide an incremental opportunity of USD 1,469.3 million and will grow 1.6X by 2035. As companies in the sectors across different industries quest for the creation of a new, more effective supply chain, the need for palletizing systems is on the rise. In the case of automatic palletizing systems, they can have a great deal of interest due to their characteristic of product handling with the speed and accuracy of a robot.

The installation of advanced sensors and data analytics at the center of these systems has led to the capability of the businesses to be dynamic and achieve real-time efficiency improvements. The paradigm of technology advancement has completely changed how businesses carry out their logistics and warehouse management.

The table below presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and current year (2025) for the palletizing systems market. This analysis reveals crucial shifts in market performance and indicates revenue realization patterns, thus providing stakeholders with a better vision of the market growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

In the first half (H1) from 2024 to 2034, the business is predicted to surge at a CAGR of 4.3%, followed by a slightly higher growth rate of 4.8% in the second half (H2).

| Particular | Value CAGR |

|---|---|

| H1 | 4.3% (2024 to 2034) |

| H2 | 4.8% (2024 to 2034) |

| H1 | 4.6% (2025 to 2035) |

| H2 | 5.0% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to increase slightly to 4.6% in the first half and remain relatively moderate at 5% in the second half. In the first half (H1) the market witnessed an increase of 30 BPS while in the second half (H2), the market witnessed an increase of 20 BPS.

Automation Gains Ground in Manufacturing and Storage

The trend in automated palletizing systems has thus been the general trend in such industries that continue to escalate the productivity and dependency on manual labour. Such automation has led to the increased rate of palletizing accuracy, which helps manufacturers meet these demands for quicker and more efficient supply chain functions.

The sectors such as food & beverages and pharmaceuticals mention this phenomenon as they need extra vigilance against handling delicate and perishable goods. Automated systems apart from making processes faster also take participation in ensuring quality control and thus become irreplaceable in today's warehousing and production units.

E-commerce Exhaust Demand for Palletizing Systems

The rapid growth in e-commerce has resulted in an increased demand for palletizing systems. When a business in online retail sells massive quantities of its products, then it needs sensible solutions for conducting intricate logistics tasks. Automated palletizing machines are a great vehicle for these businesses to expand their operations whilst retaining the efficiency and cutting down on the operational costs.

E-commerce monsters have made the decisive step in the direction of intelligent management of warehouses by purchasing robotic palletizers, automated storage systems, and shelf machines in order to meet customer expectations regarding promptly completed orders. The level of growth in this aspect of the retail and logistics sphere propels the expected surge in palletizing systems.

Robotics and IoT in Palletizing Systems

The integration of robotics and IoT technologies into palletizing systems gives their functionality and efficiency a real boost. Robotic palletizers are adept at managing more than one product type and size. This multi-faceted nature makes them ideal partners in various industries. The introduction of sensor technologies into IoT systems results in real-time monitoring and diagnostics, which allows operators to improve workflows and minimize downtime.

The increasing presence of collaborative robots or cobots is switching the paradigm of the industry. Cobots alongside the human workers to do repetitive palletizing chores thus boost productivity with safety being the foremost. These technological revolutions are the opening of a pathway for advanced palletizing.

Focus on Sustainability and Energy Efficiency

The trend for eco-friendly materials and resources extends to energy-efficient palletizing systems that are encompassed in the area of sustainability. These systems are made to lower energy consumption while also not sacrificing their high-speed operation levels. Producers, besides, keep on selecting eco-friendly materials and product designs in order to create lesser negative effects that their solutions have on the environment.

Devotion to sustainability is the conduit through which innovation in Palletizing systems is occurring, businesses through it reduce their carbon footprint and obtain operational excellence. Energy-efficient systems are being promoted through grants and subsidies from the state and regulatory bodies, thus they are further pushing the market shuffle.

The global palletizing systems system market recorded a CAGR of 3.9% during the historical period between 2020 and 2024. The growth of palletizing systems market was positive as it reached a value of USD 2,343.9 million in 2024 from USD 2,011.6 million in 2020.

The palletizing system market was under a steady growth trend from the year 2020 until 2024 as industries took advantage of automation to solve human resource issues besides enhancing efficiency. Food and beverage as well as pharmaceutical sectors were the main driving forces as they are very strict about the clean and proper handling of the products. The advanced developments in robotics and machine learning were other supportive pillars during the increased adoption rate in this retrospective period.

According to forecasts, the market would be a part of a majestic expansion process wherein industries such as food and beverages or pharmaceuticals lay emphasis on providing strict demands related to safety and health thus further leading the charge by investment into the most contemporary technologies along with automation in pallet systems. This will also make the businesses achieve greater efficiency and adaptability through additional nuered solutions with IoT and AI. The market will be further expanded by the switch from manual to automated systems in developing countries.

Tier 1 companies comprise market leaders with a market revenue of above USD 100 million capturing a significant market share of 55% to 60% in the palletizing systems market. These market leaders are characterized by extensive expertise in manufacturing across a range of packaging formats and have a wide geographic reach, with a strong foundation of consumers.

They offer an extensive range of series, which includes recycling and manufacturing with the latest technology to meet regulatory requirements and deliver quality. Prominent companies within Tier 1 ABB Flexible Automation Inc, Kuka Roboto GmbH, ABC packaging, Intelligrated Inc and Cermex group.

Tier 2 and other includes the majority of small-scale companies operating at the local presence and serving niche markets having revenue below USD 100 million. These companies are notably oriented towards fulfilling local market demands and are consequently classified within the tier 2 share segment.

They are small-scale players and have limited geographical reach. Tier 2, within this context, is recognized as an unorganized market, denoting a sector characterized by a lack of extensive structure and formalization when compared to organized competitors.

The section below covers the industry analysis for the palletizing systems market for different countries. Market demand analysis on key countries is provided. The USA is anticipated to remain at the forefront in North America, with a value share of 75.9% through 2035. In East Asia, China is projected to witness a CAGR of 4.6% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 3.8% |

| China | 4.6% |

| Germany | 3.4% |

| Japan | 3.2% |

| India | 4.9% |

Advances in automation and robotics technology are opening the USA palletizing systems market widely. This has been largely dominated by the following few sectors: food and beverage, e-commerce, and pharmaceuticals. Automation, be it AI and robotics, also brings about enhanced efficiencies with more flexibility at operations.

An example of how the 2024 FANUC robotic palletizing system, the latest advanced vision and AI, has helped in boosting precision and speeds of handling operations across sectors is that the food and beverage industry has dominated the demand as they use palletizing systems in order to accommodate higher speed, greater consistency, and lower labor cost.

Another major demand driver for automated palletizing solutions is the e-commerce industry. USA online retail sales will reach USD 1.72 trillion by 2027. E-commerce sales in the third quarter of 2024 grew only by 7.2 percent year-over-year, to USD 300.05 billion, propelled by unprecedented online sale growth since the onset of the pandemic. A quicker and accelerated packaging and order fulfillment system only makes palletizing systems absolutely vital to attaining optimal performance at the distribution center.

China's palletizing systems market is growing at a very rapid rate, mainly driven by rapid industrialization and an expanding e-commerce sector. Increasing industrial activities along with technological advances are expected to fuel the CAGR of the market at 4.6% between 2025 and 2035.

Most of this development is seen in major cities like Shanghai, Guangzhou, and Shenzhen, which are highly automating and robotics-based to ensure higher efficiency in manufacturing. Shanghai alone accounts for 20% of national manufacturing output and, therefore, contributes to the demand for automated systems.

The "Made in China 2025" initiative has accelerated this trend further by encouraging businesses to invest in advanced manufacturing technologies, including palletizing systems. Second-tier cities like Chengdu, Xi'an, and Hangzhou are emerging as new industrial and logistics hubs, thereby increasing the adoption of automated palletizing systems by 30% over the next 5 years.

This is a more general trend toward decentralization and infrastructural development. It is anticipated that the regions will continue to grow at 6.5% through 2027, beating traditional manufacturing hubs.

The market for palletizing systems in India is growing in a healthy pace due to its increasing industrialization, adoption of automation, and growth of e-commerce. Of late, there has been increasing growth in this sector mainly among the retail and e-commerce companies such as fashion, groceries, among others. It has not only improved consumer convenience but also incorporated technological innovations, which supports a growing global online presence.

International brands entering the Indian market have further increased the demand for automated solutions, as 14 new entrants opened stores in cities like Mumbai and Delhi in 2025. The growth of the middle class in India and the government initiatives, such as digitization and empowerment of MSME, have increased the demand for efficient automation solutions across all sectors.

Amongst the industries which experience industrial growth through demand for palletizing systems, the pharmaceutical industry is one such. 50 new greenfield plants are to be established for pharma and medical device manufacturing under the Production-Linked Incentive (PLI) scheme over the next two years.

These new manufacturing sites fall under the "Make in India" programme, which would further strengthen the domestic manufacturing as well as increase technology. A significant demand for efficient packaging and logistics solutions like palletizing systems would be observed as the pharmaceutical sector is also expected to increase with this measure.

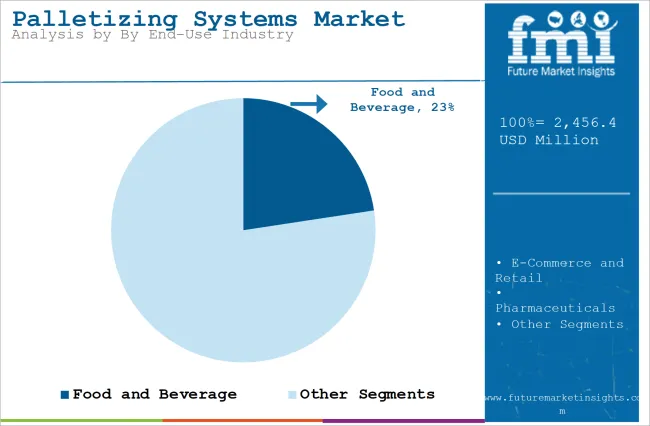

The section contains information about the leading segments in the industry. By product type, robotic palletizers segment is estimated to grow at a CAGR of 3.9% throughout 2035. Additionally, food & beverage end use industry is projected to expand at 3.5% by 2035.

| Product Type | Value Share (2035) |

|---|---|

| Robotic Palletizers | 44.6% |

Robotic palletizers are becoming widely accepted in all industries because of their flexibility, speed, and precision in complex packaging tasks. These systems, fitted with advanced robotic arms and vision systems, are designed to provide maximum adaptability to a variety of product types, sizes, and packaging requirements.

The adaptability in the systems is mostly beneficial for industry applications such as food and beverages, pharmaceutical industries, and those dealing with ecommerce, where turnarounds have to be highly rapid on most production lines.

Low human interaction in operation, further leading to increased efficiency and decrease in cost over traditional systems remains a major and driving force to demand robotic palletizers. Companies like ABB Robotics, FANUC Corporation, KUKA AG, Yaskawa Electric Corporation, and Kawasaki Robotics are the leading companies in implementing robotic palletizing solutions to cope with the ever-increasing need for high-quality automation products.

Floor-level and high-level palletizers will be more acceptable in high volume, static environments where the variety of products may not change; floor-level will handle large batch sizes of operations with repetitive nature in bulk manufacture, while high level palletizers operate in large, vertically expansive environment. However, these systems have no flexibility such as robotic palletizers that is why this industry with different types of variability in demand wants robotics.

| End-Use Industry | Value Share (2035) |

|---|---|

| Food and Beverage | 22.6% |

In this respect, food and beverages still top the list as one of the major users of palletizing systems in terms of high speed, precision, and hygiene. For this industry, rigid safety and quality standards that result in minimal defects and efficient production call for automated palletizers. Increasingly, demand for processed and packaged food has compelled producers to adapt such systems in their operations for multiple packaging formats and materials to enhance supply chain performance.

Other sectors that may include e-commerce and retail, pharmaceuticals, consumer goods, and automotive, use palletizing systems, but the needs are of a different nature. In e-commerce and retail, they prioritize speed of handling and tailoring.

The pharmaceutical industry concentrates on precision in compliance with regulations, whereas the automobile sector requires durable solutions for heavier and more unpredictable loads. As automation is generally preferred by these sectors, the unique requirements of food and beverage-quick handling, and hygiene-demand an edge as a leader of adopting advanced palletizing solutions.

Palletizing systems are in transformative growth, driven by developments in automation technology and an increasing number of industries. Demand for effective, high-speed goods handling has accelerated the development of palletizing solutions in areas like food & beverage and e-commerce. These industries are driving the adoption of robotic and hybrid palletizers due to the improvement of accuracy, savings in labor, and enhancement in throughput through automation.This development is aimed at filling the stringent requirement for speed as well as for precision in packaging formats.

Robotics in palletizers have also recently positioned their importance as the preferred of choice by most industries that desire flexibility and large volumes. They are equipped with appropriate advanced vision and sensors to allow the accurate positioning of items regardless of shapes or sizes. Traditional floor-level and high-level palletizers are still adequate but continue to be supplemented or, in most cases, replaced by robot-based palletizers that provide added flexibility and more uptimes. This is noticeable in industries like pharmaceuticals and consumer goods. Here, efficiency and accuracy count the most.

Market leaders like ABB Robotics, FANUC Corporation, and KUKA AG are among the leading names that are integrating AI and IoT into palletizing systems. All these companies have been expanding their geographical reach across emerging markets in which industrial automation is growing in popularity. Also, the competition is witnessing fresh entrants in the market bringing innovative solutions as per the demands of the various industries, and this dynamic nature of the market is likely to sustain growth for a long time.

Recent Industry Developments

In terms of product type, the industry is divided into floor level palletizers, high-level palletizers and robotic palletizers.

In terms of technology, the industry is divided into semi-automated palletizing and automatic palletizing.

In terms of application, the industry is divided into case palletizers, pail palletizers, bulk palletizers and bag palletizers.

In terms of end-use industry, the industry is divided into Food and Beverage, E-Commerce and Retail, Pharmaceuticals, Consumer Goods, Automotive and Other End-Use Industry.

Key regions of North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific and Middle East & Africa have been covered in the report.

The global palletizing systems industry is projected to witness a CAGR of 4.8% between 2025 and 2035.

The global palletizing systems industry stood at USD 2,456.4 million in 2025.

The global palletizing systems industry is anticipated to reach USD 3,925.6 million by 2035 end.

The key players operating in the global palletizing systems industry ABB Robotics, FANUC Corporation, and KUKA AG.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2017 to 2032

Table 2: Global Market Volume (Units) Forecast by Region, 2017 to 2032

Table 3: Global Market Value (US$ Million) Forecast by Types, 2017 to 2032

Table 4: Global Market Volume (Units) Forecast by Types, 2017 to 2032

Table 5: Global Market Value (US$ Million) Forecast by Applications, 2017 to 2032

Table 6: Global Market Volume (Units) Forecast by Applications, 2017 to 2032

Table 7: Global Market Value (US$ Million) Forecast by Type of Techniques, 2017 to 2032

Table 8: Global Market Volume (Units) Forecast by Type of Techniques, 2017 to 2032

Table 9: North America Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 10: North America Market Volume (Units) Forecast by Country, 2017 to 2032

Table 11: North America Market Value (US$ Million) Forecast by Types, 2017 to 2032

Table 12: North America Market Volume (Units) Forecast by Types, 2017 to 2032

Table 13: North America Market Value (US$ Million) Forecast by Applications, 2017 to 2032

Table 14: North America Market Volume (Units) Forecast by Applications, 2017 to 2032

Table 15: North America Market Value (US$ Million) Forecast by Type of Techniques, 2017 to 2032

Table 16: North America Market Volume (Units) Forecast by Type of Techniques, 2017 to 2032

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 18: Latin America Market Volume (Units) Forecast by Country, 2017 to 2032

Table 19: Latin America Market Value (US$ Million) Forecast by Types, 2017 to 2032

Table 20: Latin America Market Volume (Units) Forecast by Types, 2017 to 2032

Table 21: Latin America Market Value (US$ Million) Forecast by Applications, 2017 to 2032

Table 22: Latin America Market Volume (Units) Forecast by Applications, 2017 to 2032

Table 23: Latin America Market Value (US$ Million) Forecast by Type of Techniques, 2017 to 2032

Table 24: Latin America Market Volume (Units) Forecast by Type of Techniques, 2017 to 2032

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 26: Europe Market Volume (Units) Forecast by Country, 2017 to 2032

Table 27: Europe Market Value (US$ Million) Forecast by Types, 2017 to 2032

Table 28: Europe Market Volume (Units) Forecast by Types, 2017 to 2032

Table 29: Europe Market Value (US$ Million) Forecast by Applications, 2017 to 2032

Table 30: Europe Market Volume (Units) Forecast by Applications, 2017 to 2032

Table 31: Europe Market Value (US$ Million) Forecast by Type of Techniques, 2017 to 2032

Table 32: Europe Market Volume (Units) Forecast by Type of Techniques, 2017 to 2032

Table 33: Asia Pacific Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 34: Asia Pacific Market Volume (Units) Forecast by Country, 2017 to 2032

Table 35: Asia Pacific Market Value (US$ Million) Forecast by Types, 2017 to 2032

Table 36: Asia Pacific Market Volume (Units) Forecast by Types, 2017 to 2032

Table 37: Asia Pacific Market Value (US$ Million) Forecast by Applications, 2017 to 2032

Table 38: Asia Pacific Market Volume (Units) Forecast by Applications, 2017 to 2032

Table 39: Asia Pacific Market Value (US$ Million) Forecast by Type of Techniques, 2017 to 2032

Table 40: Asia Pacific Market Volume (Units) Forecast by Type of Techniques, 2017 to 2032

Table 41: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 42: Middle East and Africa Market Volume (Units) Forecast by Country, 2017 to 2032

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Types, 2017 to 2032

Table 44: Middle East and Africa Market Volume (Units) Forecast by Types, 2017 to 2032

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Applications, 2017 to 2032

Table 46: Middle East and Africa Market Volume (Units) Forecast by Applications, 2017 to 2032

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Type of Techniques, 2017 to 2032

Table 48: Middle East and Africa Market Volume (Units) Forecast by Type of Techniques, 2017 to 2032

Figure 1: Global Market Value (US$ Million) by Types, 2022 to 2032

Figure 2: Global Market Value (US$ Million) by Applications, 2022 to 2032

Figure 3: Global Market Value (US$ Million) by Type of Techniques, 2022 to 2032

Figure 4: Global Market Value (US$ Million) by Region, 2022 to 2032

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2017 to 2032

Figure 6: Global Market Volume (Units) Analysis by Region, 2017 to 2032

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2022 to 2032

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2022 to 2032

Figure 9: Global Market Value (US$ Million) Analysis by Types, 2017 to 2032

Figure 10: Global Market Volume (Units) Analysis by Types, 2017 to 2032

Figure 11: Global Market Value Share (%) and BPS Analysis by Types, 2022 to 2032

Figure 12: Global Market Y-o-Y Growth (%) Projections by Types, 2022 to 2032

Figure 13: Global Market Value (US$ Million) Analysis by Applications, 2017 to 2032

Figure 14: Global Market Volume (Units) Analysis by Applications, 2017 to 2032

Figure 15: Global Market Value Share (%) and BPS Analysis by Applications, 2022 to 2032

Figure 16: Global Market Y-o-Y Growth (%) Projections by Applications, 2022 to 2032

Figure 17: Global Market Value (US$ Million) Analysis by Type of Techniques, 2017 to 2032

Figure 18: Global Market Volume (Units) Analysis by Type of Techniques, 2017 to 2032

Figure 19: Global Market Value Share (%) and BPS Analysis by Type of Techniques, 2022 to 2032

Figure 20: Global Market Y-o-Y Growth (%) Projections by Type of Techniques, 2022 to 2032

Figure 21: Global Market Attractiveness by Types, 2022 to 2032

Figure 22: Global Market Attractiveness by Applications, 2022 to 2032

Figure 23: Global Market Attractiveness by Type of Techniques, 2022 to 2032

Figure 24: Global Market Attractiveness by Region, 2022 to 2032

Figure 25: North America Market Value (US$ Million) by Types, 2022 to 2032

Figure 26: North America Market Value (US$ Million) by Applications, 2022 to 2032

Figure 27: North America Market Value (US$ Million) by Type of Techniques, 2022 to 2032

Figure 28: North America Market Value (US$ Million) by Country, 2022 to 2032

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 30: North America Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 33: North America Market Value (US$ Million) Analysis by Types, 2017 to 2032

Figure 34: North America Market Volume (Units) Analysis by Types, 2017 to 2032

Figure 35: North America Market Value Share (%) and BPS Analysis by Types, 2022 to 2032

Figure 36: North America Market Y-o-Y Growth (%) Projections by Types, 2022 to 2032

Figure 37: North America Market Value (US$ Million) Analysis by Applications, 2017 to 2032

Figure 38: North America Market Volume (Units) Analysis by Applications, 2017 to 2032

Figure 39: North America Market Value Share (%) and BPS Analysis by Applications, 2022 to 2032

Figure 40: North America Market Y-o-Y Growth (%) Projections by Applications, 2022 to 2032

Figure 41: North America Market Value (US$ Million) Analysis by Type of Techniques, 2017 to 2032

Figure 42: North America Market Volume (Units) Analysis by Type of Techniques, 2017 to 2032

Figure 43: North America Market Value Share (%) and BPS Analysis by Type of Techniques, 2022 to 2032

Figure 44: North America Market Y-o-Y Growth (%) Projections by Type of Techniques, 2022 to 2032

Figure 45: North America Market Attractiveness by Types, 2022 to 2032

Figure 46: North America Market Attractiveness by Applications, 2022 to 2032

Figure 47: North America Market Attractiveness by Type of Techniques, 2022 to 2032

Figure 48: North America Market Attractiveness by Country, 2022 to 2032

Figure 49: Latin America Market Value (US$ Million) by Types, 2022 to 2032

Figure 50: Latin America Market Value (US$ Million) by Applications, 2022 to 2032

Figure 51: Latin America Market Value (US$ Million) by Type of Techniques, 2022 to 2032

Figure 52: Latin America Market Value (US$ Million) by Country, 2022 to 2032

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 57: Latin America Market Value (US$ Million) Analysis by Types, 2017 to 2032

Figure 58: Latin America Market Volume (Units) Analysis by Types, 2017 to 2032

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Types, 2022 to 2032

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Types, 2022 to 2032

Figure 61: Latin America Market Value (US$ Million) Analysis by Applications, 2017 to 2032

Figure 62: Latin America Market Volume (Units) Analysis by Applications, 2017 to 2032

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Applications, 2022 to 2032

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Applications, 2022 to 2032

Figure 65: Latin America Market Value (US$ Million) Analysis by Type of Techniques, 2017 to 2032

Figure 66: Latin America Market Volume (Units) Analysis by Type of Techniques, 2017 to 2032

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Type of Techniques, 2022 to 2032

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Type of Techniques, 2022 to 2032

Figure 69: Latin America Market Attractiveness by Types, 2022 to 2032

Figure 70: Latin America Market Attractiveness by Applications, 2022 to 2032

Figure 71: Latin America Market Attractiveness by Type of Techniques, 2022 to 2032

Figure 72: Latin America Market Attractiveness by Country, 2022 to 2032

Figure 73: Europe Market Value (US$ Million) by Types, 2022 to 2032

Figure 74: Europe Market Value (US$ Million) by Applications, 2022 to 2032

Figure 75: Europe Market Value (US$ Million) by Type of Techniques, 2022 to 2032

Figure 76: Europe Market Value (US$ Million) by Country, 2022 to 2032

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 78: Europe Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 81: Europe Market Value (US$ Million) Analysis by Types, 2017 to 2032

Figure 82: Europe Market Volume (Units) Analysis by Types, 2017 to 2032

Figure 83: Europe Market Value Share (%) and BPS Analysis by Types, 2022 to 2032

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Types, 2022 to 2032

Figure 85: Europe Market Value (US$ Million) Analysis by Applications, 2017 to 2032

Figure 86: Europe Market Volume (Units) Analysis by Applications, 2017 to 2032

Figure 87: Europe Market Value Share (%) and BPS Analysis by Applications, 2022 to 2032

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Applications, 2022 to 2032

Figure 89: Europe Market Value (US$ Million) Analysis by Type of Techniques, 2017 to 2032

Figure 90: Europe Market Volume (Units) Analysis by Type of Techniques, 2017 to 2032

Figure 91: Europe Market Value Share (%) and BPS Analysis by Type of Techniques, 2022 to 2032

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Type of Techniques, 2022 to 2032

Figure 93: Europe Market Attractiveness by Types, 2022 to 2032

Figure 94: Europe Market Attractiveness by Applications, 2022 to 2032

Figure 95: Europe Market Attractiveness by Type of Techniques, 2022 to 2032

Figure 96: Europe Market Attractiveness by Country, 2022 to 2032

Figure 97: Asia Pacific Market Value (US$ Million) by Types, 2022 to 2032

Figure 98: Asia Pacific Market Value (US$ Million) by Applications, 2022 to 2032

Figure 99: Asia Pacific Market Value (US$ Million) by Type of Techniques, 2022 to 2032

Figure 100: Asia Pacific Market Value (US$ Million) by Country, 2022 to 2032

Figure 101: Asia Pacific Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 102: Asia Pacific Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 105: Asia Pacific Market Value (US$ Million) Analysis by Types, 2017 to 2032

Figure 106: Asia Pacific Market Volume (Units) Analysis by Types, 2017 to 2032

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Types, 2022 to 2032

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Types, 2022 to 2032

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by Applications, 2017 to 2032

Figure 110: Asia Pacific Market Volume (Units) Analysis by Applications, 2017 to 2032

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by Applications, 2022 to 2032

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by Applications, 2022 to 2032

Figure 113: Asia Pacific Market Value (US$ Million) Analysis by Type of Techniques, 2017 to 2032

Figure 114: Asia Pacific Market Volume (Units) Analysis by Type of Techniques, 2017 to 2032

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by Type of Techniques, 2022 to 2032

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by Type of Techniques, 2022 to 2032

Figure 117: Asia Pacific Market Attractiveness by Types, 2022 to 2032

Figure 118: Asia Pacific Market Attractiveness by Applications, 2022 to 2032

Figure 119: Asia Pacific Market Attractiveness by Type of Techniques, 2022 to 2032

Figure 120: Asia Pacific Market Attractiveness by Country, 2022 to 2032

Figure 121: Middle East and Africa Market Value (US$ Million) by Types, 2022 to 2032

Figure 122: Middle East and Africa Market Value (US$ Million) by Applications, 2022 to 2032

Figure 123: Middle East and Africa Market Value (US$ Million) by Type of Techniques, 2022 to 2032

Figure 124: Middle East and Africa Market Value (US$ Million) by Country, 2022 to 2032

Figure 125: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 126: Middle East and Africa Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 127: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 128: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 129: Middle East and Africa Market Value (US$ Million) Analysis by Types, 2017 to 2032

Figure 130: Middle East and Africa Market Volume (Units) Analysis by Types, 2017 to 2032

Figure 131: Middle East and Africa Market Value Share (%) and BPS Analysis by Types, 2022 to 2032

Figure 132: Middle East and Africa Market Y-o-Y Growth (%) Projections by Types, 2022 to 2032

Figure 133: Middle East and Africa Market Value (US$ Million) Analysis by Applications, 2017 to 2032

Figure 134: Middle East and Africa Market Volume (Units) Analysis by Applications, 2017 to 2032

Figure 135: Middle East and Africa Market Value Share (%) and BPS Analysis by Applications, 2022 to 2032

Figure 136: Middle East and Africa Market Y-o-Y Growth (%) Projections by Applications, 2022 to 2032

Figure 137: Middle East and Africa Market Value (US$ Million) Analysis by Type of Techniques, 2017 to 2032

Figure 138: Middle East and Africa Market Volume (Units) Analysis by Type of Techniques, 2017 to 2032

Figure 139: Middle East and Africa Market Value Share (%) and BPS Analysis by Type of Techniques, 2022 to 2032

Figure 140: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type of Techniques, 2022 to 2032

Figure 141: Middle East and Africa Market Attractiveness by Types, 2022 to 2032

Figure 142: Middle East and Africa Market Attractiveness by Applications, 2022 to 2032

Figure 143: Middle East and Africa Market Attractiveness by Type of Techniques, 2022 to 2032

Figure 144: Middle East and Africa Market Attractiveness by Country, 2022 to 2032

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Palletizing Robot Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Palletizing Robots Market Size and Share Forecast Outlook 2025 to 2035

Palletizing Machines Market Growth & Demand 2025 to 2035

Systems Administration Management Tools Market Size and Share Forecast Outlook 2025 to 2035

VRF Systems Market Growth - Trends & Forecast 2025 to 2035

Cloud Systems Management Software Market Size and Share Forecast Outlook 2025 to 2035

Hi-Fi Systems Market Size and Share Forecast Outlook 2025 to 2035

Cough systems Market

Backpack Systems Market Size and Share Forecast Outlook 2025 to 2035

Unmanned Systems Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

DC Power Systems Market Trends - Growth, Demand & Forecast 2025 to 2035

Catheter Systems Market

Reporter Systems Market

Aerostat Systems Market

Cryogenic Systems Market Size and Share Forecast Outlook 2025 to 2035

Air Brake Systems Market Growth & Demand 2025 to 2035

Metrology Systems Market

Fluid Bed Systems Market

Cognitive Systems Spending Market Report – Growth & Forecast 2016-2026

Nurse Call Systems Market Insights - Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA